Currys Bundle

Can Currys Navigate the Future of Tech Retail?

From bicycles to cutting-edge gadgets, Currys plc has a rich history of adapting to technological advancements. This Currys SWOT Analysis dives deep into the company's strategic maneuvers and future trajectory. Explore how this retail giant plans to maintain its market leadership in an ever-changing consumer electronics landscape.

Currys's evolution, from its origins to its current omnichannel presence, is a testament to its resilience and strategic foresight. Understanding Currys's growth strategy is crucial for investors and analysts seeking to understand the future of consumer electronics. The company's focus on innovation and customer relationships, coupled with its strong market share, positions it for continued success. Analyzing Currys's business model and financial performance provides valuable insights into its long-term growth potential and investment opportunities.

How Is Currys Expanding Its Reach?

The expansion initiatives of Currys plc are strategically focused on enhancing its omnichannel retail approach, diversifying revenue streams through services, and optimizing its market positioning. This strategy is crucial for navigating the evolving consumer electronics market and ensuring sustained growth. The company leverages a proven model that integrates online and physical stores, catering to customers who shop through various channels, including online, in-store, or a combination of both.

A key element of Currys' strategy is its 'easy to shop' approach, which emphasizes a wide product range, product availability, and competitive pricing. This focus is designed to attract and retain customers in a competitive retail environment. The company's expansion plans also involve significant investments in services and solutions, aiming to boost customer satisfaction, improve profit margins, and generate recurring revenue streams.

Currys' growth strategy is heavily reliant on its ability to adapt to changing market dynamics and consumer preferences. This includes a strong emphasis on digital transformation and customer acquisition strategies. The company's ability to manage its supply chain efficiently and maintain a positive brand reputation are also critical for its long-term growth potential.

Currys' omnichannel strategy integrates online and physical stores, providing customers with flexible shopping options. This approach allows customers to access products and services through online-only, store-only, or a combination of both channels. This 'easy to shop' strategy is a core component of Currys' business model.

Currys is expanding its services and solutions offerings to drive customer satisfaction and recurring revenues. This includes Europe's largest technology repair facility and a comprehensive distribution network. The company's iD Mobile, a mobile virtual network in the UK, saw a significant increase in subscribers.

After selling its Greek and Cypriot business, Kotsovolos, Currys has consolidated its international focus on the Nordics. This strategic move allows the company to concentrate on core markets where it holds a strong leadership position. In the Nordics, the company continues to gain market share.

Currys is investing in its physical store presence to enhance the customer experience. This is evident through initiatives like the 'Goes Large on Stores Investment' in July 2024. These investments are aimed at improving the overall retail experience and driving sales.

Currys' expansion strategy focuses on key areas to drive growth and improve financial performance. These include strengthening its omnichannel model, expanding services, and optimizing its geographic footprint. The company's ability to adapt to market changes and maintain a strong brand reputation is crucial for its long-term success. For more information about the company's financial health, you can read about Owners & Shareholders of Currys.

- Omnichannel Strategy: Integrating online and physical stores for flexible customer experiences.

- Services Expansion: Offering a wider range of services to increase revenue.

- Geographic Consolidation: Focusing on core markets like the Nordics.

- Store Investments: Enhancing physical stores to improve the customer experience.

Currys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Currys Invest in Innovation?

The growth strategy of Currys plc hinges on leveraging technology and innovation to enhance customer experience and drive sustainable expansion. The company's approach is centered on digital transformation and the adoption of cutting-edge advancements to meet evolving consumer needs. This strategy is crucial for navigating the competitive consumer electronics market and securing its future prospects.

At the core of Currys' strategy is its commitment to providing a seamless omnichannel experience, a proven model in developed markets. This involves integrating its online and physical store presence to offer customers flexibility and convenience. Through this integrated approach, Currys aims to capture a larger market share and improve its financial performance.

The company is also focused on making technology accessible and enjoyable for everyone. This commitment is reflected in its vision, 'We Help Everyone Enjoy Amazing Technology,' which guides its innovation and technology strategy. The company's ability to adapt to online retail and provide expert advice positions it well for long-term growth potential.

Currys recognizes the transformative potential of artificial intelligence (AI). The company is actively exploring partnerships and training its colleagues to demystify AI for customers. This strategic move is designed to capitalize on the growing demand for AI-powered technology.

Currys' omnichannel strategy integrates online and physical stores to provide a seamless customer experience. This approach is crucial for adapting to changing consumer behaviors and preferences. The goal is to enhance customer acquisition strategies and improve overall customer satisfaction.

Currys is committed to sustainability, aiming for net-zero emissions by 2040. This includes promoting circular business models, such as repair, recycling, and reuse of technology. These initiatives contribute to the company's brand reputation and perception.

Currys emphasizes providing expert advice to help customers navigate complex technology. This is particularly important for AI-related products, where clear guidance can significantly influence purchasing decisions. This approach has led to increased store visits.

Currys invests in state-of-the-art repair facilities, including Europe's largest technology repair facility. This investment supports its commitment to circular business models. These facilities extend the life of technology products.

Digital transformation is a core element of Currys' strategy. The company is focused on improving its online presence and integrating digital tools to enhance the customer journey. This focus is crucial for competing in the current market.

Currys' focus on innovation and technology is a key element of its business model, impacting its market share and financial performance. The company's ability to adapt to the future of consumer electronics market and its expansion plans in Europe will be crucial for its long-term growth potential. For a deeper understanding of the company's target market, consider reading about the Target Market of Currys.

Currys' innovation strategy includes several key initiatives focused on enhancing customer experience and operational efficiency.

- AI Integration: Developing and implementing AI-powered solutions to personalize customer interactions and improve sales processes.

- Enhanced Online Experience: Improving the online platform to provide a seamless and user-friendly shopping experience, including advanced search capabilities and personalized recommendations.

- Supply Chain Optimization: Utilizing technology to streamline supply chain management, reduce costs, and improve delivery times.

- Sustainability Programs: Expanding repair and recycling services to promote circular economy models and reduce environmental impact.

- Data Analytics: Leveraging data analytics to understand customer behavior, optimize marketing campaigns, and make informed business decisions.

Currys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Currys’s Growth Forecast?

The financial outlook for Currys plc is notably positive, indicating robust growth prospects. The company's recent trading updates and strategic initiatives highlight a strengthening performance, positioning it well for future expansion. An analysis of Currys' financial performance reveals a trajectory of improvement, supported by strategic decisions and market adaptations.

Currys' financial health is demonstrably improving, with a focus on cost management and operational efficiency. This focus is evident in the company's ability to consistently meet and exceed its financial targets. The company's strategy, combined with a dynamic market approach, is driving positive outcomes.

For the 53-week year ending May 3, 2025, Currys anticipates an adjusted Profit Before Tax (PBT) of approximately £162 million. This represents a significant year-on-year increase of 37%, a clear indication of the company's growth trajectory. This positive outlook has led to the third profit guidance upgrade in 2025, reflecting confidence in its operational strategies. The company's ability to adapt to market changes and optimize its business model is a key factor in its success. This positive financial performance underscores the effectiveness of Currys' growth strategy.

Currys has reported accelerating group like-for-like sales growth, reaching +4% in the 17-week period since Peak trading. This growth is a key indicator of the company’s ability to capture market share and drive revenue. The positive sales trends reflect effective strategies in both the UK & Ireland and the Nordics segments, contributing to overall financial performance.

The UK & Ireland segment has shown a +4% like-for-like sales increase since Peak, demonstrating strong performance in a key market. This growth is a testament to Currys' robust market presence and effective customer engagement strategies. The focus on customer satisfaction and strategic product offerings has contributed to this positive outcome.

The Nordics segment has experienced a +3% growth in like-for-like sales during the same period, showcasing its strong performance. This growth is supported by effective cost management and strategic initiatives, particularly in the Nordics. The company's ability to adapt to local market dynamics and consumer preferences is a key driver of its success.

Sales growth and gross margin improvements have more than offset cost increases, particularly in the Nordics. This demonstrates the effectiveness of Currys' strategies in managing operational costs and enhancing profitability. The company's focus on operational efficiency and cost control is a key factor in its financial success.

Currys anticipates significant year-on-year growth in free cash flow, driven by lower interest costs and effective working capital management. The company’s strong cash position, with a net cash of more than £180 million by the end of the year ending May 3, 2025, supports the Board's intention to resume cash dividends. This financial strength is a result of strategic financial planning and efficient capital allocation. A final dividend of approximately 1.3 pence per share is expected to be announced alongside the full-year results in July 2025, representing around 5 times adjusted EPS cover. This strong financial position, with a net cash of £107 million and a pension deficit of £143 million as of October 26, 2024, represents the healthiest balance sheet the Group has had in a decade. For a deeper dive into the company's history, consider reading the Brief History of Currys.

The Board's intention to resume cash dividends reflects the company's strong financial position and commitment to shareholder value. This decision underscores the company's confidence in its future prospects and its ability to generate sustainable returns. The dividend policy is a key component of Currys' overall financial strategy.

The company finished the year ending May 3, 2025, with a net cash position exceeding £180 million. This strong financial position provides flexibility for future investments and strategic initiatives. The robust cash reserves enhance the company's resilience and its ability to navigate economic uncertainties.

As of October 26, 2024, the pension deficit stood at £143 million. While this represents a liability, the company's strong cash position and overall financial health provide a solid foundation for managing this obligation. The company is actively managing its pension liabilities to ensure long-term financial stability.

Currys anticipates significant year-on-year growth in free cash flow. This growth is driven by lower interest costs and effective working capital management. The increase in free cash flow will support future investments and enhance shareholder value.

The expected adjusted Profit Before Tax (PBT) for the year ending May 3, 2025, is around £162 million. This represents a 37% year-on-year increase. This positive forecast reflects the company's operational efficiency and strategic initiatives.

Currys' financial outlook is underpinned by strategic financial planning and effective capital allocation. The company's focus on cost management, working capital optimization, and dividend policy demonstrates sound financial management. These strategies are critical for long-term growth and sustainability.

Currys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Currys’s Growth?

The path to growth for Currys plc, while promising, is not without its hurdles. Several factors could impede the company's strategic objectives and overall performance. Understanding these potential risks and obstacles is crucial for a comprehensive Currys company analysis.

The retail landscape for consumer electronics and home appliances is fiercely competitive, posing a constant challenge. Furthermore, economic uncertainties and regulatory changes introduce additional layers of complexity. The company's ability to navigate these challenges will significantly influence its Currys future prospects.

External market dynamics and internal operational efficiencies need to be carefully managed. The company's response to these challenges will be critical in determining its long-term success. For a deeper look at how Currys approaches its market, explore the Marketing Strategy of Currys.

The consumer electronics and home appliance retail sector is highly competitive. Intense competition from established players and emerging online retailers like Amazon, Shein, and Temu could erode Currys market share. This competitive pressure can affect pricing and profitability, making it difficult to maintain or improve Currys financial performance.

Economic downturns, high inflation, and rising interest rates can significantly impact consumer spending. These conditions can lead to decreased demand for discretionary items like electronics and appliances, affecting like-for-like sales. A challenging consumer environment presents an ongoing obstacle to Currys growth strategy.

Changes in regulations, such as government budget measures, can increase operational costs. The UK government's budget measures are expected to add approximately £32 million in annual costs. These increased costs can squeeze profit margins and impact the company's financial outlook, affecting Currys business model.

Supply chain disruptions are an inherent risk for retailers of physical goods. While not explicitly detailed in recent reports, disruptions can lead to product shortages, increased costs, and delayed deliveries. Effective Currys supply chain management is crucial to mitigate these risks and maintain customer satisfaction.

Rapid technological advancements and shifts in consumer preferences can pose challenges. The inability to adapt quickly to new technologies, such as smart home devices or emerging retail trends, could leave the company vulnerable. Adapting to Currys digital transformation strategy is critical for sustained success.

Internal restructuring, such as redundancies, can impact operational efficiency. For example, potential redundancies across central roles, with around 80 staff affected during a consultation period, could disrupt operations. Managing internal resources effectively is essential for Currys long-term growth potential.

Currys mitigates risk through a diversified revenue base across products, channels, and services. This diversification helps cushion the impact of economic downturns or shifts in consumer preferences. A diverse revenue stream supports Currys investment opportunities and increases resilience.

The company focuses on cost discipline, particularly in the Nordics, and aims to improve gross margins even in challenging markets. This proactive approach to financial risk management helps protect profitability. Managing costs effectively is crucial for Currys competitive landscape.

A strong balance sheet and healthy cash flow provide a buffer against economic headwinds. This financial strength allows continued investment in strategic initiatives. A robust financial position supports Currys expansion plans in Europe and enhances its ability to navigate uncertainties.

Currys proactively manages risks by focusing on diversification, cost control, and financial strength. These strategies help the company navigate the complexities of the retail market. Proactive risk management is essential for the future of the consumer electronics market Currys.

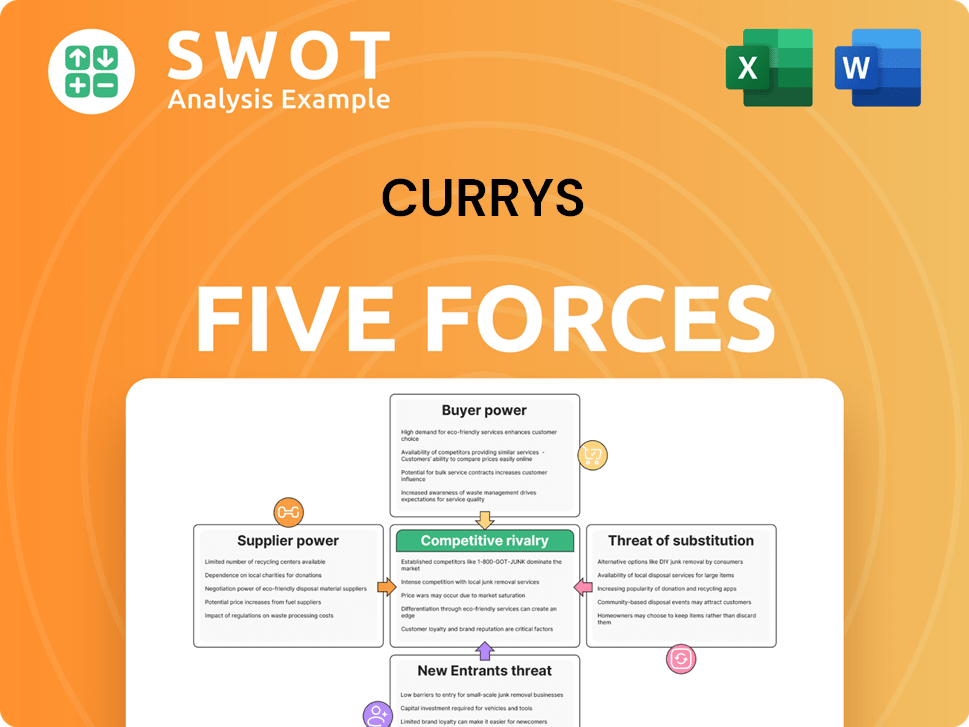

Currys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Currys Company?

- What is Competitive Landscape of Currys Company?

- How Does Currys Company Work?

- What is Sales and Marketing Strategy of Currys Company?

- What is Brief History of Currys Company?

- Who Owns Currys Company?

- What is Customer Demographics and Target Market of Currys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.