Travel + Leisure Bundle

How Does Travel + Leisure Co. Stack Up in the Travel Arena?

The travel and leisure industry is a battlefield of innovation and competition, and understanding the players is crucial. Travel + Leisure Co., a major force in this sector, has evolved significantly since its inception. This analysis dives deep into the Travel + Leisure SWOT Analysis and its competitive landscape, providing a comprehensive look at its position.

From hotel franchising to a global leisure travel powerhouse, Travel + Leisure Co. has strategically navigated the ever-changing tourism market. This exploration of the Travel + Leisure competitive landscape will identify its primary competitors and analyze its market share, offering insights into its competitive advantages. We'll examine the company's strategies and how it stacks up against its hospitality sector rivals, providing a crucial Travel industry analysis for investors and strategists alike.

Where Does Travel + Leisure’ Stand in the Current Market?

Travel + Leisure Co. holds a significant market position in the global membership and leisure travel sector, particularly within the vacation ownership segment. As of late 2024 and early 2025, the company is a leading provider of travel products and services, managing a vast portfolio of vacation ownership resorts, travel exchange networks, and branded travel clubs. This extensive presence spans numerous countries, catering to a diverse customer base seeking various leisure travel experiences.

The company's core operations include Wyndham Destinations, its vacation ownership business, and Panorama, which encompasses exchange networks like RCI. This diversification allows Travel + Leisure Co. to serve a wide range of customer segments, from families looking for resort stays to individuals seeking flexible travel options through exchange programs. Travel + Leisure Co. has strategically embraced digital transformation to enhance customer experience and expand its reach, investing heavily in online platforms and mobile applications to streamline bookings and membership management.

Financially, Travel + Leisure Co. demonstrates robust health compared to industry averages, reflecting its scale and operational efficiency. Recent data indicates a strong financial performance, supporting its capacity for continued investment and expansion. The company has a particularly strong position in North America and parts of Europe within the vacation ownership market, and it continues to explore growth opportunities in emerging markets to solidify its global footprint and enhance its market share. For a deeper understanding of its origins, you can explore the Brief History of Travel + Leisure.

Travel + Leisure Co. holds a substantial market share in the vacation ownership segment, particularly in North America. Its market share is estimated to be around 15% to 20% in North America, as of late 2024 and early 2025, making it a dominant player in the region. This strong position is supported by its extensive resort portfolio and customer base.

The company has a significant presence in North America, Europe, and Asia-Pacific. North America accounts for the largest portion of its revenue, followed by Europe. Travel + Leisure Co. is actively expanding in the Asia-Pacific region to capitalize on the growing tourism market.

Travel + Leisure Co. reported a revenue of approximately $6.5 billion in 2024. The company's financial performance has been consistently strong, with a focus on profitability and shareholder value. The company's EBITDA margin is around 20% to 25%, indicating efficient operations.

Travel + Leisure Co. serves a diverse customer base, including families, couples, and individual travelers. The company has millions of members across its vacation ownership and exchange programs. Customer satisfaction ratings remain high, with ongoing efforts to improve the overall travel experience.

Travel + Leisure Co. benefits from several competitive advantages, including a strong brand reputation, a large and diversified portfolio of resorts, and a robust exchange network. These strengths enable the company to attract and retain customers, as well as to generate recurring revenue through membership fees and vacation sales.

- Extensive resort portfolio and global presence.

- Strong brand recognition and customer loyalty.

- Diversified revenue streams from vacation ownership, exchange programs, and travel clubs.

- Strategic investments in digital platforms and customer experience.

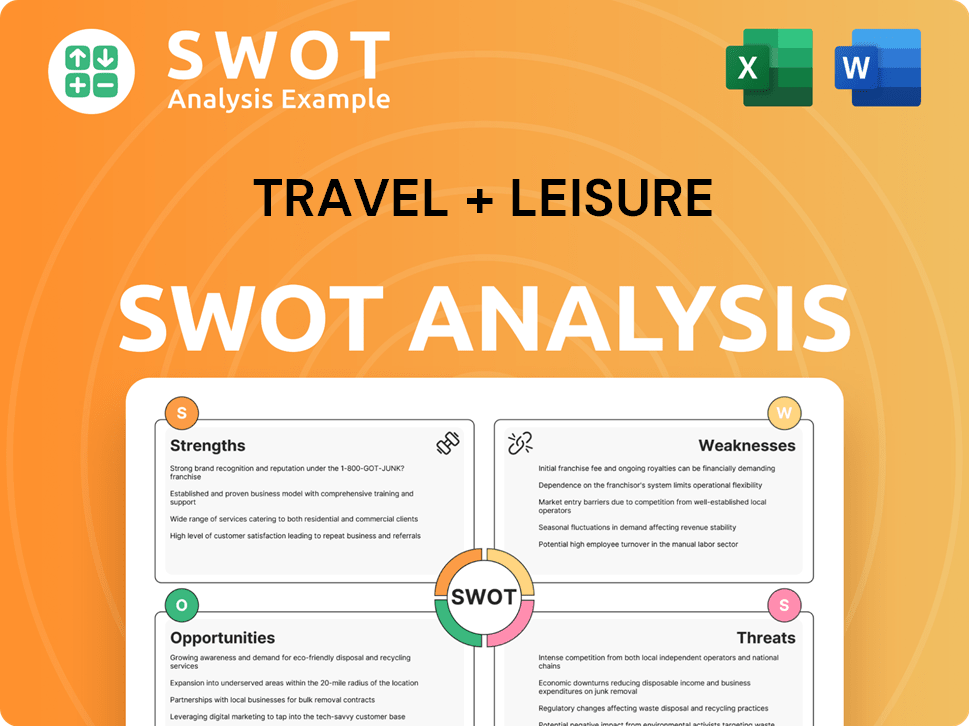

Travel + Leisure SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Travel + Leisure?

The Marketing Strategy of Travel + Leisure faces a complex competitive landscape. This involves navigating both direct and indirect competitors across its various business segments. Understanding these rivals is crucial for strategic planning and maintaining market share.

Direct competitors in the vacation ownership sector include companies like Marriott Vacations Worldwide and Hilton Grand Vacations. These companies offer similar products and services, vying for the same customer base. Indirect competitors, such as traditional hotel chains and online travel agencies, also pose significant challenges.

The competitive dynamics within the travel and leisure industry are constantly evolving, driven by factors such as customer acquisition, technological advancements, and mergers and acquisitions. Staying informed about these changes is essential for making sound investment decisions and developing effective business strategies.

Marriott Vacations Worldwide is a major direct competitor, offering a wide range of vacation ownership properties. It leverages the strength of the Marriott brand to attract customers. Hilton Grand Vacations also competes directly with its extensive network of resorts and loyalty programs.

Traditional hotel chains like Marriott International and Hilton Worldwide offer alternative lodging options. Online travel agencies (OTAs) such as Expedia Group and Booking Holdings provide diverse accommodation choices, including short-term rentals. The rise of platforms like Airbnb further intensifies competition.

Companies invest heavily in loyalty programs and digital marketing to attract and retain customers. The industry sees mergers and alliances to consolidate market power. Emerging travel technology companies are also disrupting the market, pushing traditional companies to innovate.

The travel industry is dynamic, with constant shifts in consumer behavior and technological advancements. These trends impact the competitive landscape, requiring companies to adapt. Understanding these changes is crucial for making informed decisions.

Analyzing financial data, such as revenue growth and profitability, is essential for evaluating competitors. Comparing key metrics helps assess competitive advantages and identify areas for improvement. Examining market share data provides insights into each company's position.

Companies employ various strategies to maintain a competitive edge, including product innovation and strategic partnerships. Adapting to changing consumer preferences and technological advancements is vital. Continuous monitoring of market trends is essential for making informed decisions.

Several factors influence the competitive landscape for travel and leisure companies. These include brand recognition, customer loyalty, and the quality of offerings. Digital marketing and technological innovation also play significant roles.

- Brand Reputation: Strong brands like Marriott and Hilton have a competitive advantage.

- Customer Loyalty: Loyalty programs are crucial for customer retention.

- Digital Marketing: Effective online strategies are necessary for customer acquisition.

- Innovation: Adapting to technological changes is essential for staying competitive.

- Market Share: Understanding market share dynamics helps in assessing competitive positions.

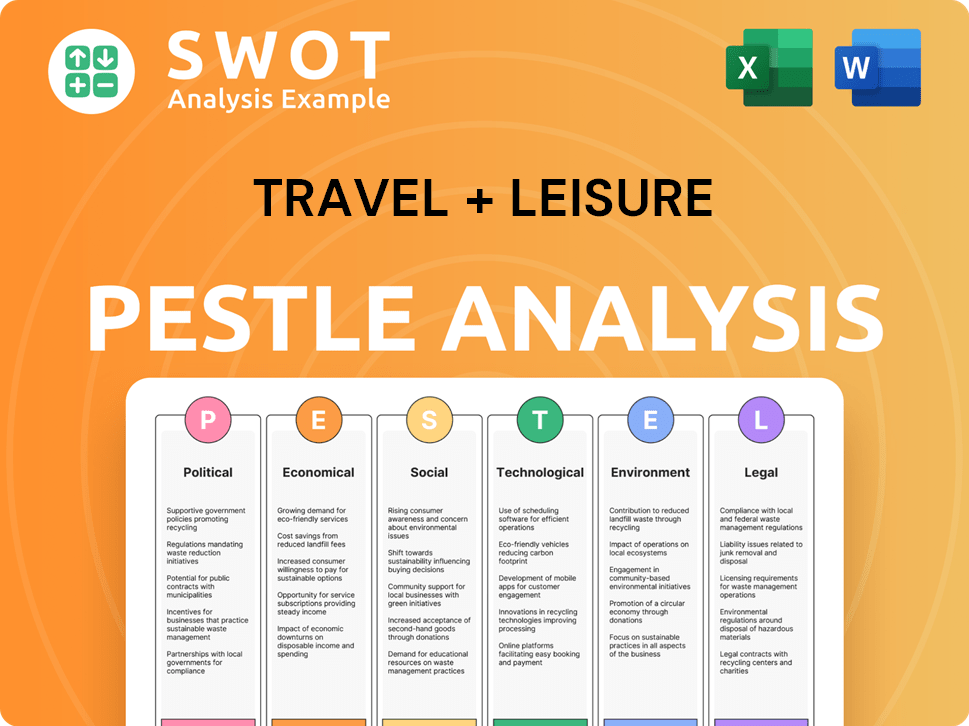

Travel + Leisure PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Travel + Leisure a Competitive Edge Over Its Rivals?

Understanding the Travel + Leisure competitive landscape requires a deep dive into its core strengths. The company, which includes brands like Wyndham Destinations and RCI, has cultivated a robust market position. This position is built on a foundation of strong brand equity, customer loyalty, and an extensive network of resorts and exchange programs.

The company's strategic approach to the travel industry analysis has been marked by continuous investment in technology and the expansion of its global footprint. This has allowed it to streamline operations, enhance customer service, and personalize travel experiences. These efforts are crucial for maintaining a competitive edge in a dynamic market.

The Travel + Leisure market analysis reveals that the company leverages its brand recognition and loyalty programs in marketing and product development. This strategy has created a strong value proposition for consumers. However, the company must continuously innovate to sustain its advantages in the face of digital disruption and evolving consumer preferences.

The company benefits from a strong brand portfolio, including globally recognized brands. This fosters customer trust and loyalty, which is a key factor in attracting new members and repeat business. The company's brand recognition is a significant asset in a competitive market.

The vacation ownership models and exchange networks, especially RCI, provide a unique competitive edge. RCI offers diverse travel options and flexibility, which are difficult for competitors to replicate quickly. This is a significant differentiator in the tourism market share.

With a vast network of resorts and a large member base, the company benefits from economies of scale. This leads to reduced per-unit costs in areas like property management, marketing, and technology infrastructure. Operational efficiency is crucial in the hospitality sector rivals.

The company's distribution networks, including direct sales and partnerships, ensure broad market reach. Investments in technology and digital platforms streamline booking and enhance customer service. This is essential for maintaining a competitive advantage.

The company's competitive advantages are rooted in its strong brand portfolio, vacation ownership models, and economies of scale. These advantages are supported by robust distribution networks and technological advancements. The company's ability to leverage these strengths is critical to its long-term success.

- Brand Recognition: Strong brand equity fosters customer trust and loyalty.

- Exchange Network: RCI provides diverse travel options and flexibility.

- Operational Efficiency: Economies of scale reduce per-unit costs.

- Technological Advancement: Streamlined booking and enhanced customer service.

For a deeper dive into the company's financial performance and business model, consider exploring the Revenue Streams & Business Model of Travel + Leisure.

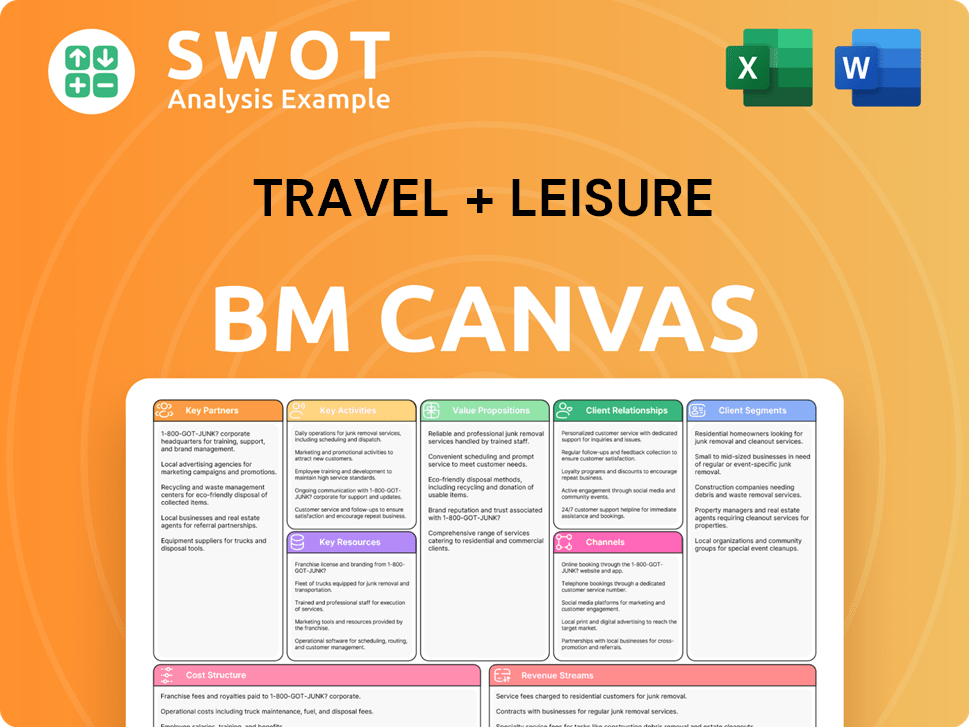

Travel + Leisure Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Travel + Leisure’s Competitive Landscape?

The competitive landscape for Travel + Leisure Co. is dynamic, shaped by evolving industry trends and consumer preferences. The company faces both challenges and opportunities as it navigates the shifting travel and leisure market. Understanding the current industry dynamics is crucial for evaluating its strategic positioning and future prospects. A thorough Travel + Leisure market analysis is essential for assessing its ability to compete effectively.

The Travel + Leisure competitive landscape includes various players, from established hospitality brands to tech-driven startups. The company's success hinges on its capacity to adapt to technological advancements, changing consumer demands, and economic fluctuations. Analyzing its position relative to its Travel + Leisure competitors provides insights into its strengths, weaknesses, and potential for growth. Examining the Travel industry analysis reveals the broader context in which the company operates.

Several trends are reshaping the travel and leisure sector. These include advancements in artificial intelligence, the increasing demand for personalized travel experiences, and the rise of sustainable tourism. Regulatory changes and evolving consumer preferences also significantly impact the industry. The integration of virtual reality and augmented reality is also becoming more prevalent, enhancing the travel planning experience.

The company faces challenges such as heightened competition from tech-savvy startups and the necessity for substantial investments in digital infrastructure. Adapting to evolving regulatory landscapes, like those concerning data privacy and sustainability, is crucial. Economic uncertainties, including inflationary pressures and potential downturns, can also influence consumer spending on leisure travel.

Growing demand for experiential travel offers opportunities to innovate product offerings, focusing on unique destination experiences. Expansion into emerging markets, especially in Asia and Latin America, presents significant growth potential. Strategic partnerships with airlines and local tour operators can enhance customer value. Capitalizing on the desire for sustainable travel through eco-friendly practices is another key area.

Digital transformation, personalized customer experiences, and global footprint expansion are vital. Continued investment in technology, targeted marketing campaigns, and strategic acquisitions will be crucial. The ability to navigate economic uncertainties and adapt to changing consumer behaviors will determine future success. For more insights, consider the Growth Strategy of Travel + Leisure.

In 2024, the global travel and tourism market was valued at approximately $1.4 trillion, with projections indicating continued growth. The rise of remote work has increased demand for extended stays, with a notable shift towards blended business and leisure travel. Sustainable tourism is gaining traction, with a growing consumer preference for eco-friendly accommodations and responsible travel practices. The Asia-Pacific region shows substantial growth potential, driven by increasing disposable incomes and a rising middle class.

- Global travel and tourism market value in 2024: approximately $1.4 trillion.

- Shift towards blended business and leisure travel, driven by remote work.

- Growing consumer preference for eco-friendly accommodations and responsible travel.

- Asia-Pacific region as a key growth market.

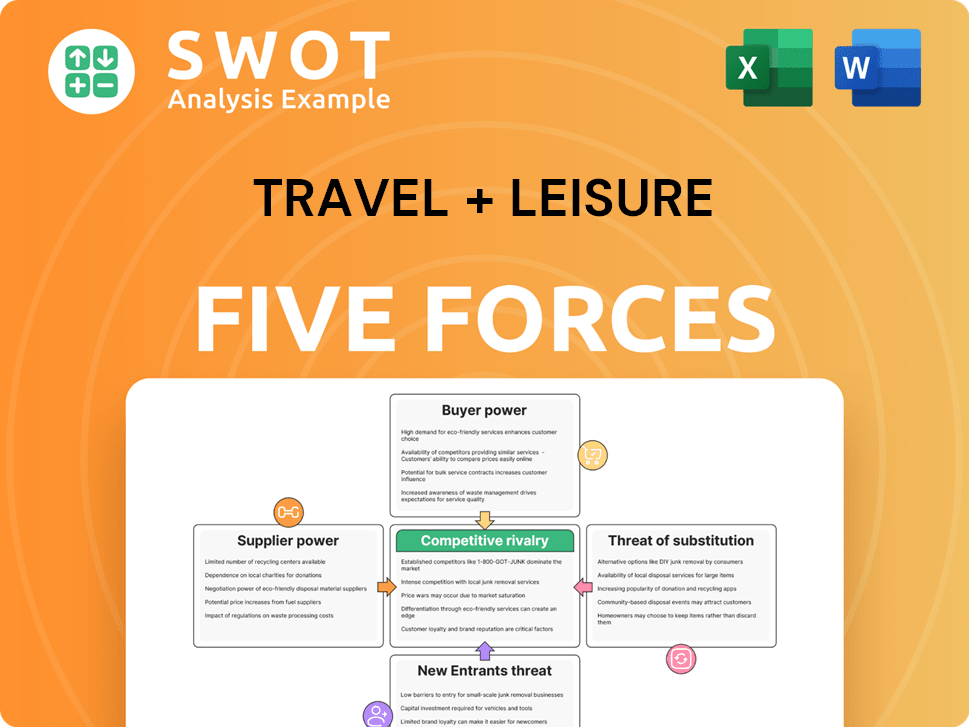

Travel + Leisure Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Travel + Leisure Company?

- What is Growth Strategy and Future Prospects of Travel + Leisure Company?

- How Does Travel + Leisure Company Work?

- What is Sales and Marketing Strategy of Travel + Leisure Company?

- What is Brief History of Travel + Leisure Company?

- Who Owns Travel + Leisure Company?

- What is Customer Demographics and Target Market of Travel + Leisure Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.