JinJiang Hotels Bundle

Can JinJiang Hotels Continue Its Global Domination?

Jin Jiang International, a titan in the JinJiang Hotels SWOT Analysis, has dramatically reshaped the global hotel landscape through strategic acquisitions, notably the Louvre Hotels Group. Founded in Shanghai, China, in 1993, the company has ascended to become one of the world's largest hotel groups. This comprehensive analysis delves into the Growth Strategy and future trajectory of JinJiang Hotels.

With approximately 11,959 hotels worldwide as of March 2025, JinJiang Hotels stands as a major player in the competitive Hotel Industry Analysis. The Chinese Hotel Market and the broader Hospitality Sector are crucial to understanding its future. This exploration will examine its Business Expansion, financial performance, and the challenges and opportunities that lie ahead, providing actionable insights for stakeholders.

How Is JinJiang Hotels Expanding Its Reach?

The Growth Strategy of Jin Jiang International centers on aggressive expansion, aiming to strengthen its position in the Hotel Industry Analysis. The company is focusing on both organic growth and strategic partnerships to broaden its market reach. This approach is crucial for navigating the competitive Chinese Hotel Market and the broader Hospitality Sector.

A core element of the expansion strategy involves opening a significant number of new hotels. Jin Jiang plans to open 1,300 new hotels and contract 2,000 new hotels in 2025. This ambitious target highlights the company's commitment to rapid growth and market penetration, reflecting its confidence in the long-term potential of the hospitality sector.

The company's strategic initiatives include a recent licensing agreement with RJJ Hotels Sdn Bhd in Southeast Asia. This partnership aims to sign approximately 200 hotel management agreements and operate over 100 hotels within the next five years across key markets, including Malaysia, Indonesia, Vietnam, the Philippines, Cambodia, and Laos. The first hotel under this partnership, a Metropolo property in Luang Prabang, Laos, is scheduled to open in early 2026. This expansion leverages the region's strong tourism growth, with Malaysia welcoming over 25 million international tourists in 2024.

Domestically, Jin Jiang is partnering with Ascott Ltd to develop Quest and Tulip Lodj aparthotels in China. This franchise model caters to underserved upscale and upper midscale segments. This asset-light approach prioritizes management contracts, franchising, and brand alliances over property ownership, facilitating rapid market entry.

The company is sharpening its global strategy by promoting platform synergy and exploring diversified business models, including long-term rental apartments. This strategy strengthens its competitive edge. In 2024, the company's overseas limited-service hotel revenue was 0.556 billion euros, with RevPAR increasing by 0.36% year-on-year, indicating a gradual recovery in its international operations.

Jin Jiang's expansion is driven by several key strategies aimed at sustainable growth and enhanced market presence.

- Strategic Partnerships: Forming alliances to accelerate growth and leverage local expertise.

- Asset-Light Model: Prioritizing management contracts and franchising to reduce capital expenditure.

- Geographic Diversification: Expanding into high-growth markets like Southeast Asia.

- Brand Portfolio Enrichment: Enhancing the brand hierarchy to cater to diverse customer segments.

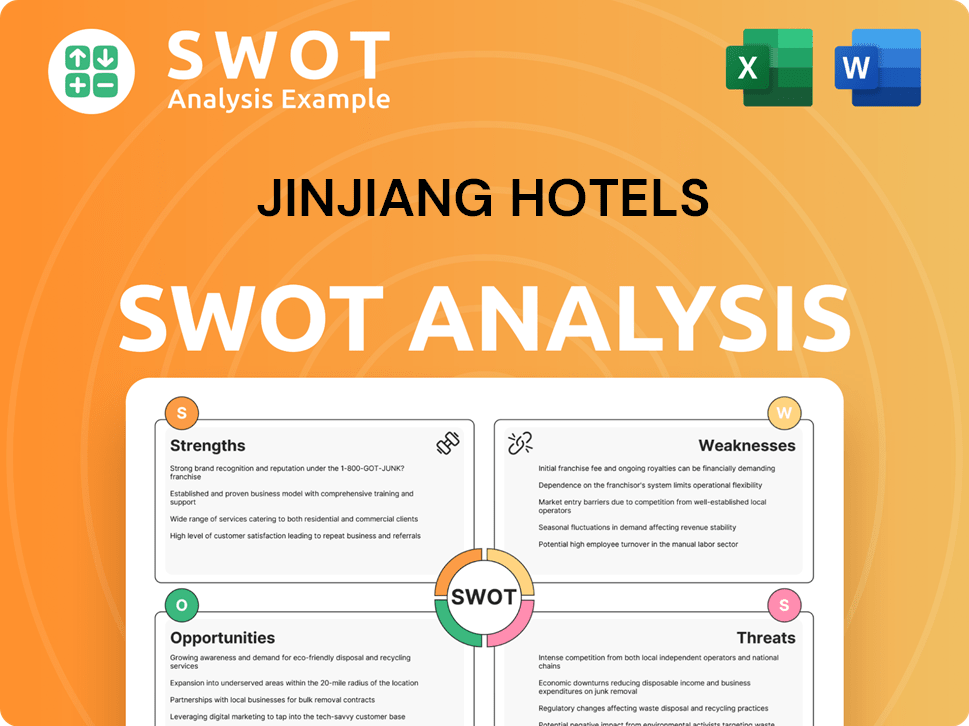

JinJiang Hotels SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does JinJiang Hotels Invest in Innovation?

To foster sustained growth, Jin Jiang International is actively embracing technology and innovation. This approach includes digital transformation and the exploration of new business models. The company adapts to evolving consumer preferences and navigates market competition through these initiatives.

While specific R&D investments or patent details for 2024-2025 are not extensively detailed, the emphasis on 'platform synergy' and 'digital operational enhancements' by its peers suggests a broader industry trend towards technological integration. This strategic direction aims to improve operational efficiency and support expansion plans.

A key element of Jin Jiang's strategy involves strengthening its 'brand+management' output capabilities and optimizing its organizational structure. This focus on technology and streamlined operations aims to contribute to growth objectives by improving efficiency and reducing costs, particularly in its asset-light expansion model.

Jin Jiang is focusing on digital transformation to enhance its competitive position. This includes leveraging technology to improve operational efficiency and adapt to changing consumer behaviors. The company’s digital initiatives support its overall growth strategy.

The company emphasizes 'platform synergy' to integrate various operational aspects. This approach aims to create a more cohesive and efficient business environment. Platform synergy is crucial for streamlining operations and enhancing customer experiences.

Jin Jiang is implementing digital operational enhancements to improve efficiency. These enhancements include the use of data analytics and automation. The goal is to optimize processes and reduce costs.

Strengthening 'brand+management' output capabilities is a key focus. This involves enhancing brand recognition and improving management practices. The aim is to provide consistent quality and service across all properties.

Optimizing the organizational structure is an important part of the strategy. This includes streamlining operations and improving decision-making processes. The goal is to create a more agile and responsive organization.

Jin Jiang utilizes an asset-light expansion model to grow efficiently. This approach involves focusing on management contracts and franchising. This strategy helps to reduce capital expenditure and accelerate growth.

The upcoming investor conference in August 2025 will see the introduction of the Jin Jiang Global Purchasing Platform (GPP) in Southeast Asia, managed by NOVAC Hospitality Sdn. Bhd. This platform will provide streamlined access to Furniture, Fixtures and Equipment (FF&E) and Operating Supplies and Equipment (OS&E). This initiative aims to improve operational efficiency and support the company's aggressive expansion plans in the region. The focus on technology and streamlined operations contributes to growth objectives by improving efficiency and reducing costs, particularly in its asset-light expansion model. For more insights into the company's values, you can read about the Mission, Vision & Core Values of JinJiang Hotels.

Jin Jiang's technological initiatives are designed to support its growth strategy within the Hotel Industry Analysis. These initiatives focus on enhancing operational efficiency, reducing costs, and improving customer experiences. The company's commitment to digital transformation is evident in its strategic investments and partnerships.

- Global Purchasing Platform (GPP): The GPP, managed by NOVAC Hospitality Sdn. Bhd., streamlines the procurement of FF&E and OS&E.

- Digital Transformation: This involves integrating digital solutions to improve various aspects of the business.

- Platform Synergy: The company focuses on integrating various platforms to create a more cohesive operational environment.

- Operational Enhancements: This includes the use of data analytics and automation to optimize processes.

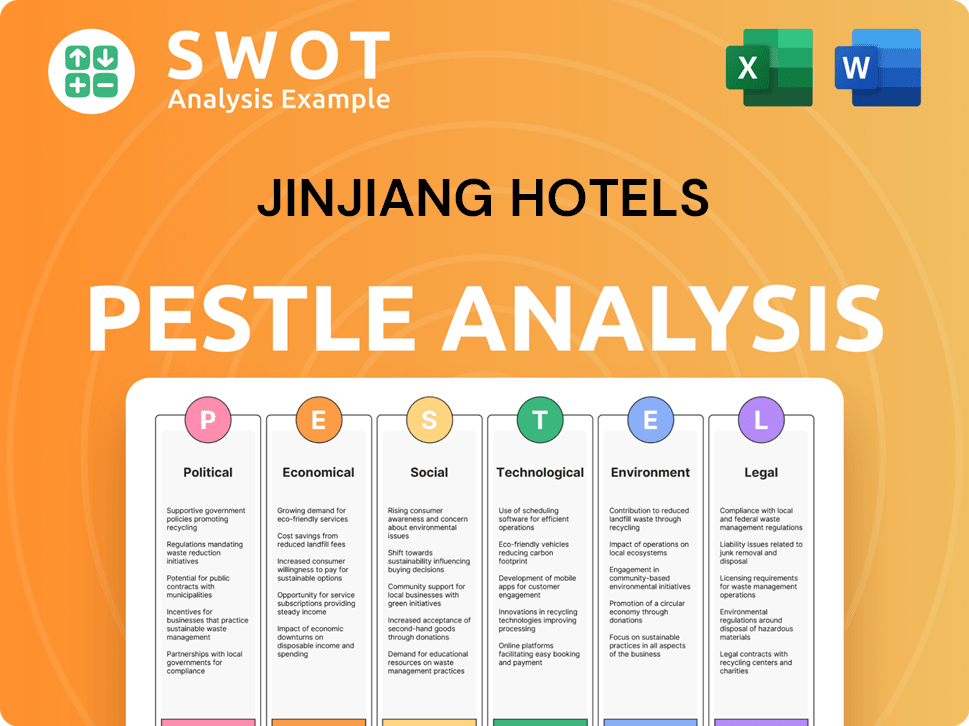

JinJiang Hotels PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is JinJiang Hotels’s Growth Forecast?

In 2024, Owners & Shareholders of JinJiang Hotels experienced a downturn in financial performance. Shanghai Jin Jiang International Hotels reported a revenue of CN¥14.1 billion (approximately USD 1.92 billion), a 4.0% decrease from the previous year. Net income also fell by 9.1% to CN¥911.0 million, with the profit margin decreasing to 6.5% from 6.8% in 2023. This financial performance reflects challenges within the Chinese Hotel Market and the broader Hospitality Sector.

The JinJiang Hotels company's earnings per share (EPS) for 2024 were CN¥0.85, a decrease from CN¥0.94 in 2023. The decline in profitability was mainly due to reduced revenue from domestic limited-service hotels. Despite these challenges, the company is focused on strategies to improve its financial outlook and achieve sustainable growth.

Looking ahead, the company anticipates improvements. Analysts project an average annual revenue growth of 5.9% over the next two years, leading to a consensus of CN¥15.0 billion in 2025. This would represent a 6.5% increase compared to the last 12 months. Statutory earnings per share are expected to rise by 43% to CN¥1.22 in 2025, indicating a positive trend in the company's financial recovery and Growth Strategy.

In 2024, revenue decreased by 4.0% to CN¥14.1 billion. Net income declined by 9.1% to CN¥911.0 million. The profit margin decreased to 6.5% from 6.8% in 2023. These figures highlight the impact of various market factors on JinJiang Hotels financial performance.

Analysts forecast a 5.9% average annual revenue growth over the next two years. Revenue is expected to reach CN¥15.0 billion in 2025, a 6.5% improvement. S&P Global Ratings projects annual revenue growth of 0.6%-2.2% for 2024-2025.

EPS for 2024 was CN¥0.85, down from CN¥0.94 in 2023. Statutory EPS is predicted to increase by 43% to CN¥1.22 in 2025. This indicates a positive outlook for the company's financial recovery and long-term growth potential.

Overseas limited-service hotel revenue in 2024 was 0.556 billion euros. RevPAR increased by 0.36% year-on-year, showing recovery in the international business. The Louvre Group, though still in a loss, is undergoing debt restructuring and organizational optimization.

The company's net profit to the mother is estimated to be 1.133 billion yuan in 2025, 1.389 billion yuan in 2026, and 1.668 billion yuan in 2027. As of May 6, 2025, Shanghai Jin Jiang International Hotels Development Company's market capitalization is $3.26 billion. The company's expansion plans China and international strategies are key to its future success. Despite slower growth compared to the wider Chinese hospitality industry, JinJiang Hotels is focused on operational improvements and strategic initiatives to enhance its financial performance and achieve sustainable growth.

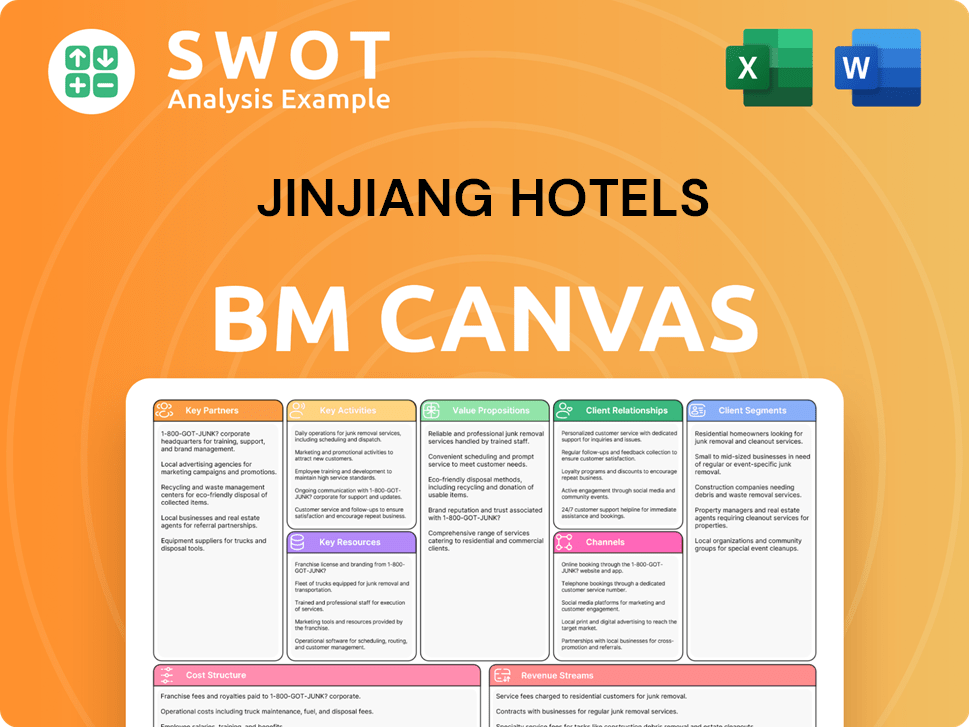

JinJiang Hotels Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow JinJiang Hotels’s Growth?

The growth strategy of JinJiang Hotels faces several risks and obstacles that could hinder its expansion and financial performance. These challenges include macroeconomic uncertainties, increased operating expenses, and intense competition within the hotel industry. The company must navigate these hurdles to maintain its market position and achieve its growth objectives.

Maintaining profitability is a key challenge for JinJiang Hotels, particularly in its core hotel business. The company's financial results in 2024 reflect this, with a reported 4% decline in revenue, indicating difficulties in operational efficiency. Furthermore, integrating recent acquisitions and managing debt remain significant concerns.

Beyond operational and financial risks, JinJiang Hotels must also address policy and compliance risks, along with exchange rate fluctuations, especially in its international operations. The company's strategic diversification, including expansion into various segments and geographical markets, and its asset-light model, which focuses on franchising, are key to mitigating these risks.

Economic fluctuations in China and globally can significantly impact the Chinese Hotel Market and overall Hospitality Sector. These uncertainties can affect travel demand, occupancy rates, and average daily rates (ADR) for JinJiang Hotels. Economic downturns may lead to reduced consumer spending on travel and leisure.

The Hotel Industry Analysis reveals intense competition from both domestic and international hotel chains. This competitive landscape puts pressure on JinJiang Hotels to maintain and improve its market share. Competitors' pricing strategies and service offerings can impact JinJiang Hotels' ability to attract and retain customers. For more insights, check out the Competitors Landscape of JinJiang Hotels.

Rising operating costs, including labor, utilities, and marketing expenses, can squeeze profit margins. Despite its large scale, maintaining ADR while improving occupancy rates has been difficult for JinJiang Hotels. The company's JinJiang Hotels financial performance is directly affected by its ability to manage these costs effectively.

Integrating recent acquisitions, especially international assets, presents complexities and can lead to increased leverage. While the company is working on debt restructuring and organizational optimization, the recovery of profitability, particularly for overseas assets like the Louvre Group, remains a focus. Effective integration is crucial for realizing the full potential of these acquisitions.

Changes in government policies and regulations can affect the Business Expansion plans of JinJiang Hotels. Compliance with local and international laws is essential for the company's operations. Regulatory changes related to taxation, labor, and environmental standards can impact costs and operational efficiency.

Fluctuations in exchange rates can affect the company's international earnings and financial performance. The impact of currency movements on revenue and profitability is a significant consideration. Hedging strategies and careful financial planning are essential to mitigate these risks.

The travel slump caused by the COVID-19 pandemic significantly impacted Jin Jiang's overseas operations, and a full recovery was delayed. The pandemic's effect on international travel and tourism has been profound. The company's JinJiang Hotels revenue forecast and recovery depend on the rebound of the global travel market.

JinJiang's shift towards an asset-light model, focusing on franchising, helps mitigate some capital expenditure risks. This strategy reduces the need for significant investments in property and infrastructure. The asset-light model can improve financial flexibility and allow for faster JinJiang Hotels expansion plans China and internationally.

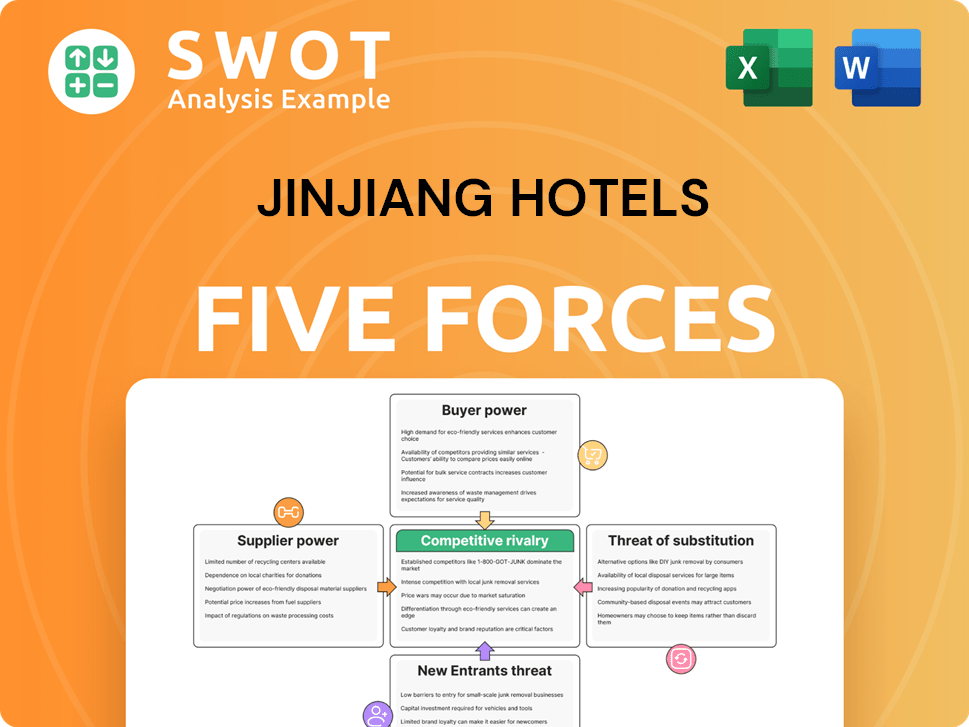

JinJiang Hotels Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JinJiang Hotels Company?

- What is Competitive Landscape of JinJiang Hotels Company?

- How Does JinJiang Hotels Company Work?

- What is Sales and Marketing Strategy of JinJiang Hotels Company?

- What is Brief History of JinJiang Hotels Company?

- Who Owns JinJiang Hotels Company?

- What is Customer Demographics and Target Market of JinJiang Hotels Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.