Eletromidia Bundle

Can Eletromidia Conquer the Future of Brazilian Advertising?

Eletromidia, a leading player in Brazil's out-of-home (OOH) advertising sector, is undergoing a significant transformation. The recent acquisition by Globo, increasing its stake to 74.01% in December 2024, marks a pivotal moment for the Eletromidia SWOT Analysis and its future trajectory. This strategic move, valued at approximately R$ 1.7 billion, signals ambitious plans for growth and market dominance in the dynamic Brazilian advertising market.

Founded in 1993, Eletromidia has evolved into the foremost OOH media owner in Brazil, managing a vast network of digital and static displays that reach millions daily. With over 69,000 panels, 75% of which are digital, the company is well-positioned to capitalize on Digital out-of-home advertising and DOOH market trends. This analysis delves into Eletromidia's growth strategy, future prospects, and its potential to reshape the advertising landscape through innovation and strategic expansion, including its expansion plans 2024.

How Is Eletromidia Expanding Its Reach?

The Eletromidia growth strategy centers on strengthening its presence in key Brazilian urban centers. This involves both organic expansion and strategic acquisitions to boost its digital out-of-home advertising (DOOH) capabilities. The company aims to diversify its advertising reach and capitalize on the evolving Brazilian advertising market.

In 2024, the company significantly increased its advertising panel inventory. This expansion strategy is supported by partnerships and acquisitions, allowing for a broader market reach and enhanced service offerings. These initiatives are designed to drive Eletromidia's future prospects within the competitive landscape.

The company's expansion strategy is designed to capitalize on DOOH market trends and increase its market share. These efforts are geared toward sustained growth and improved financial performance, making the company a key player in the urban advertising sector. For a deeper understanding of the competitive environment, consider exploring the Competitors Landscape of Eletromidia.

In 2024, Eletromidia installed 3,200 new advertising panels. This increased its total inventory to 69,000 units. 75% of these units are digital, reflecting a strong focus on digital advertising solutions.

Eletromidia expanded its operations in established markets like Belo Horizonte. The company also entered new cities, including Recife, Salvador, Fortaleza, and Florianópolis. This geographic diversification is a key element of its growth strategy.

Eletromidia secured a 20-year exclusive contract in Rio de Janeiro. The contract covers urban furniture like bus shelters and informational totems. Operations are scheduled to commence in 2027.

In September 2024, Eletromidia acquired 4 Yousee Digital Signage. This acquisition of its primary supplier is expected to achieve scale and reduce costs. This move is aimed at consolidating its market position and expanding its inventory.

In May 2025, Publibanca Brasil S.A., an affiliate of Eletromidia, agreed to acquire Clear Channel Outdoor Holdings, Inc.'s business in Brazil for about R$80 million ($14 million), subject to regulatory approval. This acquisition is designed to increase market share and inventory.

- Through a partnership with Tembici, Eletromidia expanded its urban advertising reach to four additional capitals, including Curitiba and Porto Alegre.

- These initiatives reflect the company’s commitment to expanding its presence in the Brazilian advertising market.

- These strategic moves are critical for achieving Eletromidia's future prospects and enhancing its digital signage solutions.

- The focus on both organic growth and strategic acquisitions highlights Eletromidia's comprehensive approach to the DOOH market trends.

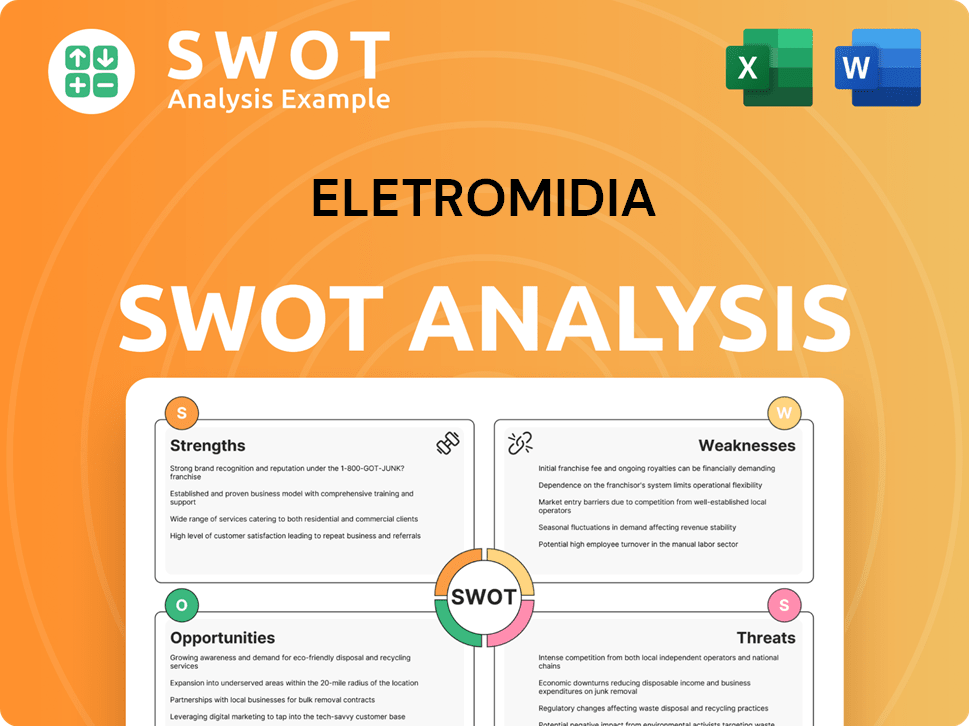

Eletromidia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Eletromidia Invest in Innovation?

The company is focused on leveraging technology and innovation to drive sustained growth, particularly through digital transformation and data-driven advertising solutions. This approach is central to its Eletromidia growth strategy, positioning it as a leader in the evolving digital out-of-home advertising (DOOH) landscape.

A key aspect of this strategy involves modernizing its portfolio. By the end of 2024, 75% of its 69,000 panels are projected to be digital, a significant advantage in the Brazilian advertising market. This shift from static billboards to digital panels underscores the company's commitment to innovation.

The company's success is significantly attributed to its investments in technologies such as artificial intelligence and data-driven advertising solutions. This data-driven approach allows for better insights and seamless ad customization, setting it apart from competitors. This focus is critical for understanding DOOH market trends and adapting to the changing needs of advertisers and consumers.

The company's digital transformation is a core element of its strategy. It invests in technologies like AI and data analytics to offer enhanced advertising solutions. This allows for more effective targeting and customization, which is crucial for attracting and retaining clients. This focus on data is essential for Eletromidia's future prospects.

- Digital Panel Dominance: Approximately 84% of Brazil's digital OOH advertising inventory is owned by the company, giving it a significant market advantage.

- Data-Driven Advertising: Solutions are tailored for small businesses, offering superior data, insights, and ad customization compared to static options.

- Strategic Partnerships: A collaboration with Hivestack by Perion in February 2024 made 46,000 displays available to advertisers, enhancing programmatic OOH capabilities.

- Programmatic OOH: The Hivestack partnership enables automated buying and targeting, streamlining the advertising process.

The company's innovative approach is also evident in its projects. The 'Guarded Bus Stop' project, developed with AlmapBBDO, won the 2024 'Chair of Judges Award' from the World Out of Home Organization. This project, which transforms bus shelters into secure havens with cameras, microphones, and internet connectivity, also received a Gold Lion at the Cannes Lions International Festival of Creativity. These initiatives highlight the company's commitment to innovation and its positive impact on urban environments. For more insights, you can read an article about the company's strategy and performance on [Eletromidia's Strategic Initiatives](https://example.com/eletromidia-strategy).

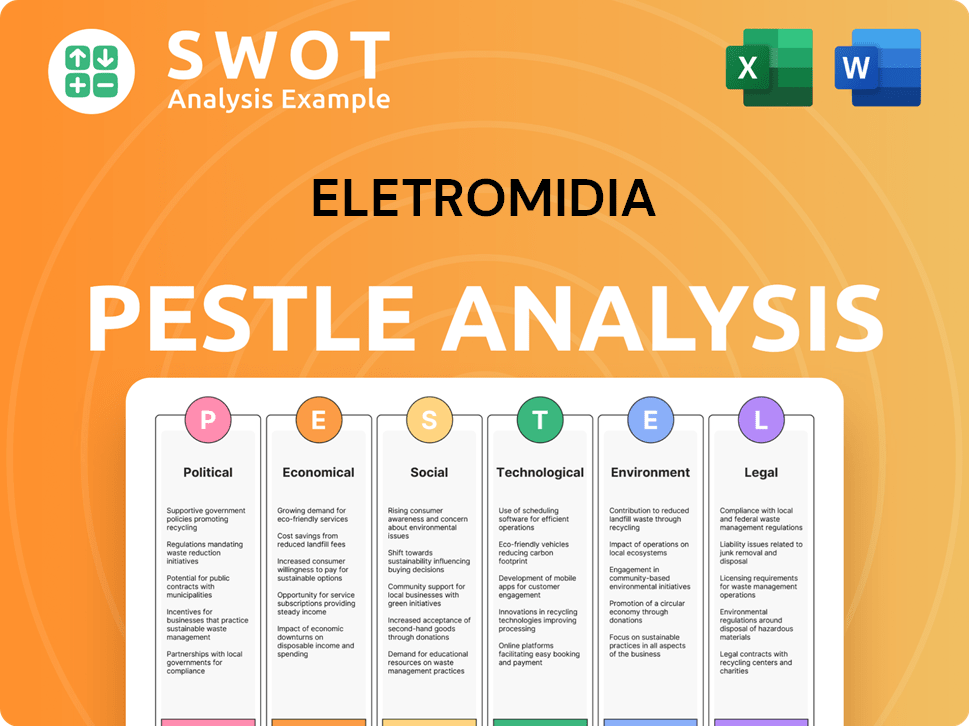

Eletromidia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Eletromidia’s Growth Forecast?

The financial landscape for Eletromidia reflects significant shifts and strategic moves. The company's 2024 performance indicates robust growth, driven by its expansion efforts in the digital out-of-home advertising sector. Understanding the financial trajectory of Eletromidia is crucial for assessing its future prospects and investment potential, especially within the dynamic Brazilian advertising market.

Eletromidia's financial strategy involves significant investments and acquisitions, which are reshaping its financial structure. The acquisition by Globo and the subsequent delisting from the stock exchange mark a pivotal moment. This chapter provides an in-depth analysis of Eletromidia's financial performance, including revenue, profitability, and debt, offering insights into its current position and future direction.

For a deeper dive into the company's origins and evolution, consider reading the Brief History of Eletromidia.

Eletromidia's revenue surged by 26.5% in 2024, reaching R$1.19 billion ($209 million). This growth highlights the company's strong performance in the digital out-of-home advertising market. The increase demonstrates the effectiveness of its expansion plans and market strategies.

Despite revenue growth, the adjusted net profit for Q4 2024 decreased by 1.5% year-over-year to R$92.05 million ($16 million). This decline was primarily due to a 62.5% increase in operational expenses, totaling R$100.3 million ($18 million), linked to expansion initiatives. This highlights the challenges of balancing growth with profitability.

Eletromidia raised R$500 million ($88 million) through debenture issuance to fund projects. This led to a rise in gross debt to R$1.36 billion ($239 million) by the end of 2024, up from R$995 million ($175 million) in 2023. This increase in debt reflects the company's aggressive growth strategy.

Globo acquired a 74.01% stake in Eletromidia in December 2024 for approximately R$1.7 billion ($298 million). The remaining 25% stake will be acquired in 2025 through a public offering valued at R$1.2 billion. Eletromidia plans to delist from the B3 stock exchange after regulatory approval on March 26, 2025.

The Brazilian OOH and DOOH market is estimated at USD 501.58 million in 2025. It is projected to reach USD 614.96 million by 2030, with a CAGR of 4.16%. This growth indicates a positive environment for companies like Eletromidia, which are well-positioned to capitalize on these trends.

- The delisting and acquisition by Globo are significant strategic moves.

- The company's focus on digital signage solutions is key.

- Understanding the competitive landscape is vital for investment decisions.

- Market analysis reveals opportunities in the Brazilian advertising market.

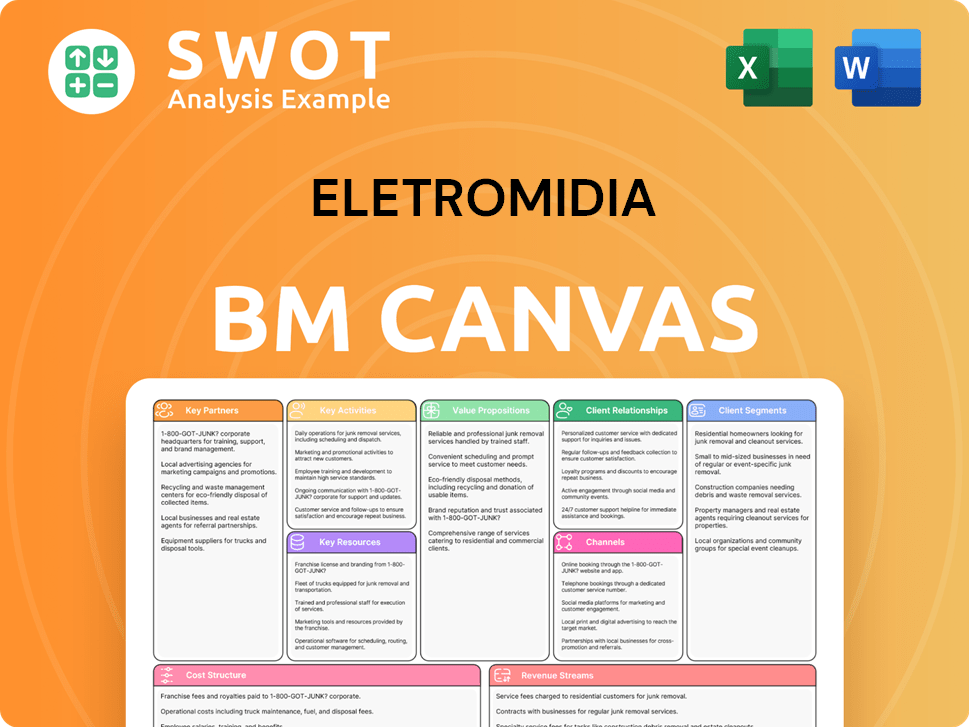

Eletromidia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Eletromidia’s Growth?

The success of the Marketing Strategy of Eletromidia is not without its hurdles. Several risks and obstacles could affect its growth plans. These challenges range from market competition and regulatory changes to technological disruptions.

One significant challenge comes from competitors in the Brazilian advertising market. The increasing adoption of programmatic Digital out-of-home advertising (DOOH) is intensifying competition, attracting new players and making it crucial for Eletromidia to maintain its market position. The company must continuously innovate and adapt to stay ahead.

Furthermore, regulatory changes pose another potential obstacle. The advertising industry is subject to evolving regulations, such as those from Anvisa and Conar. Compliance with these changes and any new restrictions could impact Eletromidia's operations and require adjustments to advertising campaigns.

The Brazilian advertising market is competitive, with major players like Central de Outdoor, Clear Channel IP LLC, and JCDecaux Brazil. The DOOH market trends show a rise in programmatic advertising, attracting new entrants and intensifying competition for Eletromidia's market share.

The regulatory landscape in Brazil is evolving. New resolutions from Anvisa, and Conar's focus on online advertising and AI, may introduce compliance requirements. Conar's scrutiny, like the over 60 representations against betting advertising in 2024, highlights the importance of adapting to new rules.

The advertising industry is rapidly evolving. The speed of technological advancements and new channels could shift market dynamics. Eletromidia's investments in digital transformation and AI are crucial, but supply chain vulnerabilities could impact display component availability and costs.

Although not explicitly detailed for Eletromidia, supply chain issues can affect the availability and cost of components for digital displays and infrastructure. These vulnerabilities can impact the company's operational efficiency and expansion plans.

Eletromidia addresses these risks through strategic acquisitions and geographic expansion. The purchase of 4yousee to integrate CMS and analytics capabilities is a key move. Focusing on platforms for small and medium-sized businesses is another strategy.

Despite rising operational costs tied to expansion, Eletromidia's strong profitability indicates effective risk management. This financial stability is crucial for navigating market challenges and ensuring sustained Eletromidia growth strategy in the Brazilian advertising market.

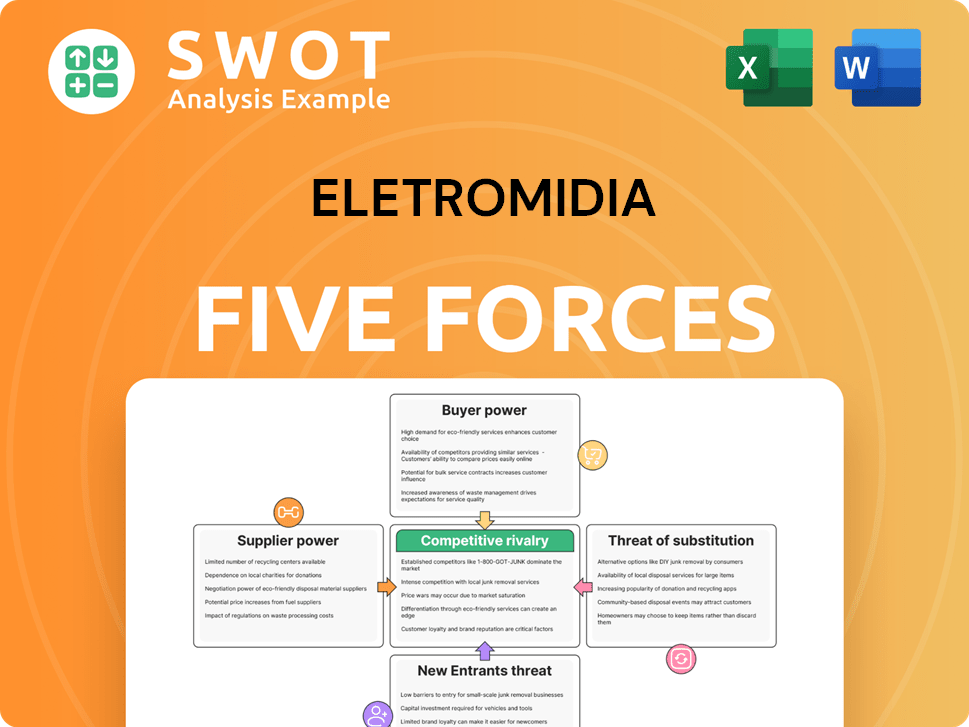

Eletromidia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eletromidia Company?

- What is Competitive Landscape of Eletromidia Company?

- How Does Eletromidia Company Work?

- What is Sales and Marketing Strategy of Eletromidia Company?

- What is Brief History of Eletromidia Company?

- Who Owns Eletromidia Company?

- What is Customer Demographics and Target Market of Eletromidia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.