Clear Secure Bundle

What's Next for Clear Secure?

Clear Secure's acquisition of Whyline in 2024 signals a bold move, reshaping its Clear Secure SWOT Analysis and future. This strategic acquisition aims to enhance the member experience by integrating digital queuing and appointment scheduling. Founded in 2010, Clear Secure has rapidly evolved, making it a key player in identity verification and travel technology.

From its roots in expedited airport security, Clear Secure's growth strategy has expanded to stadiums and entertainment venues, demonstrating its commitment to business development. This expansion highlights the company's ability to adapt and capitalize on market opportunities. Understanding Clear Secure's future prospects requires a deep dive into its technology roadmap and market analysis within the evolving cybersecurity landscape.

How Is Clear Secure Expanding Its Reach?

The expansion initiatives of the company are designed to broaden its reach and enhance its service offerings. The core strategy involves entering new markets beyond airports, such as sports stadiums, entertainment venues, and healthcare facilities. This diversification allows the company to access new customer segments and increase revenue streams.

Product and service diversification is a significant area of expansion. The acquisition of Whyline in 2024, for example, integrates digital queuing and appointment scheduling into the company's offerings. This enhances the member experience and streamlines operations in various venues. Furthermore, the company is exploring new applications for its identity verification technology, including age verification in retail and online settings and health-related credentialing.

The company's expansion strategy focuses on increasing its presence within the U.S. market and exploring strategic partnerships to achieve its growth milestones. The company has expanded its presence to over 190 locations across the U.S., including more than 50 airports. The company aims to leverage its existing biometric identity platform to provide secure and seamless access in diverse environments, thereby accessing new customer segments and diversifying revenue streams.

The company's expansion strategy focuses on entering new markets beyond airports. This includes sports stadiums, entertainment venues, and healthcare facilities. This strategy aims to leverage the existing biometric identity platform for secure and seamless access in diverse environments. This approach allows the company to access new customer segments and diversify revenue streams, driving the overall Growth strategy.

Product and service diversification is another key area of expansion. The acquisition of Whyline in 2024 is a prime example, integrating digital queuing and appointment scheduling. The company also explores new applications for its identity verification technology, including age verification and health-related credentialing. These initiatives help the company stay ahead of industry changes and provide comprehensive identity solutions.

The company focuses on deepening its penetration within the U.S. market and exploring strategic partnerships. These partnerships are crucial for achieving growth milestones. The company's strategy involves leveraging its existing biometric identity platform to provide secure and seamless access in various environments. This approach is essential for the Future prospects of the company.

The integration of digital queuing and appointment scheduling through acquisitions like Whyline enhances the member experience. The company continues to explore new applications for its identity verification technology. These initiatives are pursued to stay ahead of industry changes and provide comprehensive identity solutions. This focus on technology is vital for the Clear Secure's Business development.

The company's expansion initiatives are centered around market diversification and technological integration. The company aims to expand beyond airports, entering sports stadiums, entertainment venues, and healthcare facilities. This includes strategic partnerships and the integration of new technologies to enhance service offerings. For more details on the Clear Secure market share analysis and its competitors, refer to the Competitors Landscape of Clear Secure.

- Entering new markets such as stadiums and healthcare facilities.

- Acquiring companies like Whyline to enhance service offerings.

- Exploring new applications for identity verification technology.

- Focusing on deepening its presence within the U.S. market.

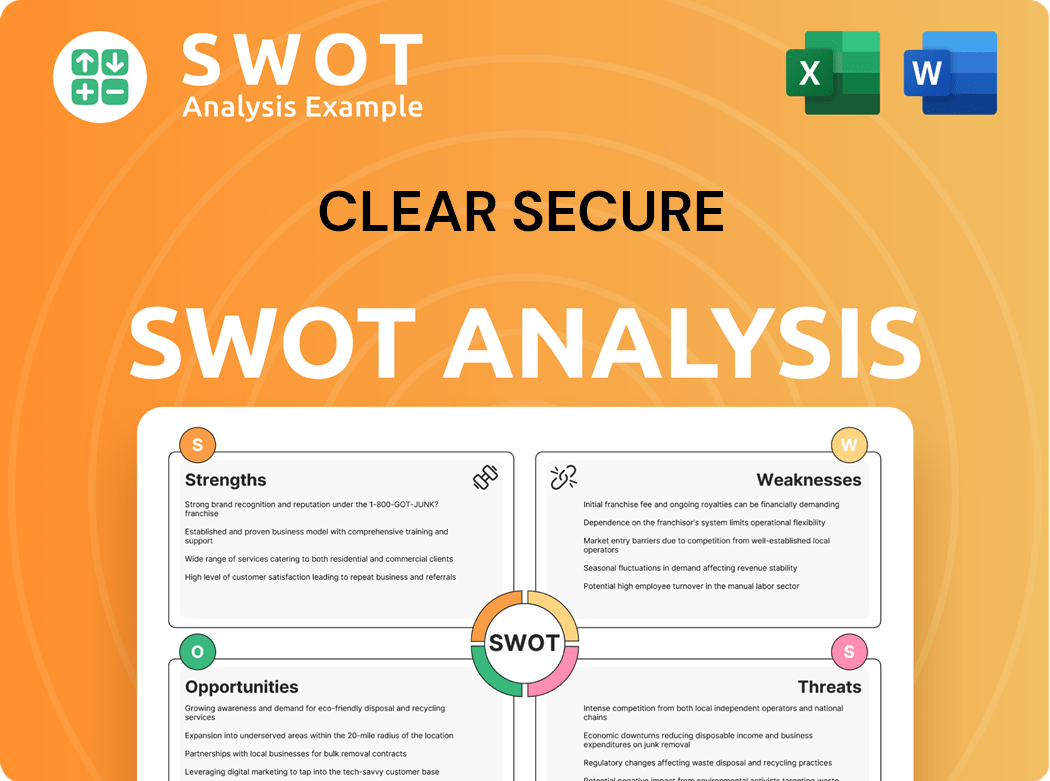

Clear Secure SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Clear Secure Invest in Innovation?

The growth strategy of the company is heavily reliant on its innovation and technology, specifically its biometric identity verification systems. This approach focuses on continuous improvement to ensure accuracy, speed, and security in its core technologies such as fingerprint and iris recognition.

The company's digital transformation strategy extends beyond physical checkpoints through mobile apps and integrated solutions. This includes the development of features like the 'Health Pass' during the pandemic, demonstrating its ability to adapt to changing societal needs.

The company consistently invests in research and development to enhance its core platform. While specific R&D investment figures for 2024-2025 are not readily available, the company's ongoing commitment to technological advancement is evident in its continuous rollout of new features and expansion into new venue types. The company also explores the integration of cutting-edge technologies like AI to further enhance its identity verification processes and personalize user experiences.

The company's foundation rests on biometric identity verification. This includes technologies like fingerprint and iris recognition to ensure secure and efficient identity verification.

The company is expanding its reach through mobile applications and integrated digital solutions. This includes features like the 'Health Pass,' which shows adaptability to new demands.

The company consistently invests in R&D to improve its platform. This includes the development of new features and expansion into new venues. The company also explores integrating AI.

Innovation is key to maintaining leadership in the secure identity space. This commitment is crucial for its long-term growth objectives and is a key part of its strategy.

The company's future prospects are closely tied to its ability to innovate and adapt. This includes expanding its services and integrating new technologies.

The company's market position is strengthened by its focus on secure identity solutions. This focus helps it maintain a competitive edge in the cybersecurity market.

The company's competitive advantage is its proprietary technology that links identity to biometrics. This creates a secure, opt-in network for frictionless experiences. The company's ability to innovate and adapt to new technologies will be key to its future prospects and expansion plans.

- The company's focus on biometric verification provides a strong foundation for its growth strategy.

- The development of mobile applications and integrated digital solutions enhances its market reach.

- Continuous investment in R&D and the integration of AI are vital for maintaining a competitive edge.

- The company's commitment to innovation supports its long-term vision and expansion plans.

- For more insights into the company's ownership and financial backing, you can refer to Owners & Shareholders of Clear Secure.

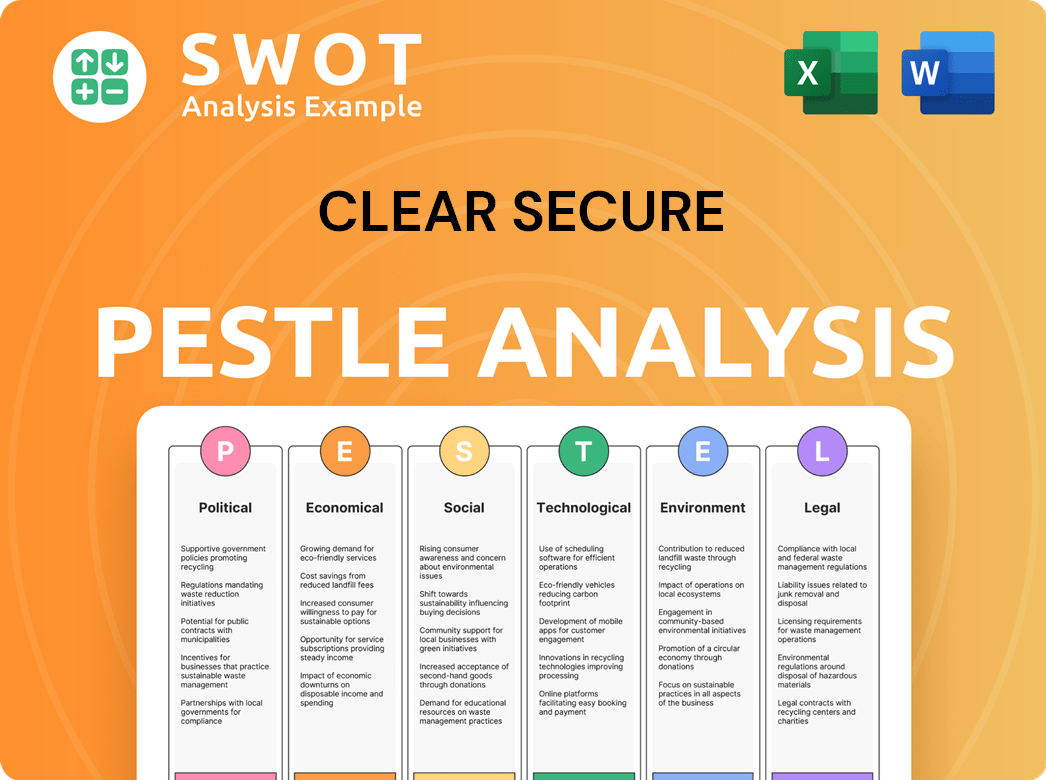

Clear Secure PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Clear Secure’s Growth Forecast?

The financial outlook for Clear Secure reflects a strong growth trajectory, underpinned by increasing membership and strategic venue partnerships. The company's growth strategy focuses on expanding its market presence and enhancing its technological capabilities within the cybersecurity sector.

For the first quarter of 2024, Clear reported total revenue of $157.9 million, a significant 19% increase year-over-year. This growth is a testament to the effectiveness of its business development strategies and the increasing demand for its services. The company’s future prospects are promising, with a clear focus on sustainable financial health and market expansion.

Membership growth is a key driver of revenue. Cumulative enrollments reached 20 million, while cumulative paid enrollments grew by 16% year-over-year to 6.8 million as of March 31, 2024. This expansion in the customer base supports Clear Secure's long-term vision and its ability to capitalize on industry trends.

Clear's Q1 2024 revenue was $157.9 million, marking a 19% increase year-over-year, demonstrating strong financial performance.

Total cumulative enrollments reached 20 million, and cumulative paid enrollments grew by 16% year-over-year to 6.8 million as of March 31, 2024, showing a growing customer base.

The company projects full-year 2024 revenue to be between $620 million and $635 million, indicating an 18% to 20% growth compared to 2023.

Clear reported a net loss of $25.2 million in Q1 2024, mainly due to investments in expansion and technology.

Despite the substantial revenue growth, Clear has been investing heavily in expansion and technology, leading to a net loss of $25.2 million in Q1 2024. These investments are crucial for the company's long-term growth strategy and its ability to maintain a competitive edge. Management anticipates improved profitability in the long term as economies of scale are realized and new initiatives mature. Analyst forecasts generally align with the company's positive revenue trajectory, though profitability remains a key focus for future performance.

Clear is continually investing in its platform and technology to enhance its services and maintain a competitive edge in the cybersecurity market.

The company is actively pursuing market expansion through strategic partnerships and increased venue presence, driving growth.

Strategic acquisitions are part of Clear's growth strategy, aimed at broadening its service offerings and increasing market share.

Clear's financial strategy focuses on achieving sustainable long-term financial health through strategic investments and operational efficiencies.

The company's long-term vision includes continued growth and expansion, supported by strategic investments and a focus on customer satisfaction.

Clear's competitive advantages include its innovative technology, strong partnerships, and a growing customer base in the cybersecurity company sector.

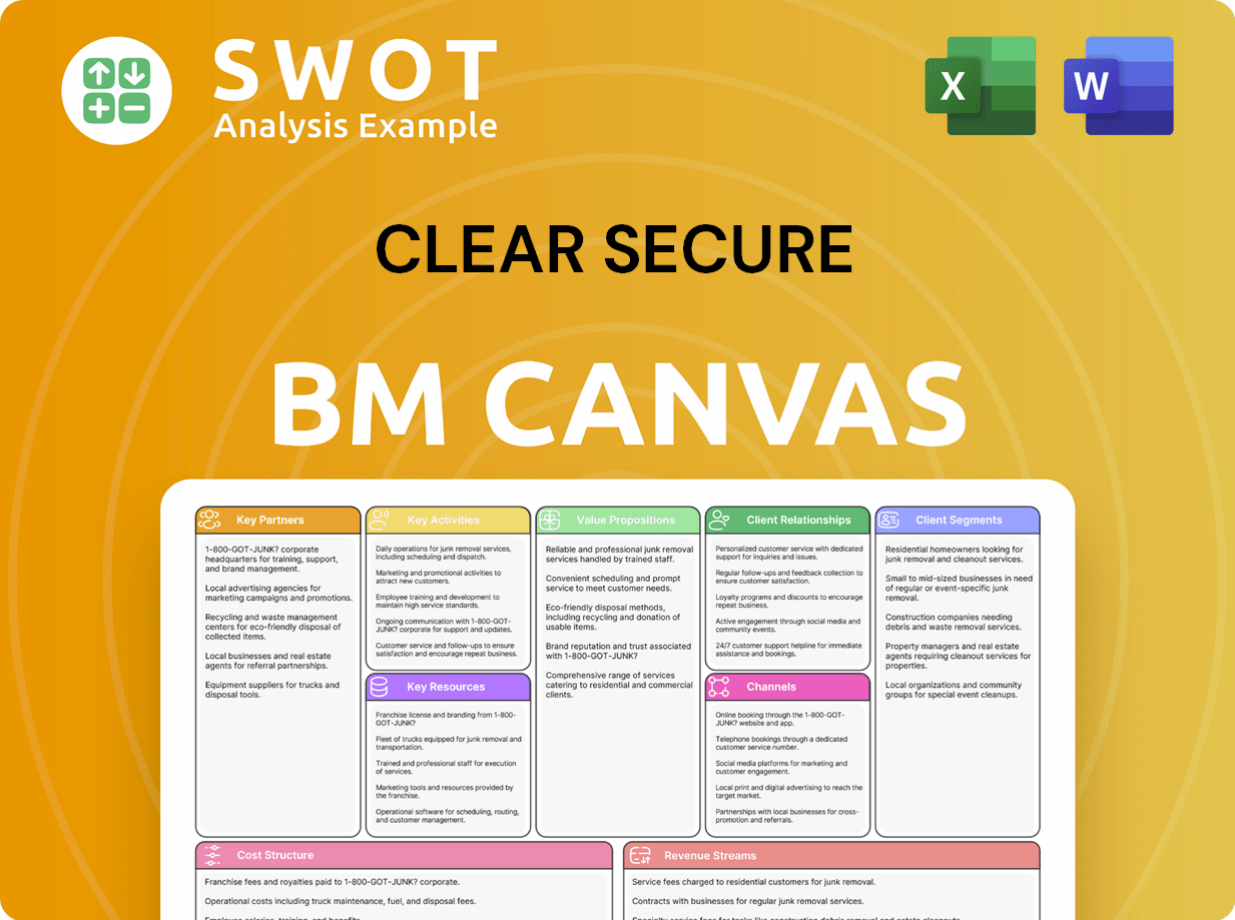

Clear Secure Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Clear Secure’s Growth?

The Growth Strategy and future prospects of Clear Secure are subject to several potential risks and obstacles. The cybersecurity company operates in a competitive market, which means it constantly faces challenges from other companies offering similar identity verification or expedited screening services. Furthermore, the company must navigate the complexities of evolving regulations, particularly concerning data privacy and security.

Technological advancements and disruptions also pose a threat. The emergence of new biometrics or alternative identity verification methods could diminish Clear Secure's competitive edge. Additionally, the company's reliance on partnerships with airports and other venues means changes in these relationships could affect its accessibility and growth. These challenges require proactive strategies to ensure sustained success.

Moreover, the acquisition of Whyline in 2024 reflects Clear Secure's efforts to adapt to evolving customer expectations for seamless digital experiences. However, this also presents integration complexities. Addressing these potential obstacles is crucial for maintaining a strong Growth Strategy and achieving its Future Prospects.

The market for identity verification and expedited screening services is competitive. Several companies offer similar services, which could impact Clear Secure's market share. This requires continuous innovation and differentiation to stay ahead of the competition.

Changes in data privacy and security regulations pose a significant risk. Compliance with evolving regulations may require costly adjustments to operations and technology. Maintaining compliance is essential for avoiding penalties and maintaining customer trust.

Advancements in biometrics or alternative identity verification methods could reduce Clear Secure's competitive advantage. Continuous investment in technology is necessary to stay ahead of the curve. The company must adapt to new technologies to maintain its market position.

Reliance on partnerships with airports and other venues means changes in these relationships could affect Clear Secure's accessibility and growth. Maintaining strong relationships and diversifying partnerships can mitigate this risk. Changes in partner priorities can also impact operations.

The acquisition of Whyline introduces integration complexities. Successfully integrating new technologies and services is crucial for realizing the benefits of the acquisition. Smooth integration is vital for enhanced customer experience and operational efficiency.

While less direct, supply chain vulnerabilities could indirectly impact the availability of necessary hardware for new installations. Diversifying suppliers and having contingency plans can help mitigate these risks. Ensuring a reliable supply chain is essential for growth.

Clear Secure addresses these risks through diversification of its venue partnerships, continuous investment in its technology to stay ahead of the curve, and robust risk management frameworks to ensure compliance with data privacy regulations. The company's ability to adapt to a dynamic regulatory landscape and maintain its technological edge will be crucial in mitigating these potential obstacles and sustaining its Growth Strategy.

These factors can influence Clear Secure's ability to expand. Effective risk management and proactive adaptation are essential for successful Business Development. The company's performance and Market Analysis will also be key to its future success. For more information on Clear Secure's target market, read this article: Target Market of Clear Secure.

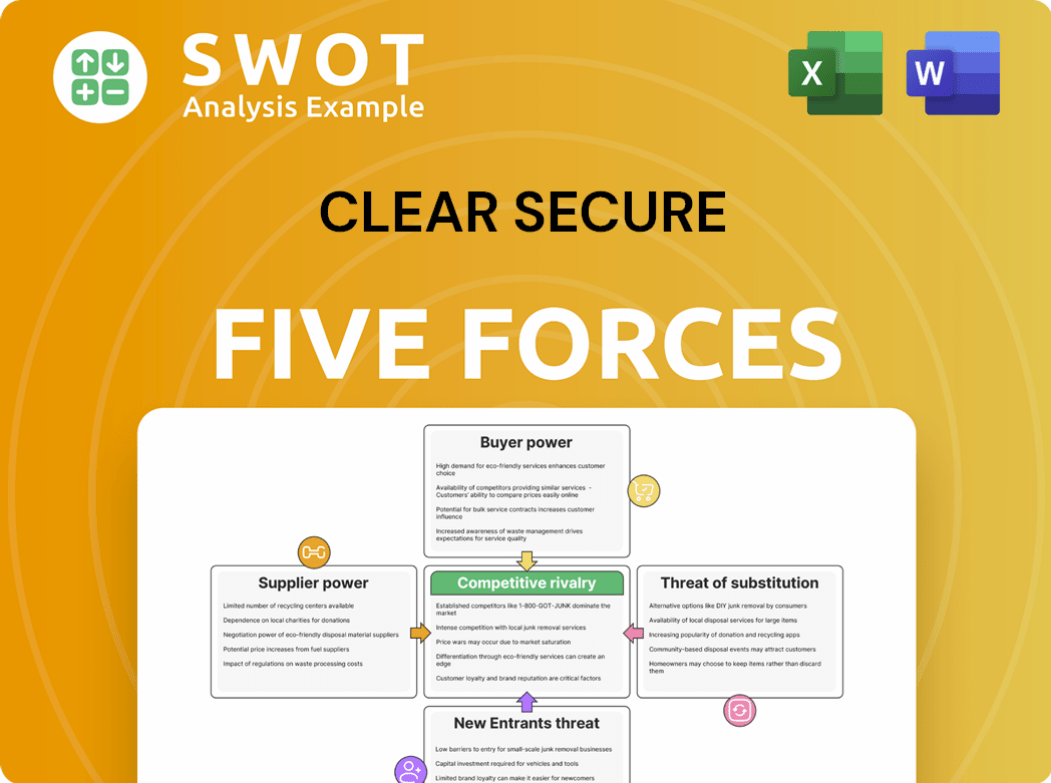

Clear Secure Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Clear Secure Company?

- What is Competitive Landscape of Clear Secure Company?

- How Does Clear Secure Company Work?

- What is Sales and Marketing Strategy of Clear Secure Company?

- What is Brief History of Clear Secure Company?

- Who Owns Clear Secure Company?

- What is Customer Demographics and Target Market of Clear Secure Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.