Ropes & Gray Bundle

How Does Ropes & Gray Dominate the Legal Arena?

In the high-stakes world of law, understanding the Ropes & Gray SWOT Analysis is key to navigating its complexities. Ropes & Gray, a titan in the Legal market, consistently advises on pivotal transactions and disputes. But what exactly fuels its success, and who are its main rivals in this fiercely competitive environment?

This deep dive into Ropes & Gray's Competitive landscape will dissect its Firm rankings, revealing its Competitive advantages of Ropes & Gray and strategies for maintaining its edge. We'll explore Ropes & Gray's key competitors and how it differentiates itself in the face of intense Industry competition, offering insights for investors and strategists alike.

Where Does Ropes & Gray’ Stand in the Current Market?

Ropes & Gray maintains a robust market position within the highly competitive legal market. The firm is a prominent player among global law firms, especially recognized for its expertise in private equity, asset management, and the life sciences sector. The firm's financial performance and strategic focus on high-value, complex legal matters have solidified its reputation as a leading firm for sophisticated transactions and disputes.

The firm's primary product lines are its legal advisory services, with a notable emphasis on private equity, M&A, litigation, intellectual property, and healthcare. Geographically, Ropes & Gray has a substantial presence in key financial centers, including Boston, New York, London, Hong Kong, and Tokyo, allowing it to serve a global client base. Its customer segments primarily include large corporations, private equity funds, hedge funds, pharmaceutical and biotechnology companies, and financial institutions.

While specific market share figures for individual law firms are not publicly disclosed in the same way as product-based industries, Ropes & Gray consistently ranks among the top law firms globally by revenue and prestige. For instance, in 2023, the firm reported gross revenue of $1.914 billion, placing it among the highest-grossing law firms worldwide.

Ropes & Gray demonstrated financial resilience with a 1.2% increase in revenue in 2023. This growth, along with its consistent high revenue figures, underscores the firm's strong market standing and ability to attract high-value clients. The firm's financial scale significantly surpasses the industry average for law firms, indicating robust financial health.

The firm's practice areas are diverse, with a strong focus on private equity, M&A, litigation, intellectual property, and healthcare. These areas are key drivers of revenue and contribute to the firm's reputation for handling sophisticated transactions and disputes. The strategic focus on these areas allows the firm to cater to a premium segment of the legal market.

Ropes & Gray has a significant global presence, with offices in major financial centers such as Boston, New York, London, Hong Kong, and Tokyo. This global footprint enables the firm to serve a diverse, international client base. The strategic locations allow the firm to tap into key markets and provide comprehensive legal services worldwide.

The firm's client base primarily includes large corporations, private equity funds, hedge funds, pharmaceutical and biotechnology companies, and financial institutions. These clients often require high-value, complex legal services, contributing to the firm's premium positioning in the legal market. The firm's ability to attract and retain these clients is a key indicator of its market strength.

Ropes & Gray's competitive advantages include its strong financial performance, expertise in high-demand practice areas, and global presence. The firm's focus on high-value, complex legal matters allows it to maintain a premium position in the market. The firm's strategic initiatives and focus on innovation continue to drive its success and market leadership.

- Strong financial performance, including a 1.2% increase in revenue in 2023.

- Expertise in key practice areas such as private equity and M&A.

- A global presence in major financial centers.

- Focus on high-value, complex legal matters.

- Strategic initiatives and innovation.

For a deeper understanding of the firm's strategic moves, consider reading about the Growth Strategy of Ropes & Gray. Ropes & Gray's ability to maintain a strong market position, despite the competitive landscape, is a testament to its strategic focus and financial strength. The firm's consistent performance and strategic initiatives position it well for continued success in the legal market.

Ropes & Gray SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Ropes & Gray?

The competitive landscape for Ropes & Gray, like other major law firms, is intense. The legal market is characterized by significant industry competition, with firms vying for top talent and high-profile clients. Understanding the competitive advantages of Ropes & Gray is crucial for assessing its position in the market.

Ropes & Gray's key competitors include several global elite law firms that offer similar services and compete for similar clients. These firms compete on various fronts, including pricing, client service models, brand recognition, and global reach. A detailed law firm analysis reveals the strategies these firms employ to maintain and grow their market share.

Ropes & Gray operates within a highly competitive legal market, facing direct competition from other global elite law firms, as well as indirect competition from boutique firms specializing in particular practice areas. Its most significant direct competitors include firms such as Kirkland & Ellis, Latham & Watkins, Paul, Weiss, Rifkind, Wharton & Garrison, and Simpson Thacher & Bartlett. These firms are comparable in size, global reach, and the sophistication of their legal services, particularly in areas like private equity, M&A, and litigation.

Kirkland & Ellis is a major rival, known for its aggressive litigation practice and strong presence in private equity. It often competes directly with Ropes & Gray for mandates in large-cap private equity transactions and high-stakes corporate disputes.

Latham & Watkins offers a broad range of services and has a particularly strong energy and infrastructure practice, often vying for similar corporate and finance work. Its global reach and diverse practice areas make it a formidable competitor.

Paul, Weiss, Rifkind, Wharton & Garrison is a formidable competitor in M&A and litigation, frequently involved in some of the largest and most complex corporate transactions. It consistently ranks among the top firms globally.

Simpson Thacher & Bartlett is another top-tier firm with a dominant private equity practice, making it a direct challenger for Ropes & Gray's core client base. It competes fiercely in the private equity space.

These competitors challenge Ropes & Gray through various means, including aggressive pricing strategies for certain types of work, innovative client service models, strong brand recognition built over decades, and extensive global distribution networks. High-profile 'battles' often occur in competitive bidding processes for major M&A deals or in significant litigation cases.

The legal industry has also seen new and emerging players, particularly in technology law and data privacy, disrupting traditional competitive landscapes, though these tend to be more niche than direct threats to Ropes & Gray's broad corporate focus. Mergers and alliances, while less common among the very top-tier firms, can also shift competitive dynamics by creating larger, more diversified entities.

The competitive landscape is dynamic. For instance, in the private equity space, firms like Ropes & Gray and Kirkland & Ellis are consistently ranked at the top for advising on the most private equity deals. Understanding the Marketing Strategy of Ropes & Gray can provide insights into how the firm positions itself within this competitive environment. Recent data indicates that the legal market is highly concentrated at the top, with a few firms capturing a significant portion of the revenue. For example, in 2024, the top 10 firms accounted for a substantial percentage of the total legal revenue generated globally. The constant evolution of the legal market requires firms to adapt and innovate to maintain their competitive edge.

Several factors drive competition among these law firms. These include:

- Pricing Strategies: Competitive pricing models for attracting clients.

- Client Service Models: Innovative approaches to client service and relationship management.

- Brand Recognition: Reputation and brand value built over time.

- Global Distribution Networks: Extensive global presence and reach.

- Practice Area Specialization: Expertise in specific areas like private equity, M&A, and litigation.

Ropes & Gray PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Ropes & Gray a Competitive Edge Over Its Rivals?

The competitive landscape for firms like Ropes & Gray is shaped by specialization, client relationships, and global reach. A deep dive into the legal market reveals that firms differentiate themselves through expertise in high-growth sectors. This approach allows for tailored legal advice, particularly in areas like private equity and life sciences. Understanding the industry competition is crucial for assessing a firm's strategic position and potential for growth.

Ropes & Gray's strategic moves have consistently focused on strengthening its core competencies and expanding its global footprint. The firm has maintained a strong presence in key financial hubs, providing a robust distribution network for multinational clients. This global presence is a key factor in its ability to serve a diverse client base and navigate complex legal challenges across jurisdictions. The firm's financial performance is closely tied to its ability to secure high-value deals and maintain client loyalty.

Analyzing the competitive advantages of Ropes & Gray highlights its ability to adapt to market demands, invest in specialized practices, and expand its global footprint. Its brand equity, built over more than 150 years, signifies reliability and excellence, fostering client loyalty. The firm's culture of collaboration and commitment to client service attracts and retains top legal talent, contributing directly to the quality of its legal advice. For more insights, check out the Brief History of Ropes & Gray.

Ropes & Gray's competitive edge comes from its deep specialization in high-growth sectors like private equity, asset management, and life sciences. This focused expertise allows the firm to offer highly tailored and sophisticated legal advice. Its intellectual property practice, particularly in the life sciences sector, is another key differentiator.

The firm's strong client relationships, built over time, foster significant loyalty and repeat business. Ropes & Gray's brand equity, built over more than 150 years, signifies reliability and excellence. This strong brand fosters significant client loyalty, often leading to repeat business and referrals.

Ropes & Gray's global presence, with offices in key financial hubs worldwide, provides a robust distribution network. This enables it to serve multinational clients seamlessly across jurisdictions. The firm's global reach is a key factor in its ability to handle complex, cross-border legal challenges.

Internally, Ropes & Gray fosters a unique company culture emphasizing collaboration and a commitment to client service. This culture attracts and retains top legal talent, forming a highly skilled talent pool. This internal culture directly contributes to the quality of its legal advice.

Ropes & Gray's competitive advantages include specialized expertise, strong client relationships, and a global presence. The firm's focus on high-growth sectors and its commitment to client service are key differentiators. These strengths have allowed the firm to maintain a strong position in the legal market.

- Specialization in high-growth sectors such as private equity and life sciences.

- Strong brand equity and client loyalty built over more than 150 years.

- Global presence with offices in key financial and legal hubs worldwide.

- A collaborative culture that attracts and retains top legal talent.

Ropes & Gray Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Ropes & Gray’s Competitive Landscape?

The legal industry is undergoing significant transformations, impacting firms like Ropes & Gray. The competitive landscape is shaped by technological advancements, regulatory changes, and evolving client expectations. Understanding these trends is crucial for assessing the firm's position and future prospects. For a deeper dive into the firm's target audience, consider exploring the Target Market of Ropes & Gray.

Law firm analysis reveals that Ropes & Gray faces both challenges and opportunities. Key risks include increased competition from alternative legal service providers and in-house legal departments. However, the firm can leverage its strengths and adapt to industry changes to maintain a strong market position. The firm's ability to innovate and respond to market dynamics will be key to its success.

Technological advancements, such as AI and automation, are reshaping legal service delivery. Regulatory changes, especially in data privacy and antitrust, create specialized legal needs. Shifting client preferences demand value-driven services and greater transparency. These trends influence how Ropes & Gray and its competitors operate.

Increased competition from alternative legal service providers (ALSPs) and in-house legal teams poses a threat. Economic downturns and geopolitical tensions can impact demand in core areas like M&A. Adapting to changing client expectations and business models presents ongoing challenges. These challenges require strategic responses.

Growth opportunities exist in emerging markets, particularly in Asia and the Middle East. Rapidly evolving practice areas, such as ESG and digital assets, offer new avenues for expansion. Leveraging technology to enhance client service and operational efficiency creates competitive advantages. These opportunities can drive future growth.

Ropes & Gray is likely to focus on investing in high-growth practices. Strategic recruitment of top talent will be crucial for maintaining a competitive edge. Leveraging technology to improve client service and operational efficiency is essential. These initiatives will help the firm adapt and thrive.

Ropes & Gray's focus on core high-growth practices, such as private equity and healthcare, is crucial. Strategic recruitment of top legal talent ensures the firm maintains its expertise. Investment in technology to enhance client service is a key priority. These areas will drive the firm's future success.

- Continued investment in core high-growth practices.

- Strategic recruitment of top legal talent.

- Leveraging technology for enhanced client service.

- Focus on emerging markets and practice areas.

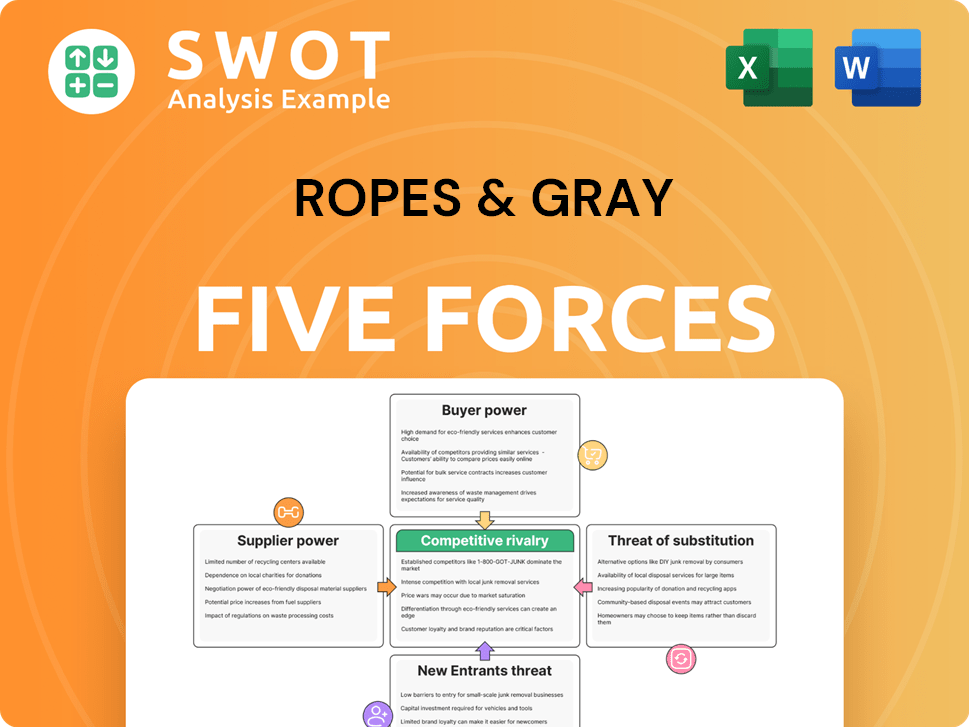

Ropes & Gray Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ropes & Gray Company?

- What is Growth Strategy and Future Prospects of Ropes & Gray Company?

- How Does Ropes & Gray Company Work?

- What is Sales and Marketing Strategy of Ropes & Gray Company?

- What is Brief History of Ropes & Gray Company?

- Who Owns Ropes & Gray Company?

- What is Customer Demographics and Target Market of Ropes & Gray Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.