Corsair Bundle

Can Corsair Maintain Its Competitive Edge in the Gaming World?

Corsair Gaming, a titan in the gaming hardware market, has consistently captivated gamers and tech enthusiasts alike. Founded in 1994, the company's journey from memory modules to a comprehensive suite of gaming peripherals and components showcases a remarkable ability to adapt. But, what does the Corsair SWOT Analysis reveal about its future prospects?

This analysis of Corsair's growth strategy will explore its expansion plans, innovation in the PC components industry, and strategic initiatives. Understanding Corsair's financial performance and its ability to navigate the competitive gaming hardware market is crucial. We'll examine the company's revenue growth drivers, market share, and how it plans to stay ahead in the dynamic landscape.

How Is Corsair Expanding Its Reach?

The Corsair growth strategy is significantly driven by strategic expansion initiatives, focusing on both new geographical markets and product categories. The company consistently aims to diversify its revenue streams and reach new customer segments. A key element of this expansion involves the continuous launch of new products and services, as evidenced by its robust product pipeline. This diversification is designed to capture a larger share of the evolving gaming and content creation ecosystems. Analyzing the Corsair company analysis reveals a proactive approach to market dynamics.

Corsair's future prospects are closely tied to its ability to execute these expansion plans effectively. The company actively explores merger and acquisition opportunities to accelerate market entry into new segments or to acquire complementary technologies. International expansion remains a core focus, with the company continually seeking to strengthen its distribution networks and brand presence in emerging markets. These initiatives are designed not only to boost sales but also to enhance the brand ecosystem, providing comprehensive solutions for its target audience and staying ahead of industry trends. The company's approach to the PC components industry is dynamic.

The company's strategic moves are crucial in the highly competitive gaming hardware market. The company's expansion strategy is a key factor in its long-term success. The company's approach to the market is a key factor in its long-term success. For more insight into the competitive landscape, consider reading about the Competitors Landscape of Corsair.

The company regularly introduces new products to stay competitive. This includes new PC components, peripherals, and streaming equipment. These launches help Corsair maintain its market position and attract new customers. The company's product roadmap for next year is a key indicator of its growth strategy.

Corsair focuses on expanding its presence in emerging markets. This involves strengthening distribution networks and brand presence in regions with high growth potential. International expansion is a key strategy for accessing new customer bases and increasing revenue.

The company actively explores M&A opportunities to accelerate market entry. This can involve acquiring companies with complementary technologies or entering new market segments. M&A activity is a strategic tool for rapid growth and diversification.

Corsair diversifies its product offerings beyond traditional PC components. This includes expanding into areas like streaming equipment and content creation tools. This diversification aims to capture a larger share of the evolving gaming and content creation ecosystems.

Corsair's expansion strategies include product diversification, geographical expansion, and strategic acquisitions. These strategies are designed to drive revenue growth and increase market share. The company's focus on innovation in areas like liquid cooling and RGB lighting technology is also a key differentiator.

- Product Diversification: Expanding beyond core PC components into areas like streaming and content creation.

- Geographical Expansion: Targeting emerging markets to access new customer bases.

- Strategic Acquisitions: Utilizing M&A to enter new segments and acquire complementary technologies.

- Innovation: Focusing on innovation in areas like liquid cooling and RGB lighting.

Corsair SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Corsair Invest in Innovation?

The sustained growth of the company is deeply connected to its strong focus on innovation and technology. This approach prioritizes research and development (R&D) and the integration of cutting-edge technologies. The company consistently invests in R&D to develop proprietary technologies and improve its product offerings, ensuring it remains at the forefront of the gaming and PC enthusiast markets, which is a key element of its Corsair growth strategy.

Their commitment is apparent in their in-house development capabilities and strategic collaborations with external innovators. These partnerships help bring novel solutions to the market, which is crucial in the competitive PC components industry. This strategy is important for understanding the Corsair company analysis and its Corsair future prospects.

The company's dedication to digital transformation is clear in its software platforms, such as iCUE. This platform integrates control over various products, offering users a seamless and customizable experience. The company also explores applying advanced technologies like AI and IoT in its products to improve performance, user experience, and personalization.

The company consistently invests in research and development to create proprietary technologies and enhance its product offerings. This investment is crucial for maintaining a competitive edge in the gaming hardware market.

Software platforms like iCUE integrate control over various products, providing users with a seamless and customizable experience. This integration enhances user experience and brand loyalty.

The company explores the application of advanced technologies such as AI and IoT to improve product performance, user experience, and personalization. This forward-thinking approach is key for future growth.

The company's history of product innovation, including advancements in memory technology, cooling solutions, and mechanical keyboards, demonstrates its leadership in the field. These innovations are essential for attracting and retaining customers.

Strategic collaborations with external innovators help bring novel solutions to market. These partnerships are crucial for staying ahead of the competition and driving innovation.

Technological advancements contribute directly to growth objectives by creating differentiated products that attract and retain customers, fostering brand loyalty and driving sales. This customer-centric approach is vital for long-term success.

The company's technological advancements directly support its growth objectives. These innovations create differentiated products that attract and retain customers, fostering brand loyalty and boosting sales. For a deeper dive into the company's financial strategies, you can explore the Revenue Streams & Business Model of Corsair.

- Memory Technology: Continuous improvements in memory modules enhance system performance, crucial for gaming and professional applications.

- Cooling Solutions: Innovations in liquid and air cooling systems ensure optimal thermal management, which is essential for high-performance components.

- Mechanical Keyboards: Advancements in switch technology, customization options, and RGB lighting enhance the user experience and appeal to gamers.

- Software Ecosystem: Platforms like iCUE provide integrated control, enhancing user experience and product differentiation.

- Future Technologies: Exploration of AI and IoT applications to improve product functionality and user interaction.

Corsair PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Corsair’s Growth Forecast?

The financial outlook for Corsair reflects its strategic growth initiatives, with a focus on sustained revenue growth and healthy profit margins. The company's performance in the gaming hardware market and PC components industry is closely watched by investors and analysts. A detailed Corsair company analysis reveals the company's strategies for navigating market dynamics and capitalizing on emerging opportunities.

In Q1 2024, Corsair reported net revenue of $263.3 million. While this reflects a decrease compared to the previous year, primarily due to lower sales in the gamer and creator peripherals segment, the company is actively working to improve profitability. The company's ability to adapt to market fluctuations is a key factor in its long-term success. Owners & Shareholders of Corsair are interested in understanding the company's financial health and future prospects.

Corsair's strategic focus includes expanding into new product categories and geographical markets, alongside continued investment in research and development. The company aims to leverage its strong brand recognition and diversified product portfolio to drive future growth. Corsair's financial performance is a key indicator of its ability to execute these plans and achieve its long-term goals.

Corsair's Q1 2024 net revenue was $263.3 million. Despite the decrease compared to the previous year, the company reported a net income of $0.1 million, a significant improvement from a net loss in the same period last year. This demonstrates the company's focus on operational efficiency and cost management.

Corsair anticipates full-year 2024 revenue to be in the range of $1.35 billion to $1.45 billion. This guidance suggests a projected stabilization and potential rebound in the latter half of the year. This outlook reflects the company's confidence in its growth strategy.

Corsair's long-term financial goals are supported by its expansion into new product categories and geographical markets, as well as continued investment in R&D. The company aims to leverage its strong brand recognition and diversified product portfolio to drive future growth. These strategies are designed to enhance Corsair's market position.

Corsair consistently emphasizes operational efficiency and cost management to improve profitability. While specific profit margin targets are not always publicly detailed, the company's focus on these areas is crucial for sustainable growth. This approach is vital for maximizing shareholder value.

Corsair's revenue growth drivers include product innovation, market expansion, and strategic partnerships. The company's ability to adapt to the changing demands of the gaming hardware market and PC components industry is critical. The future of Corsair's gaming peripherals is closely tied to these factors.

- Product Innovation: Continuous development of new and improved products.

- Market Expansion: Entering new geographical markets and expanding product offerings.

- Strategic Partnerships: Collaborations with esports teams and other industry players.

- Operational Efficiency: Focusing on cost management and improving profitability.

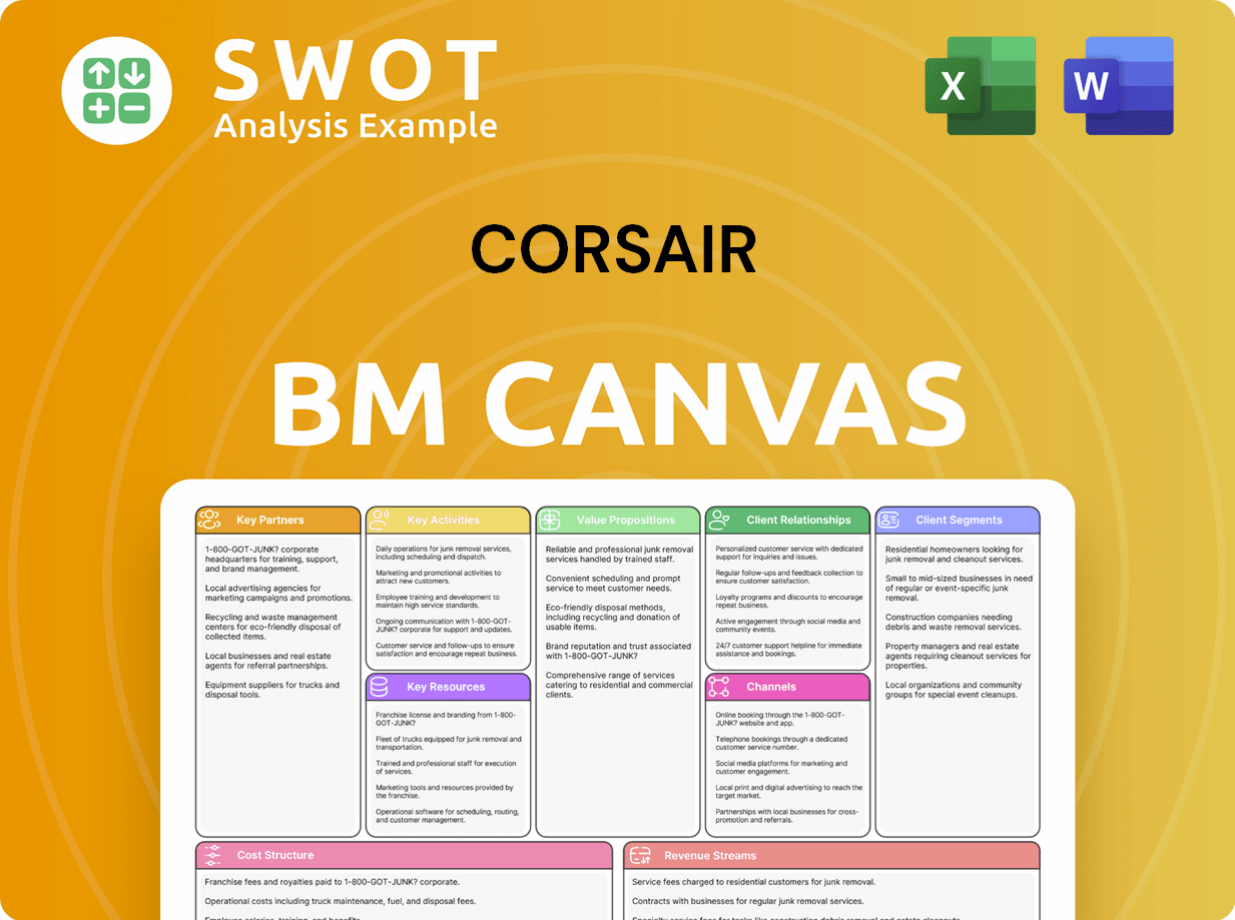

Corsair Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Corsair’s Growth?

The path to growth for the company is paved with potential risks and obstacles that could influence its trajectory in the competitive tech and gaming sectors. The company's ability to navigate these challenges will be critical to realizing its ambitious expansion plans and maintaining a strong position in the market. Understanding these potential pitfalls is essential for investors, stakeholders, and anyone interested in the company's future.

Market competition, regulatory changes, supply chain vulnerabilities, and the rapid pace of technological innovation all pose significant challenges. Effective risk management and strategic foresight are essential for the company to mitigate these impacts and capitalize on growth opportunities. Maintaining a competitive edge requires continuous adaptation and a proactive approach to emerging threats.

The company's Corsair growth strategy faces several hurdles. The gaming hardware market is fiercely competitive, with established brands and new entrants constantly vying for market share. This intense competition can lead to pricing pressures, impacting profitability. The company must continually innovate to stay ahead, especially in areas like PC components industry and gaming peripherals. For a deeper look into the company's origins, consider reading the Brief History of Corsair.

The company faces intense competition from established players and new entrants. This can squeeze profit margins and requires continuous innovation. Maintaining a competitive edge necessitates ongoing investment in product development and marketing.

Global events, geopolitical tensions, or natural disasters can disrupt manufacturing and logistics. These disruptions can lead to production delays and increased costs. Diversifying suppliers and robust risk management are critical to mitigate these risks.

Rapid advancements in gaming hardware and software require continuous adaptation. Failure to keep pace with technological changes could diminish market relevance. Investing in research and development is essential to stay ahead.

Changes in international trade, data privacy, and product safety regulations can impact operations. Compliance with evolving regulations can increase costs and complexity. Monitoring and adapting to regulatory changes are crucial.

Attracting and retaining top talent in specialized fields can be challenging. Competition for skilled labor may hinder growth initiatives. Investing in employee development and creating a positive work environment are vital.

Economic downturns can reduce consumer spending on discretionary items. Economic slowdowns may negatively affect sales of gaming hardware. Diversifying the product portfolio and focusing on value-driven offerings can help.

The company mitigates risks through product diversification, robust risk management frameworks, and scenario planning. Diversifying the product portfolio helps spread risk across different market segments. Strong risk management includes identifying and addressing potential threats to ensure business continuity. Scenario planning allows for anticipating and responding to potential disruptions effectively.

The Corsair financial performance is closely tied to its ability to manage these risks. Revenue growth drivers include new product launches and market expansion. The company's ability to maintain profitability in a competitive market is crucial. Analyzing recent financial reports provides insights into the company's resilience and adaptability.

Corsair Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Corsair Company?

- What is Competitive Landscape of Corsair Company?

- How Does Corsair Company Work?

- What is Sales and Marketing Strategy of Corsair Company?

- What is Brief History of Corsair Company?

- Who Owns Corsair Company?

- What is Customer Demographics and Target Market of Corsair Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.