Caseking Bundle

Can Caseking Conquer the Future of Gaming Hardware?

In 2024, Equistone Partners Europe's investment in Caseking signaled a bold move in the competitive gaming hardware sector. Founded in Berlin, Caseking has evolved from a niche online retailer to a prominent European player, catering to PC enthusiasts with high-performance components. This Caseking SWOT Analysis delves into the company's strategic roadmap for continued expansion and market dominance.

This deep dive into Caseking's business model will explore its ambitious growth strategy, examining its expansion plans within the e-commerce market and assessing its potential for international growth. We'll analyze the PC components industry landscape, evaluating Caseking's competitive positioning and future prospects. Furthermore, the analysis will cover Caseking's financial performance review, customer acquisition strategies, and the impact of economic trends on its long-term sustainability.

How Is Caseking Expanding Its Reach?

The expansion initiatives are central to the Caseking growth strategy. These initiatives are designed to deepen market penetration and diversify revenue streams. The company focuses on geographic expansion within Europe and product category diversification to maintain its competitive edge in the e-commerce market.

Caseking's strategy includes exploring underserved regions within Europe, building on its established presence in markets like Germany, the UK, and France. This approach aims to capture new customer segments and increase market share. The company also plans to expand its product offerings, including the latest innovations in gaming hardware and accessories, to meet evolving consumer demands.

Mergers and acquisitions are expected to play a crucial role in accelerating Caseking's expansion. The investment by Equistone Partners Europe is providing the financial backing for inorganic growth opportunities. This will allow Caseking to acquire smaller businesses that enhance its product offerings, customer base, or supply chain. The company is also focused on accessing new customer demographics, particularly within the growing esports and content creation communities.

Caseking is focusing on expanding its presence across Europe, targeting underserved regions to increase market penetration. This involves leveraging its existing infrastructure and customer-centric approach to gain traction in new areas. The company's goal is to capitalize on the growing demand for PC components industry products and gaming accessories across the continent.

The company is consistently broadening its portfolio to include the latest innovations in PC hardware, gaming peripherals, and related accessories. This includes stocking new products from existing brands and forging partnerships with emerging manufacturers. Caseking aims to offer a comprehensive range of products to meet the evolving needs of its customer base.

Caseking plans to use mergers and acquisitions to accelerate its expansion. The investment from Equistone Partners Europe provides the capital needed for these inorganic growth opportunities. Potential targets include specialized peripheral manufacturers, custom PC builders, or smaller online retailers. These acquisitions are designed to enhance product offerings and expand the customer base.

The company is targeting new customer demographics, particularly within the growing esports and content creation communities. This involves integrating new product lines such as advanced simulation gear and professional-grade streaming equipment. Caseking aims to cater to the specific needs of these communities to drive growth and maintain its competitive edge.

Caseking's expansion strategy is supported by strategic partnerships and investments, such as the investment from Equistone Partners Europe. These partnerships are crucial for funding acquisitions and expanding product offerings. The company's focus on the Caseking future prospects is evident in its proactive approach to market opportunities.

- Acquisitions of specialized peripheral manufacturers to broaden product lines.

- Partnerships with emerging manufacturers to bring cutting-edge technology to customers.

- Investment in advanced simulation gear and professional-grade streaming equipment.

- Focus on understanding the Owners & Shareholders of Caseking to align expansion strategies.

Caseking SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Caseking Invest in Innovation?

The sustained growth of the company is closely tied to its proactive technology adoption and innovation efforts. This approach is evident in its continuous investment in research and development, encompassing both internal expertise and collaborations with external innovators and key industry players. The company’s focus on optimizing its e-commerce platforms, improving customer experience, and streamlining logistics is a testament to its commitment to technological advancement.

The company's digital transformation initiatives are apparent through its ongoing improvements to website functionality, mobile accessibility, and personalized recommendation engines. These efforts are designed to boost engagement and conversion rates, which are critical in the competitive e-commerce market. By staying at the forefront of technological advancements, the company aims to enhance its market position and cater to the evolving needs of its customer base.

The company is also exploring the application of cutting-edge technologies, such as AI, to improve customer support through intelligent chatbots and predictive analytics for inventory management, ensuring optimal stock levels and faster fulfillment. Automation within its warehousing and distribution centers is another area of focus, aiming to increase efficiency and reduce operational costs. This strategic approach is crucial for maintaining a competitive edge in the PC components industry.

The company continuously refines its e-commerce platform to improve user experience and drive sales. This includes upgrades to website design, mobile responsiveness, and personalized recommendations. These features are vital for attracting and retaining customers in the competitive e-commerce market.

The company is exploring AI and machine learning to enhance customer support and inventory management. This includes using chatbots for instant customer service and predictive analytics to optimize stock levels. These technologies help improve efficiency and customer satisfaction.

Automation is being implemented in warehousing and distribution centers to increase efficiency and reduce operational costs. This includes automated picking, packing, and sorting systems. These improvements help streamline operations and reduce fulfillment times.

The company consistently introduces new and specialized products, often ahead of market availability. This includes the latest graphics cards, processors, and niche cooling solutions. This strategy helps the company cater to the enthusiast market and maintain a competitive edge.

The company is focusing on sustainability by offering more energy-efficient components and exploring eco-friendly packaging. This approach aligns with the growing demand for environmentally responsible products. This includes offering more energy-efficient components and exploring eco-friendly packaging options.

The company prioritizes customer experience through intuitive interfaces, personalized recommendations, and efficient customer support. This focus is critical for building customer loyalty and driving repeat business. This includes offering more energy-efficient components and exploring eco-friendly packaging options.

The company’s commitment to innovation is evident in its technology strategy, which focuses on enhancing e-commerce platforms, integrating AI, and automating warehouse operations. These initiatives are designed to improve customer experience, streamline operations, and drive growth. For insights into the company's marketing strategies, see Marketing Strategy of Caseking.

- E-commerce Platform Optimization: Continuous improvements to website functionality, mobile accessibility, and personalized recommendation engines to enhance user experience and drive sales.

- AI and Machine Learning Integration: Implementation of AI-powered chatbots for customer support and predictive analytics for inventory management to optimize stock levels and improve fulfillment.

- Automation in Warehousing: Use of automation within warehousing and distribution centers to increase efficiency and reduce operational costs.

- Product Innovation: Consistent introduction of new and specialized products, often ahead of market availability, to cater to the enthusiast market's demand for the latest technology.

- Sustainability Initiatives: Offering more energy-efficient components and exploring eco-friendly packaging options to resonate with environmentally conscious consumers.

Caseking PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Caseking’s Growth Forecast?

The financial outlook for Caseking appears promising, bolstered by a strategic investment from Equistone Partners Europe. This investment is expected to provide significant capital, fueling the company's growth initiatives. While specific financial details, such as revenue targets and profit margins for 2024-2025, remain undisclosed due to the company's private status, industry trends suggest a strong growth trajectory.

The computer hardware and gaming peripheral market provides a favorable backdrop for Caseking's financial performance. The ongoing popularity of gaming, the increasing demand for powerful workstations, and technological advancements are driving market growth. This positive market environment supports the company's projected financial outcomes.

Analyst forecasts indicate continued expansion in the broader PC gaming hardware market. Some estimates project a compound annual growth rate (CAGR) exceeding 10% through 2025. As a specialized retailer, Caseking is well-positioned to capitalize on this trend. The investment from Equistone is anticipated to facilitate increased investments in expansion, technological upgrades, and potential acquisitions, all aimed at boosting revenue and market share. This financial backing also suggests a focus on strengthening the company's financial resilience and improving operational efficiency to enhance profit margins. For a deeper dive into the company's strategy, you can read a comprehensive analysis of Caseking's business model.

The investment from Equistone is expected to enable Caseking to expand its market presence. This expansion could involve entering new geographical markets or increasing its footprint in existing ones. Such moves are designed to boost revenue and market share.

Technological upgrades are a key area of focus, ensuring Caseking remains competitive in the fast-paced PC components industry. This includes enhancements to its e-commerce platform, logistics, and customer service capabilities. These upgrades are vital for maintaining a competitive edge.

Acquisitions represent another avenue for growth. Caseking may pursue strategic acquisitions to broaden its product offerings and customer base. This could involve acquiring complementary businesses or expanding into new product categories.

Improving operational efficiency is critical for enhancing profit margins. This involves streamlining processes, optimizing supply chain management, and implementing cost-saving measures. These improvements can significantly impact the bottom line.

Product diversification is a key strategy for mitigating risk and capturing a wider customer base. This includes expanding the range of gaming hardware and peripherals offered. Diversification helps Caseking cater to a broader customer base.

Strengthening financial resilience is a priority, ensuring the company can withstand economic fluctuations. This involves maintaining a healthy balance sheet and managing financial risks effectively. Strong financial backing supports these efforts.

Caseking Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Caseking’s Growth?

The journey of the company, despite its promising outlook, is not without its hurdles. Understanding these potential risks and obstacles is crucial for a comprehensive Caseking company analysis. Several factors could impact its Caseking future prospects and overall growth trajectory.

One significant challenge is the competitive landscape, especially within the dynamic e-commerce market. The company must navigate pricing pressures, intense marketing efforts, and rapid product cycles. Additionally, supply chain vulnerabilities and technological disruptions pose ongoing threats that require proactive management.

Internal resource constraints, such as attracting and retaining skilled talent, could also hinder growth. The company's management likely employs robust risk management frameworks to prepare for these potential obstacles and ensure business continuity.

The PC components industry and gaming peripherals market is highly competitive. The company faces competition from large e-commerce giants and specialized retailers. Constant vigilance and strategic agility are crucial to maintain market share.

Regulatory changes, particularly regarding data privacy (like GDPR in Europe), consumer protection, and international trade, could increase operational costs. Compliance with evolving regulations is an ongoing challenge.

Geopolitical events, natural disasters, or sudden demand surges can lead to component shortages and shipping delays. These issues directly impact product availability and pricing. The company has to have diversified sourcing strategies.

Rapid advancements in hardware and software can quickly render existing products obsolete. The company addresses this by continually updating its product offerings and investing in R&D to stay ahead of emerging technologies.

Attracting and retaining skilled talent, especially in specialized IT and logistics roles, is crucial. Competition for skilled labor could hinder growth. The company needs to offer competitive compensation and benefits.

Economic downturns can impact consumer spending on discretionary items like gaming hardware. Inflation and changes in consumer confidence could affect sales. The company needs to have a flexible pricing strategy.

The company needs to implement robust risk management frameworks. This includes scenario planning and contingency measures. These measures are essential for business continuity and sustained growth. The company should also focus on operational efficiency.

Competitive analysis is essential for the Caseking growth strategy. This involves monitoring competitor pricing, marketing campaigns, and product offerings. The company must differentiate its products and services. The company needs to innovate to stay ahead.

The company must embrace technological advancements and adapt to evolving market demands. This includes investing in R&D and regularly updating product offerings. The company needs to anticipate future trends. This is crucial for long-term sustainability.

Forming strategic partnerships can help the company expand its reach and access new markets. Collaborations with suppliers and other industry players can strengthen its position. These partnerships can drive innovation. They can also enhance customer value.

For a deeper dive into the company's financial structure and business model, see Revenue Streams & Business Model of Caseking. This analysis provides valuable insights into the company's operations and potential for future success.

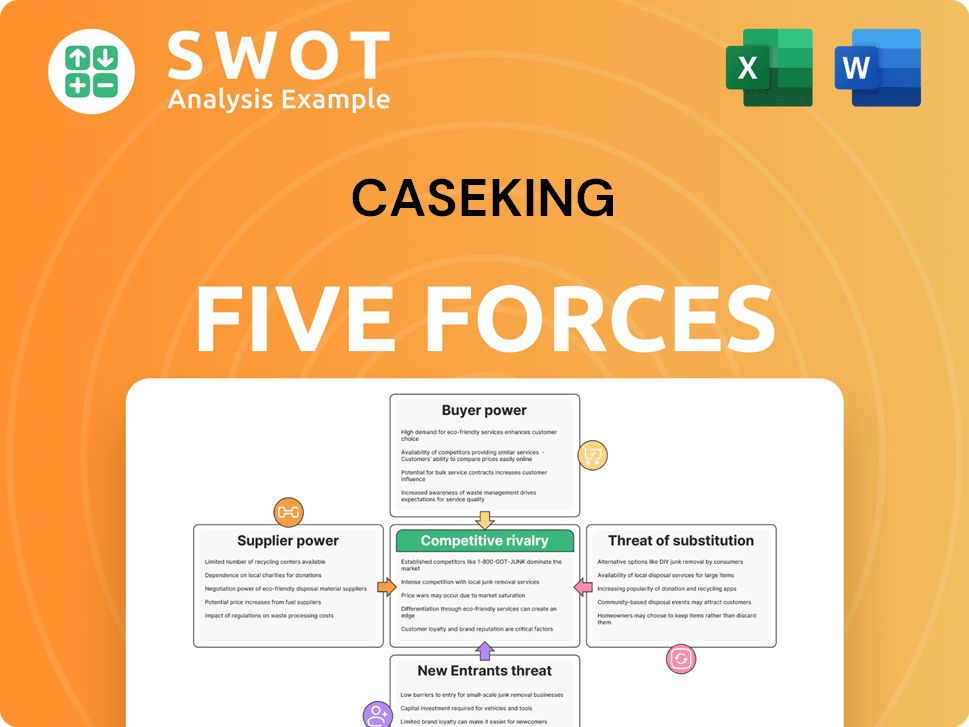

Caseking Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Caseking Company?

- What is Competitive Landscape of Caseking Company?

- How Does Caseking Company Work?

- What is Sales and Marketing Strategy of Caseking Company?

- What is Brief History of Caseking Company?

- Who Owns Caseking Company?

- What is Customer Demographics and Target Market of Caseking Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.