Deliveroo Bundle

Can Deliveroo Continue to Deliver Growth in a Crowded Market?

Born from a simple idea in London, Deliveroo revolutionized how we access restaurant meals. Its rapid rise showcases a significant shift in consumer behavior towards on-demand services, but what does the future hold? With a presence across Europe, the Middle East, and Asia, Deliveroo's Deliveroo SWOT Analysis reveals the core strategies driving its expansion.

This exploration delves into Deliveroo's Deliveroo growth strategy and Deliveroo future prospects, examining its Deliveroo business model within the dynamic food delivery market. We'll analyze its Deliveroo expansion plans, assess its Deliveroo market share analysis within the Deliveroo competitive landscape, and evaluate its potential for Deliveroo sustainable growth amidst the challenges and opportunities of the online food ordering sector. Furthermore, we will dive into Deliveroo financial performance and Deliveroo revenue streams.

How Is Deliveroo Expanding Its Reach?

The Marketing Strategy of Deliveroo focuses heavily on expansion initiatives to drive its Deliveroo growth strategy. These initiatives span across new product categories, customer loyalty enhancements, and operational optimizations. The company's Deliveroo future prospects are closely tied to its ability to successfully execute these expansion plans and adapt to the evolving food delivery market.

A key element of Deliveroo's strategy involves diversification beyond traditional restaurant food delivery. This includes a significant push into grocery and retail, aiming to capture a larger share of the online food ordering market. By expanding its offerings, Deliveroo seeks to increase its relevance to customers and boost its overall Deliveroo business model.

Deliveroo's expansion initiatives are multifaceted, focusing on entering new product categories, enhancing its loyalty program, and optimizing delivery operations. A significant area of expansion is into new verticals beyond traditional restaurant food delivery, particularly grocery and retail. In the second half of 2024, grocery delivery constituted 16% of the Group's Gross Transaction Value (GTV), a notable increase from 13% in the second half of 2023. Deliveroo aims to serve more customer missions by expanding into mid-sized grocery baskets (valued between £30-£60) through range expansion and enhanced technology, alongside driving greater category adoption via new features and targeted merchandising. The company is also scaling its retail proposition globally by partnering with leading brands and local favorites, with plans to launch in additional markets. Deliveroo has added partners like Ann Summers, The Perfume Shop, and Not On The High Street to its shopping ranges, with grocery and retail accounting for about one-sixth of its income in April 2025, and the CEO projecting it could grow to more than half eventually.

Deliveroo is expanding into grocery and retail to diversify its offerings. Grocery delivery accounted for 16% of GTV in the second half of 2024, up from 13% the previous year. Partnerships with brands like Ann Summers and The Perfume Shop are part of this expansion.

Deliveroo is improving its Plus loyalty program to boost customer retention. Plus subscribers are twice as likely to try new restaurants and order three times more often. The company aims to make Plus its primary customer engagement strategy by 2026.

Deliveroo focuses on dispatch innovation and delivery network efficiency. Multi-pickup stacking increased stacked orders by approximately 50% year-on-year in 2024. The company is also focusing on markets with strong performance, such as the UAE and Italy, while exiting less profitable ones.

Deliveroo is strategically focusing on markets with strong performance and profitability. The company exited the Hong Kong market in early 2025 to concentrate on more profitable regions like the UK, Ireland, the UAE, and Italy.

Deliveroo's expansion strategy involves entering new product categories, enhancing customer loyalty, and optimizing delivery operations. This includes a strong emphasis on grocery and retail, along with improvements to its Plus loyalty program.

- Expanding into grocery and retail to diversify revenue streams.

- Enhancing the Plus loyalty program to improve customer retention.

- Optimizing delivery operations through dispatch innovation and network efficiency.

- Focusing on profitable markets and exiting less successful ones.

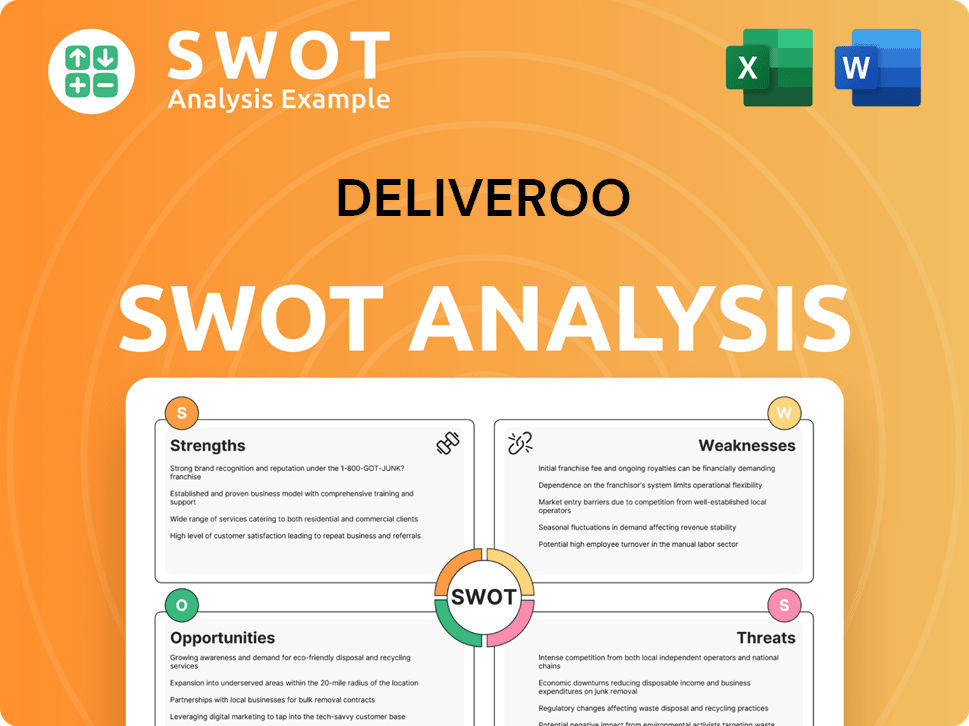

Deliveroo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Deliveroo Invest in Innovation?

The innovation and technology strategy of the company is crucial for its continued growth. This strategy focuses on using advanced technology to improve the customer experience, streamline operations, and broaden service offerings. The company's approach to digital transformation includes enhancing the in-app consumer experience through new navigation methods, better tools for narrowing choices, and seamless order placement, with an increased focus on discovery.

The company has made substantial investments in artificial intelligence (AI) and machine learning (ML) to boost efficiency and optimize delivery routes. The company is also committed to sustainability initiatives, aiming to achieve a 50% reduction in carbon emissions by 2025. These technological advancements and sustainability efforts support the company's growth objectives by improving operational efficiency, enhancing customer satisfaction, and aligning with evolving consumer preferences for eco-friendly services.

As the company continues to evolve, understanding its technological advancements and strategic initiatives is vital for assessing its potential within the dynamic food delivery market. This analysis will delve into the specific technologies employed, the impact of these innovations on the business, and how they contribute to the overall Revenue Streams & Business Model of Deliveroo.

The company has invested over £100 million in AI and machine learning to optimize delivery routes and improve efficiency as of 2024. This investment enhances operational capabilities and improves customer satisfaction by reducing delivery times and optimizing order fulfillment.

In 2023, the company invested £50 million in technology upgrades, including the development of its AI-based algorithm for order optimization. This resulted in a 20% reduction in delivery times, showcasing the effectiveness of these technological advancements.

The company's proprietary picking app technology delivered over 70% of grocery orders in 2024. This technology helps reduce inaccurate orders and increases suitable substitutions, demonstrating significant advancements in its grocery business.

The company aims to achieve a 50% reduction in carbon emissions by 2025. As of 2024, 20% of its deliveries are made using electric bikes and scooters, reflecting a commitment to sustainability.

The company announced partnerships with over 1,000 restaurants in 2023 that are focused on sustainable practices. These collaborations highlight the company's dedication to eco-friendly operations and its influence on the food delivery market.

The company uses generative AI to make customer care faster and more personalized. This technology enhances customer service efficiency and improves overall customer satisfaction.

The company's focus on innovation and technology is a core part of its Deliveroo growth strategy. The company is leveraging AI and ML to improve efficiency and enhance customer experience, which is critical for its Deliveroo future prospects in the competitive food delivery market.

- AI-Driven Route Optimization: AI and ML are used to optimize delivery routes, reducing delivery times and improving efficiency.

- In-App Experience Enhancement: The company is improving the in-app consumer experience through new navigation methods and better tools for narrowing choices.

- Grocery Order Technology: Proprietary picking app technology reduces order inaccuracies and increases suitable substitutions.

- Sustainability Efforts: The company is committed to reducing carbon emissions and using electric vehicles for deliveries.

- Customer Care Improvement: Generative AI is used to make customer care faster and more personalized.

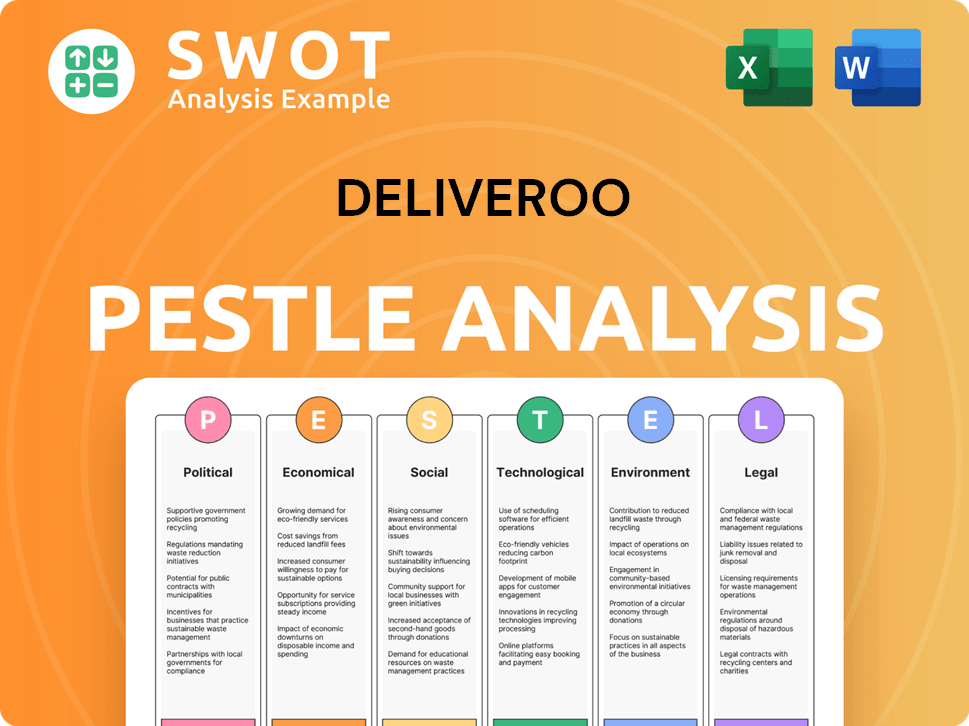

Deliveroo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Deliveroo’s Growth Forecast?

The financial outlook for Deliveroo is showing signs of a significant turnaround and positive momentum. The company's Deliveroo growth strategy has led to its first full year of profit and positive free cash flow in 2024. This shift indicates a strengthening of the Deliveroo business model and its ability to generate sustainable value within the competitive food delivery market.

In 2024, Deliveroo reported a profit of £2.9 million, a substantial improvement from a loss of £31.8 million in 2023. Free cash flow reached £86 million in 2024, a significant increase from an outflow of £38 million in 2023. This financial performance highlights the company's progress in achieving profitability and managing its cash flow effectively. These improvements are crucial for its Deliveroo future prospects and long-term sustainability.

Looking ahead to 2025, Deliveroo anticipates high single-digit percentage GTV growth in constant currency. Adjusted EBITDA for 2025 is expected to be in the range of £170 million to £190 million. This projection builds on the adjusted EBITDA of £129.6 million reported in 2024, which was a 52% increase from £85 million in 2023. These forecasts suggest continued growth and improved financial health for the company.

In the first quarter of 2025, Deliveroo reported an 8% year-on-year growth in total revenue, reaching £518 million. This demonstrates the company's ability to expand its revenue streams within the online food ordering sector.

GTV increased by 9% year-on-year in the first quarter of 2025, with orders also seeing a 7% increase across the group. Strong performance in the UK and Ireland (7% order growth, 9% GTV growth) and internationally (7% order growth, 9% GTV growth) contributed to these positive results.

Deliveroo aims for mid-teens percentage GTV growth per annum in constant currency and an adjusted EBITDA margin of 4%+ in the medium term. The company is focused on margin improvement accelerating from 2026.

The company's financial strategy emphasizes disciplined capital allocation and continued investment in its customer value proposition and diversified offerings. This approach is crucial for achieving Deliveroo expansion and sustainable growth.

The financial narrative of Deliveroo supports its strategic plans, focusing on disciplined capital allocation and continuous investment. Deliveroo is demonstrating its ability to navigate the food delivery market.

- Profitability: Achieved first full year of profit in 2024, with £2.9 million.

- Free Cash Flow: Reached £86 million in 2024, a significant improvement.

- Revenue Growth: 8% year-on-year growth in total revenue in Q1 2025.

- GTV Growth: 9% year-on-year increase in GTV in Q1 2025.

- Adjusted EBITDA: Expected to be between £170 million and £190 million in 2025.

To understand the core values driving Deliveroo, one can explore the Mission, Vision & Core Values of Deliveroo. The company's financial performance reflects its commitment to operational efficiency and strategic investments, positioning it for sustained growth in the competitive landscape.

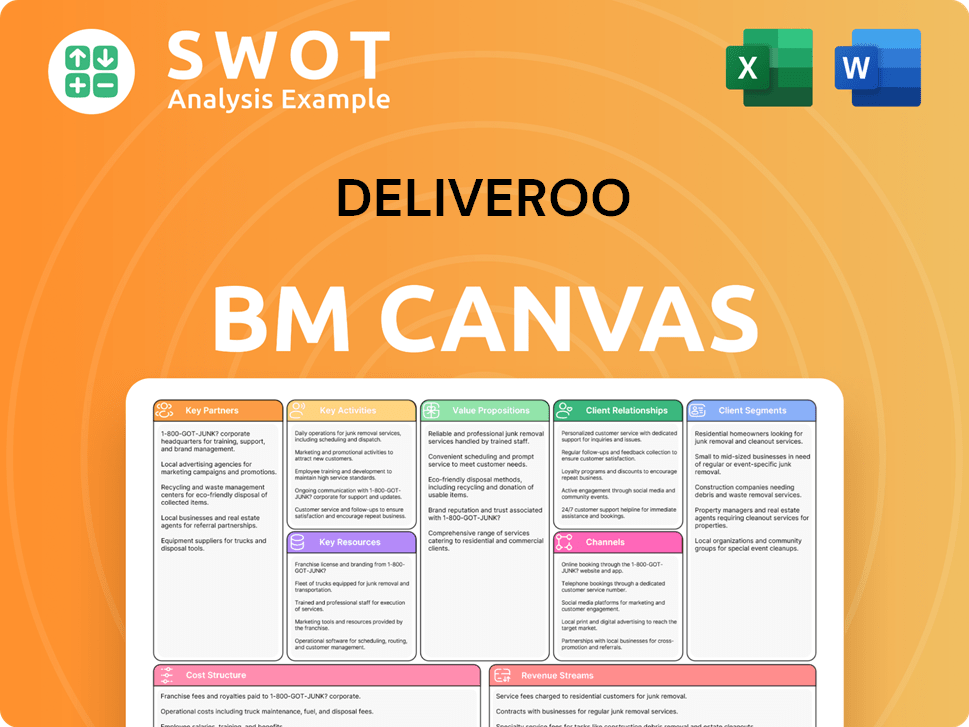

Deliveroo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Deliveroo’s Growth?

The path to growth for the company, a prominent player in the food delivery market, is fraught with potential risks and significant obstacles. The intensely competitive environment, regulatory uncertainties, and macroeconomic factors present substantial challenges to its expansion plans and financial performance. Understanding these risks is crucial for evaluating the company's future prospects and its ability to achieve sustainable growth.

The company's business model faces challenges from competitors such as Uber Eats and Just Eat Takeaway. These rivals continuously innovate and expand their services, intensifying the pressure to acquire and retain customers. Furthermore, the evolving regulatory landscape, particularly concerning the status of gig economy workers, could significantly impact the company's profitability, especially in high-wage markets.

Economic uncertainties, including rising costs and inflation, also pose a threat by potentially curbing consumer spending on takeaway meals. Despite diversification into grocery and retail delivery, the company must navigate these challenges while striving to maintain customer growth and loyalty in key markets.

The food delivery market is highly competitive, with rivals like Uber Eats and Just Eat Takeaway constantly vying for market share. This competition drives up customer acquisition costs and impacts profitability. The Brief History of Deliveroo shows how the company has navigated this landscape.

Changes in regulations, especially regarding gig economy workers, pose a significant risk. Potential mandates for fully employed riders could materially affect profitability, particularly in developed markets. While regulatory clarity exists in many markets, this remains an evolving area.

Rising costs and inflation can impact consumer spending on takeaways and discretionary purchases. This uncertainty could reduce demand, affecting revenue. Diversification into grocery and retail delivery offers some resilience, but consumer caution remains a factor.

Maintaining consistent customer growth, especially in core markets like the UK and Ireland, is a concern. In Q1 2025, monthly active customers in the UK and Ireland declined. This stagnation could impact long-term strategic positioning and customer loyalty.

Strategic decisions, such as exiting the Hong Kong market in early 2025, reflect challenges. These moves aim to focus on more profitable operations. The company's ability to adapt to competitive pressures is crucial.

Ongoing efforts to enhance the customer value proposition and improve operational efficiency are critical. The company focuses on expanding into new consumer missions. This is a key part of the Deliveroo growth strategy.

The company faces the challenge of maintaining and growing its market share in a competitive landscape. Its ability to differentiate itself through service quality, partnerships, and technological advancements is crucial. The decline in monthly active customers in the UK and Ireland highlights the need for strategic initiatives to regain and expand its market presence.

The company's financial performance is directly impacted by the factors mentioned above. Rising customer acquisition costs, potential changes in labor costs, and fluctuating consumer demand can affect profitability. The company's ability to manage costs and maintain revenue growth is crucial for its future prospects. In Q1 2025, overall monthly active users globally saw a 4.5% increase to 7.0 million.

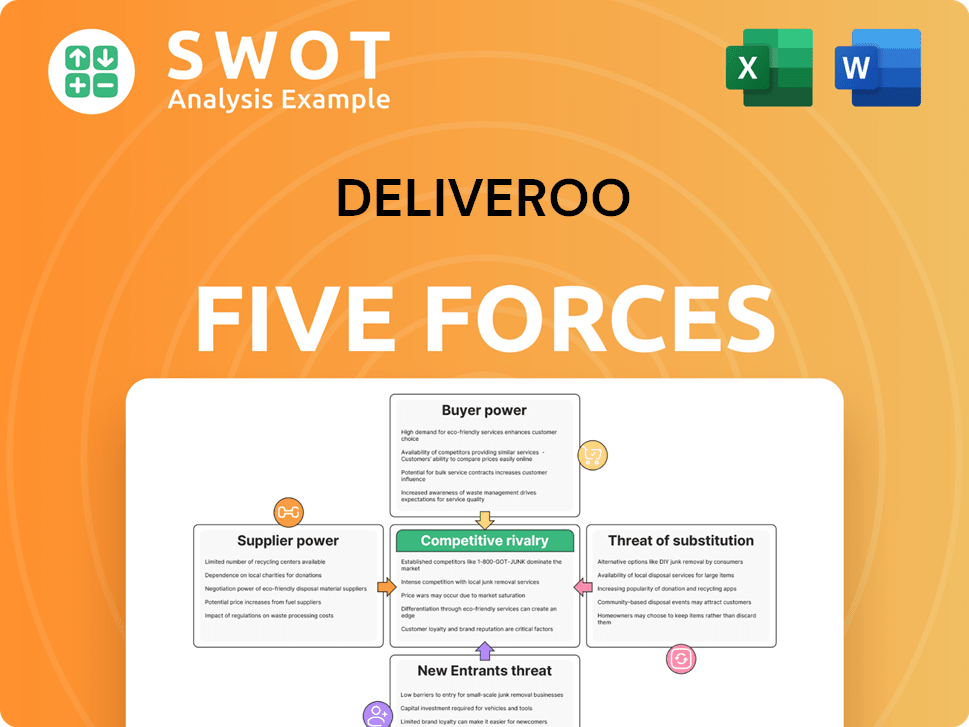

Deliveroo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Deliveroo Company?

- What is Competitive Landscape of Deliveroo Company?

- How Does Deliveroo Company Work?

- What is Sales and Marketing Strategy of Deliveroo Company?

- What is Brief History of Deliveroo Company?

- Who Owns Deliveroo Company?

- What is Customer Demographics and Target Market of Deliveroo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.