Rio Tinto Bundle

Can Rio Tinto Maintain Its Mining Dominance?

The global mining industry is undergoing a dramatic transformation, fueled by the need for critical minerals and sustainable practices. As a leading player, Rio Tinto faces both incredible opportunities and significant challenges. Founded in 1873, the company has evolved from a copper miner to a global powerhouse. This article explores the Rio Tinto SWOT Analysis.

This exploration of the Rio Tinto competitive landscape will dissect its strategies, identify its key Rio Tinto competitors, and evaluate its Rio Tinto market share in this dynamic sector. We'll analyze the impact of commodity prices and the strategies employed by global mining companies as we examine Rio Tinto's main rivals and its response to market fluctuations. Understanding Rio Tinto's market position in copper and its competitive advantages is crucial for investors and strategists alike.

Where Does Rio Tinto’ Stand in the Current Market?

Rio Tinto holds a significant market position within the global mining industry. As of early 2024, the company is a dominant force, particularly in key commodities such as iron ore and aluminum. Its extensive operations and strategic focus on high-quality assets contribute to its robust competitive standing.

The company's primary product lines include iron ore, aluminum, copper, and diamonds, with additional interests in borates, titanium dioxide, and other minerals. Rio Tinto's geographical footprint spans Australia, North America, South America, Africa, and Europe, serving a diverse range of industrial and manufacturing customer segments globally. This widespread presence and diversified portfolio are key elements of its market position.

Over time, Rio Tinto has refined its positioning, increasingly focusing on high-quality, long-life assets and prioritizing value over volume in certain segments. This strategic shift is evident in its continued investment in large-scale, high-grade deposits. For instance, the Oyu Tolgoi copper-gold mine in Mongolia, a significant growth project, underscores its commitment to future-facing commodities. Financially, Rio Tinto generally exhibits strong health, characterized by substantial revenues and profitability, often exceeding industry averages due to its efficient operations and large-scale assets.

Rio Tinto consistently ranks among the top global iron ore producers. While specific market share figures fluctuate, the company often contends with Vale and BHP for the leading positions. Its Pilbara operations in Western Australia are crucial for global steel production.

Rio Tinto is a significant player in the aluminum sector, leveraging its integrated bauxite mines, alumina refineries, and aluminum smelters. This integrated approach provides a competitive advantage in terms of cost control and supply chain management.

In the fiscal year 2023, Rio Tinto reported robust financial results, reflecting strong commodity prices and operational performance. The company's financial health is a key indicator of its market strength and ability to invest in future growth projects.

While strong in iron ore and aluminum, Rio Tinto is actively working to strengthen its position in copper, a critical mineral for the energy transition. Projects like Oyu Tolgoi and exploration efforts highlight this strategic priority.

Rio Tinto's competitive advantages include its large-scale, high-quality assets, integrated operations, and global presence. However, the company faces challenges such as commodity price volatility, geopolitical risks, and environmental concerns. Understanding these dynamics is crucial for assessing the Growth Strategy of Rio Tinto.

- Competitive landscape: The company competes with major players like BHP and Vale in iron ore.

- Market share: Rio Tinto's market share fluctuates based on production volumes and global demand.

- Commodity prices impact: The company's financial performance is significantly influenced by commodity prices.

- Sustainability initiatives: Rio Tinto is increasingly focusing on sustainability to maintain its competitive edge.

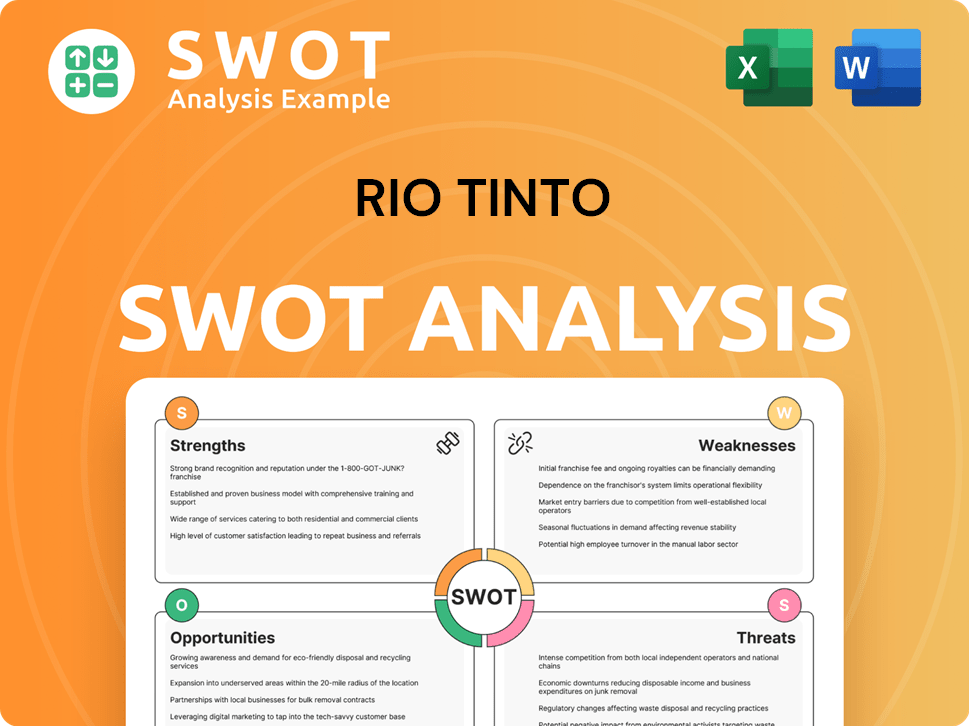

Rio Tinto SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Rio Tinto?

The Rio Tinto competitive landscape is shaped by a diverse group of global mining companies. These companies compete across various commodities, including iron ore, copper, aluminum, and diamonds. Understanding Rio Tinto's competitors is crucial for assessing its market position and financial performance.

Mining industry analysis reveals that competition is intense, with companies constantly vying for market share. Factors such as commodity prices and production costs significantly influence the competitive dynamics. The impact of BHP on Rio Tinto and other major players is substantial, given their size and diversified portfolios.

The Rio Tinto competitive landscape features several key players. These companies challenge Rio Tinto in various ways, affecting its market share and financial results. A detailed look at these rivals provides insights into the strategies and challenges faced by Rio Tinto.

BHP Group is a major direct competitor, particularly in iron ore, copper, and coal. BHP's size and diverse asset base provide a strong competitive edge. The company's financial performance directly impacts the Rio Tinto market share in key commodities.

Vale S.A. is a significant competitor, especially in iron ore, where it is a leading producer. Vale's production capacity and pricing strategies directly affect the iron ore market. The competition between Rio Tinto and Vale is often intense, particularly in the iron ore sector.

Anglo American competes with Rio Tinto across various commodities, including diamonds (through De Beers), platinum group metals, and copper. Anglo American's diverse portfolio and global presence create significant competition. The company's performance influences the overall Rio Tinto competitive landscape.

Glencore is a notable competitor, especially in copper and other base metals. Glencore's trading arm gives it unique market insights and agility. The company's activities can significantly impact commodity prices and market dynamics.

Fortescue Metals Group is a major iron ore producer in Australia. Fortescue has rapidly expanded its market share through efficient, large-scale iron ore production. This expansion directly challenges Rio Tinto's position in the iron ore market.

New and emerging players, particularly those focused on critical minerals for the energy transition, are disrupting the traditional landscape. These companies are influencing the competitive environment. Their entry can lead to shifts in market dynamics.

The Rio Tinto competitive landscape is shaped by various factors, including production expansions, cost efficiencies, and supply chain disruptions. Rio Tinto's main rivals constantly adjust their strategies to maintain or gain market share. For instance, competition in the iron ore market is consistently intense, with producers reacting to global steel demand and China's economic growth. Understanding these dynamics is crucial for assessing the company's performance.

- Market Share Shifts: Competition often leads to shifts in market share in key commodity markets.

- Cost Efficiencies: Companies focus on reducing production costs to improve profitability.

- Supply Chain Disruptions: External factors can significantly impact the competitive environment.

- Consolidation: Mergers and acquisitions can create larger, more formidable rivals.

For a deeper understanding of the market, consider reading about the Target Market of Rio Tinto. This analysis can provide further insights into the company's competitive position and strategic direction. The Rio Tinto's financial performance compared to peers is a key indicator of its competitive standing. The company's response to market fluctuations and its sustainability initiatives and competition also play crucial roles in shaping its future.

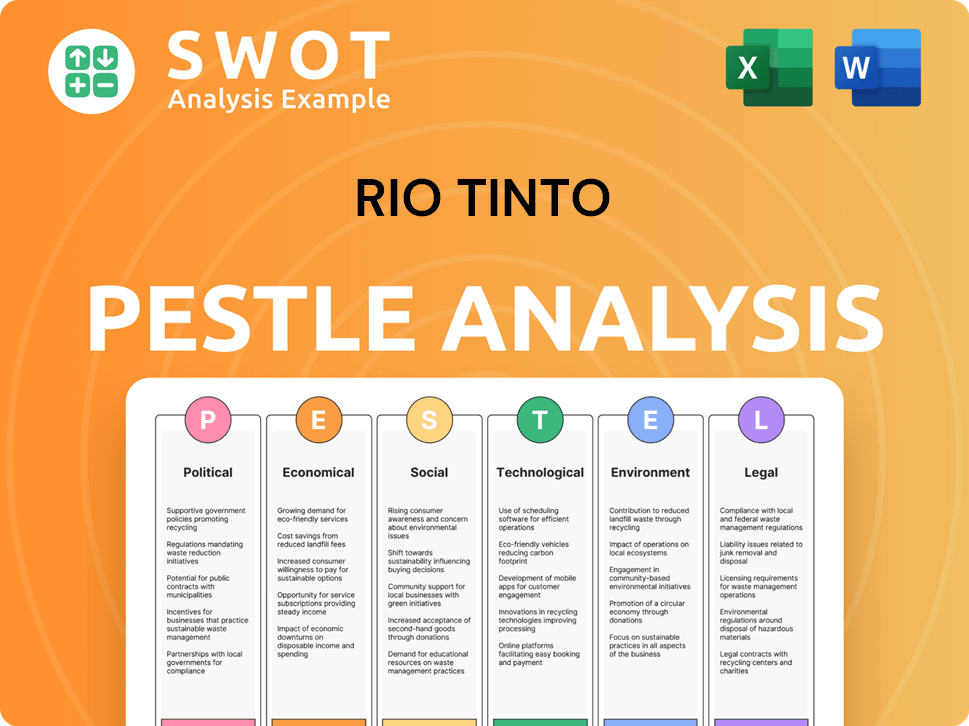

Rio Tinto PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Rio Tinto a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of a major player like Rio Tinto requires a deep dive into its strengths. The company's competitive advantages are multifaceted, stemming from its extensive asset base, operational efficiency, and strategic focus on high-quality resources. These factors collectively position it strongly within the global mining industry.

A key element of Rio Tinto's success is its ownership of world-class assets, particularly its iron ore mines in the Pilbara region of Western Australia. These mines are known for their large scale, low operating costs, and high-grade ore. This provides a significant cost advantage over many competitors, allowing the company to remain profitable even during periods of lower commodity prices. Furthermore, Rio Tinto's integrated value chain, from mining to processing and logistics, enhances efficiency and control over its supply chain.

The company's strong brand equity and reputation for reliability also contribute to its competitive edge, fostering strong relationships with global customers. Additionally, Rio Tinto's commitment to technological innovation, including automation and digitalization in its mining operations, is a key differentiator. The company benefits from economies of scale, which allow it to invest in large-scale infrastructure and advanced technologies that smaller competitors cannot easily replicate. For a deeper understanding of the company's origins and evolution, consider reading a Brief History of Rio Tinto.

Rio Tinto's vast asset base, including its iron ore mines in the Pilbara, provides a significant competitive advantage. These assets are characterized by their large scale, low operating costs, and high-grade ore. This enables the company to maintain profitability even during commodity price fluctuations.

Operational excellence is a cornerstone of Rio Tinto's strategy. The company's integrated value chain, from mining to processing and logistics, enhances efficiency and control. Technological innovations, such as automation in the Pilbara mines, further improve productivity and safety.

Rio Tinto's brand equity and reputation for reliability foster strong relationships with global customers. This trust is crucial in maintaining market share and navigating competitive pressures. The company's commitment to quality also plays a key role.

Technological innovation, including automation and digitalization, is a key differentiator for Rio Tinto. The company benefits from economies of scale, allowing for investment in advanced technologies. This advantage is difficult for smaller competitors to replicate.

Rio Tinto's competitive advantages are substantial, yet not entirely immune to imitation. Competitors also invest in technology and efficiency, but the scale and capital intensity of Rio Tinto's operations create significant barriers to entry. The company’s diverse portfolio of commodities provides resilience against price fluctuations.

- World-Class Assets: Ownership of large-scale, low-cost mines, particularly in iron ore.

- Operational Efficiency: Integrated value chain and technological advancements.

- Brand Equity: Strong reputation and customer relationships.

- Economies of Scale: Ability to invest in advanced technologies and infrastructure.

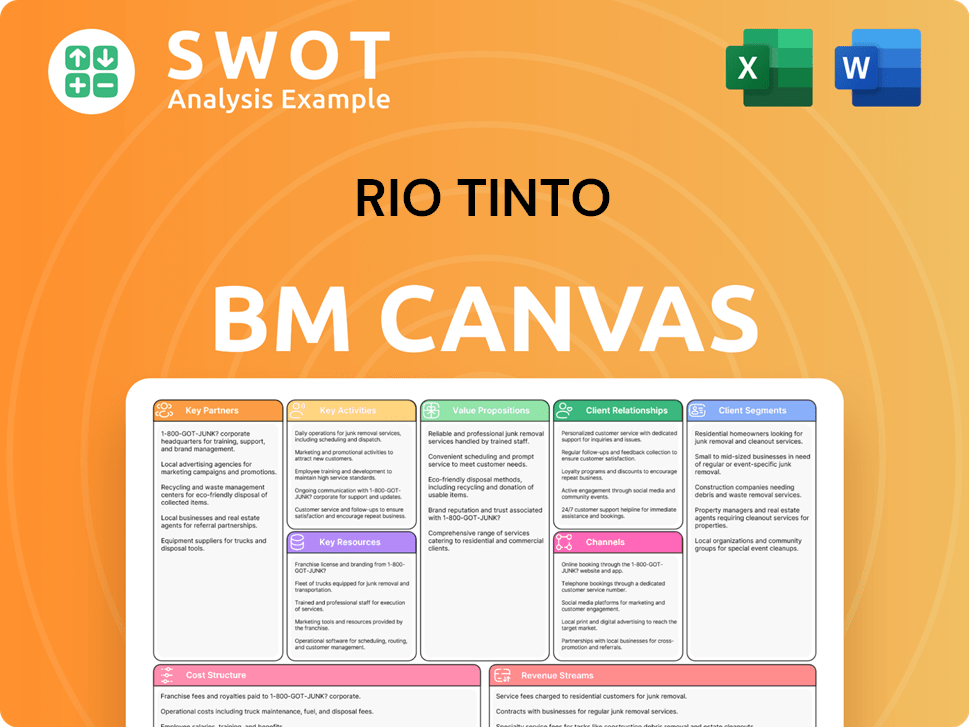

Rio Tinto Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Rio Tinto’s Competitive Landscape?

The Growth Strategy of Rio Tinto is significantly influenced by the evolving dynamics of the global mining industry. The company faces both challenges and opportunities stemming from technological advancements, regulatory changes, shifting consumer preferences, and global economic shifts. Understanding these factors is crucial for assessing Rio Tinto's competitive landscape and its future prospects.

Rio Tinto's performance is closely tied to commodity prices and geopolitical stability, making it susceptible to market fluctuations. The company's focus on operational efficiency, technological adoption, and sustainable practices will be key to navigating these complexities and maintaining its market position.

Technological advancements, particularly in automation and data analytics, are transforming mining operations. Regulatory pressures related to ESG factors are increasing, driving demand for sustainable practices. Consumer preferences are shifting towards responsibly sourced materials.

Declining demand for traditional commodities, increased regulatory burdens, and new competitors in emerging markets pose challenges. Volatility in commodity prices and geopolitical tensions introduce uncertainty. The energy transition may reduce demand for fossil fuels.

Emerging markets experiencing rapid industrialization and urbanization offer growth potential. Product innovations and strategic partnerships can unlock new value chains. Demand for 'future-facing' commodities like copper and lithium is expected to increase.

The company is focusing on operational efficiency, technological adoption, and responsible mining practices. Rio Tinto is strategically investing in copper and lithium projects to capitalize on future demand. It aims for a 15% reduction in Scope 1 & 2 emissions by 2025 and 50% by 2030.

The Rio Tinto competitive landscape is shaped by its main rivals and its ability to adapt to market fluctuations. Key competitors include BHP and Vale, particularly in iron ore. Understanding Rio Tinto's market share and its competitive advantages is crucial for assessing its performance.

- BHP: A major competitor in iron ore, copper, and coal, with significant market influence.

- Vale: A key player in iron ore and nickel, impacting Rio Tinto's competitors in these sectors.

- Glencore: Involved in various commodities, including copper and zinc, increasing competition.

- Other Players: Smaller companies and new entrants in the critical minerals space are also influencing the market.

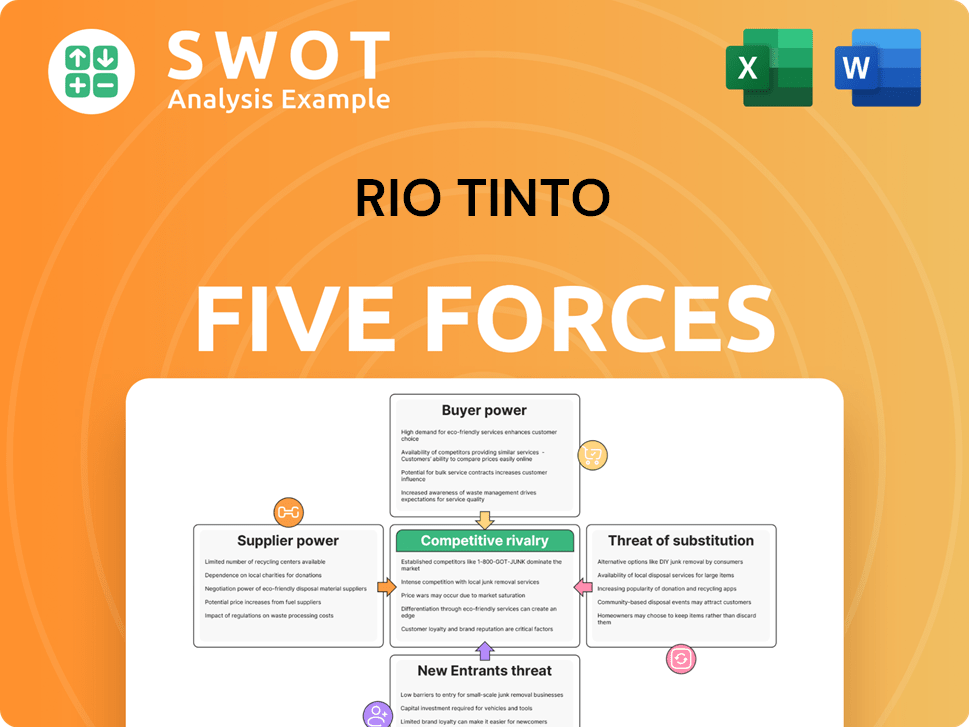

Rio Tinto Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rio Tinto Company?

- What is Growth Strategy and Future Prospects of Rio Tinto Company?

- How Does Rio Tinto Company Work?

- What is Sales and Marketing Strategy of Rio Tinto Company?

- What is Brief History of Rio Tinto Company?

- Who Owns Rio Tinto Company?

- What is Customer Demographics and Target Market of Rio Tinto Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.