Publix Super Markets Bundle

Can Publix Super Markets Maintain Its Dominance?

In the dynamic world of grocery retail, understanding the Publix Super Markets SWOT Analysis is crucial. Publix, a stalwart in the supermarket industry, faces constant challenges from evolving consumer demands and aggressive Publix competitors. This analysis dives deep into the Publix competitive landscape, exploring its strategies and market positioning.

This exploration of Publix's competitive environment will provide a comprehensive understanding of its strengths, weaknesses, opportunities, and threats. We'll analyze Publix's market share against rivals like Kroger and Whole Foods, examining its unique customer service model and employee ownership structure. Furthermore, we'll assess how Publix adapts to the rise of online grocery shopping and the impact of discounters like Aldi, offering actionable insights for investors and industry observers alike.

Where Does Publix Super Markets’ Stand in the Current Market?

Publix Super Markets maintains a strong market position, especially in the Southeastern United States. The company's core operations revolve around providing a wide range of grocery products, including fresh produce, meats, dairy, baked goods, and prepared foods, alongside pharmacy services and general merchandise. This focus on quality products and a pleasant shopping experience is central to its value proposition.

Publix differentiates itself from budget-oriented competitors by prioritizing a full-service supermarket model. This includes a strong emphasis on customer service and a pleasant in-store environment. The company has also invested in digital transformation, such as online ordering and delivery, but its primary strategy remains focused on its physical stores and customer relationships.

Publix often holds a dominant market share in its core operating states, such as Florida, Georgia, and Alabama. This regional dominance is a key factor in its competitive advantage. The company's strong presence and customer loyalty contribute to its robust financial performance.

In 2023, Publix reported sales of $57.1 billion, a 4.7% increase from $54.5 billion in 2022. Net earnings for 2023 were $4.3 billion, a decrease from $4.8 billion in 2022. This financial health allows for strategic investments and expansions.

Publix's employee ownership model is a significant differentiator, contributing to its strong financial performance and high customer satisfaction. This model fosters a culture of dedication and customer focus, setting it apart from many competitors. This model also affects Target Market of Publix Super Markets.

The company has been steadily expanding its presence in neighboring states, solidifying its regional dominance. Its strategy focuses on providing quality products and excellent customer service. This approach has allowed it to maintain a strong position in the competitive grocery market.

Publix's competitive advantages include its strong regional presence, employee ownership model, and focus on customer service. These factors contribute to its ability to maintain a significant market share and differentiate itself from competitors.

- Strong regional presence, especially in the Southeast.

- Employee ownership model fostering customer focus.

- Emphasis on quality products and excellent customer service.

- Consistent revenue growth and profitability.

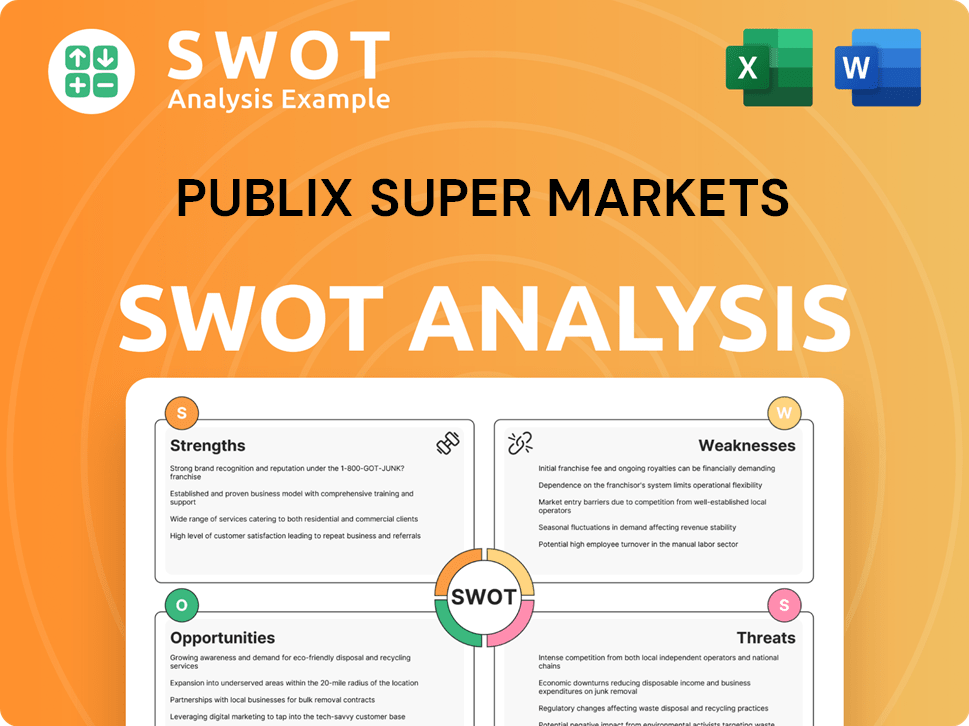

Publix Super Markets SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Publix Super Markets?

The Publix competitive landscape is shaped by a diverse mix of rivals, from established supermarket chains to emerging discount retailers and online grocery services. These competitors vie for market share, customer loyalty, and operational efficiency within the retail food market. Understanding these dynamics is crucial for analyzing Publix's strategic positioning and future prospects.

Publix's main rivals include traditional grocery stores like Walmart and Kroger, which compete on scale and price. Additionally, the rise of discount grocers such as Aldi and Lidl presents a challenge, emphasizing value and efficiency. The supermarket industry analysis reveals a complex environment where Publix must constantly adapt to maintain its competitive edge.

Online grocery services and warehouse clubs also influence the competitive landscape. These players offer alternative shopping experiences, requiring Publix to invest in digital infrastructure and consider new strategies. The competitive advantages of Publix in the grocery market are often centered on customer service and high-quality products.

Direct competitors include traditional supermarket chains. Walmart, Kroger, and Ahold Delhaize (Food Lion, Hannaford) are key players. These companies compete directly with Publix for customer spending.

Discount retailers like Aldi and Lidl are rapidly expanding. They attract price-sensitive consumers with limited assortments. This expansion directly impacts Publix's market share, particularly in the Southeast.

Warehouse clubs such as Costco and Sam's Club also pose indirect competition. They offer bulk products at competitive prices. These clubs appeal to consumers with different shopping missions.

Online grocery services like Amazon Fresh and Instacart intensify competition. They challenge traditional brick-and-mortar sales. This requires significant investment in digital infrastructure.

High-profile 'battles' often manifest as pricing wars and enhancements to loyalty programs. These strategies are used to attract and retain customers. Publix continuously adjusts its strategies to stay competitive.

Accelerated store expansion in key growth markets is a common strategy. The continued expansion of Aldi and Lidl in the Southeast directly impacts Publix's market share. Publix focuses on service and quality differentiators.

The competitive landscape is influenced by pricing strategies, loyalty programs, and store expansion. Publix's customer loyalty compared to other supermarkets is a key differentiator. The impact of Aldi on Publix market share is significant.

- Pricing Strategies: Walmart's aggressive pricing puts pressure on all competitors.

- Loyalty Programs: Kroger's loyalty program offers personalized deals, impacting customer retention.

- Store Expansion: Aldi and Lidl's rapid expansion in the Southeast challenges Publix.

- Private Label Brands: Publix's private label brands compete with national brands.

- E-commerce: Investment in online grocery delivery is crucial for staying competitive.

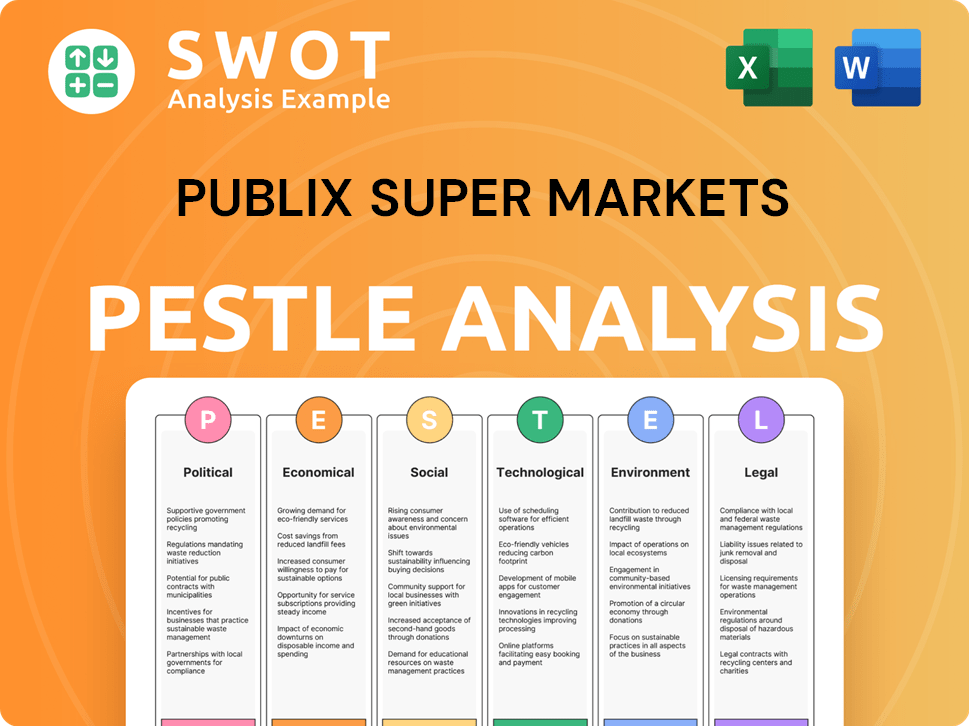

Publix Super Markets PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Publix Super Markets a Competitive Edge Over Its Rivals?

The Owners & Shareholders of Publix Super Markets Company, distinguishes itself in the fiercely competitive grocery market through several key advantages. These strengths have allowed it to maintain a strong position despite facing aggressive competition from both traditional supermarkets and emerging online retailers. Understanding these advantages is crucial for anyone analyzing the Publix competitive landscape.

One of the most significant differentiators is its unique employee-ownership model. This structure fosters a culture of exceptional customer service, as employees are also shareholders, directly benefiting from the company's success. This leads to high employee morale and a consistently positive shopping experience, a key factor in customer loyalty. Publix's strong brand equity, built on decades of consistent quality and a reputation for fresh products, further solidifies its market position.

Furthermore, Publix benefits from economies of scale within its regional footprint, enabling efficient procurement and distribution. Its focus on prepared foods and in-store bakeries provides a distinct offering that many competitors struggle to replicate. These advantages have evolved over time, with Publix consistently investing in employee training and store aesthetics to maintain its high standards.

The employee-ownership model at Publix is a core competitive advantage. This structure incentivizes employees to provide excellent customer service, leading to higher customer satisfaction. This model also contributes to lower employee turnover rates compared to some competitors.

Publix has built a strong brand reputation over decades. This reputation is based on consistent quality, cleanliness, and a focus on fresh products. This strong brand loyalty acts as a significant barrier to entry for new competitors.

Publix benefits from economies of scale within its regional footprint. This allows for efficient procurement and distribution networks, ensuring consistent product availability and freshness. The company's supply chain is a key strength.

Publix's focus on prepared foods and in-store bakeries provides a distinct offering. These offerings differentiate Publix from competitors and cater to customer demand for convenience. This is a key factor in the supermarket industry analysis.

Publix's competitive advantages are multi-faceted, contributing to its sustained success in the retail food market. These advantages help Publix compete effectively against a diverse range of rivals.

- Employee Ownership: Fosters a customer-centric culture and high employee engagement.

- Strong Brand Loyalty: Built on decades of consistent quality and service.

- Efficient Operations: Enables competitive pricing and product availability.

- Differentiated Offerings: Prepared foods and in-store bakeries enhance the shopping experience.

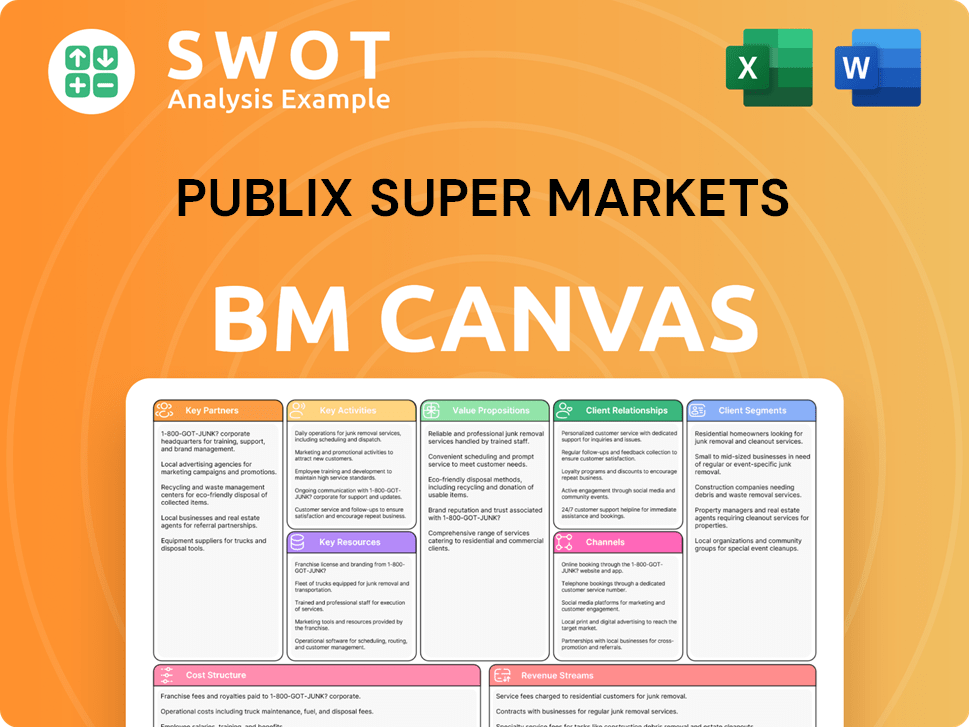

Publix Super Markets Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Publix Super Markets’s Competitive Landscape?

The grocery industry is currently experiencing significant shifts, driven by e-commerce growth, evolving consumer preferences for convenience and health, and inflationary pressures. These trends are reshaping the competitive landscape for all players, including Publix. The ability to adapt to these changes will be crucial for maintaining and growing market share. Understanding the dynamics of the Publix competitive landscape is essential for strategic planning and investment decisions.

Technological advancements, particularly in automation and data analytics, are influencing supply chains and store operations. Regulatory changes concerning food safety and sustainability are also impacting business practices. For Publix, this means a continuous need to balance its traditional in-store experience with the growing demand for online grocery shopping and delivery. The supermarket industry analysis reveals a complex environment where various factors influence success.

E-commerce continues to expand, with online grocery sales projected to reach significant figures in the coming years. Consumer demand for healthier and more convenient options is rising. Inflationary pressures impact consumer spending, potentially shifting preferences towards lower-cost alternatives. These trends are shaping the future of the retail food market.

Intense competition from online grocery retailers and established mass retailers with strong online platforms poses a threat. Inflation can affect consumer spending habits. Maintaining customer loyalty and brand reputation in a dynamic market is crucial. The competitive advantages of Publix must be continuously evaluated.

Expanding organic, natural, and specialty food offerings can capture growing consumer interest in health and wellness. Strategic partnerships could enhance e-commerce and delivery services. Leveraging a strong brand and loyal customer base supports growth in existing and new markets. Analyzing Publix market share vs Kroger and other competitors is vital.

Continued investment in an omnichannel strategy is essential. Leveraging brand strength and customer service will be critical for resilience. Monitoring competitor activities and market trends is crucial for adapting strategies. Publix's expansion plans and competitive threats must be constantly assessed.

To thrive in the evolving grocery market, Publix must focus on several key areas. This includes enhancing its digital presence, optimizing supply chain efficiencies, and responding effectively to changing consumer demands. Publix's financial performance compared to competitors will be a key indicator of its success.

- Strengthening E-commerce Capabilities: Investing in user-friendly online platforms and efficient delivery services.

- Expanding Product Offerings: Growing the selection of organic, natural, and specialty foods to meet consumer preferences.

- Enhancing Customer Experience: Maintaining exceptional customer service and store environments to foster loyalty.

- Strategic Partnerships: Collaborating with technology providers to improve operations and customer engagement.

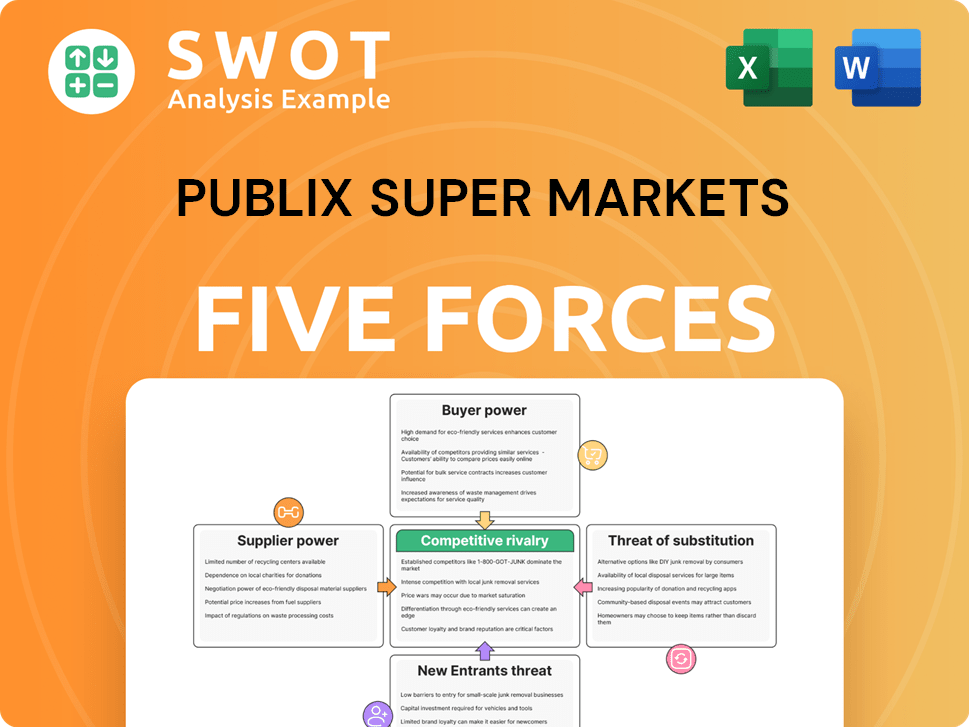

Publix Super Markets Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Publix Super Markets Company?

- What is Growth Strategy and Future Prospects of Publix Super Markets Company?

- How Does Publix Super Markets Company Work?

- What is Sales and Marketing Strategy of Publix Super Markets Company?

- What is Brief History of Publix Super Markets Company?

- Who Owns Publix Super Markets Company?

- What is Customer Demographics and Target Market of Publix Super Markets Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.