Koch Industries Bundle

Can Koch Industries Maintain Its Momentum?

Koch Industries, a sprawling conglomerate with roots in crude oil refining, has evolved into a global powerhouse. With over $125 billion in estimated annual revenue as of 2023, the company's journey from its 1940 founding showcases remarkable growth. This article examines the Koch Industries SWOT Analysis to understand how this privately held giant plans to sustain its impressive trajectory.

Koch Industries' enduring success stems from its unique market-based management philosophy, enabling it to navigate complex global markets. This exploration of Koch Industries' growth strategy will uncover its expansion initiatives, innovation, and strategic financial planning. Understanding the Koch company's future prospects requires a deep dive into its long-term growth potential and strategic planning process, offering insights into its competitive landscape and industry outlook.

How Is Koch Industries Expanding Its Reach?

The expansion initiatives of Koch Industries are driven by a multifaceted approach. This includes strategic acquisitions, market diversification, and the development of new products and services. The company consistently seeks to enter new geographical markets and product categories.

This strategy allows Koch Industries to access new customer bases. It also diversifies revenue streams and proactively adapts to evolving industry landscapes. Koch Engineered Solutions (KES), a subsidiary, is actively pursuing growth in areas like carbon capture and renewable energy. This reflects a strategic pivot towards sustainable solutions.

Within its consumer products segment, Georgia-Pacific, a Koch subsidiary, continues to invest in optimizing its supply chain. They also expand its product lines to meet changing consumer demands in the packaging and tissue sectors. Koch Disruptive Technologies (KDT), the company's venture capital arm, plays a crucial role in identifying and investing in promising startups.

Koch Industries frequently uses acquisitions to grow and diversify its business. These acquisitions are a key part of their Owners & Shareholders of Koch Industries growth strategy. The goal is to enhance existing capabilities and explore opportunities within and beyond its core businesses. Although specific details are often private, the trend shows a commitment to expansion.

Koch Industries focuses on entering new markets to broaden its reach. This includes expanding into different geographical areas and product categories. Diversification helps reduce risk and creates new revenue streams. The company's moves into renewable energy and sustainable solutions are examples of this.

The company continually develops new products and services. This is done to meet changing consumer demands and industry trends. This includes investment in areas like carbon capture and renewable energy. This strategy helps Koch Industries stay competitive and relevant in the market.

Koch Industries is increasingly focused on sustainability. This includes investments in renewable energy and sustainable solutions. These initiatives align with broader industry trends and demonstrate a commitment to environmental responsibility. This is a key aspect of their long-term growth potential.

Koch Industries is expanding into several key areas to drive growth. These include renewable energy, sustainable solutions, and consumer products. The company is also focused on strategic acquisitions and market diversification. These efforts aim to enhance existing capabilities and explore new opportunities.

- Renewable Energy: Investing in solar, wind, and other sustainable energy sources.

- Sustainable Solutions: Developing technologies for carbon capture and reducing environmental impact.

- Consumer Products: Expanding product lines and optimizing supply chains within the consumer goods sector.

- Strategic Acquisitions: Acquiring companies to enter new markets and enhance existing capabilities.

Koch Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Koch Industries Invest in Innovation?

The innovation and technology strategy of Koch Industries is a cornerstone of its sustained growth. The company strategically invests in research and development across its diverse subsidiaries. This approach fosters a culture of continuous improvement and breakthrough innovation, driving its business strategy.

Digital transformation and automation are central to Koch's operational strategy. They focus on integrating cutting-edge technologies like artificial intelligence (AI), the Internet of Things (IoT), and advanced analytics. These technologies improve decision-making, streamline processes, and create new value propositions. This commitment is evident across multiple sectors.

Koch Industries also prioritizes sustainability initiatives. This focus leads to the development of more environmentally friendly products and processes. This approach is particularly evident in its pulp and paper (Georgia-Pacific) and chemicals (Invista) businesses. The company’s forward-thinking approach is a key part of its long-term growth potential.

Koch Industries allocates significant resources to research and development across its various subsidiaries. These investments are crucial for fostering innovation and maintaining a competitive edge. This approach supports the company's overall business strategy.

Koch Industries is actively embracing digital transformation to enhance operational efficiency. This involves the integration of AI, IoT, and advanced analytics. These technologies are used to streamline processes and improve decision-making.

Sustainability is a key driver of innovation at Koch Industries. The company focuses on developing environmentally friendly products and processes. This commitment is demonstrated across its business units, including Georgia-Pacific and Invista.

Koch Industries often engages in strategic collaborations to accelerate innovation and technology adoption. These partnerships help the company access new technologies and expertise. This approach supports its growth strategy.

Koch Industries leverages AI and IoT to optimize operations across its value chain. This includes predictive maintenance in manufacturing and supply chain logistics. These technologies enhance efficiency and reduce costs.

Koch Industries fosters a culture of continuous improvement through its innovation efforts. This approach ensures that the company remains at the forefront of technological advancements. This is a key element of its long-term success.

Koch Industries' approach to innovation and technology is multifaceted, encompassing both internal development and strategic partnerships. This strategy is critical for the company's Marketing Strategy of Koch Industries and its future prospects. The company’s investments in R&D and digital transformation, coupled with its sustainability initiatives, position it well for continued growth. While specific financial figures for R&D spending are not always publicly available, the scale and scope of its operations suggest substantial investment in these areas. The integration of AI and IoT across its businesses, from manufacturing to supply chain, underscores its commitment to leveraging technology for competitive advantage. Koch Industries' focus on innovation and technology is a key driver of its long-term growth potential and its ability to adapt to changing market conditions.

Koch Industries' technological initiatives span various sectors, focusing on efficiency, sustainability, and new value creation. The company's strategic investments in these areas are critical for its future. These initiatives are designed to enhance its competitive position.

- Precision Agriculture: Koch Ag & Energy Solutions (KAES) employs advanced technologies to optimize resource utilization in agriculture.

- Sustainable Energy: KAES is also involved in developing and implementing sustainable energy solutions.

- AI-Powered Predictive Maintenance: AI is used in manufacturing facilities to predict and prevent equipment failures.

- IoT in Supply Chain: IoT sensors are deployed to optimize supply chain logistics.

- Environmentally Friendly Products: The company focuses on developing sustainable products and processes.

Koch Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Koch Industries’s Growth Forecast?

As a privately held entity, detailed financial disclosures for Koch Industries aren't publicly available. However, insights into its financial health and strategic approach can be gleaned from industry reports and company statements. The company's financial strategy is built on long-term value creation and reinvestment.

Koch Industries focuses on disciplined capital allocation. This involves reinvesting earnings into its businesses. This strategy supports both organic and inorganic growth. The company's financial performance is closely tied to its diverse portfolio and strategic investments.

Estimates suggest that Koch Industries had an annual revenue exceeding $125 billion as of 2023. This highlights the company's significant financial scale and market presence. Koch Industries' approach to financial management emphasizes operational excellence and maximizing long-term profitability across its integrated enterprise.

Koch Industries' financial strength is underpinned by its diverse portfolio of businesses. These include sectors like manufacturing, chemicals, and energy. The company generates substantial cash flow from its established businesses, enabling strategic investments.

Koch Industries strategically allocates capital to support its growth initiatives. A significant portion of earnings is reinvested into existing businesses for expansion and upgrades. This approach fuels both organic growth and strategic acquisitions.

While specific figures are not publicly disclosed, the company's revenue is estimated to be over $125 billion annually. The company's focus on long-term value creation and reinvestment suggests robust earnings and financial stability.

The company's investment strategy prioritizes long-term value creation. Koch Industries typically reinvests a significant portion of its earnings into its businesses. This approach supports expansion, technological advancements, and strategic acquisitions.

The financial outlook for Koch Industries is characterized by its disciplined capital deployment and focus on long-term profitability. The company's financial strategy supports sustained growth. Koch Industries continues to be a major player in diverse industries.

- Revenue: Estimated at over $125 billion annually.

- Investment: Reinvests earnings for expansion and upgrades.

- Strategy: Focus on long-term value creation and operational excellence.

- Growth: Supports both organic and inorganic growth strategies.

Koch Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Koch Industries’s Growth?

The Koch Industries faces several potential risks and obstacles that could influence its long-term growth. These challenges span market dynamics, regulatory changes, supply chain disruptions, and the need for continuous technological adaptation. Understanding these risks is crucial for assessing the Koch Industries future and its ability to maintain its competitive position.

Market competition remains a constant pressure across its diverse sectors, including refining, chemicals, and consumer products. Regulatory changes, particularly in environmental and energy policies, pose significant risks. Supply chain vulnerabilities and technological disruptions are also key considerations.

Internal resource constraints, such as acquiring and retaining skilled talent, can also hinder growth. The company mitigates these risks through a comprehensive risk management framework. This includes diversification across industries, proactive engagement with regulatory bodies, and robust scenario planning.

Koch Industries operates in highly competitive markets. Continuous innovation and cost optimization are essential to maintain market share against rivals. The pressure to innovate and adapt is constant across all sectors.

Changes in environmental and energy policies can increase compliance costs. Evolving climate regulations may particularly impact the energy and chemical businesses. Koch Industries must proactively manage these risks.

Geopolitical events and natural disasters can disrupt operations. Recent global supply chain fluctuations have highlighted these vulnerabilities. Diversification and robust planning are critical to mitigate these risks.

The rapid pace of technological change can render existing processes obsolete. Koch Industries must invest in innovation to stay ahead. Proactive technology adoption is essential for sustained growth.

Acquiring and retaining talent in specialized fields can be challenging. This can hinder the company's growth. Strategic workforce planning is vital to address this.

Koch Industries employs a comprehensive risk management framework. This framework includes diversification, engagement with regulatory bodies, and scenario planning. The decentralized structure supports localized risk management.

Koch Industries addresses these challenges through strategic planning and operational agility. The company's consistent ability to adapt its business models and invest in new technologies demonstrates its resilience. For a deeper understanding of Koch Industries's approach to its target market, consider reading about the Target Market of Koch Industries.

Koch Industries uses strategic planning to navigate market volatility. This helps in anticipating and responding to changes in the business environment. The company’s decentralized structure enables localized risk assessment and response.

Operational agility allows Koch Industries to adapt to changing conditions. This includes adjusting business models and investing in new technologies. The ability to quickly respond to market shifts is key.

Koch Industries has demonstrated resilience in managing financial risks. The company's financial performance is a testament to its effective risk management. This includes careful investments and strategic diversification.

The company's ability to navigate these risks is critical for its future. Proactive measures and strategic investments will shape the company's trajectory. Koch Industries prospects depend on its ability to adapt and innovate.

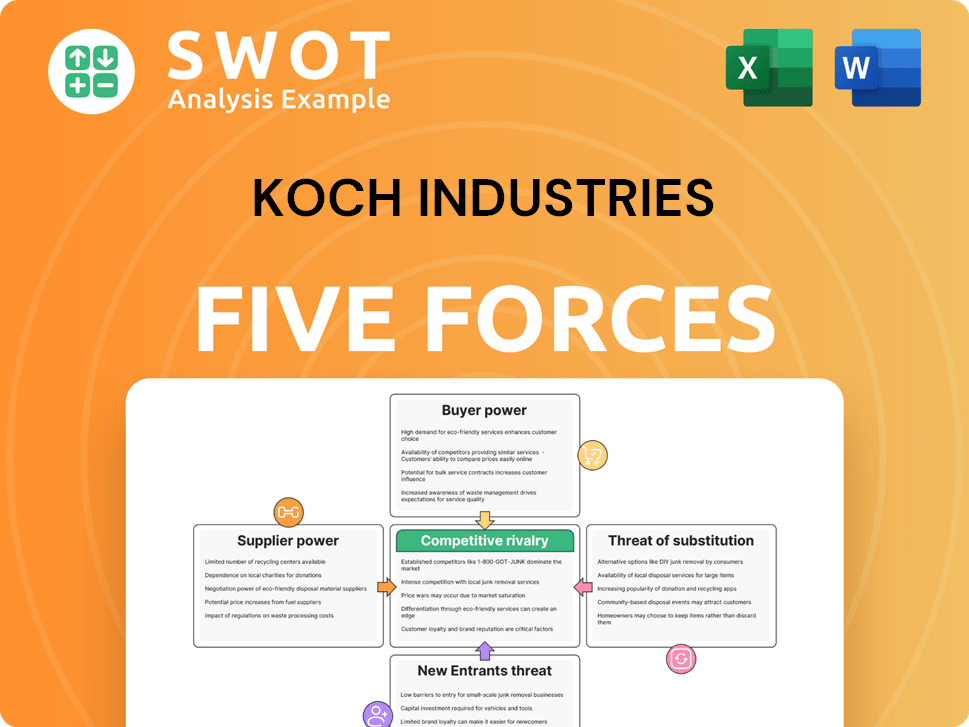

Koch Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Koch Industries Company?

- What is Competitive Landscape of Koch Industries Company?

- How Does Koch Industries Company Work?

- What is Sales and Marketing Strategy of Koch Industries Company?

- What is Brief History of Koch Industries Company?

- Who Owns Koch Industries Company?

- What is Customer Demographics and Target Market of Koch Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.