Graham Holdings Bundle

Can Graham Holdings Company Continue Its Successful Evolution?

Graham Holdings Company, a diversified entity, has masterfully navigated the ever-changing business world, proving the power of a dynamic Graham Holdings SWOT Analysis. From its media roots, established in 1947, to its current diverse portfolio, the company's strategic shifts highlight its adaptability. This evolution showcases a commitment to growth and a keen eye for market opportunities, making it a compelling case study for any investor or business strategist.

The story of Graham Holdings Company offers valuable insights into effective Business Strategy and strategic diversification. Its journey underscores the importance of a robust Growth Strategy, particularly in sectors like education and healthcare. Understanding the Future Prospects of Graham Holdings Company requires a deep dive into its Investment Portfolio and market dynamics. This analysis is crucial for anyone looking to understand the company's Market Analysis and long-term growth potential.

How Is Graham Holdings Expanding Its Reach?

The Growth Strategy of Graham Holdings Company involves active expansion across its diverse portfolio. This approach aims to capture new customers, diversify revenue streams, and adjust to industry changes. The company's strategy is designed to foster long-term growth and resilience in a dynamic market environment. This strategy is crucial for maintaining and enhancing its market position.

Graham Holdings Company's expansion initiatives are carefully planned and executed across its various business segments. These initiatives are typically detailed in the company's annual reports, demonstrating a measured approach to growth. The company focuses on strategic investments and acquisitions to achieve its goals. The company's approach reflects a commitment to sustainable growth and value creation.

Graham Holdings Company continually evaluates its Future Prospects, adapting its strategies to changing market conditions. This includes a focus on digital transformation, strategic acquisitions, and operational efficiencies. The company's ability to adapt and innovate is key to its long-term success. This proactive approach is designed to capitalize on emerging opportunities.

Kaplan, a key part of Graham Holdings Company's portfolio, is actively exploring new program offerings and digital learning solutions. This is in response to the evolving needs of students and professionals globally. The focus is on adapting to online education trends and potentially expanding into new international markets. This ensures the company remains competitive in the education sector.

In television broadcasting, even with traditional challenges, Graham Holdings Company is exploring opportunities in digital content delivery and local market penetration. This involves investments in streaming capabilities and partnerships. The goal is to enhance viewership and increase advertising revenue. This is a key part of their Business Strategy.

Expansion in manufacturing includes optimizing production processes and entering new product categories. The company may also acquire complementary businesses to broaden its industrial footprint. These strategic acquisitions are part of their Investment Portfolio. This will help to diversify their revenue streams.

Given the robust growth in healthcare, Graham Holdings Company is looking to expand its service offerings. This includes investing in new facilities and pursuing strategic alliances to enhance market share. This is a key element of their Market Analysis. This will help them to reach more patients.

Graham Holdings Company often uses strategic acquisitions to enter new markets and expand its existing businesses. Partnerships are also crucial for enhancing its capabilities and reach. These moves are designed to drive both short-term and long-term value. The company is always looking for ways to improve its performance.

- Acquisitions: Expanding into new markets.

- Partnerships: Enhancing capabilities.

- Strategic Alliances: Increasing market share.

- Investment: Driving both short-term and long-term value.

For more insights into the company's marketing approaches, consider reading the Marketing Strategy of Graham Holdings. This article provides a deeper understanding of how the company positions itself in the market and drives growth.

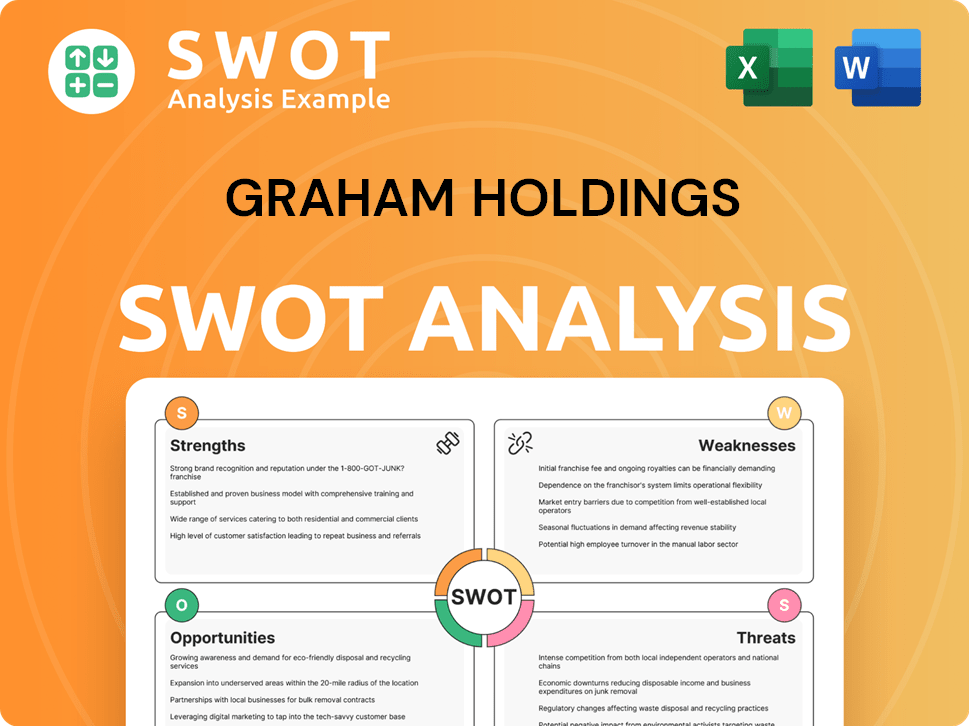

Graham Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Graham Holdings Invest in Innovation?

The innovation and technology strategy of Graham Holdings Company is crucial for its sustained growth, particularly within its educational services and broadcasting segments. The company leverages technology to enhance operational efficiency, improve customer experience, and unlock new revenue streams across its diverse businesses. This approach ensures long-term growth and maintains a competitive edge in a rapidly evolving market.

A key area of focus is the integration of digital transformation. This involves investing in research and development to create advanced online platforms, adaptive learning technologies, and AI-powered educational tools. This commitment allows the company to offer personalized and effective learning experiences, which directly supports its growth objectives by attracting a larger global student base.

In television broadcasting, the company likely adopts cutting-edge technologies for content creation, distribution, and audience engagement. This includes investments in high-definition broadcasting, streaming technologies, and data analytics to optimize programming and advertising strategies. The overarching goal is to leverage technology to drive growth across all its diversified businesses.

Kaplan's digital transformation is centered on advanced online platforms and AI-powered tools. This approach enhances the learning experience and attracts more students. The focus is on personalized and effective learning to meet evolving student needs.

The broadcasting segment likely invests in high-definition broadcasting and streaming technologies. Data analytics are used to optimize programming and advertising. This ensures the company stays competitive in the media landscape.

Technology investments improve operational efficiency across all business units. This includes streamlining processes and reducing costs. The goal is to maximize resources and enhance profitability.

Technology is used to improve customer experience, particularly in education. Personalized learning and better content delivery are key. This leads to higher customer satisfaction and retention.

New revenue streams are unlocked through technology investments. This includes digital content and online services. Diversification helps to reduce reliance on traditional revenue sources.

Continuous technological upgrades help maintain a competitive edge. This ensures the company can adapt to market changes. Staying ahead of the curve is critical for long-term success.

The company's approach involves continuous technological upgrades across its subsidiaries, demonstrating a commitment to maintaining a competitive edge. By leveraging technology, Graham Holdings Company aims to enhance operational efficiency, improve customer experience, and unlock new revenue streams across all its diversified businesses, ensuring long-term growth. For more insights into the company's structure, consider exploring Owners & Shareholders of Graham Holdings.

Graham Holdings Company's investments in technology are focused on enhancing its core business areas. These investments are crucial for driving growth and maintaining a competitive advantage in the market. The company's strategic approach to technology is central to its long-term success.

- Digital Learning Platforms: Development of advanced online platforms and adaptive learning technologies.

- AI-Powered Tools: Integration of AI to personalize learning experiences.

- High-Definition Broadcasting: Investments in high-definition broadcasting and streaming technologies.

- Data Analytics: Use of data analytics to optimize programming and advertising strategies.

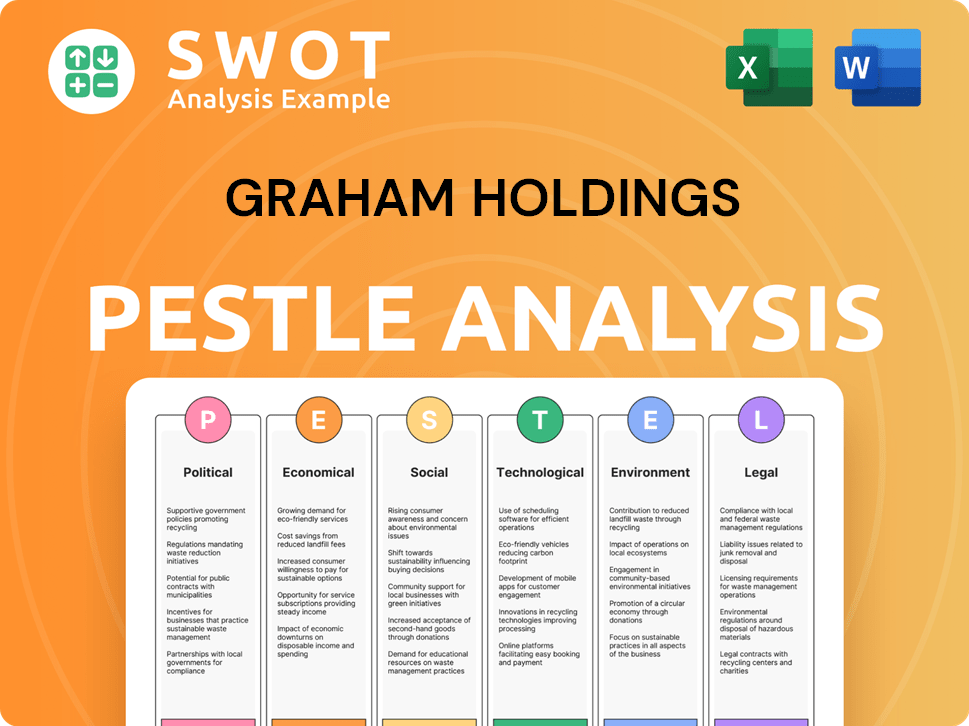

Graham Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Graham Holdings’s Growth Forecast?

The financial outlook for Graham Holdings Company appears stable, supported by its diverse revenue streams. While specific forward-looking revenue targets and profit margins for 2025 are not publicly detailed, recent performance and analyst forecasts offer insights into the company's trajectory. The company's diversified portfolio includes educational services, television broadcasting, manufacturing, and healthcare, providing resilience against market fluctuations.

In the first quarter of 2024, Graham Holdings reported revenues of $1.15 billion, a slight decrease from $1.20 billion in the same period of 2023. This decrease was primarily due to lower revenues at its Kaplan International and automotive dealerships segments. However, the company's net income attributable to common shares increased significantly to $139.7 million, or $30.08 per share, in Q1 2024, compared to $34.5 million, or $7.01 per share, in Q1 2023.

This increase was largely driven by a non-cash gain of $114.3 million from the sale of certain assets by its automotive dealerships. Investment levels are likely to remain focused on enhancing digital capabilities within Kaplan, modernizing broadcasting infrastructure, and exploring targeted expansions within its manufacturing and healthcare ventures. Graham Holdings' financial strategy emphasizes prudent capital allocation and reinvestment in its core businesses to support organic growth and potential strategic acquisitions.

Graham Holdings benefits from a diversified revenue model, which includes education, media, manufacturing, and healthcare. This diversification helps to mitigate risks associated with economic downturns in any single sector. The company’s ability to generate revenue from multiple sources contributes to its overall financial stability and growth potential.

The company's investment strategy focuses on enhancing digital capabilities, modernizing infrastructure, and exploring expansions. Capital allocation is geared towards organic growth and strategic acquisitions. These investments are designed to drive long-term profitability and shareholder value, reflecting a balanced approach to growth and financial stability.

In Q1 2024, Graham Holdings reported revenues of $1.15 billion. Net income attributable to common shares increased to $139.7 million, or $30.08 per share. These figures demonstrate the company’s ability to generate profits and manage its assets effectively. The company's financial performance reflects its ability to adapt to market changes.

The future prospects for Graham Holdings are promising, with a focus on sustainable profitability and increasing shareholder value. The company's growth strategy includes investments in its core businesses and potential strategic acquisitions. With a diversified portfolio and a disciplined approach to capital allocation, Graham Holdings is well-positioned for continued growth.

Market analysis indicates that Graham Holdings is adapting to digital transformation and expanding its presence in key sectors. The company's competitive advantages include a diversified portfolio and a strong financial position. These factors contribute to its ability to navigate market challenges and capitalize on growth opportunities in the education, media, and healthcare industries.

Graham Holdings has a history of strategic acquisitions aimed at expanding its business portfolio and enhancing its market position. These acquisitions are carefully considered to align with the company's long-term growth objectives and financial goals. The company's approach to acquisitions reflects its commitment to sustainable growth and value creation.

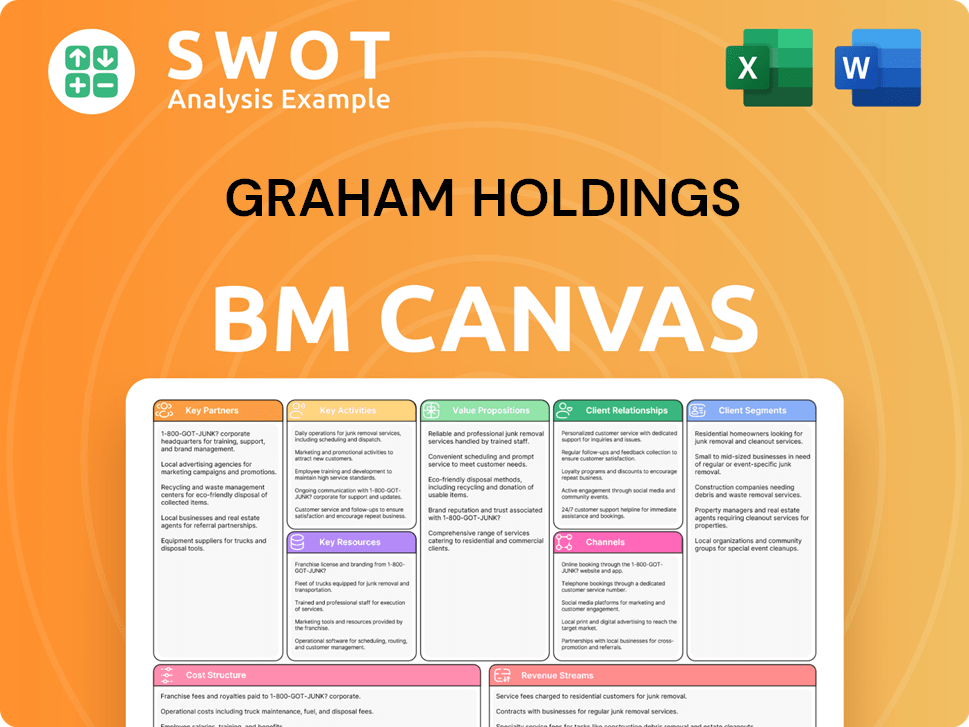

Graham Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Graham Holdings’s Growth?

Graham Holdings Company faces several risks that could affect its Growth Strategy and Future Prospects. These challenges span across its diversified portfolio, impacting its ability to maintain and expand its market presence. Understanding these potential obstacles is crucial for investors and stakeholders assessing the company's long-term viability.

Market competition, technological disruption, and regulatory changes are key areas of concern. The company must continuously innovate and adapt to stay ahead, especially in sectors like education and broadcasting. Effective risk management and strategic planning are essential to navigate these challenges and capitalize on opportunities.

Graham Holdings Company's ability to thrive depends on its capacity to mitigate these risks effectively. This requires a proactive approach, including strategic investments, diversification, and robust risk management frameworks. The company's success hinges on its capacity to adapt and respond to evolving market dynamics.

Intense competition across all sectors poses a significant risk to Graham Holdings Company. Kaplan, for example, competes with numerous online learning platforms and traditional educational institutions. This requires constant innovation to maintain or grow market share.

Changes in regulations, particularly in education and healthcare, could pose risks. New compliance burdens or operational limitations can impact profitability. Accreditation standards and healthcare policies are areas to watch closely.

Rapid technological advancements represent a constant threat. The rise of digital platforms and AI could render existing business models obsolete if the company fails to adapt. This is especially relevant in broadcasting and education.

Supply chain issues, though less critical than in some industries, can still affect manufacturing operations. Delays or increased costs due to supply chain disruptions can impact financial performance. This requires proactive management.

Cybersecurity threats are a growing concern across all digital platforms. Protecting sensitive data and ensuring operational continuity is essential. This requires ongoing investment in cybersecurity measures and protocols.

The broader economic climate can influence consumer spending in education and advertising markets. Economic downturns or shifts in consumer behavior can affect revenue and profitability. Monitoring economic trends is crucial.

Graham Holdings Company mitigates risks through diversification. This strategy inherently reduces reliance on any single sector, providing a buffer against downturns in specific industries. Diversification is a key component of their Business Strategy.

The company employs risk management frameworks to assess and prepare for various scenarios. This includes identifying potential threats and implementing strategies to mitigate their impact. This includes digital transformation initiatives.

Investment in digital transformation, particularly within Kaplan, is a proactive measure against technological disruption. Adapting to digital platforms and AI is crucial for long-term success. This impacts their Investment Portfolio.

Graham Holdings Company's consistent profitability in a dynamic market indicates a robust approach to risk management and adaptation. The company continuously innovates to stay ahead of market trends, ensuring its Future Prospects. For more details, consider reading an article about the company's performance.

Graham Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Graham Holdings Company?

- What is Competitive Landscape of Graham Holdings Company?

- How Does Graham Holdings Company Work?

- What is Sales and Marketing Strategy of Graham Holdings Company?

- What is Brief History of Graham Holdings Company?

- Who Owns Graham Holdings Company?

- What is Customer Demographics and Target Market of Graham Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.