Marqeta Bundle

Who's Challenging Marqeta in the Fintech Arena?

Marqeta has revolutionized the payment processing industry with its innovative card issuing platform, but the fintech world is a battlefield. Understanding the Marqeta SWOT Analysis is crucial for grasping its position. This deep dive explores the competitive landscape, dissecting the key players vying for dominance in the embedded finance space.

As Marqeta's business model continues to evolve, a thorough Marqeta market analysis is essential to assess its strengths and weaknesses against its competitors. The analysis will cover Marqeta's main competitors 2024, examining how Marqeta differentiates itself in the face of intense Fintech competition. This exploration will also delve into Marqeta's competitive strategy, partnerships, and the impact of regulations on its future.

Where Does Marqeta’ Stand in the Current Market?

Marqeta carves out a significant niche within the global card issuing and embedded finance market. It primarily serves businesses that require highly customizable and flexible payment solutions. As a leader in the modern card issuing platform space, Marqeta offers a developer-friendly API platform. This platform allows companies to issue physical and virtual cards, manage transactions, and control spending in real-time.

The company's core operation revolves around providing a robust, scalable platform that simplifies the complexities of payment card issuing. This includes features such as real-time transaction processing, fraud prevention, and advanced analytics. Marqeta's value proposition lies in its ability to offer businesses greater control, flexibility, and speed in managing their payment programs, which is crucial in the fast-paced fintech environment.

Marqeta's business model is centered on providing its platform as a service, generating revenue through transaction fees and other value-added services. Over time, Marqeta has expanded its services to include advanced analytics and fraud prevention tools, enabling it to capture larger enterprise clients and diversify its revenue streams. For a deeper understanding of the company's origins and evolution, consider reading the Brief History of Marqeta.

Marqeta holds a strong position in the payment processing industry, particularly within the competitive fintech market. It focuses on businesses needing customizable payment solutions. This focus allows Marqeta to maintain a strong foothold in segments requiring dynamic card controls and rapid program deployment.

Marqeta differentiates itself through its developer-friendly API platform. This platform offers real-time transaction processing, fraud prevention, and advanced analytics. This allows businesses greater control, flexibility, and speed in managing their payment programs.

In Q1 2024, Marqeta reported a net revenue of $118 million. This financial performance showcases the company's substantial scale within the industry. Marqeta's focus on innovative payment solutions has helped it maintain a strong market position.

Marqeta's target market includes fintech companies, digital banks, and large enterprises. These businesses often require flexible and customizable payment solutions. The company serves customers across North America, Europe, and Asia-Pacific.

Marqeta's competitive strategy involves focusing on innovation and partnerships to expand its market reach. It continuously enhances its platform to meet the evolving needs of its clients. This includes offering advanced analytics and fraud prevention tools.

- Focus on developer-friendly APIs for easy integration.

- Expansion into new geographic markets to increase its customer base.

- Strategic partnerships to enhance service offerings and reach.

- Continuous investment in technology to stay ahead of the competition.

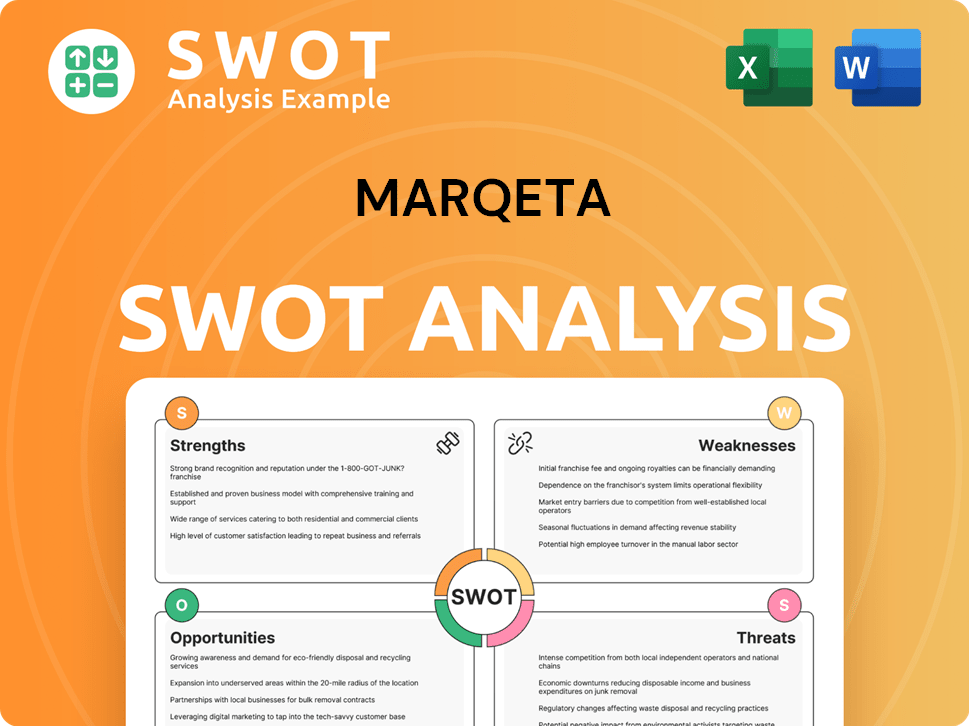

Marqeta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Marqeta?

The Marqeta competitive landscape is dynamic, shaped by both established payment processors and innovative fintech companies. Understanding Marqeta's competitors is crucial for assessing its market position and growth potential. This Marqeta market analysis reveals the key players and competitive dynamics in the card issuing space.

Marqeta's business model centers on providing a modern card issuing platform. This platform allows businesses to create and manage their own payment cards. The company's success depends on its ability to attract and retain clients by offering flexible, scalable, and customizable solutions. The payment processing industry is highly competitive, with various companies vying for market share.

Fintech competition is intensifying, influencing Marqeta's strategic decisions. The company faces both direct and indirect competition from a range of players, each with their own strengths and weaknesses. The competitive environment is also affected by mergers, acquisitions, and strategic partnerships. For more information about the company, you can read the article about Owners & Shareholders of Marqeta.

Direct competitors offer similar card issuing and program management services. They often target the same customer segments, including fintech companies and neobanks. These competitors compete for market share by offering competitive pricing, features, and customer support.

Galileo, now part of SoFi, is a major competitor. It provides an API-based platform for card issuing and program management. Galileo's strong platform and integration capabilities make it a significant player in the market. As of 2024, SoFi's focus on expanding its financial services has strengthened Galileo's position.

Stripe has expanded into card issuing, leveraging its extensive developer network. Stripe's existing client base and brand recognition give it a competitive edge. Stripe's card issuing services are integrated into its broader payment platform, offering a comprehensive solution.

Adyen provides card issuing capabilities, especially for large enterprises. Adyen's integrated payment solutions across various channels are a key differentiator. Adyen's focus on enterprise clients and global reach makes it a formidable competitor.

Indirect competitors include traditional banks and legacy payment infrastructure providers. These entities are attempting to modernize their offerings. New entrants focusing on specific niches also pose potential challenges. These companies may offer different value propositions or target unique market segments.

Traditional banks and legacy providers are slowly modernizing their payment infrastructure. They have established customer relationships and significant resources. Their ability to adapt and offer competitive solutions is a key factor in the market. These providers often face challenges in terms of agility and innovation.

Marqeta's ability to offer comprehensive, scalable, and customizable solutions is a critical differentiator. The company's focus on innovation and its platform's flexibility allows it to meet the evolving needs of its clients. Marqeta's competitive strategy involves securing large enterprise contracts and attracting innovative fintech startups.

- API-First Platform: Marqeta's platform is built with APIs, which allows for greater flexibility and customization.

- Scalability: The platform is designed to handle large transaction volumes, making it suitable for growing businesses.

- Customization: Marqeta offers a high degree of customization to meet the specific needs of its clients.

- Focus on Fintech: Marqeta has a strong focus on serving fintech companies and neobanks.

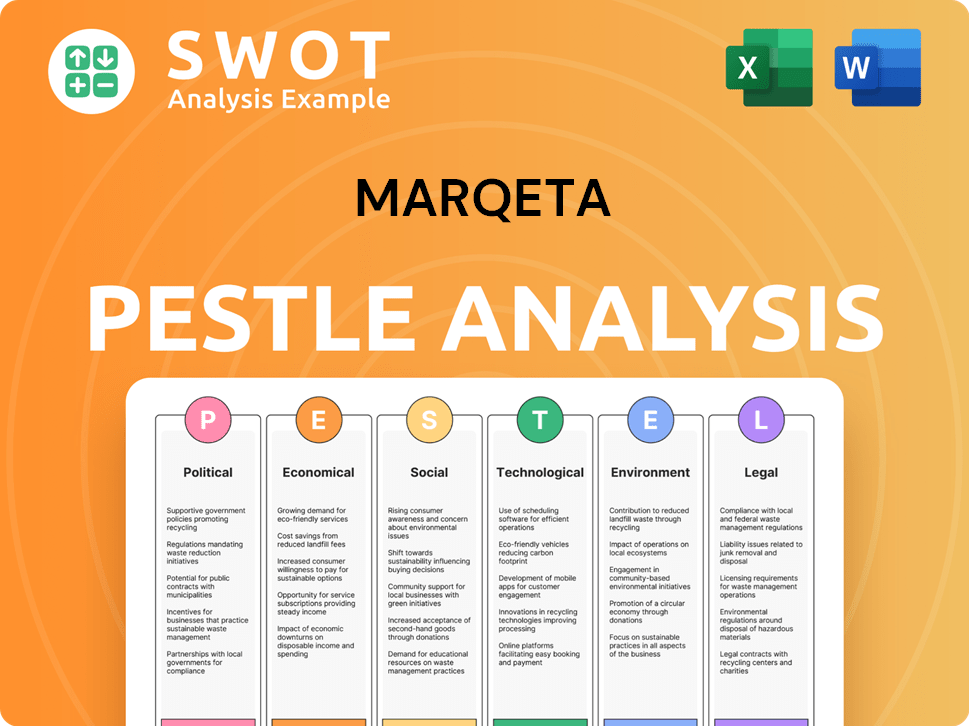

Marqeta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Marqeta a Competitive Edge Over Its Rivals?

Understanding the Marqeta competitive landscape involves recognizing its core strengths in the payment processing industry. The company's success is rooted in its proprietary technology and developer-focused approach to card issuing. This has allowed it to carve out a significant niche within the rapidly evolving fintech competition.

Marqeta's market analysis reveals a company that has consistently innovated, leveraging its open API platform to offer flexibility and customization in payment solutions. This technological prowess enables it to support complex use cases, setting it apart from traditional card issuing platforms. Furthermore, Marqeta's focus on real-time transaction processing and dynamic spending controls provides a significant barrier to entry for competitors.

The company's strategy has evolved from empowering developers to enabling embedded finance, and it continues to enhance its platform to meet evolving market demands. This has allowed it to establish strong brand equity within the fintech ecosystem, recognized for its innovation and reliability. For a deeper dive into how Marqeta operates, you can explore the Revenue Streams & Business Model of Marqeta.

Marqeta's open API platform allows for highly customized payment experiences. This flexibility enables rapid deployment of new card programs. Its real-time transaction processing capabilities provide a significant advantage in the market.

The company's focus on developers fosters innovation and rapid integration. This approach helps Marqeta attract and retain a wide array of clients. This is a key differentiator in the fintech market.

Marqeta has cultivated a strong brand reputation within the fintech ecosystem. It is recognized for its innovation and reliability. This reputation helps in attracting and retaining clients.

The company's infrastructure is designed to handle high transaction volumes. This scalability supports global operations. This is crucial for serving large clients.

Marqeta's competitive strategy includes continuous investment in research and development to maintain its technological edge. While the company has a substantial lead, the threat of imitation from well-funded competitors and the rapid pace of innovation in fintech necessitates this ongoing investment. The company's ability to handle high transaction volumes and support global operations is a key advantage. In 2024, the payment processing industry saw significant growth, with companies like Marqeta adapting to changing consumer behaviors and technological advancements. Marqeta's focus on innovation and developer-friendly solutions positions it well in the competitive landscape.

Marqeta's primary advantages include its advanced technology, developer-centric approach, and strong brand recognition. The company's open API platform allows for customized payment solutions, setting it apart from traditional providers. Its focus on real-time transaction processing and dynamic spending controls provides a significant competitive edge.

- Open API Platform: Enables customization and rapid deployment.

- Real-Time Processing: Provides immediate transaction insights.

- Developer-Focused Approach: Fosters innovation and integration.

- Scalable Infrastructure: Supports high transaction volumes and global operations.

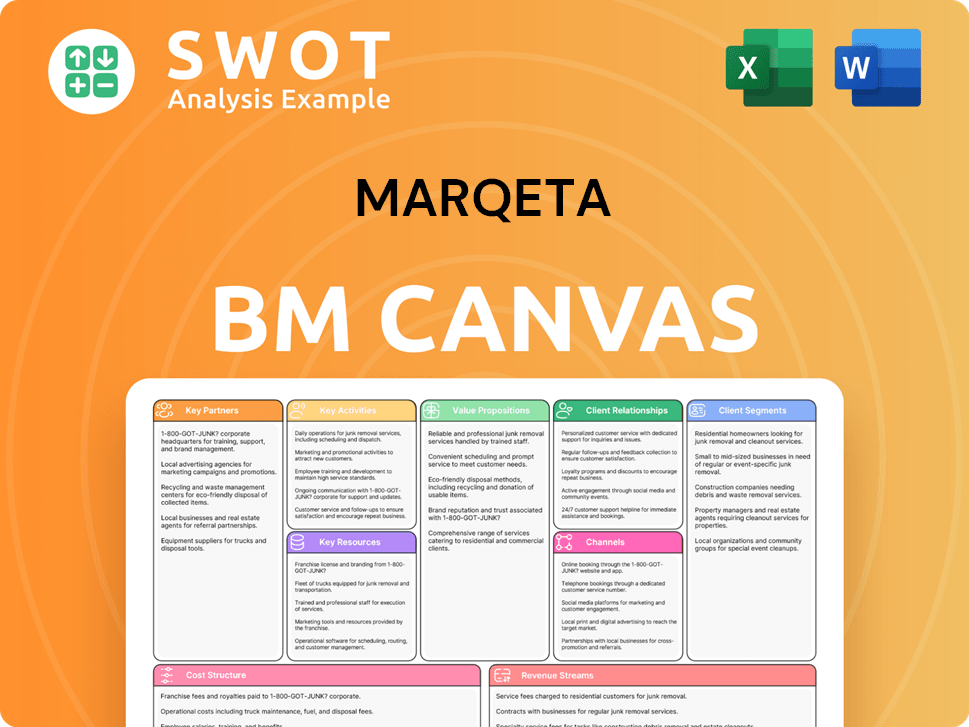

Marqeta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Marqeta’s Competitive Landscape?

Analyzing the Marqeta competitive landscape reveals a dynamic environment shaped by industry trends, challenges, and opportunities. The company's position is influenced by the rapid growth of embedded finance and the evolving payment processing industry. Understanding the interplay of these factors is crucial for assessing Marqeta's future prospects and potential for sustained growth.

The Marqeta market analysis indicates that the company faces both internal and external pressures. While technological advancements and strategic partnerships offer avenues for expansion, increased competition and regulatory changes present significant hurdles. A deep dive into these elements is essential for understanding Marqeta's resilience and its ability to navigate the fintech competition.

The payment processing industry is experiencing significant shifts. The rise of embedded finance, where financial services are integrated into non-financial platforms, is a major trend. AI and machine learning are also transforming fraud detection and customer experiences. Regulatory changes, such as open banking initiatives, are also reshaping the landscape.

Marqeta's competitors include large tech companies and specialized fintechs. Declining demand in certain sectors and increased regulatory scrutiny pose potential risks. Maintaining market share and adapting to evolving consumer expectations are ongoing challenges. The need for continuous innovation and strategic partnerships is critical.

Emerging markets present significant growth opportunities for digital payments. Product innovation, such as expanding into new payment rails, can unlock new revenue streams. Strategic partnerships with financial institutions and businesses are crucial. The company's agility and adaptability are key to long-term success.

Marqeta's competitive strategy involves focusing on its core strengths in card issuing and payment processing. Differentiating through technology and customer service is essential. Building a strong ecosystem of partners and adapting to market changes will be key. Further insights can be found in the Marketing Strategy of Marqeta.

Several factors will shape Marqeta's future. These include the ability to navigate fintech competition, capitalize on emerging market opportunities, and adapt to regulatory changes. The company's success will depend on its ability to innovate and maintain strong partnerships.

- Expansion into new geographic markets, particularly in Asia-Pacific, where digital payments are rapidly growing (projected to reach $1.6 trillion by 2027).

- Development of new products and services, such as enhanced fraud detection tools and expanded support for different payment types.

- Strategic partnerships with major financial institutions and technology providers to increase market reach and technological capabilities.

- Investment in AI and machine learning to improve payment processing efficiency and customer experience, aiming for a reduction in fraud rates by up to 30%.

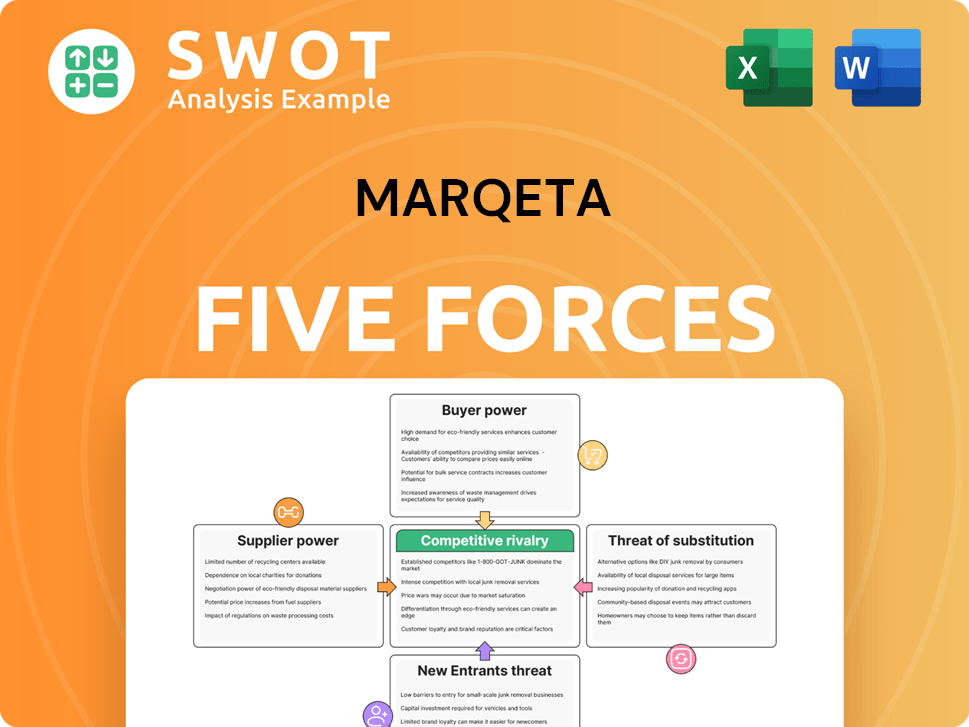

Marqeta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Marqeta Company?

- What is Growth Strategy and Future Prospects of Marqeta Company?

- How Does Marqeta Company Work?

- What is Sales and Marketing Strategy of Marqeta Company?

- What is Brief History of Marqeta Company?

- Who Owns Marqeta Company?

- What is Customer Demographics and Target Market of Marqeta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.