Labcorp Bundle

How Does Labcorp Navigate the Fierce Healthcare Competition?

In the dynamic world of healthcare, understanding the Labcorp SWOT Analysis is crucial. Labcorp, a global leader in life sciences, faces a complex and ever-changing competitive landscape. This analysis dives deep into the

This exploration will provide a comprehensive

Where Does Labcorp’ Stand in the Current Market?

Labcorp holds a leading market position in the global diagnostics and drug development sectors. It is consistently recognized as one of the two largest clinical laboratory companies in the United States, alongside Quest Diagnostics. In 2023, Labcorp reported revenues of $12.2 billion, demonstrating its substantial scale within the healthcare industry.

The company's core operations involve a broad spectrum of diagnostic tests. These include routine blood work, specialized esoteric testing, and genetic diagnostics, serving a diverse customer base. This includes physicians, hospitals, managed care organizations, and biopharmaceutical companies. Labcorp's value proposition lies in its comprehensive service offerings and its ability to provide critical insights for healthcare providers and pharmaceutical companies.

Geographically, Labcorp has a significant presence across the United States and operates in over 100 countries, extending its reach globally. This extensive network supports its ability to deliver timely and accurate testing services worldwide. Labcorp's strategic focus has been on integrating its diagnostic and drug development capabilities to enhance its market position. This integration allows Labcorp to leverage insights from its diagnostic business to inform and accelerate drug discovery and clinical trials.

Labcorp's consistent ranking among the top players underscores its strong hold in both general and specialized diagnostic markets. While specific market share figures are proprietary, the company's revenue of $12.2 billion in 2023 highlights its significant market presence. This financial performance reflects Labcorp's strong position in the healthcare industry.

With operations in over 100 countries, Labcorp has a substantial global footprint. This extensive reach allows Labcorp to serve a diverse customer base. The company's ability to operate worldwide supports its competitive advantages and market position.

Labcorp strategically emphasizes its integrated capabilities in diagnostics and drug development. This approach allows the company to leverage insights from its diagnostic business to improve drug discovery. The company's investments in technology and infrastructure maintain its competitive edge.

In 2024, Labcorp continued to expand its oncology portfolio, highlighting its focus on high-growth, specialized testing areas. This expansion is a key part of Labcorp's strategic focus on specialized testing. This strategic move strengthens Labcorp's position in the competitive landscape.

Labcorp's strong market position is supported by its significant revenue, global presence, and integrated service offerings. The company's focus on specialized testing areas, such as oncology, and its investments in technology contribute to its competitive advantages. For more information on the company's target market, see Target Market of Labcorp.

- Leading market position in diagnostics and drug development.

- Revenues of $12.2 billion in 2023.

- Operations in over 100 countries.

- Strategic emphasis on integrated diagnostics and drug development.

- Expansion of oncology portfolio.

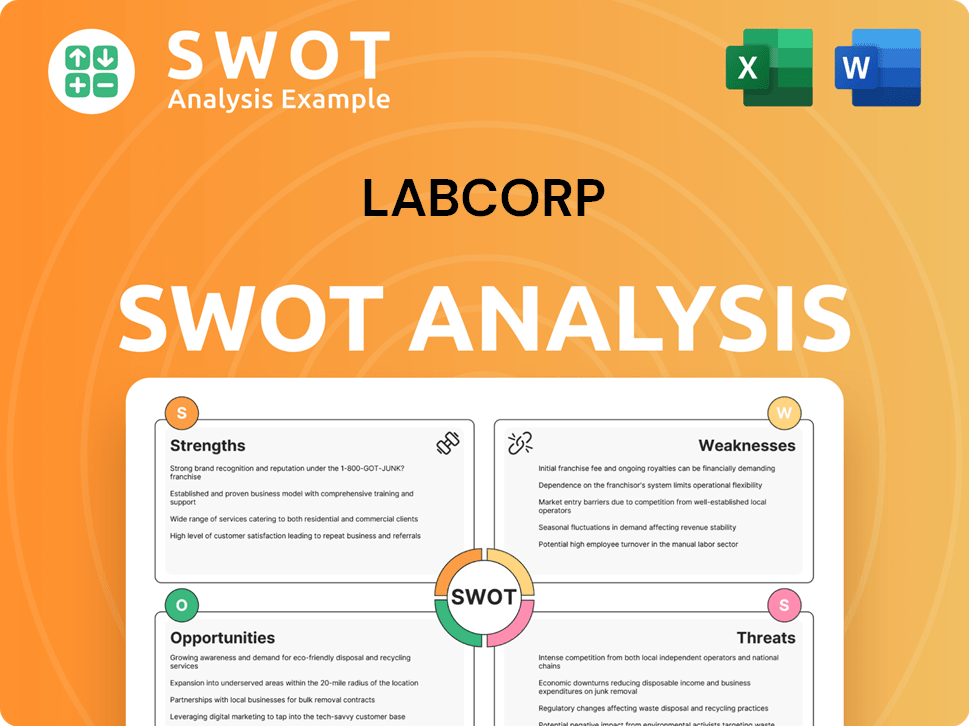

Labcorp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Labcorp?

The Labcorp competitive landscape is shaped by its dual focus on diagnostics and drug development. This positioning places it against a diverse set of rivals, each vying for market share in the healthcare and pharmaceutical sectors. Understanding these competitors is crucial for a thorough Labcorp market analysis.

The Labcorp industry faces constant evolution, driven by technological advancements, regulatory changes, and shifts in healthcare delivery. This dynamic environment necessitates continuous assessment of the competitive forces at play. The company's ability to navigate this landscape directly impacts its financial performance and strategic positioning.

In the diagnostics sector, Labcorp's main competitors in 2024 include Quest Diagnostics. Both companies offer extensive diagnostic testing services, competing for contracts with healthcare providers and patients. They also compete for Labcorp market share.

Quest Diagnostics is a direct rival, with reported revenues of $9.15 billion in 2023. They offer a wide array of diagnostic testing services. They compete head-to-head with Labcorp.

Other competitors include hospital-based labs and specialized independent labs. These entities often focus on specific areas like genetic testing or infectious diseases. Emerging players leverage advanced technologies.

In the drug development segment, Labcorp competitors include contract research organizations (CROs). These CROs offer services spanning preclinical research to post-market surveillance. The competition focuses on expertise and global reach.

IQVIA is a significant CRO competitor, with revenues of $14.9 billion in 2023. They provide services in clinical development, commercialization, and technology solutions. IQVIA competes for partnerships with pharmaceutical and biotechnology companies.

Syneos Health and Charles River Laboratories are also key competitors. These CROs compete with Labcorp for partnerships with pharmaceutical and biotechnology companies. The competition often revolves around specialized expertise, global reach, and the ability to accelerate drug development timelines.

The competitive environment is also shaped by mergers and acquisitions. These strategic moves create larger, more diversified entities. Understanding these dynamics is essential for evaluating Labcorp's business model and its long-term prospects. The competitive advantages of Labcorp include its extensive service offerings and global presence.

Several factors influence the competitive dynamics in the diagnostics and drug development sectors. These include:

- Service offerings: The breadth and depth of diagnostic tests and drug development services.

- Technology and innovation: The adoption of advanced technologies like AI and liquid biopsies.

- Geographic reach: The ability to serve clients globally.

- Pricing and cost-effectiveness: Competitive pricing strategies.

- Strategic partnerships: Collaborations with healthcare providers and pharmaceutical companies.

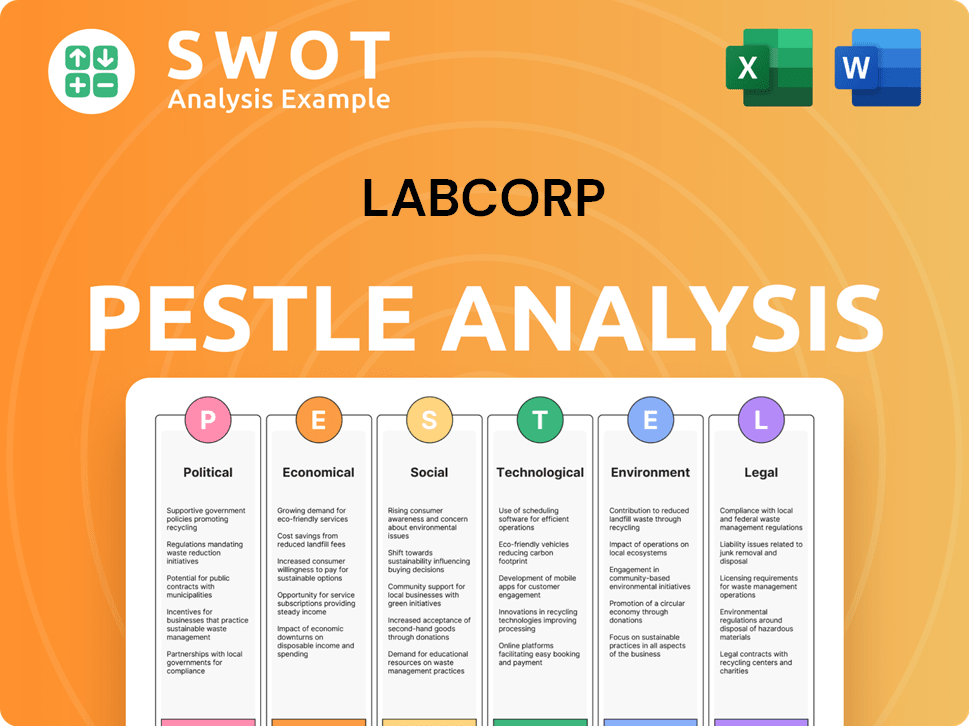

Labcorp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Labcorp a Competitive Edge Over Its Rivals?

Understanding the Labcorp competitive landscape involves recognizing its key strengths and how they position it within the healthcare industry. The company's integrated business model, spanning both diagnostics and drug development, provides a significant advantage. This unique structure allows for data-driven insights to enhance drug development services, setting it apart from many Labcorp competitors.

Labcorp's extensive operational scale is another critical advantage. With a vast network of patient service centers, laboratories, and logistical infrastructure, it offers a wide range of tests with broad geographic accessibility. This scale often leads to cost efficiencies, allowing Labcorp to serve millions of patients annually. Furthermore, the company's brand equity, built over decades, fosters trust among healthcare providers and patients, contributing to strong customer loyalty.

The company's investment in advanced technologies, including automation, genomics, and digital pathology, enhances its testing capabilities and efficiency. Labcorp also benefits from a robust talent pool of scientists, pathologists, and clinical research professionals, allowing for continuous innovation and the development of specialized testing and research solutions. These advantages are sustained through ongoing investments in research and development and strategic partnerships.

Labcorp's dual presence in diagnostics and drug development creates a synergistic relationship. Diagnostic data informs and enhances drug development services, a key differentiator. This integrated approach allows for more informed clinical trial design and patient stratification, improving efficiency.

Labcorp operates a vast network of patient service centers and laboratories. This extensive infrastructure enables broad geographic accessibility and cost-effective operations. The company serves millions of patients annually, leveraging economies of scale to maintain a competitive edge.

Labcorp invests heavily in advanced technologies like automation, genomics, and digital pathology. These investments enhance testing capabilities and overall efficiency. Continuous innovation is a key factor in maintaining a competitive advantage in the Labcorp industry.

Labcorp's long-standing presence in the market has built strong brand equity. This fosters trust among healthcare providers and patients. Strong customer loyalty is a significant advantage, contributing to sustained market share.

Labcorp's competitive advantages stem from its integrated business model, operational scale, and technological investments. These factors contribute to its strong market position and ability to serve a wide range of healthcare needs. The company continues to focus on innovation and strategic partnerships to maintain its competitive edge.

- Integrated Diagnostics and Drug Development: Leveraging data for enhanced services.

- Extensive Operational Scale: Broad geographic reach and cost efficiencies.

- Technological Leadership: Investments in automation and advanced testing.

- Strong Brand Reputation: High customer trust and loyalty.

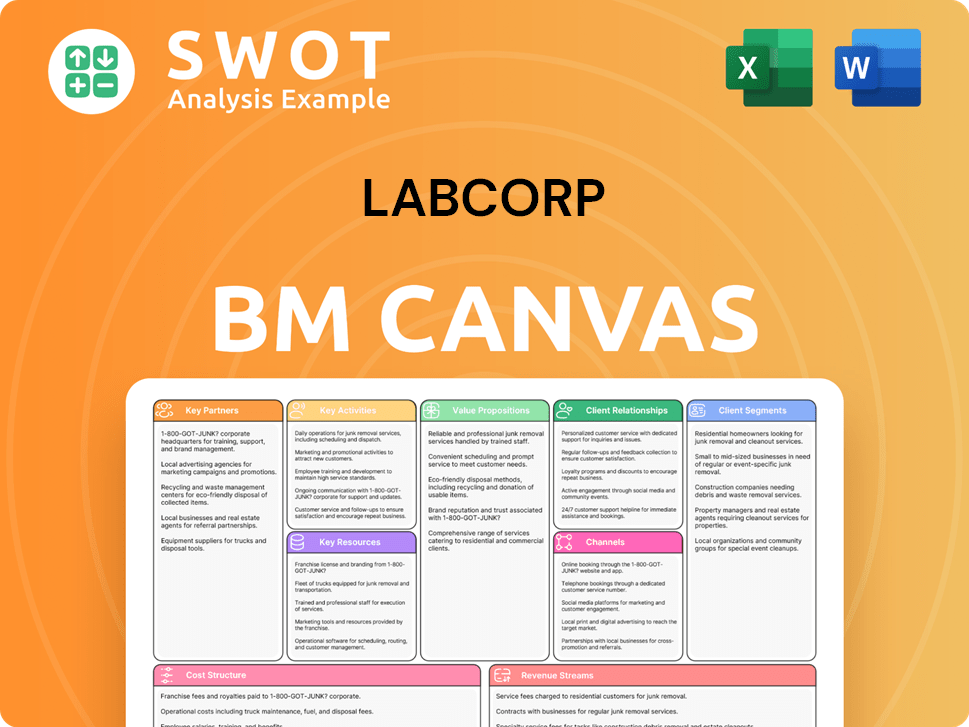

Labcorp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Labcorp’s Competitive Landscape?

The competitive landscape for Labcorp is shaped by significant industry trends, future challenges, and emerging opportunities. Understanding these factors is crucial for analyzing Labcorp's market position and potential for growth. The healthcare industry's evolution, driven by technological advancements and shifting consumer preferences, plays a pivotal role in defining Labcorp's strategic direction and financial performance.

Labcorp's position in the healthcare industry is continually evolving. The company faces both risks and opportunities related to market dynamics, technological shifts, and regulatory changes. Strategic decisions and investments will determine its future outlook, particularly in the context of the competitive environment. Analyzing these elements provides a comprehensive view of Labcorp's potential for sustained success.

Technological advancements, especially in genomics and AI, are reshaping diagnostics and drug development. Regulatory changes, including those related to data privacy, impact operational frameworks. Personalized healthcare and preventative medicine are increasing demand for advanced diagnostic tests.

Intense price competition and the need for continuous innovation are significant challenges. Navigating complex global regulatory landscapes is crucial. The rise of direct-to-consumer genetic testing presents a potential disruption to traditional lab models.

The aging population and increasing chronic diseases drive demand for diagnostic services. Expanding into emerging markets offers growth potential. Leveraging AI and big data analytics can accelerate drug discovery. Precision medicine and companion diagnostics represent key areas for investment.

Labcorp strategically focuses on precision medicine, oncology, and companion diagnostics. The company is actively engaging in collaborations and acquisitions to enhance its capabilities. Continued investments in technology and strategic partnerships are essential.

The lab testing industry is experiencing rapid changes, driven by technological advancements and evolving healthcare needs. These trends create both challenges and opportunities for companies like Labcorp. Strategic responses involve innovation, market expansion, and leveraging data analytics.

- AI and Data Analytics: AI is being used to improve diagnostic accuracy and efficiency. Labcorp is investing in data analytics to enhance drug discovery and clinical trial outcomes.

- Personalized Medicine: There is a growing focus on personalized medicine, driving demand for advanced diagnostic tests. Labcorp is expanding its offerings in oncology and companion diagnostics.

- Emerging Markets: Expanding into emerging markets provides significant growth opportunities. Labcorp is strategically positioning itself to capitalize on these opportunities.

- Regulatory Compliance: Navigating complex global regulations is crucial. Labcorp must adapt its operations to comply with data privacy and new test approval standards.

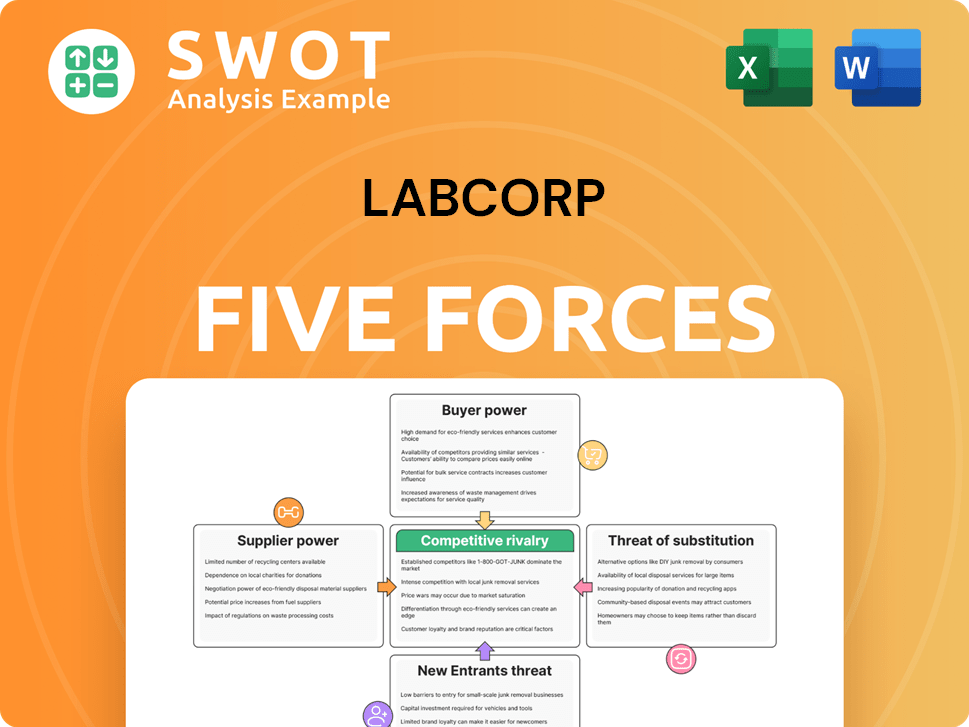

Labcorp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Labcorp Company?

- What is Growth Strategy and Future Prospects of Labcorp Company?

- How Does Labcorp Company Work?

- What is Sales and Marketing Strategy of Labcorp Company?

- What is Brief History of Labcorp Company?

- Who Owns Labcorp Company?

- What is Customer Demographics and Target Market of Labcorp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.