Dometic Group Bundle

Can Dometic Group Continue Its Growth Journey?

Dometic Group, a leader in mobile living solutions, has consistently pursued a dynamic growth strategy, making it a compelling subject for investors and strategists alike. Founded in 1919, the company has evolved significantly, but its core mission remains: to enhance the mobile living experience through innovative products and services. This exploration will uncover the key drivers behind Dometic's past successes and future prospects.

From its humble beginnings, Dometic has strategically expanded its reach, catering to diverse sectors such as recreational vehicles and marine applications. Understanding Dometic's Dometic Group SWOT Analysis is crucial for grasping its current market position and future trajectory. The company's ability to adapt and innovate, coupled with its strategic initiatives, will be key to its long-term growth strategy and overall financial performance. Analyzing Dometic's business model and market share analysis provides valuable insights into its competitive landscape and potential investment opportunities.

How Is Dometic Group Expanding Its Reach?

The Marketing Strategy of Dometic Group includes several key expansion initiatives designed to drive growth and enhance its market position. These initiatives focus on geographical expansion, product innovation, and strategic partnerships. The company aims to capitalize on the increasing demand for mobile living solutions and sustainable products.

One of the primary strategies for Dometic Group is to broaden its market reach. This involves entering new geographical markets and strengthening its presence in existing ones. The company is also focused on expanding its service and support network to better serve its customers globally. This includes strengthening its aftermarket business, increasing accessibility to spare parts, and maintenance services.

Dometic Group's growth strategy also includes continuous product innovation. The company consistently launches new products and solutions to meet evolving consumer demands in recreational vehicles, marine, and professional applications. This includes new climate solutions and power and control products designed to enhance comfort and sustainability for mobile living. The company's emphasis on sustainability drives new product development, aligning with global trends and consumer preferences for greener products.

Dometic Group is actively expanding its presence in key geographical markets. This includes focusing on regions with growing mobile living trends and increasing its service and support network globally. The company aims to capitalize on the increasing demand for recreational vehicles and marine products in these regions.

Product innovation is a core component of Dometic's growth strategy. The company continuously launches new products and solutions that cater to evolving consumer demands. This includes new climate solutions and power and control products designed to enhance comfort and sustainability for mobile living.

Dometic emphasizes strategic partnerships and potential mergers and acquisitions to accelerate its growth. These initiatives aim to access new customer segments and bolster its product portfolio. The company's focus on sustainability also drives new product development, aligning with global trends and consumer preferences for greener products.

Dometic is committed to sustainability, driving new product development toward more energy-efficient and environmentally friendly solutions. This aligns with global trends and consumer preferences for greener products. The company's focus on sustainability also drives new product development, such as more energy-efficient and environmentally friendly solutions.

Dometic Group's expansion plans include entering new geographical markets, expanding its product portfolio, and strengthening its service and support network. These initiatives are designed to capitalize on market trends and enhance the company's competitive position. The company also focuses on strategic partnerships and acquisitions to accelerate growth.

- Geographical expansion into key markets with growing mobile living trends.

- Continuous product innovation to meet evolving consumer demands.

- Strategic partnerships and potential mergers and acquisitions.

- Emphasis on sustainability through energy-efficient and environmentally friendly solutions.

Dometic Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Dometic Group Invest in Innovation?

The innovation and technology strategy of the Dometic Group is a core element of its overall growth strategy. The company consistently invests in research and development (R&D) to create cutting-edge solutions for mobile living. This approach includes both internal development and collaborations with external innovators and technology partners.

A key focus of Dometic's innovation strategy is digital transformation. This involves integrating smart technologies into its product offerings. This includes the use of the Internet of Things (IoT) to enable connectivity and remote control of its products, enhancing user convenience and efficiency. The company also emphasizes developing products that align with sustainability initiatives, such as energy-efficient climate systems and solutions that minimize environmental impact.

Dometic's commitment to innovation is evident in its ongoing product launches and updates, which help maintain its leadership position in specialized markets. While specific recent patents or industry awards for 2024-2025 are not readily available in the provided context, the continuous introduction of new products and features underscores its dedication to technological advancement. For more insights into the company's business model, consider reading about the Revenue Streams & Business Model of Dometic Group.

Dometic's technology and innovation strategy is multifaceted, focusing on several key areas to drive growth and maintain a competitive edge. These strategies include:

- R&D Investments: Continuous investment in research and development is a cornerstone of Dometic's approach, ensuring the creation of advanced solutions for mobile living.

- Digital Transformation: Integrating smart technologies and IoT to enhance product functionality and user experience. This includes features like remote control and connectivity.

- Sustainability Focus: Developing eco-friendly products, such as energy-efficient climate systems, to reduce environmental impact and align with sustainability goals.

- Product Innovation: Regularly launching new products and updating existing ones to meet evolving market demands and maintain a leadership position.

Dometic Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Dometic Group’s Growth Forecast?

The financial outlook for Dometic Group is shaped by its strategic growth initiatives, which are designed to boost shareholder value and ensure sustainable profitability. The company closely monitors financial performance using key metrics such as revenue targets, profit margins, and investment levels. For the first quarter of 2024, the company reported net sales of SEK 5,892 million, reflecting an organic decline of 8% compared to the previous year.

The adjusted EBITA for the same period was SEK 708 million, with an adjusted EBITA margin of 12.0%. Furthermore, Dometic's cash flow from operating activities was SEK 1,029 million, demonstrating strong cash generation. These figures highlight the company's focus on maintaining a healthy financial position while pursuing its growth objectives.

Dometic's financial strategy involves optimizing its product portfolio and expanding into higher-growth segments. The company's focus on aftermarket sales, service, and digital solutions is expected to contribute positively to future financial performance. This approach is detailed further in the article on the Dometic Group's growth strategy.

While specific long-term revenue targets beyond 2024 are not consistently publicized in detail, the company’s strategic focus on aftermarket sales and digital solutions is expected to contribute positively to future financial performance, driving Dometic Group revenue growth.

Dometic aims to improve operational efficiency to achieve its long-term financial goals. The adjusted EBITA margin of 12.0% in Q1 2024 shows a commitment to maintaining and improving profitability. This focus supports the company's overall Dometic future outlook.

The company's financial strategy includes managing its capital structure to support growth initiatives. This includes potential acquisitions and R&D investments, which are crucial for Dometic Group expansion plans.

Strong cash flow from operating activities, as seen in Q1 2024, provides financial flexibility for investments and growth. The SEK 1,029 million generated in cash flow supports Dometic Group investment opportunities and strategic initiatives.

The financial health of Dometic is assessed through various key metrics, reflecting its Dometic financial performance and strategic direction. These metrics are essential for understanding the company's progress and future prospects.

- Net Sales: SEK 5,892 million (Q1 2024)

- Organic Growth: -8% (Q1 2024)

- Adjusted EBITA: SEK 708 million (Q1 2024)

- Adjusted EBITA Margin: 12.0% (Q1 2024)

- Cash Flow from Operating Activities: SEK 1,029 million (Q1 2024)

- Strategic Focus: Aftermarket sales, service, and digital solutions

Dometic Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Dometic Group’s Growth?

The Dometic Group faces several potential risks that could influence its growth strategy and future prospects. These challenges span market dynamics, operational hurdles, and the need for continuous innovation. Understanding these risks is crucial for investors and stakeholders assessing the company's long-term viability.

Dometic Group must navigate a competitive landscape, manage supply chain disruptions, and adapt to technological advancements. The company's ability to proactively address these obstacles will be pivotal in achieving its Dometic future goals. Furthermore, the company's strategic agility will be tested by evolving consumer preferences and regulatory changes.

Market competition is a significant risk factor for Dometic Group. Several players in the mobile living solutions sector compete for market share, which can pressure pricing and profitability. Regulatory changes, especially concerning environmental standards and product safety, require adjustments to product development and manufacturing processes. Supply chain vulnerabilities, as seen in recent global disruptions, pose an ongoing risk to production and delivery schedules. The availability and cost of raw materials, alongside geopolitical events, can also affect operations.

The mobile living solutions market is highly competitive, with numerous companies vying for market share. This competition can lead to price wars and reduced profit margins. Understanding the Dometic Group competitive landscape is essential for evaluating its market position.

Changes in environmental standards and product safety regulations can significantly impact product development and manufacturing costs. Compliance with these regulations is crucial for maintaining market access and avoiding penalties. Adapting to evolving regulatory requirements is essential for Dometic Group.

Global disruptions can severely impact supply chains, leading to production delays and increased costs. The ability to secure raw materials and components is critical for meeting customer demand. Strengthening supply chain resilience is a key priority for Dometic Group.

Rapid technological advancements could render existing products obsolete if Dometic Group fails to innovate. The company must invest in research and development to stay ahead of the curve. Continuous Dometic Group product innovation is vital.

Attracting and retaining skilled talent can be a challenge, potentially hindering growth. Competition for skilled labor is intense in some regions. Investing in employee development and creating a positive work environment is crucial.

Geopolitical instability can disrupt operations, impact supply chains, and affect market demand. Monitoring and adapting to geopolitical risks are essential. The company must be prepared for unforeseen events.

Dometic Group employs a diversified approach, spreading investments across product categories and geographical markets. It utilizes robust risk management frameworks and scenario planning to prepare for potential disruptions. The company's strategic adjustments demonstrate its capacity to adapt to evolving market conditions.

Understanding Dometic Group industry trends is crucial for anticipating future challenges and opportunities. The mobile living solutions market is influenced by factors like consumer preferences, technological advancements, and regulatory changes. Staying informed allows for proactive strategic adjustments.

Analyzing Dometic Group financial performance helps assess its ability to withstand risks. Key metrics like revenue growth, profit margins, and cash flow provide insights into the company's financial health. Monitoring these indicators is vital for investors and stakeholders.

A thorough Dometic Group market analysis includes a competitive analysis, identifying key competitors and their strategies. Understanding the strengths and weaknesses of competitors helps Dometic Group formulate effective strategies. For more information on the competitive landscape, see Competitors Landscape of Dometic Group.

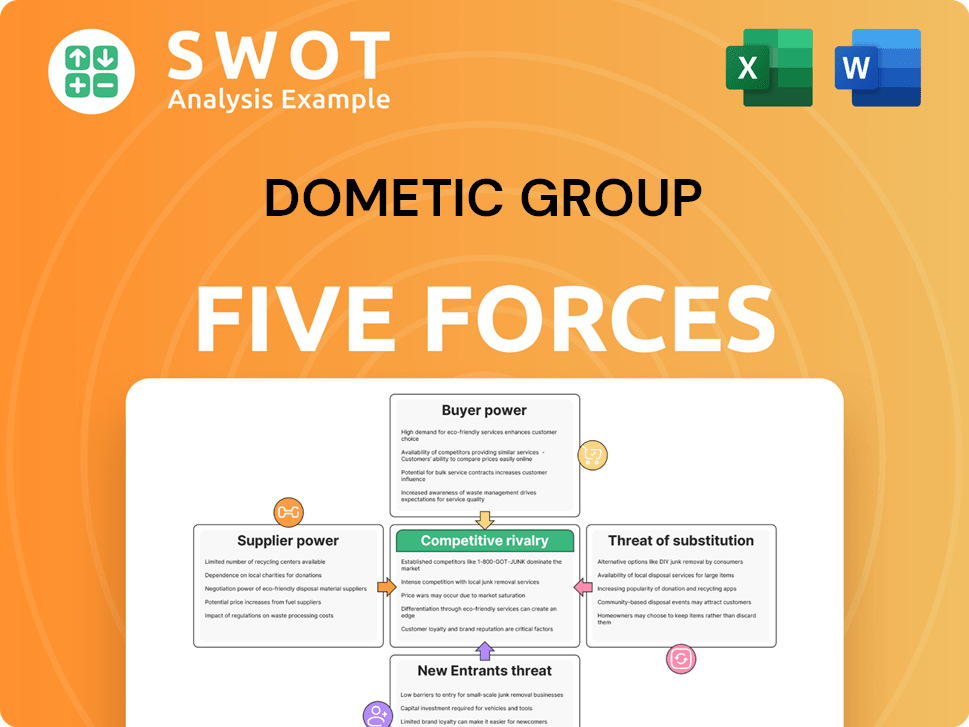

Dometic Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dometic Group Company?

- What is Competitive Landscape of Dometic Group Company?

- How Does Dometic Group Company Work?

- What is Sales and Marketing Strategy of Dometic Group Company?

- What is Brief History of Dometic Group Company?

- Who Owns Dometic Group Company?

- What is Customer Demographics and Target Market of Dometic Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.