Ryder System Bundle

How Does Ryder System Stack Up in Today's Logistics Arena?

Ryder System, a stalwart in transportation and logistics, recently showcased its strength with impressive Q4 2024 financial results, demonstrating resilience amidst market volatility. But how does this industry giant truly fare against its rivals? This analysis dives deep into the Ryder System SWOT Analysis and the competitive landscape it navigates.

This exploration of the Ryder System competitive landscape will provide a thorough Ryder System market analysis, examining key competitors and the company's strategic positioning within the Ryder System industry. We'll dissect Ryder's business model, evaluate its service offerings, and assess its competitive advantages, all while considering current industry trends. Understanding Ryder System's challenges and opportunities is crucial for anyone seeking insights into the transportation and logistics companies and their future prospects.

Where Does Ryder System’ Stand in the Current Market?

Ryder System, Inc. (Ryder) holds a strong position in the transportation and logistics industry. The company's comprehensive service portfolio supports its significant market presence. In 2024, Ryder's total revenue reached $12.6 billion, marking a 7% increase from the previous year. The company's financial health is robust, with a reported net income of $489 million in 2024, up from $406 million in 2023.

Ryder operates through three main segments: Fleet Management Solutions (FMS), Supply Chain Solutions (SCS), and Dedicated Transportation Solutions (DTS). FMS provides full-service leasing and maintenance. SCS optimizes logistics networks, offering warehousing and distribution. DTS combines leasing and maintenance with professional drivers, providing customized transportation solutions. These segments serve a wide array of customers, including globally recognized brands across various industries.

Ryder has strategically shifted its focus, particularly through digital transformation and diversifying its offerings. The company is increasingly leaning towards asset-light businesses, with SCS and DTS contributing significantly to revenue. Geographically, Ryder has a substantial presence, especially across North America, with an extensive operational infrastructure. The company's ability to generate a return on equity (ROE) of 16% in 2024, during a freight cycle downturn, highlights the resilience of its transformed business model. For more in-depth information, you can read about Owners & Shareholders of Ryder System.

Ryder is a key player in the transportation and logistics sector, offering a wide range of services. The company's financial performance in 2024 demonstrates its solid market standing. Its diverse service offerings cater to various customer segments, including major brands in different industries.

In 2024, Ryder's operating revenue (non-GAAP) grew by 8% to $10.3 billion. The company's adjusted return on equity (ROE) was 16% in 2024, with a forecast of 17% to 18% for 2025. This performance reflects the company's strong financial health and strategic initiatives.

Ryder's operations are divided into Fleet Management Solutions (FMS), Supply Chain Solutions (SCS), and Dedicated Transportation Solutions (DTS). These segments offer a range of services from vehicle leasing to supply chain optimization. The strategic focus is increasingly on asset-light businesses.

Ryder is undergoing digital transformation and diversifying its offerings. The company has a strong presence in North America, with extensive infrastructure. The expected revenue from asset-light operations is 60% in 2025.

The Ryder System competitive landscape is shaped by its diverse service offerings and strategic focus. Key aspects include financial performance, business segment contributions, and geographic presence. Understanding these elements is crucial for a thorough Ryder System market analysis.

- Ryder's financial health, with a net income of $489 million in 2024, underscores its stability.

- The shift towards asset-light businesses, with 60% of 2025 revenue expected from SCS and DTS, indicates strategic adaptation.

- A substantial presence in North America, with 361 service locations, highlights its operational scale.

- Ryder's ability to maintain a strong ROE during an industry downturn showcases its resilience and competitive advantages.

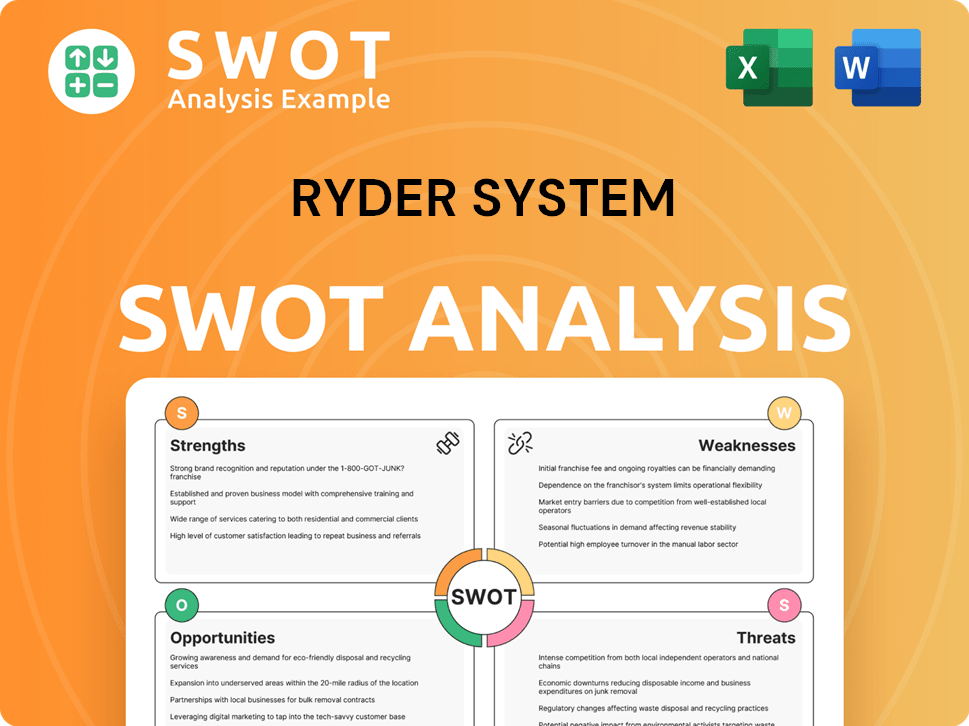

Ryder System SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Ryder System?

The competitive landscape for Ryder System, Inc. is dynamic, shaped by a diverse array of rivals in the transportation and logistics sector. A thorough Ryder System competitive landscape analysis reveals both direct and indirect competitors vying for market share. Understanding these competitors is crucial for assessing Ryder's position and formulating effective strategies.

Ryder System market analysis indicates that the company faces competition across various service lines, from fleet management to supply chain solutions. This competition necessitates a deep dive into the Ryder System competitors, their strengths, and their strategies. The industry is constantly evolving, with new technologies and market trends influencing the competitive dynamics.

Ryder System industry peers include major players in trucking and logistics, as well as smaller, specialized firms. These competitors challenge Ryder on multiple fronts, including pricing, service offerings, and geographic reach. The competitive environment requires continuous adaptation and innovation to maintain a strong market position.

Direct competitors offer similar services, such as truck leasing, fleet management, and supply chain solutions. These companies compete directly with Ryder's core business segments. Key players include J.B. Hunt Transport, Penske Truck Leasing, and Schneider National.

Indirect competitors may offer different but related services that can impact Ryder's market share. This includes companies specializing in specific logistics niches or those leveraging technology to disrupt traditional models. Examples include U-Haul and digital freight platforms.

J.B. Hunt Transport offers a broad range of transportation and logistics services, directly competing with Ryder's Dedicated Transportation Solutions (DTS) and Supply Chain Solutions (SCS) segments. Penske Truck Leasing provides full-service truck leasing, rental, and contract maintenance, posing a direct threat in the Fleet Management Solutions segment. Schneider National and Knight-Swift Transportation, with their extensive trucking operations, compete on price and efficiency.

Competitors employ various strategies, including competitive pricing, network expansion, and technological innovation. Some focus on specific niches, such as e-commerce fulfillment or cold chain logistics. Others leverage data analytics and real-time visibility to gain an edge.

Industry trends, such as the rise of digital freight platforms and the increasing demand for sustainable logistics solutions, are reshaping the competitive landscape. Mergers and acquisitions, like Ryder's acquisition of Cardinal Logistics in February 2024, also play a significant role in shifting market dynamics.

Despite challenges, Ryder's contractual lease, supply chain, and dedicated businesses demonstrated double-digit earnings growth in 2024, indicating their competitive strength. This performance reflects the company's ability to navigate a tough freight environment and maintain its market position.

A detailed analysis of Ryder System vs. competitors comparison reveals specific strengths and weaknesses. Understanding the Ryder System competitive advantages is crucial for strategic planning. The Ryder System business model is challenged by rivals offering similar or alternative services, requiring continuous adaptation. For more insights into the company's financial health and strategies, consider exploring the Ryder System financial performance.

- J.B. Hunt Transport: Offers a wide array of services, including intermodal and dedicated solutions.

- Penske Truck Leasing: Focuses on fleet management and leasing services, directly competing with Ryder.

- Schneider National: Provides truckload and logistics services, competing on price and network.

- U-Haul: Competes in the fleet management space, offering rental services.

- Digital Freight Platforms: Emerging competitors leveraging technology and data analytics.

Ryder System PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Ryder System a Competitive Edge Over Its Rivals?

Understanding the Ryder System competitive landscape requires a deep dive into its strategic strengths. The company's ability to provide comprehensive logistics solutions, from fleet management to last-mile delivery, sets it apart in the Ryder System industry. This integrated approach allows for end-to-end service offerings, which is a significant competitive advantage.

Ryder System's strategic moves, including investments in technology and acquisitions, have expanded its capabilities and market understanding. The company's focus on innovation and customer-centric solutions underscores its commitment to staying ahead in the rapidly evolving transportation and logistics sector. These moves are aimed at strengthening its position in the Ryder System market analysis.

This article provides insights into the Ryder System competitive advantages, highlighting its operational efficiencies, customer loyalty, and extensive network. The following sections will explore these aspects in detail, offering a comprehensive view of Ryder System's position in the market.

Ryder offers a wide range of services, including fleet management, dedicated transportation, and supply chain solutions. This "port-to-door" approach allows for complete control over logistics networks. The ability to provide end-to-end services gives Ryder a competitive edge, especially in the Ryder System vs. competitors comparison.

The company uses advanced technologies, like AI and data analytics, for predictive maintenance and optimized delivery schedules. RyderView™ technology enhances delivery scheduling and real-time tracking. With up to 70% of consumers wanting more visibility, this is a crucial advantage.

Ryder serves over 40,000 customers, many of which are globally recognized brands. Strong contractual relationships provide revenue stability. Approximately 70% of Fleet Management Solutions revenue comes from contractual streams.

Ryder is committed to sustainable fleet solutions, including electric vehicles and alternative fuel vehicles. This focus positions the company well in an environmentally conscious market. This commitment is part of their broader Ryder System business model.

Ryder's competitive advantages include its extensive service offerings, technological innovations, and strong customer relationships. These factors contribute to its market position and ability to generate consistent revenue. Strategic partnerships and acquisitions, like the 2024 acquisition of Cardinal Logistics, enhance its capabilities.

- Comprehensive service offerings, including Ryder System fleet management services and supply chain solutions.

- Integration of advanced technologies for operational efficiency and customer visibility.

- Strong customer loyalty and contractual relationships with major brands.

- Focus on sustainable fleet solutions, catering to environmental concerns.

- Extensive distribution network with 361 locations across 48 U.S. states.

For a deeper dive into Ryder System's marketing strategies, consider reading the Marketing Strategy of Ryder System.

Ryder System Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Ryder System’s Competitive Landscape?

The transportation and logistics industry is experiencing rapid transformation, significantly impacting the competitive landscape of Ryder System. Technological advancements, regulatory changes, and evolving consumer demands are reshaping the sector, creating both challenges and opportunities. Understanding these dynamics is crucial for assessing the future outlook and strategic positioning of companies like Ryder.

The industry faces risks from economic uncertainties, labor shortages, and potential geopolitical issues. However, it also presents opportunities for growth through strategic investments and innovative service offerings. A thorough market analysis of Ryder System reveals its potential to capitalize on these trends and maintain a competitive edge.

The industry is driven by technological advancements, including AI and automation, which are transforming supply chain management and fleet operations. Environmental regulations, such as mandates for fleet emissions reduction, are also significantly impacting the sector. Consumer preferences for faster delivery are intensifying the need for last-mile logistics solutions.

Potential challenges include a flat freight market, weak rental market conditions, and labor shortages, particularly for skilled drivers. Geopolitical uncertainty and potential tariffs could also negatively affect the economy and customer decisions. These factors could pressure the financial performance of companies.

There is an increasing demand for outsourced logistics and transportation solutions, creating opportunities for growth. Expansion of supply chain management and logistics technology services, and strategic acquisitions, like Cardinal Logistics in 2024, are expected to enhance profitability. Focus on contractual businesses is a key strategy for resilience.

For 2025, the company forecasts a comparable EPS (non-GAAP) between $12.85 and $13.60. The adjusted return on equity (ROE) is projected to be between 16.5% and 17.5%, indicating confidence in its growth strategy. Free cash flow generation is expected to be between $375 million and $475 million in 2025.

The Ryder System industry is adapting to significant shifts. Key drivers include the integration of AI and automation in fleet operations, with investments in these tools expected to increase by 20% annually through 2025. Environmental mandates, such as the EPA's goal of a 40% fleet emissions reduction by 2030, are also shaping the market. The Ryder System competitive landscape is influenced by these factors.

- Technology and Automation: AI and data analytics are crucial for predictive maintenance, route optimization, and overall efficiency.

- Regulatory Changes: Environmental mandates require investment in clean technology and compliance.

- Market Dynamics: Consumer demand for faster delivery, driving the need for last-mile logistics solutions.

- Nearshoring: Companies are increasingly using nearshoring to reduce lead times and mitigate risks.

Ryder System Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ryder System Company?

- What is Growth Strategy and Future Prospects of Ryder System Company?

- How Does Ryder System Company Work?

- What is Sales and Marketing Strategy of Ryder System Company?

- What is Brief History of Ryder System Company?

- Who Owns Ryder System Company?

- What is Customer Demographics and Target Market of Ryder System Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.