Berlin Packaging Bundle

Can Berlin Packaging Continue Its Packaging Industry Dominance?

Berlin Packaging, a leading Berlin Packaging SWOT Analysis, has dramatically transformed the packaging landscape through strategic acquisitions and a customer-centric approach. Founded in 1989, the company's journey from a Chicago-based startup to a global packaging solutions provider is a testament to its robust growth strategy. This deep dive explores the Berlin Packaging's expansion and its innovative approach to packaging solutions.

This analysis will provide a comprehensive overview of Berlin Packaging's growth strategy, examining its market position and future prospects within the competitive packaging industry. We will explore how Berlin Packaging plans to expand its business, considering its strategic initiatives for growth and its ability to navigate market challenges. The focus will be on understanding the Berlin Packaging's financial performance and outlook, offering insights into its long-term growth plans and potential future prospects.

How Is Berlin Packaging Expanding Its Reach?

The Target Market of Berlin Packaging has been driven by an aggressive expansion strategy focused on geographical market entry, product diversification, and strategic mergers and acquisitions. This approach is designed to access new customer bases, diversify revenue streams, and maintain a competitive edge in the dynamic packaging industry. The company's growth strategy centers on both organic and inorganic initiatives, with a strong emphasis on acquisitions to accelerate market penetration and broaden its product offerings. Berlin Packaging's expansion efforts are particularly notable in Europe and North America, where it has made significant strides through strategic acquisitions.

A key aspect of Berlin Packaging's growth strategy involves integrating acquired entities into its global network, leveraging their existing market knowledge and customer relationships. This inorganic growth strategy enables the company to quickly enter new product categories and geographies, significantly accelerating its growth trajectory. The company's long-term vision includes continuing this acquisitive growth while also focusing on organic growth through enhanced customer service and innovative packaging solutions. These efforts are supported by a robust financial strategy, enabling the company to invest in and execute its expansion plans effectively.

The company's commitment to expansion is evident in its recent acquisitions. For example, in April 2024, Berlin Packaging acquired Glass Line, a glass packaging distributor in Italy, which further solidified its position in the Italian market. The company's strategic moves are aimed at bolstering its product pipeline, particularly in glass and plastic containers, and expanding its service capabilities across different regions. These acquisitions are not isolated incidents but are part of a broader strategy to create a global footprint and offer comprehensive packaging solutions.

In 2024, Berlin Packaging acquired Raepak Limited, a UK-based supplier of plastic packaging. This acquisition strengthens its presence in the beauty, personal care, and pharmaceutical markets.

In April 2024, Berlin Packaging acquired Glass Line, a glass packaging distributor. This move solidified its position in the Italian market and expanded its product offerings.

Early in 2024, Berlin Packaging acquired Bazooka Packaging, expanding its presence in the Benelux region. This acquisition enhanced its product pipeline and service capabilities.

Berlin Packaging often integrates acquired entities into its global network, leveraging their existing market knowledge and customer relationships. This approach accelerates market penetration.

Berlin Packaging's expansion strategy focuses on both organic and inorganic growth. Inorganic growth is driven by strategic acquisitions, while organic growth is supported by enhanced customer service and innovative packaging solutions. This dual approach allows Berlin Packaging to quickly adapt to market changes and maintain a competitive edge.

- Geographical Market Entry: Expanding into new regions to access new customer bases.

- Product Diversification: Broadening the range of packaging solutions offered.

- Strategic Mergers and Acquisitions: Acquiring companies to accelerate growth and market share.

- Customer Service: Enhancing customer relationships and satisfaction.

Berlin Packaging SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Berlin Packaging Invest in Innovation?

Berlin Packaging's growth strategy heavily relies on innovation and technology to meet evolving customer needs. The company focuses on providing comprehensive packaging solutions, which requires continuous advancements in materials, design, and operational efficiency. This approach is crucial for maintaining a competitive edge in the dynamic packaging industry.

A key aspect of their strategy involves digital transformation to enhance operational efficiencies and customer experience. This includes optimizing supply chain management through advanced logistics and inventory systems. They also prioritize sustainability, aligning with growing consumer and regulatory demands for environmentally friendly products.

The company's commitment to innovation is evident in its strategic investments and acquisitions. These moves often bring new technological capabilities and product innovations. For example, the acquisition of Raepak Limited in 2024 added expertise in plastic packaging, which often involves specialized dispensing technologies and sustainable material innovations.

Berlin Packaging strategically invests in research and development to drive innovation. While specific R&D expenditure details for 2024-2025 are not publicly available, these investments are crucial for staying ahead in the market. The company's growth strategy includes continuous development of new packaging solutions.

Digital transformation is a core element of Berlin Packaging's strategy. This involves leveraging technology to enhance operational efficiencies and improve customer experience. Advanced logistics and inventory systems play a key role in optimizing the supply chain.

Sustainability is a major focus, with the company promoting recyclable and reusable packaging. This focus aligns with consumer and regulatory demands for environmentally friendly products. They explore new materials and optimize designs for reduced material usage.

Acquisitions are a key part of Berlin Packaging's growth strategy, bringing in new technological capabilities. The acquisition of Raepak Limited in 2024 is a good example. Partnerships are also crucial for expanding market reach and technological capabilities.

Berlin Packaging emphasizes its 'Everywhere Global' capabilities to provide seamless solutions across regions. This global integration and digital platform approach enhance customer retention. They are focused on attracting new clients seeking comprehensive and technologically advanced packaging partners.

The future prospects for Berlin Packaging are promising, driven by its commitment to innovation, sustainability, and global expansion. The company's ability to adapt to market changes and customer needs positions it well for sustained growth. The company's strategy is designed to address challenges and capitalize on opportunities in the packaging industry.

Berlin Packaging's growth strategy incorporates several key elements to ensure continued success in the packaging industry. These strategies are designed to enhance its market position and drive long-term value. The company's focus on innovation and sustainability is expected to attract new clients and retain existing ones.

- Innovation in Packaging Solutions: Continuous development of new packaging designs and materials to meet evolving market demands.

- Digital Transformation: Implementation of advanced technologies to improve operational efficiency and customer experience.

- Sustainability Initiatives: Promoting eco-friendly packaging solutions to meet consumer and regulatory demands.

- Strategic Acquisitions: Expanding capabilities and market reach through strategic acquisitions.

- Global Expansion: Leveraging 'Everywhere Global' capabilities to provide seamless packaging solutions worldwide.

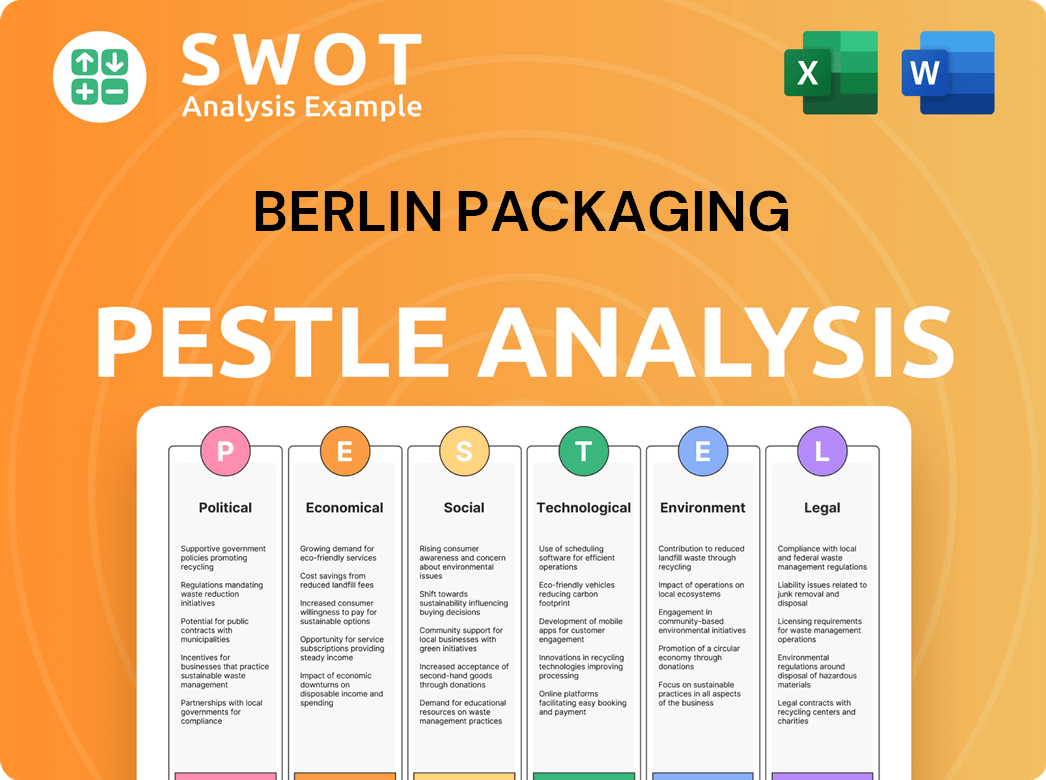

Berlin Packaging PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Berlin Packaging’s Growth Forecast?

The financial outlook for Berlin Packaging is largely driven by its aggressive growth strategy, primarily through acquisitions. This strategy has allowed the packaging company to expand its global footprint and increase its market share. While specific financial details are not always public due to the company's private status, the consistent pattern of mergers and acquisitions (M&A) signals a strong financial position and a commitment to expansion.

A key indicator of Berlin Packaging's financial health is its ability to secure significant capital. In late 2023, the company successfully secured a new revolving credit facility and term loan totaling €1.2 billion. This oversubscribed financing round demonstrates investor confidence and provides substantial resources to fuel future acquisitions and organic growth, supporting its business development efforts.

The company's approach involves integrating acquired entities to create synergies and broaden its global reach, which is expected to drive revenue growth. For instance, the acquisitions of Glass Line in April 2024 and Bazooka Packaging in early 2024 are expected to contribute to increased sales volumes and market penetration in key European markets. Berlin Packaging's financial ambitions appear to be focused on continuous expansion and market leadership, building upon its historical performance of consistent growth through strategic integrations.

Berlin Packaging regularly engages in M&A activities, indicating a proactive approach to growth. These acquisitions are a core part of their growth strategy, aimed at expanding their market presence and product offerings. The company’s ability to secure large financing rounds, like the €1.2 billion facility, underscores its financial stability and investor confidence.

Acquisitions are strategically integrated to leverage synergies and expand the global footprint. Integrating acquired companies allows Berlin Packaging to increase sales volumes and penetrate key markets. The acquisitions of Glass Line and Bazooka Packaging in Europe are examples of this strategy in action, contributing to their market analysis.

Berlin Packaging's financial strategy is focused on long-term growth and market leadership. The ongoing investments and strategic integrations reflect a commitment to solidifying its position as a leading global hybrid packaging supplier. This approach is designed to ensure sustained growth and adaptability in the packaging industry.

The company's consistent capital investments, including the recent financing, support its expansion plans. These investments are crucial for funding future acquisitions, driving organic growth, and enhancing operational capabilities. This financial backing allows Berlin Packaging to pursue its future prospects with confidence.

Berlin Packaging's financial strategy is centered on aggressive expansion through acquisitions and strategic investments. The company's ability to secure significant capital, such as the €1.2 billion financing, underscores its strong financial position and investor confidence. The integration of acquired companies is a key element of its strategy to enhance market penetration and drive revenue growth.

- Consistent M&A activity fuels expansion.

- Significant capital raises support growth initiatives.

- Strategic integrations drive market penetration.

- Focus on long-term market leadership.

For more insights into the company's core values and mission, you can read about the Mission, Vision & Core Values of Berlin Packaging.

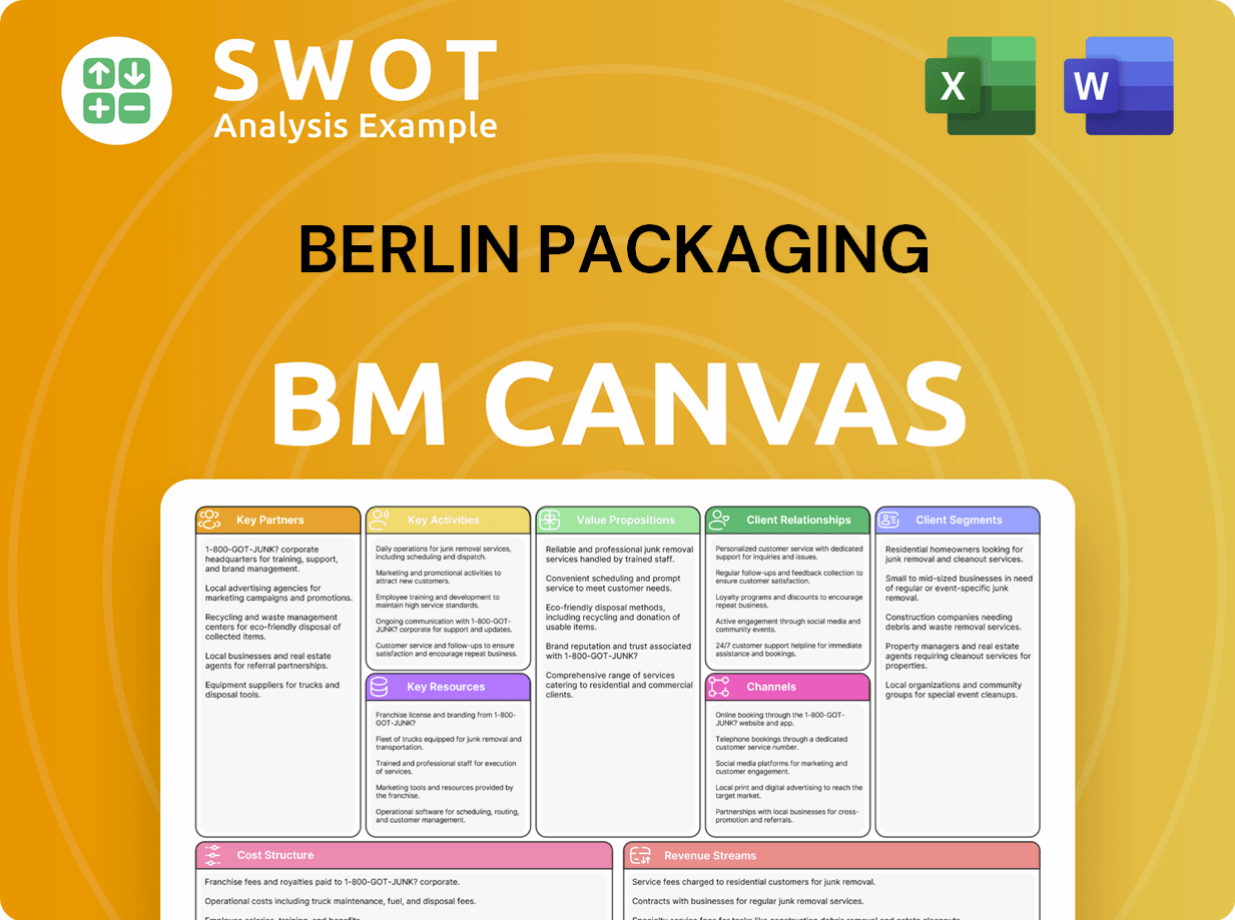

Berlin Packaging Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Berlin Packaging’s Growth?

The Berlin Packaging's ambitious Growth Strategy is not without its potential pitfalls. Navigating the complexities of the packaging industry requires careful management of various risks. Understanding these challenges is crucial for assessing the Future Prospects of the Packaging Company.

The company must contend with intense competition and evolving regulations. Supply chain disruptions and technological advancements also present significant hurdles. Moreover, internal resource constraints and the integration of acquisitions require constant attention.

The packaging industry is highly competitive, featuring both established and emerging players. This competition can impact market share and profitability. The company's 'hybrid' model, offering a wide range of products and services, helps to differentiate it in this crowded market.

Environmental regulations, particularly those concerning plastic waste and recyclability, are constantly evolving. Compliance may require significant investments in new materials and processes. Staying ahead of these changes is critical for long-term sustainability and market access.

Global events can disrupt supply chains, affecting raw material availability and logistics. This can lead to increased costs and delayed deliveries. Diversified sourcing and robust supply chain management are essential to mitigate these risks. For example, in 2023, many packaging companies faced increased shipping costs due to geopolitical issues.

Technological advancements can quickly render existing products and services obsolete. Competitors' innovations could pose a threat if the company is slow to adapt. Investing in innovation and integrating new technologies through acquisitions is crucial to remain competitive. The adoption of e-commerce solutions is a key area for technological advancement.

Rapid growth, especially through acquisitions, can strain internal resources like talent and operational capacity. Successfully integrating new businesses and maintaining organizational efficiency is a constant challenge. Effective talent management and a scalable organizational structure are essential for sustained growth. The company's experience in previous acquisitions is a key asset in managing these challenges.

Economic downturns can reduce demand for packaging materials, affecting sales and profitability. A diversified customer base across various industries can help mitigate these risks. Monitoring economic indicators and adjusting strategies accordingly is crucial. Recessions can significantly impact the packaging industry's performance.

To counter these risks, the company employs several strategies. These include its 'hybrid' business model, proactive sustainability initiatives, and a focus on supply chain resilience. Continuous investment in innovation and strategic acquisitions are also key components of its risk management approach. For a deeper understanding of its business model, consider reading about Revenue Streams & Business Model of Berlin Packaging.

The packaging industry is influenced by several factors. These include consumer preferences, technological advancements, and economic conditions. Understanding these market dynamics is critical for making informed strategic decisions. The company's ability to adapt to changing market demands will significantly influence its future success.

Berlin Packaging Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Berlin Packaging Company?

- What is Competitive Landscape of Berlin Packaging Company?

- How Does Berlin Packaging Company Work?

- What is Sales and Marketing Strategy of Berlin Packaging Company?

- What is Brief History of Berlin Packaging Company?

- Who Owns Berlin Packaging Company?

- What is Customer Demographics and Target Market of Berlin Packaging Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.