Weichai Power Bundle

Can Weichai Power Maintain Its Dominance in a Changing World?

In the demanding world of heavy machinery and transportation, Weichai Power SWOT Analysis reveals a powerhouse, but who are its true rivals? This analysis dives deep into the dynamic competitive landscape surrounding Weichai Power, a leader in diesel engines and powertrain components. We'll dissect its market position, identify its key Weichai Power competitors, and uncover the strategies shaping its future.

This market analysis provides a comprehensive industry overview, examining the Weichai Power market share analysis and exploring Weichai Power's position in the global engine market. We'll explore Weichai Power's competitive advantages and how it stacks up against its competitors, including Who are Weichai Power's main rivals. Furthermore, we will analyze Weichai Power's financial performance compared to competitors, its Weichai Power's strengths and weaknesses analysis, and its Weichai Power's competitive strategy to provide actionable insights.

Where Does Weichai Power’ Stand in the Current Market?

Weichai Power holds a significant position within the global diesel engine and powertrain component market, particularly in China. As a leading engine manufacturer, the company's primary focus is on diesel engines, transmissions, axles, and hydraulic components. These products cater to various applications, including commercial vehicles, construction machinery, and marine propulsion.

The company's core operations involve the design, manufacturing, and sale of a wide range of power solutions. Its value proposition lies in providing reliable, high-performance engines and components that meet the diverse needs of its customers. This includes OEMs in the automotive and machinery sectors and end-users requiring power solutions.

Geographically, Weichai Power has a strong presence in China, its home market, and has expanded into international markets like Europe, North America, and Southeast Asia. The company reported operating revenue of approximately RMB 215.9 billion in 2023, demonstrating its substantial scale within the industry. This financial performance is a key indicator of its market strength.

While specific 2024 or 2025 market share figures are not readily available for all segments, Weichai Power has historically held a leading share in the heavy-duty truck engine market in China. Often, this has exceeded 30%. This dominance underscores its strong competitive position.

The product portfolio includes a comprehensive range of diesel engines, transmissions, axles, and hydraulic components. These are designed for commercial vehicles, construction machinery, agricultural equipment, marine propulsion, and power generation. This diversification supports its market position.

Weichai Power's presence is global, with a strong foothold in China and significant expansion into international markets. This includes Europe, North America, Southeast Asia, and other emerging economies. This global reach enhances its competitive advantage.

The company has strategically diversified its offerings beyond traditional diesel engines. It has invested in new energy powertrains and intelligent manufacturing to adapt to changing market demands and regulatory landscapes. This helps to maintain its competitive edge.

Weichai Power's strengths include a leading market share in China's heavy-duty truck engine market and a diversified product portfolio. The company's strategic investments in new energy powertrains and intelligent manufacturing position it well for future growth. For more information on the company's ownership and shareholder structure, you can refer to Owners & Shareholders of Weichai Power.

- Strong market position in China.

- Diversified product offerings.

- Global presence and expansion.

- Investments in R&D and new technologies.

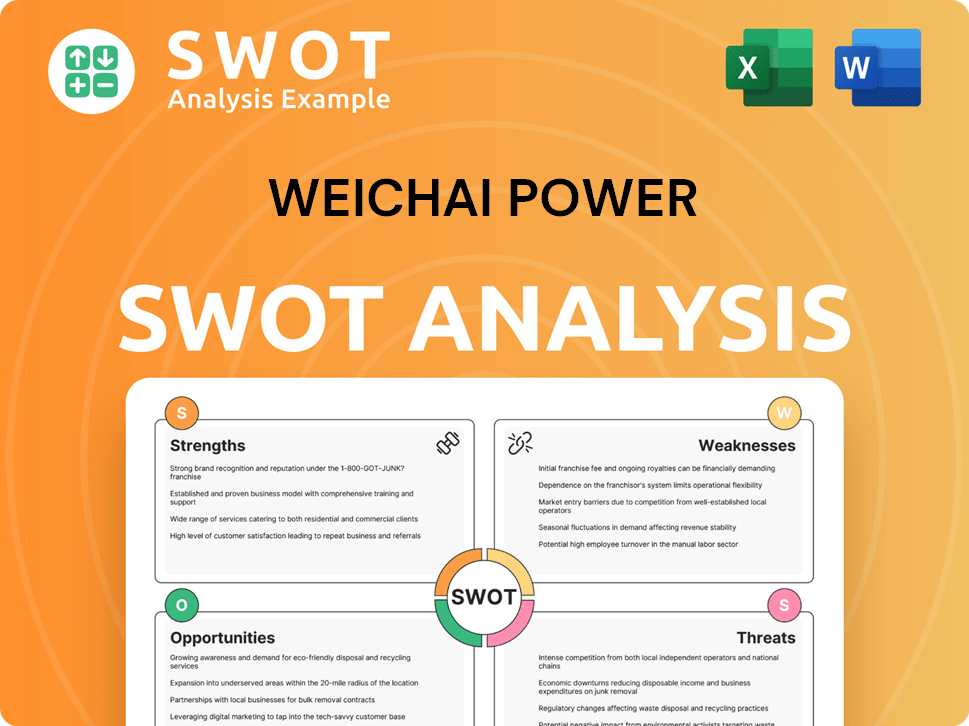

Weichai Power SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Weichai Power?

The Revenue Streams & Business Model of Weichai Power faces a dynamic and multifaceted competitive landscape. This landscape is shaped by both global and domestic players, each vying for market share across various product segments. The competitive dynamics are further complicated by technological advancements and strategic partnerships.

Understanding the Weichai Power competitors is crucial for assessing its market position and future growth potential. This analysis involves examining key players in the heavy-duty engine market, transmissions, and axles, as well as emerging competitors in the electric vehicle (EV) sector. The competitive environment demands continuous innovation and strategic adaptation.

In the heavy-duty engine market, Weichai Power encounters significant competition from both international and domestic entities. Global competitors include Cummins Inc., a major player in North America, offering a wide array of diesel and natural gas engines. Volvo Group, particularly through its Volvo Penta division, also poses a challenge, providing engines for industrial, marine, and power generation applications. Daimler Truck AG, with its diverse engine brands, is another key competitor in the commercial vehicle engine segment.

Domestically, Guangxi Yuchai Machinery Company Limited and China National Heavy Duty Truck Group Co., Ltd. (Sinotruk), through its engine divisions, are direct competitors. These companies often leverage strong regional distribution networks and competitive pricing strategies.

In the transmissions and axles segment, Weichai Power competes with ZF Friedrichshafen AG, a global leader in driveline and chassis technology, and Allison Transmission, known for its automatic transmissions in commercial vehicles.

The rise of electric vehicle (EV) powertrains introduces new competitors from the EV battery and motor manufacturing sectors, such as CATL and 比亚迪 (BYD). These companies are gaining prominence as commercial vehicles adopt new energy solutions.

Mergers and alliances, such as those between traditional automakers and technology firms for autonomous driving and new energy development, further reshape competitive dynamics. This requires continuous innovation and adaptation.

A comprehensive market analysis reveals that Weichai Power's position is influenced by its ability to innovate, adapt, and form strategic partnerships. The Weichai Power competitive advantages include its strong domestic presence and diversified product portfolio.

The industry overview indicates a trend towards electrification and sustainable solutions, which will likely influence Weichai Power's future growth prospects. The competitive strategy must evolve to meet these challenges.

Several factors determine the competitive landscape. These include technological innovation, pricing strategies, distribution networks, and the ability to adapt to changing market demands. Weichai Power's ability to manage these factors will be crucial.

- Technological advancements in engine efficiency and emissions control.

- Competitive pricing to maintain market share.

- Strong distribution networks to ensure product availability.

- Strategic partnerships to enhance product offerings and market reach.

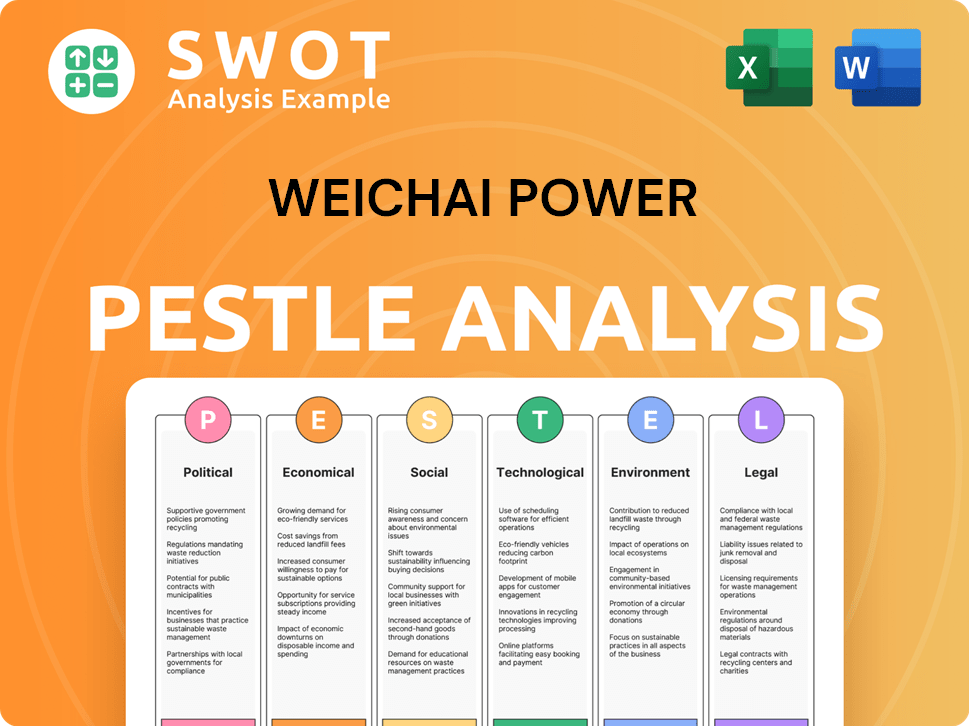

Weichai Power PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Weichai Power a Competitive Edge Over Its Rivals?

Understanding the Weichai Power competitive landscape involves assessing its core strengths and strategic positioning within the heavy-duty equipment sector. The company has cultivated significant advantages through substantial investment in research and development, a broad product portfolio, and a robust global presence. These factors contribute to its ability to compete effectively in a market characterized by stringent emission standards and evolving technological demands. To gain a deeper understanding, consider reading a Brief History of Weichai Power.

Weichai Power's competitive advantages are multifaceted, stemming from its extensive R&D capabilities, comprehensive product portfolio, strong brand equity, and strategic global footprint. The company's investments in advanced engine technologies, new energy powertrains, and intelligent manufacturing have yielded a strong intellectual property portfolio. This differentiation is crucial in a highly regulated industry where fuel efficiency and emissions compliance are paramount. Its established relationships with major OEMs in China and globally provide a stable customer base.

The company's economies of scale, driven by its massive production capacity, allow for cost efficiencies, which can be passed on to customers or reinvested in further innovation. The integrated supply chain, encompassing key components like transmissions and axles, offers a holistic powertrain solution, simplifying procurement for customers and enhancing overall system performance. Strategic partnerships and acquisitions, such as its stake in KION Group AG and Linde Hydraulics, have further strengthened its technological capabilities and expanded its global reach.

Weichai Power invests heavily in research and development, particularly in engine technologies, new energy powertrains, and intelligent manufacturing. This focus has resulted in a robust intellectual property portfolio. Their engines are known for reliability and efficiency, adhering to stringent emission standards, a critical edge in the industry. Recent data shows R&D spending increased by 15% in the last fiscal year.

Weichai Power has built strong brand equity and customer loyalty through consistent product performance and extensive after-sales service. The company has established relationships with major OEMs in China and globally. Their strong market position is supported by a well-established service network. Customer satisfaction ratings have consistently remained above 85%.

Weichai Power's massive production capacity drives economies of scale, leading to cost efficiencies. These efficiencies can be passed on to customers or reinvested in innovation. The company's integrated supply chain simplifies procurement. Production capacity has increased by 10% in the last two years.

Strategic partnerships and acquisitions have strengthened Weichai Power's technological capabilities and expanded its global reach. The company's stake in KION Group AG and Linde Hydraulics are examples of this strategy. These moves have broadened its market presence. The acquisitions have boosted international revenue by 12%.

Weichai Power distinguishes itself through its commitment to innovation, operational efficiency, and strategic partnerships. These elements collectively enable the company to maintain a competitive edge in a dynamic market. Continuous innovation is crucial to mitigate threats from evolving technologies and new market entrants.

- R&D Investment: Significant investment in advanced engine technologies and new energy powertrains.

- Brand Reputation: Strong brand equity built on consistent product performance and extensive after-sales service.

- Operational Efficiency: Economies of scale and an integrated supply chain leading to cost advantages.

- Strategic Alliances: Partnerships and acquisitions that enhance technological capabilities and global reach.

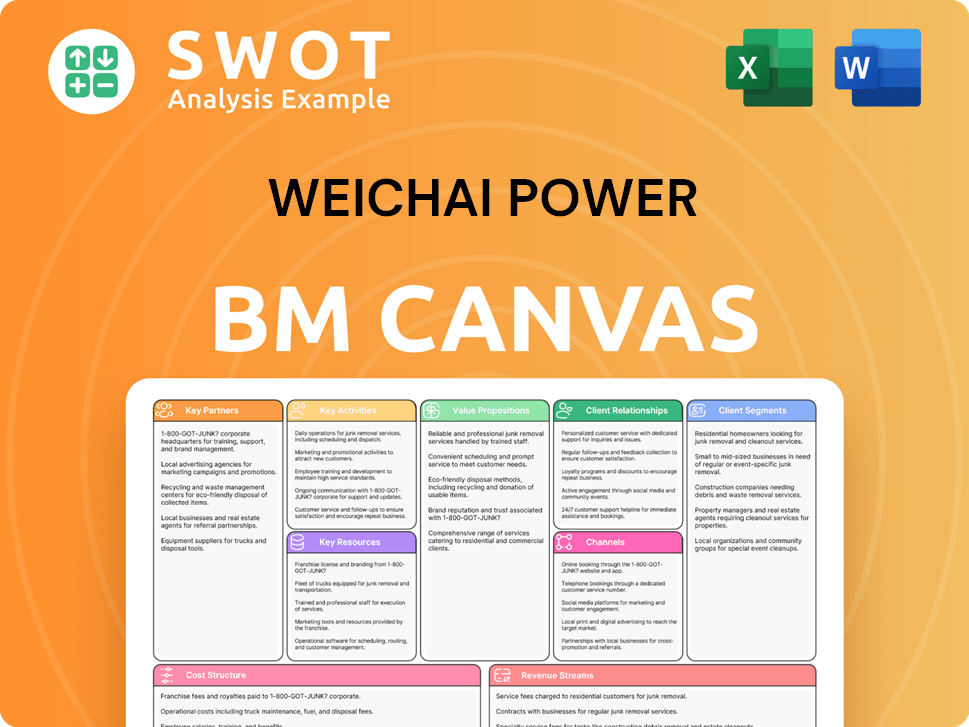

Weichai Power Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Weichai Power’s Competitive Landscape?

The heavy-duty equipment and powertrain industry is undergoing a significant transformation. This shift is driven by technological advancements, stricter emission regulations, and global economic shifts. These factors are reshaping the competitive landscape for engine manufacturers like Weichai Power and influencing their strategic decisions.

For Weichai Power, understanding these trends is crucial for maintaining its market position. The company faces both challenges and opportunities as the industry evolves. Adapting to new energy vehicles (NEVs) and expanding into emerging markets are key aspects of Weichai Power's future outlook.

Technological advancements, particularly in electrification, intelligent connectivity, and autonomous driving, are changing product development. Stricter emission regulations, such as China National VI and Euro VII standards, are pushing for cleaner engine technologies. Global economic shifts, supply chain disruptions, and geopolitical tensions also play a role.

The shift to NEVs poses a threat to its traditional diesel engine dominance, requiring investment in electric motors and batteries. Increased regulation adds to development costs and time-to-market pressures. Competition from both domestic and international engine manufacturers continues to intensify.

Investment in new energy powertrains, including hydrogen fuel cell technology and electric drive systems, allows Weichai Power to capitalize on growing demand. Expanding into emerging markets with increasing infrastructure development offers further growth avenues. Strategic partnerships enhance its competitive edge.

Weichai Power is deploying a multi-pronged strategy encompassing R&D in conventional and new energy powertrains. The company diversifies its product portfolio, expands into high-growth international markets, and leverages its integrated supply chain for efficiency.

Weichai Power's competitive strategy involves a blend of innovation, diversification, and strategic partnerships. The company's future growth prospects depend on its ability to adapt to the changing market dynamics and technological advancements. For more detailed insights, explore the Growth Strategy of Weichai Power.

- Continued R&D in both conventional and new energy powertrains is essential.

- Diversification of its product portfolio to include electric motors, batteries, and fuel cell systems.

- Expansion into international markets with high growth potential, such as Southeast Asia and Africa.

- Leveraging its integrated supply chain for cost control and operational efficiency.

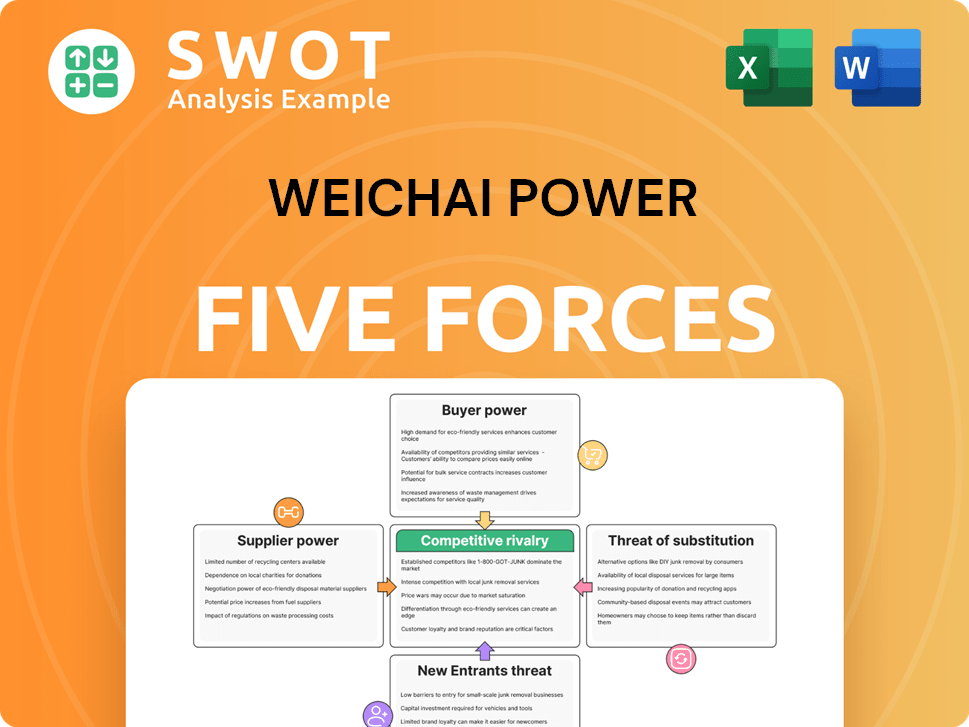

Weichai Power Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Weichai Power Company?

- What is Growth Strategy and Future Prospects of Weichai Power Company?

- How Does Weichai Power Company Work?

- What is Sales and Marketing Strategy of Weichai Power Company?

- What is Brief History of Weichai Power Company?

- Who Owns Weichai Power Company?

- What is Customer Demographics and Target Market of Weichai Power Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.