GE HealthCare Technologies Bundle

Can GE HealthCare Continue Its Ascent in the Healthcare Technology Sector?

The healthcare industry is rapidly evolving, fueled by cutting-edge technologies and a demand for more efficient patient care. GE HealthCare, a leader in GE HealthCare Technologies SWOT Analysis, is at the forefront of this transformation, offering innovative solutions in medical imaging, and digital health. This exploration delves into GE HealthCare's ambitious growth strategy and its promising future prospects in a dynamic market.

With a strong foundation built on over a century of experience and a substantial $19.7 billion in revenue for 2024, GE HealthCare is poised for significant expansion. This analysis will uncover the key drivers behind GE HealthCare's growth, including its strategic initiatives in medical devices, the impact of AI, and its plans for future investment. Understanding GE HealthCare's Growth Strategy and Future Prospects is crucial for investors and industry professionals alike.

How Is GE HealthCare Technologies Expanding Its Reach?

As part of its Growth Strategy, GE HealthCare is actively pursuing expansion initiatives to broaden its market reach and diversify revenue streams. These initiatives are designed to capitalize on the strong demand for its medical devices, especially within the U.S., and to mitigate challenges in markets like China. The company's approach involves strategic acquisitions, partnerships, and new product launches to strengthen its global presence and offerings.

One of the key strategies involves entering new markets and reinforcing its presence in existing ones through strategic acquisitions and partnerships. This includes expanding its geographical footprint and enhancing its product and service offerings. These efforts are crucial for sustaining GE HealthCare's long-term growth and competitiveness in the dynamic Healthcare Technology sector.

GE HealthCare's expansion initiatives are multifaceted, encompassing both geographical and product-based strategies. The company focuses on launching new products and services, particularly in high-growth segments, to drive revenue growth. These initiatives are supported by strategic investments and partnerships aimed at increasing capacity and expanding access to quality care, ensuring the company remains at the forefront of innovation in the medical field.

In 2025, GE HealthCare completed the acquisition of Nihon Medi-Physics (NMP), a leading radiopharmaceutical company in Japan. This acquisition aims to increase global access to its next-generation radiopharmaceuticals, aligning with the company's focus on expanding its radiopharmaceutical footprint. These strategic moves are essential for GE HealthCare's Growth Strategy.

In 2024, GE HealthCare invested $138 million in a manufacturing facility in Cork, Ireland, further expanding its global operational footprint. This investment underscores GE HealthCare's commitment to strengthening its presence in key markets and supporting its long-term growth objectives. These actions are part of the company's broader strategy to enhance its global reach and operational capabilities.

GE HealthCare is focused on launching new products and services, particularly in high-growth segments. In 2024, the company introduced approximately 40 innovations. Recent product launches include the U.S. launch of Flyrcado™ (flurpiridaz F 18) injection at the American College of Cardiology in 2025, and the unveiling of Revolution™ Vibe CT system with Unlimited One-Beat Cardiac imaging and AI solutions. These innovations are key to its Future Prospects.

GE HealthCare is engaging in strategic, long-term enterprise partnerships to increase capacity and expand access to quality care. Examples include partnerships with Sutter Health in the U.S. and Nuffield Health in the UK. These collaborations are designed to leverage GE HealthCare's expertise in Medical Devices and technology to improve healthcare delivery and patient outcomes. Learn more about the company's history in Brief History of GE HealthCare Technologies.

GE HealthCare's expansion initiatives are designed to drive GE HealthCare revenue growth and strengthen its position in the Healthcare Technology market. These initiatives are crucial for achieving its Future Prospects.

- Acquisitions: Strategic acquisitions, such as Nihon Medi-Physics, to expand product offerings and market reach.

- Geographical Expansion: Investments in manufacturing facilities, like the one in Cork, Ireland, to increase operational capacity.

- Product Innovation: Launching new products and services, including AI solutions and advanced imaging systems.

- Strategic Partnerships: Forming long-term collaborations with healthcare providers to improve access to care and enhance service delivery.

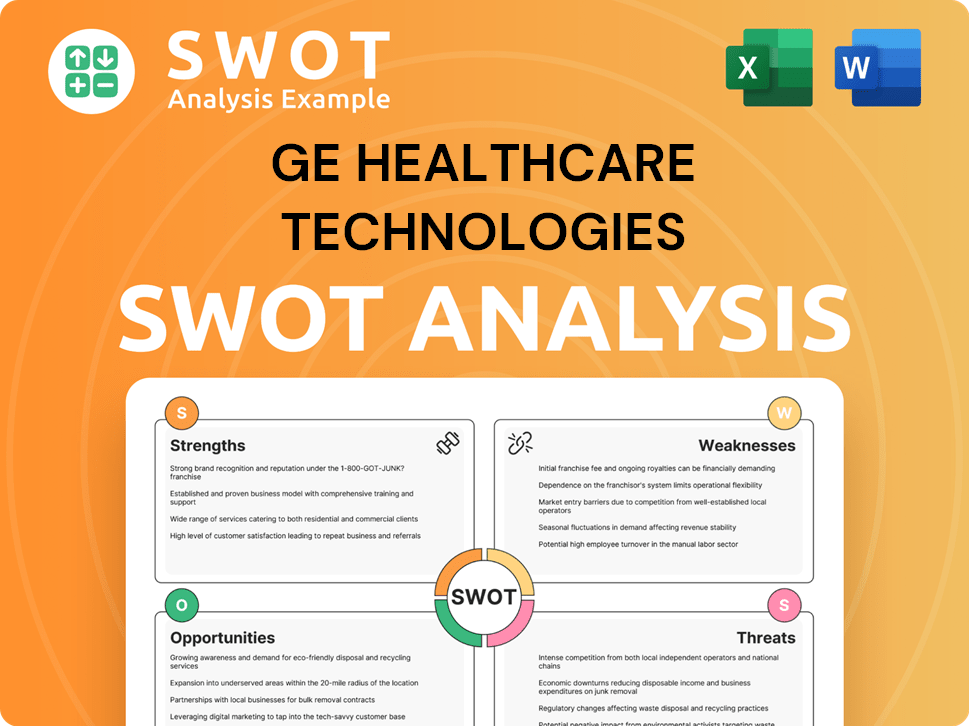

GE HealthCare Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GE HealthCare Technologies Invest in Innovation?

GE HealthCare's approach to innovation and technology is central to its Growth Strategy. The company strategically invests in research and development (R&D) to create new products and solutions. This focus allows it to stay ahead in the competitive landscape of Healthcare Technology.

The company leverages cutting-edge technologies like artificial intelligence (AI), the Internet of Things (IoT), and cloud-based solutions to improve its offerings. This integration helps GE HealthCare enhance patient care and streamline healthcare processes. For a deeper understanding of the company's target market, consider reading about the Target Market of GE HealthCare Technologies.

Since 2022, GE HealthCare has invested approximately $2.2 billion in R&D. This significant investment underscores its commitment to innovation and its long-term Future Prospects.

GE HealthCare leads in AI-enabled medical devices. The company has received 85 authorizations from the FDA for AI-enabled devices. This demonstrates GE's leadership in integrating AI into its products.

GE HealthCare's digital strategy focuses on AI integration and cloud-based solutions. This strategy enhances decision-making across care pathways and improves patient outcomes. The company aims to more than triple its offerings of cloud-enabled products by 2028.

GE HealthCare is developing AI applications to improve healthcare efficiency. For example, Sonic DL can reduce cardiac MRI scan time by up to 83%. The company is collaborating with Enlitic to streamline imaging data migration.

GE HealthCare launched Genesis solutions, a new portfolio of cloud enterprise imaging software-as-a-service (SaaS) solutions. These solutions are designed to enhance efficiency and precision in medical imaging. This expansion reflects the company's focus on cloud-based technologies.

GE HealthCare is committed to sustainability through initiatives like the Circularity and Environmentally Conscious Design program. These programs aim to extend product lifespans and reduce environmental impact. This approach aligns with the growing importance of environmental responsibility in the healthcare sector.

GE HealthCare plans to significantly expand its cloud-enabled product offerings. By 2028, the company aims to more than triple the number of these products. This strategic move is part of GE HealthCare's broader digital transformation strategy.

GE HealthCare's innovation strategy includes significant investments in R&D and the integration of advanced technologies. These efforts are designed to drive GE HealthCare revenue growth and maintain a strong position in the market.

- AI-Powered Solutions: Developing AI applications to improve diagnostic accuracy and efficiency.

- Cloud-Based Platforms: Expanding cloud-enabled product offerings to enhance data management and accessibility.

- Sustainability Programs: Implementing initiatives to reduce environmental impact and promote product longevity.

- Strategic Partnerships: Collaborating with other companies to accelerate innovation and expand market reach.

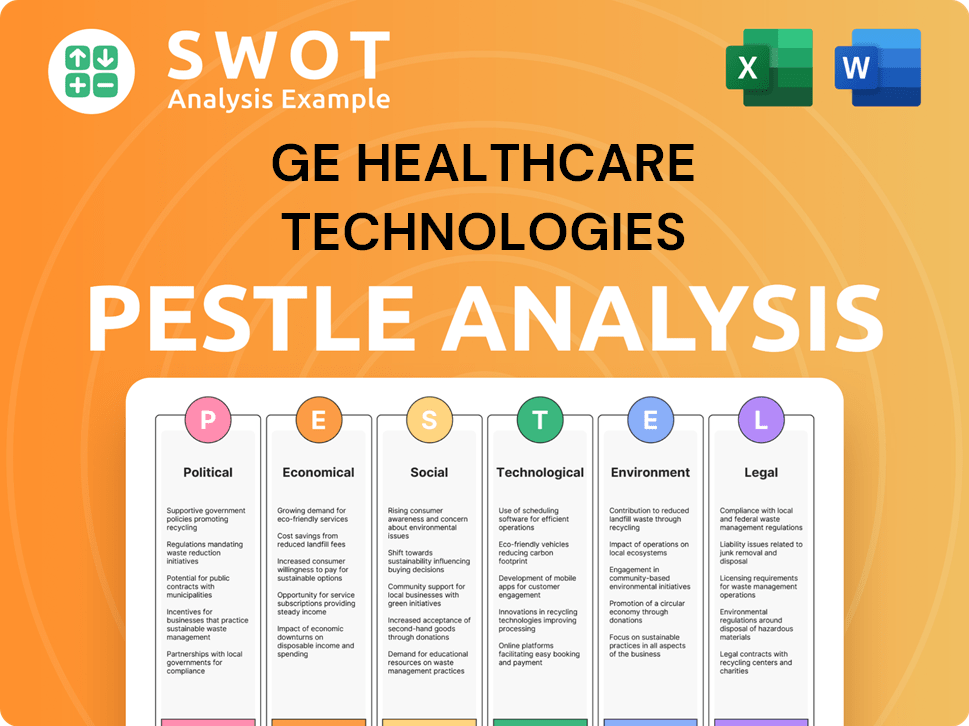

GE HealthCare Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is GE HealthCare Technologies’s Growth Forecast?

The financial outlook for GE HealthCare in 2025 is positive, with expectations of continued profit expansion. This optimism is fueled by strong demand for medical devices, particularly in the U.S., which is expected to offset challenges in other markets.

In 2024, GE HealthCare reported revenues of $19.7 billion, reflecting a 1% year-over-year growth. The company achieved a net income margin of 10.1% and a diluted EPS of $4.34, a significant increase from $3.04 in 2023. These results set a solid foundation for future growth and investment.

Looking at the Growth Strategy and Future Prospects, GE HealthCare anticipates organic revenue growth of 2% to 3% in 2025. Adjusted EPS is projected to be in the range of $4.61 to $4.75, indicating a 3% to 6% increase from the 2024 adjusted EPS of $4.49. However, a revised outlook in April 2025 adjusted the adjusted EPS forecast to $3.90 to $4.10 per share due to the estimated impact of tariffs. The adjusted EBIT margin is expected to be between 14.2% and 14.4% for 2025. These projections highlight the company's focus on financial performance and strategic planning.

GE HealthCare anticipates organic revenue growth of 2% to 3% in 2025. This growth is driven by strong demand for medical devices, especially in the U.S. market. The company's focus on innovation and market expansion contributes to these positive revenue projections.

Adjusted EPS for 2025 is projected to be in the range of $4.61 to $4.75, reflecting a 3% to 6% growth over 2024's adjusted EPS of $4.49. However, a revised outlook in April 2025 adjusted the adjusted EPS forecast to $3.90 to $4.10 per share due to the estimated impact of tariffs. This demonstrates the company's ability to adapt to changing market conditions.

The adjusted EBIT margin is expected to be between 14.2% and 14.4% for 2025. This reflects GE HealthCare's commitment to operational efficiency and profitability. The company's strategic initiatives support these financial targets.

GE HealthCare forecasts free cash flow of at least $1.75 billion for 2025. This strong cash flow position allows for strategic investments and shareholder returns. The company's financial health is a key factor in its growth strategy.

In April 2025, the Board of Directors authorized a $1 billion share repurchase program, showcasing confidence in the business and its financial flexibility. This action, along with the company's strategic financial planning, underscores its commitment to creating value for shareholders. To understand the core values and mission that drive GE HealthCare, you can read more about it in Mission, Vision & Core Values of GE HealthCare Technologies.

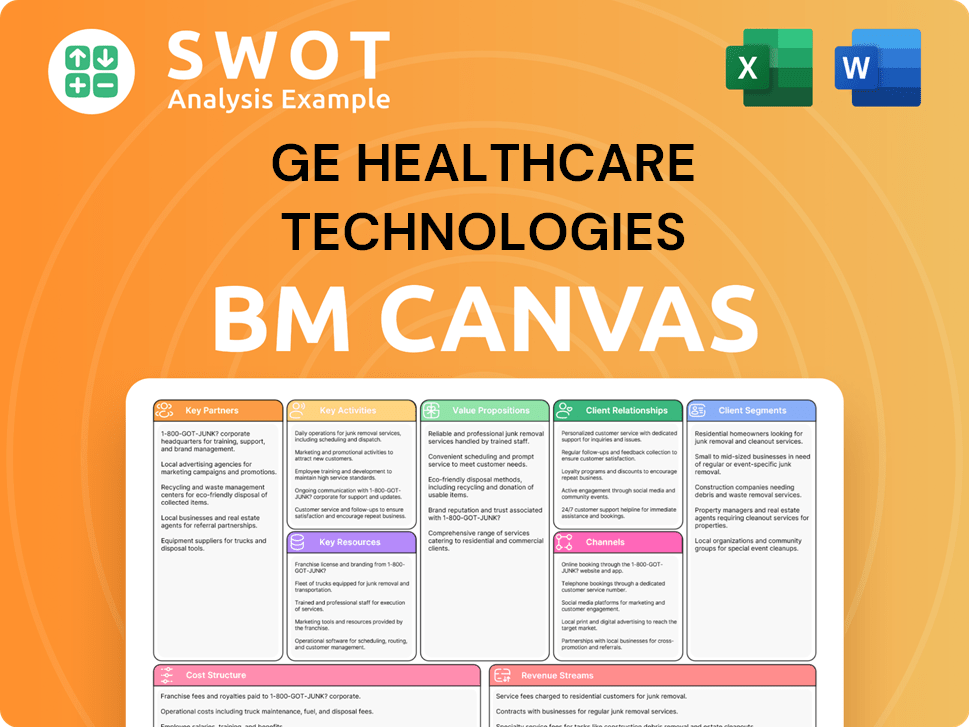

GE HealthCare Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow GE HealthCare Technologies’s Growth?

The path to growth for GE HealthCare is fraught with potential obstacles. The company faces significant challenges in a highly competitive market. These risks include regulatory changes, geopolitical tensions, and supply chain vulnerabilities, all of which could impact its financial performance and strategic goals.

Intense competition from major players in the Healthcare Technology sector, such as Siemens Healthineers and Philips Healthcare, requires continuous innovation and differentiation. Moreover, external factors like tariffs and market softness in key regions pose additional hurdles. Addressing these risks is crucial for sustaining GE HealthCare's Growth Strategy and realizing its Future Prospects.

To understand how GE generates revenue and operates, you can refer to this article: Revenue Streams & Business Model of GE HealthCare Technologies.

The Medical Devices market is fiercely competitive, with companies like Siemens Healthineers, Philips Healthcare, and Canon Medical Systems vying for market share. Constant innovation and technological advancements are essential for GE HealthCare to maintain a competitive edge. This requires significant investment in research and development to stay ahead.

GE HealthCare is exposed to regulatory changes and geopolitical tensions, including U.S. tariffs on Chinese products. In April 2025, these tariffs were projected to reduce adjusted earnings by an estimated 85 cents per share. Market dynamics in China, such as hospital order delays and anti-corruption measures, also affect revenue.

Challenges in obtaining components and raw materials could restrict manufacturing and increase costs. These supply chain issues can disrupt operations and impact the company's ability to meet customer demand. Diversification of suppliers and strategic inventory management are crucial to mitigate these risks.

The increasing focus on cloud, edge computing, AI, and software offerings presents risks related to deployment failures and customer adoption. These technologies require robust infrastructure and skilled personnel. GE HealthCare must ensure seamless integration and user acceptance to succeed in this area.

Cybersecurity threats are a constant concern, potentially harming the company's reputation and business operations. Protecting sensitive patient data and maintaining system integrity is vital. GE HealthCare must invest in robust cybersecurity measures to safeguard its operations and maintain customer trust.

Economic downturns can negatively impact healthcare spending, affecting GE HealthCare revenue growth. Reduced capital expenditure by hospitals and clinics can lead to lower demand for Medical Devices. The company's ability to navigate economic cycles is crucial for long-term success.

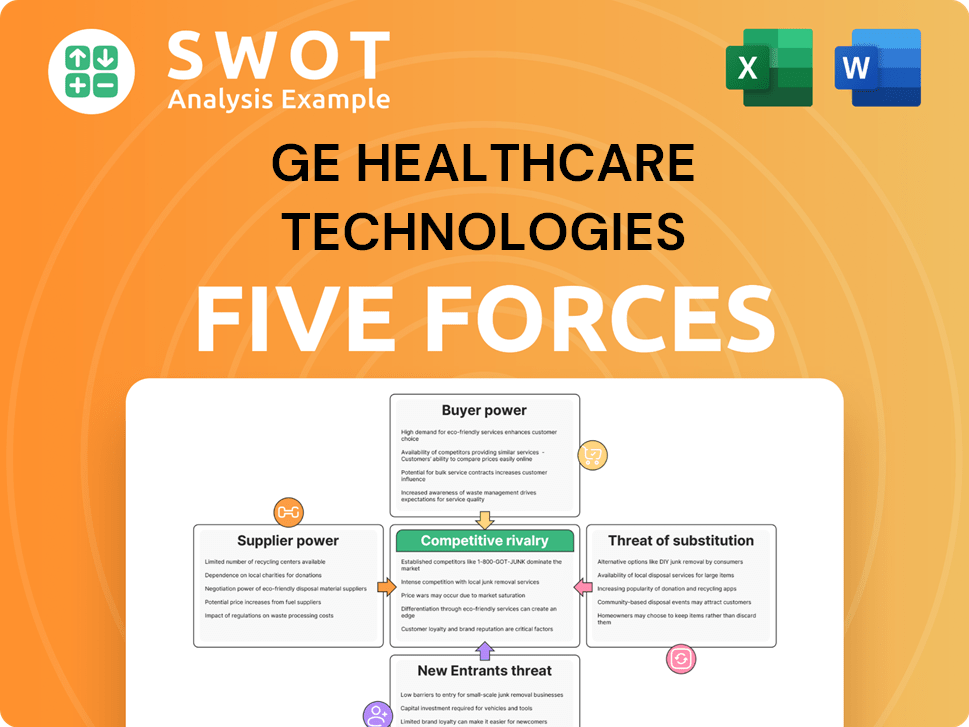

GE HealthCare Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GE HealthCare Technologies Company?

- What is Competitive Landscape of GE HealthCare Technologies Company?

- How Does GE HealthCare Technologies Company Work?

- What is Sales and Marketing Strategy of GE HealthCare Technologies Company?

- What is Brief History of GE HealthCare Technologies Company?

- Who Owns GE HealthCare Technologies Company?

- What is Customer Demographics and Target Market of GE HealthCare Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.