Hobby Lobby Stores Bundle

Can Hobby Lobby Continue Its Retail Dominance?

From its Oklahoma roots, Hobby Lobby has become a retail powerhouse in the arts and crafts sector, but what does the future hold? This comprehensive analysis dives into the Hobby Lobby Stores SWOT Analysis, exploring its evolution from a small business to a national chain with over 900 stores across the United States. Understanding Hobby Lobby's growth strategy is crucial in today's dynamic retail landscape.

As the retail industry trends shift, Hobby Lobby's ability to adapt and innovate will be key. This in-depth Hobby Lobby company analysis will examine its expansion plans, online sales strategy, and strategic financial planning to assess its future prospects. We'll explore the Hobby Lobby business model, the competitive landscape, and how it aims to maintain its market share in the arts and crafts market, providing valuable insights for investors and industry observers alike.

How Is Hobby Lobby Stores Expanding Its Reach?

The growth strategy of the company is primarily centered on disciplined physical store expansion and strategic product diversification. The company has consistently focused on increasing its footprint within the United States. This approach is driven by identifying underserved markets and leveraging its established supply chain and operational efficiencies. This strategy has allowed the company to maintain a steady growth trajectory within the competitive retail industry trends.

Beyond geographical expansion, the company emphasizes expanding its product categories to cater to evolving consumer interests in crafts, home decor, and seasonal items. This includes introducing new product lines and updating existing assortments to remain competitive and relevant. The company's business model focuses on attracting new customers and encouraging repeat business by offering a comprehensive selection. For a comprehensive understanding, consider reviewing the Marketing Strategy of Hobby Lobby Stores.

While specific merger and acquisition activities are not a prominent public feature of its recent growth strategy, the company's organic growth through new store openings and product line enhancements remains central to its business model. The company's focus on these elements reflects a commitment to sustainable growth within the arts and crafts market.

The company's expansion strategy includes opening new stores, with a reported plan for approximately 20 new locations in 2024. This steady growth demonstrates a deliberate approach to increasing its market presence across the United States. The company's store location analysis often targets areas where it can establish a strong customer base.

The company continually updates its product offerings to meet changing consumer demands. New product offerings and updates to existing lines are key to maintaining competitiveness. This strategy helps attract new customers and encourages repeat business.

The company concentrates on the arts and crafts market, home decor, and seasonal items. The company's strategic focus ensures it caters to a broad range of customer interests. This approach helps the company maintain its market share analysis.

The company leverages its established supply chain and operational efficiencies to support its expansion. This focus on efficiency helps the company manage costs and ensure profitability. Effective supply chain management is critical to its growth.

The company's future prospects appear positive, driven by its strategic focus on physical store expansion and product diversification. The company's commitment to organic growth, through store openings and product enhancements, suggests a sustainable growth model. The company's ability to adapt to retail industry trends and consumer preferences will be crucial for long-term success.

- Continued store expansion with approximately 20 new stores planned for 2024.

- Ongoing product line updates to meet evolving consumer interests.

- Emphasis on operational efficiencies and supply chain management.

- Focus on the arts and crafts market, home decor, and seasonal items.

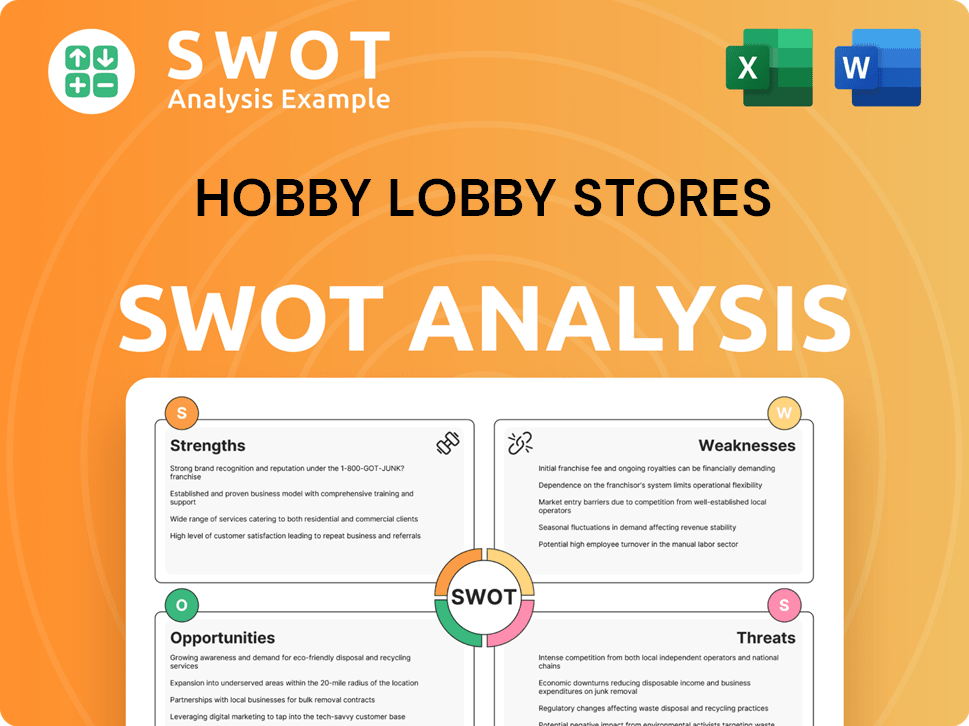

Hobby Lobby Stores SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hobby Lobby Stores Invest in Innovation?

The innovation and technology strategy of the company focuses on enhancing in-store experiences and operational efficiency. Unlike some e-commerce businesses, the company's approach doesn't prioritize cutting-edge digital transformations. This strategic focus supports its extensive physical retail presence and ensures efficient store operations.

The company has invested in optimizing its supply chain and inventory management systems. While specific details on research and development investments or patents are not widely disclosed, the company’s technological efforts are geared towards supporting its core retail business. This approach helps the company maintain a competitive edge in the arts and crafts market.

The company maintains an online store to complement its brick-and-mortar operations. This digital platform is crucial for reaching a broader customer base and offering convenience. The company likely uses technology for internal processes such as data analytics for merchandising decisions and operational streamlining. This approach supports the company's overall Revenue Streams & Business Model of Hobby Lobby Stores.

The company focuses on optimizing its supply chain to ensure product availability. This includes efficient inventory management systems to support store operations. This is a key element of the company's growth strategy.

The company operates an online store to complement its physical locations. This digital platform is essential for reaching a wider customer base. The online store allows customers to shop remotely, enhancing convenience.

The company likely uses technology for internal processes, such as data analytics. This data is used for merchandising decisions and operational streamlining. These internal applications support the core retail business.

The company's customer-facing technology is not at the forefront of AI or extensive automation. The focus is on practical applications that directly support the core retail business. This approach prioritizes customer service.

The company's innovation strategy prioritizes practical applications of technology. These applications directly support its core retail business. This approach helps the company maintain its competitive edge in the arts and crafts market.

The company invests in technology to improve operational efficiency. This includes supply chain optimization and inventory management. These improvements support the company's overall growth.

The company's technological investments are primarily aimed at enhancing in-store experiences and operational efficiency. This includes a focus on supply chain management and inventory optimization. The company uses data analytics for merchandising decisions and operational streamlining.

- Supply Chain Optimization: Investments in systems to ensure product availability and efficient store operations.

- Inventory Management: Implementation of efficient systems to manage inventory levels and reduce costs.

- Data Analytics: Use of data analytics for merchandising decisions and operational streamlining.

- Online Store: Maintaining an online platform to reach a broader customer base and offer convenience.

- Customer Service: Prioritizing practical applications of technology that directly support customer service.

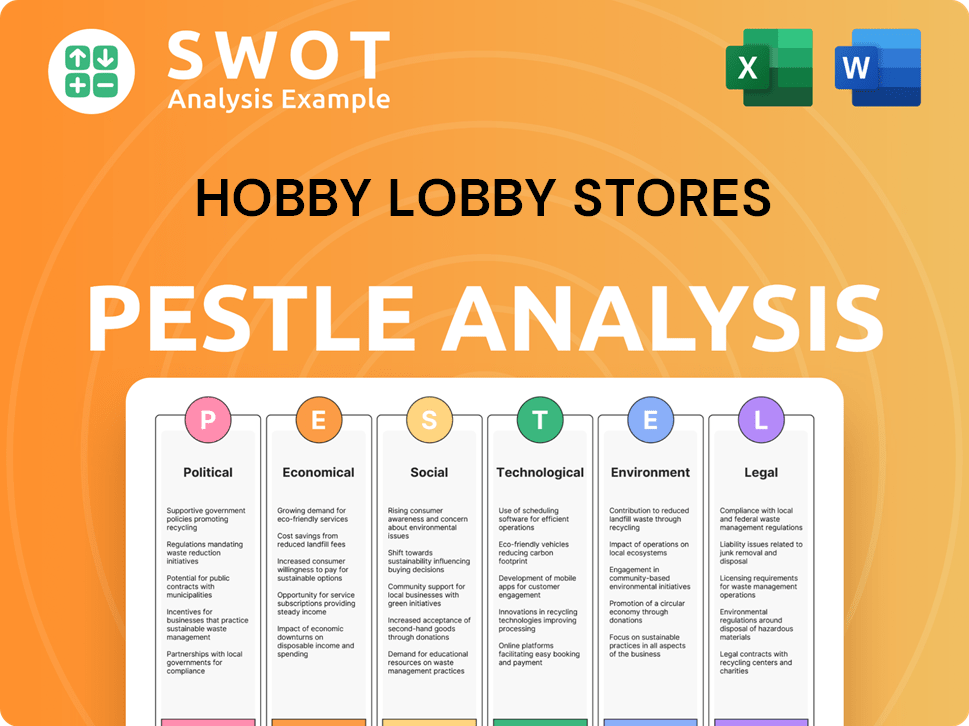

Hobby Lobby Stores PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Hobby Lobby Stores’s Growth Forecast?

Due to its status as a privately held company, detailed financial information for Hobby Lobby is not publicly available. This lack of transparency makes it difficult to provide precise figures regarding its financial outlook. However, industry analysts often estimate the company's revenue based on its extensive store network and market presence. This makes it challenging to provide exact figures for its financial outlook.

Despite the absence of public financial reports, the company's consistent expansion strategy implies a healthy financial position. The focus on sustainable growth, rather than rapid expansion, suggests a strategy centered on long-term profitability. This approach likely involves maintaining competitive pricing and a wide product selection to attract and retain customers within the arts and crafts market.

The company's financial goals likely revolve around continued market penetration and operational efficiency. Specific comparisons to industry benchmarks or detailed projections remain speculative without publicly available financial statements. However, its sustained growth indicates robust underlying financial performance, supporting its ongoing expansion and market position. For more insights, explore the Competitors Landscape of Hobby Lobby Stores.

Industry analysts estimate Hobby Lobby's annual revenues to be in the multi-billion dollar range. This reflects its significant scale within the arts and crafts retail sector. These estimates are based on factors like store count and market share.

Hobby Lobby has a history of cautious expansion, focusing on sustainable growth. This approach suggests a long-term financial strategy aimed at maintaining profitability. The company's expansion plans likely involve strategic store openings.

Hobby Lobby maintains a strong market position within the arts and crafts market. This is supported by its extensive store network and competitive pricing. Its ability to offer a wide product variety also contributes.

The company's financial goals likely include continued market penetration and operational efficiency. These goals are aimed at maintaining its competitive pricing and product variety. This approach supports long-term financial health.

Revenue growth is supported by store expansion and market share. Hobby Lobby focuses on increasing sales through new store openings. The company's growth is also driven by customer loyalty and product selection.

Profitability is maintained through efficient operations and cost management. The company focuses on controlling expenses to ensure profitability. This includes supply chain management and store operations.

Investments are likely directed towards new store openings and infrastructure. The company invests in its supply chain to improve efficiency. This also includes investments in technology and employee training.

Hobby Lobby adapts to retail industry trends and consumer preferences. This includes responding to shifts in online sales and customer demands. The company also focuses on sustainability and customer experience.

The competitive landscape includes other arts and crafts retailers. Hobby Lobby differentiates itself through its product offerings and pricing. The company also focuses on customer service and store experience.

Future prospects involve continued expansion and market share growth. The company's long-term strategy includes adapting to changing market conditions. This also includes maintaining its strong financial position.

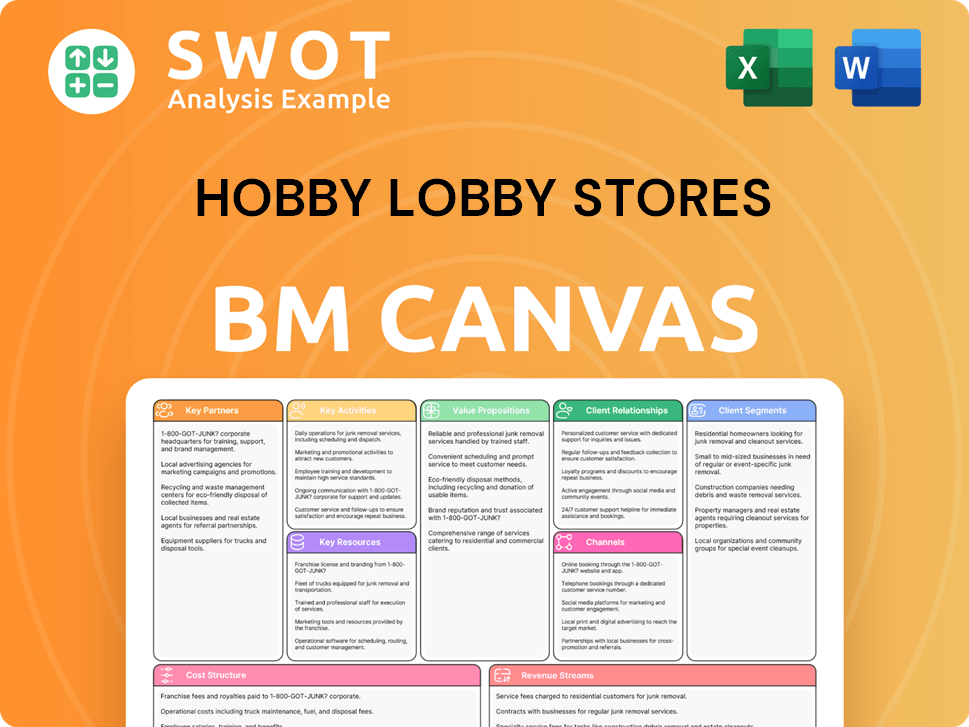

Hobby Lobby Stores Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Hobby Lobby Stores’s Growth?

The company faces several potential risks that could affect its expansion and profitability. These challenges include intense competition from established retailers and online marketplaces, as well as the need to adapt to evolving consumer preferences and technological advancements. Understanding these risks is crucial for assessing the long-term viability of the company's growth strategy.

One of the primary obstacles is the highly competitive retail landscape. The company must continually innovate and differentiate its offerings to maintain its market share and attract customers. Additionally, external factors such as economic downturns or shifts in consumer spending habits could negatively impact sales and financial performance. These factors will influence the company's future prospects.

Moreover, operational challenges such as supply chain disruptions and internal resource constraints can also hinder growth. Effective risk management and strategic planning are essential for the company to navigate these obstacles and capitalize on opportunities within the arts and crafts market. A thorough Target Market of Hobby Lobby Stores analysis is also crucial to understand the customer base and adapt to their evolving needs.

The company competes with large retailers like Michaels and Jo-Ann Stores, as well as online platforms such as Amazon and Etsy. These competitors offer a wide range of products and often engage in aggressive pricing strategies. To maintain its market position, the company must continually differentiate its offerings and provide a compelling shopping experience.

Failure to adequately adapt to e-commerce trends and consumer preferences for digital engagement could limit future growth. The company's online sales strategy must evolve to meet the growing demand for online shopping. This includes improving its website, enhancing the online shopping experience, and leveraging digital marketing strategies.

Supply chain disruptions, including those caused by global events, raw material price fluctuations, or transportation issues, could impact inventory levels and profitability. The company must develop robust supply chain management strategies to mitigate these risks. This includes diversifying suppliers and implementing effective inventory management systems.

Regulatory changes, especially those related to labor laws, trade policies, or product safety standards, could pose compliance burdens and affect operational costs. The company must stay informed about regulatory changes and ensure compliance. This may involve investing in legal and compliance resources.

Challenges in attracting and retaining skilled labor, especially in specialized craft areas, could hinder service quality and operational efficiency. The company needs to focus on employee satisfaction and create a positive work environment. This might involve offering competitive wages, benefits, and opportunities for professional development.

Economic downturns or shifts in consumer spending habits could negatively impact sales and financial performance. The company should have a conservative financial approach to provide a buffer against economic downturns. This includes careful financial planning and cost management strategies.

The company mitigates risks through a diversified product offering, enabling it to adapt to changing consumer demands. It likely employs robust inventory management and supplier relationship strategies to minimize supply chain disruptions. Its conservative financial approach provides a buffer against economic downturns.

The arts and crafts market is subject to evolving retail industry trends and shifts in consumer preferences. The company must stay agile to capitalize on new product offerings and adapt to changing customer demographics. The competitive landscape requires continuous innovation and strategic adjustments.

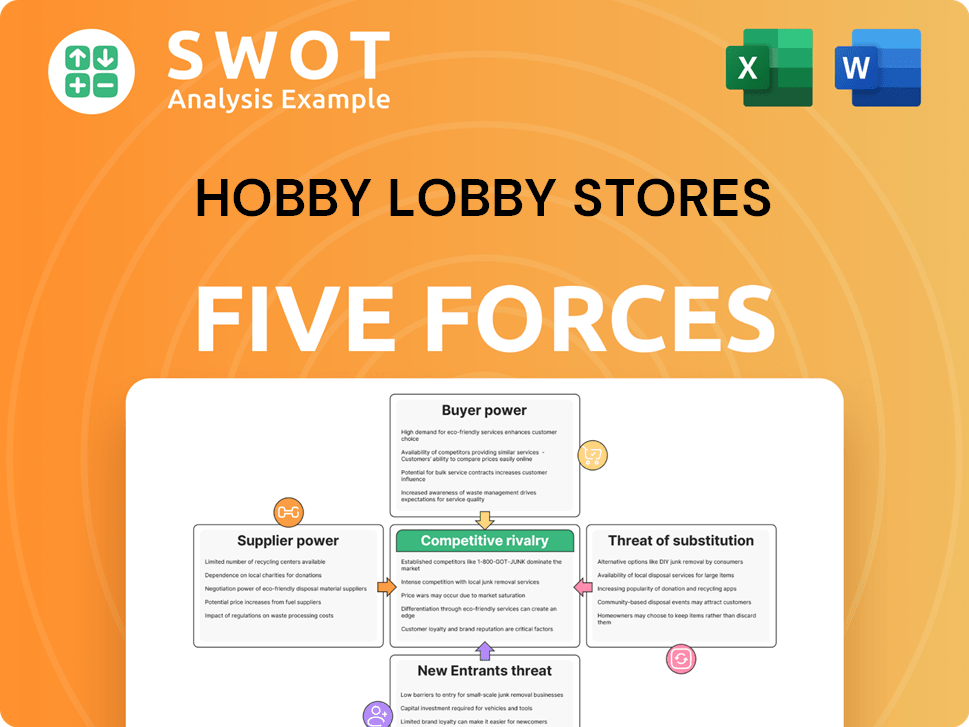

Hobby Lobby Stores Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hobby Lobby Stores Company?

- What is Competitive Landscape of Hobby Lobby Stores Company?

- How Does Hobby Lobby Stores Company Work?

- What is Sales and Marketing Strategy of Hobby Lobby Stores Company?

- What is Brief History of Hobby Lobby Stores Company?

- Who Owns Hobby Lobby Stores Company?

- What is Customer Demographics and Target Market of Hobby Lobby Stores Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.