Kerry Logistics Network Bundle

Can Kerry Logistics Network Continue Its Ascent in the Global Logistics Arena?

Established in 1981, Kerry Logistics Network (KLN) has transformed from a Hong Kong-based entity into a global logistics powerhouse. With a vast network spanning over 1,000 locations across more than 50 countries, KLN has established a strong foothold in the Kerry Logistics Network SWOT Analysis. Their integrated logistics, international freight forwarding, and supply chain solutions have been instrumental in connecting businesses worldwide.

The strategic alliance with S.F. Holding, particularly the joint venture at Ezhou Airport, exemplifies KLN's proactive approach to expansion and its ability to capitalize on emerging opportunities. This initiative, exceeding initial revenue projections, has significantly bolstered KLN's competitive positioning in the parcel cargo sector. This analysis will delve into the Kerry Logistics Network Growth Strategy, examining its Logistics Company future prospects and how it plans to navigate the complexities of the global Supply Chain landscape, including its Freight Forwarding capabilities, with a strong focus on the Asia Pacific region.

How Is Kerry Logistics Network Expanding Its Reach?

Kerry Logistics Network, a leading logistics company, is strategically expanding its operations to capitalize on emerging market opportunities and strengthen its global footprint. The company's growth strategy focuses on both geographical expansion and service diversification, particularly within the Asia-Pacific region and beyond. This multi-faceted approach aims to enhance its competitive position and drive sustainable revenue growth.

The company is actively broadening its warehouse network and international freight forwarding (IFF) capabilities. These initiatives are designed to address evolving geopolitical dynamics and meet the increasing demands of its diverse customer base. By strategically expanding its infrastructure and service offerings, Kerry Logistics Network seeks to solidify its position as a key player in the global supply chain.

The company's expansion strategy includes significant investments in warehouse infrastructure, particularly in Southeast Asia and other overseas regions. This strategic focus aims to capitalize on new trade flows and address geopolitical shifts. For instance, the expansion of its first warehouse in Tepotzotlan, Mexico, from 20,000 m² to 50,000 m² by the end of 2024, along with new warehouses in Guadalajara, Monterrey, and the Bajio region, exemplifies this commitment.

Kerry Logistics Network is significantly expanding its warehouse network, especially in Southeast Asia and other international markets. This expansion is in response to evolving geopolitical dynamics and the emergence of new trade routes. The company plans to increase its warehouse capacity in Mexico by the end of 2024, with new facilities planned across key regions.

The company's IFF business is a significant revenue driver, accounting for 52% of consolidated segment profit in the first half of 2024. Kerry Logistics Network aims to expand its IFF services, potentially through partnerships and acquisitions, to meet growing demand. The focus is on regions outside China, such as the rest of Asia and Latin America.

Kerry Logistics Network is expanding its perishable goods vertical by establishing new distribution centers. These centers are being set up in key locations such as Mexico City, Guadalajara, and Monterrey. This expansion is designed to meet the growing demand for temperature-controlled logistics solutions.

The joint venture with S.F. Holding is a key strategic initiative, contributing over HK$200 million in revenue in its first year. This collaboration provides ground handling services at Ezhou Airport and allows Kerry Logistics Network to be the exclusive general sales agent for SF's air cargo freight for international flights. Additionally, Kerry Logistics Network receives a 10% discount on SF's cargo services.

Kerry Logistics Network is also leveraging the international expansion of Chinese corporations, particularly in Southeast Asia, to drive growth in its Integrated Logistics (IL) business. The company aims to increase its market share in the Asia-Pacific region by 15% by 2025. Further insights into the company's structure and ownership can be found in this article about Owners & Shareholders of Kerry Logistics Network.

Kerry Logistics Network's expansion initiatives are focused on geographical reach and service diversification. The strategic focus includes expanding warehouse capacity, growing its international freight forwarding business, and capitalizing on the international expansion policies of Chinese corporations.

- Expanding warehouse networks, particularly in Southeast Asia and Mexico.

- Growing international freight forwarding capabilities through partnerships or acquisitions.

- Leveraging the expansion of Chinese corporations in Southeast and South Asia.

- Aiming for a 15% increase in Asia-Pacific market share by 2025.

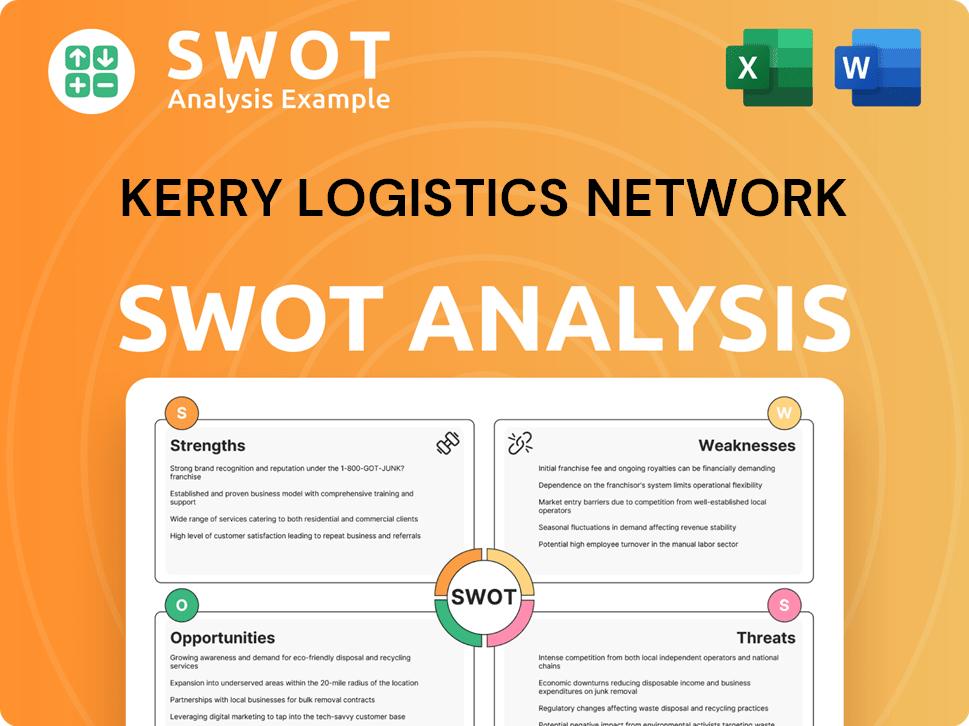

Kerry Logistics Network SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kerry Logistics Network Invest in Innovation?

The ongoing growth strategy of Kerry Logistics Network (KLN) heavily relies on innovation and technology. KLN is committed to integrating advanced technologies into its logistics solutions to enhance efficiency and customer service. This focus is crucial for maintaining its competitive edge in the dynamic supply chain and freight forwarding sectors.

KLN's strategic investments in technology are substantial, reflecting its dedication to digital transformation. These investments are aimed at optimizing operations, reducing costs, and improving overall performance. The company's approach to innovation is comprehensive, covering various aspects of its business, from warehouse automation to data analytics.

KLN's innovation strategy is closely tied to its commitment to sustainability. The company actively seeks to integrate eco-friendly practices and technologies into its operations. This approach not only benefits the environment but also aligns with the increasing demand for sustainable logistics solutions, enhancing KLN's appeal to environmentally conscious customers.

In 2023, KLN invested approximately $50 million in technology upgrades. This included AI-driven supply chain management systems.

These technology investments improved delivery times by 15%. This highlights the immediate impact of technology on operational performance.

Approximately HKD 500 million was allocated towards technology upgrades in 2023, specifically targeting warehouse automation. This investment is expected to increase productivity by 30% over the next two years.

KLN utilizes AI algorithms for demand prediction and route optimization. These technologies help reduce delivery times and minimize operational costs.

The company established its first IT Development Centre in Penang, Malaysia. This center provides offshore support to increase operational efficiency.

KLN received the Best Sustainability-Linked Loan – Logistics accolade at The Asset Triple A Sustainable Finance Awards 2025. This recognized a five-year HK$1 billion syndicated Sustainability-linked & Social Term Loan Facility signed in 2024.

KLN's technology strategy includes several key initiatives aimed at enhancing its services and sustainability efforts. These initiatives are integral to its growth strategy and future outlook.

- Warehouse Automation: Significant investment in automating warehouse operations to improve efficiency and reduce operational costs.

- Data Analytics: Implementation of data analytics for supply chain optimization, enabling better decision-making and improved service delivery.

- Tracking Technology: Utilization of tracking technology for real-time updates, providing customers with enhanced visibility and control over their shipments.

- AI and IoT Integration: Adoption of AI and IoT technologies to predict demand, optimize routes, and reduce delivery times, contributing to both cost savings and environmental benefits.

- Sustainability-Linked Financing: Securing sustainability-linked loans to support environmentally friendly initiatives and reinforce the company's commitment to ESG principles.

For more details on the company's history and development, you can read a Brief History of Kerry Logistics Network.

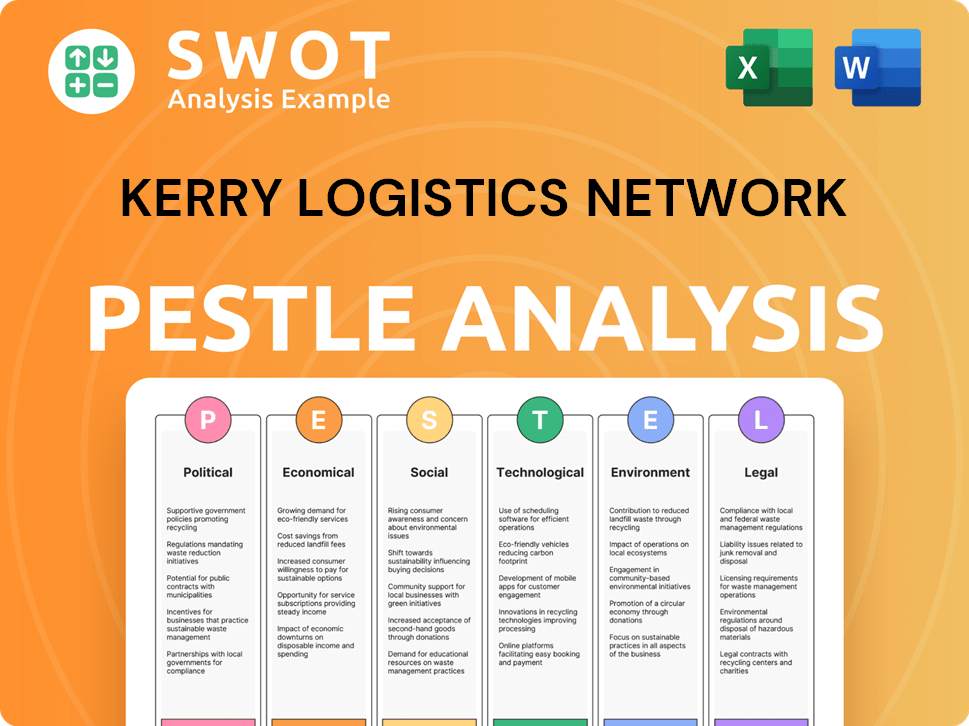

Kerry Logistics Network PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kerry Logistics Network’s Growth Forecast?

In 2024, Kerry Logistics Network experienced significant financial growth, demonstrating its strong position as a leading logistics company. The company's performance reflects its strategic initiatives and adaptability within the dynamic global supply chain environment. This growth is particularly evident in the International Freight Forwarding (IFF) sector, highlighting the company's ability to capitalize on market opportunities.

The company's financial results for 2024 show a robust increase in revenue and core operating profit, underscoring its operational efficiency and market penetration. The expansion in key markets, particularly in Asia Pacific, contributed significantly to the overall positive financial outlook. This performance is a testament to the company's effective growth strategy and its ability to navigate complex market conditions.

Kerry Logistics Network's financial success in 2024 is largely attributed to the International Freight Forwarding (IFF) business. The IFF segment saw a substantial increase in profit, driven by strong performance in major markets like Mainland China, the US, Hong Kong, and the rest of Asia. This growth highlights the company's strength in the freight forwarding sector and its ability to meet the increasing demands of global trade. The company's strategic focus on these key markets has clearly paid off, contributing to its overall revenue growth and profitability.

Kerry Logistics Network reported a 23% increase in revenue, reaching HK$58,274 million (approximately US$7.5 billion) in 2024, compared to HK$47,408 million in 2023. This substantial growth reflects the company's successful expansion and market penetration. The increase in revenue indicates strong demand for its services and effective operational strategies.

Core operating profit also saw a 23% increase, reaching HK$2,725 million (US$350 million) in 2024 from HK$2,207 million in 2023. This growth in profitability underscores the company's efficiency and effective cost management. The increase in core operating profit demonstrates Kerry Logistics Network's ability to generate strong returns from its operations.

Core net profit grew by 12% to HK$1,357 million (US$174 million) in 2024, up from HK$1,214 million in 2023. This increase in core net profit reflects the company's overall financial health and its ability to convert revenue into profit. The growth in core net profit is a positive indicator of the company's financial performance.

Profit attributable to shareholders surged by 95%, reaching HK$1,542 million (US$198 million) in 2024, compared to HK$791 million in 2023. This significant increase highlights the company's strong performance and its ability to deliver value to its shareholders. This substantial growth is a key highlight of the financial results.

The International Freight Forwarding (IFF) business was a primary driver of growth, with a 39% increase in segment profit to HK$1,950 million in 2024. This segment's strong performance was supported by growth in key markets. The Integrated Logistics (IL) business saw a 3% decrease in segment profit to HK$1,251 million, primarily due to shifting domestic consumption trends. However, the IL business in the rest of Asia registered a 25% increase, benefiting from growth in India, Singapore, and Vietnam.

- International Freight Forwarding (IFF): 39% increase in segment profit to HK$1,950 million.

- Integrated Logistics (IL): 3% decrease in segment profit to HK$1,251 million.

- IL in Rest of Asia: 25% increase, driven by India, Singapore, and Vietnam.

Kerry Logistics Network anticipates that supply chain anomalies will persist in 2025. The company expects corporations to shift investment focus towards Southeast Asian and South Asian regions, which are expected to become growth areas for its Integrated Logistics (IL) business. The company is strategically positioning itself to capitalize on these emerging opportunities.

While Morningstar projects a negative 2% revenue CAGR and negative 4% recurring EBIT CAGR for Kerry Logistics Network over the next five years, the company itself anticipates outperforming international freight forwarding peers with over 6% EBIT growth for 2025. This indicates a positive outlook for the company's operational efficiency and market competitiveness.

The company has proposed a final dividend of 15 HK cents per share, payable around June 10, 2025. This dividend demonstrates the company's commitment to returning value to its shareholders. The dividend payment reflects the company's strong financial position and its confidence in future performance.

The company is adapting to a volatile policy environment, which is influencing corporate investment decisions. The shift towards Southeast and South Asian regions is creating new growth opportunities for Kerry Logistics Network. The company's ability to adapt to changing market dynamics is crucial for its sustained success.

Kerry Logistics Network's focus on international freight forwarding and its expansion in key markets are central to its growth strategy. The company's ability to navigate supply chain disruptions and capitalize on regional growth opportunities is a key factor in its success. The company's strategic initiatives are designed to drive long-term value creation.

The company's strong financial performance and strategic positioning provide a competitive advantage in the logistics industry. Kerry Logistics Network's focus on key markets and its ability to adapt to changing market conditions contribute to its resilience and sustained growth. For more insights, you can read about the [Kerry Logistics Network's competitive analysis](0).

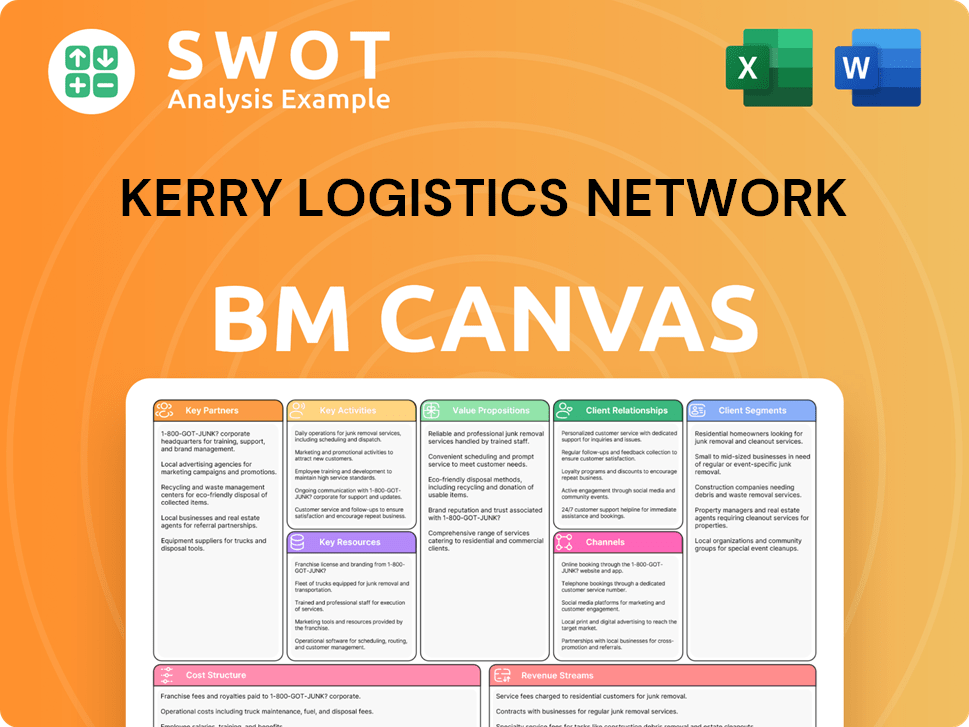

Kerry Logistics Network Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kerry Logistics Network’s Growth?

The Kerry Logistics Network faces numerous challenges that could impact its Growth Strategy and future prospects. These risks include market competition, geopolitical tensions, and disruptions within the Supply Chain. Understanding these potential obstacles is crucial for assessing the company's long-term viability and investment potential.

Intensified competition, particularly in the Greater China region, poses a significant threat to profit margins. Furthermore, the volatile global landscape, marked by geopolitical instability and evolving regulations, introduces uncertainties that could affect the Logistics Company's operations and financial performance. These factors highlight the need for proactive risk management and strategic adaptation.

The company's Integrated Logistics (IL) business experienced a 3% drop in segment profit in 2024, a reflection of the challenging operating environment. This decline underscores the impact of domestic consumption patterns and operational difficulties in key markets like Hong Kong and Mainland China. The company's ability to navigate these complexities will be critical for its future success. For more details on the company's financial structure, check out Revenue Streams & Business Model of Kerry Logistics Network.

Intense competition, especially in Greater China, can erode profit margins. The Kerry Logistics Network must continuously innovate and optimize its services to remain competitive. The company's ability to differentiate itself will be key to maintaining its market share.

Geopolitical tensions and regulatory changes create significant risks. The ongoing Red Sea situation and rising international trade restrictions, such as new US tariffs, can disrupt supply chains. These factors can lead to increased costs and operational challenges.

Supply Chain vulnerabilities, including port congestion and labor shortages, pose constant challenges. The maritime industry faces significant disruptions, with events like the Houthi rebel attacks in the Red Sea causing severe congestion. These issues can increase transit times and costs.

New environmental regulations, like those from the IMO, can increase operational costs. The adoption of greener technologies is pushing carriers to adapt. Compliance with these regulations requires significant investment and strategic planning.

Economic downturns and currency fluctuations can impact profitability. Decreased purchasing power and rising interest rates can affect the demand for logistics services. The company must manage these financial risks effectively.

Port worker strikes and extended transit times can disrupt operations. Potential labor actions, such as those on the US coasts, can significantly impact containerized imports. Efficient management of these operational issues is essential.

Kerry Logistics Network aims to expand outside Greater China to reduce its reliance on a single market. Cost-cutting measures are also being implemented within the region. The company is actively seeking merger and acquisition opportunities to expand into new segments in Southeast Asia.

To address policy volatility, the company leverages its diversified market presence. This includes its overseas warehouse network and ocean and air freight services. The company aims to capitalize on opportunities from supply chain reshuffles.

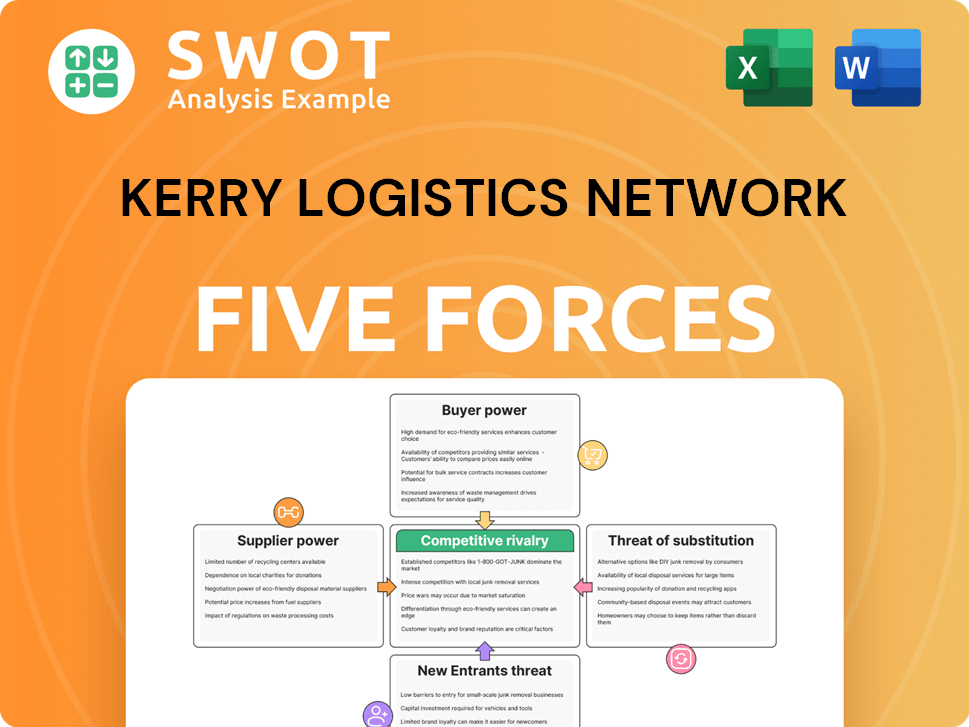

Kerry Logistics Network Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kerry Logistics Network Company?

- What is Competitive Landscape of Kerry Logistics Network Company?

- How Does Kerry Logistics Network Company Work?

- What is Sales and Marketing Strategy of Kerry Logistics Network Company?

- What is Brief History of Kerry Logistics Network Company?

- Who Owns Kerry Logistics Network Company?

- What is Customer Demographics and Target Market of Kerry Logistics Network Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.