ARC International SA Bundle

Can ARC International SA Capitalize on the Booming Tableware Market?

In a market projected for substantial growth, ARC International SA, a key player in glassware and tableware, faces both opportunities and challenges. With the global glassware market estimated at $8.2 billion in 2024 and the tableware market expected to reach $83.44 billion by 2035, understanding ARC International SA's ARC International SA SWOT Analysis is crucial. This analysis delves into the company's strategic positioning and future prospects within this dynamic landscape.

This exploration of ARC International SA's business development will uncover its growth strategy, examining how the company plans to navigate industry trends and seize market expansion opportunities. We will analyze the company's financial performance and strategic planning to understand its competitive landscape and long-term goals. Ultimately, this article aims to provide actionable insights into ARC SA's future, including potential investment opportunities and the challenges it may encounter.

How Is ARC International SA Expanding Its Reach?

The expansion initiatives for ARC International SA are centered around leveraging market trends and potentially entering new geographical areas and product categories. The tableware market is experiencing a shift towards sustainable and biodegradable products, such as bamboo, ceramic, and glass. There's also a rising demand for designer and high-quality tableware, particularly within the hospitality sector.

The increasing popularity of home entertainment and home bars is driving consumers to invest in premium glassware. Additionally, rising disposable incomes, especially in developing countries, are encouraging purchases of high-quality glassware in both residential and commercial markets. This creates a favorable environment for ARC International SA's expansion plans.

While specific details about ARC International SA's international expansion or new product pipelines aren't publicly available in the provided search results, the general market trends point towards opportunities in expanding into new markets with a focus on premium, sustainable, and aesthetically appealing products. The growth in demand from the hospitality sector, including restaurants, hotels, and cafes, presents a significant avenue for business development. The global glassware market's growth, with Asia-Pacific expected to be the fastest-growing region, indicates potential for geographical expansion for tableware and glassware manufacturers. This is a key part of the ARC SA future.

The tableware and glassware market is seeing growth, particularly in Asia-Pacific. This region is expected to be the fastest-growing, offering significant opportunities for ARC International SA. The focus should be on premium and sustainable products.

There's a growing demand for sustainable and biodegradable tableware, such as bamboo, ceramic, and glass. Consumers are also seeking designer and high-quality options. This trend opens avenues for product diversification.

The hospitality sector, including restaurants, hotels, and cafes, presents a significant avenue for business growth. This sector's demand for high-quality glassware and tableware is increasing, offering a target market for ARC International SA.

Home entertainment and home bars are driving consumer investment in premium glassware. Rising disposable incomes, particularly in developing countries, are also encouraging purchases of high-quality glassware in both residential and commercial markets. This impacts the ARC International SA growth strategy.

ARC International SA can focus on expanding into the Asia-Pacific region, which is expected to have the highest growth in the glassware market. The company should prioritize premium and sustainable product lines to meet consumer demand and capitalize on the growing hospitality sector.

- Geographical expansion into high-growth regions.

- Development of premium and sustainable product lines.

- Targeting the hospitality sector for increased sales.

- Capitalizing on rising consumer disposable incomes.

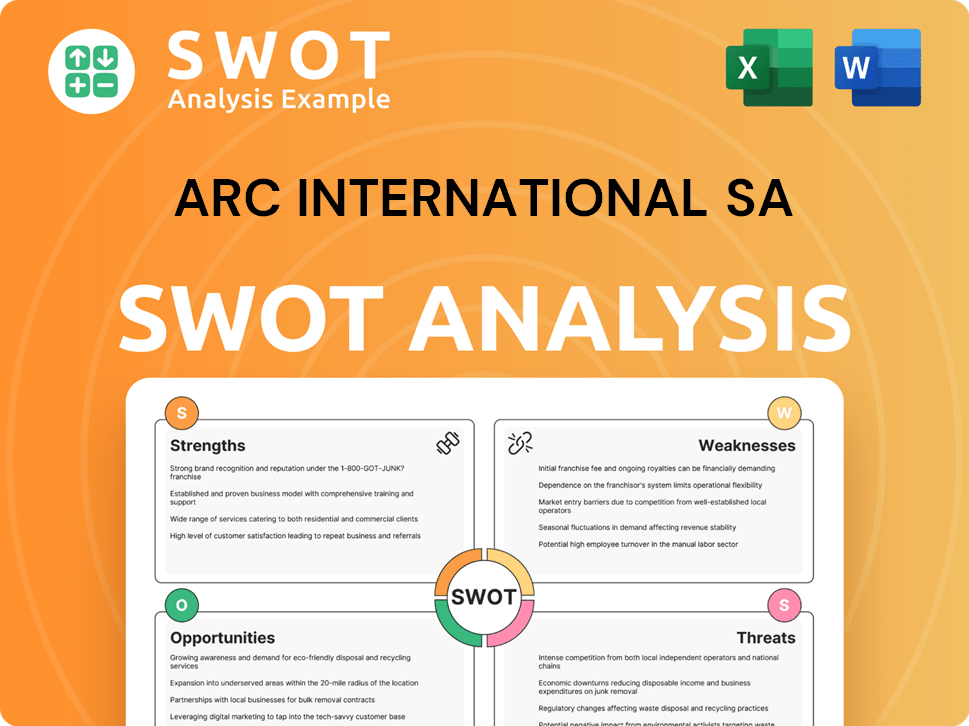

ARC International SA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ARC International SA Invest in Innovation?

Innovation and technology are critical for the ARC International SA's (ARC SA) Growth Strategy. The tableware and glassware industry is seeing significant changes, particularly in materials and manufacturing techniques. These advancements influence how companies like ARC SA develop and market their products, shaping their ARC SA Future.

The industry is experiencing a push toward stronger, thinner glass and the integration of technology to enhance product offerings. For example, the ceramic tableware market is adopting advanced techniques and textures, blending technology with craftsmanship. This shift necessitates that ARC International SA stay at the forefront of these trends to remain competitive.

While specific details about ARC International SA's R&D investments aren't available, the company's focus on 'Innovative glass for a better world' suggests a commitment to responsible production and consumption. This aligns with broader industry trends, such as sustainability, eco-friendly practices, and low-impact production, which are becoming increasingly important for consumer appeal and market positioning.

The adoption of digital transformation and cutting-edge technologies, like AI and digital twins, is gaining importance in manufacturing. These technologies enable more intricate designs, vibrant colors, and enhanced functionality in tableware.

Manufacturers are increasingly incorporating eco-friendly practices. This includes using recycled materials, focusing on low-impact production, and employing energy-efficient kilns and innovative glazing techniques to reduce environmental impact.

Ongoing research and development are essential for creating high-strength, ultra-thin glass and exploring new materials and manufacturing processes. This allows for the creation of innovative and competitive products.

Adapting to changing consumer preferences and market demands is crucial. This includes understanding the demand for sustainable products and incorporating these features into the product line to maintain and increase market share.

Innovation in design, materials, and manufacturing processes helps to differentiate ARC International SA from its competitors. This differentiation is essential for maintaining a strong position in the market and attracting new customers.

Implementing advanced technologies, such as AI and digital twins, can improve operational efficiency. These technologies can optimize production processes, reduce waste, and lower costs, increasing profitability.

The tableware and glassware market is expected to continue growing, with projections indicating a global market size of approximately $80 billion by 2028. This growth is driven by increasing demand from the food service industry and rising consumer spending on home decor. For ARC International SA, this presents opportunities for Business Development and Market Expansion. For more insights, consider reading about the Competitors Landscape of ARC International SA.

To ensure ARC SA Future success, the company should focus on several key strategies.

- Investment in R&D: Allocate resources to research and development to explore new materials, manufacturing processes, and design innovations.

- Digital Transformation: Implement digital technologies like AI and digital twins to improve operational efficiency and enhance product design.

- Sustainability: Integrate sustainable practices into all aspects of production, from sourcing materials to manufacturing processes, to meet consumer demand for eco-friendly products.

- Collaboration: Foster partnerships with technology providers, research institutions, and other industry players to leverage external expertise and accelerate innovation.

- Market Analysis: Continuously monitor market trends and consumer preferences to adapt product offerings and stay ahead of the competition.

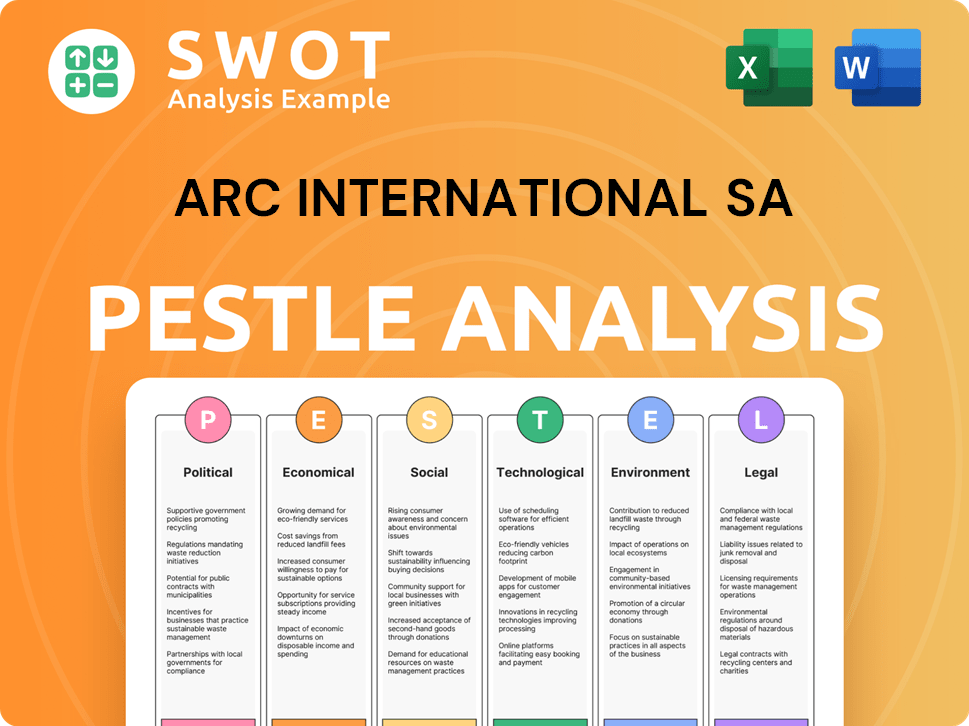

ARC International SA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ARC International SA’s Growth Forecast?

While specific financial data for ARC International SA is unavailable in the provided search results, the outlook appears positive, driven by the growth of the glassware and tableware markets. The global glassware market is projected to reach $14.5 billion by 2034, presenting a favorable environment for ARC International SA's future financial performance. This growth is supported by increasing consumer interest in home dining and rising disposable incomes, particularly in emerging markets.

The overall tableware market is estimated to generate $51.71 billion in 2025, increasing to $83.44 billion by 2035. This significant growth indicates strong potential for ARC International SA to expand its market share. Furthermore, the glass drinkware market is expected to grow at a CAGR of 11.1% from 2025 to 2030, reaching $13.95 billion in 2024, which provides additional opportunities for the company's growth.

For context, other companies with the 'ARC' brand have demonstrated strong financial health. For example, ARC Resources Ltd. reported funds from operations of $857 million in the first quarter of 2025. The company's strategic planning and business development efforts are likely contributing to its success. The increasing consumer interest in home dining and sustainability initiatives, as well as rising disposable incomes, are all key factors driving growth in the ceramic tableware market, which is projected to reach $145.5 billion by 2030.

ARC International SA can leverage the projected growth in the global glassware and tableware markets for market expansion. The company can focus on increasing its presence in emerging markets where disposable incomes are rising. This will allow for increased revenue growth.

The projected growth in the glassware market, with a CAGR of 5.9% to 2034, offers significant opportunities for revenue growth. The glass drinkware market, expected to reach $13.95 billion in 2024, presents another avenue for increased sales. The company's strategic planning should include initiatives to capitalize on these trends.

The favorable market conditions create investment opportunities for ARC International SA. The company can consider investing in new product development, marketing, and distribution channels. The company's business model can be enhanced by these investments.

Consumers' growing awareness of sustainability provides an opportunity for ARC International SA to implement eco-friendly practices. This could involve using sustainable materials and reducing waste in production. The company can also focus on its long term goals.

The strong financial performance of companies such as ARC Resources Ltd. indicates the potential for profitability within the broader 'ARC' branded entities. For a deeper dive into the strategic approach, consider reading about the Marketing Strategy of ARC International SA. The company's ability to capitalize on these trends will be crucial for its future prospects. The projected growth in the ceramic tableware market, reaching $145.5 billion by 2030, further supports a positive outlook for ARC SA's financial performance.

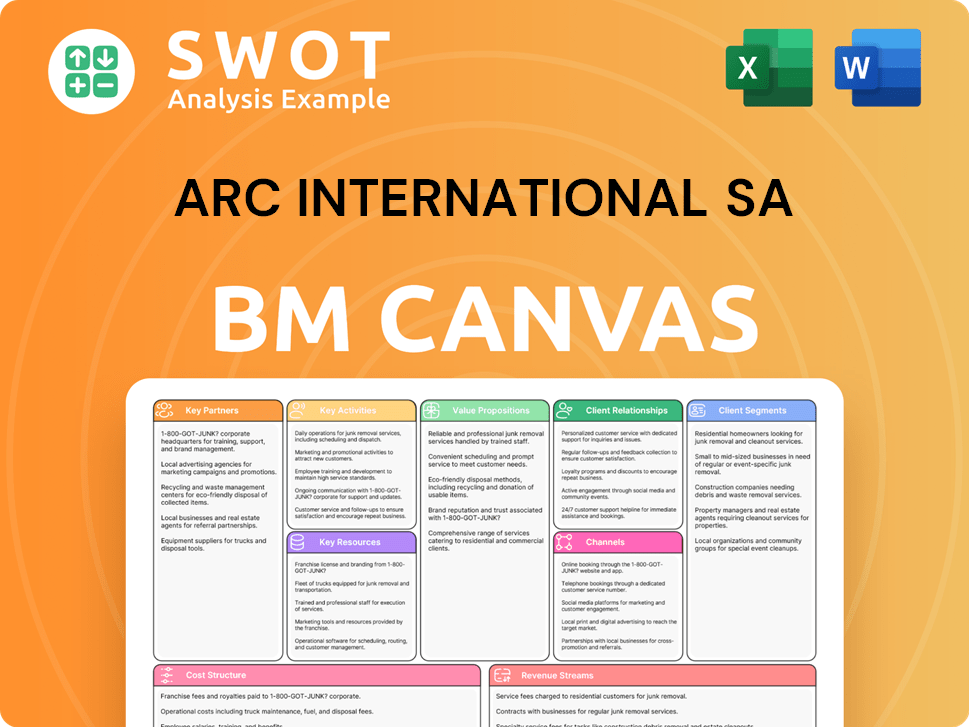

ARC International SA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ARC International SA’s Growth?

The path to growth for ARC International SA, like any major player in the glassware and tableware manufacturing sector, is fraught with potential risks and obstacles. A comprehensive Company Analysis reveals that navigating these challenges is crucial for realizing its Growth Strategy and securing its ARC SA Future. Understanding these potential pitfalls is vital for investors, stakeholders, and the company itself as it plans for Business Development and Market Expansion.

One of the primary hurdles is the intense competition within the industry, where numerous companies vie for market share. Furthermore, evolving consumer preferences demand continuous innovation in product design and offerings. Addressing these challenges requires a proactive approach to stay ahead of trends and maintain a competitive edge in the market. Mission, Vision & Core Values of ARC International SA provides insights into the company's strategic direction, which is essential for mitigating risks.

Regulatory changes, particularly concerning environmental standards, can also pose significant challenges. However, the industry's shift towards sustainability offers opportunities for companies embracing eco-friendly practices. The increasing demand for sustainable products is evident in the market. For instance, the global market for sustainable packaging is projected to reach $400 billion by 2027, growing at a CAGR of 6.8% from 2020 to 2027. Supply chain disruptions, especially in a globalized environment, and economic downturns, such as rising interest rates and decreased consumer spending, can further complicate operations. These factors necessitate robust risk management and strategic planning for ARC International SA.

The glassware and tableware market is highly competitive, with numerous global and regional players. Companies must differentiate themselves through product innovation, pricing strategies, and effective marketing to maintain or grow their ARC International SA market share.

Consumer tastes are constantly evolving, with trends like minimalist designs, sustainable materials, and versatile products gaining popularity. ARC International SA needs to adapt quickly to these shifts to remain relevant and competitive, ensuring ARC SA financial performance.

Stricter environmental regulations and the push for sustainability can increase production costs. However, embracing eco-friendly practices can also create new market opportunities. The company needs to invest in ARC International SA sustainability initiatives.

Global supply chains are susceptible to disruptions caused by geopolitical events, natural disasters, or economic instability. Diversifying suppliers and maintaining robust inventory management are essential for mitigating these risks. The goal is to ensure ARC International SA strategic planning.

Economic recessions, high inflation, and rising interest rates can reduce consumer spending on discretionary items like glassware and tableware. ARC International SA must prepare for challenging trading conditions and adjust its strategies accordingly. This impacts ARC International SA revenue growth.

Political instability, trade wars, and international conflicts can disrupt supply chains and increase operational costs. Companies must monitor global events and develop contingency plans to protect their operations and investments, and ensure ARC International SA challenges and opportunities are addressed.

Diversification: Expanding product lines and entering new markets can reduce reliance on a single product or region. For example, ARC International SA could explore opportunities in emerging markets with growing middle classes.

Implementing robust risk management frameworks, including scenario planning and stress testing, helps the company prepare for various challenges. This includes assessing the impact of potential disruptions on ARC International SA investment opportunities.

Continuous innovation in product design, materials, and manufacturing processes is crucial for meeting evolving consumer demands. This involves investing in R&D and staying ahead of ARC International SA industry trends. The company needs to have ARC International SA expansion plans.

Embracing sustainable practices, such as using recycled materials and reducing carbon emissions, not only meets regulatory requirements but also appeals to environmentally conscious consumers. This supports ARC International SA long term goals.

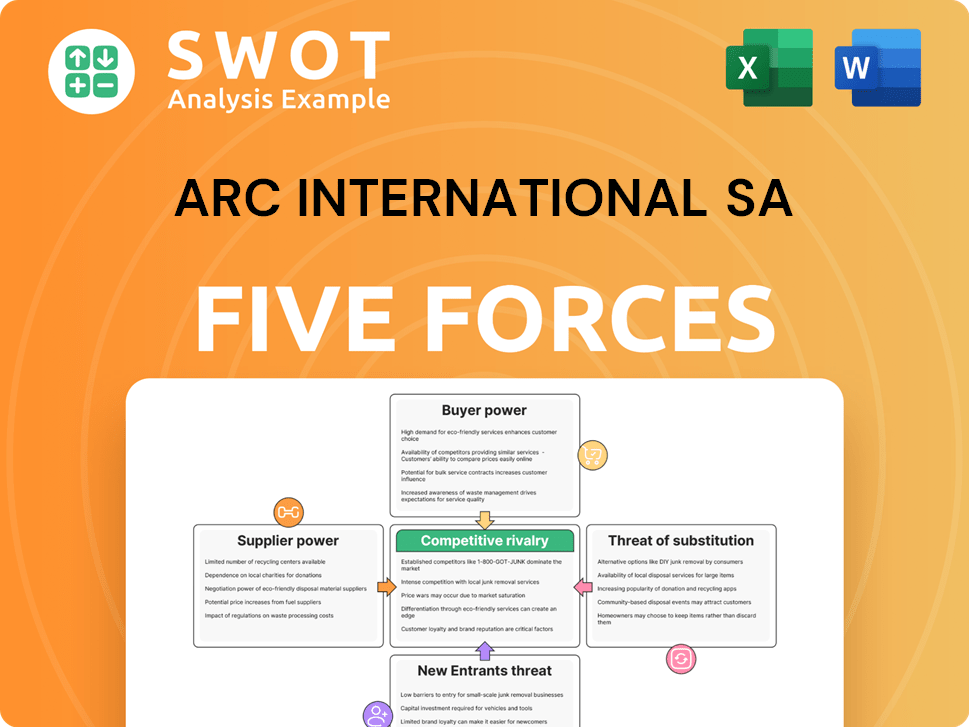

ARC International SA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ARC International SA Company?

- What is Competitive Landscape of ARC International SA Company?

- How Does ARC International SA Company Work?

- What is Sales and Marketing Strategy of ARC International SA Company?

- What is Brief History of ARC International SA Company?

- Who Owns ARC International SA Company?

- What is Customer Demographics and Target Market of ARC International SA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.