Linamar Bundle

Can Linamar Maintain Its Competitive Edge?

Linamar, a global manufacturing leader, is at a critical juncture as the automotive and industrial sectors transform. Founded in 1966, the company has evolved from a small machining operation into a multi-billion dollar enterprise. Understanding the Linamar SWOT Analysis is crucial for assessing its position in this dynamic environment.

This exploration delves into the Linamar competitive landscape, providing a detailed Linamar market analysis of its rivals. We'll dissect Linamar competitors and assess the company's Linamar business strategy to understand its Linamar industry position and future prospects, including its Linamar financial performance. Analyzing these factors will reveal how Linamar navigates challenges and capitalizes on opportunities in the evolving mobility sector.

Where Does Linamar’ Stand in the Current Market?

Linamar Corporation operates across two main segments: Industrial Manufacturing and Mobility. The Mobility segment focuses on automotive and diversified industrial markets, where Linamar is a Tier 1 supplier of complex metal components and systems. These components are used in engines, transmissions, drivelines, and chassis, serving a wide range of global automotive original equipment manufacturers (OEMs).

The Industrial Manufacturing segment includes Skyjack (aerial work platforms) and MacDon (harvesting equipment). Skyjack is a significant player in the aerial work platform market, particularly in North America and Europe. Linamar's strategy involves adapting to industry trends, such as the increasing demand for electric vehicle (EV) components and integrating advanced technologies in its industrial machinery.

In 2023, Linamar's revenue reached approximately CAD 7.9 billion, demonstrating its substantial presence in the global automotive supply chain. The company has a broad geographic footprint, with manufacturing facilities and sales offices in North America, Europe, and Asia, enabling it to serve a diverse global customer base. This widespread presence contributes to its strong market position and ability to compete effectively in the Linamar competitive landscape.

While specific market share figures for individual components are proprietary, Linamar's consistent revenue generation highlights its strong position. The company is a key supplier in the automotive industry, providing crucial components. Linamar's strategic moves, such as adapting to the EV market, have helped maintain its competitive edge.

Linamar has a significant global presence with manufacturing facilities and sales offices across North America, Europe, and Asia. This broad footprint allows it to serve a diverse customer base. The company's strong position in North America is particularly noteworthy for both automotive components and industrial equipment.

Linamar's financial health is robust, as evidenced by consistent profitability and investments in research and development. This financial stability positions Linamar favorably against industry averages. The company's ability to maintain profitability and invest in innovation supports its long-term growth and competitiveness.

Linamar is adapting to industry trends, such as the increasing demand for electrified vehicle components. This includes integrating advanced technologies in its industrial machinery. These strategic shifts are crucial for maintaining its competitive advantage in the evolving market.

Linamar's strengths include its diverse product portfolio, global presence, and financial stability. The company's ability to adapt to market changes, such as the shift towards electric vehicles, is also a key advantage. The Linamar industry faces challenges like supply chain disruptions and technological advancements, but the company’s strategic initiatives help it stay competitive.

- Strong position in the North American market.

- Adaptation to the electric vehicle market.

- Consistent revenue generation and profitability.

- Extensive global manufacturing and sales network.

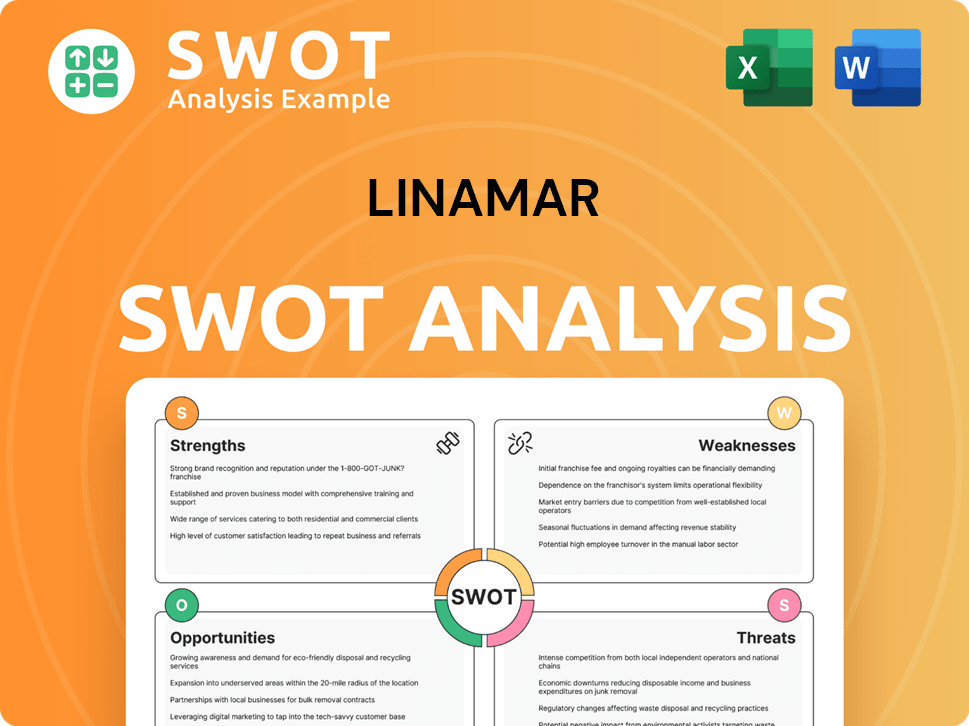

Linamar SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Linamar?

Understanding the Linamar competitive landscape is crucial for assessing its position within the automotive and industrial manufacturing sectors. This Linamar market analysis reveals a complex web of rivals, each vying for market share and technological dominance. The following sections will delve into the key competitors shaping Linamar's industry dynamics.

As the automotive industry transitions towards electric vehicles (EVs), competition has intensified. Companies are aggressively pursuing contracts for new EV platforms, which is a significant factor in the Linamar business strategy. This dynamic environment requires a close examination of the key players and their strategic approaches.

In the Mobility segment, Linamar's primary competitors include global automotive component suppliers. These rivals compete across various product lines, including powertrain and body and chassis systems. These companies often leverage their broader product portfolios and global scale to gain an advantage.

Magna International, a major Canadian-based automotive supplier, directly competes with Linamar in several product areas. Magna's extensive product offerings and global reach provide a significant competitive advantage. Recent financial data shows Magna's sales at approximately $46.6 billion in 2023, underscoring its substantial market presence.

ZF Friedrichshafen, a German company, is a key competitor, especially in driveline and chassis technology. ZF often challenges Linamar with advanced technological offerings in transmission and axle components. In 2023, ZF reported sales of over €46.6 billion, reflecting its strong position in the automotive market.

Aisin Seiki, a Japanese multinational, is a significant competitor in automatic transmissions and other automotive components. Aisin benefits from strong ties with Japanese OEMs. The company's automotive sales in fiscal year 2023 were approximately ¥4.1 trillion, demonstrating its robust market share.

These competitors challenge Linamar through economies of scale, substantial R&D budgets for next-generation technologies, and well-established global distribution networks. The shift towards EVs has intensified competition, requiring Linamar to adapt and innovate.

In the Industrial Manufacturing segment, Linamar's Skyjack competes with major players in aerial work platforms. These competitors offer similar equipment and often compete on price, product innovation, and dealer network strength. Additionally, MacDon competes in the agricultural equipment sector.

The industrial segment competition includes established leaders and emerging players. These companies often have greater brand recognition and extensive dealer networks. Understanding the competitive landscape is essential for Linamar's strategic planning. For more insights into Linamar's strategic positioning, consider exploring the Target Market of Linamar.

- JLG Industries (Oshkosh Corporation): A major player in aerial work platforms, competing on product range and dealer networks. Oshkosh Corporation reported revenues of approximately $8.9 billion in 2023.

- Genie (Terex Corporation): Another significant competitor in aerial work platforms, known for innovation and global presence. Terex's net sales in 2023 were around $4.6 billion.

- John Deere: A dominant force in agricultural equipment, competing with MacDon in harvesting equipment. John Deere's net sales and revenues for fiscal year 2023 were $61.257 billion.

- CNH Industrial (New Holland Agriculture and Case IH): A major player in agricultural machinery, offering a wide range of products and services. CNH Industrial's net sales for 2023 were $24.7 billion.

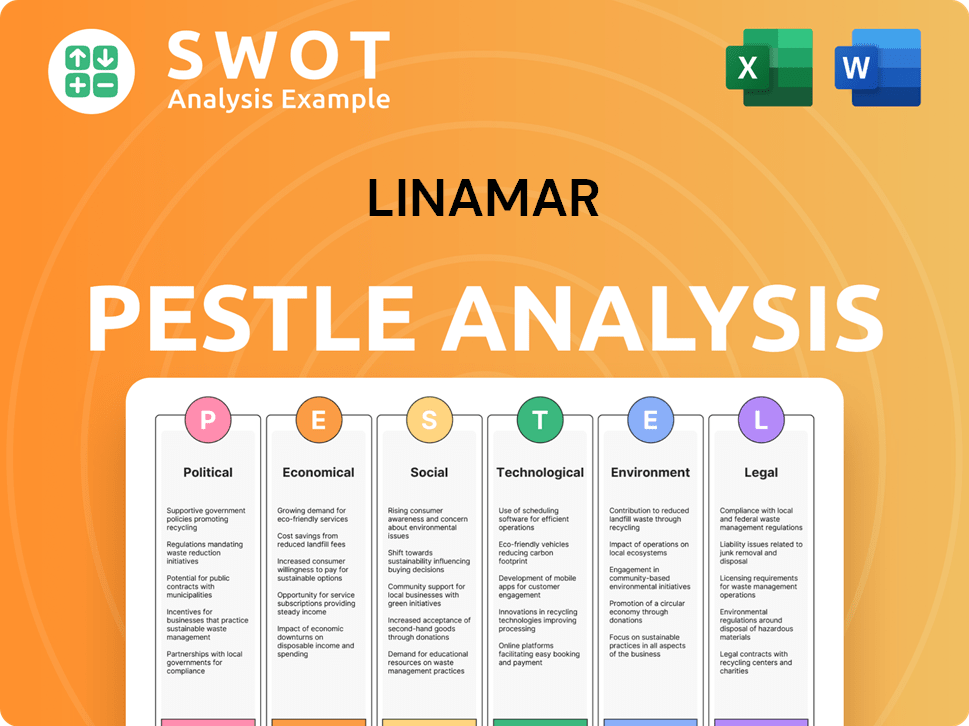

Linamar PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Linamar a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of Linamar involves a deep dive into its competitive advantages. These advantages are crucial for its success in the dynamic automotive and industrial sectors. A key factor is its vertically integrated manufacturing, which gives it significant control over its supply chain and production processes. This allows the company to maintain high quality and efficiency, setting it apart in the Linamar competitive landscape.

The company's strategic focus on innovation and its strong relationships with original equipment manufacturers (OEMs) also play a vital role. By working closely with OEMs from the design phase, it fosters long-term partnerships and secures recurring business. Furthermore, its global presence ensures localized production and delivery, allowing it to meet the specific needs of regional markets effectively. This approach helps mitigate geopolitical risks and supports its competitive positioning.

Linamar's diversification across the Mobility and Industrial Manufacturing segments provides a buffer against industry-specific downturns. This diversification ensures more stable revenue streams and enhances its financial resilience. The company's ability to adapt and innovate, particularly in the evolving electric vehicle (EV) market, underscores its commitment to maintaining its competitive edge. This adaptability is critical in the current Linamar industry environment.

Linamar's vertical integration covers precision machining, casting, forging, and assembly. This integration gives it control over the supply chain. It enhances efficiency and ensures high-quality components, critical for automotive and industrial systems. This is a core aspect of its competitive advantage.

The company invests heavily in research and development. This includes areas like EV driveline systems and advanced manufacturing processes. This investment allows the company to offer innovative solutions. It also supports its adaptability in the evolving market.

Linamar has built strong relationships with OEMs over decades. These long-term partnerships often start from the design phase. This approach secures recurring business. It also provides valuable insights into market needs.

With manufacturing facilities worldwide, Linamar offers localized production. This global presence allows it to cater to specific regional market needs. It also helps in mitigating geopolitical risks. This is a key element of its Linamar's global presence and market reach.

Linamar's success is rooted in its vertically integrated manufacturing, advanced engineering, and diversified product portfolio. Its strong customer relationships and global footprint further enhance its competitive position. The company's ability to innovate and adapt to the changing automotive landscape ensures its long-term sustainability.

- Vertical integration provides supply chain control and efficiency.

- Engineering expertise drives innovation in EV and advanced manufacturing.

- Strong customer relationships foster long-term partnerships.

- Global footprint allows for localized production and risk mitigation.

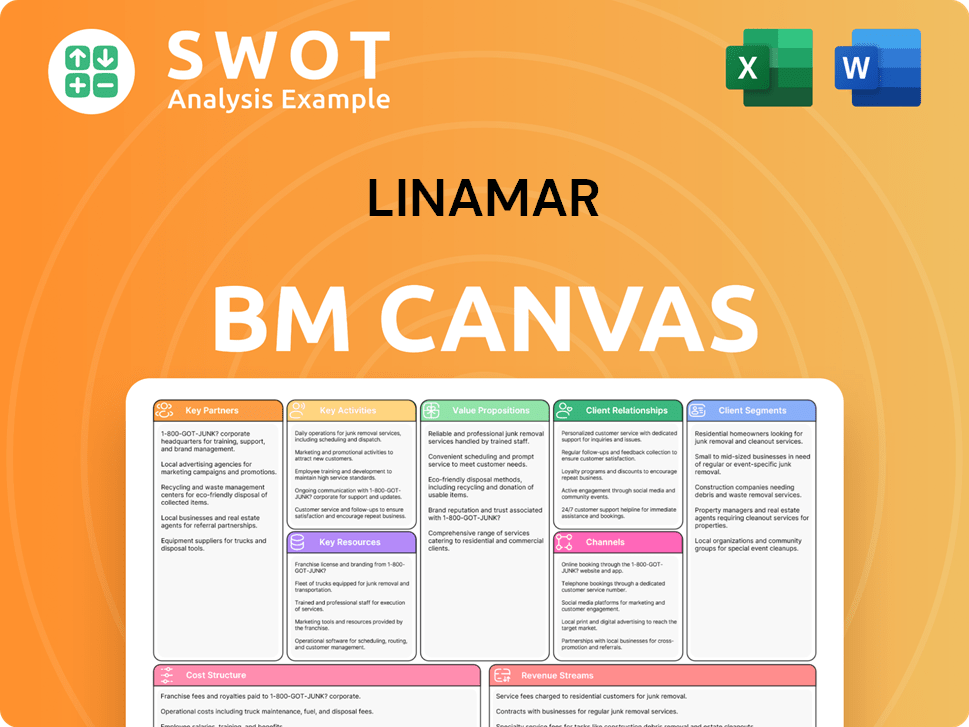

Linamar Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Linamar’s Competitive Landscape?

The Linamar competitive landscape is undergoing significant transformation, influenced by industry-wide trends and emerging challenges. The company's position is shaped by its ability to adapt to evolving market dynamics, technological advancements, and geopolitical factors. Understanding these elements is crucial for assessing Linamar's future outlook and strategic direction.

The automotive and industrial sectors, where Linamar operates, face both risks and opportunities. Increased competition, regulatory changes, and economic uncertainties create challenges. However, advancements in electric vehicles (EVs), automation, and global infrastructure development offer avenues for growth and innovation. Linamar's ability to navigate these complexities will determine its success in the coming years.

The automotive industry's shift towards vehicle electrification is a primary trend. This change impacts Linamar's product demand. Automation and robotics in manufacturing are also gaining traction, driving efficiency. Regulatory changes, like stricter emissions standards, are influencing product development and market demand.

Intense price competition from global rivals is a key challenge. Geopolitical tensions and trade protectionism could disrupt supply chains. Adapting to the rapid technological changes in the automotive sector presents ongoing hurdles. These factors could impact Linamar's financial performance.

Expanding global demand for aerial work platforms and agricultural equipment offers growth. New markets and strategic partnerships can broaden Linamar's reach. Continued investment in advanced manufacturing technologies is crucial. Adapting to customer demands, especially in sustainable solutions, is key.

Linamar is focusing on expanding its EV-related product offerings. The company is investing in automation and robotics to enhance efficiency. Diversifying its product portfolio and exploring new markets are also priorities. These strategies are essential for maintaining a strong competitive position.

Linamar's success hinges on its ability to navigate industry trends and address future challenges. The company must capitalize on opportunities for growth and innovation. Strategic investments, technological advancements, and market diversification are vital for long-term success. The company's commitment to sustainability and intelligent solutions will also play a key role.

- Market Analysis: Understanding the changing dynamics of the automotive and industrial sectors is crucial.

- Technological Innovation: Investing in advanced manufacturing technologies and sustainable solutions is essential.

- Strategic Partnerships: Forming alliances can help expand market reach and diversify product offerings.

- Financial Performance: Maintaining strong financial health and stability is critical for weathering economic uncertainties.

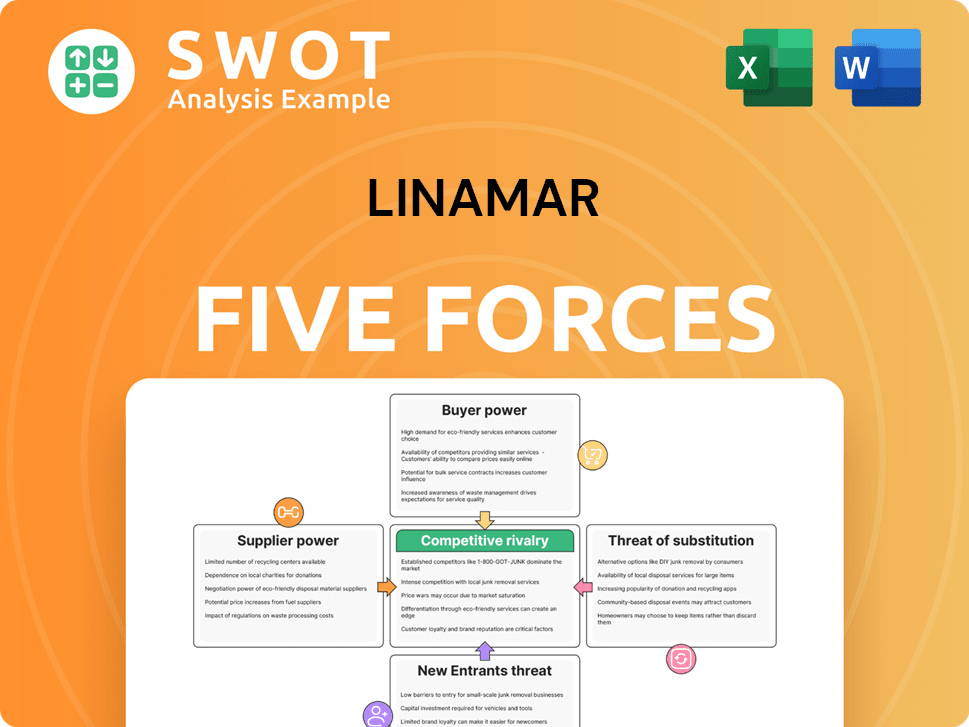

Linamar Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Linamar Company?

- What is Growth Strategy and Future Prospects of Linamar Company?

- How Does Linamar Company Work?

- What is Sales and Marketing Strategy of Linamar Company?

- What is Brief History of Linamar Company?

- Who Owns Linamar Company?

- What is Customer Demographics and Target Market of Linamar Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.