Cryoport Bundle

Can Cryoport Revolutionize Biopharma Logistics and Deliver Exceptional Returns?

Cryoport (NASDAQ: CYRX) stands at the forefront of the biopharma logistics revolution, offering critical cold chain solutions for the life sciences industry. Established in 1999, the company has become a global leader in temperature-controlled supply chain solutions, with a strong focus on the burgeoning cell and gene therapy (CGT) market. With a record number of clinical trials supported and impressive revenue growth, Cryoport is poised for significant expansion.

This in-depth analysis explores Cryoport's Cryoport SWOT Analysis, detailing its strategic roadmap for future growth and providing insights into its financial performance. We will delve into the company's market share analysis, recent developments, and key partnerships, all while examining the exciting investment opportunities within the temperature-controlled storage sector. Understanding Cryoport's competitive landscape and acquisition strategy is crucial for investors seeking to capitalize on the expanding cell and gene therapy logistics market.

How Is Cryoport Expanding Its Reach?

Cryoport is actively pursuing multiple expansion initiatives, focusing on the burgeoning life sciences sector, particularly cell and gene therapies. Their strategy includes geographical expansion and the establishment of new supply chain centers to meet the increasing demand for biopharma logistics and cold chain solutions. This approach is crucial for the company's growth and future prospects, as it positions them to capitalize on the rapid expansion of the cell and gene therapy market.

A key element of Cryoport's strategy involves strategic partnerships and collaborations. By forming alliances with key players in the industry, Cryoport aims to strengthen its market position and broaden its reach. These collaborations are designed to enhance the company's capabilities in temperature-controlled storage and clinical trial support, driving revenue growth and solidifying its leadership in the field. This strategic approach is essential for navigating the competitive landscape and capitalizing on investment opportunities.

Product and service diversification is another critical component of Cryoport's expansion strategy. By launching new services and products, the company aims to enhance existing revenue streams and create new ones. This diversification is designed to meet the evolving needs of its customers and to expand its market share. These initiatives are crucial for sustaining long-term growth and addressing the challenges and opportunities within the cell and gene therapy logistics sector.

Cryoport has expanded its global footprint with new Global Supply Chain Centers in Paris, France, and Santa Ana, CA. They've also launched IntegriCell™ Cryopreservation Solution plants in Houston, TX, and Liège, Belgium. These facilities are designed to standardize cryopreservation processes, supporting cell-based therapies. This expansion is a key part of their Cryoport growth strategy.

The company continues to innovate with new offerings. The IntegriCell™ Cryopreservation Solution was introduced in Q4 2024. In Q1 2025, Cryoport launched the Cryoport Express® Cryogenic HV3 Shipping System and the MVE High Efficiency 800C cryogenic storage system. These new products enhance their cold chain solutions.

Cryoport announced a strategic partnership with the DHL Group in Q1 2025. This includes DHL's anticipated acquisition of Cryoport's CRYOPDP business, expected to close in Q2 or Q3 2025. This deal is designed to expand Cryoport's reach, especially in the Asia Pacific and EMEA regions. This is a key part of their acquisition strategy.

Cryoport's role in the CGT industry has grown significantly. They supported approximately 70% of the industry's clinical trials by Q4 2024, up from approximately 43% in 2020. As of December 31, 2024, they supported 701 global clinical trials, with 81 in Phase 3. This highlights their strong position in cell and gene therapy logistics.

For 2025, Cryoport anticipates up to 23 additional application filings for therapies, five new therapy approvals, and five approvals for label/geographic expansions or moves to earlier lines of treatment. These projections indicate continued growth and investment opportunities. This is a key factor in understanding Cryoport's future prospects.

- Strategic partnerships with companies like DHL are crucial for expansion.

- New product launches, such as the Cryoport Express® Cryogenic HV3 Shipping System, will drive revenue.

- Continued support for clinical trials and growth in the cell and gene therapy sector will be key.

- Geographical expansion, including new facilities in Europe and the US, will increase their market share.

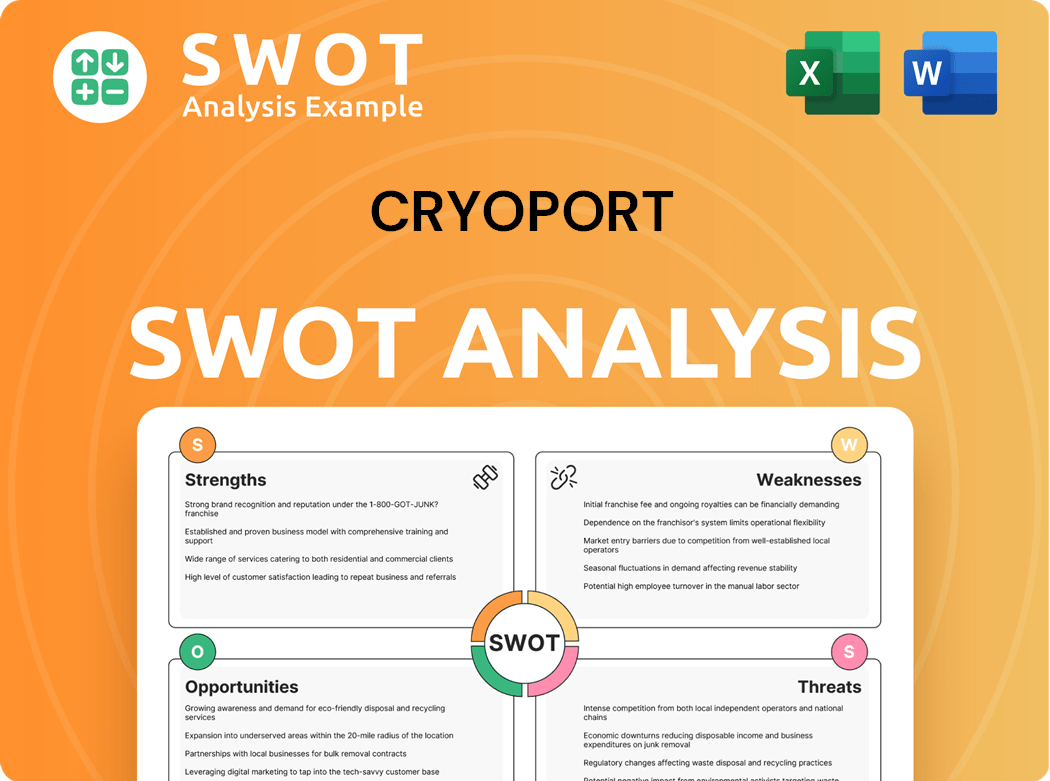

Cryoport SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cryoport Invest in Innovation?

The core of the company's strategy centers on continuous innovation and technological advancement, particularly in temperature-controlled logistics for life sciences. This approach is vital for meeting the evolving needs of the biopharma industry. The company focuses on expanding and enhancing its services through technology-driven solutions, ensuring reliability and cost-effectiveness.

The company's commitment to innovation is evident in its product development and strategic initiatives. They are constantly working to improve their offerings and adapt to the changing demands of the market. This includes leveraging cutting-edge technologies to optimize operations and build a more resilient business.

The company's growth strategy is deeply intertwined with its continuous investment in innovation and technology, particularly in the highly specialized field of temperature-controlled logistics for life sciences. The company consistently works to expand and improve its products and services with innovative, technology-centric solutions.

The company offers Cryoport Express® Shippers, which are engineered for reliability and cost-effectiveness. These shippers range from liquid nitrogen dry vapor shippers (-150℃) to C3™ Shippers (2-8℃) powered by phase-change materials. They are also designed for reusability or recyclability.

The company leverages cutting-edge technologies, including new gene-editing technologies, automation, and AI. These technologies are reshaping the possibilities within the Cell and Gene Therapy (CGT) industry. The company plans to integrate Tec4Med technology across many of its products and services to optimize operations.

In the first quarter of 2025, the company introduced the Cryoport Express® Cryogenic HV3 Shipping System. The MVE High Efficiency 800C cryogenic storage system was also released in Q1 2025. These launches demonstrate the company's commitment to providing high-quality solutions.

A new state-of-the-art IntegriCell™ facility in Houston was launched in October 2024. This facility addresses critical aspects of the supply chain for cell-based therapies. The company also expanded its IntegriCell™ Cryopreservation Services with a European Center of Excellence in Belgium.

Strategic initiatives include investments in new supply chain solutions and technology. These investments are crucial for supporting the growth of the cell and gene therapy market. The company is focused on providing high-quality, standardized, cryopreserved starting material.

The company is a leader in providing high-quality, standardized, cryopreserved starting material. They are optimizing the supply chain for cell-based therapies. This focus is essential for supporting the rapidly expanding cell and gene therapy market.

The company's technology strategy includes the integration of advanced technologies to improve efficiency and resilience. They are expanding their capabilities to meet the growing demand for biopharma logistics. The company's focus on innovation is a key driver for future growth.

- Continuous investment in R&D for new shipping solutions.

- Integration of AI and automation to streamline processes.

- Expansion of IntegriCell™ facilities to support cell and gene therapy.

- Strategic partnerships to enhance supply chain capabilities.

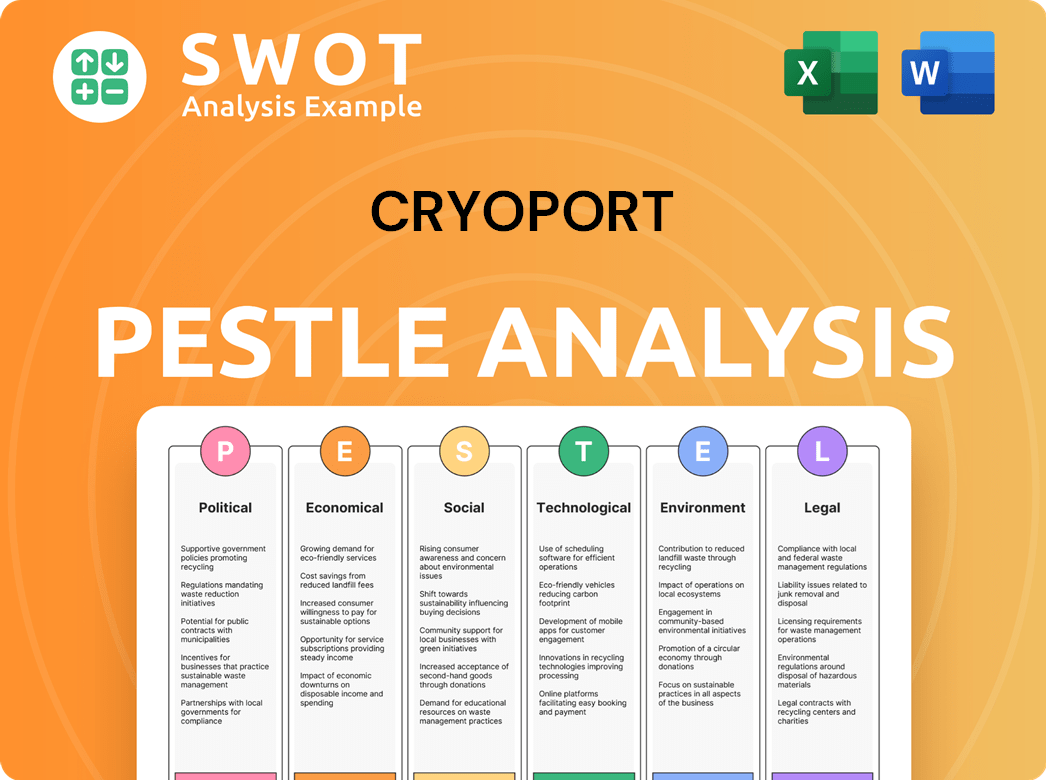

Cryoport PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Cryoport’s Growth Forecast?

The financial outlook for Cryoport in 2025 is centered on sustained profitable growth and improved operational efficiency. The company's performance in 2024 and early 2025 sets a positive tone for the future, particularly within the expanding Cell & Gene Therapy market. This strategic focus is supported by a strong financial position, with significant cash reserves and a commitment to achieving positive adjusted EBITDA.

Cryoport's 2024 financial results showed resilience. Total revenue for the year was $228.4 million, a slight decrease of 2.1% compared to 2023. However, the company demonstrated significant growth in key areas, particularly in commercial Cell & Gene therapies. This growth, coupled with improvements in gross margin, indicates a strategic shift towards higher-margin services and products.

Looking ahead, Cryoport projects revenue in the range of $240 million to $250 million for 2025. This forecast reflects the company's confidence in its ability to capitalize on the growth opportunities within the biopharma logistics sector. The company's ability to manage its finances effectively, as shown by its cash position, is crucial for its continued expansion and investment in future growth initiatives.

Total revenue for 2024 was $228.4 million. Commercial Cell & Gene therapy revenue increased significantly. Life Sciences Services revenue also saw a year-over-year increase.

Total revenue from continuing operations in Q1 2025 was $41.0 million, a 10.1% increase year-over-year. Life Sciences Services revenue grew by 17.3%. Commercial Cell & Gene therapy revenue increased by 33% year-over-year.

Gross margin improved to 45.8% in Q4 2024 from 40.6% in Q4 2023. The total gross margin for FY 2024 was 43.6%, up from 42.6% in FY 2023.

Cryoport ended Q1 2025 with a strong cash, cash equivalents, and short-term investments position of $244.0 million. The company expects to finance its operations through sales of equity securities and debt instruments.

The company's focus on the Cell & Gene Therapy market is a key driver for its Cryoport growth strategy. The increasing demand for cold chain solutions supports Cryoport's expansion plans. The company's ability to navigate the Cryoport competitive landscape is crucial for maintaining and growing its market share.

Cryoport's Cryoport financial performance in 2024 and Q1 2025 demonstrates its ability to improve profitability. The company's focus on achieving positive adjusted EBITDA in 2025 is a key indicator of its financial health. Investors should consider the company's Cryoport stock forecast 2024 in light of its financial results.

Cryoport's acquisition strategy and Cryoport expansion plans are vital for its long-term success. The company's involvement in Cryoport cell and gene therapy logistics and Cryoport clinical trial support are key differentiators. Understanding the Cryoport revenue growth drivers is essential for evaluating the company's potential.

The company's supply chain management plays a critical role in its operations. Cryoport's focus on temperature-controlled storage is a key aspect of its services. The company's investment opportunities are worth exploring given its growth potential.

Stay informed about Cryoport recent developments to understand the company's progress. Cryoport key partnerships can provide insights into its strategic alliances. The company must address Cryoport challenges and opportunities to maintain its growth trajectory.

Cryoport sustainability initiatives may influence its long-term value. For a deeper understanding of the competitive environment, refer to the Competitors Landscape of Cryoport. The company's focus on profitable growth suggests a positive outlook for Cryoport future prospects.

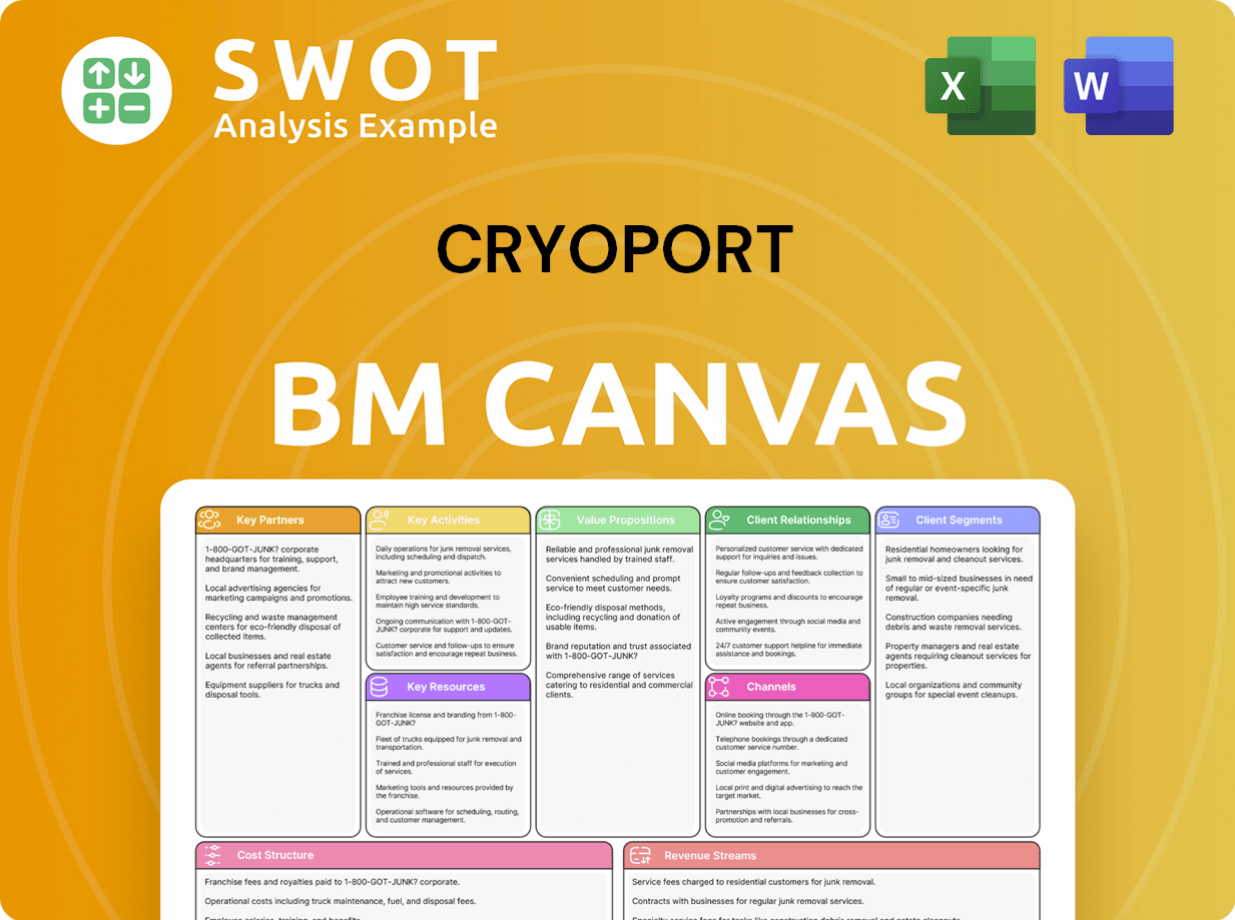

Cryoport Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Cryoport’s Growth?

The path of the [Company Name] toward expansion is fraught with potential risks and obstacles. The company navigates a competitive landscape, regulatory shifts, and supply chain vulnerabilities. These factors, along with technological disruptions and internal resource constraints, could impact its financial performance and strategic goals.

Understanding these challenges is critical for assessing the [Company Name]'s Revenue Streams & Business Model of Cryoport and future growth trajectory. Investors and stakeholders must consider these factors when evaluating the company's potential. The company's ability to mitigate these risks will significantly influence its long-term success.

Competition within the biopharma logistics sector is intense. The [Company Name] faces competition from approximately 218 active competitors, including major players. Maintaining a competitive edge requires continuous innovation and differentiation in its cold chain solutions.

The life sciences industry is heavily regulated, and changes in government regulations can affect operations and compliance costs. Ongoing changes in regulatory landscapes, especially internationally, require constant monitoring. The company anticipates minimal impact from proposed NIH spending reductions on Cell & Gene therapy clinical trials.

Supply chain vulnerabilities, including inflationary pressures and potential tariffs, pose a risk. Diversifying the supply chain is a key strategy to counter tariff impacts. The COVID-19 pandemic highlighted vulnerabilities in global supply chains, which could continue to affect operations.

Technological disruption is an ongoing threat. Reliance on the Cryoportal® software platform for operations means any failure in critical information systems could harm the company. Cybersecurity risks are increasing, and breaches could have significant financial and reputational impacts.

Internal resource constraints and the need for enhanced sales, marketing, and distribution capabilities are areas for improvement. Cost reduction and capital realignment strategies, including headcount reductions, are being implemented to improve the cost structure. The company's net loss increased in FY 2024 to $114.8 million.

The economic situation in China is a factor, with the company's 2025 revenue guidance assuming no revenue recovery in that region. Demand for MVE Biological Solutions products has shown some softness, impacting overall revenue. These factors can influence

Reliance on third-party manufacturers for components introduces procurement risks, where delays or increased costs could adversely affect business operations. The company must manage these risks to ensure consistent product delivery and maintain profitability. This impacts the company’s

The company operates in a competitive market with major players like Americold, Marken, and SkyCell. The ability to differentiate through specialized cold chain solutions is crucial. The company must continually innovate to maintain its

The company's net loss increased in FY 2024 to $114.8 million. The company is implementing cost reduction measures and capital realignment strategies, including headcount reductions. The goal is to move towards positive adjusted EBITDA in 2025. These details are important for

Cryoport Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cryoport Company?

- What is Competitive Landscape of Cryoport Company?

- How Does Cryoport Company Work?

- What is Sales and Marketing Strategy of Cryoport Company?

- What is Brief History of Cryoport Company?

- Who Owns Cryoport Company?

- What is Customer Demographics and Target Market of Cryoport Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.