Sydney Airport Bundle

Who are Sydney Airport Company's Main Rivals in the Aviation Arena?

Sydney Airport Company, a cornerstone of Australian aviation, is more than just a transit hub; it's a battleground for market share. With over 40 million passengers passing through its gates in 2023, the airport's dominance is constantly challenged. Understanding the Sydney Airport SWOT Analysis is crucial to grasp the competitive dynamics at play.

The competitive landscape of the Sydney Airport Company is a complex interplay of factors, from airport competition to airline strategies. This analysis dives deep into the airport industry analysis, examining Sydney Airport market share and its rivals. We'll explore the airlines operating in Sydney, providing insights into how Sydney Airport maintains its position in a competitive environment, and evaluate Sydney Airport passenger traffic statistics compared to rivals.

Where Does Sydney Airport’ Stand in the Current Market?

Sydney Airport Company holds a commanding market position within the Australian aviation sector, particularly in New South Wales, where it manages the largest volume of passenger traffic. While specific market share data for 2024-2025 is still being compiled, the airport consistently leads in passenger numbers nationwide. This dominance is a key factor in its strategic importance as Australia's primary international gateway and a vital domestic travel hub.

The company's core operations involve providing essential infrastructure for both airlines and passengers. This includes three operational runways, four passenger terminals, and extensive retail and dining facilities. It caters to a diverse customer base, from major international carriers to budget airlines, ensuring a broad reach across various segments of the aviation market. Its geographical focus is primarily in Sydney, but its connectivity extends globally, serving as a crucial link to Asia, North America, and Europe.

Sydney Airport has strategically diversified its offerings to enhance non-aeronautical revenue streams. This diversification includes significant expansions in its retail and property portfolios, which helps to mitigate the impact of fluctuations in passenger numbers. This approach strengthens its financial health and overall market resilience. For further insights into the ownership structure, you can explore the Owners & Shareholders of Sydney Airport.

In the 11 months leading up to November 2023, Sydney Airport handled approximately 38.6 million passengers. This figure represents 86.8% of the passenger volume recorded in 2019, demonstrating a robust recovery from the pandemic. This data underscores its leading position in the Australian airport industry.

The airport's financial health is strong, as reflected in its recent acquisition valuation. In 2023, it reported a net profit after tax of A$146.2 million. This financial performance highlights the airport's operational efficiency and profitability, further solidifying its market position.

Sydney Airport provides essential infrastructure, including three runways and four terminals. These facilities support a wide range of airlines, from major international carriers to regional operators. The extensive retail and dining outlets enhance the passenger experience and contribute to non-aeronautical revenue.

Sydney Airport has strategically expanded its retail and property portfolios. This diversification helps to stabilize revenue streams and reduce reliance on passenger numbers. This strategy supports long-term financial health and resilience against market fluctuations.

Sydney Airport faces competition from other major Australian airports, particularly for domestic routes and as alternative international gateways. However, its scale and connectivity remain unmatched. The airport's strong financial performance and strategic diversification provide a competitive edge in the market.

- Dominant Market Position: Holds the largest passenger volume in Australia.

- Infrastructure: Operates three runways and four terminals.

- Financial Health: Reported a net profit after tax of A$146.2 million in 2023.

- Strategic Focus: Diversifies revenue through retail and property.

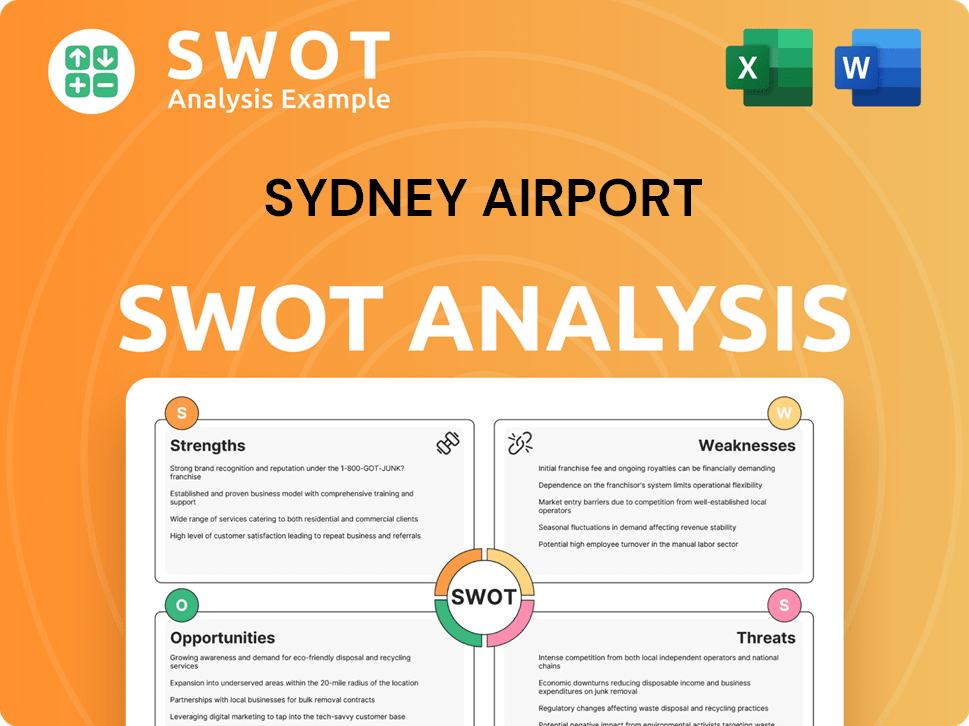

Sydney Airport SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Sydney Airport?

The Sydney Airport Company faces a dynamic competitive landscape, shaped by both direct and indirect rivals. Understanding these competitors is crucial for assessing the airport's market position and future strategies. The airport industry analysis reveals a complex interplay of factors influencing competition, including passenger traffic, route development, and airline partnerships.

Sydney Airport's market share is constantly challenged by other major airports and alternative transportation methods. The strategies of airlines and the expansion plans of competing airports further complicate the competitive environment. Analyzing these factors provides insights into the challenges and opportunities facing Sydney Airport.

Airport competition extends beyond direct rivals to include regional airports and evolving transportation options. This comprehensive view helps to understand the pressures on Sydney Airport to innovate and maintain its competitive edge. The following sections detail the key competitors and the factors influencing their impact on Sydney Airport.

Direct competitors primarily include other major Australian international airports. These airports compete for both international and domestic passenger traffic. They also vie for airline partnerships and route development.

Melbourne Airport is Australia's second busiest airport, offering a similar range of services. It actively competes with Sydney for international and domestic passengers. Melbourne focuses on attracting airlines and expanding its route network.

Brisbane Airport, the third busiest, serves as a gateway to Queensland and northern Australia. It attracts airlines and passengers with its own set of routes and facilities. Brisbane competes with Sydney through route development and incentives.

These airports challenge Sydney through route development, terminal upgrades, and airline incentives. They aim to capture a larger share of the lucrative international and domestic travel markets. Both Melbourne and Brisbane have pursued new international routes.

The actions of these competitors directly impact Sydney's market share in specific segments. Their strategies can influence the flow of passengers and the profitability of routes. Continuous monitoring of these competitors is essential.

Recent expansions and upgrades at Melbourne and Brisbane Airports highlight the ongoing pressure. These developments underscore the need for Sydney to innovate and maintain its competitive edge. These expansions are ongoing.

Indirect competition comes from regional airports and alternative transportation. Airlines' strategies and mergers also shape the landscape. These factors influence the overall competitive environment.

- Regional Airports: Gold Coast Airport (OOL) and Adelaide Airport (ADL) offer alternative entry points. They can divert some domestic traffic.

- High-Speed Rail: Proposals for high-speed rail could pose a long-term threat. They would offer a competitive alternative for inter-city travel.

- Airline Strategies: Major airlines can shift hubs or increase capacity at competing airports. This is based on commercial agreements and efficiencies.

- Mergers and Alliances: Consolidated carriers may prioritize certain hubs. This reshapes the competitive dynamics.

- Infrastructure Projects: Ongoing expansions at competing airports put pressure on Sydney. Sydney needs to innovate and maintain its edge.

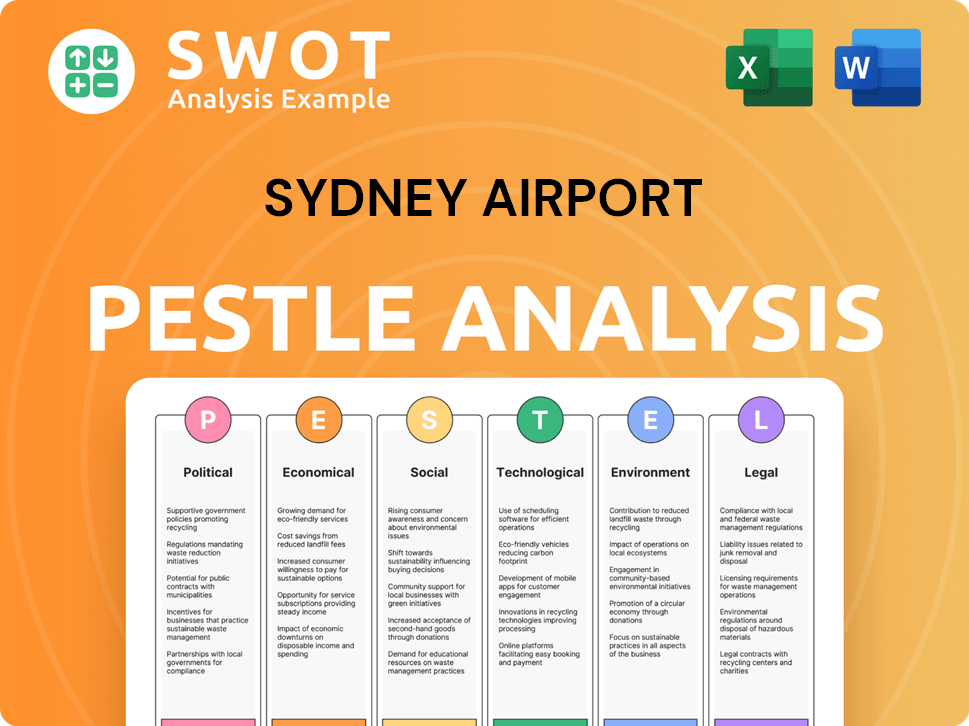

Sydney Airport PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Sydney Airport a Competitive Edge Over Its Rivals?

The Revenue Streams & Business Model of Sydney Airport is shaped significantly by its competitive advantages. Sydney Airport, as the primary international gateway to Australia, enjoys a strategic location and a robust network, making it a critical hub for both international and domestic travel. This established connectivity and network effect are difficult for competitors to replicate, thus solidifying its position within the airport industry.

Sydney Airport's competitive landscape is defined by its ability to handle a high volume of aircraft movements and passenger throughput efficiently, thanks to its three operational runways and four passenger terminals. This operational capacity, combined with strong brand equity and established airline relationships, provides a significant edge. These advantages are further enhanced by ongoing investments in infrastructure upgrades and technological advancements, ensuring the airport remains competitive.

The airport's strategic importance and continuous investment in infrastructure and services contribute to the sustainability of its competitive edge. However, it faces threats from potential capacity constraints and the ongoing development of competing airports. The airport's financial performance, including its non-aeronautical revenue streams, is crucial for maintaining its competitive position within the airport competition.

Sydney Airport's strategic location near the Sydney CBD and its role as Australia's primary international gateway are key advantages. This central location makes it the preferred entry point for a vast majority of international visitors. Its extensive network of international and domestic flights further strengthens its position, making it a crucial hub for domestic travel.

The airport's three runways and four passenger terminals provide significant capacity and operational flexibility. This allows it to efficiently handle a high volume of aircraft movements and passenger throughput. Ongoing infrastructure upgrades and technological advancements further enhance operational efficiency and passenger experience.

Sydney Airport benefits from strong brand equity and long-standing partnerships with major global airlines. These relationships often translate into preferred slots and operational agreements. The airport's large passenger base and access to the lucrative Sydney market attract airlines, solidifying its position.

Economies of scale allow for more efficient operations and potentially lower per-passenger costs. The airport's extensive retail and dining offerings provide a significant non-aeronautical revenue stream, diversifying its income. Continuous upgrades to these offerings enhance the passenger experience and contribute to overall financial performance.

Sydney Airport's competitive advantages are multifaceted, encompassing its strategic location, operational efficiency, brand equity, and diverse revenue streams. These factors contribute to its strong market position within the airport industry analysis. The airport's ability to maintain and enhance these advantages is crucial for its long-term success.

- Strategic Location: Australia's primary international gateway.

- Operational Efficiency: Three runways and four terminals.

- Brand Equity: Strong airline partnerships.

- Revenue Streams: Diversified income from retail and dining.

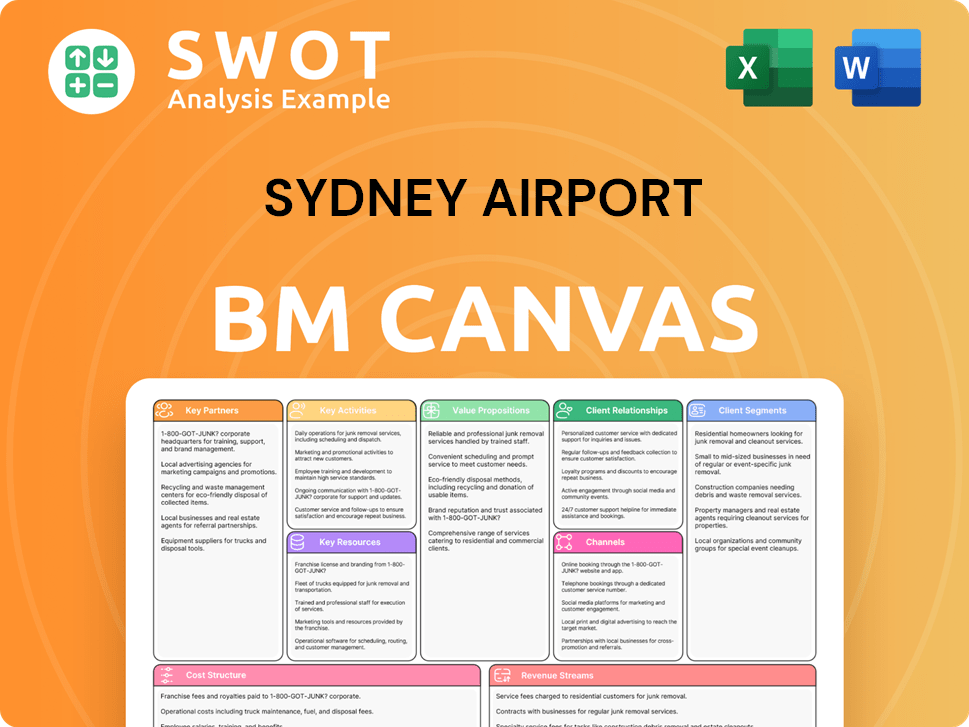

Sydney Airport Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Sydney Airport’s Competitive Landscape?

The competitive landscape of the Sydney Airport Company is significantly shaped by industry trends, challenges, and opportunities. These factors influence the airport's strategic decisions and operational performance. Understanding these elements is crucial for assessing the airport's position and future prospects. Recent data indicates that the airport is handling increasing passenger numbers, which puts it in a strong position for growth, but it also needs to meet the challenges of the future.

The airport faces both risks and opportunities in a dynamic market. Technological advancements, regulatory changes, and evolving consumer preferences all play a role in shaping the airport's competitive standing. Furthermore, global economic conditions and geopolitical events can significantly impact the airport's operations. The airport's strategic responses to these factors will determine its ability to maintain and enhance its market position.

Technological advancements, such as biometrics and AI, are transforming airport operations, enhancing efficiency and passenger experience. Regulatory changes, especially concerning environmental sustainability and noise abatement, present ongoing challenges. Evolving consumer preferences, including demand for seamless travel and sustainable practices, necessitate continuous innovation in service delivery.

Potential new market entrants, such as expanding regional airports or high-speed rail, could divert traffic. Geopolitical shifts and economic volatility can impact international travel demand and airline profitability. The increasing focus on sustainability requires significant investment in sustainable aviation fuels and infrastructure, posing financial and operational challenges.

The growing middle class in Asia drives demand for international travel, benefiting Sydney Airport. Product innovations, such as enhanced digital services and improved ground transport, offer avenues for revenue diversification. Strategic partnerships with airlines and tourism bodies can unlock new routes and optimize operations.

Ongoing infrastructure upgrades, diversification of revenue streams beyond aeronautical services, and a strong focus on enhancing the passenger experience are key strategies. Technological integration, sustainability initiatives, and strategic collaborations are essential for capitalizing on emerging opportunities. The company aims to maintain its competitive position through these measures.

Sydney Airport's strategies focus on maintaining its competitive position through several key initiatives. These include infrastructure upgrades, which are critical for handling increasing passenger volumes and improving operational efficiency. Diversifying revenue streams, such as retail and commercial activities, enhances financial resilience.

- Infrastructure Upgrades: Continuous investment in terminals, runways, and other facilities to accommodate growth.

- Revenue Diversification: Expanding retail, commercial, and other non-aeronautical revenue streams.

- Passenger Experience: Enhancing services and amenities to improve passenger satisfaction and loyalty.

- Strategic Partnerships: Collaborating with airlines, technology providers, and tourism bodies.

The Brief History of Sydney Airport reveals how it has adapted to industry changes, providing insights into its current strategies. The airport's ability to navigate these challenges and capitalize on opportunities will determine its long-term success.

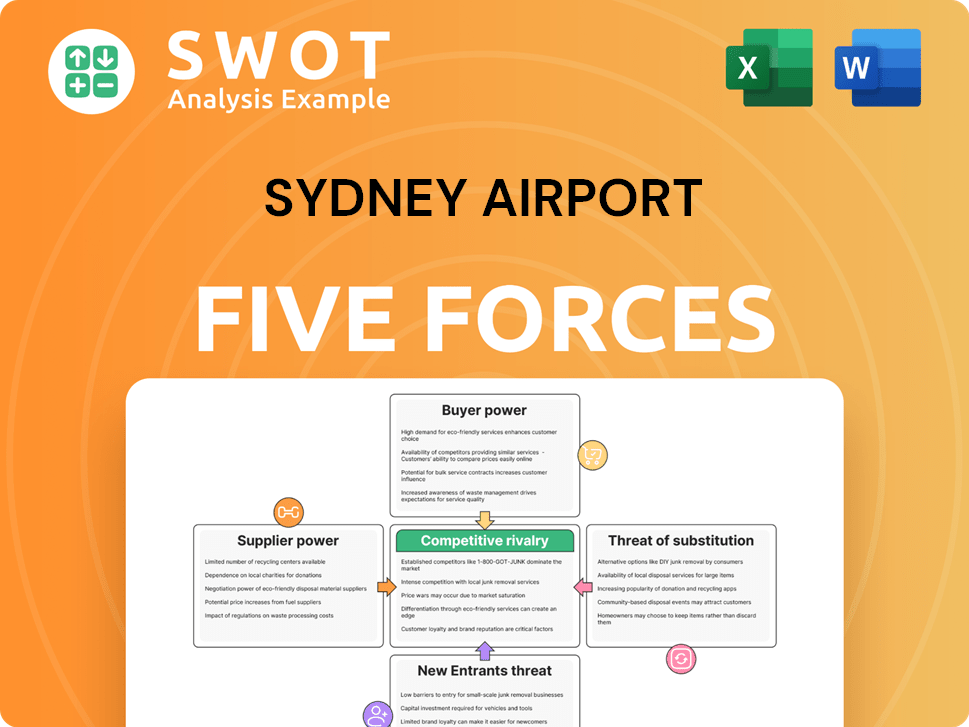

Sydney Airport Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sydney Airport Company?

- What is Growth Strategy and Future Prospects of Sydney Airport Company?

- How Does Sydney Airport Company Work?

- What is Sales and Marketing Strategy of Sydney Airport Company?

- What is Brief History of Sydney Airport Company?

- Who Owns Sydney Airport Company?

- What is Customer Demographics and Target Market of Sydney Airport Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.