Exel Industries Bundle

What's Next for Exel Industries?

From its humble beginnings in 1946, Exel Industries has blossomed into a global force, and its journey is far from over. This analysis dives into the core of Exel Industries SWOT Analysis to uncover the strategies fueling its expansion and the innovative approaches shaping its future. We'll explore how this French family-owned group plans to navigate the complexities of the global market.

Understanding Exel Industries' growth strategy is crucial for anyone assessing its company prospects. This exploration will examine the company's strategic acquisitions, market analysis, and financial performance, providing insights into its long-term goals and investment opportunities. Furthermore, we will investigate Exel Industries' business model and competitive landscape to understand its position in the industry trends and how it plans to overcome challenges and opportunities in the future.

How Is Exel Industries Expanding Its Reach?

EXEL Industries is actively pursuing several expansion initiatives to drive future growth, focusing on market penetration, product diversification, and operational optimization. These efforts are crucial for the company's long-term success, especially in a dynamic market environment. The company's strategic approach involves a multi-faceted strategy to enhance its position across various segments.

The company's expansion plans are designed to capitalize on emerging opportunities and mitigate potential risks. By focusing on key areas such as agricultural spraying, leisure activities, and industrial applications, EXEL Industries aims to strengthen its market presence and improve its financial performance. These initiatives are supported by investments in innovation, sustainability, and operational efficiency.

In agricultural spraying, EXEL Industries is seeing signs of recovery, particularly in Europe and large-scale crop markets. Despite challenges in North America due to economic uncertainty, sales in Europe are showing slight increases. The company is also prioritizing the development of its after-sales activity in 2025 with enriched services to better support customers. This focus on customer service and support is part of the company's broader business strategy.

Recovery signs are appearing in Europe and large-scale crop markets. Sales in Europe are showing slight increases. After-sales activity is a priority for 2025, with enriched services. The company is adapting to market dynamics.

Garden activity sales are holding up well. Encouraging outlook for the rest of 2025. Satisfactory order intake levels and lower distributor inventory. The company is focused on this segment.

Industrial spraying sales are dynamic in Europe and North America, with a slowdown anticipated in Asia. The company is developing and modernizing its plants. A new Sames plant in Stains, France, is under construction as part of a €20 million project for 2024–2025.

- Focus on expanding product ranges, such as increasing the proportion of recycled PVC in technical hoses.

- Commitment to innovation and sustainability.

- Strategic investments in new facilities and technologies.

- Continuous improvement of operational efficiency.

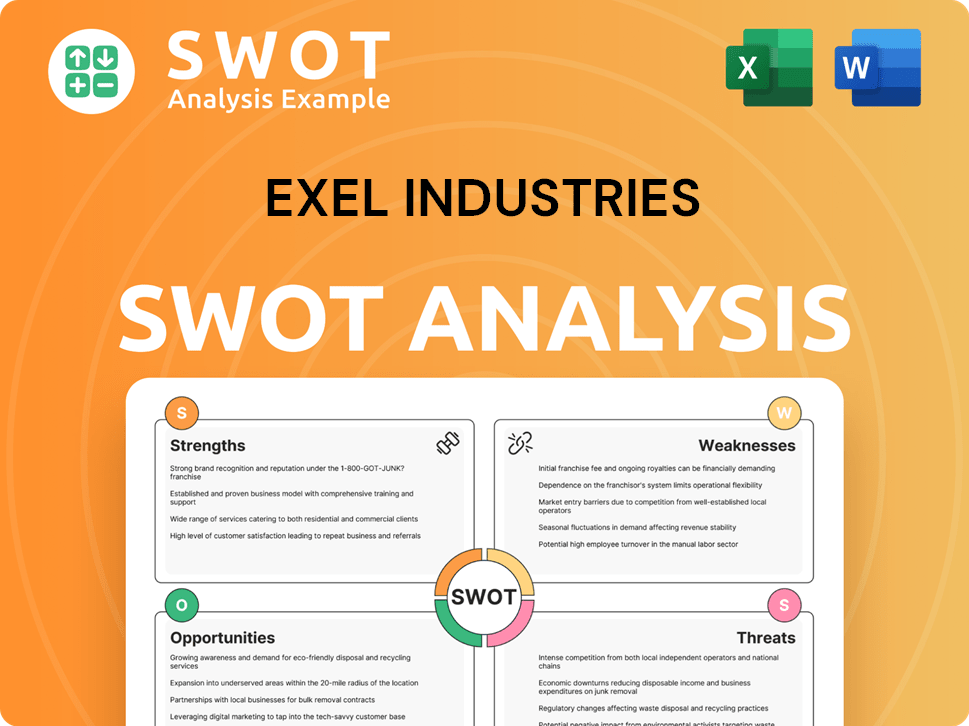

Exel Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Exel Industries Invest in Innovation?

Innovation and technology are central to the long-term Exel Industries brief history and its growth strategy. The company consistently leverages technology to develop unique, efficient, and user-friendly products. This commitment to innovation has been a key factor in its success for over seven decades.

The company's focus on innovation extends across various aspects of its operations, including digital transformation and sustainability. This comprehensive approach ensures that Exel Industries remains competitive and responsive to market demands. By integrating these elements, the company aims to secure its position in the market and foster sustainable growth.

Exel Industries actively participates in industry trade fairs, such as PotatoEurope 2024 and Vinitech-Sifel, to showcase its solutions and engage with key stakeholders. This presence allows the company to promote its products and gather valuable feedback. These events provide opportunities to highlight its latest innovations and strengthen relationships within the industry.

Exel Industries is upgrading its ERP systems to streamline operations and improve efficiency. This digital transformation supports better data management and decision-making. The upgrade is part of a broader strategy to modernize its technological infrastructure.

The company recently presented the Auto Reel Mobile Hozelock, a new hose reel with automatic rewinding and enhanced mobility. This product exemplifies Exel Industries' commitment to developing user-friendly solutions. The Auto Reel Mobile Hozelock is designed to meet evolving customer needs.

Exel Industries is increasing the use of recycled PVC in its technical hoses to reduce its environmental footprint. This initiative aligns with the company's sustainability goals and regulatory requirements. The focus on sustainability is a key element of its long-term strategy.

The company dynamically registers patents to protect its innovations and maintain a competitive edge. This proactive approach ensures that Exel Industries can safeguard its intellectual property. Patent registration is crucial for its long-term business strategy.

Exel Industries is preparing for CSRD (Corporate Sustainability Reporting Directive) and SBTi (Science Based Targets initiative) certification. These certifications demonstrate its commitment to environmental sustainability. Achieving these certifications will enhance its reputation.

Exel Industries actively participates in industry trade fairs, such as PotatoEurope 2024, the Livestock Summit, Dionysud, and Vinitech-Sifel. These events provide platforms to showcase its solutions and engage with key industry players. Participation in trade fairs supports its market presence.

Exel Industries' technological and innovation strategies are designed to drive sustainable growth, enhance operational efficiency, and meet evolving market demands. These strategies are critical for maintaining a competitive advantage in the industry. The company's focus on digital transformation, product innovation, and sustainability initiatives underscores its commitment to long-term success.

- Digital Transformation: Upgrading ERP systems to improve data management and streamline operations.

- Product Innovation: Developing new products like the Auto Reel Mobile Hozelock to meet customer needs.

- Sustainability: Increasing the use of recycled materials and pursuing certifications like CSRD and SBTi.

- Market Engagement: Participating in trade fairs to showcase solutions and engage with stakeholders.

- Intellectual Property: Dynamically registering patents to protect innovations.

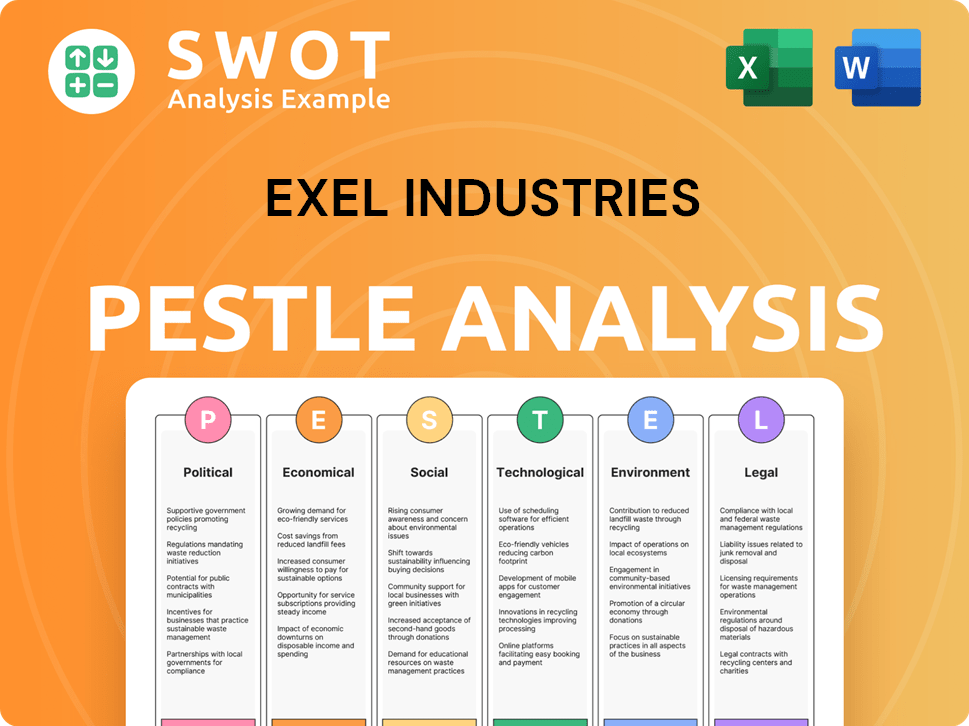

Exel Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Exel Industries’s Growth Forecast?

The financial outlook for EXEL Industries reflects a period of strategic adjustment and resilience. In the first half of the 2024–2025 fiscal year, the company faced a 10.0% decrease in revenue, totaling €443.4 million, primarily due to reduced volumes in agricultural spraying. Despite this, other areas of the business demonstrated stability or growth, indicating a diversified approach to revenue generation. The company is actively managing its financial health through cost-cutting measures and debt reduction strategies.

Recurring EBITDA for the first half of 2024–2025 was €20.3 million, representing 4.6% of revenue, a decrease from 6.2% in the previous year. This reflects the impact of the challenging economic environment and the company's focus on financial prudence. Net income for the same period was positive at €1.5 million, though lower than the €4.7 million recorded in the first half of 2023–2024. These figures highlight the company's ability to maintain profitability amidst headwinds.

EXEL Industries has shown significant progress in reducing its net financial debt, which stood at €174.5 million as of March 31, 2025. This represents a €38 million improvement compared to the first half of 2024, showcasing effective management of working capital requirements and inventory levels. The company's commitment to investment continues, with capital expenditures of €15.6 million, including the construction of a new Sames plant. For the full fiscal year 2023-2024, EXEL Industries maintained its revenue at €1.1 billion, with a recurring EBITDA of €87.4 million (7.9% margin) and net income of €31.2 million. Analysts forecast 2025 revenues to be approximately €1.04 billion.

In the first half of the 2024–2025 fiscal year, revenue decreased by 10.0% to €443.4 million. This decline was primarily due to lower volumes in agricultural spraying. Other activities remained stable or showed growth, indicating diversification within the business. The company is focused on navigating the current economic challenges.

Recurring EBITDA for the first half of 2024–2025 was €20.3 million, representing 4.6% of revenue. This is a decrease from the previous year's 6.2%. The company implemented cost-cutting measures to manage profitability. Net income for the period was €1.5 million.

Net financial debt significantly improved, standing at €174.5 million as of March 31, 2025, a €38 million improvement. This was achieved through optimizing working capital requirements and reducing inventory levels. The company's financial health is a key focus.

Capital expenditures amounted to €15.6 million, including the construction of a new Sames plant. The company is committed to its investment policy. Analysts forecast 2025 revenues to be approximately €1.04 billion, indicating a positive outlook for the future.

The financial performance of EXEL Industries reflects a strategic approach to navigating economic challenges. The company is focusing on debt reduction, cost management, and strategic investments. The following points summarize key financial aspects:

- Revenue decrease of 10.0% in H1 2024–2025 to €443.4 million.

- Recurring EBITDA of €20.3 million (4.6% of revenue) in H1 2024–2025.

- Net income of €1.5 million in H1 2024–2025.

- Net financial debt reduced to €174.5 million as of March 31, 2025.

- Capital expenditures of €15.6 million, including the new Sames plant.

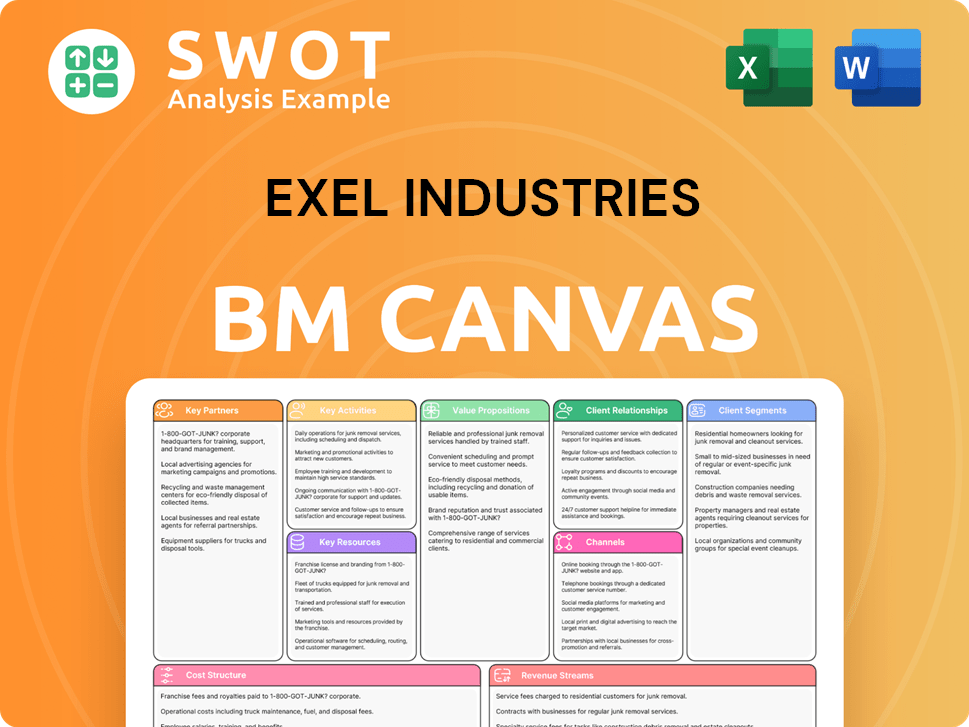

Exel Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Exel Industries’s Growth?

The path forward for EXEL Industries is not without its hurdles. The company faces a complex interplay of market dynamics, regulatory shifts, and economic uncertainties that could impact its business strategy and overall financial performance. Understanding these potential risks is crucial for assessing the future of EXEL Industries and its ability to achieve its growth objectives.

EXEL Industries's growth strategy is significantly influenced by external factors. The competitive landscape, particularly in key markets like Asia, poses a constant challenge. Furthermore, the company must navigate the impacts of geopolitical events and regulatory changes, such as trade policies, which can affect costs and supply chains. These factors require proactive management to ensure sustainable growth and protect the company's market share.

Supply chain vulnerabilities and macroeconomic conditions add to the complexity. Economic uncertainty can lead to delayed investments and reduced demand in critical sectors like agriculture. To address these challenges, EXEL Industries is implementing various strategies, including cost-cutting measures, optimizing production, and reducing inventory levels to enhance financial stability and operational efficiency.

Intense competition, especially from local integrators in Asia, affects sales, particularly in the Industrial Spraying segment. This requires continuous innovation and a strong focus on customer relationships to maintain a competitive edge. The company must adapt its business strategy to counter these challenges effectively.

Changes in regulations and geopolitical factors, such as US tariff policies, introduce economic uncertainty. EXEL Industries needs to assess and mitigate the effects on costs and supply chains. This includes diversifying its supply base and adapting to new trade conditions to ensure its continued financial performance.

Disruptions in the supply chain can significantly impact production and delivery schedules. The company must focus on building resilient supply chains and managing inventory effectively. This includes diversifying suppliers and improving logistics to minimize disruptions and maintain consistent operations.

Economic uncertainty, such as the 'wait-and-see' attitude among North American farmers, can lead to reduced demand and impact revenue. EXEL Industries must closely monitor market trends and adjust its strategies accordingly. This includes offering flexible solutions and proactively managing inventory levels.

The agricultural spraying activity has experienced a downturn, returning to a more traditional seasonal pattern after exceptional years. The outlook for European viticulture markets also remains uncertain. This requires a diversified product portfolio and strategic market positioning to mitigate the impact of seasonal fluctuations.

Managing debt and generating cash flow are key priorities. The company focuses on these areas to strengthen its financial position. This involves cost control, efficient capital allocation, and disciplined financial management to ensure long-term sustainability. You can also learn more about the Marketing Strategy of Exel Industries.

EXEL Industries is implementing cost-cutting strategies across all activities to improve profitability. This involves optimizing operational efficiency and reducing expenses to enhance financial performance. These measures are designed to streamline operations and improve the company's overall financial health.

Optimizing production capacities is a key focus to ensure efficient resource utilization. This includes adapting to market demands and improving manufacturing processes to increase productivity. The goal is to maximize output while minimizing costs and waste.

Reducing inventory levels is critical to improving cash flow and reducing storage costs. This involves implementing efficient inventory management systems and optimizing supply chain processes to minimize excess stock. The focus is on maintaining the right amount of inventory to meet demand without overstocking.

EXEL Industries prioritizes debt reduction and cash flow generation to strengthen its financial position. This includes managing debt levels and focusing on generating sufficient cash to support operations and investments. These efforts aim to improve the company's financial flexibility and resilience.

Exel Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exel Industries Company?

- What is Competitive Landscape of Exel Industries Company?

- How Does Exel Industries Company Work?

- What is Sales and Marketing Strategy of Exel Industries Company?

- What is Brief History of Exel Industries Company?

- Who Owns Exel Industries Company?

- What is Customer Demographics and Target Market of Exel Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.