Glacier Media Group Bundle

Can Glacier Media Group Thrive in the Evolving Media Landscape?

Glacier Media Group, a Canadian Glacier Media Group SWOT Analysis, has strategically adapted its business model to navigate the dynamic media environment. This exploration delves into the core of Glacier Media Group's Growth Strategy, examining its evolution from local community newspapers to a diversified information and marketing solutions provider. We'll uncover how this

This analysis will provide a comprehensive

How Is Glacier Media Group Expanding Its Reach?

The expansion initiatives of Glacier Media Group are primarily centered on bolstering its position within specialized information sectors and broadening its digital offerings. This strategy involves entering new product categories within its existing B2B information segments, such as agriculture and environmental risk. The company is focused on providing more comprehensive solutions to its business clients.

A key aspect of Glacier Media Group's growth strategy involves strategic acquisitions, particularly of businesses that complement its existing B2B information services or provide entry into new, high-growth digital markets. This inorganic growth strategy allows the company to quickly gain market share and expertise in targeted areas. Furthermore, the company aims to expand its digital product pipeline, focusing on subscription-based models and enhanced digital marketing services.

Glacier Media Group's approach to expansion is multifaceted, targeting both organic and inorganic growth opportunities. The company is actively developing new online platforms and tools that cater to the evolving needs of businesses and consumers, thereby staying ahead of industry changes and capitalizing on the ongoing shift towards digital consumption. This strategic direction is crucial for sustaining long-term growth and adapting to the dynamic media landscape.

Glacier Media Group is expanding into new product categories within its existing B2B information segments. This includes focusing on sectors like agriculture and environmental risk. The goal is to offer more comprehensive solutions to business clients, increasing revenue streams.

The company actively pursues mergers and acquisitions to complement its existing B2B information services. This strategy provides a strategic entry into new, high-growth digital markets. Acquisitions help to quickly gain market share and expertise.

Glacier Media Group is expanding its digital product pipeline, focusing on subscription-based models. They are also enhancing digital marketing services. This includes developing new online platforms and tools for businesses and consumers.

The company is focused on adapting to the ongoing shift towards digital consumption. This involves staying ahead of industry changes. This approach is crucial for sustaining long-term growth and success in the media landscape.

To understand the historical context of these expansion efforts, it's helpful to review the Brief History of Glacier Media Group. This provides insights into the company's evolution and strategic shifts over time. The company's financial performance in 2024 and early 2025 will be crucial in assessing the effectiveness of these expansion initiatives, with a focus on how new revenue streams and market share gains contribute to overall financial health. The company's investment strategies and long-term goals are directly tied to these expansion plans, making them a key indicator of future prospects.

Glacier Media Group's expansion strategies focus on both organic and inorganic growth. This includes entering new product categories and pursuing strategic acquisitions. The aim is to strengthen its position in specialized information sectors.

- Entering new product categories within existing B2B segments, like agriculture and environmental risk.

- Actively pursuing mergers and acquisitions to enhance B2B services.

- Expanding the digital product pipeline with subscription-based models and digital marketing services.

- Developing new online platforms and tools to meet evolving business and consumer needs.

Glacier Media Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Glacier Media Group Invest in Innovation?

The innovation and technology strategy of the company is focused on leveraging digital transformation, data analytics, and platform development to drive sustained growth within its specialized information sectors. This approach emphasizes the application of existing and emerging technologies to enhance content delivery, audience engagement, and marketing solutions. The company continuously invests in its proprietary digital platforms to improve user experience, data collection, and targeted content distribution.

A key element of their technological approach involves the use of data analytics to better understand audience behavior, delivering more personalized content and advertising solutions. This strategy supports growth objectives by increasing engagement and providing more effective marketing solutions for their clients. The company's leadership in innovation is demonstrated by its ability to adapt traditional media assets into robust digital offerings and its continued success in providing specialized information services through technologically advanced platforms.

Their focus remains on practical applications of technology to enhance their core business, rather than speculative ventures into cutting-edge, unproven technologies. This pragmatic approach allows the company to maintain a competitive edge in the rapidly evolving media landscape, ensuring that it can meet the changing demands of its audience and clients.

The company is actively engaged in digital transformation to modernize its operations and enhance its service offerings. This involves migrating traditional media assets to digital platforms and developing new digital products.

Data analytics plays a crucial role in understanding audience behavior and personalizing content delivery. This helps in creating more targeted and effective marketing solutions for clients.

Continuous investment in proprietary digital platforms is a key strategy. These platforms are designed to improve user experience, data collection, and content distribution.

Focus on enhancing content delivery methods to reach a wider audience and improve engagement. This includes optimizing content for various digital platforms.

Strategies to increase audience engagement through interactive content, personalized recommendations, and improved user interfaces. This helps in building a loyal user base.

Providing effective marketing solutions for clients by leveraging data-driven insights and targeted advertising. This increases the value proposition for clients.

The company's technological initiatives are centered around practical applications that enhance its core business, rather than speculative ventures. This approach ensures that the company remains competitive and adaptable in a rapidly changing media environment. For a deeper understanding of the company's financial structure, consider reading about the Revenue Streams & Business Model of Glacier Media Group.

- Digital Platforms: Continuous upgrades and enhancements to proprietary digital platforms to improve user experience and data collection.

- Data-Driven Content: Utilizing data analytics to create more personalized content and improve audience engagement.

- Marketing Solutions: Providing clients with data-driven marketing solutions to increase effectiveness and ROI.

- Adaptation: Adapting traditional media assets into robust digital offerings to meet evolving market demands.

Glacier Media Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Glacier Media Group’s Growth Forecast?

The financial outlook for Glacier Media Group is centered around its strategic shift toward digital and specialized information services. This Media Company aims to achieve sustained growth in both revenue and profitability through this transition. The company's strategic focus includes enhancing its digital revenue streams and optimizing operational efficiencies to drive long-term value.

In the year ending December 31, 2023, Glacier Media Group reported consolidated revenue of $189.6 million. This figure reflects a slight decrease compared to the previous year, mainly due to reduced print advertising revenue and economic factors affecting certain segments. However, the company's investments in digital and B2B information services are expected to significantly contribute to overall revenue growth in the coming years.

The long-term financial objectives of Glacier Media Group are supported by its strategy to expand its recurring revenue base through subscriptions and specialized data services. These services typically offer higher margins and greater stability, which aligns with the company's goal of achieving consistent financial performance. The company's financial strategy focuses on prudent capital allocation to support its expansion initiatives and maintain a healthy balance sheet.

Glacier Media Group is diversifying its revenue streams. The company is focusing on digital media and specialized information services. These areas are expected to drive future growth and profitability.

The company aims to improve profit margins through digital services and operational efficiency. This will involve strategic investments in digital infrastructure and content development. The goal is to achieve sustainable financial performance.

Investment is directed towards digital infrastructure and content development. Strategic acquisitions are also part of the investment strategy. These investments support the company's Growth Strategy.

The company focuses on prudent capital allocation to support expansion. Maintaining a healthy balance sheet is a key financial goal. This approach ensures financial stability for future growth.

To understand the competitive environment, consider the Competitors Landscape of Glacier Media Group. This Market Analysis provides insights into the industry dynamics and the company's position. The company's strategic acquisitions play a role in its expansion plans, aiming to strengthen its market presence and enhance its service offerings.

Glacier Media Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Glacier Media Group’s Growth?

The Glacier Media Group faces several potential risks and obstacles in its pursuit of a robust growth strategy and promising future prospects. These challenges span the dynamic media industry and broader economic conditions, requiring proactive adaptation and strategic foresight. Understanding these potential pitfalls is crucial for investors, stakeholders, and anyone interested in the Glacier Media Group's trajectory.

A key area of concern is the evolving media landscape, marked by intense competition from larger digital media companies and specialized online information providers. The ongoing shift in advertising revenue from traditional print to digital platforms continues to pressure legacy businesses, necessitating constant innovation and strategic shifts. Furthermore, regulatory changes, particularly concerning data privacy and content distribution, could pose additional hurdles, demanding adjustments to operational frameworks.

Supply chain vulnerabilities, although less pronounced than in manufacturing, can still affect print operations through fluctuations in paper costs and distribution challenges. Technological disruption, while also an opportunity for the media company, presents a risk if the company fails to keep pace with rapid advancements in digital tools and platforms. Internally, resource constraints, specifically in attracting and retaining specialized digital talent, could impede their innovation and expansion efforts. For more information about the company's core values, you can read Mission, Vision & Core Values of Glacier Media Group.

The company faces stiff competition from established digital media giants and niche online providers. This competitive environment requires constant innovation and adaptation to maintain and grow market share. Strategic acquisitions and partnerships may be necessary to stay ahead of the competition.

The decline in print advertising and the rise of digital advertising pose a significant challenge. Adapting the business model to capitalize on digital platforms is crucial for future success. This involves investing in digital content creation, SEO, and digital marketing.

Changes in data privacy regulations and content distribution rules can impact operations. Compliance with new regulations may require adjustments to business practices and increased operational costs. Staying informed about these changes is essential.

Fluctuations in paper costs and distribution challenges can affect print operations. Diversifying suppliers and optimizing distribution networks can help mitigate these risks. Monitoring these factors is important for financial planning.

Rapid advancements in digital tools and platforms require continuous innovation. Failure to keep pace with technological changes can lead to a loss of competitiveness. Investment in technology and digital expertise is critical.

Attracting and retaining specialized digital talent can be a challenge. Investment in employee development and competitive compensation packages are important. Building a strong company culture can also help.

The company is diversifying its revenue streams beyond traditional print to include specialized information services and digital marketing. This helps reduce reliance on a single revenue source and increases resilience. This strategy includes expansion into B2B segments and digital media.

The company uses risk management frameworks to assess and prepare for potential market shifts and operational challenges. This proactive approach helps identify and mitigate potential risks. This includes regular market analysis and financial forecasting.

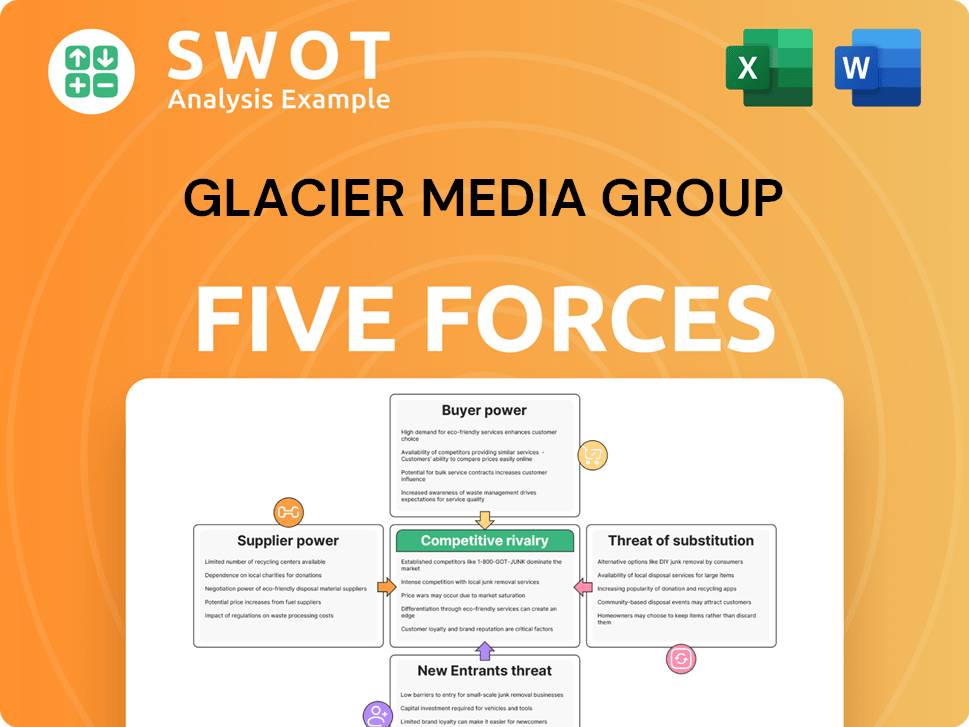

Glacier Media Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Glacier Media Group Company?

- What is Competitive Landscape of Glacier Media Group Company?

- How Does Glacier Media Group Company Work?

- What is Sales and Marketing Strategy of Glacier Media Group Company?

- What is Brief History of Glacier Media Group Company?

- Who Owns Glacier Media Group Company?

- What is Customer Demographics and Target Market of Glacier Media Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.