Doro Bundle

Can Doro Company Continue to Thrive in the Age of Tech?

Founded in Sweden, Doro has become a European leader by focusing on accessible telecom solutions for seniors. Their commitment to user-friendly mobile phones and services has allowed them to capture a significant market share. But what does the Doro SWOT Analysis reveal about their future?

Doro's Doro growth strategy is crucial, especially given the rising global aging population and the increasing demand for Doro mobile phones tailored for seniors. The Doro company has strategically positioned itself to capitalize on this demographic shift. This article delves into the Doro future prospects, examining their expansion plans, innovation, and strategic planning within the competitive landscape of the mobile phone market, providing a comprehensive Doro market analysis and exploring the Doro business model for sustained growth.

How Is Doro Expanding Its Reach?

The expansion initiatives of the Doro company are primarily focused on reinforcing its leading position in the European market for senior telephony. This includes a strategic broadening of its product portfolio to cater to a wider demographic with special needs. The company is actively pursuing growth by entering new product categories and strengthening its presence in key geographical markets, which is crucial for understanding the Doro growth strategy.

A key component of Doro's expansion involves the development and launch of new product lines. The company is placing significant emphasis on the 'Leva' series of feature phones and the upcoming 'Aurora' range of smartphones. These products are designed to meet evolving consumer needs and comply with eco-directives, reflecting Doro's commitment to innovation and sustainability. For example, the Leva L30 model quickly became the best-selling feature phone in France in December 2024, demonstrating the success of this product-focused expansion.

In terms of international expansion, Doro is particularly focused on the DACH (Germany, Austria, Switzerland) countries. The company is building its own sales organization to strengthen its market penetration in these regions. Doro's products are distributed through a network of approximately 200 telecom operators, distributors, specialists, and retailers, as well as online channels, across more than 20 countries, showcasing the Doro company's extensive reach.

Doro is expanding its product range beyond traditional senior-friendly phones. This includes the 'Leva' series of feature phones and the 'Aurora' range of smartphones. These new product lines are designed to meet the evolving needs of consumers and comply with environmental directives.

The company is focusing on expanding its presence in key geographical markets, particularly the DACH region. Doro is building its own sales organization in these countries to strengthen market penetration. This expansion strategy is crucial for the Doro company's future prospects.

Doro utilizes a comprehensive distribution network. The company's products are sold through approximately 200 telecom operators, distributors, specialists, and retailers. Online channels also play a significant role in reaching consumers across more than 20 countries.

A major development is the acquisition of Doro by Xplora Technologies. Xplora, known for smartwatches for children, aims to enter the senior market. This strategic move is expected to add scale and open new growth avenues.

A significant recent development in Doro's expansion strategy is the acquisition by Norwegian company Xplora Technologies. Xplora, traditionally focused on smartwatches for children, aims to expand into the senior market through this acquisition, valuing the deal at approximately SEK 830 million. As of January 13, 2025, Xplora had secured approximately 88.32% of Doro's shares, with plans to potentially initiate a compulsory buy-out to achieve 100% ownership. This acquisition is a transformative strategic move that adds significant scale and opens new growth avenues, and Xplora intends to begin offering Doro-branded mobile phone connectivity and services across Doro's customer base in the second quarter of 2025. This partnership is expected to broaden the strategic scope of the business and support long-term growth ambitions. Understanding the Mission, Vision & Core Values of Doro can provide further insights into the company's strategic direction and future prospects.

Doro's expansion strategies include product portfolio diversification, geographical market expansion, and strategic acquisitions. These initiatives are designed to strengthen Doro's market position and drive future growth. These strategies are crucial for the Doro mobile phone market future.

- Product Development: Launching new product lines like the Leva and Aurora series to meet evolving consumer needs.

- Market Penetration: Strengthening presence in key markets, particularly the DACH region, through direct sales organizations.

- Strategic Acquisitions: The acquisition by Xplora Technologies to expand into the senior market and leverage synergies.

- Distribution Network: Utilizing a robust network of telecom operators, distributors, and online channels across multiple countries.

Doro SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Doro Invest in Innovation?

The core of the Doro growth strategy centers on understanding and meeting the specific needs of seniors and individuals with special needs. This involves creating technology that is easy to use and enhances their daily lives. The company's focus on accessibility and user-friendliness is a key driver in its market approach.

Doro's customer base values simplicity, safety, and reliability in their mobile phones and related products. They prioritize features that address common challenges faced by seniors, such as hearing loss and the need for emergency assistance. This customer-centric approach is crucial for the Doro company's success.

By continuously innovating and refining its product offerings, Doro aims to maintain its strong position in the market. This includes the development of new features and product lines that cater to the evolving needs of its target demographic, ensuring the company's future prospects.

Doro ClearSound™ enhances sound frequencies, and Doro Secure Button™ provides quick assistance. These features are designed to address the specific needs of seniors, making technology accessible and safe.

The 'Leva' range of feature phones and the 'Aurora' series of smartphones highlight Doro's commitment to innovation. The Leva L30 was the top-selling feature phone in France in December 2024.

The Leva series is designed to be eco-directive compliant, demonstrating Doro's commitment to sustainability. This approach resonates with environmentally conscious consumers.

Doro focuses on premium 4G products within the feature phone category. This strategic choice aligns with the growing value and demand in this segment.

The cooperation with Xplora Technologies is expected to foster further innovation. This partnership expands Doro's digital transformation efforts.

Ongoing investment in development is evident through the continuous product pipeline. Features like 4G capabilities and senior-friendly interfaces are continuously enhanced.

Doro's innovation strategy emphasizes ease of use and accessibility for seniors. Their focus on continuous product development and strategic partnerships supports their Doro growth strategy and future prospects.

- Doro ClearSound™: Acoustic profile to enhance sound frequencies.

- Doro Secure Button™: Provides a quick way to call for assistance.

- Leva Series: Eco-directive compliant feature phones, with the L30 as a top seller in France.

- Aurora Smartphones: Upcoming series with a major marketing campaign.

- Strategic Partnerships: Cooperation with Xplora Technologies for mobile phone connectivity and services.

Doro PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Doro’s Growth Forecast?

The Target Market of Doro is primarily focused on senior citizens and individuals seeking user-friendly mobile technology. This focus is evident in the design and features of their mobile phones, which prioritize simplicity, ease of use, and safety features. This strategic positioning within the mobile phone market allows for a dedicated customer base.

In 2024, the Doro company experienced a mixed financial performance, highlighting the challenges and opportunities within its target market. Despite a decrease in net sales, the company demonstrated strong improvements in profitability margins. This financial performance sets the stage for understanding the Doro growth strategy and future prospects.

The acquisition by Xplora Technologies in early 2025 significantly reshaped the financial outlook for Doro, opening new avenues for growth and integration within the broader market.

For the full year 2024, Doro's net sales were SEK 882.3 million, a decrease of 9.4% compared to SEK 973.6 million in 2023. The gross margin improved to 45.9% (40.1% in 2023). Operating profit (EBIT) increased to SEK 86.6 million, resulting in an operating margin of 9.8% (7.1% in 2023).

Profit after tax reached SEK 86.1 million, up from SEK 32.4 million in 2023. Earnings per share were SEK 3.53, a 165% increase from SEK 1.33 in 2023. Free cash flow for 2024 was SEK 112.3 million.

Q1 2025 saw a return to sales growth, with net sales increasing by 13.2% to SEK 220.3 million. The gross margin further improved to 53.3%. Operating profit (EBIT) for Q1 2025 was SEK 4.4 million.

Analyst forecasts estimate full-year 2025 sales of SEK 921 million, with an EBIT margin around 10%. Long-term gross margins are projected to improve from 43% to 46%, and EBIT margins are expected to reach approximately 13% in a few years.

The Board of Directors proposed no dividend for the 2024 financial year. This decision reflects a focus on reinvestment and strategic growth initiatives.

The acquisition by Xplora Technologies, completed in January 2025, significantly impacts Doro's financial outlook. Xplora reported a 188% year-over-year increase in group revenues to NOK 339 million in Q1 2025.

The integration with Xplora is expected to enhance profitability and open new growth avenues. Plans include developing a recurring revenue base by offering mobile subscriptions and services across Doro's customer base, starting in Q2 2025.

The strategy to introduce mobile subscriptions and services is a key element of the Doro business model, aiming to create a stable and predictable revenue stream. This shift is crucial for long-term financial health.

The acquisition supports Doro's expansion plans by leveraging Xplora's market presence and resources. This expansion is expected to enhance Doro's competitive landscape.

The long-term financial goals include improving gross and EBIT margins. Achieving these goals will be crucial for the Doro company's sustainability initiatives and overall success.

Doro Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Doro’s Growth?

The Doro company faces several potential risks and obstacles as it pursues its growth strategy. These challenges span market dynamics, competitive pressures, regulatory hurdles, and the integration of recent acquisitions. Understanding these risks is crucial for assessing the company's future prospects and its ability to maintain and expand its market position.

One of the primary concerns is the ongoing decline in the feature phone market, a segment historically vital for Doro's sales. While the company is focusing on high-quality 4G feature phones, the long-term trend presents a significant challenge. Additionally, delays in product approvals and launches, such as those experienced with the 'Leva' series, can disrupt sales cycles and negatively impact revenue, particularly during key shopping seasons.

Market competition adds another layer of complexity. While Doro holds a leading position in the European senior phone market, competition from mainstream products and other specialized providers could erode its market share and profitability. Furthermore, regulatory changes, including product safety and compliance standards, demand substantial resources and pose ongoing challenges for Doro and the industry.

The decreasing demand for feature phones poses a significant risk to Doro's revenue. While Doro is focusing on 4G feature phones, the overall market trend remains downward. This requires continuous innovation and adaptation to maintain sales.

Delays in product approvals and launches, like the 'Leva' series, can disrupt sales and impact revenue. Such delays can be particularly damaging during key shopping periods, affecting financial performance.

Competition from mainstream products or other specialized providers can affect Doro's market share and profitability. Maintaining a competitive edge requires continuous innovation and strong brand reputation.

Ever-growing regulations regarding product safety, labeling, and compliance standards demand significant resources. These ongoing challenges require Doro to adapt and invest in compliance measures.

The recent acquisition by Xplora Technologies presents integration challenges. The inability of Xplora to reach 90% ownership as of January 2025 creates uncertainty. Integration of two companies of similar size could lead to unforeseen challenges.

Geopolitical situations and global trade uncertainty pose risks, particularly following the election of a new US president. Supply chain vulnerabilities, although not explicitly detailed for 2024-2025, could impact product availability and costs.

Doro's management addresses risks through strategies like focusing on specific product segments (e.g., 4G feature phones) and maintaining efficient logistics and cost control. The company's commitment to quality aims to minimize return rates, strengthening brand reputation and customer relationships.

The integration of Doro with Xplora Technologies introduces uncertainties. The success of the integration and the realization of synergies will be crucial for future growth. The inability of Xplora to reach 90% ownership as of January 2025 creates uncertainty.

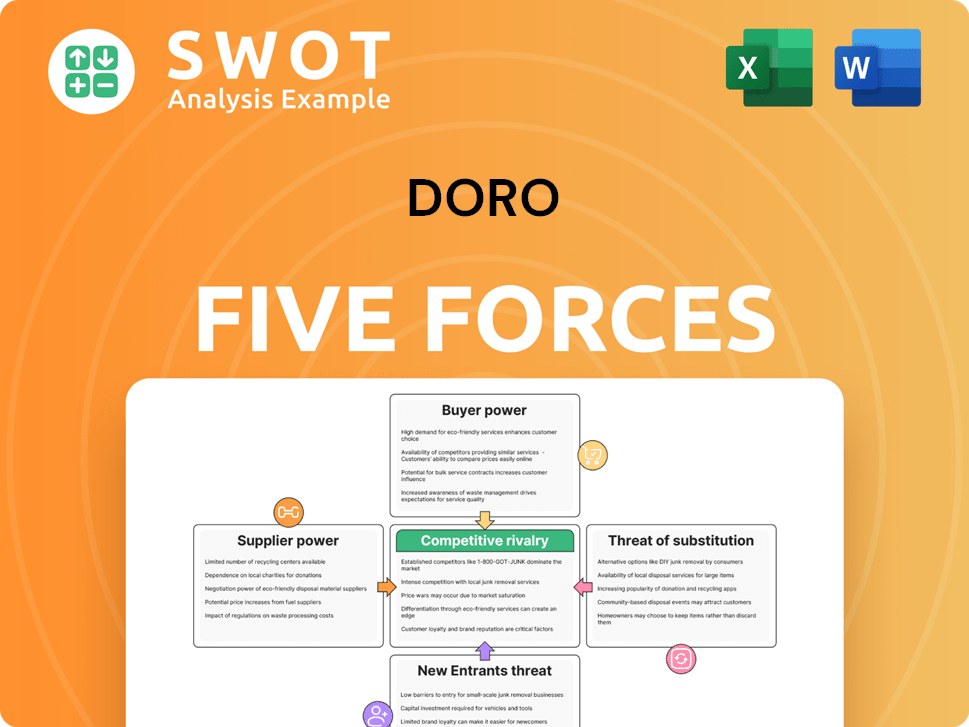

Doro Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Doro Company?

- What is Competitive Landscape of Doro Company?

- How Does Doro Company Work?

- What is Sales and Marketing Strategy of Doro Company?

- What is Brief History of Doro Company?

- Who Owns Doro Company?

- What is Customer Demographics and Target Market of Doro Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.