EY Bundle

What's Next for Ernst & Young?

EY, a global powerhouse in professional services, is navigating a dynamic landscape. From its roots in early 20th-century accounting practices to a US$51.2 billion revenue giant in 2024, EY has consistently evolved. Today, the company advises diverse clients, helping them achieve sustainable growth through strategic financial solutions.

This report delves into the EY SWOT Analysis and the firm's strategic vision, exploring its ambitious EY growth strategy and EY future prospects. We'll examine how Ernst & Young company is adapting to market shifts, leveraging its EY business strategy to drive innovation and expansion, and analyzing its EY financial performance through rigorous EY market analysis.

How Is EY Expanding Its Reach?

The EY growth strategy is heavily focused on expansion initiatives to boost its EY future prospects. These initiatives include targeting new markets, broadening service offerings, and forming strategic collaborations. The firm's global strategy aims to generate the next US$50 billion in revenue, with significant investments in areas like transformation, managed services, and sustainability. This approach is critical for maintaining and enhancing EY's financial performance.

A core element of EY's business strategy involves strengthening its impact through alliances and ecosystems. The company has established over 100 ecosystem relationships and alliances in the last five years. In 2024 alone, they formed 20 new alliances, which contributed to 48% of the firm's overall growth during the 2024 financial year. These collaborations help offset losses in certain business areas and are a major driver of fee growth. For a deeper understanding of the competitive environment, consider exploring the Competitors Landscape of EY.

Geographically, EY is expanding its presence. EY Luxembourg, for example, saw a 13% growth for the fiscal year ending June 30, 2024, with revenues reaching €416.6 million. This regional growth is supported by strategic expansions, such as the firm's plan to occupy an additional 8,000 square meter building in Luxembourg from Q3 2025, accommodating 450 seats. This strategic move positions EY as the only firm with a presence in both Cloche d'Or and Kirchberg in Luxembourg.

EY anticipates a 10% rise in total M&A activity in 2025, following a 13% increase in 2024. This growth is influenced by robust economic activity and lower interest rates. The firm's focus on smaller, more agile deals in 2024 is expected to shift, with larger transactions becoming more prevalent in 2025 as market conditions evolve.

For private equity, EY predicts a 16% rise in 2025. Corporate M&A is expected to grow by 8% in 2025. EY's role as a transaction advisor was significant in 2024, topping the Venture Intelligence League Table for Transaction Advisor to M&A Deals, advising on 34 deals worth $4.1 billion.

Several factors are driving EY's expansion and financial performance. Strategic alliances and ecosystem partnerships are boosting fee growth and offsetting losses. Geographic expansion, particularly in regions like Luxembourg, is also contributing significantly to revenue growth. The firm's strategic focus on transformation, managed services, and sustainability is expected to drive further growth.

- Strategic Alliances: Over 100 ecosystem relationships and alliances.

- Geographic Expansion: 13% growth in EY Luxembourg in fiscal year 2024.

- M&A Activity: Anticipated 10% rise in total M&A activity in 2025.

- Investment Areas: Transformation, managed services, and sustainability.

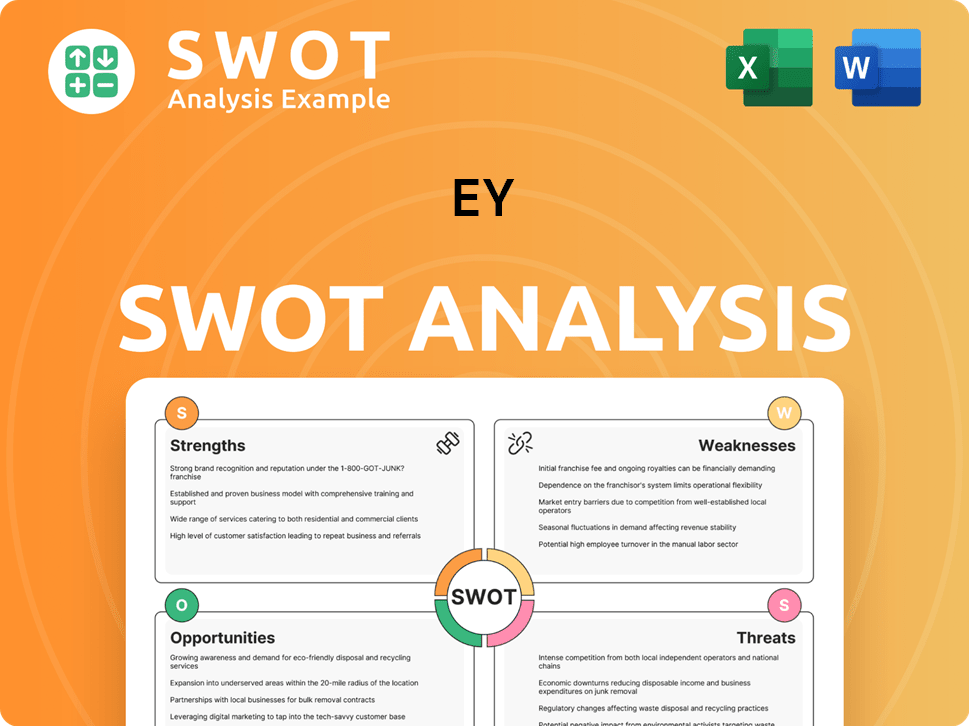

EY SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does EY Invest in Innovation?

The focus of EY's growth strategy centers on leveraging innovation and technology to enhance its service offerings and operational efficiency. This approach is crucial for maintaining a competitive edge in the evolving professional services landscape. EY's commitment to digital transformation and AI integration is a key element of its future prospects.

EY's strategic investments in technology, particularly in AI, are designed to improve client service delivery and internal processes. These investments are intended to drive both organic growth and operational improvements. This strategy is designed to position the firm for sustained success in the coming years.

EY is heavily investing in technology and innovation to sustain its growth, with a particular emphasis on artificial intelligence (AI) and digital transformation. The firm has invested more than US$1 billion in technology over the past year, focusing on integrating AI capabilities into its global operations and daily functions. This investment includes building its own large language model and deploying it across its global workforce, with further embedding of AI into its operations planned for FY25.

A significant milestone is the integration of AI-powered capabilities into EY's global Assurance platform, announced in April 2025. This initiative is part of a broader audit transformation program. It aims to enhance audit quality and provide more data-driven insights.

EYQ Assurance Knowledge uses generative AI (GenAI) to assist professionals in detailed searches and summarization of accounting and auditing content. This tool helps improve the efficiency and accuracy of audit processes.

This technology helps EY's 140,000 assurance professionals quickly find relevant information tailored to specific audit engagements. It considers factors like geography, industry, and complexity, streamlining the audit process.

EY's approach to digital transformation is shifting towards AI-led operations. This involves moving from experimental AI deployments to comprehensive strategies where AI agents work autonomously alongside human employees.

The firm's EY.ai platform is central to this transformation. It brings together human capabilities and AI to help clients adopt AI confidently and responsibly. This platform is crucial for driving innovation.

EY is enhancing its sustainability technology portfolio, integrating AI, cloud computing, and industrial IoT to support environmental initiatives. This is part of a broader commitment to sustainability.

EY is undertaking a five-year review of its environmental strategy to align with updated standards, with an updated Environment Strategy planned for FY25. This includes a science-aligned decarbonization plan and plans to assess impacts on nature and biodiversity. EY has already achieved carbon negative status and is targeting net zero by 2025.

- 40% reduction in Scope 1, 2, and 3 emissions by 2025 compared to a 2019 baseline.

- Focus on integrating AI, cloud computing, and industrial IoT to support environmental initiatives.

- Aligning environmental strategy with updated standards through a five-year review.

- The firm aims to achieve net zero emissions by 2025.

For more on the structure of the firm, insights can be found in an article about Owners & Shareholders of EY.

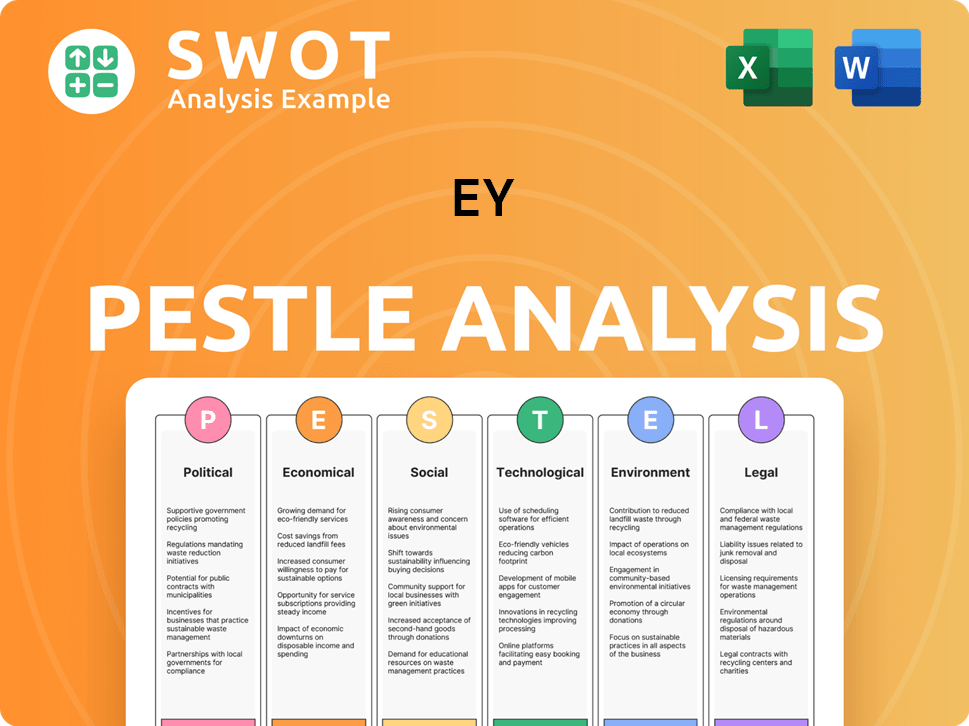

EY PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is EY’s Growth Forecast?

EY's EY financial performance in fiscal year 2024, which concluded in June, showed a combined global revenue of US$51.2 billion. This represents a 3.9% increase in local currency, demonstrating the firm's resilience. All service lines contributed to this growth, with tax and assurance leading with a 6.3% increase.

The firm's strategic focus for 2025 involves shaping the next US$50 billion in revenue. This will be achieved through purposeful growth and investments in areas like transformation, managed services, and sustainability. A strong emphasis on audit quality remains a priority. For example, EY Luxembourg reported a 13% growth for the fiscal year ending June 30, 2024, with revenues reaching €416.6 million.

The EY business strategy includes a strong emphasis on mergers and acquisitions (M&A). The M&A outlook anticipates a 10% rise in total M&A activity in 2025, following a 13% increase in 2024. Private equity is expected to see a 16% rise in 2025, and corporate M&A is projected to grow by 8% in the same year. These projections indicate a positive environment for EY's transaction advisory services.

EY's global revenue increased by 3.9% in local currency during fiscal year 2024. This growth was supported by all service lines. The firm's strategy includes investing in high-growth service areas to sustain revenue growth.

EY is focusing investments on transformation, managed services, and sustainability to drive future growth. These investments are part of the firm's plan to shape the next US$50 billion in revenue. The firm is also investing in technology and AI.

A 10% rise in total M&A activity is predicted for 2025, following a 13% increase in 2024. Private equity M&A is expected to grow by 16% in 2025. Corporate M&A is projected to increase by 8% in 2025, creating opportunities for EY's transaction advisory services.

EY Luxembourg saw a 13% growth in the fiscal year ending June 30, 2024, with revenues reaching €416.6 million. The Luxembourg firm aims to nearly double its sales to €500 million by 2026. This demonstrates strong financial ambition.

The EY growth strategy is driven by continued investment in technology and AI. Strategic alliances and a focus on high-growth service areas are also key. These initiatives aim at achieving sustained revenue growth and long-term value creation.

EY's future prospects are centered around purposeful growth and strategic investments. The firm is focused on adapting to digital transformation and expanding its services. EY aims to maintain a strong market position.

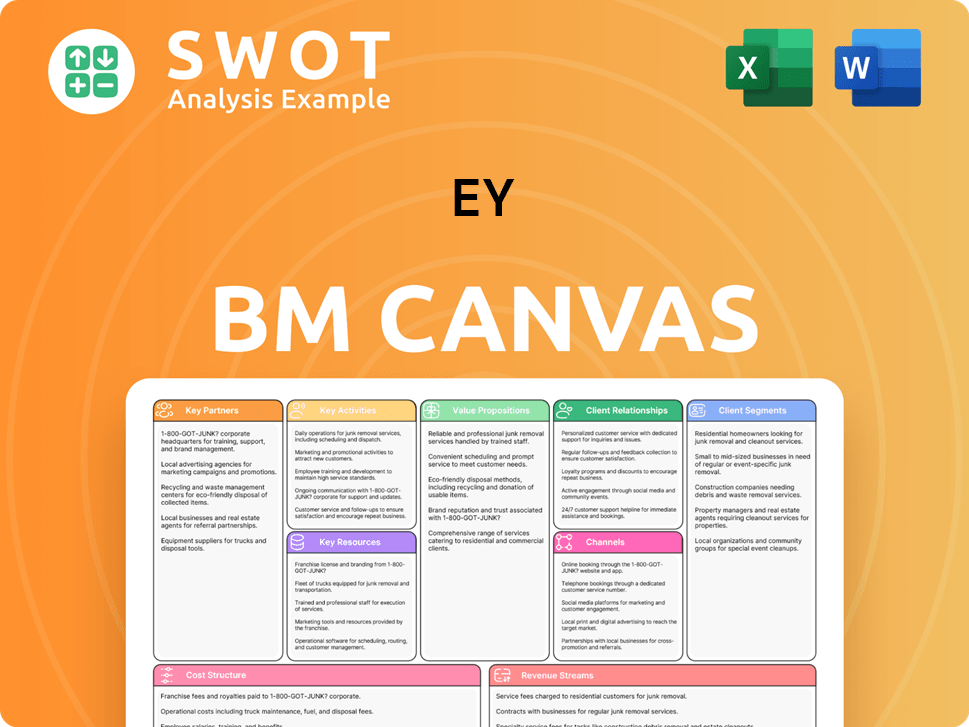

EY Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow EY’s Growth?

The path to growth for EY, like any major professional services firm, is paved with potential risks and significant obstacles. These challenges span market dynamics, regulatory shifts, technological disruptions, and internal resource constraints. Understanding and proactively addressing these issues is crucial for EY's sustained success and achieving its ambitious EY growth strategy.

One of the most pressing concerns is the intensity of market competition within the professional services industry. EY must continuously innovate and differentiate its offerings to maintain its competitive edge. Furthermore, the firm faces the need to navigate complex and evolving regulatory landscapes, particularly in areas such as AI and data privacy, which can significantly impact operations and service delivery. These factors are critical to understanding EY's future prospects.

Supply chain vulnerabilities and geopolitical tensions also present significant risks that EY must manage. These issues can affect costs and service delivery, necessitating strategic adjustments. Finally, internal resource limitations, including staffing and the complexity of accounts, can impede growth, as seen in recent audit challenges. A look back at the Brief History of EY can also help in understanding the firm's trajectory and adaptability.

The professional services industry is highly competitive, requiring continuous innovation and differentiation. Firms must constantly evolve their service offerings to stay ahead. This includes adopting new technologies and providing specialized expertise to meet client demands effectively.

Regulatory changes pose significant risks, impacting operations and service delivery. Compliance with new frameworks, especially those related to AI and data privacy, adds complexity. For example, the EU AI Act and similar regulations globally will require substantial adaptation.

Geopolitical tensions and trade policy risks can disrupt global supply chains, increasing costs. Cyberattacks, particularly those targeting sub-tier suppliers, pose a significant threat. EY itself experienced a supply chain attack in March 2023, highlighting the widespread impact.

Rapid advancements in AI and other technologies require significant investment and adaptation. The complexity of integrating new technologies and budgetary constraints can be barriers. Organizations must keep pace to remain competitive.

Staffing shortages and the complexity of accounts can hinder internal processes and growth. Attracting and retaining skilled professionals is crucial, especially in specialized areas. Resource constraints can delay projects and impact service quality.

Increased cyberattacks, particularly those targeting supply chains, can compromise data and operations. Protecting against such threats requires robust cybersecurity measures and proactive risk management. The frequency and sophistication of cyberattacks are on the rise.

EY emphasizes a proactive approach to transformation, including strategic investments in technology and talent. Risk management frameworks are crucial for mitigating potential threats across various business areas. Continuous adaptation to market changes is essential for long-term success.

In the mining sector, EY advises balancing capital discipline with strategic investments for sustainable growth. Solutions like advanced technologies enhance exploration and productivity. Focusing on decarbonization, supplier diversification, and circular economy strategies is also vital.

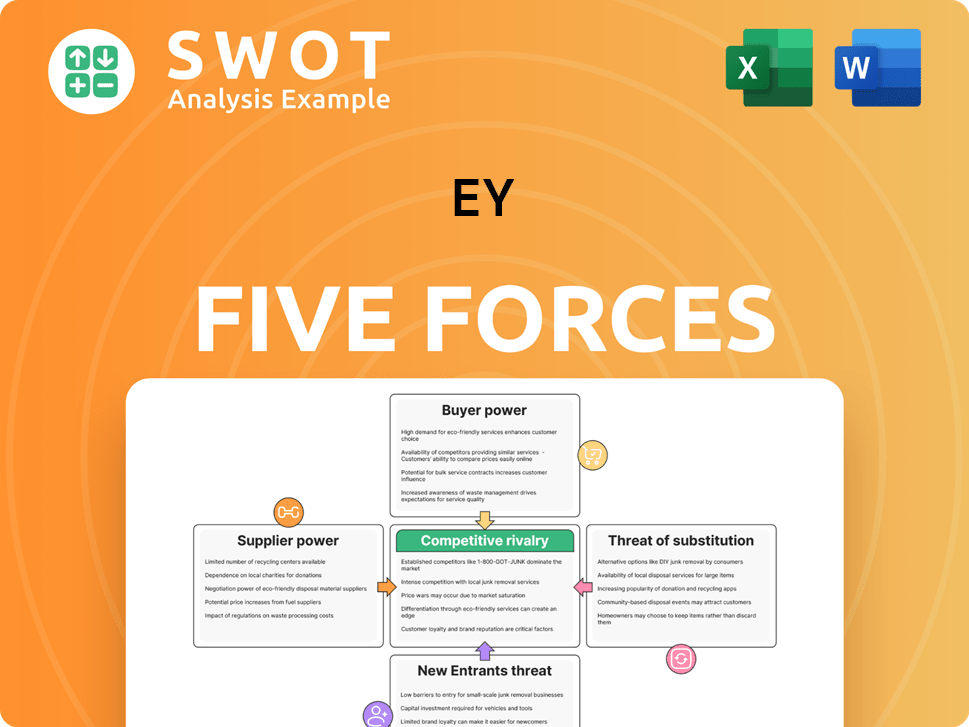

EY Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.