Jenoptik Bundle

Can Jenoptik Continue Its Ascent in the Photonics Arena?

Jenoptik, a global technology leader, has strategically positioned itself for substantial growth. Its transformation into a photonics powerhouse, with a footprint spanning approximately 80 countries, underscores a commitment to innovation and strategic expansion. This Jenoptik SWOT Analysis delves into the core of its business model and future trajectory.

This comprehensive Jenoptik company analysis examines the company's ambitious growth strategy, including its focus on organic expansion, operational excellence, and customer-centric innovation. With a keen eye on Jenoptik's future prospects, particularly in high-growth markets, we'll explore the drivers behind its financial performance and market share, and assess the potential for sustainable growth initiatives in the competitive landscape.

How Is Jenoptik Expanding Its Reach?

The expansion initiatives of the company are primarily guided by its 'Agenda 2025 'MORE VALUE',' which focuses on sustainable, profitable growth within the photonic core markets. This strategic direction is crucial for understanding the company's future prospects and its approach to the competitive landscape. The company is actively investing in expanding its production capabilities to meet growing market demands, particularly in the semiconductor equipment industry.

A key aspect of this expansion includes the construction of a new high-tech factory in Dresden, Germany. This facility represents the largest single investment in the company's history, with a budget just under €100 million. The new clean room fab commenced production in early 2025, significantly increasing the production capacity for micro-optics and sensors. These components are essential for semiconductor lithography and inspection processes, supporting the production of high-precision sensors for high-performance chips, including those used in AI applications.

In addition to geographical expansion, the company is also focused on entering new product categories and diversifying its revenue streams. The core strategy emphasizes three high-growth future markets: semiconductor and electronics, life science and medical technology, and smart mobility. This diversification is part of the company's long-term strategy to ensure sustained growth and resilience in a dynamic market.

The new factory in Dresden is a major step in expanding the company's presence in the semiconductor market. The facility's increased capacity for micro-optics and sensors will support the growing demand for high-performance chips. This expansion is vital for the company's growth strategy in photonics and strengthens its position in the global market.

The Biophotonics SBU saw a significant revenue increase of 25.8% to €63.8 million in Q1 2025, driven by strong development in the dental business. This growth highlights the company's focus on innovative applications in the medical field. The expansion includes investments in production equipment and the expansion of the biophotonics production site in Berlin, inaugurated in June 2023.

The Smart Mobility Solutions division grew revenue by 19.7% to €28.7 million in Q1 2025, primarily due to strong business in the Americas and Middle East/Africa. This growth demonstrates the company's ability to capitalize on market opportunities in the automotive industry and other mobility sectors. These initiatives are designed to access new customers and diversify revenue streams.

The company continues to invest in production equipment and expand its facilities to meet growing demand. The strategic focus on the semiconductor and electronics, life science and medical technology, and smart mobility markets is designed to drive future growth. These initiatives are designed to access new customers, diversify revenue, and stay ahead of industry changes.

These expansion initiatives are designed to access new customers, diversify revenue, and stay ahead of industry changes. The company's strategic investments and focus on high-growth markets are key to its future prospects. For more insights into the competitive landscape, consider exploring the Competitors Landscape of Jenoptik.

The company's expansion includes significant investments in new facilities and technologies. The focus on high-growth markets like semiconductors, life sciences, and smart mobility drives revenue growth. These initiatives are designed to ensure long-term sustainable growth and enhance the company's market share.

- New high-tech factory in Dresden, Germany, with a nearly €100 million investment.

- Biophotonics SBU revenue increased by 25.8% to €63.8 million in Q1 2025.

- Smart Mobility Solutions division revenue grew by 19.7% to €28.7 million in Q1 2025.

- Strategic focus on semiconductor and electronics, life science and medical technology, and smart mobility.

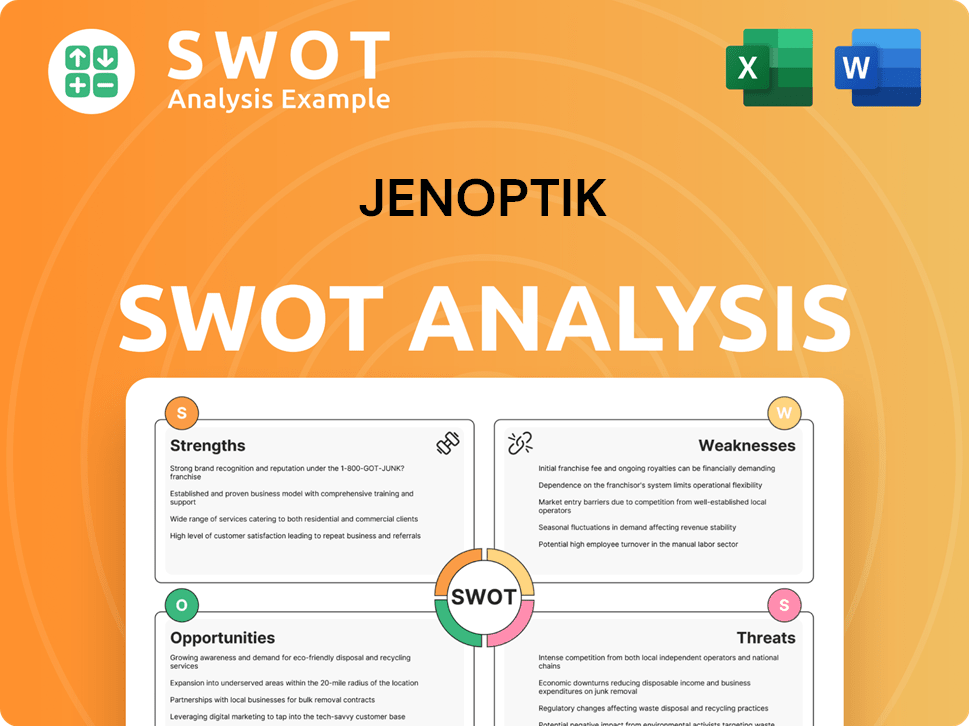

Jenoptik SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Jenoptik Invest in Innovation?

The core of the Jenoptik growth strategy hinges on technological innovation and the strategic application of cutting-edge technologies. This approach is deeply embedded within the company's 'Agenda 2025 'MORE VALUE',' which actively seeks to anticipate and meet future customer needs and market trends. This proactive stance allows for the development of technologies and products that are not only current but also future-proof, driving sustainable growth.

A significant portion of Jenoptik's investment is channeled into research and development (R&D), aiming to expand capacity, increase flexibility, and build strong competencies. This includes a focus on pre-development activities and the ownership of innovative technologies. The company's commitment to innovation is further demonstrated by its new high-tech factory in Dresden, which began production in early 2025. This facility is dedicated to manufacturing micro-optics and sensors, specifically for the semiconductor equipment industry, supporting high-precision sensors for advanced applications like AI.

Jenoptik's strategic focus areas include digitalization, health, smart manufacturing, and mobility, all of which leverage photonics. The company's ability to adapt and innovate within these sectors is key to its Jenoptik future prospects and overall market positioning. This strategic alignment ensures that Jenoptik remains at the forefront of technological advancements, contributing to its long-term success and ability to capitalize on emerging market opportunities.

Jenoptik provides high-performance optics, micro-optics, and innovative test and measurement systems to support digitalization efforts across various industries.

The company supplies optical systems for genome sequencing, digital image processing, microscope cameras, and laser systems, contributing to advancements in healthcare technologies.

Jenoptik offers solutions for laser processing, enhancing efficiency and precision in manufacturing processes.

The company delivers innovative products for road safety and public security, supporting the development of smarter and safer transportation systems.

Jenoptik integrates sustainability into its corporate strategy, using its expertise and innovative products to address social and climate challenges.

Jenoptik consistently invests in R&D, with a focus on expanding capacity and developing new technologies. In 2023, R&D expenses were approximately €67.5 million, reflecting a commitment to innovation and future growth.

Jenoptik's technology portfolio spans various sectors, driving its Jenoptik company analysis and market position. The company's focus on photonics enables it to provide solutions across diverse applications, ensuring its relevance and competitiveness.

- Semiconductor Industry: High-precision sensors and micro-optics for advanced chip manufacturing.

- Healthcare: Optical systems for genome sequencing and digital imaging.

- Smart Manufacturing: Laser processing solutions for enhanced production efficiency.

- Smart Mobility: Innovative products for road safety and public security.

- Digitalization: High-performance optics and measurement systems.

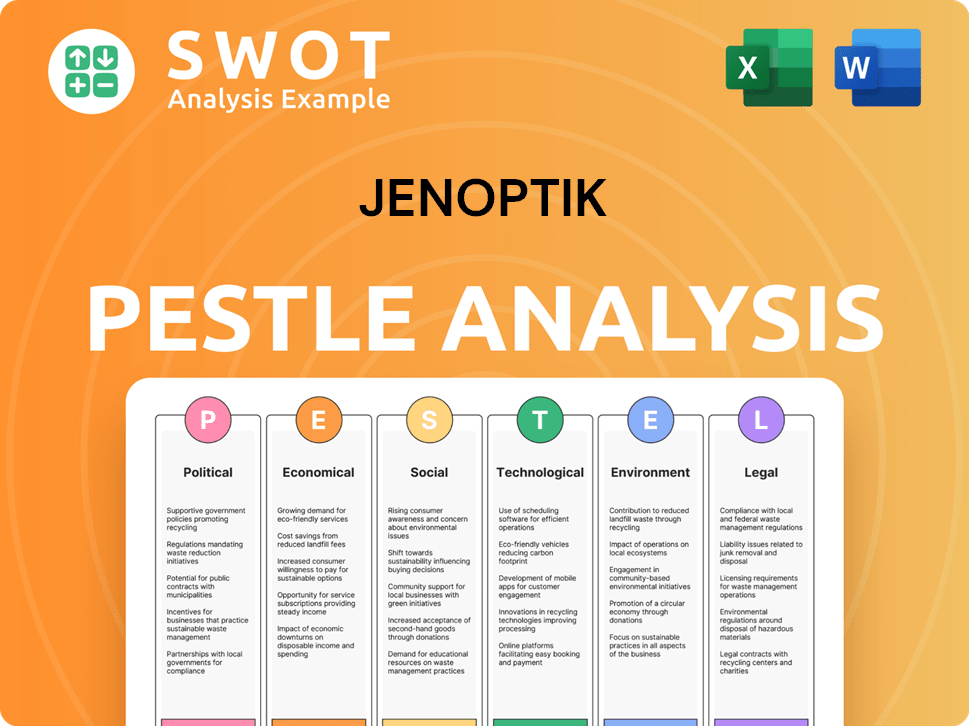

Jenoptik PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Jenoptik’s Growth Forecast?

The financial performance of the company in fiscal year 2024 showed robust results. The company's revenue reached a record high, driven by contributions from all divisions. The company's growth strategy focused on organic expansion, contributing to overall financial success. For a deeper understanding of the company's origins, you can explore the Brief History of Jenoptik.

Revenue increased by 4.7% to €1,115.8 million, demonstrating strong performance across all sectors. Group EBITDA also saw an increase, rising by 5.7% to €221.5 million, with the EBITDA margin slightly improving to 19.9%. The net profit for the year significantly increased to €92.6 million, reflecting the company's profitability and effective cost management.

Looking ahead, the company anticipates a challenging market environment in fiscal year 2025. The Executive Board projects revenue to remain stable, with a variation of plus or minus 5%, estimating around €1,116 million. The EBITDA margin is expected to be between 18.0% and 21.0% in 2025. Capital expenditure is expected to be significantly lower than the prior year's €114.6 million, following the completion of the new clean room fab in Dresden.

The company's market share is influenced by its strategic focus on photonics and its diverse business model. The company operates in various sectors, including semiconductor equipment, automotive, and industrial solutions. The company's competitive landscape includes both established and emerging players in the photonics market.

The company's financial performance in 2024 was strong, with record revenue and earnings. The company's revenue growth was driven by organic expansion across all divisions. The company's financial outlook for 2025 anticipates stable revenue but with potential market uncertainties.

The company's business model is based on a diversified portfolio of technologies and solutions. The company serves various industries, including semiconductor equipment, automotive, and industrial solutions. The company's business model supports its growth strategy and expansion plans.

Strategic acquisitions have been a part of the company's growth strategy. These acquisitions have helped expand the company's technology portfolio and market opportunities. The company's expansion plans may involve further strategic acquisitions to strengthen its market position.

Despite a difficult start to 2025, particularly impacting the Semiconductor & Advanced Manufacturing SBU, the company expects an upturn in demand in the second half of the year, especially in the semiconductor equipment industry. In Q1 2025, group revenue was €243.6 million, a 4.9% decrease compared to the previous year, and group EBITDA declined to €36.2 million. However, free cash flow before interest and taxes improved significantly to €28.9 million in Q1 2025, driven by strong operating cash flow. The company maintains a solid financial and balance sheet position, with an equity ratio of 57.7% and net debt of €382.2 million as of March 31, 2025. The company has also proposed a dividend payment of €0.38 per share for fiscal year 2024, an increase of 8.6%. The previously targeted revenue of €1.2 billion and an EBITDA margin of 21% to 22% for fiscal year 2025 are now expected to be achieved in 2026 due to the delayed upturn in the semiconductor equipment industry.

The company's growth strategy heavily relies on its photonics technology portfolio. The company focuses on innovation and R&D investments to drive growth in this sector. Strategic acquisitions also play a role in expanding its photonics capabilities.

The company sees future prospects in the automotive industry, particularly in areas like advanced driver-assistance systems (ADAS). The company's technology portfolio supports its expansion into the automotive sector. Market opportunities in the automotive industry are a key focus for the company.

The company makes significant R&D investments to drive innovation and maintain its competitive edge. These investments support the company's long-term strategy and technology portfolio. R&D is crucial for the company's sustainable growth initiatives.

The company has expansion plans that include both organic growth and strategic acquisitions. These plans aim to increase the company's market share and reach. The company's expansion plans are supported by its strong financial position.

The company faces challenges and risks, including market uncertainties and economic conditions. The company's risk management strategies help mitigate these challenges. The company's sustainable growth initiatives aim to address these risks.

The company maintains strong investor relations to communicate its performance and strategy. Investor relations activities help build trust and transparency with stakeholders. The company's investor relations efforts support its long-term strategy.

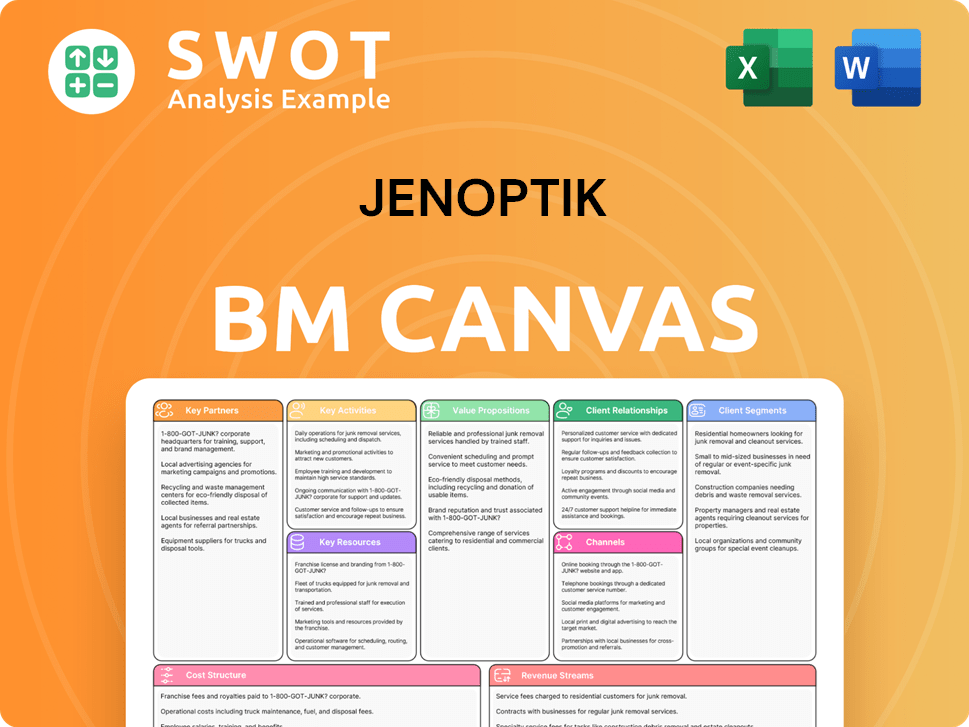

Jenoptik Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Jenoptik’s Growth?

The path to realizing the Jenoptik growth strategy and achieving its Jenoptik future prospects is not without its hurdles. Several strategic and operational risks could impact the company's trajectory. These challenges primarily stem from intense market competition, regulatory shifts, and broader economic uncertainties that may affect the company.

Jenoptik's company analysis reveals that the management has acknowledged a high level of market uncertainty, especially in the first half of 2025. This uncertainty significantly impacts the company's ability to meet its order intake and revenue targets, particularly due to the cyclical nature of the semiconductor equipment industry.

The automotive sector also presents a challenging market environment, with weak demand contributing to a decline in Jenoptik's overall order intake. Geopolitical conflicts and tariff discussions add further risks, potentially affecting customer demand and global economic growth in 2025 and beyond.

The semiconductor equipment industry's cyclical nature poses a significant challenge. The expected upturn has been delayed, affecting order intake and revenue. For example, the Semiconductor & Advanced Manufacturing SBU saw lower revenue in Q1 2025 due to weaker performance in lithography.

Weak demand in the automotive sector contributes to a decline in Jenoptik's overall order intake. This issue is compounded by geopolitical risks and discussions around tariffs, increasing the overall risk profile. In the first nine months of 2024, order intake lagged behind the previous year's levels.

Total order intake has declined, with Q1 2025 showing a 15.5% year-on-year decrease. This decline is partly due to challenges in the semiconductor equipment market and the automotive sector. The non-photonics business unit also saw a sharp drop in demand.

Geopolitical conflicts and discussions around tariffs increase overall risks for 2025 and beyond. These factors can impact direct customer demand and global economic growth. These risks require proactive management and strategic planning.

Jenoptik is mitigating these risks through strategic diversification and capacity expansion. The company is committed to its expansion plans, including the new factory in Dresden. These plans demonstrate a proactive approach to manage risks effectively.

The implementation of a leaner organizational structure is aimed at improving operational efficiency. This approach allows Jenoptik to focus on core markets and adapt more quickly to market changes. It also strengthens the company's competitive position.

Despite the challenges, Jenoptik's financial performance remains solid. The company maintains a healthy equity ratio and has reduced its net debt. This financial strength provides a buffer against market fluctuations and supports long-term investments. For a deeper understanding of Jenoptik's revenue streams and business model, consider reading Revenue Streams & Business Model of Jenoptik.

Jenoptik's business model includes a diverse portfolio, targeting high-growth markets like life science, medical technology, and smart mobility. This diversification helps mitigate risks associated with specific industry downturns. The focus on diverse markets supports sustainable growth initiatives.

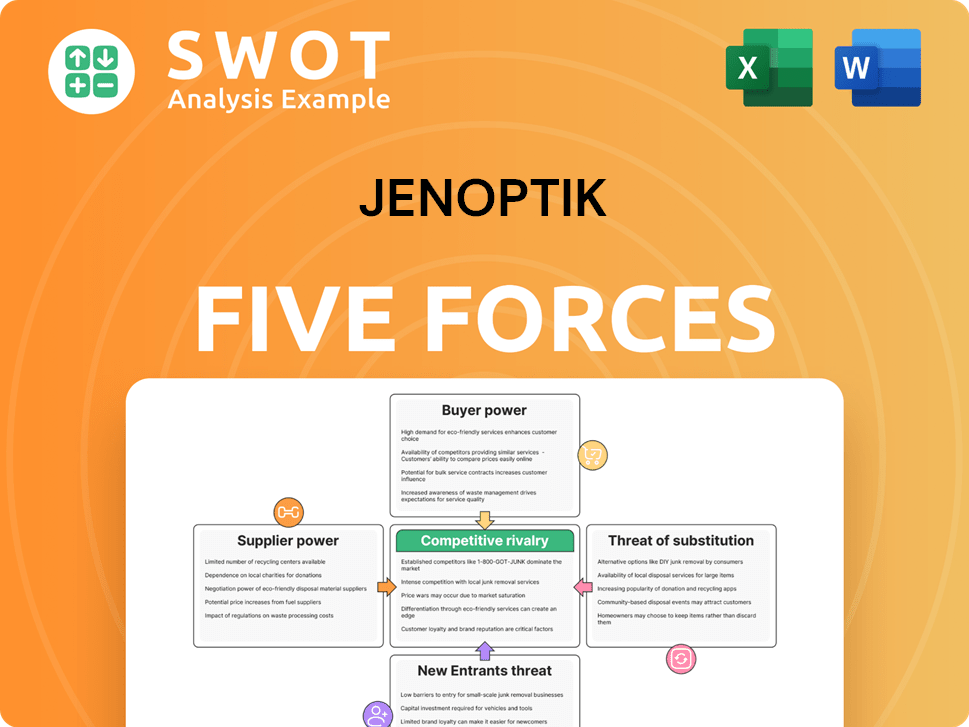

Jenoptik Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Jenoptik Company?

- What is Competitive Landscape of Jenoptik Company?

- How Does Jenoptik Company Work?

- What is Sales and Marketing Strategy of Jenoptik Company?

- What is Brief History of Jenoptik Company?

- Who Owns Jenoptik Company?

- What is Customer Demographics and Target Market of Jenoptik Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.