Convatec Group Bundle

Can Convatec Group Continue Its Growth Trajectory in the Healthcare Market?

Convatec Group PLC, a global leader in medical products and technologies, has strategically positioned itself for sustained growth in the dynamic healthcare industry. From its origins in 1978, the company has evolved, driven by a commitment to innovation and strategic acquisitions. A key example is the Amcare Group acquisition, which enhanced its Convatec Group SWOT Analysis and market presence in ostomy care.

Convatec's success is rooted in its ability to adapt and expand, serving millions across over 100 countries with products in ostomy care, advanced wound care, and continence solutions. The company's future hinges on its ability to leverage new technologies and expand into new markets. This strategic focus on both organic growth and strategic partnerships positions Convatec Group for continued success in the competitive medical devices sector, driving its growth strategy and future outlook.

How Is Convatec Group Expanding Its Reach?

The Convatec Group is actively pursuing several expansion initiatives to fuel its future growth. These initiatives are strategically designed to broaden its market presence and enhance its product offerings within the Medical Devices and Healthcare Market.

A core element of this strategy involves entering new geographical markets, particularly in emerging economies. This approach aims to reach underserved patient populations and diversify revenue streams. The company's focus on strengthening its core franchises, including Wound Care, is a key component of its growth strategy.

The company is aiming for mid-single-digit organic revenue growth. This is driven by strategic initiatives focused on innovation, market expansion, and partnerships.

Convatec Group is expanding into new geographical markets, especially in emerging economies. This includes a strong focus on the Chinese market, which presents significant growth potential due to its aging population and increasing healthcare spending. This expansion is crucial for diversifying revenue streams and reaching underserved patient populations.

The company is committed to strengthening its core franchises: Ostomy Care, Advanced Wound Care, Continence & Critical Care, and Infusion Care. This involves investing in product innovation and expanding the range of solutions offered within these key areas. The goal is to achieve mid-single-digit organic revenue growth by focusing on these core product lines.

New product launches are central to Convatec's expansion strategy. The company consistently invests in its product pipeline, focusing on solutions that improve patient outcomes and ease of use. This includes innovations within existing product lines, such as new ostomy bags or advanced wound dressings. This is a key driver for Convatec Group's future growth.

Strategic partnerships and collaborations are vital for Convatec. These partnerships help co-develop and commercialize new technologies, accelerating market entry for novel solutions. The acquisition of the Amcare Group in China in 2023 is a prime example of targeted mergers and acquisitions to expand its footprint and product offerings. For more information, consider reading about the Competitors Landscape of Convatec Group.

Convatec Group's expansion initiatives are multifaceted, focusing on geographical expansion, product innovation, and strategic partnerships. These initiatives are designed to ensure sustainable growth and enhance its market position.

- Entering new geographical markets, particularly in emerging economies like China.

- Strengthening core franchises through product innovation and expansion.

- Investing in new product launches to improve patient outcomes.

- Leveraging strategic partnerships and acquisitions to accelerate growth.

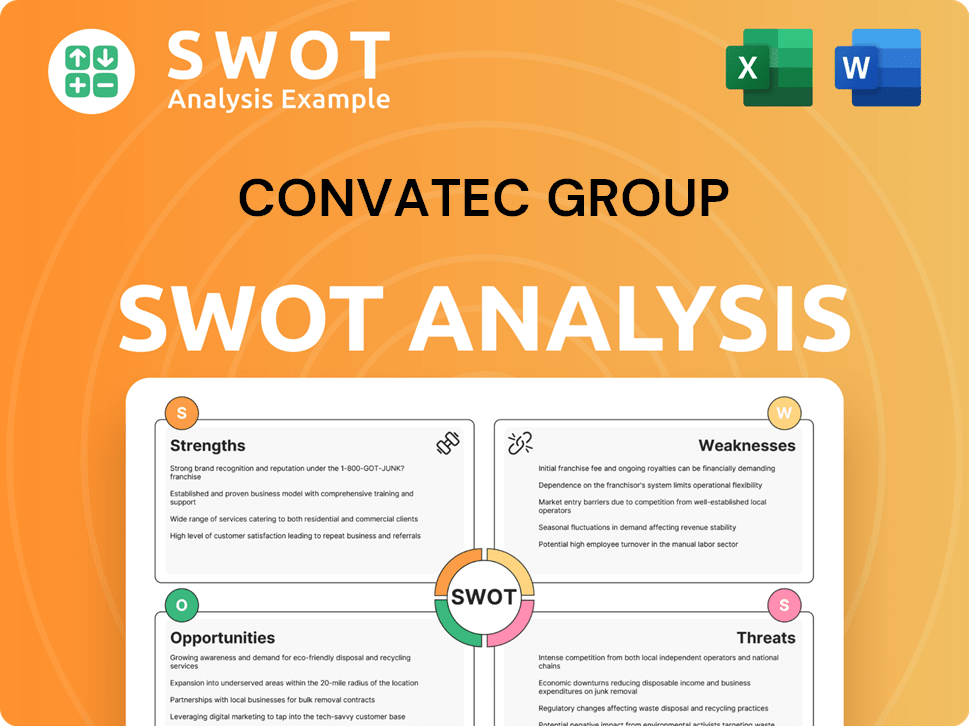

Convatec Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Convatec Group Invest in Innovation?

The Convatec Group's growth strategy is deeply rooted in innovation and technological advancements. The company heavily invests in research and development (R&D) to create new products and enhance existing ones, driving its future prospects in the medical devices and healthcare market.

This commitment to innovation is crucial for Convatec Group to maintain a competitive edge and meet the evolving needs of patients and healthcare providers. By focusing on cutting-edge technologies and patient-centric solutions, Convatec aims to improve patient outcomes and expand its market share.

Convatec Group's focus on innovation is evident in its sustained investment in R&D, which is expected to be in the range of $100 million to $120 million for the full year 2024. This financial commitment fuels the development of new products and enhancements to existing ones, driving the company's growth. This investment is particularly focused on areas like advanced wound care, exploring biomaterials and smart technologies to improve healing times and patient comfort.

Convatec Group allocates significant resources to research and development. This investment is a key driver for new product launches and enhancements.

The company is embracing digital technologies to improve operational efficiency and patient care. This includes digital platforms for patient support and data analytics for product development.

Key areas of innovation include advanced wound care and ostomy care. These innovations directly address unmet patient needs.

Convatec Group prioritizes patient outcomes through technological advancements. This approach strengthens its market position and reputation.

Innovations differentiate Convatec Group's products in competitive markets. New adhesive technologies and discreet designs in ostomy care are examples of this.

Innovations directly contribute to Convatec Group's growth objectives. They address unmet patient needs and increase market share.

Convatec Group is also undergoing a digital transformation to enhance operational efficiency and improve patient solutions. This includes the development of digital platforms for patient education and support, as well as the use of data analytics to inform product development and market strategies. The continence care business, for example, leverages digital tools to provide enhanced support and education to patients. These digital initiatives are crucial for supporting the company's long-term growth and competitiveness. To learn more about the ownership structure and strategic direction, explore Owners & Shareholders of Convatec Group.

Innovations are central to Convatec Group's growth strategy, differentiating its products and addressing patient needs. Advancements in ostomy care, such as new adhesive technologies and discreet designs, directly lead to increased market share.

- Advanced Wound Care: Exploring biomaterials and smart technologies to improve healing times and patient comfort.

- Ostomy Care: New adhesive technologies and discreet designs to enhance patient experience and market share.

- Digital Platforms: Development of digital tools for patient education and support, improving patient outcomes.

- Data Analytics: Using data to inform product development and market strategies, improving efficiency.

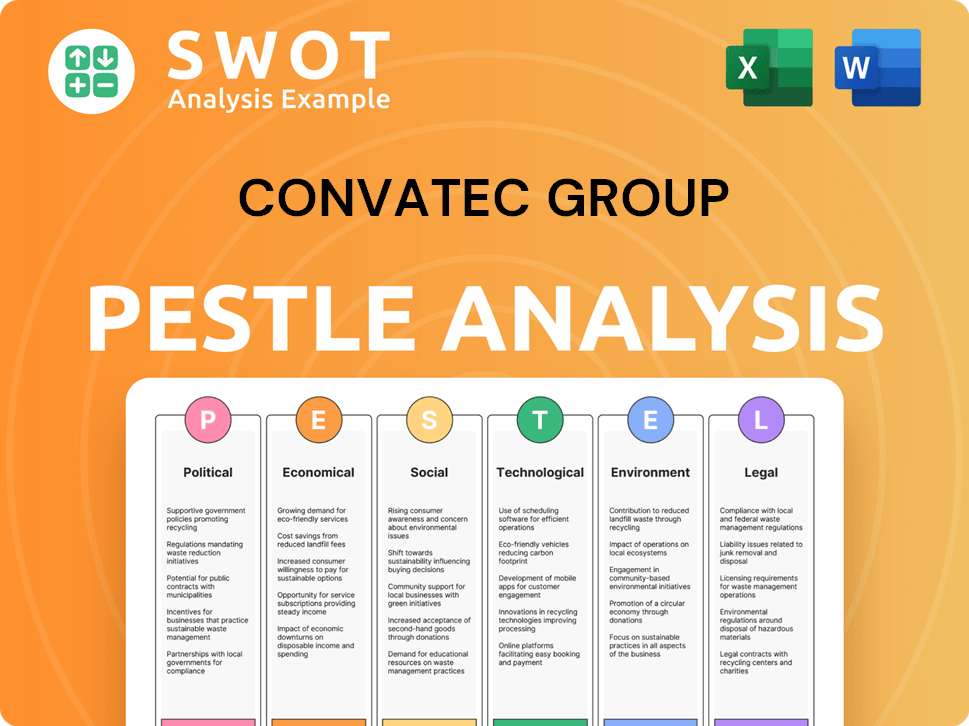

Convatec Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Convatec Group’s Growth Forecast?

The financial outlook for the Convatec Group is positive, reflecting its strategic growth initiatives within the medical devices sector. For 2024, the company anticipates solid organic revenue growth, projecting an increase between 5% and 6.5%. This positive trajectory is supported by strong performance in key areas like Ostomy Care and Advanced Wound Care, indicating a robust position within the healthcare market.

Convatec's financial strategy emphasizes efficient capital allocation and a strong balance sheet to support its expansion plans. The company's commitment to innovation and market diversification is expected to drive sustained financial performance. The company's management has expressed confidence in achieving its mid-term targets, focusing on mid-single-digit organic revenue growth and expanding adjusted operating profit margins.

The company’s financial performance is driven by its diversified product portfolio and strong market position. Convatec's focus on innovation and strategic acquisitions is essential for its future growth. To understand more about their business model, you can explore Revenue Streams & Business Model of Convatec Group.

Convatec is projecting reported revenue between $2.380 billion and $2.435 billion for 2024. This forecast highlights the company's expectation of sustained growth in the healthcare market. These figures demonstrate Convatec's ability to navigate the competitive landscape and capitalize on opportunities within the medical devices industry.

The adjusted operating profit margin is anticipated to be in the range of 20.3% to 20.8% in 2024. This indicates a healthy profitability trend, reflecting efficient operations and effective cost management. This profitability outlook is a key indicator of Convatec's financial health and its ability to generate value for shareholders.

Convatec's investment levels are aligned with its growth ambitions, with significant capital allocated to R&D and strategic acquisitions. These investments are critical for driving innovation and expanding the company's product portfolio, ensuring its competitiveness in the healthcare market. These strategic investments are crucial for long-term growth.

The company aims to deliver mid-single-digit organic revenue growth and expand adjusted operating profit margins. These targets demonstrate the company's commitment to sustained financial performance and value creation. These goals are a testament to Convatec's dedication to achieving its long-term strategic objectives.

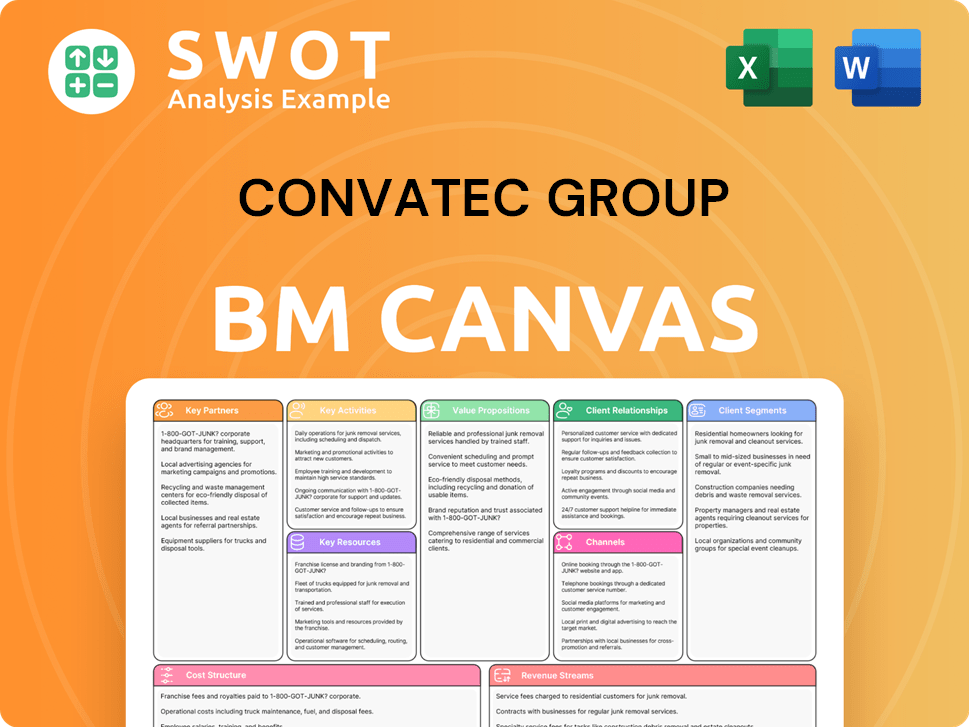

Convatec Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Convatec Group’s Growth?

The Convatec Group faces several risks and obstacles in its growth strategy, inherent in the medical technology industry. Competition, regulatory changes, supply chain issues, and technological disruptions could impact its financial performance and market position. Understanding these challenges is crucial for evaluating the Convatec Future and its ability to achieve sustained growth within the Healthcare Market.

Market competition in areas like Wound Care and ostomy care remains intense, with both established companies and new entrants vying for market share. Changes in healthcare regulations and reimbursement policies across different geographies can increase operational costs and limit market access. Supply chain vulnerabilities, especially in the current global economic climate, can also cause problems.

Convatec Group addresses these risks through a diversified approach. The company focuses on diversification across its product portfolio and geographical markets. Robust risk management frameworks are in place to identify and monitor potential threats. For example, in response to supply chain pressures, Convatec Group has strengthened supplier relationships. The company's consistent financial performance in a dynamic environment suggests effective risk mitigation strategies are in place. Further insights into the company's strategies can be found in an analysis of the Target Market of Convatec Group.

The Convatec Group faces competition from numerous players in the Medical Devices sector. Aggressive pricing strategies and innovative products from competitors can affect Convatec Group's revenue. Maintaining a competitive edge requires continuous innovation and effective market strategies.

Evolving healthcare regulations and stricter product approval processes pose a significant risk. Changes in reimbursement policies across different regions can increase operational costs. Navigating these regulatory landscapes is crucial for Convatec's market access and product launches.

Disruptions in the supply of raw materials and manufacturing delays can impact product availability. Logistical challenges can lead to lost sales. Strengthening supplier relationships and exploring alternative sourcing strategies are essential for mitigating these risks.

Rapid advancements in medical technology can render existing products less competitive. Convatec Group must continuously innovate to stay ahead of the curve. Investing in R&D and embracing new technologies is vital for long-term success.

Attracting and retaining top talent in R&D and sales is crucial for growth. Resource constraints can hinder Convatec's ability to innovate and expand its market presence. Effective talent management is a key strategic priority.

Increasing cybersecurity threats to healthcare data pose a growing concern. The demand for sustainable and environmentally friendly medical products requires adaptation and investment. Convatec Group must address these evolving challenges.

Convatec Group employs diversification across its product portfolio and geographical markets. Robust risk management frameworks are in place to identify and monitor potential threats. Scenario planning helps prepare for various market and regulatory eventualities, ensuring the company is well-prepared for different challenges.

Convatec Group has focused on strengthening its supplier relationships and exploring alternative sourcing strategies. This proactive approach helps mitigate supply chain disruptions and ensures product availability. These strategies are crucial for maintaining operational efficiency.

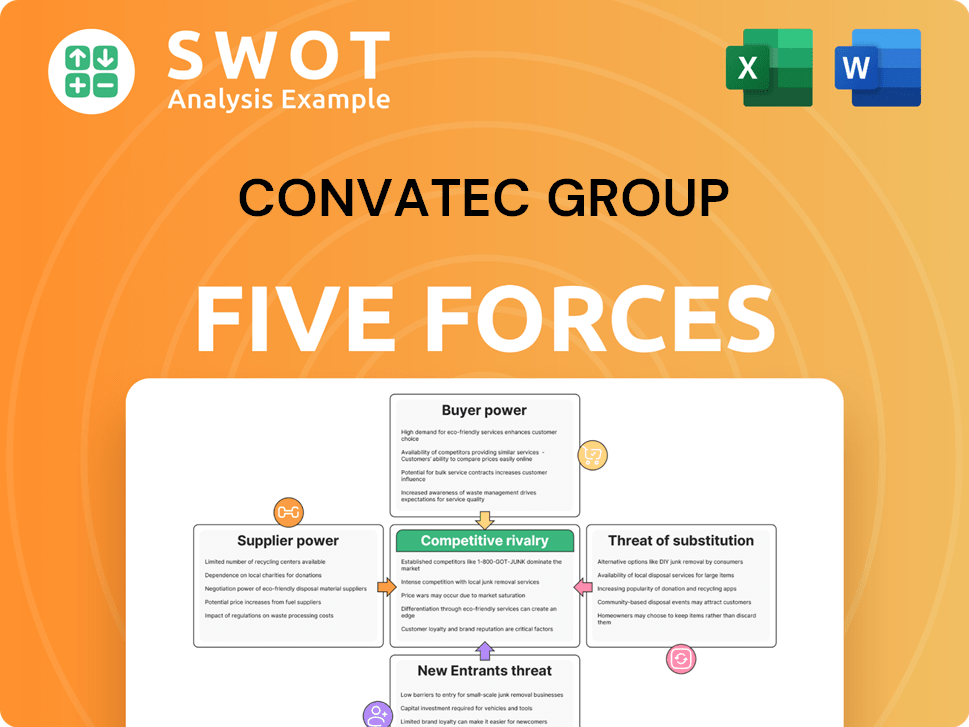

Convatec Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Convatec Group Company?

- What is Competitive Landscape of Convatec Group Company?

- How Does Convatec Group Company Work?

- What is Sales and Marketing Strategy of Convatec Group Company?

- What is Brief History of Convatec Group Company?

- Who Owns Convatec Group Company?

- What is Customer Demographics and Target Market of Convatec Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.