Carl Zeiss Meditec Bundle

How Does Carl Zeiss Meditec Dominate the Medical Technology Arena?

The medical technology sector is a hotbed of innovation, with advancements constantly reshaping patient care. At the forefront of this revolution stands Carl Zeiss Meditec, a key player in ophthalmology and microsurgery. Their dedication to cutting-edge solutions has cemented their position as an industry leader.

Founded on a legacy of optical excellence, Carl Zeiss Meditec SWOT Analysis reveals a company deeply rooted in precision and innovation. This commitment has propelled them to the top, offering a comprehensive portfolio of ophthalmic devices and solutions. This market analysis will delve into the competitive landscape, identifying industry rivals and assessing Carl Zeiss Meditec's strategic advantages within the dynamic medical technology sector, exploring how they maintain their edge in a competitive environment.

Where Does Carl Zeiss Meditec’ Stand in the Current Market?

Carl Zeiss Meditec AG maintains a strong market position within the medical technology industry, especially in ophthalmology and microsurgery. The company is recognized as a leader in ophthalmic devices, holding a significant share in markets for diagnostic equipment, surgical microscopes, and intraocular lenses.

The company's primary product lines include diagnostic instruments like OCT (Optical Coherence Tomography) devices, surgical microscopes for various specialties, and a comprehensive range of ophthalmic implants and consumables for cataract and refractive surgery. This diverse portfolio supports its competitive standing. The company's financial performance reflects its strength in the market.

Geographically, Carl Zeiss Meditec has a strong global presence, serving customers in private practices, clinics, and large hospital networks across North America, Europe, and Asia. The company has shown strategic shifts, emphasizing digital transformation and integrated solutions to improve workflow efficiency for healthcare providers, as highlighted in this Growth Strategy of Carl Zeiss Meditec.

Carl Zeiss Meditec is a key player in the medical technology sector, particularly in ophthalmology. The company's market share in diagnostic equipment, surgical microscopes, and intraocular lenses is significant. This strong position is supported by its comprehensive product offerings and global reach.

For the first half of fiscal year 2023/2024, revenues were EUR 999.6 million. The company's earnings before interest and taxes (EBIT) for the same period stood at EUR 136.3 million. These figures demonstrate the company's financial health and ability to maintain profitability.

The company has a strong global presence, serving customers in North America, Europe, and Asia. Carl Zeiss Meditec is expanding its footprint in emerging economies. This expansion highlights the company's strategic focus on growth in high-potential markets for advanced medical technologies.

The product portfolio includes diagnostic instruments, surgical microscopes, and ophthalmic implants. Innovation in laser eye surgery is a key area of focus. These products support the company's position in the competitive medical technology market.

The competitive landscape for Carl Zeiss Meditec involves several key factors. The company faces competition from industry rivals in the ophthalmic device market. The company's strategy includes digital transformation and integrated solutions.

- Focus on digital transformation and integrated solutions.

- Expansion in emerging economies.

- Strong financial performance, with consistent investment in R&D.

- Comprehensive product portfolio.

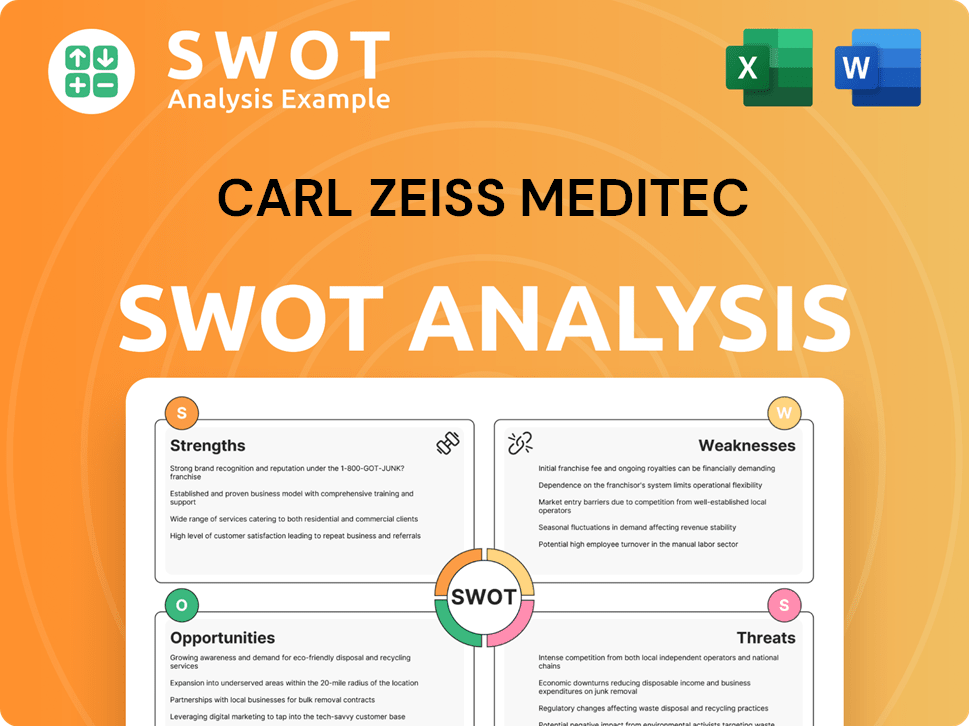

Carl Zeiss Meditec SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Carl Zeiss Meditec?

The competitive landscape for Carl Zeiss Meditec is shaped by a diverse group of rivals in the medical technology sector. This competitive analysis is crucial for understanding the company’s position and strategies within the ophthalmic devices and microsurgery markets. The market analysis reveals a dynamic environment where innovation, market share, and strategic partnerships play vital roles.

Understanding the competitive dynamics is essential for investors and stakeholders. The company's performance is directly impacted by its ability to compete effectively. This article provides insights into the key players and the competitive advantages that define the industry.

The competitive landscape of Carl Zeiss Meditec is multifaceted, with key players vying for market share in both ophthalmology and microsurgery. This analysis examines the main rivals and their strategies, providing a comprehensive view of the industry's competitive dynamics. For an in-depth look at the company's ownership structure, you can refer to Owners & Shareholders of Carl Zeiss Meditec.

In ophthalmology, Carl Zeiss Meditec faces significant competition from companies like Alcon, Johnson & Johnson Vision, and Bausch + Lomb. These companies compete across various segments, including surgical and vision care.

Alcon is a global leader in eye care, competing in surgical and vision care. They offer a wide range of products, including intraocular lenses and surgical equipment. Their extensive product range and global distribution network are key strengths.

Johnson & Johnson Vision is a strong competitor, particularly in contact lenses and surgical vision products. They leverage their healthcare network and brand recognition. They offer products like femtosecond lasers and phacoemulsification systems.

Bausch + Lomb competes with a diverse portfolio in vision care, pharmaceuticals, and surgical products. They are a well-established player in the industry. Their broad product offerings make them a significant competitor.

In microsurgery, Carl Zeiss Meditec competes with Leica Microsystems and Olympus Corporation. These companies focus on surgical microscopes and advanced visualization technologies.

Leica Microsystems, part of Danaher Corporation, is a strong competitor in surgical microscopes. They are known for high-quality optics and integrated imaging solutions. Their products are used in various surgical disciplines.

Several factors influence the competitive dynamics within the medical technology market. These include technological innovation, market strategies, and customer relationships. Emerging players and strategic alliances also play a significant role.

- Technological Innovation: Continuous advancements in surgical platforms and diagnostic tools are crucial.

- Market Strategies: Aggressive market strategies and customer relationship management are key.

- Emerging Players: Digital health and AI-powered diagnostics are disrupting the market.

- Mergers and Alliances: Consolidations can create larger, more diversified competitors.

- Clinical Outcomes: Superior clinical outcomes influence market share.

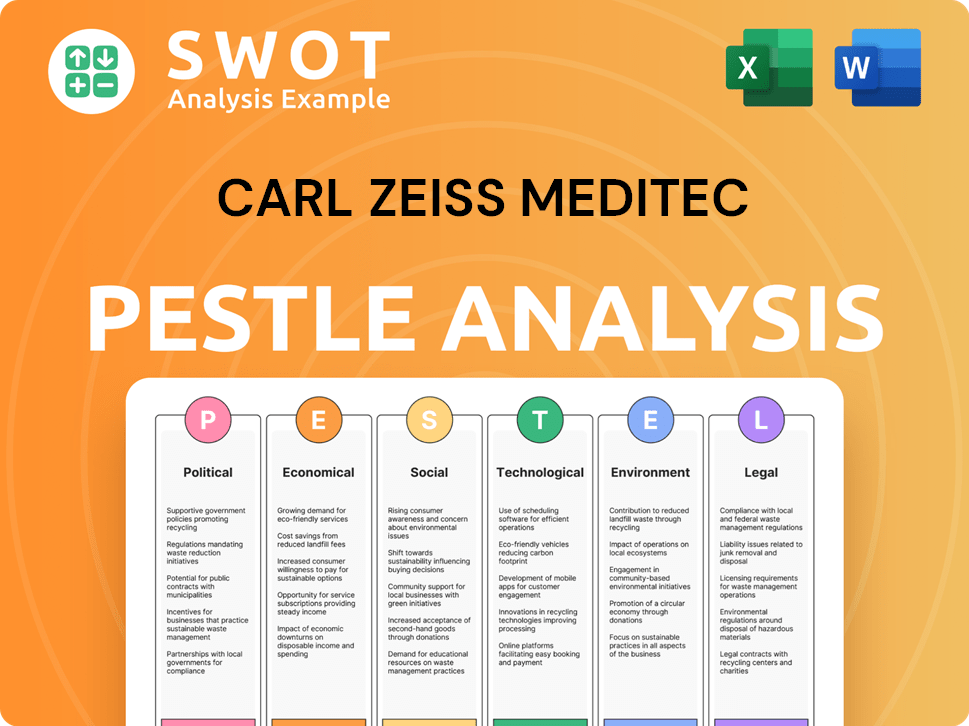

Carl Zeiss Meditec PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Carl Zeiss Meditec a Competitive Edge Over Its Rivals?

The competitive landscape for Carl Zeiss Meditec is shaped by its strong foundation in optical technology and a strategic focus on ophthalmic devices and medical technology. The company's ability to innovate and maintain a robust product portfolio is crucial in a market characterized by rapid technological advancements and intense competition. Understanding the competitive advantages of Carl Zeiss Meditec is essential for anyone involved in market analysis, from investors to industry professionals.

Carl Zeiss Meditec's strategic moves, including investments in research and development and strategic partnerships, are key to maintaining its market position. These moves are designed to enhance its product offerings and expand its global reach. A deep dive into the company's competitive edge reveals how it differentiates itself from industry rivals and sustains its growth trajectory. This analysis is critical for assessing its long-term viability and potential for future success.

The company's financial performance, which can be reviewed through a detailed financial performance review, reflects its ability to capitalize on its competitive strengths. This includes its ability to generate revenue, manage costs, and maintain profitability in a dynamic market environment. A thorough examination of its financial health is essential for understanding its overall competitiveness and strategic direction.

Carl Zeiss Meditec holds a significant advantage through its extensive portfolio of patented technologies, particularly in advanced optics, laser systems, and imaging. For instance, the OPMI surgical microscopes and VISUMAX femtosecond lasers are recognized for their precision. The company's intellectual property in intraocular lenses and diagnostic imaging platforms provides a barrier to entry for competitors, fostering innovation in laser eye surgery.

The 'Zeiss' name is globally associated with quality, precision, and innovation in the optical and medical fields. This strong brand equity fosters customer loyalty among ophthalmologists and surgeons. The company's consistent performance and clinical efficacy of its products have built a strong reputation. Carl Zeiss Meditec leverages this brand strength in its marketing and product development.

Economies of scale in manufacturing and a robust global distribution network contribute to Carl Zeiss Meditec's competitive edge. The company efficiently produces high-quality instruments and delivers them to a vast international customer base. This enhances market penetration and cost-effectiveness. The company’s global presence is supported by a well-established distribution network.

Carl Zeiss Meditec's commitment to a strong talent pool, particularly in R&D and clinical applications, allows it to continually innovate and adapt to evolving market needs. Strategic partnerships also play a crucial role. These collaborations enhance its reputation and help it stay at the forefront of technological advancements. For more insights, see the Marketing Strategy of Carl Zeiss Meditec.

Carl Zeiss Meditec's competitive advantages are rooted in its legacy of optical excellence, proprietary technologies, and strong brand equity. These advantages are crucial for maintaining its market position and driving innovation. The company’s focus on R&D and strategic partnerships further strengthens its position in the ophthalmic device market.

- Patented Technologies: Extensive IP in advanced optics, laser systems, and imaging.

- Brand Equity: Strong global reputation for quality and innovation.

- Economies of Scale: Efficient manufacturing and global distribution.

- Talent and Partnerships: Strong R&D and strategic collaborations.

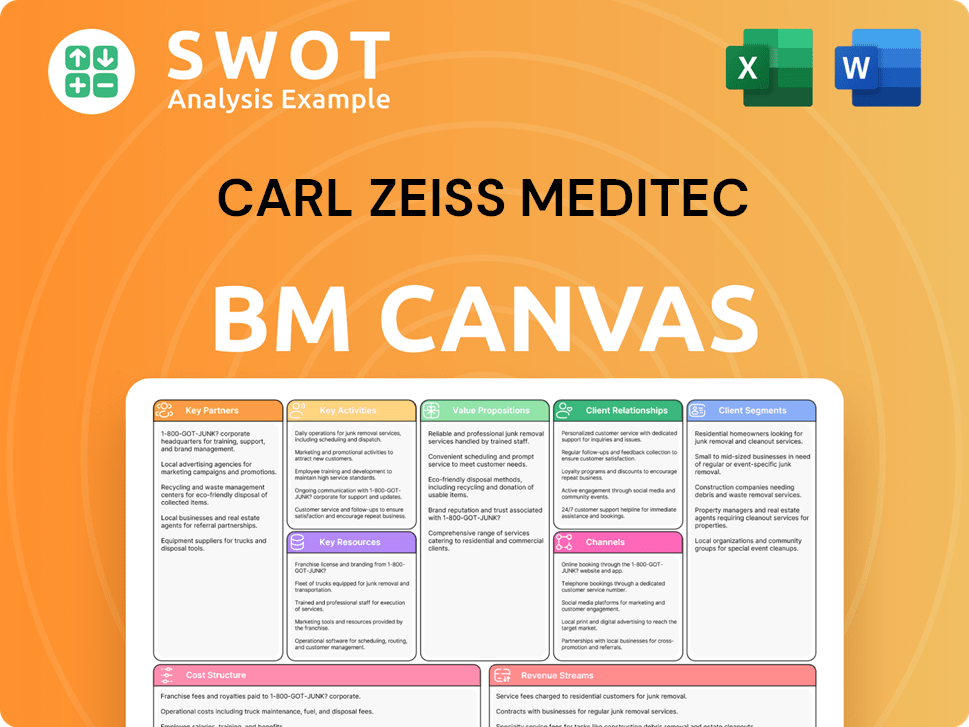

Carl Zeiss Meditec Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Carl Zeiss Meditec’s Competitive Landscape?

The medical technology industry, including the competitive landscape of Carl Zeiss Meditec, is experiencing rapid transformation. Technological advancements, regulatory changes, and evolving consumer preferences are significantly influencing the market dynamics. This creates both challenges and opportunities for companies like Carl Zeiss Meditec, requiring strategic adaptation and innovation to maintain a strong market position.

Understanding the competitive landscape of Carl Zeiss Meditec involves analyzing industry trends, potential threats, and growth opportunities. This includes assessing the impact of new technologies, the influence of regulatory environments, and the shifting demands of healthcare consumers. A comprehensive market analysis is crucial for navigating these complexities and ensuring long-term success.

Technological advancements, particularly in AI and machine learning, are driving innovation in diagnostics and surgical procedures. Regulatory changes, including increased scrutiny on device approvals and data privacy, are impacting the industry. Consumer preferences are shifting towards less invasive procedures and personalized medicine, influencing product development and market strategies.

Aggressive competition from new entrants, especially from Asia, poses a threat due to potentially lower-cost alternatives. Ongoing pressure on healthcare budgets globally can impact capital equipment purchases. The rapid pace of technological change necessitates continuous innovation to avoid disruption and maintain a competitive edge in the market.

Significant growth opportunities exist in emerging markets with expanding healthcare infrastructure and rising demand for advanced medical technologies. Strategic partnerships with healthcare providers and technology firms can enhance innovation and market reach. The focus on minimally invasive procedures and personalized medicine offers avenues for expanding product portfolios and catering to evolving patient needs.

Continuous investment in research and development is crucial to stay ahead of technological advancements. Strengthening cybersecurity and data privacy measures is essential to comply with regulatory requirements. Building strong relationships with key stakeholders, including healthcare professionals and research institutions, can foster innovation and market access.

To maintain its competitive position, Carl Zeiss Meditec must navigate several critical areas. These include adapting to technological shifts, responding to regulatory pressures, and meeting evolving patient demands. Strategic decisions will shape the company's future in the ophthalmic devices market.

- Innovation in AI and Machine Learning: Integrating AI into diagnostic tools and surgical platforms. For example, the global AI in medical imaging market is projected to reach $12.8 billion by 2025.

- Regulatory Compliance: Ensuring adherence to global regulatory standards, including cybersecurity and data privacy.

- Strategic Partnerships: Collaborating with healthcare providers and technology firms to enhance market reach and innovation.

- Emerging Markets: Capitalizing on growth opportunities in regions with expanding healthcare infrastructure, such as Asia-Pacific, where the ophthalmic devices market is expected to grow significantly.

- Minimally Invasive Procedures: Expanding the portfolio of minimally invasive surgical options to meet patient preferences. The global minimally invasive surgical instruments market was valued at $35.3 billion in 2023.

A detailed analysis of the competitive landscape, including a review of Carl Zeiss Meditec's financial performance and product portfolio comparison, is essential. Understanding the competitive advantages of Carl Zeiss Meditec and how it compares to industry rivals like Alcon and Johnson & Johnson Vision is critical. The Brief History of Carl Zeiss Meditec provides further context on the company's evolution.

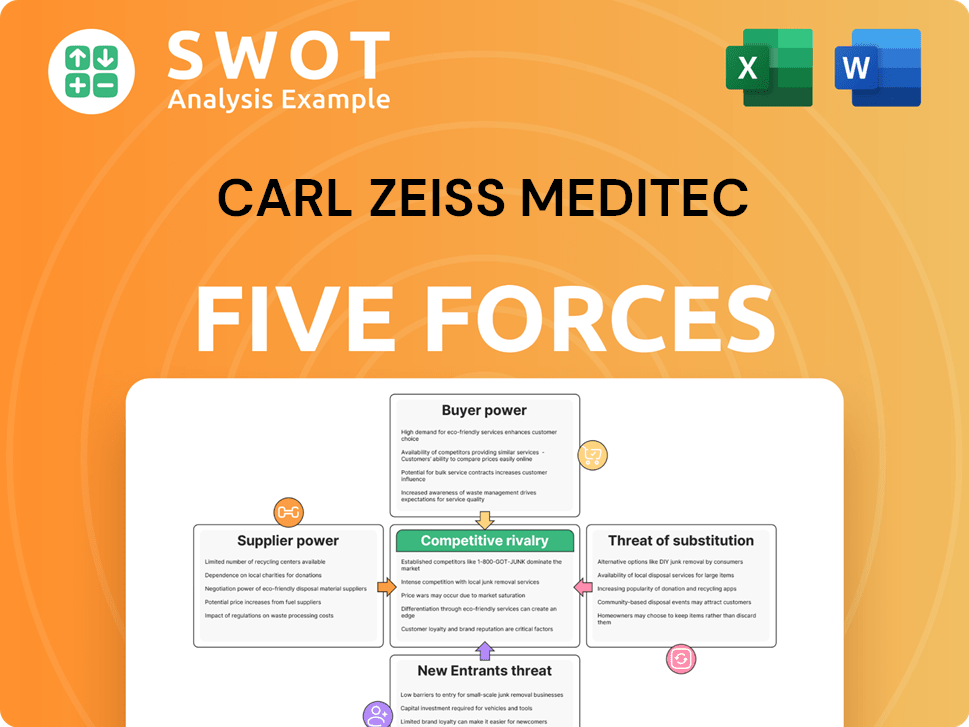

Carl Zeiss Meditec Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Carl Zeiss Meditec Company?

- What is Growth Strategy and Future Prospects of Carl Zeiss Meditec Company?

- How Does Carl Zeiss Meditec Company Work?

- What is Sales and Marketing Strategy of Carl Zeiss Meditec Company?

- What is Brief History of Carl Zeiss Meditec Company?

- Who Owns Carl Zeiss Meditec Company?

- What is Customer Demographics and Target Market of Carl Zeiss Meditec Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.