Via Location SA Bundle

How Does Via Location SA Navigate the Cutthroat Vehicle Rental Market?

The transportation sector is experiencing a seismic shift, and Via Location SA SWOT Analysis reveals its position within this dynamic environment. This company, a veteran in industrial and commercial vehicle rental, offers crucial services aimed at minimizing downtime for businesses. Its comprehensive offerings, including fleet management and maintenance, are central to its role in the industry.

This exploration delves into the Via Location SA competitive landscape, providing a thorough market analysis of its position. We'll examine its key rivals, Via Location SA competitors, and distinct advantages, offering insights into its business strategy and future outlook. Understanding the Competitive Landscape is crucial for anyone seeking to understand this key player in the industry.

Where Does Via Location SA’ Stand in the Current Market?

Via Location SA, a key player in the industrial and commercial vehicle rental sector, focuses on providing comprehensive vehicle solutions. The company specializes in both short-term and long-term rentals of industrial and commercial vehicles, including trucks. They also offer related services like fleet management, maintenance, and driver management.

The company's business model centers on owning the vehicles and ensuring their availability to clients. This approach allows businesses to optimize their operations by outsourcing their vehicle needs. This includes a wide array of services designed to support the operational efficiency of its clients.

Via Location SA has a strong presence across metropolitan France, its overseas departments, and the Benelux region. This extensive reach allows the company to serve a broad customer base. The company supports its operations with a network of 55 agencies and 40 integrated workshops.

As of early 2017, Via Location SA was recognized as the 'challenging n°3' player in its sector in France. The company's strategic moves, such as the acquisition by Fraikin in October 2020, indicate a dynamic positioning within the market. This acquisition suggests a focus on consolidation within the French industrial vehicle rental market, with the intent to play a leading role.

In early 2017, the company had a turnover of approximately 150 million Euros. This financial scale underscores its significant presence within the industry. This financial standing highlights its capacity to invest in its fleet and services.

The company's ambition to reach 'the next level' and its readiness to explore external growth opportunities highlight its proactive approach. This proactive approach is aimed at maintaining and strengthening its market standing. This includes a focus on expanding its service offerings and geographic reach.

The Competitive Landscape of Via Location SA is shaped by its focus on full-service vehicle solutions. The company's strategy involves both organic growth and strategic acquisitions to strengthen its market position. The company's success is tied to its ability to meet the evolving needs of its customers.

- Focus on full-service vehicle solutions.

- Strategic acquisitions for market consolidation.

- Extensive network of agencies and workshops.

- Strong presence in France and Benelux.

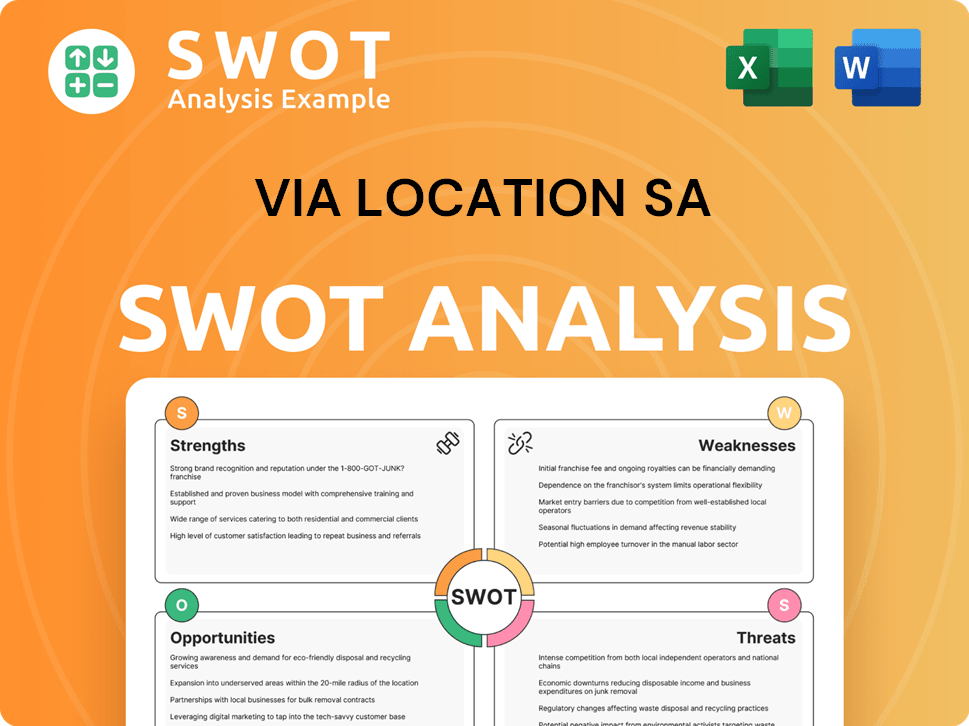

Via Location SA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Via Location SA?

The competitive landscape for Via Location SA, a company in the industrial and commercial vehicle rental sector, involves both direct and indirect competitors. A thorough market analysis is crucial for understanding the challenges and opportunities within this industry. The company's competitive landscape is shaped by various factors, including pricing strategies, service offerings, and geographic reach.

Direct competitors typically include other full-service vehicle rental companies that provide leasing, maintenance, and fleet management solutions. Indirect competition arises from logistics companies with their own fleets and the broader location-based services market. Understanding these dynamics is essential for assessing Via Location SA's industry position and developing effective business strategy.

The Company Overview reveals that Via Location SA operates within a sector experiencing significant changes. The acquisition of Via Location by Fraikin in 2020 suggests a trend toward consolidation within the industry. This move aims to strengthen market positions and enhance competitive advantages.

Direct competitors offer similar services, including long-term and short-term vehicle rentals, maintenance, and fleet management. These companies compete on factors like pricing, service breadth, and geographic coverage. Key players in this space frequently vie for major fleet contracts.

Indirect competition comes from logistics companies managing their own vehicle fleets and the broader location-based services market. The growth of location-based services, projected to reach $131.33 billion in 2025, influences demand for traditional rental services. Technological advancements in fleet management software also play a role.

The vehicle rental market is influenced by economic trends, technological advancements, and changing customer preferences. Consolidation, such as the Fraikin acquisition, reflects strategic moves to enhance market share. Understanding these dynamics is vital for Via Location SA's future outlook.

Technological advancements in fleet management software and telematics allow clients to manage their own fleets more efficiently. These advancements can indirectly challenge full-service rental providers. The integration of technology is a key industry trend.

The geographic presence of competitors impacts Via Location SA's market share. Companies with a broader geographic reach often have a competitive advantage. Expansion into new regions is a common strategy for growth within the vehicle rental industry.

Understanding the customer base is crucial for tailoring services and maintaining a competitive edge. Analyzing customer needs and preferences helps in developing effective product offerings. A strong customer base analysis supports strategic decision-making.

To gain a deeper understanding of the company's strategic direction, consider reading about the Growth Strategy of Via Location SA. This article provides further insights into the company's plans for navigating the competitive environment and achieving its objectives. The vehicle rental industry is dynamic, and continuous adaptation is necessary for success.

Via Location SA must focus on several key areas to maintain and improve its market position. These include enhancing service offerings, expanding geographic reach, and leveraging technology. Addressing these factors will help the company manage its challenges and opportunities.

- Competitive Advantages: Differentiating through specialized services or pricing strategies.

- Market Share: Analyzing and monitoring market share to identify growth opportunities.

- Financial Performance: Reviewing financial performance review to assess profitability and efficiency.

- SWOT Analysis: Conducting a SWOT analysis to identify strengths, weaknesses, opportunities, and threats.

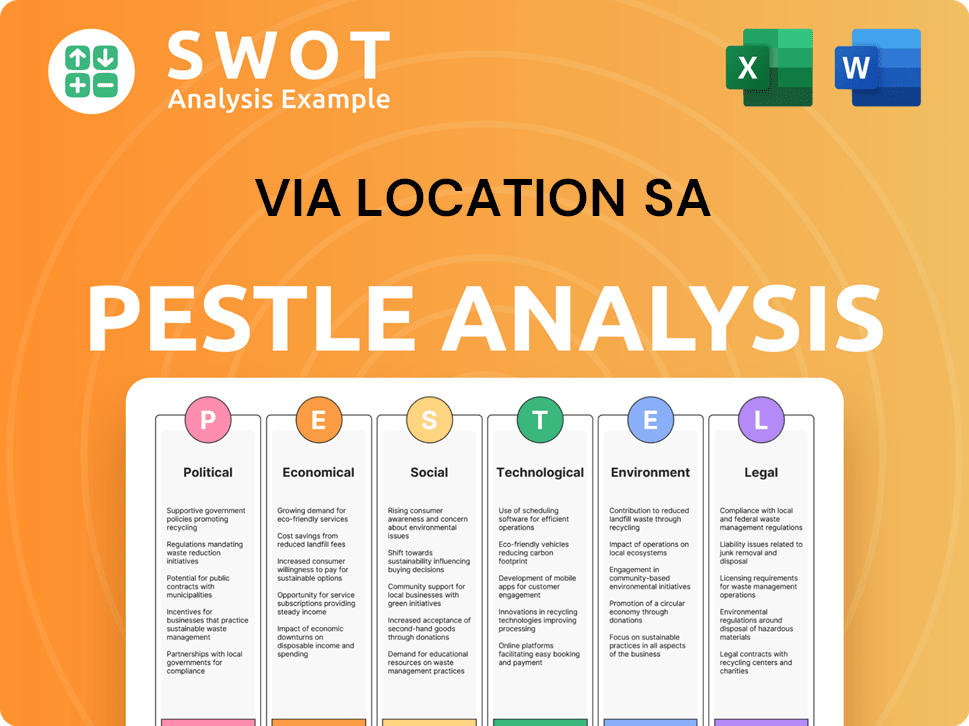

Via Location SA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Via Location SA a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of Via Location SA involves examining its competitive strengths. The company's competitive advantages are rooted in its comprehensive service model and extensive operational infrastructure. This approach allows it to offer a full-service industrial and commercial vehicle rental, including fleet management, driver management, and maintenance.

A key strength of Via Location SA is its wide-reaching network. With a presence across France, its overseas departments, and the Benelux region, it ensures vehicle availability and timely support. The ownership of its vehicle fleet and direct responsibility for vehicle reliability further enhance its service quality. The ability to customize vehicles, acquiring around 1,500 'cabins' annually, demonstrates responsiveness to client needs.

While specific technological details are limited, the adoption of automation and mobility solutions indicates ongoing investments in operational efficiency. This focus on continuous adaptation to customer requirements and optimizing costs through tailored fleet solutions strengthens its competitive position. These advantages appear sustainable due to the integrated services, extensive network, and customer-centric approach, making them difficult for new entrants to replicate quickly. This comprehensive approach to the Competitive Landscape sets it apart in the market.

Via Location SA has likely achieved significant milestones in expanding its agency network, enhancing its service offerings, and improving its fleet management capabilities. These milestones would include the acquisition of new agencies and workshops. The company's continuous adaptation to customer needs, striving to optimize costs for clients by providing tailored fleet solutions, is a key aspect of its strategy.

Strategic moves would likely involve investments in technology to improve operational efficiency and customer service. This includes the adoption of automation and mobility solutions. The company's focus on acquiring approximately 1,500 'cabins' annually and custom-building 'boxes' shows a commitment to adapting to client needs.

The company's competitive edge is built on its full-service approach, extensive network, and customer-centric solutions. The ability to offer comprehensive services, from rentals to fleet management, provides a significant advantage. The wide geographic presence, with 55 agencies and 40 workshops, ensures vehicle availability and support. This integrated approach makes it difficult for competitors to match.

The Market Analysis reveals that Via Location SA competes in the industrial and commercial vehicle rental sector. Industry trends include a growing demand for full-service solutions, driven by businesses seeking to outsource vehicle management. The company's ability to adapt to customer needs, offering tailored fleet solutions, is crucial in the competitive landscape.

Via Location SA's competitive advantages are multifaceted, including its full-service model and extensive network. The company's ability to offer complete vehicle solutions, from rentals to maintenance, sets it apart. Its wide geographic presence ensures vehicle availability and support across key regions.

- Full-Service Offering: Comprehensive vehicle solutions, including rentals, fleet management, and maintenance.

- Extensive Network: 55 agencies and 40 workshops across France, overseas departments, and the Benelux region.

- Customization Capabilities: Ability to acquire and customize vehicles to meet specific client needs.

- Customer-Centric Approach: Focus on adapting to customer requirements and optimizing costs through tailored fleet solutions.

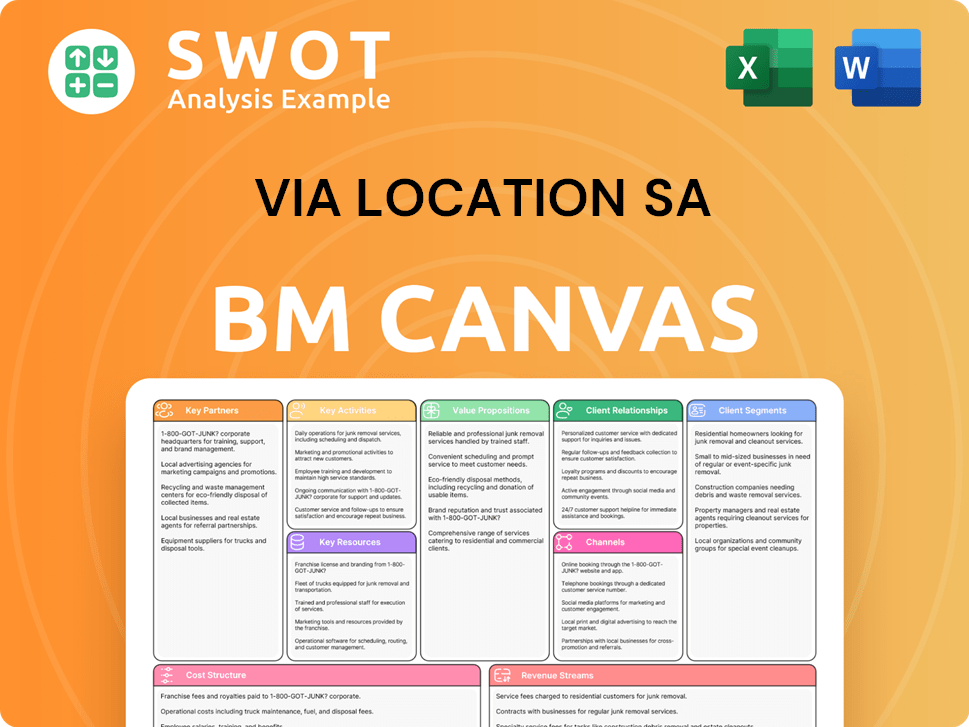

Via Location SA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Via Location SA’s Competitive Landscape?

Understanding the Revenue Streams & Business Model of Via Location SA requires an examination of the broader industry dynamics. The industrial and commercial vehicle rental sector is subject to evolving market forces, including technological advancements, regulatory changes, and shifting consumer preferences. A thorough market analysis reveals both challenges and opportunities for companies like Via Location SA, shaping their strategic positioning and future outlook.

The competitive landscape for Via Location SA is influenced by its ability to adapt to these trends and navigate potential risks. The company's success will depend on its capacity to leverage technological advancements, comply with regulatory demands, and respond to the growing demand for sustainable and efficient transportation solutions. The future outlook hinges on proactive strategies that capitalize on emerging opportunities while mitigating potential threats.

The industrial and commercial vehicle rental sector is experiencing significant technological shifts. The integration of digital transformation, including 5G networks and AI, is reshaping operations. The global location-based services market is projected to reach $131.33 billion in 2025, up from $105.74 billion in 2024, highlighting growth opportunities.

Regulatory changes are a critical factor, particularly in corporate governance and compliance. Amendments to the Companies Act and changes introduced by the Companies and Intellectual Property Commission (CIPC) in South Africa, where Via Location SA operates, impact operational strategies. These changes necessitate careful navigation to ensure compliance.

Key challenges include transitioning to more sustainable vehicle fleets. The rise of electric mobility and climate technology poses a need for strategic adaptation. Cybersecurity and data protection are also critical, requiring investments in secure IT infrastructure.

Opportunities lie in expanding into emerging markets and leveraging technological advancements. The growth of e-commerce drives demand for efficient logistics solutions. Strategic partnerships with technology providers can enhance service offerings and competitiveness.

Via Location SA's competitive landscape is shaped by industry trends, regulatory factors, and future challenges and opportunities. The company must adapt to technological advancements and regulatory changes, focusing on sustainability and data security.

- Market Analysis: The global location-based services market is growing, presenting opportunities for telematics integration.

- Regulatory Compliance: Navigating regulatory changes, such as those in South Africa, is crucial for operational compliance.

- Sustainable Fleet: Transitioning to environmentally friendly vehicles is a key challenge and opportunity.

- Strategic Partnerships: Collaborations with technology and logistics providers can enhance competitiveness.

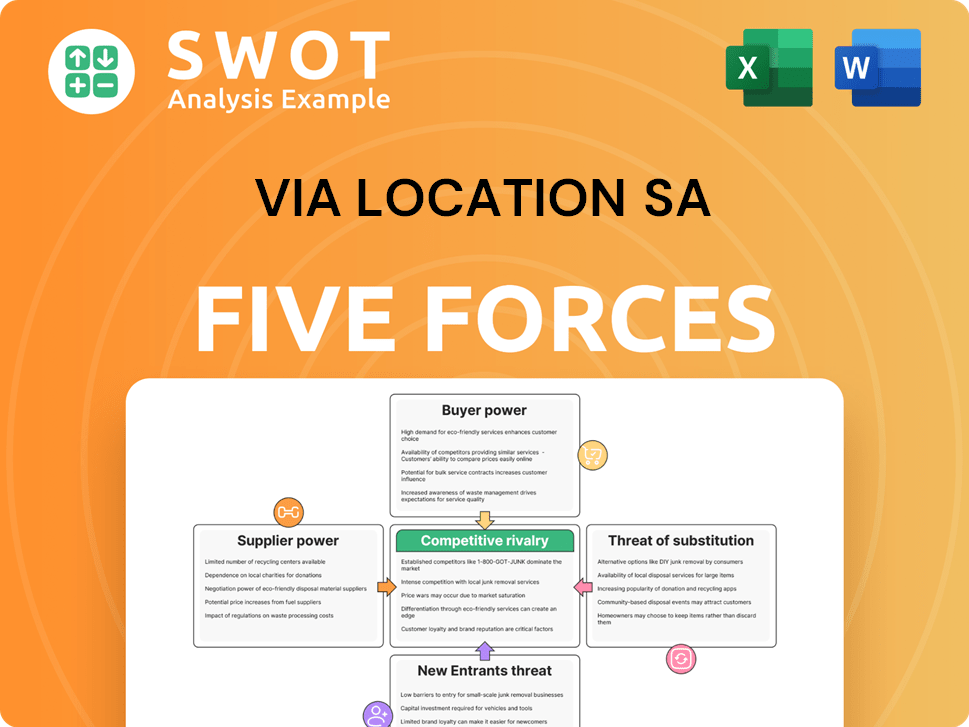

Via Location SA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Via Location SA Company?

- What is Growth Strategy and Future Prospects of Via Location SA Company?

- How Does Via Location SA Company Work?

- What is Sales and Marketing Strategy of Via Location SA Company?

- What is Brief History of Via Location SA Company?

- Who Owns Via Location SA Company?

- What is Customer Demographics and Target Market of Via Location SA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.