Siam Cement Bundle

How Does Siam Cement Company Dominate its Rivals?

Founded over a century ago, Siam Cement Company (SCG) has evolved from a cement producer to a regional industrial giant. This transformation reflects SCG's ability to adapt and thrive amidst evolving market dynamics. Understanding the Siam Cement SWOT Analysis is crucial to grasping its strategic positioning.

This deep dive into the Competitive Landscape of SCG will provide a comprehensive market analysis, examining its business strategy and the industry trends shaping its future. We'll explore SCG's market position, its competitive advantages, and the challenges it faces, offering insights into its financial performance and strategic partnerships. Discover who are SCG's main competitors and how it continues to innovate and expand its operations across Southeast Asia and beyond.

Where Does Siam Cement’ Stand in the Current Market?

SCG, or Siam Cement Company, maintains a strong market position within its core industries across Southeast Asia. The company's operations are particularly prominent in cement and building materials. A detailed Market Analysis reveals SCG's dominance in the Thai cement market and its significant presence throughout the ASEAN region.

The company's value proposition centers on providing a comprehensive range of construction materials and solutions. This includes cement, concrete, roofing, insulation, and ceramic tiles. SCG serves a broad spectrum of customers, from large-scale infrastructure projects to individual homeowners, making it a key player in the Competitive Landscape.

SCG's strategic focus has evolved beyond traditional building materials. The company is embracing digital transformation and diversifying its offerings. This includes expanding into high-value-added products and sustainable solutions, aligning with Industry Trends towards green building and circular economy principles. Understanding SCG's Ownership Structure can provide further insight into its strategic direction.

SCG traditionally holds a dominant market share in the Thai cement market. The company has a significant presence in key ASEAN markets. This strong market position is a key aspect of its Business Strategy.

SCG has an extensive geographic presence across ASEAN. Operations and investments are spread across countries such as Vietnam, Indonesia, the Philippines, Cambodia, Myanmar, and Laos. This broad reach supports its overall market position.

In 2023, SCG reported sales revenue of 499,350 million Thai Baht (approximately 14.3 billion USD). The profit for the year amounted to 25,915 million Thai Baht (approximately 743 million USD). This financial performance is a key indicator of its robust scale.

SCG's product lines include cement, concrete, roofing, insulation, and ceramic tiles. These products serve a broad spectrum of customer segments. This includes large-scale infrastructure projects and individual homeowners.

SCG faces increasing competition in more mature markets and from specialized players in niche segments. Its strategic shift towards digital transformation and sustainable solutions is crucial for maintaining its competitive edge. The company's early entry into ASEAN markets and extensive distribution networks have been key SCG competitive advantages.

- SCG's market position in Thailand remains particularly strong.

- Emerging ASEAN economies offer significant growth opportunities.

- Challenges faced by SCG include competition and market dynamics.

- SCG's digital transformation strategy is key for future growth.

Siam Cement SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Siam Cement?

Understanding the competitive landscape is crucial for evaluating the performance and potential of the Siam Cement Company (SCG). A thorough market analysis reveals the key players and their strategies, shaping the industry trends and influencing SCG's business strategy. This analysis is essential for investors, business strategists, and anyone interested in the construction materials and petrochemical sectors.

SCG's competitive environment is dynamic, with both direct and indirect competitors vying for market share. The company's ability to adapt and innovate is critical for maintaining its market position. This chapter will explore the key competitors of SCG, providing insights into their strengths, strategies, and the challenges they pose.

SCG faces a diverse array of direct and indirect competitors across its various business segments. In the cement and building materials sector, key direct competitors include global giants such as Holcim Group and Heidelberg Materials. Regional players like Vietnam's Vicem and Indonesia's Semen Indonesia also pose significant challenges. These competitors often challenge SCG through competitive pricing, aggressive expansion strategies, and investments in new production capacities. For a deeper dive into SCG's customer base, consider reading about the Target Market of Siam Cement.

Holcim Group and Heidelberg Materials represent formidable competitors due to their global presence and advanced technologies. They often have significant financial resources and established distribution networks. These companies can exert pressure on pricing and market share, especially in regions where SCG operates.

Vicem and Semen Indonesia leverage local market knowledge and extensive distribution networks. They often have a strong understanding of regional customer preferences and regulatory environments. This allows them to tailor their products and strategies to specific markets, posing a challenge to SCG's market share.

Competitors often employ competitive pricing strategies and aggressive expansion plans. They invest in new production capacities to increase their market share. This necessitates that SCG continually optimize its operations and maintain a competitive edge through cost management and innovation.

In the petrochemicals segment, SCG Chemicals competes with major global and regional players such as PTT Global Chemical (Thailand) and Indorama Ventures (Thailand), and various large Chinese and Middle Eastern petrochemical companies. These rivals often have access to cheaper feedstock or larger economies of scale, leading to intense price competition. The battle for market share in this segment often revolves around product innovation, specialized grades, and efficient supply chain management. The ongoing global shifts in energy prices and feedstock availability can create high-profile 'battles' for cost leadership and market dominance in specific petrochemical products.

PTT Global Chemical and Indorama Ventures are major players in the Thai petrochemicals market. They often have significant production capacity and access to resources. The competition is fierce, with a focus on product innovation and cost efficiency.

- PTT Global Chemical: A major integrated petrochemical company in Thailand, competing directly with SCG in various petrochemical products.

- Indorama Ventures: A global chemical company with a significant presence in Thailand, competing in specific product segments.

- Chinese and Middle Eastern Companies: These companies often have advantages in feedstock costs and economies of scale, intensifying price competition.

- Product Innovation: The ability to offer specialized grades and innovative products is critical for gaining market share.

- Supply Chain Management: Efficient supply chains are essential for minimizing costs and ensuring timely delivery.

Emerging players and technological disruptions also present a competitive challenge. New entrants focusing on sustainable and green building materials, or specialized chemical products, can carve out niche markets. Furthermore, the increasing focus on digitalization and automation in manufacturing and supply chain management means that companies failing to adapt quickly risk losing their competitive edge. Mergers and alliances, such as consolidation among smaller regional players or strategic partnerships between international giants, also continuously reshape the competitive dynamics, requiring SCG to remain agile and strategically responsive. For example, in 2024, the global construction market was valued at approximately $15 trillion, highlighting the vast opportunities and intense competition.

Siam Cement PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Siam Cement a Competitive Edge Over Its Rivals?

The Siam Cement Company (SCG) has built a robust competitive position through strategic moves and consistent execution. Its success is underpinned by key milestones and a forward-looking approach. A deep understanding of the competitive landscape and proactive adaptation to industry trends have been crucial for SCG's sustained growth.

SCG's strategic focus includes expanding its presence across Southeast Asia and investing in innovative and sustainable products. This strategy has allowed the company to maintain a strong market position. The company's commitment to operational excellence and financial discipline has also been a key factor in its success, as highlighted in a recent market analysis.

SCG's ability to navigate economic cycles and adapt to changing market dynamics showcases its resilience and strategic acumen. The company's continuous efforts in digital transformation and sustainability further strengthen its competitive edge, ensuring it remains relevant in the evolving business environment. Learn more about the Growth Strategy of Siam Cement.

SCG's widespread distribution network across Southeast Asia is a significant competitive advantage. This network allows for efficient delivery of products to diverse customer segments. This deep market penetration, built over decades, provides a logistical edge, especially in regions with developing infrastructure.

The 'SCG' brand is synonymous with quality and reliability in ASEAN. This strong brand equity translates into sustained customer preference and the ability to command a premium. This brand loyalty helps maintain market share, even in price-sensitive markets. The company's reputation has been built over more than a century.

SCG's continuous investment in research and development provides a technological edge, particularly in sustainable solutions. The company focuses on developing high-value-added products like eco-friendly cement and advanced petrochemicals. This focus meets evolving market demands and regulatory requirements, such as green polymer and circular economy practices.

SCG benefits from significant economies of scale across its diversified operations. This allows for cost efficiencies in production, procurement, and logistics. The integrated business model, spanning upstream manufacturing to downstream distribution, enhances operational synergies. These efficiencies contribute to the company's profitability.

SCG's competitive advantages are multifaceted, contributing to its strong market position. These advantages include a robust distribution network, strong brand equity, technological innovation, and economies of scale. These factors enable SCG to maintain a leading position in the construction and industrial materials sectors.

- Extensive distribution network across Southeast Asia.

- Strong brand equity and reputation for quality.

- Continuous investment in research and development.

- Significant economies of scale across diversified operations.

Siam Cement Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Siam Cement’s Competitive Landscape?

The competitive landscape for Siam Cement Company (SCG) is shaped by dynamic industry trends and evolving market conditions. Understanding these factors is crucial for assessing SCG's market position and future prospects. This analysis provides insights into the industry trends, challenges, and opportunities that SCG faces, offering a comprehensive view of its competitive environment.

SCG's market position is influenced by its ability to adapt to changing industry dynamics, including sustainability, technological advancements, and regulatory shifts. The company's future outlook depends on its strategic responses to these trends and its capacity to capitalize on emerging opportunities, ensuring long-term competitiveness and growth. A thorough market analysis reveals the critical factors shaping SCG's strategic direction and financial performance.

The construction and materials industry is experiencing significant shifts. There's a rising demand for sustainable products and green building materials. Technological advancements, such as AI and automation, are transforming manufacturing processes. SCG must adapt to these trends to maintain its competitive edge.

SCG faces challenges from environmental regulations and carbon emission standards. Global economic shifts, including inflation and interest rate fluctuations, impact demand. New market entrants with niche products pose a competitive threat. Navigating these challenges requires strategic agility and investment.

Emerging markets in Southeast Asia offer significant growth potential for SCG. Product innovations, particularly in high-value and sustainable offerings, present opportunities for increased profitability. Strategic partnerships and mergers can expand the product portfolio and enhance market reach.

SCG's strategic focus on ESG factors and innovation in green solutions is critical. The company's ability to navigate industry trends, capitalize on opportunities, and mitigate threats is essential. Continuous adaptation and strategic investment will determine SCG's future competitive position.

SCG's success hinges on several key factors. Sustainability initiatives and green solutions are increasingly important. Technological integration and digital transformation are crucial for efficiency. Strategic partnerships and international expansion drive growth.

- Sustainability: SCG's focus on sustainable practices, such as Green Polymer solutions, is vital. In 2024, the company invested heavily in eco-friendly materials to meet growing demand.

- Technology: Automation and AI are transforming manufacturing. SCG is investing in digital transformation to enhance efficiency and customer engagement.

- Market Expansion: Expanding in Southeast Asia and other emerging markets is a key strategy. SCG is actively seeking strategic partnerships to broaden its market reach.

- Financial Performance: In 2024, SCG aimed to increase revenue by 5% through strategic investments and market expansion, demonstrating its commitment to sustainable growth.

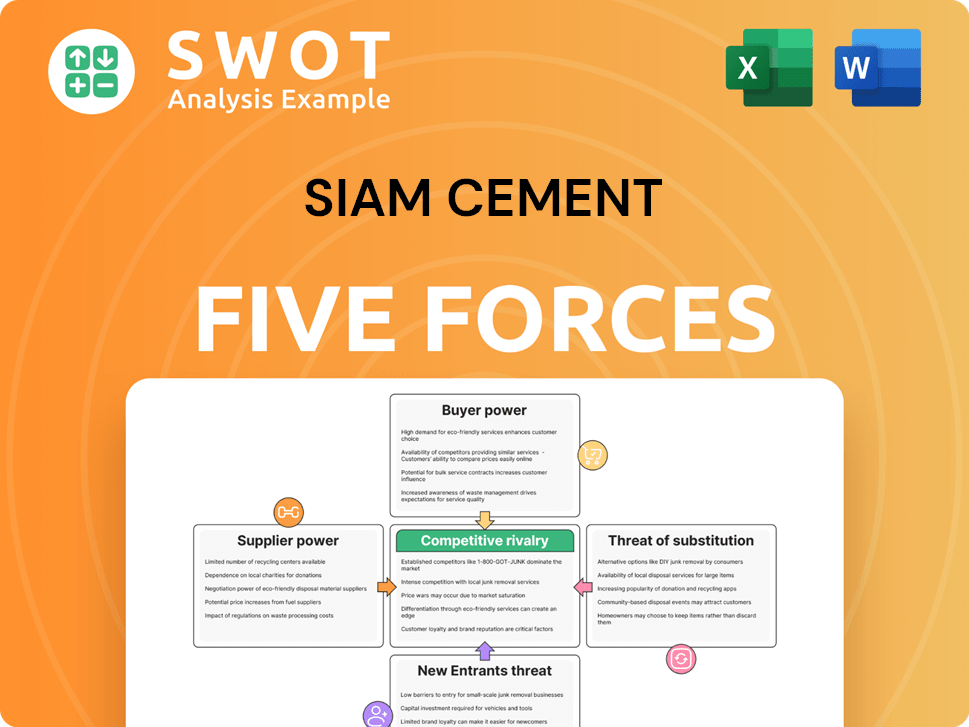

Siam Cement Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Siam Cement Company?

- What is Growth Strategy and Future Prospects of Siam Cement Company?

- How Does Siam Cement Company Work?

- What is Sales and Marketing Strategy of Siam Cement Company?

- What is Brief History of Siam Cement Company?

- Who Owns Siam Cement Company?

- What is Customer Demographics and Target Market of Siam Cement Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.