Lands' End Bundle

Can Lands' End Navigate the Ever-Changing Retail Waters?

In today's fast-paced retail world, a solid growth strategy is crucial for any company's success. Lands' End, a well-known name in classic apparel and home goods, has been adapting to these changes since 1963. This analysis will explore how Lands' End plans to thrive in the future, examining its key strategies for market expansion and innovation.

This deep dive into Lands' End SWOT Analysis and its future prospects will dissect the company's business model, market position, and financial performance. We'll examine its expansion plans for 2024, competitive advantages, and online sales strategy to understand its long-term growth potential. By understanding these aspects, we can assess Lands' End's ability to overcome e-commerce challenges and capitalize on partnership opportunities within the dynamic clothing market trends.

How Is Lands' End Expanding Its Reach?

The Owners & Shareholders of Lands' End are actively pursuing several expansion initiatives to broaden its market reach and diversify revenue streams. A key focus is the expansion of its retail footprint, including both standalone stores and shop-in-shops. This strategy is a crucial part of the overall Lands' End growth strategy, aiming to enhance brand visibility and accessibility for customers.

In fiscal year 2023, the company opened 10 new retail stores. This brought the total to 30 stores as of February 3, 2024. This expansion is a direct response to the evolving retail landscape and consumer preferences, reflecting the company's commitment to adapting its business model for sustained growth. These initiatives are designed to bolster the Lands' End market position.

This retail expansion is complemented by continued growth in its wholesale business, notably through its partnership with Kohl's. This collaboration provides significant access to new customer segments and enhances brand visibility. The company's strategic partnerships and expansion plans are vital for its long-term growth potential.

The company is increasing its physical retail presence through standalone stores and shop-in-shops. In 2023, 10 new stores were opened, bringing the total to 30 by early 2024. This expansion is a key component of the Lands' End business model, aiming to improve customer access and brand visibility. This directly impacts Lands' End's financial performance.

Lands' End is leveraging wholesale partnerships, particularly with Kohl's, to expand its reach. The partnership allows the company to access new customer segments. In 2023, Lands' End products were available in approximately 300 Kohl's stores and online. This strategy is crucial for Lands' End's customer acquisition strategies.

The company is exploring new product categories and brand collaborations to attract a wider audience. While specific details for 2024-2025 were not fully disclosed, the emphasis on direct-to-consumer channels and strategic partnerships suggests a continued effort to optimize product offerings. This is an important part of the Lands' End clothing market trends.

Lands' End is also looking at international expansion, although specific timelines and new geographical markets for 2024-2025 were not explicitly outlined in the latest financial reports. The existing e-commerce infrastructure supports global reach. This indicates potential for further international market penetration, which is key for Lands' End future revenue projections.

Lands' End is focused on expanding its retail presence, enhancing wholesale partnerships, and exploring new product categories. These initiatives are designed to drive growth and improve the company's market position. These efforts are part of the Lands' End expansion plans 2024.

- Expanding retail footprint through new stores and shop-in-shops.

- Strengthening partnerships like the one with Kohl's.

- Exploring new product categories and brand collaborations.

- Leveraging e-commerce for potential international market expansion.

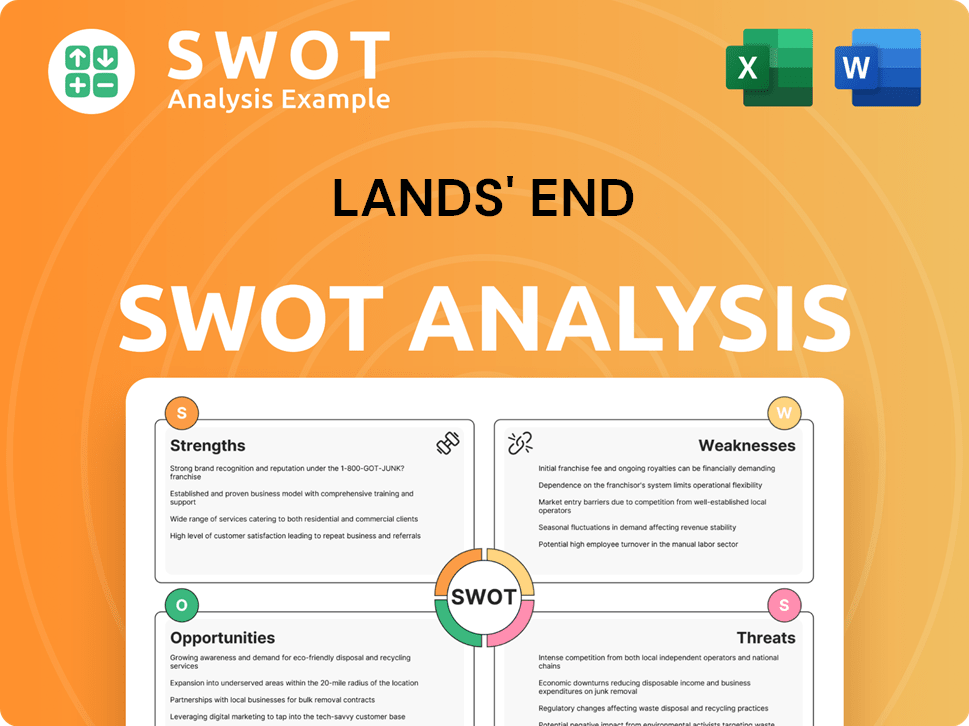

Lands' End SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lands' End Invest in Innovation?

The company's approach to innovation and technology is central to its Lands' End growth strategy. This strategy focuses on enhancing customer experience and optimizing operations. The company leverages its digital platform, data analytics, and operational efficiencies to drive sustained growth and maintain its market position.

Lands' End invests in its e-commerce platform, which is a primary sales channel and a hub for customer engagement. Investments in website functionality, mobile optimization, and personalized shopping experiences are crucial for attracting and retaining online customers. The company's digital transformation efforts are ongoing, reflecting its commitment to technological advancement.

Lands' End focuses on data analytics to understand customer preferences and personalize marketing efforts. This is a key component of modern retail innovation. The company also integrates sustainability initiatives into its strategy, focusing on responsible sourcing and manufacturing processes.

The e-commerce platform is a primary sales channel. It is a hub for customer engagement. Investments in website functionality are ongoing.

Mobile optimization is crucial for attracting and retaining online customers. The company focuses on improving the mobile shopping experience. This is a key part of the digital strategy.

Personalized shopping experiences are key to customer retention. Data analytics are used to understand customer preferences. Marketing efforts are tailored to individual customer needs.

Data analytics are used to understand customer preferences. This drives personalized marketing efforts. It is a key component of retail innovation.

Technology supports operational efficiency. This streamlines inventory management and order fulfillment. It ensures a seamless customer journey.

Sustainability is integrated into the strategy. This includes responsible sourcing and manufacturing. Technology enables tracking of these processes.

The company's Lands' End business model relies heavily on its digital presence. This is evident in its online sales strategy and customer acquisition strategies. The company's ability to adapt to Lands' End clothing market trends and leverage technology will be critical for its Lands' End future prospects. For example, in 2023, e-commerce sales accounted for a significant portion of the company's revenue, demonstrating the importance of its online platform. The company's focus on operational efficiency also helps it maintain its Lands' End competitive advantages.

Lands' End uses technology to enhance customer experience and optimize operations. The company's digital transformation is evident in its e-commerce platform. Data analytics are used for personalized marketing. Operational efficiency is supported by technology in inventory management and logistics.

- E-commerce Platform: The primary sales channel, focusing on website functionality and mobile optimization.

- Data Analytics: Used to understand customer preferences and personalize marketing.

- Operational Efficiency: Technology streamlines inventory management, order fulfillment, and logistics.

- Sustainability: Integrates responsible sourcing and manufacturing processes, tracked through technology.

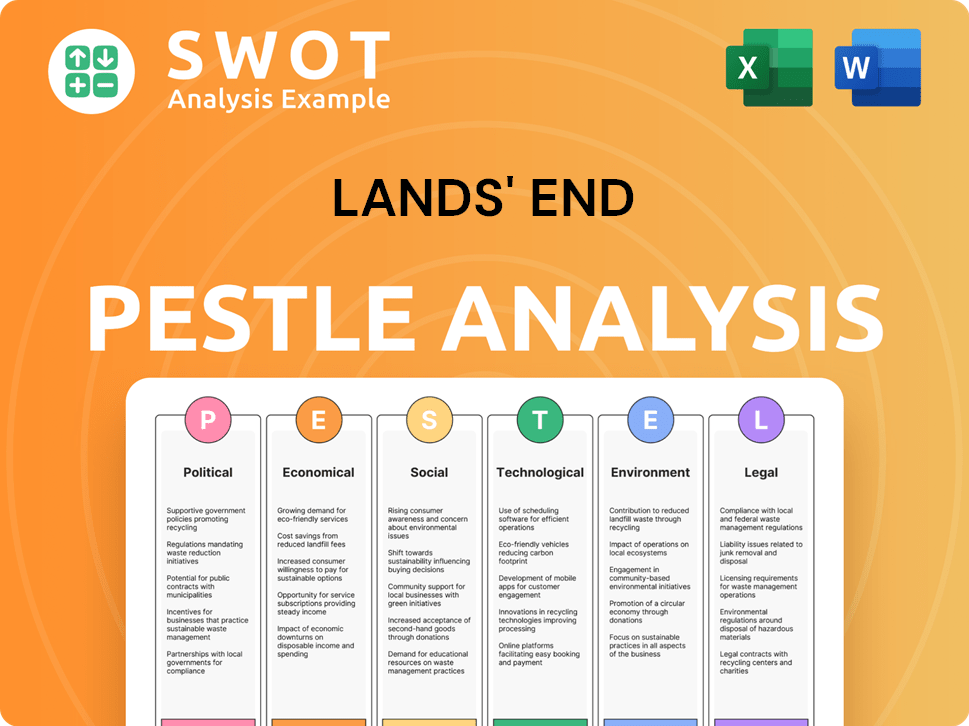

Lands' End PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Lands' End’s Growth Forecast?

The financial outlook for Lands' End reflects a strategic pivot towards profitability and sustainable growth. The company's performance in fiscal year 2023 showed a decrease in total revenue, but also demonstrated improvements in gross margin, indicating a focus on operational efficiency and cost management. This approach is crucial for navigating the current retail landscape and setting the stage for future growth.

Lands' End's Lands' End growth strategy involves careful management of inventory, cost control, and strategic investments in its direct-to-consumer channels. These efforts are designed to stabilize revenue and improve financial performance. The company's projections for fiscal year 2024 suggest a cautious but determined approach to achieve its financial goals.

The company's Lands' End future prospects are tied to its ability to execute its strategic initiatives effectively. These initiatives include retail expansion, wholesale partnerships, and a strong focus on direct-to-consumer channels. The long-term financial goals are underpinned by these strategic investments aimed at returning to top-line growth and improved profitability, despite the current market challenges.

In fiscal year 2023, Lands' End reported total revenue of $1.458 billion. This represents a decrease of 7.6% compared to the previous year. The decline was primarily due to lower sales in the wholesale and services segments.

For fiscal year 2024, Lands' End anticipates net revenue to be between $1.39 billion and $1.45 billion. The company's projections reflect a cautious outlook, considering the current market conditions and strategic initiatives.

The company projects a net loss for fiscal year 2024, ranging from a loss of $10.0 million to a loss of $4.0 million. This reflects the ongoing challenges and strategic investments.

Lands' End reported a gross margin of 42.0% for fiscal year 2023, an increase of 100 basis points compared to the prior year. This improvement was driven by lower shipping costs and reduced promotional activities.

Effective inventory management is a key component of Lands' End's financial strategy. The company focuses on optimizing inventory levels to improve profitability and reduce costs. This includes strategies to minimize excess inventory and streamline supply chain operations.

Cost control is a critical aspect of Lands' End's financial planning. The company is implementing various measures to manage expenses and enhance profit margins. This includes optimizing operational efficiencies and reducing unnecessary costs.

Lands' End is investing in its direct-to-consumer channels to drive future growth. This includes enhancing its e-commerce platform and improving customer experience. These investments are aimed at increasing sales and strengthening customer relationships.

The company is exploring retail expansion opportunities to increase its market presence. This includes evaluating new store locations and enhancing the existing retail network. The expansion aims to reach more customers and boost sales.

Lands' End is focused on forming strategic wholesale partnerships to expand its distribution network. These partnerships can help increase brand visibility and reach new customer segments. The company is actively seeking collaborations to drive revenue growth.

Lands' End projects an adjusted EBITDA between $46.0 million and $52.0 million for fiscal year 2024. This projection reflects the company's efforts to manage costs and improve operational efficiency. The EBITDA forecast is a key indicator of the company's financial health.

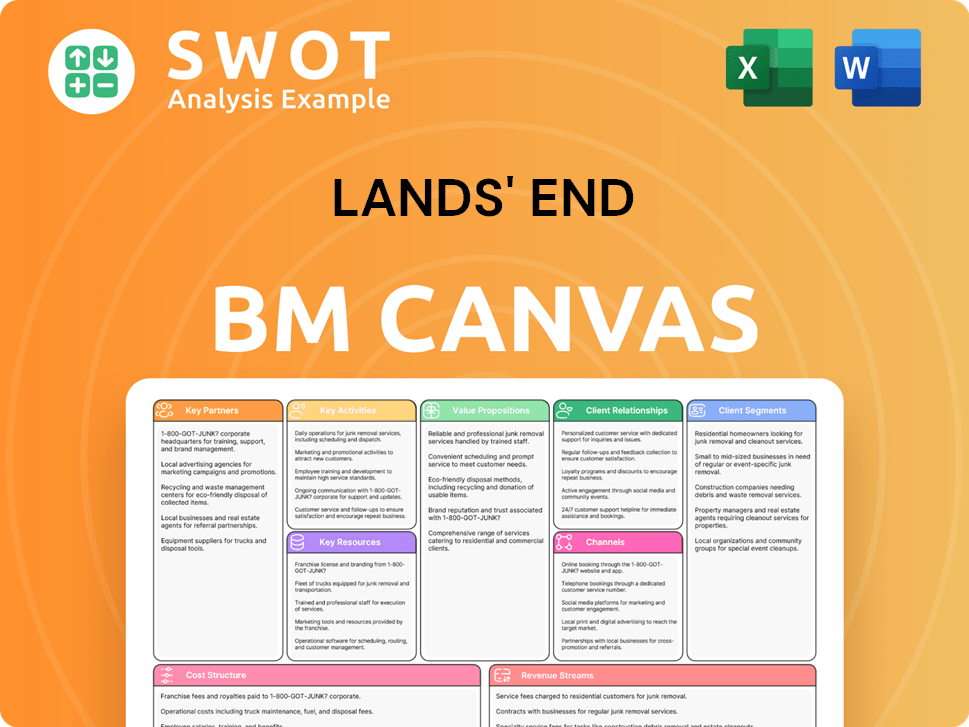

Lands' End Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Lands' End’s Growth?

Several risks and obstacles could affect the future of the company. The retail industry is highly competitive, with intense price wars and rapidly changing consumer preferences. This environment can impact market share, pricing power, and profitability for the company.

Supply chain disruptions, stemming from geopolitical events, natural disasters, or labor shortages, pose another significant challenge. The company’s reliance on direct-to-consumer channels also exposes it to changes in digital marketing effectiveness, online privacy regulations, and cybersecurity threats, potentially impacting its Marketing Strategy of Lands' End.

The company faces these challenges through a multi-channel sales approach, including e-commerce, catalogs, and retail stores, which helps to mitigate reliance on any single channel. Risk management frameworks are also used to prepare for potential disruptions, including scenario planning for supply chain resilience. Continuous investment in digital platforms and customer data analytics is crucial to remain competitive.

The retail landscape is fiercely competitive, with established e-commerce giants and intense price competition. This can erode profit margins and make it difficult to maintain market share. Staying ahead of consumer trends and adapting to changing preferences is essential for survival.

Disruptions in the supply chain, such as those caused by geopolitical events, natural disasters, or labor shortages, can lead to inventory delays and increased costs. The company needs to build resilience into its supply chain to mitigate these risks. Effective inventory management is critical.

A strong reliance on direct-to-consumer channels makes the company vulnerable to changes in digital marketing effectiveness, online privacy regulations, and cybersecurity threats. Adapting to evolving digital landscapes and maintaining robust cybersecurity measures are crucial for success.

Economic downturns can reduce consumer spending on discretionary items like clothing. The company's financial performance is sensitive to broader economic conditions. Diversifying product offerings and maintaining financial flexibility are important strategies.

Consumer preferences evolve rapidly, requiring constant innovation in product design and marketing. Maintaining brand relevance and adapting to new trends is essential. Understanding customer needs and responding quickly is a key factor.

Evolving consumer expectations regarding sustainability and ethical sourcing present both challenges and opportunities. Meeting these expectations requires investment in sustainable practices and transparent supply chains. This is becoming increasingly important for brand reputation.

The company uses a multi-channel approach, including e-commerce, catalogs, and retail stores, to reduce reliance on any single channel. Risk management frameworks are in place to prepare for disruptions, including scenario planning for supply chain resilience. Continuous investment in digital platforms and customer data analytics is also critical.

In fiscal year 2024, the company's net revenue was approximately $1.4 billion. The company's gross profit margin was around 46%, reflecting the impact of promotional activity and higher costs. The company continues to focus on improving its financial performance through strategic initiatives.

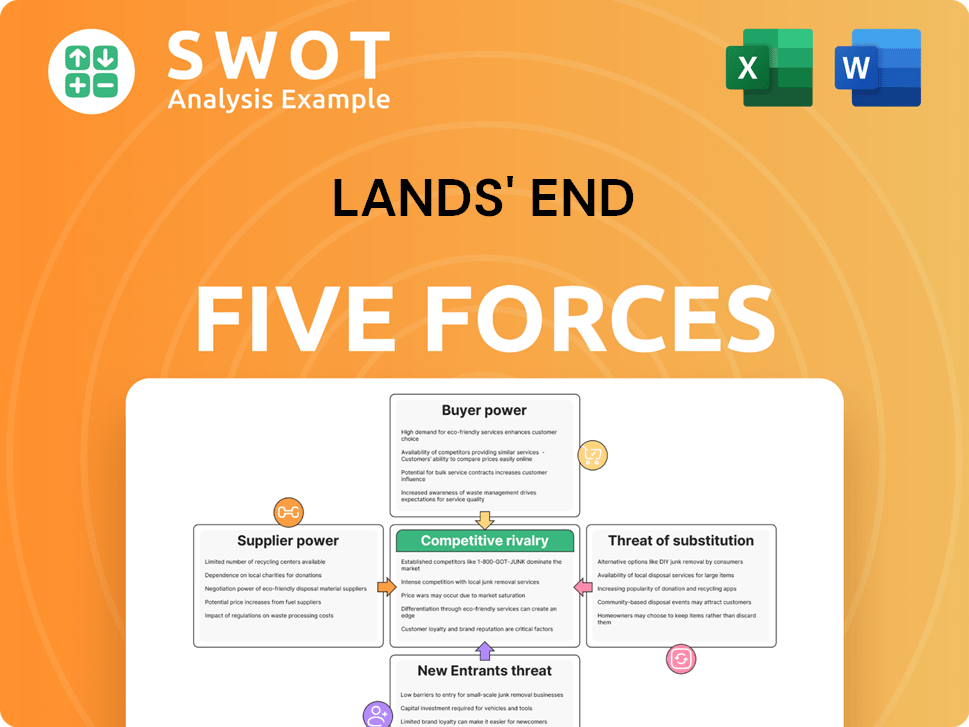

Lands' End Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lands' End Company?

- What is Competitive Landscape of Lands' End Company?

- How Does Lands' End Company Work?

- What is Sales and Marketing Strategy of Lands' End Company?

- What is Brief History of Lands' End Company?

- Who Owns Lands' End Company?

- What is Customer Demographics and Target Market of Lands' End Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.