Delta Galil Bundle

Can Delta Galil Conquer the Future of Fashion?

Delta Galil, a leading Delta Galil SWOT Analysis, has evolved from an Israeli textile company into a global apparel powerhouse. This transformation, marked by strategic acquisitions like the DBA Group's intimates and swimwear businesses, showcases its ambition to expand its global footprint and product offerings. This exploration dives into the Delta Galil Growth Strategy and its prospects in the dynamic Textile Industry.

The Apparel Company's journey from a regional manufacturer to a global leader highlights the critical role of a robust growth strategy. Understanding Delta Galil Future hinges on examining its adaptation to consumer trends, technological advancements, and the evolving retail landscape. This Business Analysis will explore how Delta Galil aims to achieve future growth through strategic initiatives, innovation, and sound financial planning, considering potential risks and opportunities within the competitive market.

How Is Delta Galil Expanding Its Reach?

The Delta Galil's growth strategy is a multi-pronged approach, focusing on both geographical and product category expansion. This strategy is designed to leverage its strong brand portfolio and adapt to evolving consumer preferences in the apparel market. A key element involves strategic acquisitions and partnerships to broaden its market reach and enhance its product offerings, as highlighted in recent business analyses.

One of the primary goals is to expand into new regions and bolster its presence in existing markets. This is achieved through a combination of organic growth, new product launches, and strategic acquisitions. The company's focus on innovation in activewear and leisurewear, which have seen significant growth, is a testament to its ability to stay ahead of industry trends. This approach is crucial in the competitive textile industry.

The company's expansion strategy is supported by its commitment to product innovation and sustainability. The company aims to meet the evolving demands of consumers for comfort, performance, and eco-friendly products. Strategic partnerships with retailers and other brands also play a vital role in broadening its distribution channels and reaching a wider audience. For more information, you can explore the details on Owners & Shareholders of Delta Galil.

Delta Galil is actively expanding its global footprint by entering new markets and strengthening its position in existing ones. This includes strategic investments in regions with high growth potential. The company's focus on international expansion is a key driver for its future outlook.

The company is diversifying its product offerings to meet evolving consumer demands and capture new market segments. This includes expanding into activewear, leisurewear, and other high-growth categories. This diversification strategy helps mitigate risks and capitalize on emerging trends.

Delta Galil leverages strategic acquisitions to expand its market share and product portfolio. The acquisitions of brands like Dim, Nur Die, and Lovable have significantly boosted its presence in Europe. These acquisitions provide access to new customer segments and consolidate market positions.

The company focuses on organic growth through new product launches and service innovations. This includes continuous innovation in activewear and leisurewear to meet evolving consumer preferences. Delta Galil aims to stay ahead of industry trends through product development.

Delta Galil's expansion initiatives are designed to drive sustainable growth and enhance its market position. These strategies include geographical expansion, product diversification, and strategic acquisitions. The company's focus on innovation and sustainability further supports its growth objectives.

- Strategic Partnerships: Collaborations with retailers and other brands to broaden distribution channels.

- Product Innovation: Continuous development of new products to meet evolving consumer preferences.

- Sustainability Initiatives: Commitment to eco-friendly practices and sustainable materials.

- Market Analysis: Ongoing assessment of market trends and consumer behavior.

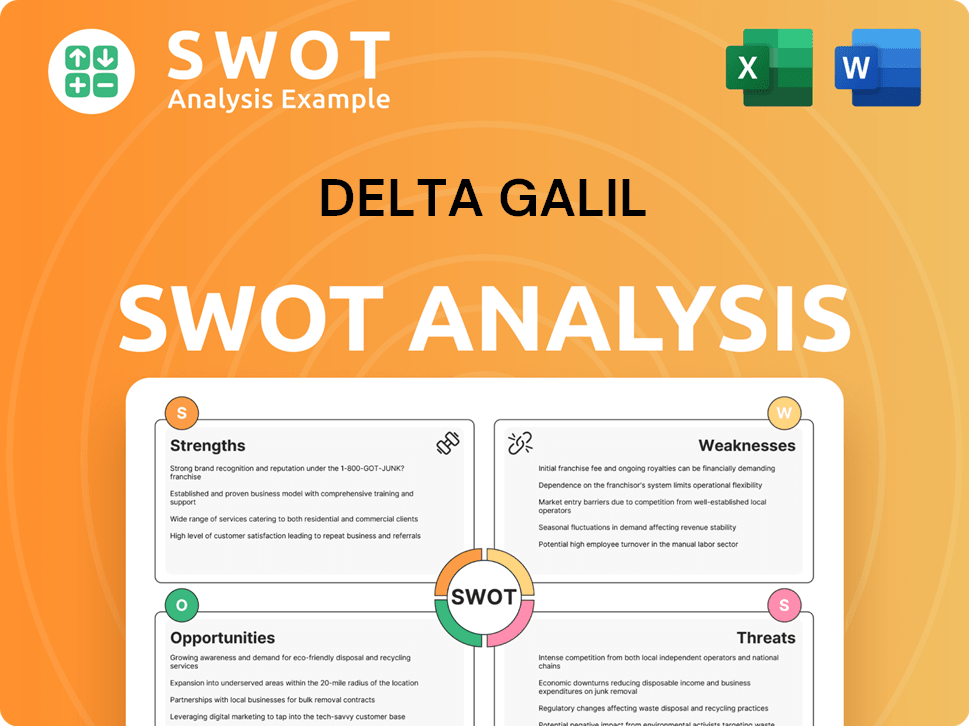

Delta Galil SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Delta Galil Invest in Innovation?

Delta Galil's innovation and technology strategy is a core element of its growth strategy, focusing on enhancing product development, manufacturing efficiency, and supply chain management. As a leading apparel company, Delta Galil invests heavily in research and development to create innovative fabrics and apparel technologies, staying ahead in the competitive textile industry. The company's commitment to 'smart creation' emphasizes sustainability and responsible manufacturing processes, which aligns with the increasing consumer demand for eco-friendly products.

The company's approach to digital transformation is evident in its efforts to streamline design processes, improve inventory management, and enhance its e-commerce capabilities. Delta Galil leverages technology to optimize its global manufacturing footprint, embracing automation and data-driven decision-making to improve efficiency and responsiveness. New product platforms and technical capabilities contribute directly to growth objectives by enabling the company to offer differentiated products and faster time-to-market, driving its future outlook.

Delta Galil's strategy includes integrating new technologies into product development and manufacturing, which is crucial for maintaining its competitive edge. This focus allows the company to adapt to market trends and meet the evolving needs of its customer base. For a deeper understanding of their target market, explore the Target Market of Delta Galil.

Delta Galil invests in R&D to create innovative fabrics and apparel technologies. This includes exploring new materials and production techniques to reduce waste and conserve resources. The company's focus on innovation helps it to differentiate its products in the market.

Delta Galil is actively engaged in digital transformation to streamline design processes and improve inventory management. The company enhances its e-commerce capabilities to meet the growing demand for online shopping. This digital focus improves efficiency and responsiveness.

The company emphasizes 'smart creation' through its focus on sustainability and responsible manufacturing processes. Delta Galil aims to minimize its environmental impact across operations. This includes reducing waste and conserving resources.

Delta Galil focuses on optimizing its global manufacturing footprint through automation and data-driven decision-making. This approach improves efficiency and responsiveness in its supply chain. The company aims to enhance its overall operational performance.

New product platforms and technical capabilities contribute directly to growth objectives. This enables the company to offer differentiated products and faster time-to-market. Delta Galil continuously works on enhancing its product offerings.

Delta Galil's ability to adapt to market trends and integrate new technologies is crucial for maintaining its competitive edge. This includes continuous efforts in innovation. The company's reputation for quality and design supports its market position.

Delta Galil's innovation strategy focuses on several key areas to drive growth and maintain a competitive advantage in the apparel and textile industry. These strategies are essential for its future outlook and overall success.

- Research and Development: Continuous investment in R&D to develop innovative fabrics and apparel technologies.

- Sustainability: Implementing sustainable manufacturing processes to minimize environmental impact and meet consumer demand for eco-friendly products.

- Digital Transformation: Streamlining design processes, improving inventory management, and enhancing e-commerce capabilities.

- Supply Chain Optimization: Leveraging automation and data-driven decision-making to improve efficiency and responsiveness.

- Product Innovation: Launching new product platforms and technical capabilities to offer differentiated products and faster time-to-market.

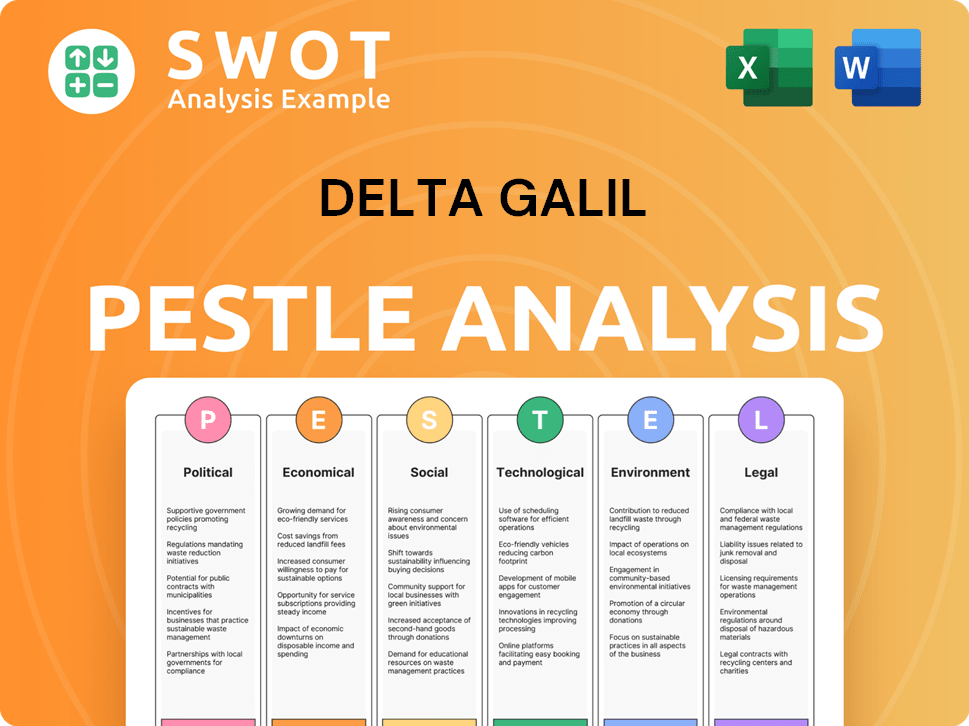

Delta Galil PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Delta Galil’s Growth Forecast?

The financial outlook for Delta Galil reflects a strategic approach to navigate the dynamic apparel market. The company's performance in 2024 showcases resilience, with stable sales figures and a focus on profitability. This is supported by strategic decisions and operational efficiencies.

In Q4 2024, Delta Galil reported sales of $475.2 million, slightly down from $494.6 million in Q4 2023. However, for the full year 2024, sales reached $1.859 billion, a marginal increase from $1.852 billion in 2023. This indicates a steady performance amidst market fluctuations. Net income for Q4 2024 was $27.0 million, or $0.98 per diluted share, compared to $31.8 million, or $1.15 per diluted share, in Q4 2023. For the full year, net income was $94.6 million, or $3.43 per diluted share, down from $103.8 million, or $3.75 per diluted share, in 2023.

Looking at the Brief History of Delta Galil, the company's financial strategy includes managing inventory levels and optimizing operational efficiencies to support its growth targets. Delta Galil consistently generates cash flow and allocates capital effectively, which is crucial for future expansion and maintaining a strong financial position. The projections for 2025 suggest a cautious yet optimistic growth trajectory.

Delta Galil's 2024 sales reached $1.859 billion, demonstrating stability in a competitive market. The slight increase from 2023's $1.852 billion reflects effective strategies. This performance is key to understanding the company's overall financial health.

Net income for 2024 was $94.6 million, or $3.43 per diluted share, a decrease from 2023. This reflects challenges and strategic adjustments. The company is focused on improving profitability through operational efficiencies.

For 2025, Delta Galil projects sales between $1.88 billion and $1.95 billion. This represents a 1% to 5% increase compared to 2024. The guidance reflects a positive outlook for the apparel company.

The company anticipates 2025 diluted earnings per share to be between $3.55 and $3.85. This indicates an expected increase of 3% to 12% compared to 2024. These projections show confidence in their growth strategy.

Delta Galil's financial strategies are focused on sustained growth and profitability. These strategies are crucial for navigating the competitive landscape of the textile industry.

- Inventory Management: Optimizing inventory levels to reduce costs and improve efficiency.

- Operational Efficiency: Streamlining operations to enhance productivity and reduce expenses.

- Capital Allocation: Disciplined capital allocation to fund expansion and maintain financial stability.

- Cash Flow Generation: Consistent cash flow generation to support future initiatives.

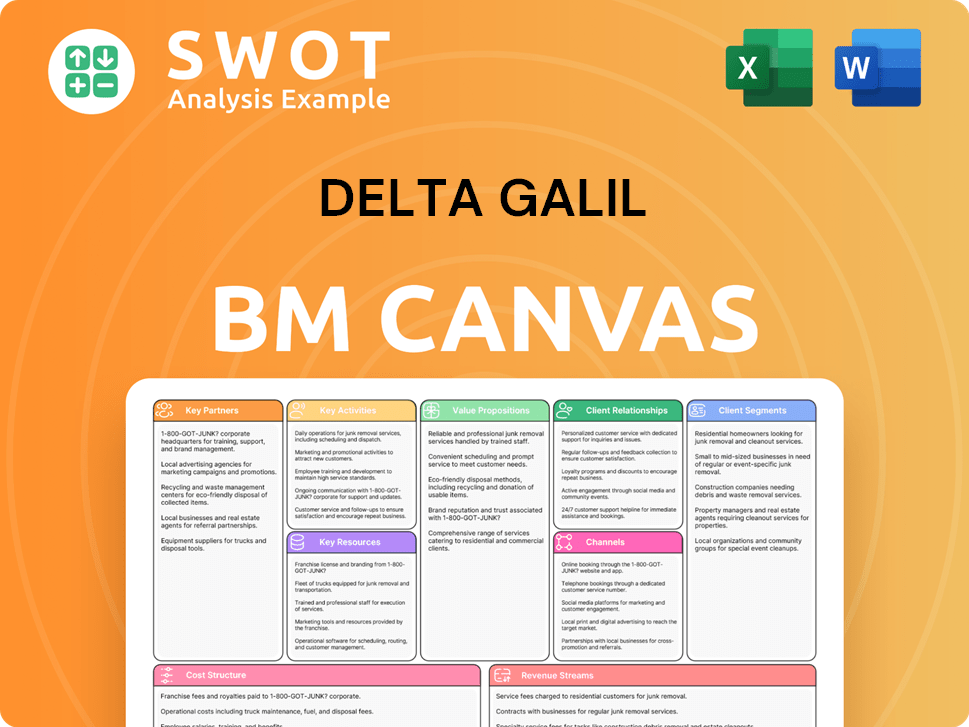

Delta Galil Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Delta Galil’s Growth?

The path of Delta Galil toward its growth strategy and future is not without its challenges. As an apparel company operating in the dynamic textile industry, it faces numerous risks that could impact its performance. Understanding these potential obstacles is crucial for a comprehensive business analysis.

Market competition, rapid fashion trends, and regulatory changes are key areas of concern. Supply chain vulnerabilities and technological disruptions also pose significant threats. Proactive risk management and strategic planning are essential for navigating these challenges and sustaining Delta Galil's growth trajectory.

Delta Galil's success hinges on its ability to adapt and mitigate these risks effectively. The company's ability to respond to shifts in consumer demand, manage supply chain pressures, and embrace technological advancements will determine its future success. The Delta Galil future depends on proactive strategies.

The apparel market is highly competitive, with numerous established and emerging brands. This competition can squeeze profit margins and necessitate constant innovation in product offerings. Delta Galil must continually differentiate itself to maintain and grow its market share.

Fashion trends evolve quickly, demanding that Delta Galil swiftly adapt its product development and marketing strategies. Failing to anticipate or respond to changing consumer preferences can lead to inventory issues and lost sales. The company must stay agile and responsive.

Changes in international trade regulations, labor practices, and environmental standards can significantly affect manufacturing costs and supply chain operations. Compliance with these regulations requires investment and operational adjustments. The company must monitor and adapt to these changes.

Geopolitical events, natural disasters, and pandemics can disrupt supply chains, impacting production and delivery schedules. Delta Galil's global manufacturing footprint makes it particularly susceptible to these disruptions. Effective supply chain management is crucial for mitigating these risks.

Competitors adopting new manufacturing processes or digital sales platforms more rapidly can pose a threat. Delta Galil must invest in technology and innovation to remain competitive. The company needs to embrace digital transformation.

Limited access to skilled labor or capital for new technology investments can impede growth. Efficient resource allocation and strategic partnerships are vital. Delta Galil must manage its resources effectively.

Delta Galil employs several strategies to mitigate these risks. Diversification across product categories and geographical markets reduces its exposure to specific market downturns. Robust risk management frameworks are in place to anticipate and address potential disruptions. Strategic scenario planning helps the company prepare for various challenges.

While specific details are not always publicly available, Delta Galil's sustained performance in volatile markets demonstrates its ability to navigate challenges. This includes adapting to shifts in consumer demand during economic downturns and managing supply chain pressures. The company's resilience is key.

Increasing cybersecurity threats to digital operations and the growing pressure for greater supply chain transparency are emerging risks. These factors could significantly shape the company's future trajectory. Proactive management is essential.

To enhance its growth strategy, Delta Galil must continue to invest in innovation, streamline its supply chains, and strengthen its brand portfolio. The company's ability to adapt to these challenges will be crucial. For further insights, consider reading about the Marketing Strategy of Delta Galil.

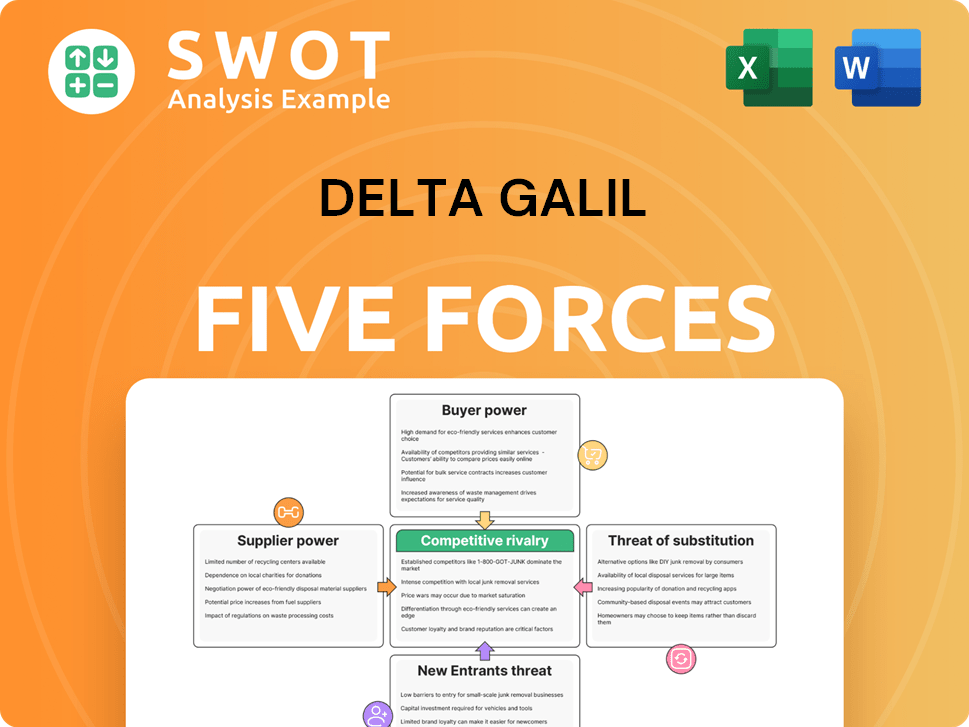

Delta Galil Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Delta Galil Company?

- What is Competitive Landscape of Delta Galil Company?

- How Does Delta Galil Company Work?

- What is Sales and Marketing Strategy of Delta Galil Company?

- What is Brief History of Delta Galil Company?

- Who Owns Delta Galil Company?

- What is Customer Demographics and Target Market of Delta Galil Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.