Mirae Asset Financial Group Bundle

Can Mirae Asset Financial Group Maintain Its Ascent in the Global Financial Arena?

Mirae Asset Financial Group, a titan in the financial services sector, has steadily expanded its global footprint since its inception in 1997. From its roots in South Korea, the company has transformed into a multinational powerhouse, managing trillions of won in assets. This success is a testament to its innovative investment strategies and forward-thinking approach to the market.

Understanding the Mirae Asset Financial Group SWOT Analysis is crucial to understanding its market position. This analysis will dissect the competitive landscape of Mirae Asset, examining its industry rivals and evaluating its financial performance. We'll explore Mirae Asset's competitive advantages, recent acquisitions, and growth potential, providing a comprehensive financial company analysis to inform your investment decisions.

Where Does Mirae Asset Financial Group’ Stand in the Current Market?

Mirae Asset Financial Group has established a strong market position within the global financial services sector. The company's core operations include asset management, investment banking, securities brokerage, and life insurance services. These services cater to a diverse clientele, including individuals, corporations, and institutions worldwide, reflecting its broad value proposition.

The company's focus on global diversification and digital transformation has been a key strategy, as evidenced by its strategic acquisitions and expansion into various international markets. This approach has allowed it to strengthen its global footprint and enhance its competitive advantages within the financial services sector. The firm's financial performance in 2024 further underscores its market position.

Mirae Asset Global Investments ranked as the world's 12th-largest exchange-traded fund (ETF) manager as of late 2024. The company managed over 200 trillion won ($141 billion) in net asset value (NAV) across 624 ETFs in 13 countries. Its total assets under management (AUM) reached 403 trillion won ($288 billion) by May 2025, with 45% (181 trillion won) managed in international markets.

In South Korea, the firm's TIGER ETFs held a 36% market share as of November 2024. This strong domestic presence is a testament to its competitive advantages. Mirae Asset's industry ranking has been consistently high, reflecting its strong performance and strategic initiatives.

Mirae Asset operates in 19 regions across 14 countries on five continents. Recent acquisitions, such as ShareKhan in India (2024), and Global X ETFs in 2018, have bolstered its international competitiveness. These moves have significantly expanded its global reach.

Mirae Asset Securities reported a 217% surge in pre-tax profit to 1.18 trillion won ($802 million) in 2024. Net profit rose by 168% to 893.7 billion won, and revenue increased by 9% to 22.27 trillion won. Consolidated equity capital reached 12.2 trillion won in 2024.

The company's investment strategies focus on global diversification, digital transformation, and strategic acquisitions. These strategies have fueled its growth potential. For more details on their approach, see this article about Marketing Strategy of Mirae Asset Financial Group.

Mirae Asset's strengths include a strong global presence, robust financial performance, and strategic acquisitions. These factors contribute to its competitive advantages in the financial services sector. The company's ability to adapt and expand internationally has been crucial.

- Strong ETF market share in South Korea.

- Significant assets under management (AUM) globally.

- Strategic acquisitions to expand international footprint.

- Consistent financial growth and profitability.

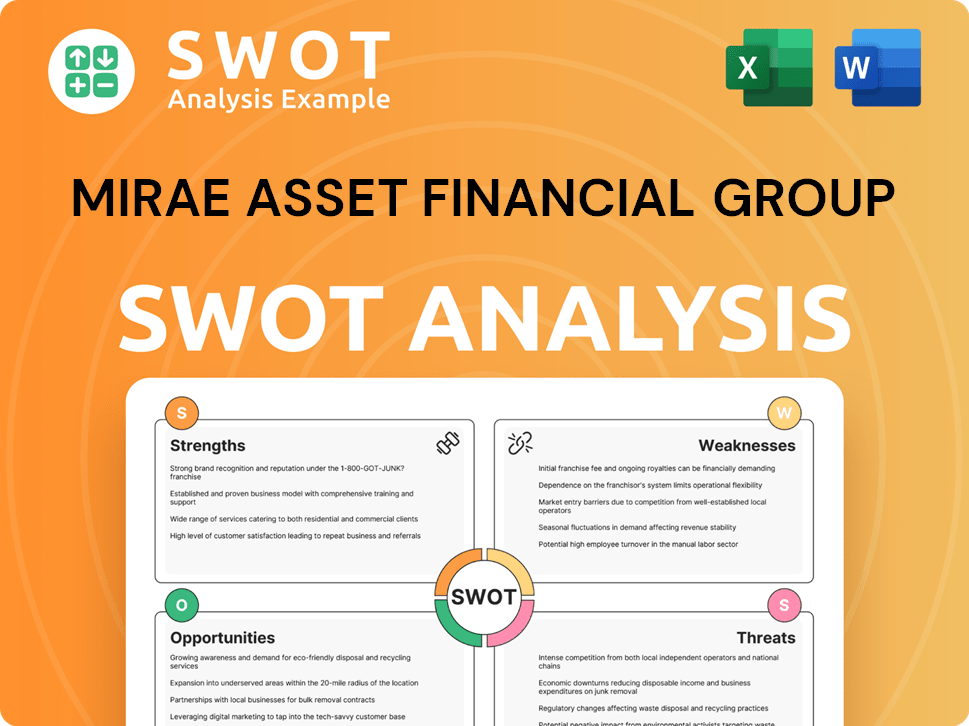

Mirae Asset Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Mirae Asset Financial Group?

The Owners & Shareholders of Mirae Asset Financial Group operates within a dynamic and competitive global financial services market. This financial company analysis reveals a landscape shaped by both direct and indirect competitors across its various business segments. Understanding the competitive dynamics is crucial for assessing its market position and future growth potential.

Mirae Asset faces competition in asset management, securities brokerage, and investment banking. The competitive landscape includes established global players and emerging firms. Its strategy involves both organic growth and strategic acquisitions to strengthen its market share and expand its product offerings.

The competitive environment is also influenced by technological advancements and evolving consumer preferences. This includes the rise of robo-advisors, which presents both a challenge and an opportunity for firms like Mirae Asset. The company's ability to adapt and innovate will be key to its success.

In the asset management sector, Mirae Asset competes with major global players. Key competitors include S&P Global, Bank of America, and FIS. Other notable rivals are Mitterbauer Beteiligungs, GIC, Franklin Templeton, and Dimensional Fund Advisors.

Mirae Asset is a significant player in the ETF market. It competes with global asset managers offering similar passive investment products. Domestically in Korea, Mirae Asset Global Investments surpassed Samsung Asset Management in ETF revenue in early 2025.

In securities brokerage and investment banking, Mirae Asset competes with large domestic financial groups in South Korea. The acquisition of KDB Daewoo Securities strengthened its market position. Globally, it competes with established brokerage firms in markets like India.

The rise of robo-advisors presents a new competitive frontier. The global robo-advisory market is projected to reach $2.06 trillion in assets under management by 2025. Mirae Asset is addressing this through AI business units and acquisitions.

Mergers and acquisitions are a common competitive tactic. Mirae Asset's aggressive M&A strategy allows it to expand its market reach and consolidate its offerings. This is a key element of its growth strategy.

Mirae Asset's global presence is expanding, putting it in direct competition with local and international firms. Its entry into markets like India through acquisitions, such as ShareKhan in 2024, exemplifies this expansion.

Several factors influence Mirae Asset's competitive position. These include product innovation, global presence, and strategic acquisitions. Understanding these factors helps in comparing Mirae Asset to its competitors.

- Market Share: Analyzing Mirae Asset's market share in various segments.

- Product Offerings: Comparing its product offerings with those of competitors.

- Financial Performance: Assessing its financial performance relative to industry rivals.

- Growth Strategies: Evaluating its growth strategies, including M&A and global expansion.

- Technological Adoption: Assessing its adoption of new technologies, like robo-advisors.

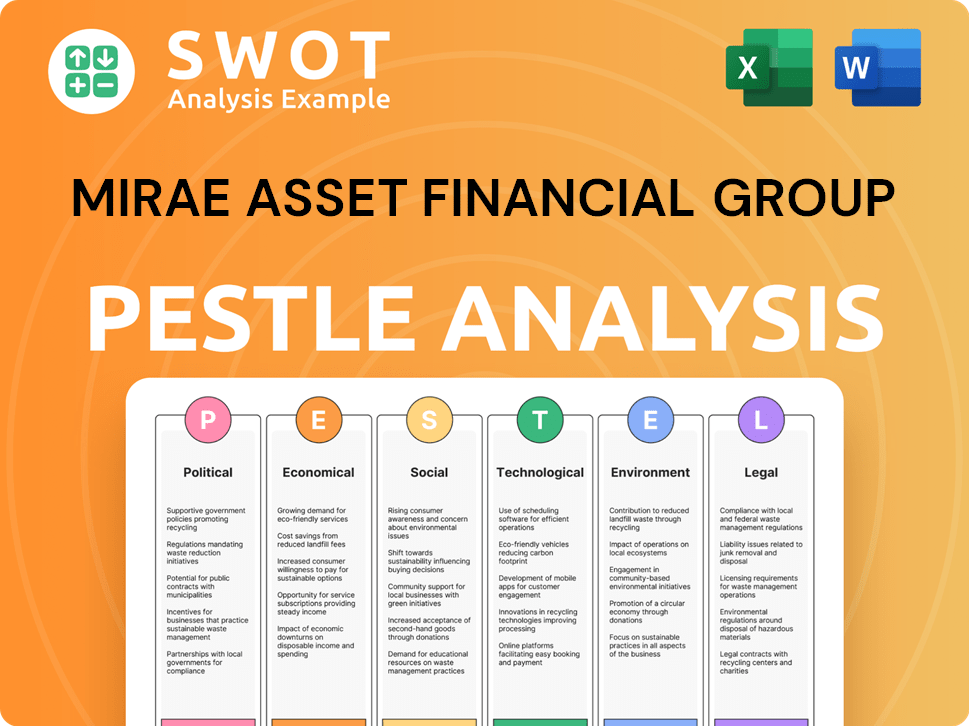

Mirae Asset Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Mirae Asset Financial Group a Competitive Edge Over Its Rivals?

Analyzing the competitive landscape, Mirae Asset Financial Group distinguishes itself through strategic moves and a robust global footprint. The company's expansion, particularly via acquisitions, has been a cornerstone of its growth strategy. This approach, coupled with a focus on innovation and technology, positions Mirae Asset favorably within the financial services sector.

Mirae Asset's commitment to long-term investment strategies and technological integration further enhances its market position. The firm's ability to identify and capitalize on emerging market opportunities, along with its forward-thinking approach to product development, sets it apart from industry rivals. This focus is crucial for maintaining a competitive edge in the dynamic financial world.

The company's "clients first" philosophy and strong brand equity also contribute to its competitive advantages. These factors, combined with a culture of continuous innovation, foster customer loyalty and support sustainable growth. For a deeper dive into the firm's target audience, consider exploring Target Market of Mirae Asset Financial Group.

Mirae Asset has a significant global presence, with 47 overseas subsidiaries and offices across 19 regions. This extensive network provides access to diverse investment opportunities. The company's aggressive M&A strategy, with 7 acquisitions averaging $111 million each by April 2025, has fueled its international expansion.

Mirae Asset is a leader in the ETF market, offering 624 ETFs across 13 countries. As of November 2024, the firm managed $141 billion in NAV. The launch of the world's first passive target-date ETF in March 2025 highlights its commitment to innovative financial products.

Mirae Asset integrates AI into its operations, launching robo-advisors for pension services in 2022. The planned establishment of WealthSpot, a dedicated AI business unit in New York City, by late 2024, underscores its focus on AI-driven solutions. This focus enhances client services and portfolio efficiency.

The firm's foresight and emphasis on long-term investment strategies are key. Mirae Asset made early investments in ventures like SpaceX and X (formerly Twitter) between 2022 and 2023. This strategic vision is a core strength in the competitive landscape.

Mirae Asset's competitive advantages stem from its global diversification, product innovation, and technological integration. The company's expansive global network, coupled with its focus on long-term investment strategies, provides a strong foundation for future growth. These strengths are crucial in the financial services sector.

- Extensive global network through strategic acquisitions.

- Leadership in the ETF market with innovative product offerings.

- Integration of AI to enhance client services and portfolio management.

- Commitment to long-term investment strategies and identifying growth opportunities.

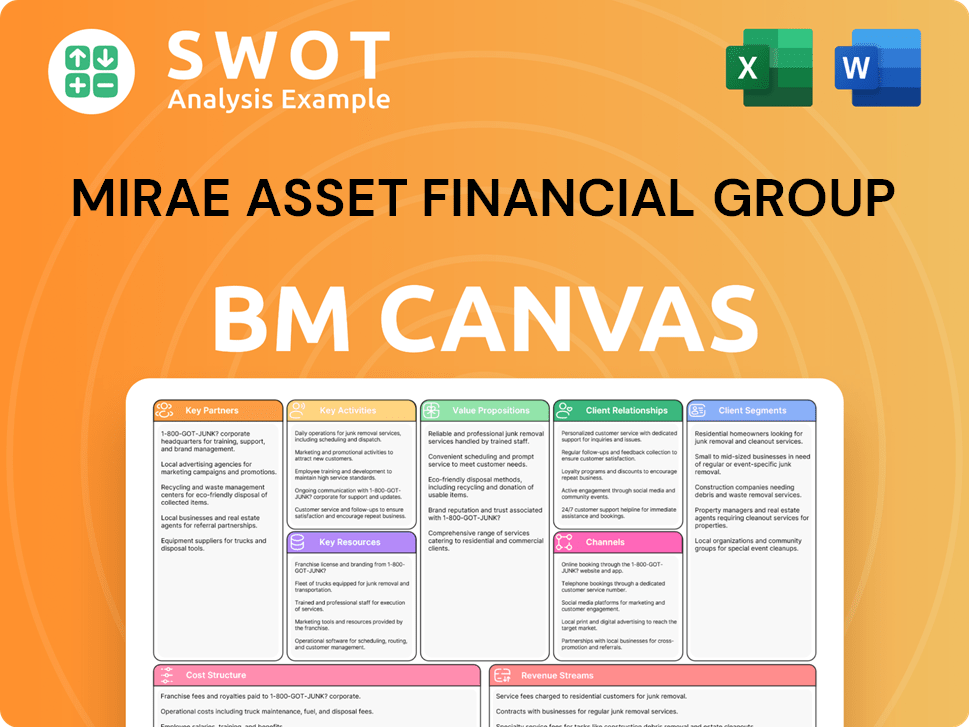

Mirae Asset Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Mirae Asset Financial Group’s Competitive Landscape?

The global financial services sector is undergoing significant transformation, with technological advancements, regulatory changes, and shifting consumer preferences reshaping the competitive landscape for companies like Mirae Asset Financial Group. Understanding these trends is crucial for assessing Mirae Asset's market position, identifying potential risks, and evaluating its future outlook. This analysis will delve into the key industry trends, challenges, and opportunities that will shape the company's performance.

The financial company analysis of Mirae Asset reveals a proactive approach to these changes, with strategic moves aimed at strengthening its competitive advantages. The company's focus on digitalization, global expansion, and innovative product offerings positions it to navigate the evolving financial services sector. However, it also faces challenges from increasing competition and market volatility, necessitating a robust and adaptable strategy.

Digital transformation is a key trend, with the robo-advisory market projected to reach $2.06 trillion in assets under management by 2025, growing at an annual rate of 3.66% through 2029. Mirae Asset is actively embracing AI, establishing AI business units like WealthSpot and acquiring robo-advisor firms. The launch of its first AI-driven investment product in the first half of 2025 exemplifies its commitment to innovation and enhancing client services.

Regulatory changes and geopolitical issues, such as US trade policies and central bank rate trajectories, significantly impact financial markets. China's economic challenges also present investment complexities. Mirae Asset is responding by introducing China-focused investment products and educating investors, demonstrating its adaptability to navigate these challenges.

Opportunities for growth lie in emerging markets and global diversification. Mirae Asset's interest in undervalued markets like China and strategic acquisitions in India with ShareKhan highlight its pursuit of new growth avenues. Expanding into the global pension market and rolling out diverse businesses like REITs and venture capital also support its growth strategy.

The competitive landscape includes traditional financial institutions and new fintech players, with market volatility and sector-specific demand declines posing threats. Mirae Asset's strategy of permanent innovation, developing unique offerings, and leveraging its global network allows it to remain resilient. This is further elaborated in the Growth Strategy of Mirae Asset Financial Group.

Mirae Asset's competitive advantages are rooted in its strategic investments in technology, strategic acquisitions, and a focus on delivering globally diversified and innovative financial solutions. The company's ability to adapt to market changes and its commitment to long-term investment strategies are key to its success. The focus on a bottom-up fundamental analysis approach will be crucial in navigating market volatility and identifying sustainable competitive advantages.

- Embracing AI and Digital Transformation

- Strategic Global Expansion

- Diversified Product Offerings

- Focus on Long-Term Investment Strategies

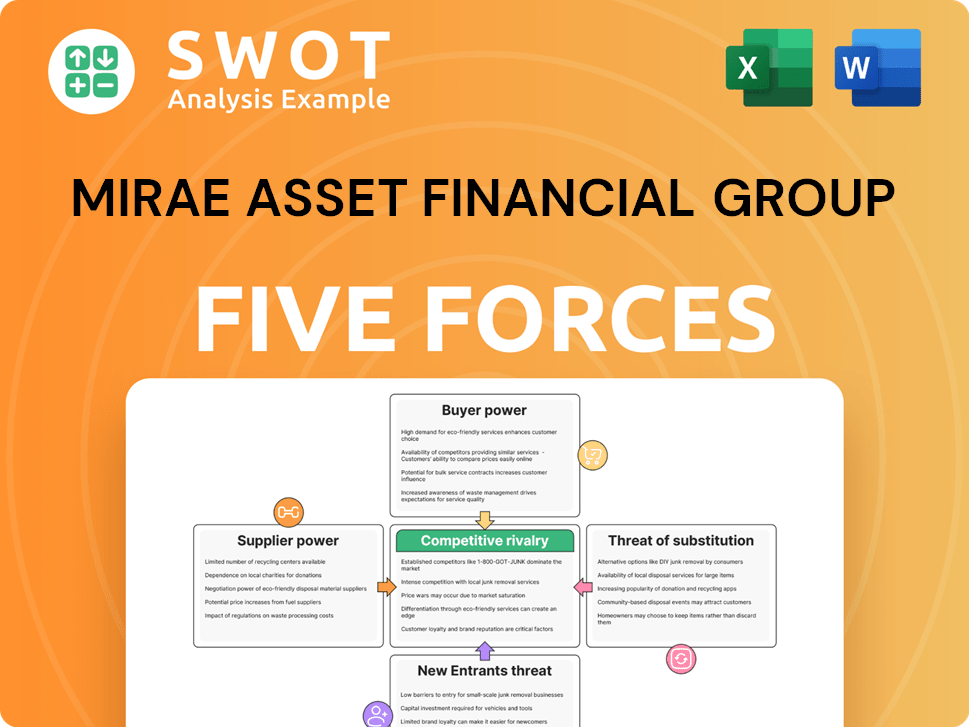

Mirae Asset Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mirae Asset Financial Group Company?

- What is Growth Strategy and Future Prospects of Mirae Asset Financial Group Company?

- How Does Mirae Asset Financial Group Company Work?

- What is Sales and Marketing Strategy of Mirae Asset Financial Group Company?

- What is Brief History of Mirae Asset Financial Group Company?

- Who Owns Mirae Asset Financial Group Company?

- What is Customer Demographics and Target Market of Mirae Asset Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.