Eurotech Bundle

Can Eurotech Maintain Its Edge in the IoT Revolution?

Founded in 1992, Eurotech has become a key player in the embedded computing and Internet of Things (IoT) landscape. From its origins in industrial automation, the company has evolved to offer comprehensive hardware, software, and services for edge computing and IoT applications. Its strategic moves, including a successful IPO, have defined its path, but what does the future hold?

This Eurotech SWOT Analysis will delve into Eurotech's growth strategy and future prospects, examining its market position and business model within the context of the rapidly changing tech industry. We'll explore how Eurotech plans to expand its market share, analyzing its financial performance and the potential impact of its strategic partnerships. Understanding Eurotech's challenges and opportunities is crucial for anyone looking to make informed decisions in the tech sector.

How Is Eurotech Expanding Its Reach?

The growth strategy of Eurotech centers on expanding into new markets, launching innovative products, and strategically acquiring businesses. This approach aims to diversify revenue streams and broaden its customer base. A key element of their plan involves targeting markets with significant size and high Compound Annual Growth Rates (CAGR) over the next five years, which is crucial for the company's future prospects.

Eurotech's business model is evolving to capitalize on emerging opportunities. They are focusing on regions with strong growth potential, such as the U.S. and the Middle East. These geographical expansions are supported by product innovations and strategic acquisitions, aiming to strengthen Eurotech's market position in the tech industry.

The company's financial performance is being driven by these strategic initiatives. Recent investments and acquisitions are designed to enhance Eurotech's competitive advantages and drive long-term revenue growth. These moves are expected to contribute to a positive outlook for Eurotech's stock performance.

Eurotech is reorganizing its operations in the U.S. to develop its Edge AIoT business. This includes exploring potential mergers and acquisitions. In the Middle East, EuroTech ME anticipates at least a 50% overall business growth in 2024.

In November 2024, Eurotech launched the ReliaGATE 15A-14, a cybersecurity-certified modular edge gateway. In September 2024, they introduced new generative AI servers optimized for NVIDIA AI Enterprise. Everyware GreenEdge was launched in May 2024.

Following the acquisition of InoNet Computer GmbH in Germany in September 2022, Eurotech is seeking a similar acquisition in the U.S. The target companies have revenues between €15-20 million. Funding includes a €2.5 million capital injection in September 2024.

The controlling shareholder, Emera, pledged €6.0 million in January 2025. These financial commitments support Eurotech's expansion initiatives. The company's focus on strategic acquisitions and product innovation is expected to enhance its market share.

Eurotech's strategic moves, including geographical expansion, product launches, and mergers and acquisitions, are designed to drive growth and strengthen its position in the tech industry. The company's commitment to innovation and strategic investment, such as the recent capital increases, are key to its future prospects. This approach is expected to enhance Eurotech's financial performance and competitive advantages.

Eurotech's expansion strategy is multifaceted, focusing on geographical growth, product innovation, and strategic acquisitions to drive revenue and market share. These initiatives are supported by significant financial investments and strategic partnerships.

- Reorganizing U.S. operations for Edge AIoT and considering M&A.

- Expanding in the Middle East, with EuroTech ME aiming for 50% growth in 2024.

- Launching innovative products like the ReliaGATE 15A-14 and generative AI servers.

- Pursuing acquisitions, such as a potential U.S. acquisition, to expand market access.

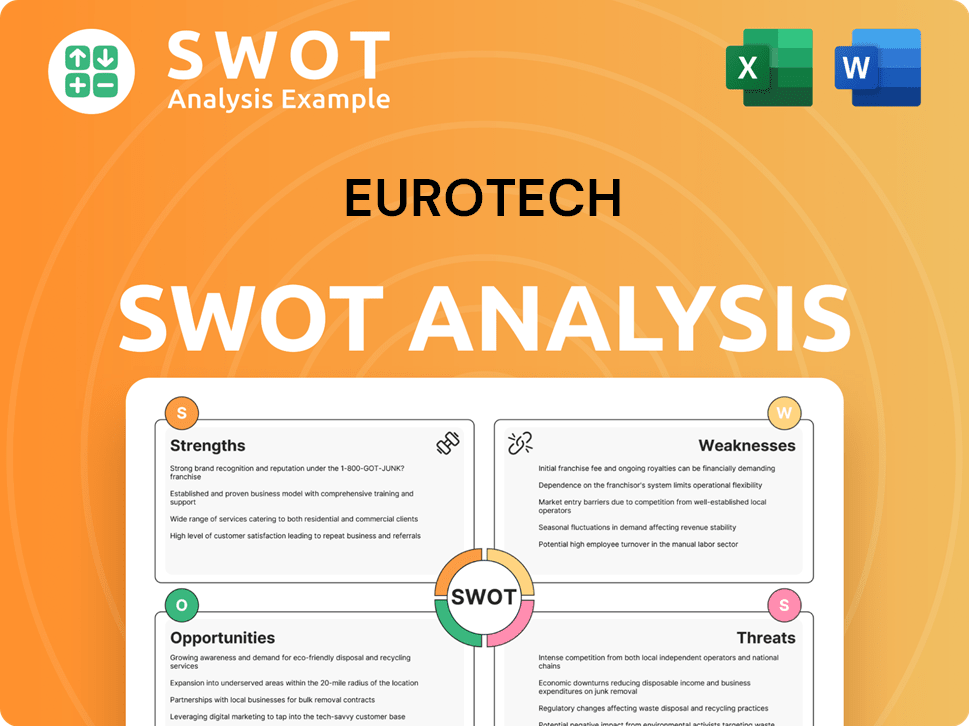

Eurotech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Eurotech Invest in Innovation?

The innovation and technology strategy of Eurotech is a core element of its Eurotech growth strategy, focusing on advanced technologies and strategic partnerships. The company is heavily invested in research and development to maintain its leadership in embedded computing and IoT solutions. This approach is essential for shaping the Eurotech future prospects.

A significant part of Eurotech's strategy involves leveraging advancements in Artificial Intelligence (AI) and the Internet of Things (IoT). This focus is crucial for the company's Eurotech market position and its ability to capture new opportunities in the tech industry. The company's strategic initiatives are designed to drive innovation and enhance its competitive advantages.

Eurotech's commitment to digital transformation and automation is evident in its product design, which emphasizes ruggedness and reliability for industrial and embedded applications. This approach supports their Eurotech business model by ensuring products meet the demands of long-lifecycle applications. The company's focus on innovation is key to its Eurotech company analysis.

In September 2024, Eurotech launched a comprehensive lineup of generative AI servers. These servers are designed to function as complete platforms, supporting various generative AI models, including large language models (LLMs).

The servers are optimized for NVIDIA AI Enterprise, including NVIDIA NIM and NVIDIA Metropolis. This optimization enables efficient inference for a wide array of popular AI models. This allows for the development of intelligent chatbots, advanced copilots, and visual AI agents.

By enabling organizations to leverage generative AI, Eurotech aims to enhance productivity and provide secure, in-house data knowledge bases. This approach offers cost savings compared to cloud-based alternatives, which is a key aspect of their customer acquisition strategies.

In November 2024, Eurotech launched the ReliaGATE 15A-14, the industry's first cybersecurity-certified modular edge gateway. This product addresses the growing demand for secure, flexible, and globally deployable IoT solutions.

The ReliaGATE 15A-14 simplifies compliance with regional and carrier certifications. It provides native support for field asset integration, streamlining the deployment process for IoT solutions. This is crucial for Eurotech's expansion into new markets.

Eurotech is committed to providing environmentally friendly solutions to support its customers' sustainability goals. This commitment is reflected in certifications such as ISO 14001. This is a key part of Eurotech's sustainability initiatives and goals.

Eurotech's portfolio includes embedded boards and modules, such as COM Express, Single Board Computers (SBC), VME, CompactPCI, and PC/104, based on various CPU architectures. Their integrated hardware and software solutions, along with their edge hardware, software, and AI appliance, are designed to enable asset monitoring and high-performance edge computing for AI applications. This focus is critical for their Eurotech growth strategy in the tech industry.

- AI and IoT Integration: Focus on AI and IoT solutions for asset monitoring and high-performance edge computing.

- Edge Computing: Development of edge hardware, software, and AI appliances.

- Everyware GreenEdge Software: Launched in May 2024, this software addresses challenges in onboarding and managing edge IoT devices, enabling seamless connection to Amazon Web Services (AWS).

- Digital Transformation: Eurotech's approach to digital transformation is highlighted by the Everyware GreenEdge software.

- Strategic Partnerships: Eurotech's collaborations are essential to its strategic partnerships and alliances.

The EuroTech Universities Alliance, of which Eurotech is a part, has a roadmap until 2025 that includes initiatives in areas like Sustainable Society, Artificial Intelligence for Engineering Systems, and Additive Manufacturing. These initiatives promote the United Nations Sustainable Development Goals and contribute to Europe's digital sovereignty. For more information about the company's financial performance, you can read about the Owners & Shareholders of Eurotech.

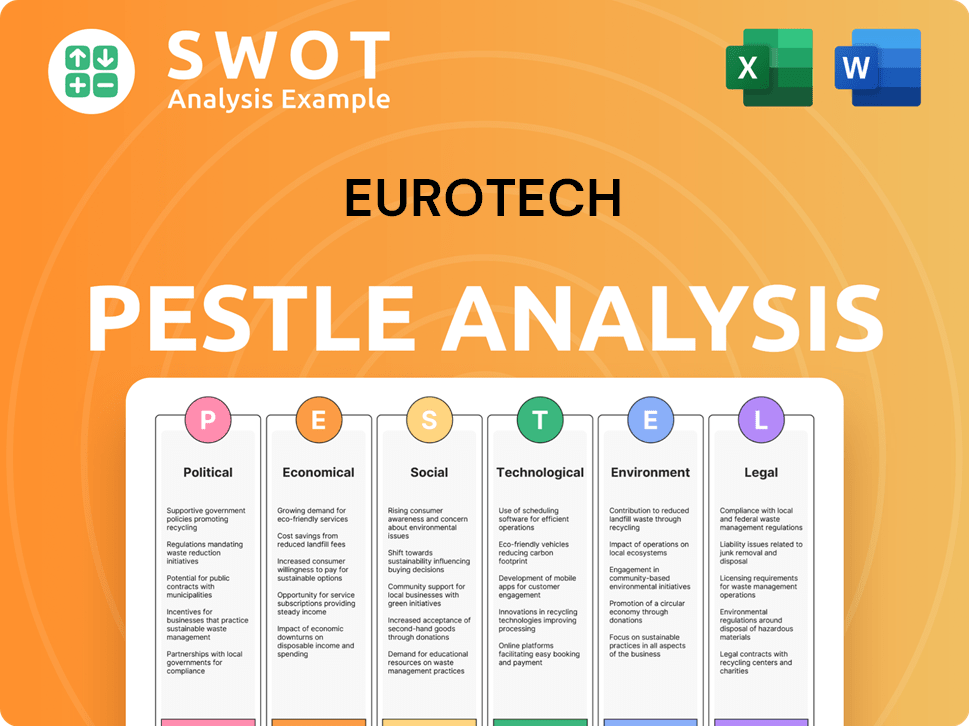

Eurotech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Eurotech’s Growth Forecast?

The Brief History of Eurotech reveals that the company's financial outlook reflects a challenging period. The year 2024 saw a significant downturn, impacting both revenues and profitability. This situation underscores the need for a robust Eurotech growth strategy to navigate current market dynamics and secure future prospects.

In 2024, Eurotech's financial performance was notably affected by a slowdown in the industrial sector and the departure of a major US customer. These factors contributed to a substantial decrease in revenue and a shift from profit to loss. The company's ability to adapt and implement effective strategies will be crucial for its recovery.

Despite these setbacks, Eurotech has shown resilience. The focus on cost reduction and an improved gross profit margin in 2024 provide some positive indicators. The company's strategic initiatives and the financial support from its controlling shareholder are vital for achieving sustainable growth and improving its market position.

Consolidated revenues for 2024 were €59.1 million, a 35.7% decrease at constant exchange rates compared to €93.8 million in 2023. The net loss was €36.2 million, a significant drop from a net loss of €3.1 million in the previous year. Consolidated EBITDA was €-5.0 million, down from €+5.3 million in 2023, reflecting the impact of market challenges on Eurotech's business model.

The net financial position as of December 31, 2024, showed a net debt of €20.4 million, relatively stable compared to €20.6 million in 2023. Shareholders' equity decreased to €63.71 million at the end of 2024 from €113.33 million at the end of 2023 due to write-downs. This highlights challenges in Eurotech's financial performance over the last 5 years.

Gross profit improved to 50.7% of revenues in 2024, up from 47.4% in 2023, indicating a favorable product mix. Operating costs were reduced by €5.1 million compared to 2023, net of non-recurring costs. This demonstrates Eurotech's ability to manage costs and improve efficiency despite revenue declines.

Analysts anticipate a final loss in 2025 before achieving positive profits of €115,000 in 2026, requiring an optimistic average annual growth rate of 128%. Emera, the controlling shareholder, has pledged financial support, including €2.5 million injected in September 2024 and €6.0 million pledged in January 2025. This is crucial for Eurotech's expansion into new markets.

Here are the key financial highlights:

- 35.7% decrease in revenues in 2024.

- Net loss of €36.2 million in 2024.

- Gross profit margin improved to 50.7%.

- Net debt of €20.4 million as of December 31, 2024.

- Anticipated profit of €115,000 in 2026.

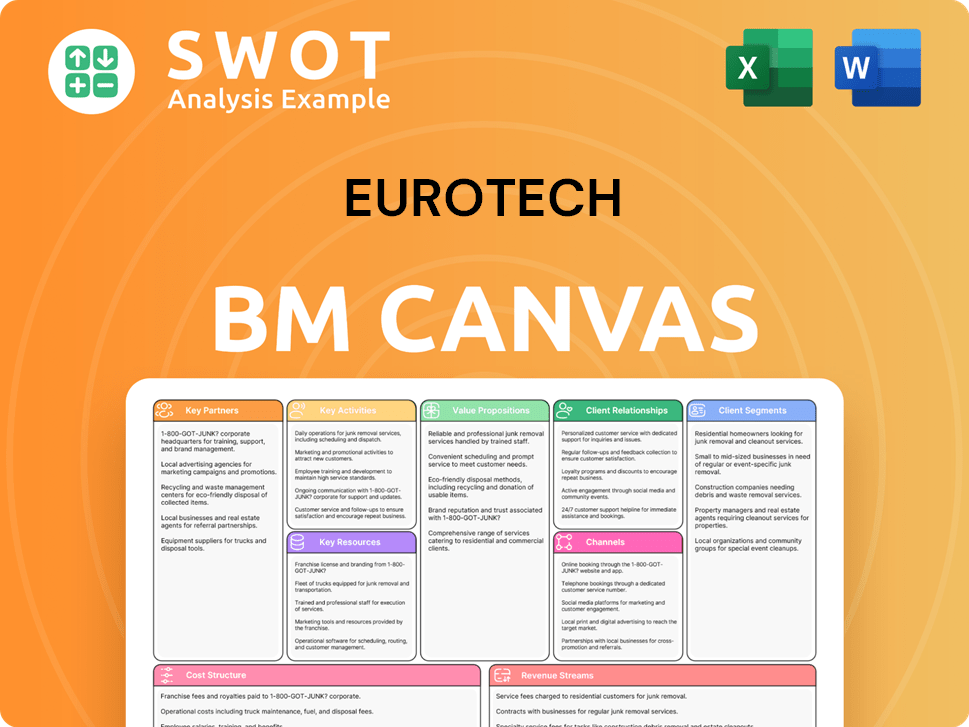

Eurotech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Eurotech’s Growth?

The path to growth for the company, faces several potential risks and obstacles. These challenges span market dynamics, operational vulnerabilities, and the need for continuous adaptation in a rapidly evolving technological landscape. Successfully navigating these hurdles is crucial for realizing its ambitious growth plans and maintaining its market position.

The company's ability to execute its growth strategy is influenced by its response to these challenges. Proactive risk management, strategic investments, and a focus on innovation will be essential. Understanding and addressing these potential obstacles is key to ensuring a sustainable and successful future.

The company's future prospects depend on its ability to overcome these challenges. The competitive environment, technological advancements, and regulatory changes all pose significant risks. The company's strategic initiatives and financial performance over the last 5 years will be crucial in navigating these complexities.

Intense competition in the embedded computing, edge AI, and IoT solutions sectors poses a significant challenge. The company must continually innovate and differentiate its offerings to maintain its market position. Understanding the Competitors Landscape of Eurotech is crucial.

The company's financial results in 2024 were affected by a slowdown in the industrial sector and the loss of a major customer. This highlights the risk of economic downturns in key industrial segments. The company’s financial performance is vulnerable to broader economic trends.

Supply chain disruptions, due to geopolitical events or natural disasters, could impact production and delivery. While good practices in component sourcing helped in 2024, the global nature of supply chains remains a risk. The company must manage supply chain risks effectively.

The rapid pace of technological innovation requires continuous investment in R&D to avoid obsolescence. Integrating new technologies like AI, IoT, and sustainability initiatives demands significant resources. The company must adapt to technological changes.

Evolving cybersecurity regulations, such as the US IoT Cybersecurity Improvement Act and EU's NIS2, require ongoing investment and adaptation. Compliance with these regulations is becoming increasingly important. The company must stay compliant with regulatory changes.

The need for skilled personnel and other internal resources can hinder growth. The company plans to double its employees in Saudi Arabia in 2024. Talent development and resource management are critical for growth.

The company focuses on diversifying its customer base and product offerings. This strategy includes higher-margin products and new engineering activities in Japan, expected to support growth in 2026 and 2027. Diversification is a key strategy for mitigating risks.

The company is pursuing mergers and acquisitions in the US to gain market access and potentially a 'made in USA' fabrication facility. This strategic move aims to mitigate risks and accelerate growth. M&A activity is a key part of the growth strategy.

Financial support from its controlling shareholder, Emera, provides a buffer against short-term market weaknesses. This support allows the management team to focus on strategy execution. Financial stability is crucial for navigating challenges.

The company experienced a 35.7% decline in consolidated revenues at constant exchange rates in 2024 compared to 2023. This decline underscores the importance of addressing market challenges. The financial impact highlights the urgency of risk management.

Eurotech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eurotech Company?

- What is Competitive Landscape of Eurotech Company?

- How Does Eurotech Company Work?

- What is Sales and Marketing Strategy of Eurotech Company?

- What is Brief History of Eurotech Company?

- Who Owns Eurotech Company?

- What is Customer Demographics and Target Market of Eurotech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.