Bloomin' Brands Bundle

Can Bloomin' Brands Steer Through the Shifting Restaurant Landscape?

Bloomin' Brands, the parent company behind Outback Steakhouse and other popular dining concepts, is facing a pivotal moment in the ever-evolving restaurant industry. With a global footprint and a history rooted in innovative dining experiences, the company's future hinges on its ability to adapt and thrive. This analysis dives deep into Bloomin' Brands' Bloomin' Brands SWOT Analysis, growth strategies, and long-term potential.

This exploration of Bloomin' Brands will analyze its strategic initiatives, including Bloomin' Brands expansion plans 2024 and international expansion strategy, to understand how it aims to capture market share. We'll examine the company's recent financial results, assess its competitive landscape analysis, and evaluate its ability to navigate challenges like the impact of inflation. The goal is to provide a comprehensive Restaurant Industry Analysis, including Bloomin' Brands Market Share and Bloomin' Brands Financial Performance, to understand the company's trajectory and long-term growth potential.

How Is Bloomin' Brands Expanding Its Reach?

The expansion strategy of Bloomin' Brands, a prominent player in the restaurant industry, is currently focused on a multi-faceted approach. This involves strategic adjustments within its portfolio, alongside a dual focus on domestic and international market growth. The company is adapting its strategies to navigate the evolving Restaurant Industry Analysis and capitalize on opportunities for sustained growth.

A key move was the sale of a majority stake in its Brazil operations in late 2024. This transition to a franchise model in Brazil, while retaining a minority interest, is designed to streamline operations and improve cash flow. This strategic shift allows for a more concentrated effort on the core U.S. market, which is a critical component of the company's Bloomin' Brands Growth Strategy.

Despite the shift in Brazil, the company anticipates its partner will open approximately 17 new units in 2025. Domestically, Bloomin' Brands is strategically slowing down new restaurant openings in the U.S. to focus on existing assets. This includes remodels and operational enhancements, particularly for Outback Steakhouse, which is a key brand within the company's portfolio.

In 2025, Bloomin' Brands plans to open between 18 and 20 new company-owned restaurants in the U.S. Additionally, the company projects around 30 new franchised restaurants for the same year. This approach allows for more efficient allocation of resources and capital.

Bloomin' Brands is exploring international expansion in key markets. This includes China, Mexico, and South Korea, alongside its continued focus on Brazil. The company's international strategy is a key element in its Bloomin' Brands Future Prospects.

The company plans to allocate approximately $40 million for remodels as it moves into 2026 and beyond. Total capital expenditure is projected between $190 million and $210 million for 2025. This investment is crucial for maintaining the brand's appeal and improving the guest experience.

The focus on existing assets is intended to improve traffic trends and the overall guest experience. This includes remodeling over 100 Outback locations in 2023, with plans to continue this effort in 2024 and 2025. This strategic approach is essential for long-term growth.

Bloomin' Brands' expansion strategy is multifaceted, involving both domestic and international growth. The company is adapting to changing consumer trends and focusing on maximizing returns. For more insights, check out the Marketing Strategy of Bloomin' Brands.

- Prioritizing remodeling and operational enhancements in the U.S.

- Exploring international expansion opportunities in key markets.

- Streamlining operations through strategic partnerships and franchise models.

- Focusing on improving guest experience to drive traffic and sales.

Bloomin' Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bloomin' Brands Invest in Innovation?

The company is actively using technology and innovation to enhance customer experiences, improve operational efficiency, and foster sustainable growth. This approach is crucial for navigating the competitive landscape of the restaurant industry and ensuring long-term success. These strategies are integral to the company's growth strategy and future prospects.

Through these initiatives, the company aims to meet evolving customer preferences while optimizing its operations. This commitment to innovation is a key factor in the company's ability to adapt to changing consumer trends and maintain its market share. Understanding these strategies is essential for a comprehensive restaurant industry analysis.

The company's strategic focus includes implementing Ziosk tablets, simplifying menus, and promoting environmental sustainability. These efforts demonstrate a proactive approach to enhancing both the customer experience and operational efficiency. For a deeper understanding of the company's financial performance, consider exploring Revenue Streams & Business Model of Bloomin' Brands.

The implementation of Ziosk tablets in Outback Steakhouse restaurants is a prime example of leveraging technology. This has led to increased table turns, improving operational efficiency.

The company is simplifying menus across all brands, targeting a 10% to 20% reduction in menu items by the end of 2025. This strategy streamlines kitchen operations and improves food quality.

Menu simplification involves removing items with low sales or customer satisfaction. Outback's April menu had about 10 fewer items, with a target of a 15% reduction by the end of 2025.

The company is committed to environmental sustainability, aiming to reduce direct emissions by 46.2% by 2030 from a 2019 baseline. It aims to reach net-zero emissions by 2050.

In 2024, the company reduced its Scopes 1 and 2 emissions by 16% compared to 2019. This was achieved through energy-efficient equipment and operational improvements.

The company is committed to sustainable sourcing, aiming to source 60% of all products from verified deforestation-free suppliers. The goal is to reach 100% in the future.

The company's innovation strategy is multifaceted, focusing on technology, operational efficiency, and environmental responsibility. These initiatives are crucial for the company's long-term growth potential and adapting to the impact of inflation.

- Ziosk Tablets: Enhancing customer experience and improving table turnover rates.

- Menu Simplification: Streamlining operations and improving food quality.

- Environmental Sustainability: Reducing emissions and promoting responsible business practices.

- Sustainable Sourcing: Ensuring products come from deforestation-free suppliers.

- Financial Goals: Reducing direct emissions by 46.2% by 2030.

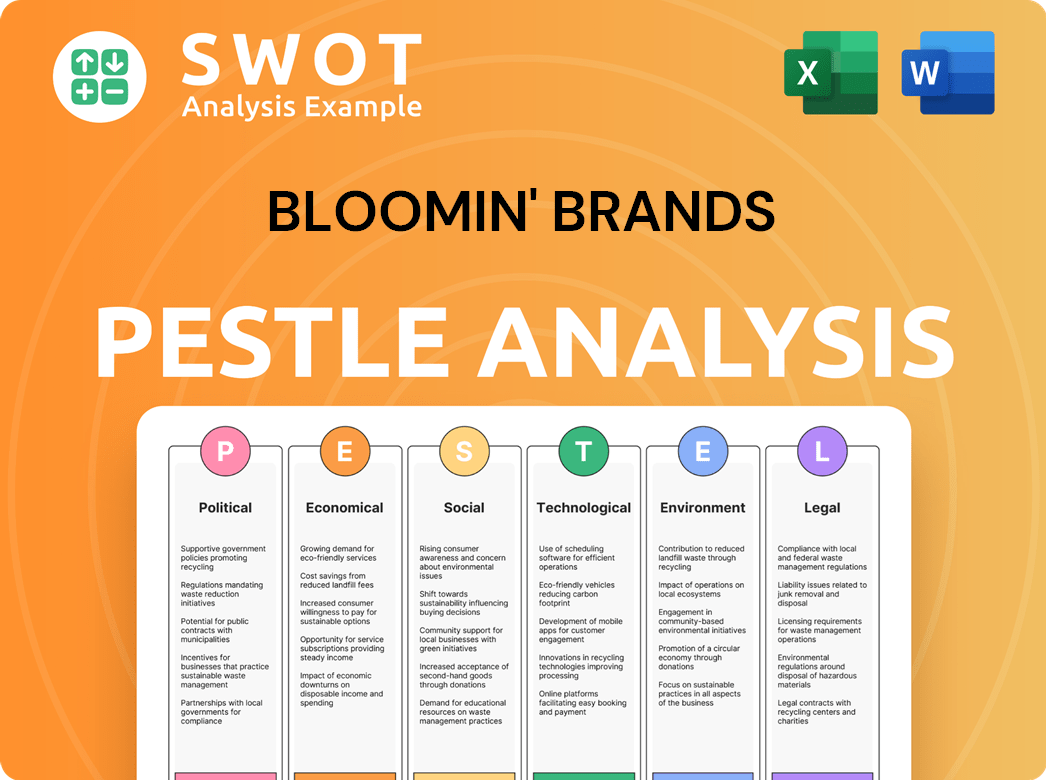

Bloomin' Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bloomin' Brands’s Growth Forecast?

The financial outlook for Bloomin' Brands in 2025 reflects a strategic approach amidst economic challenges. The company's performance in the first quarter of 2025 provides insights into its current financial health and future prospects. This analysis considers revenue trends, sales figures, and projected financial metrics to assess the company's position in the restaurant industry.

Bloomin' Brands, like other players in the restaurant industry, faces various economic pressures. Understanding these factors is crucial for evaluating the company's growth strategy and long-term potential. The company's ability to adapt to changing consumer behaviors and market dynamics will be key to its future success. For a comprehensive understanding, consider the Competitors Landscape of Bloomin' Brands.

In Q1 2025, Bloomin' Brands reported total revenues of $1.05 billion, a 1.8% decrease year-over-year. This decline was primarily due to net restaurant closures and lower comparable restaurant sales. U.S. comparable restaurant sales decreased by 0.5% in Q1 2025, with a 3.9% decrease in traffic.

Carrabba's Italian Grill and Fleming's Prime Steakhouse & Wine Bar showed positive comparable sales of 1.4% and 5.1% respectively in Q1 2025. However, Outback Steakhouse and Bonefish Grill experienced declines in comparable sales. These varying performances highlight the diverse nature of the company's brand portfolio.

The Q1 2025 GAAP diluted EPS was $0.50, an improvement from a loss of $1.00 in Q1 2024. The adjusted diluted EPS was $0.59, compared to $0.64 in Q1 2024. Adjusted operating margins for Q1 2025 were 6.1%, down from 7.8% in Q1 2024.

Operating margins were impacted by lower restaurant-level operating margin, higher operating, labor, and commodity costs driven by inflation, and an unfavorable product cost mix. Commodity inflation is projected to be 2.5% to 3.5% for the full year 2025, and labor inflation is expected to be 4% to 5%.

Bloomin' Brands is reaffirming its guidance for the full fiscal year 2025. The company expects U.S. comparable restaurant sales to range from a decline of 2.0% to flat. Adjusted diluted EPS is expected to be between $1.20 and $1.40. Capital expenditures for 2025 are projected to be between $190 million and $210 million.

- The company anticipates being at the low end of its adjusted diluted EPS range.

- A quarterly cash dividend of $0.15 per share was declared, payable in June 2025.

- As of May 2025, the trailing twelve months (TTM) operating margin was 3.14%.

Bloomin' Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bloomin' Brands’s Growth?

The future prospects of Bloomin' Brands face several potential risks and obstacles that could impact its growth strategy. The company operates in a highly competitive casual dining sector, where maintaining market share and driving traffic are constant challenges. Macroeconomic factors, including inflation and changing consumer behavior, add further complexity to the business environment, potentially affecting Bloomin' Brands' financial performance.

Operational risks, such as supply chain issues and the need to ensure consistent quality, also pose challenges. Additionally, the company's strategic decisions, like the sale of its Brazilian operations, could lead to different operational dynamics. These factors require careful management to ensure sustained growth and profitability, as detailed in a recent analysis of Owners & Shareholders of Bloomin' Brands.

Bloomin' Brands' ability to navigate these challenges will be crucial for achieving its long-term objectives. In Q1 2025, the company reported a decline in U.S. traffic and comparable restaurant sales, highlighting the need for effective strategies to counteract these trends. The company anticipates commodity inflation between 2.5% and 3.5% and labor inflation between 4% and 5% in 2025, which could further squeeze margins. These pressures, combined with evolving consumer preferences, necessitate proactive measures to adapt and maintain a competitive edge.

The casual dining segment is intensely competitive, requiring continuous efforts to attract customers. The company faces competition from both established and emerging restaurant chains. Intense competition impacts Bloomin' Brands' market share and profitability.

Inflation, including higher operating, labor, and commodity costs, presents a significant challenge. Consumer spending patterns and economic conditions can influence customer choices. These factors can negatively impact Bloomin' Brands' financial performance.

Supply chain disruptions and the need to maintain consistent food quality are key operational risks. The company must ensure a positive guest experience across all locations. Effective management of these factors is critical for success.

The sale of a majority stake in the Brazil operations introduces new dynamics. Regulatory changes, such as new accounting standards, also present compliance challenges. These strategic shifts require careful planning and execution.

Changes in consumer preferences, such as a shift towards lower-priced options, pose a risk. The company must adapt its offerings to meet evolving consumer demands. Understanding and responding to these trends are crucial.

Rising costs, including commodity and labor inflation, can squeeze profit margins. The company needs to implement cost-saving initiatives to mitigate these pressures. Effective cost management is essential for financial health.

The restaurant industry is highly competitive, and Bloomin' Brands must differentiate itself. Market share is influenced by consumer preferences and economic conditions. Understanding the competitive landscape is vital for strategic planning.

Recent financial results, including comparable sales and traffic, are critical indicators. The company's ability to manage costs and maintain profitability is essential. Monitoring financial performance is key to assessing progress.

Bloomin' Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bloomin' Brands Company?

- What is Competitive Landscape of Bloomin' Brands Company?

- How Does Bloomin' Brands Company Work?

- What is Sales and Marketing Strategy of Bloomin' Brands Company?

- What is Brief History of Bloomin' Brands Company?

- Who Owns Bloomin' Brands Company?

- What is Customer Demographics and Target Market of Bloomin' Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.