Grid Dynamics Bundle

Can Grid Dynamics Continue Its Digital Domination?

Grid Dynamics, a key player in the digital engineering services arena, is helping Fortune 1000 companies navigate their digital transformation journeys. With a track record of impressive revenue growth, including a record-breaking $100.3 million in Q4 2024, the company's strategic moves and innovative approach demand close scrutiny. This article delves into the Grid Dynamics SWOT Analysis, exploring the company's ambitious growth strategy and its potential to shape the future of IT Services.

This exploration will dissect Grid Dynamics' Growth Strategy, examining its recent acquisitions and expansion plans, and analyzing its financial performance to provide a comprehensive understanding of its future prospects. We'll also investigate the company's technology solutions and its ability to capitalize on the evolving industry trends within the Software Engineering and Digital Transformation landscapes. Understanding the Grid Dynamics company overview is critical for investors and business strategists alike.

How Is Grid Dynamics Expanding Its Reach?

The Grid Dynamics is actively pursuing several expansion initiatives to foster future growth. This strategy focuses on both geographical expansion and enhanced service offerings. A key component of their strategy involves entering new markets and diversifying their industry presence. Recent acquisitions play a significant role in this expansion.

These initiatives are designed to attract new customers, diversify revenue streams, and adapt to industry changes. The company aims to increase industry diversification, building on the success of its Retail and Finance verticals. Additionally, Grid Dynamics plans to scale its delivery locations further, aligning with its 'Follow-the-Sun' model. Deepening partnerships, including those with hyperscalers, is another crucial part of their expansion strategy.

The company has identified five key priorities for 2025 to achieve its growth aspirations, which include leveraging AI and data strengths, increasing accelerators and technology artifacts, expanding industry diversification, scaling delivery locations, and deepening partnerships. These strategic moves are expected to significantly impact the company's future prospects.

The acquisition of JUXT, a UK-based company, in September 2024, bolstered Grid Dynamics' expertise in banking and financial services. The acquisition of Mobile Computing, based in Argentina, in October 2024, strengthened Grid Dynamics' global delivery capabilities, particularly in the Americas. These acquisitions are key examples of their expansion strategy.

Grid Dynamics aims to diversify its industry presence. The Retail vertical accounted for 31.4% of total revenues in Q1 2025. The Finance vertical demonstrated strong sequential growth. This diversification strategy is crucial for mitigating risks and capturing opportunities in various sectors.

Grid Dynamics plans to scale its delivery locations further, aligning with its 'Follow-the-Sun' model. This model supports continuous service delivery across different time zones. Expanding delivery locations is essential for meeting global client demands and ensuring operational efficiency.

Deepening partnerships, including those with hyperscalers like Google Cloud, Microsoft, AWS, and NVIDIA, is a crucial part of their expansion strategy. Partner-influenced revenues have grown significantly over the past three years. Leveraging AI and data strengths is a key priority for 2025.

Grid Dynamics has identified five key priorities for 2025 to achieve its growth aspirations. These priorities are designed to drive innovation and enhance market position. These strategies are critical for the company's future growth opportunities.

- Leveraging AI and data strengths.

- Increasing accelerators and technology artifacts.

- Expanding industry diversification.

- Scaling delivery locations.

- Deepening partnerships.

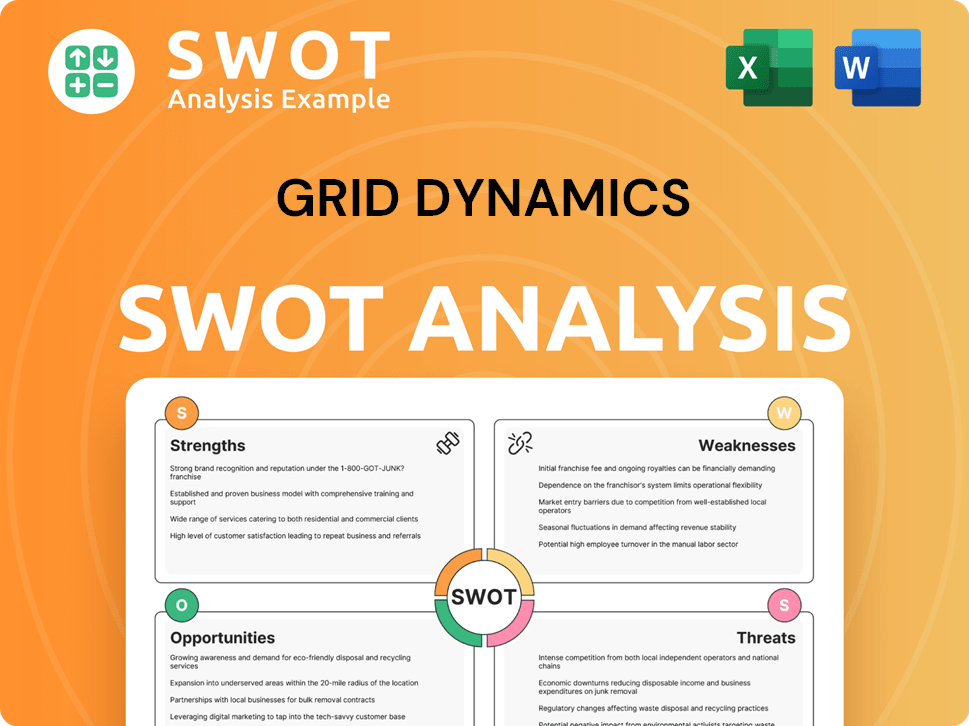

Grid Dynamics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Grid Dynamics Invest in Innovation?

The core of Grid Dynamics' Growth Strategy centers on innovation and technology, particularly in artificial intelligence (AI) and digital transformation. The company strategically invests in AI and data capabilities to enhance its service offerings, targeting Fortune 1000 companies. This focus allows Grid Dynamics to position itself as a leader in enterprise-level AI transformation.

Grid Dynamics is actively pursuing collaboration opportunities, especially with major U.S.-based global banks, with promising prospects anticipated in 2025. The company's commitment to innovation is evident in its increasing number of accelerators and technology artifacts, which are essential for delivering end-to-end AI-powered business solutions. This approach is designed to drive revenue growth and improve operational efficiency for their clients.

In Q4 2024, Grid Dynamics identified 130 AI opportunities, marking a 30% increase from the previous quarter, demonstrating strong momentum in its AI initiatives. This momentum is crucial for the company's Future Prospects, particularly in a rapidly evolving IT landscape. Their strategy includes expanding capabilities in cloud computing and cybersecurity, alongside data and AI, to meet the growing demands of its clients.

Grid Dynamics heavily invests in AI and data capabilities. These capabilities are central to its service offerings, ensuring they meet the demands of Fortune 1000 companies. This focus drives revenue growth and improves operational efficiency.

Digital transformation is a key driver. The company focuses on digital transformation, automation, and the use of cutting-edge technologies. This approach helps clients modernize their operations and stay competitive in the market.

The 'GigaCube' initiative aims to reach $1 billion in annual revenue. This initiative highlights the company's commitment to investing in an engineering culture and fostering innovation. It underscores the company's ambitious growth targets.

Grid Dynamics is expanding its capabilities in cloud computing and cybersecurity. These areas are crucial for modern IT services. This expansion helps the company offer comprehensive solutions to its clients.

The company has 8 years of experience and leadership in enterprise AI. This experience is supported by ongoing investment in data, analytics, and other key areas. This positions them well in the market.

Grid Dynamics is increasing the number of accelerators and technology artifacts. These tools are crucial for delivering end-to-end AI-powered business solutions. They enhance the company's ability to provide innovative services.

Grid Dynamics distinguishes itself through its deep expertise in enterprise AI and a strategic focus on key technology areas. This approach supports its Growth Strategy and enhances its Future Prospects. The company's commitment to innovation and its ability to deliver cutting-edge solutions are key to its success.

- Data and Analytics: Ongoing investment in data and analytics services.

- Application Modernization: Focus on modernizing applications to improve efficiency.

- Cloud Platform and Product Engineering: Expertise in cloud platforms and product engineering.

- Digital Engagement Services: Providing digital engagement services to enhance customer experiences.

For further insights into the company's ownership structure and financial performance, you can read more about the Owners & Shareholders of Grid Dynamics.

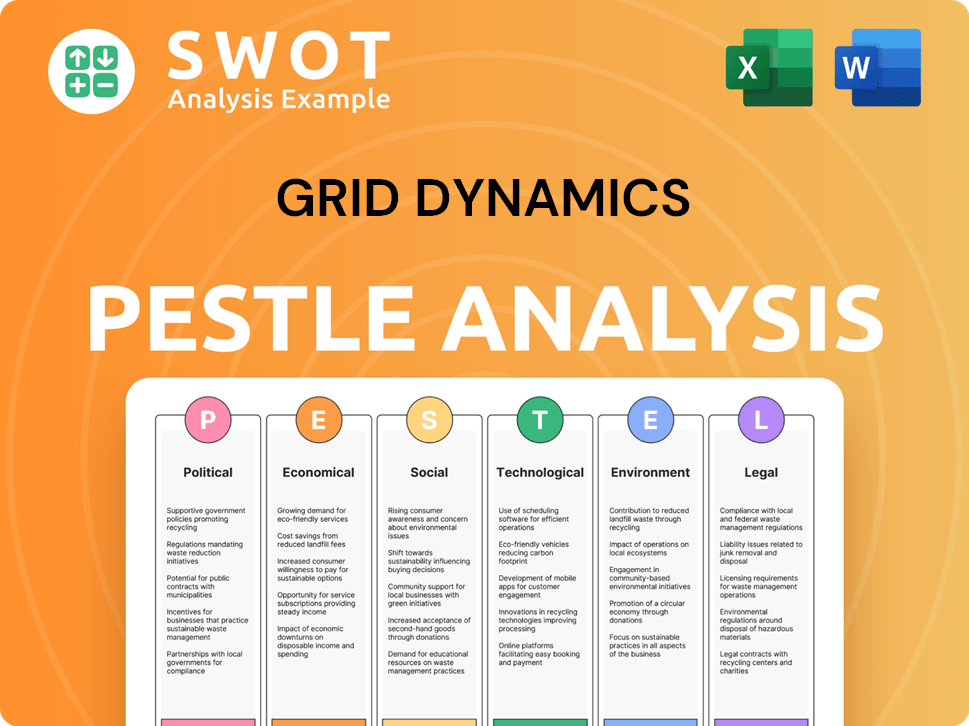

Grid Dynamics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Grid Dynamics’s Growth Forecast?

The financial outlook for Grid Dynamics in 2025 is promising, building on strong performance. The company's focus on IT Services and Digital Transformation is driving growth, with significant revenue projections for the year. This positive trajectory reflects the company's strategic initiatives and market positioning.

Grid Dynamics reported a record-breaking revenue of $350.6 million for the full year 2024, marking a 12.0% increase compared to 2023. The company's performance in the first quarter of 2025 continued this trend, with revenues reaching $100.4 million, surpassing the outlook range. This strong start sets a positive tone for the rest of the year and highlights the effectiveness of its growth strategy.

The company anticipates continued growth in the upcoming quarters, with projected revenues for the second quarter of 2025 in the range of $100 million to $102 million. These projections are supported by a robust client base and increased demand from key sectors. The company's ability to secure new enterprise clients and capitalize on industry trends positions it well for sustained expansion. For more details, you can explore the Marketing Strategy of Grid Dynamics.

Grid Dynamics forecasts full-year 2025 revenues to be between $415.0 million and $435.0 million. This represents a year-over-year growth of 18.4% to 24.1%. At the midpoint of $425.0 million, the growth is estimated at 21.2% over 2024.

Non-GAAP EBITDA for the first quarter of 2025 was between $12.9 million and $13.9 million. The company demonstrated strong financial health, with cash and cash equivalents totaling $325.5 million as of March 31, 2025.

The company expects revenues in the second quarter of 2025 to be between $100 million and $102 million. Non-GAAP EBITDA for the second quarter of 2025 is projected to be between $12.5 million and $13.5 million.

Grid Dynamics signed three notable enterprise clients in Q4 2024. The company also benefited from increased demand from fintech and insurance customers. A follow-on public offering of common stock generated $107.6 million in net proceeds during Q4 2024.

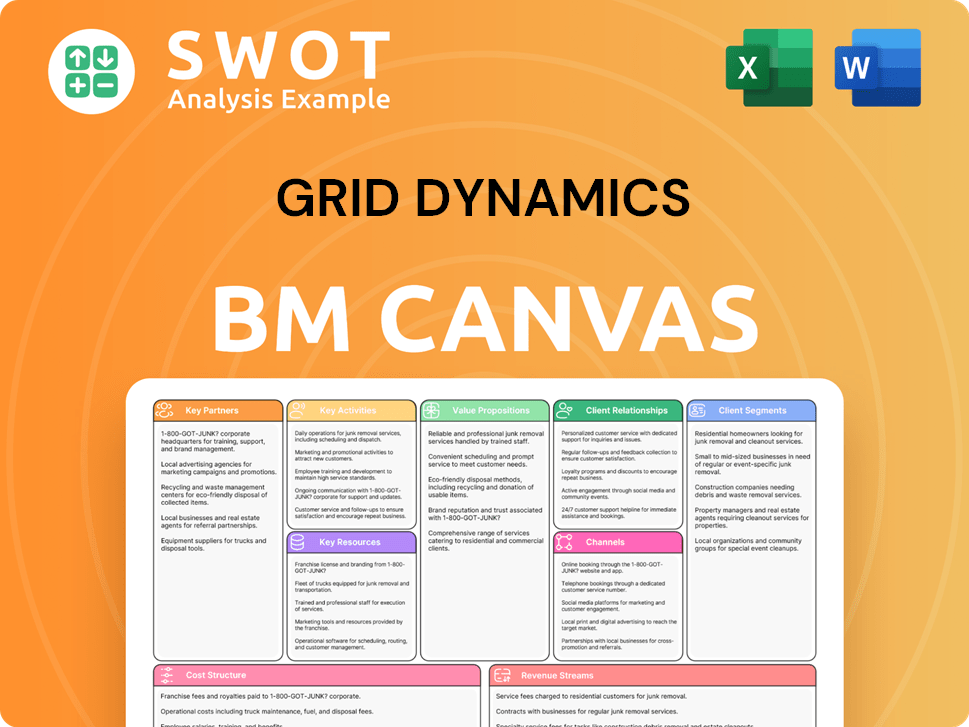

Grid Dynamics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Grid Dynamics’s Growth?

The path for Grid Dynamics, while promising, is not without its potential pitfalls. Several strategic and operational risks could influence the company's future trajectory. These challenges range from intense market competition to the ever-changing landscape of technology.

One of the primary hurdles Grid Dynamics faces is the competitive nature of the IT Services market. Larger players such as Accenture pose significant competition. The rapidly evolving AI landscape also demands continuous adaptation to maintain a competitive edge. Moreover, economic uncertainties and supply chain disruptions could affect revenue projections and delivery capabilities.

Furthermore, the company’s financial health is influenced by its ability to manage operational costs and navigate earnings volatility. Dependency on key customers also presents a risk. For instance, a significant portion of revenue comes from a single client, showing a customer concentration risk.

The IT Services market is highly competitive, with major players like Accenture vying for market share. This competitive environment requires continuous innovation and strategic positioning for Grid Dynamics to maintain its growth. The ability to differentiate services and solutions is critical.

The rapid advancement of AI presents both opportunities and challenges. Grid Dynamics must continually invest in AI capabilities to stay ahead of the curve. This includes developing new solutions and adapting to emerging technologies to meet client needs effectively.

Managing operational costs and mitigating earnings volatility are essential for financial stability. Economic fluctuations and market dynamics can impact revenue streams. Effective cost management and strategic financial planning are vital for sustained profitability.

A significant portion of revenue from a single customer poses a customer concentration risk. For example, in Q1 2025, one customer accounted for 14.2% of Grid Dynamics' total revenue. Losing a major client could significantly affect revenue.

Maintaining compliance with various regulations requires ongoing investment in robust programs. Changes in data privacy laws and industry-specific regulations can create additional operational complexities and costs. Staying compliant is crucial for maintaining client trust.

Economic uncertainties can affect revenue projections, and supply chain disruptions can impact delivery capabilities. Grid Dynamics must develop strategies to mitigate these risks. This includes diversifying its client base and optimizing its supply chain.

To address these risks, Grid Dynamics employs several strategic measures. These include expanding its customer base, diversifying its revenue streams, and scaling its global delivery locations. Additionally, the company focuses on cost optimization and staying current with technological trends. For more insights, you can explore the Target Market of Grid Dynamics.

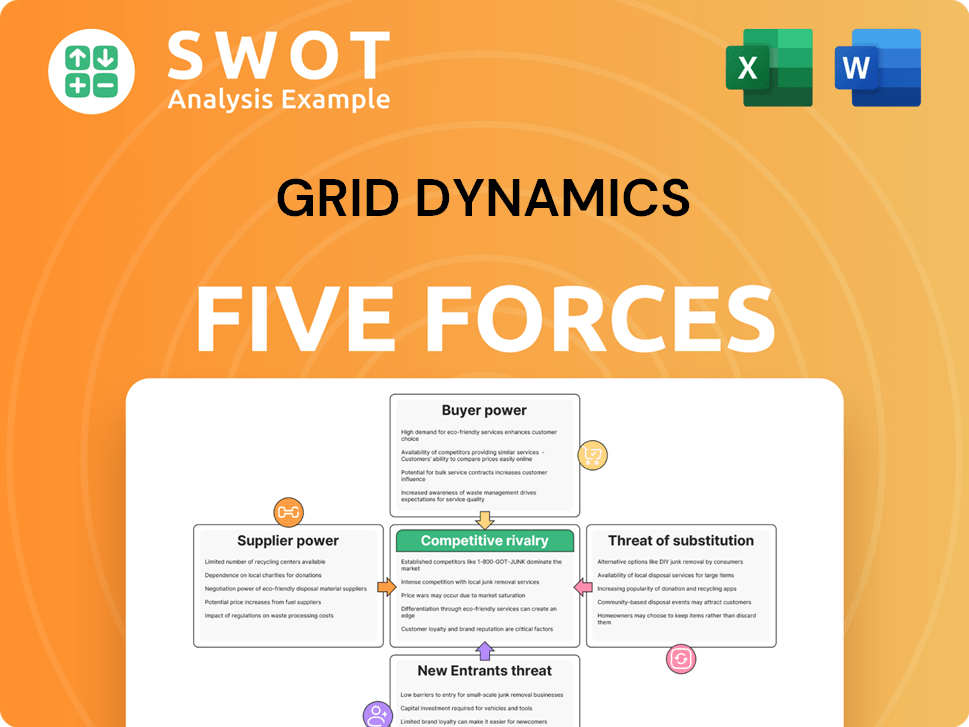

Grid Dynamics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grid Dynamics Company?

- What is Competitive Landscape of Grid Dynamics Company?

- How Does Grid Dynamics Company Work?

- What is Sales and Marketing Strategy of Grid Dynamics Company?

- What is Brief History of Grid Dynamics Company?

- Who Owns Grid Dynamics Company?

- What is Customer Demographics and Target Market of Grid Dynamics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.