Bain & Company Bundle

How is Bain & Company Shaping the Future of Management Consulting?

Explore the dynamic world of Bain & Company, a titan in the Bain & Company SWOT Analysis and strategic consulting realm. Founded in 1973, Bain has consistently redefined success by prioritizing tangible client outcomes. This introduction delves into the firm's evolution and the core principles driving its continued growth.

From its inception, Bain & Company has focused on delivering measurable results, setting it apart in the competitive landscape of management consulting. This client-centric philosophy, combined with a keen understanding of industry trends, has fueled its expansion into a global powerhouse. This analysis will examine Bain & Company's strategic initiatives, including its digital transformation strategy and its impact on the consulting industry, providing insights into its future revenue projections and competitive landscape.

How Is Bain & Company Expanding Its Reach?

Bain & Company's growth strategy is heavily focused on expansion initiatives, particularly through mergers and acquisitions (M&A) and geographical diversification. The firm recognizes M&A as a critical tool for navigating the changing business landscape, including technological disruptions, shifts in the global economy, and evolving profit pools. Their strategic approach aims to strengthen their capabilities and broaden their global reach to better serve clients.

In 2024, the global M&A market showed signs of recovery, reversing a two-year decline. Total corporate deals increased by 12%, and financial acquisitions rose by 29%, leading to an overall M&A deal value of approximately $3.5 trillion. This positive trend suggests a favorable environment for Bain & Company's expansion plans. The firm anticipates a potential rebound in M&A activity in 2025, driven by factors such as easing interest rates and addressing regulatory challenges.

Bain & Company's recent acquisition of PiperLab in March 2024, a provider of business data science and big data solutions, highlights their commitment to enhancing their technological capabilities. This strategic move is a key part of their Bain & Company's target market strategy, allowing them to offer more comprehensive services to clients. The firm has a history of successful acquisitions, with a focus on IT services and management consulting services, primarily in the United Kingdom and the United States.

Bain & Company views mergers and acquisitions as a crucial element of its growth strategy. They use M&A to adapt to technological changes, economic shifts, and evolving profit pools. This approach allows them to quickly acquire new capabilities and expand their service offerings.

The firm combines its global reach with local market knowledge. With offices in over 37 countries, Bain & Company can serve multinational clients effectively. This global presence is a key part of their strategy to provide tailored solutions based on local market insights.

Bain & Company's expansion initiatives include strategic acquisitions to enhance technological capabilities and geographical diversification to serve clients globally. They focus on IT Services and Management Consulting Services, with a strong presence in the United Kingdom and the United States. In 2024, the M&A market showed positive trends, with a rise in deal volume and value, which supports Bain's growth strategy.

- Acquisition of PiperLab in March 2024 to boost technological capabilities.

- Focus on IT Services and Management Consulting Services.

- Global presence with offices in over 37 countries.

- Anticipation of increased M&A activity in 2025.

Bain & Company SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bain & Company Invest in Innovation?

Bain & Company is heavily investing in innovation and technology to enhance its Management Consulting services and drive growth. A key focus is on leveraging artificial intelligence (AI) to transform its operations and offerings. This strategic direction is evident in its partnerships and internal initiatives.

The firm's approach to technology is not just about adopting new tools but also about changing how it works with clients. This includes redesigning business processes and implementing change management strategies to maximize the value of AI. Bain & Company's commitment to sustainability also reflects its forward-thinking approach, with ambitious goals for reducing emissions.

Bain & Company's strategic initiatives are significantly influenced by advancements in AI and digital transformation. Their focus on integrating these technologies into their consulting services is a key element of their business strategy, aiming to provide clients with cutting-edge solutions and maintain a competitive edge in the market. This commitment to innovation is crucial for their future prospects and sustained growth.

Bain & Company has deepened its collaboration with OpenAI, launching an OpenAI Center of Excellence (CoE) in October 2024. This partnership aims to maximize the transformative potential of AI for businesses globally.

Technology and AI now contribute to 30% of Bain's revenue. Projections indicate this could reach 50% in the coming years, highlighting the significant impact of these technologies on the firm's financial performance.

Bain co-designs AI tools with OpenAI to create industry-specific solutions. These include tools for retail and healthcare life sciences, which are then deployed internally to boost productivity and collaboration.

Bain's 2024 Technology Report highlights the sweeping impact of AI on industry structure and enterprise value. Early client work suggests generative AI initiatives could be worth up to 20% of EBITDA.

Bain expects one in three M&A practitioners to use generative AI in dealmaking by the end of 2024. Early adopters are using these tools to draft integration workplans and transition service agreements.

Bain has committed to reducing its Scope 1 and 2 emissions by 30% by 2026 from a 2019 baseline. They also aim to cut Scope 3 emissions from business travel by 35% per employee over the same period.

Bain & Company's strategic initiatives focus on leveraging technology and innovation to drive growth and enhance its consulting services. This involves significant investments in AI, sustainability, and digital transformation.

- Deepening partnerships with technology leaders like OpenAI to develop AI-driven solutions.

- Focusing on industry-specific applications of AI, such as in retail and healthcare.

- Implementing AI tools internally to improve productivity and collaboration.

- Emphasizing the importance of change management and process redesign to maximize AI's value.

- Setting and achieving ambitious sustainability targets, including emissions reductions.

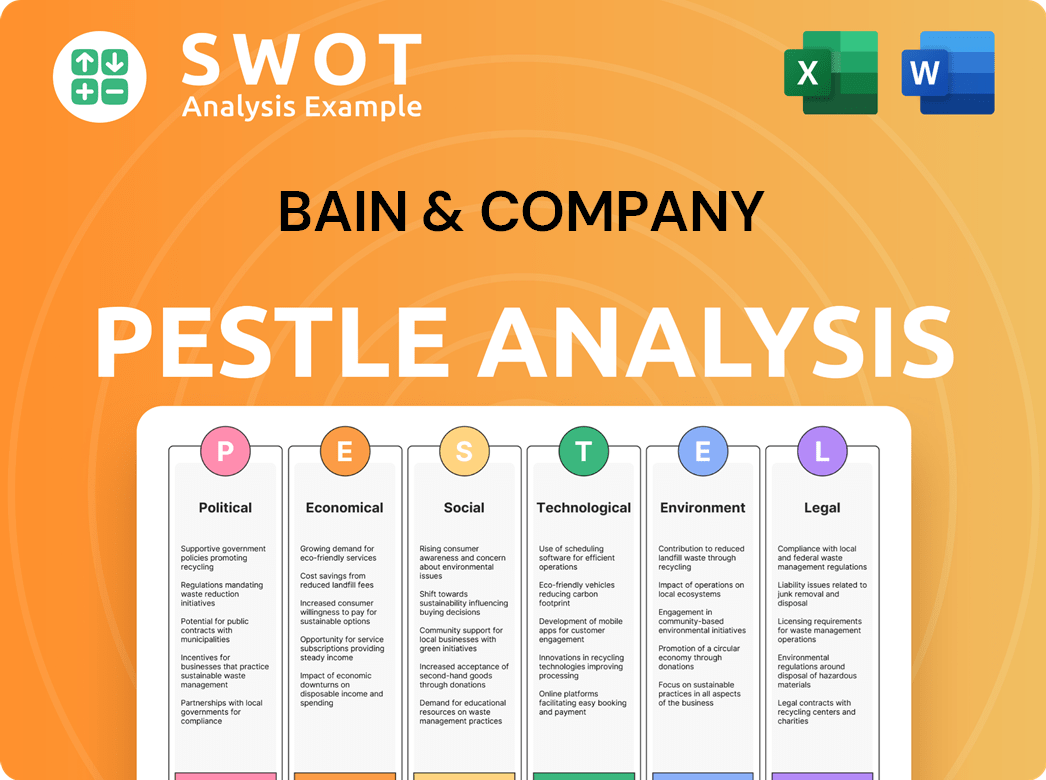

Bain & Company PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bain & Company’s Growth Forecast?

The financial outlook for Bain & Company reflects a strategy focused on growth, driven by strategic investments and an optimistic view of market recovery. While specific revenue figures aren't publicly released, Forbes estimated the firm's annual revenues at $7 billion in 2024. This financial performance supports the company's expansion plans and its ability to invest in future growth areas.

Bain & Company is strategically investing in technology and AI to boost operational efficiency and revenue. The firm's internal adoption of AI tools has significantly increased productivity, with technology and AI contributing to 30% of its revenue. Projections indicate this figure will reach 50% in the coming years, demonstrating a strong commitment to digital transformation strategy.

The company's growth strategy is further supported by its outlook on key market trends. For instance, Bain & Company forecasts a 4% year-over-year growth for the 2025 fiscal year in total U.S. retail sales, amounting to $5.2 trillion. This growth is fueled by a 10% surge in e-commerce and a 2% increase in in-store sales. The insights from Marketing Strategy of Bain & Company offer further context on the firm's approach to market dynamics.

Bain & Company anticipates a rebound in the global M&A market in 2025. Deal values are expected to increase into double digits, contingent on stable economic growth. This follows a 2024 where global M&A deal value reached $3.5 trillion, marking a 15% increase from 2023.

The private equity market saw a strong rebound in dealmaking in 2024. Buyout investment value rose by 37% year-on-year to $602 billion, excluding add-on deals. Global exit value also jumped by 34% to $468 billion. However, fundraising remains a lagging indicator and is expected to be stressed throughout 2025 and potentially into 2026.

Bain & Company has committed to providing $2 billion worth of pro bono social impact services by 2035. This commitment triples its previous decade-long pledge. This demonstrates a significant investment in corporate social responsibility and sustainability strategy.

The firm's strategic initiatives are aligned with industry trends. The growth in e-commerce and the rebound in M&A activity are key factors. These trends influence Bain & Company's consulting services offered and overall business strategy.

Bain & Company maintains a strong position within the competitive landscape of management consulting. The firm's focus on digital transformation and strategic consulting positions it for continued growth. Its market share analysis indicates a robust presence.

While specific future revenue projections are not publicly available, the firm's strategic investments and market outlook suggest positive growth. The expansion plans include a focus on technology and AI to drive future revenue.

Bain & Company's strategic initiatives include investments in AI and a focus on key market sectors. These initiatives support the firm's global presence and its ability to provide effective business strategy consulting.

Bain & Company's growth strategy and focus on digital transformation have a significant impact on the consulting industry. The firm's leadership and vision set benchmarks for strategic consulting and business strategy.

Bain & Company Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bain & Company’s Growth?

The growth strategy of Bain & Company faces several risks and obstacles. The management consulting industry is intensely competitive, making differentiation a constant challenge. Bain & Company's reliance on specific sectors like private equity and consumer products exposes it to industry-specific fluctuations.

High operational costs, particularly those related to talent acquisition and retention, can significantly impact profitability. Understanding these challenges is crucial for evaluating the long-term prospects of Bain & Company. The firm's ability to navigate these issues will be key to sustaining its market position and achieving its strategic goals.

Looking ahead, Bain & Company's future is also influenced by broader market trends. For instance, in the luxury goods sector, Bain & Company anticipates a sales decline between 2% and 5% in 2025 due to economic pressures and consumer behavior. This downturn highlights the need for adaptive strategies. These conditions underscore the importance of strategic planning and responsiveness in the consulting sector.

The consulting industry is highly competitive, with numerous firms vying for the same clients. This intense competition can make it difficult for Bain & Company to differentiate itself and maintain a strong market position. This competitive environment can affect Bain & Company's ability to win new projects and retain existing clients.

A significant portion of Bain & Company's revenue is derived from sectors like private equity and consumer products. Fluctuations in these industries can directly impact Bain & Company's financial performance. Economic downturns or changes in consumer behavior can lead to decreased demand for consulting services in these areas.

High operational costs, particularly related to talent acquisition and retention, can impact Bain & Company's profitability. The consulting industry requires highly skilled professionals, and attracting and retaining top talent is expensive. These costs can affect the firm's financial performance.

Shifting consumer behaviors, economic volatility, regulatory changes, and trade complexities in the retail sector pose challenges. Bain & Company must adapt to these changes to remain relevant. The ability to navigate these dynamics is crucial for the firm's success.

The luxury goods sector is expected to face challenges, with sales potentially declining. This decline is due to economic pressures and changing consumer preferences. Bain & Company must adjust its strategies to address these industry-specific issues effectively. The consulting industry must adapt to these changes.

Technology disruption and post-globalization are ongoing forces that require strategic responses. Bain & Company must help clients leverage cutting-edge technologies. The firm also needs to assist clients in adapting to these evolving market conditions.

Bain & Company needs to help its clients adapt to changing consumer behaviors and economic volatility. In the retail sector, Bain & Company must help clients navigate the complexities of shifting consumer preferences and trade regulations. The ability to provide relevant advice and solutions is crucial for maintaining a competitive edge.

The firm must develop strategies to address the challenges in specific sectors, such as luxury goods. Bain & Company should assist clients in rethinking loyalty programs and fortifying supply chains. These targeted strategies are essential for mitigating risks and capitalizing on opportunities. Bain & Company's ability to adapt to these changes.

Bain & Company needs to help its clients leverage cutting-edge technologies and digital transformation. The consulting firm should assist clients in reimagining their business models. This focus is vital for staying ahead in a rapidly evolving market. Bain & Company's focus on technology and innovation.

Bain & Company should advise clients on strategic responses, including mergers and acquisitions (M&A), to address post-globalization and shifting profit pools. The firm should guide clients in adapting to these forces. The ability to provide such guidance is essential for long-term success. For more information on the Competitors Landscape of Bain & Company.

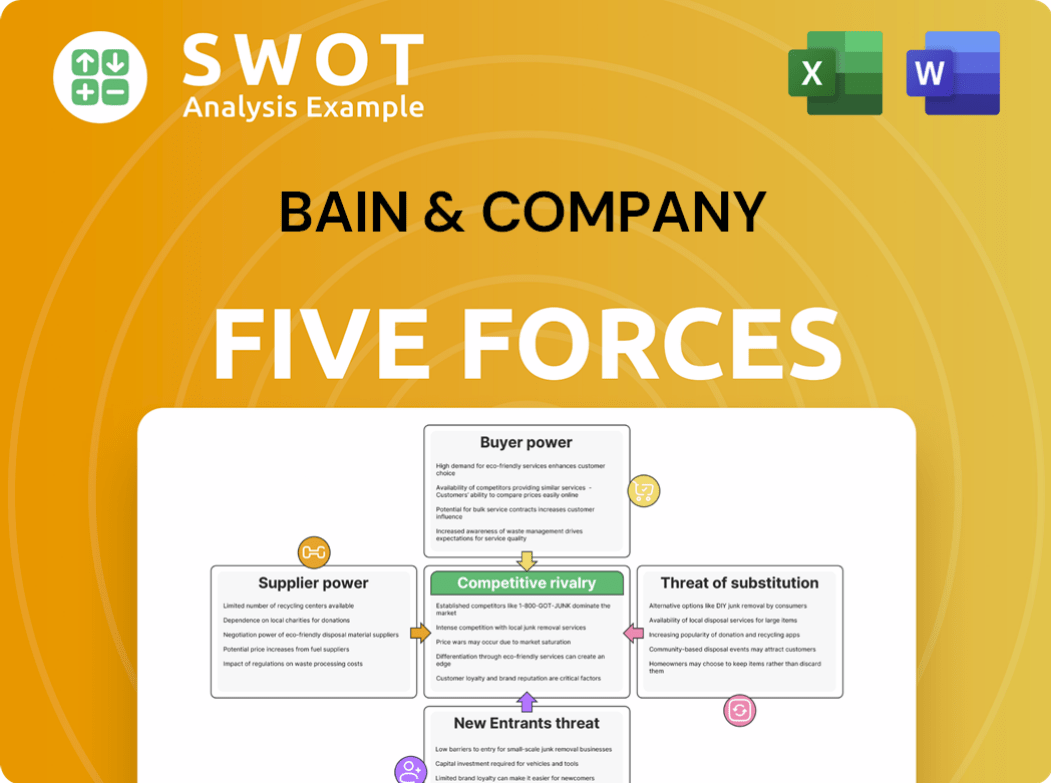

Bain & Company Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bain & Company Company?

- What is Competitive Landscape of Bain & Company Company?

- How Does Bain & Company Company Work?

- What is Sales and Marketing Strategy of Bain & Company Company?

- What is Brief History of Bain & Company Company?

- Who Owns Bain & Company Company?

- What is Customer Demographics and Target Market of Bain & Company Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.