Lindt & Sprungli Bundle

Can Lindt & Sprüngli Maintain Its Sweet Success?

Lindt & Sprüngli's journey from a Swiss chocolatier to a global confectionery giant is a testament to its strategic vision and unwavering commitment to quality. The 2014 acquisition of Russell Stover was a game-changer, propelling the company into new markets and solidifying its position in the competitive chocolate industry. Founded in 1845, Lindt & Sprüngli has consistently innovated, expanded, and adapted to market changes, making it a fascinating case study for any investor or business strategist.

This analysis will explore the Lindt & Sprungli SWOT Analysis, examining its growth strategy, future prospects, and market analysis within the dynamic confectionery market. We'll delve into Lindt's expansion plans, innovation strategies, and financial performance to understand how this Swiss chocolate brand aims to navigate chocolate industry trends and maintain its competitive advantages. Understanding the challenges and opportunities facing Lindt & Sprüngli is crucial for anyone interested in the future of Swiss chocolate brands and the broader global market.

How Is Lindt & Sprungli Expanding Its Reach?

The company is strategically expanding its business through a multi-pronged approach, focusing on both geographical market penetration and product portfolio diversification. This strategy aims to capitalize on the growing global demand for premium chocolate products. The firm's expansion initiatives are designed to enhance its market presence and cater to evolving consumer preferences.

A key element of the company's strategy involves broadening its global retail network, especially in emerging markets where chocolate consumption is on the rise. This includes opening new retail locations and leveraging existing distribution channels to reach a wider customer base. The company's expansion plans are carefully targeted to maximize growth potential in key regions.

Beyond geographical expansion, the company is also focused on product innovation to meet changing consumer demands. This involves introducing new product lines, limited editions, and seasonal offerings to maintain consumer interest and capture new market segments. These efforts are supported by ongoing market analysis to identify opportunities for growth and innovation.

The company is increasing its global presence through new retail locations and enhanced distribution networks. Key markets for expansion include Brazil and China, where premium chocolate consumption is growing. This strategy aims to capture a larger share of the confectionery market. Marketing Strategy of Lindt & Sprungli highlights the company's approach to market penetration.

The company is launching new product lines, limited editions, and seasonal offerings to meet evolving consumer preferences. This includes expanding its vegan chocolate range to cater to the growing demand for plant-based options. Continuous innovation is a core element of the company's strategy to stay competitive in the chocolate industry.

The company continually assesses opportunities for strategic mergers and acquisitions to gain market share. This approach can provide access to new technologies and capabilities. The company's past acquisitions, such as the Russell Stover acquisition, have been instrumental in expanding its market reach.

The company's financial performance reflects the success of its expansion initiatives. The 2023 annual report highlighted a 10.3% organic sales growth. This strong performance indicates effective execution of its growth strategy and positive market reception of its products.

The company's future prospects are promising, driven by its strategic focus on geographical expansion, product innovation, and strategic acquisitions. The company is well-positioned to capitalize on the growing demand for premium chocolate products worldwide. These strategies are crucial for long-term growth.

- Continued expansion in emerging markets, particularly in Asia.

- Ongoing product innovation to meet evolving consumer preferences, including new flavors and formats.

- Strategic investments in digital marketing and online sales channels.

- Focus on sustainability initiatives to align with consumer values.

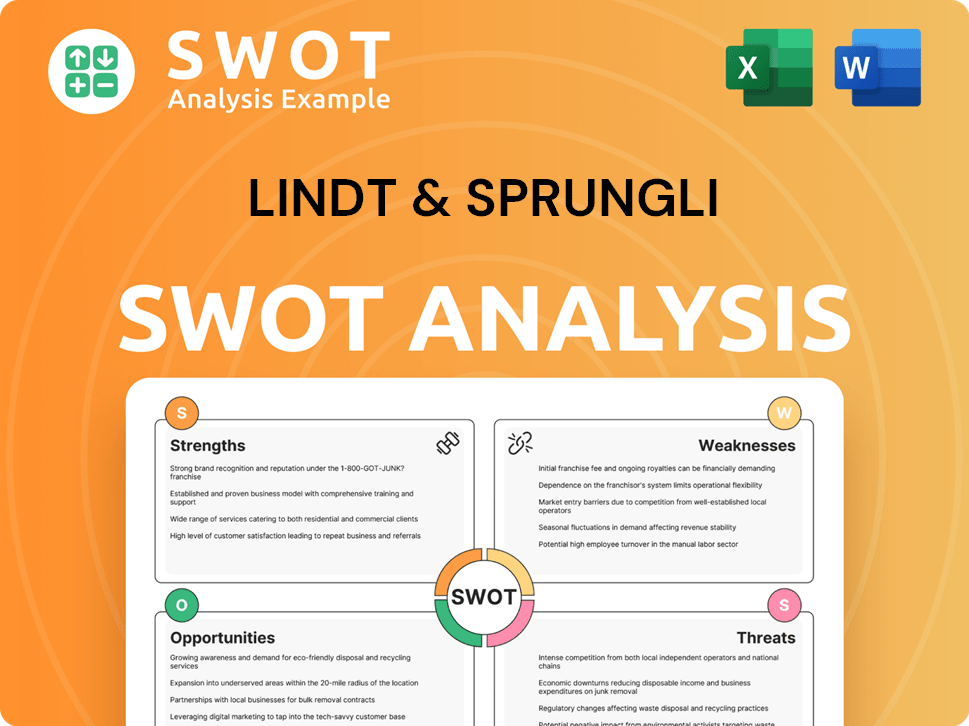

Lindt & Sprungli SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lindt & Sprungli Invest in Innovation?

Innovation and technology are central to the Lindt & Sprungli growth strategy, driving both product development and operational efficiency. The company consistently invests in research and development (R&D) to create new chocolate formulations, improve existing products, and explore novel ingredients. This commitment allows them to introduce innovative products that meet changing consumer tastes, which is crucial in the dynamic confectionery market.

The company's focus on premium chocolate positions it well to capitalize on evolving consumer preferences. By enhancing the sensory experience of their chocolates, they maintain a key differentiator in the premium segment. This emphasis on quality and innovation is evident in their consistent ability to introduce new products that resonate with consumers, contributing to their growth objectives.

In terms of operational technology, digital transformation and automation are being embraced across its production and supply chain. This includes optimizing manufacturing processes for greater efficiency and consistency, as well as leveraging data analytics to better understand consumer behavior and market trends. The company's emphasis on supply chain resilience and efficient production suggests an underlying adoption of advanced technologies to streamline operations.

Significant investments in R&D are made to create new chocolate formulations and improve existing products. This helps in staying ahead of Chocolate industry trends.

The introduction of innovative products, such as expanded vegan chocolate ranges, caters to changing consumer tastes. This is a key aspect of Lindt company future prospects.

Digital transformation and automation are implemented across production and supply chains. This improves efficiency and ensures consistent product quality.

Data analytics are used to understand consumer behavior and market trends. This helps in making informed decisions about product development and marketing strategies.

Sustainability initiatives are integrated into the innovation strategy, including environmentally friendly packaging and sourcing. This aligns with consumer demand for ethical products.

Consistent introduction of new products that resonate with consumers drives growth. This is a key factor in maintaining a strong brand presence.

The company focuses on several key technological and innovation strategies to drive growth and maintain its competitive edge. These include:

- R&D Investments: Continuous investment in research and development to create new chocolate formulations and improve existing products.

- Product Innovation: Introduction of innovative products to meet changing consumer tastes, such as vegan chocolates.

- Digital Transformation: Implementation of digital technologies and automation across production and supply chains to improve efficiency.

- Data Analytics: Leveraging data analytics to understand consumer behavior and market trends, enabling data-driven decision-making.

- Sustainability Initiatives: Integrating sustainability into the innovation strategy, including environmentally friendly packaging and sourcing methods.

- New Product Launches: Consistent introduction of new products that resonate with consumers, driving sales and market share.

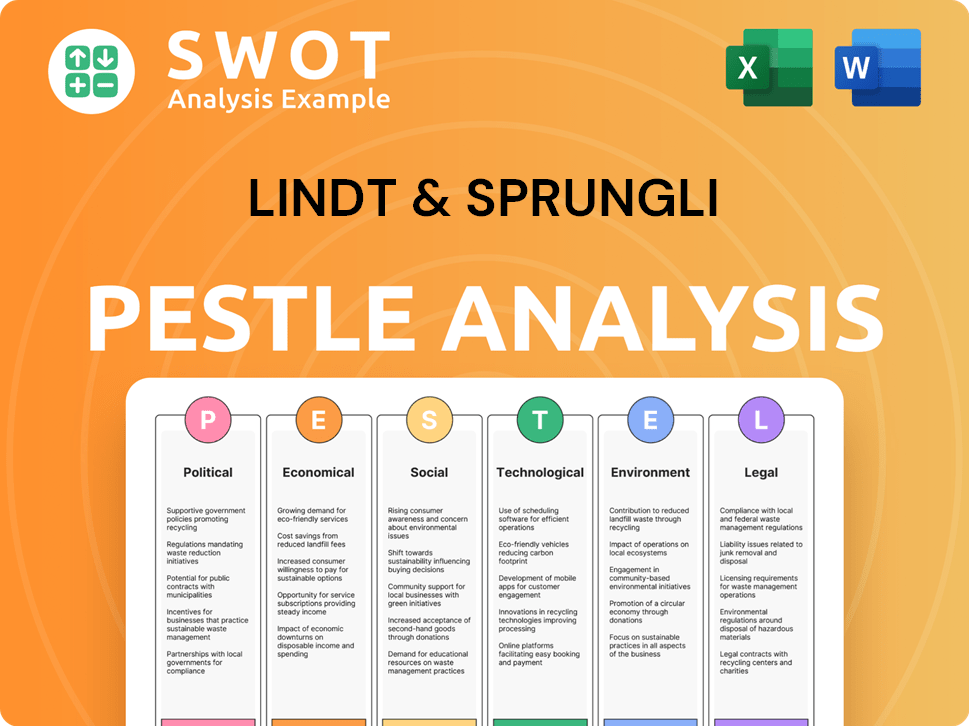

Lindt & Sprungli PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Lindt & Sprungli’s Growth Forecast?

The financial outlook for the company remains positive, underpinned by strong recent performance and strategic initiatives. The company's ability to maintain and improve its financial metrics is a key factor in its long-term success. This positive trajectory is expected to continue, supported by strategic market expansion and premiumization strategies.

The company's financial performance in 2023 showcased robust growth. Organic sales increased by 10.3%, and operating profit (EBIT) rose by 17.2% to CHF 881.9 million. The EBIT margin improved to 15.6%, reflecting efficient operational management and strong demand for its products. This performance highlights the company's resilience and its ability to adapt to evolving market conditions.

Looking ahead, the company anticipates continued growth. For 2024, the forecast includes organic sales growth of 6% to 8% and an operating profit margin between 15% and 16%. These projections are based on ongoing investments in expansion, product innovation, and operational efficiency. The company's financial strategy focuses on sustainable growth, aiming to consistently outperform industry benchmarks.

The company achieved an organic sales growth of 10.3%, demonstrating strong consumer demand and effective market strategies. Operating profit (EBIT) saw a significant increase of 17.2%, reaching CHF 881.9 million. This growth in profitability reflects efficient operations and successful cost management, contributing to the company's overall financial health. The positive results are a testament to the company's strategic initiatives and its ability to capitalize on Chocolate industry trends.

For 2024, the company projects organic sales growth of 6% to 8%, indicating continued confidence in its market position. The anticipated operating profit margin is between 15% and 16%, reflecting sustained profitability. These forecasts are supported by ongoing investments in expansion and product innovation, ensuring the company’s ability to adapt to market changes and maintain its competitive edge. The Lindt & Sprungli growth strategy is clearly focused on sustainable expansion.

The company aims to maintain an organic sales growth of 6% to 8%, demonstrating a commitment to sustained expansion. A continuous improvement in the operating profit margin of 20 to 40 basis points per year is also targeted. These long-term goals are supported by strategic investments and operational efficiencies, ensuring the company's continued success in the Confectionery market.

Investments focus on expansion initiatives, product innovation, and efficient operational management. The company's strong cash flow and solid balance sheet provide a stable foundation for these strategies. These investments support brand building and market penetration, driving sustainable growth. These initiatives are key to the Lindt company future prospects.

The company benefits from strong cash flow generation, which supports its growth initiatives. A solid balance sheet provides financial stability and allows for strategic investments. This financial strength enables the company to pursue its expansion plans without relying heavily on external funding.

Strategic market expansion is a key driver of the company's growth strategy. The company focuses on both geographical expansion and increased market share in existing regions. This expansion is supported by targeted marketing and distribution strategies.

The company's premiumization strategy involves offering high-quality products that command higher prices. This strategy enhances profitability and strengthens the brand's image. The focus on premium products aligns with consumer preferences for quality and indulgence.

The company's financial narrative emphasizes sustainable growth, driven by premiumization and strategic market expansion. This approach ensures long-term value creation for stakeholders. The company aims to consistently outperform industry benchmarks, demonstrating its commitment to sustainable business practices.

The company benefits from strong brand recognition and a reputation for quality. This competitive advantage allows the company to maintain its market position and attract customers. The company's commitment to innovation and excellence further strengthens its position. For more details, you can read the Brief History of Lindt & Sprungli.

The company conducts thorough market analysis to identify growth opportunities and adapt to changing consumer preferences. This analysis informs product development, marketing strategies, and expansion plans. The company's ability to understand and respond to market trends is critical to its success. The Lindt market analysis helps to guide future decisions.

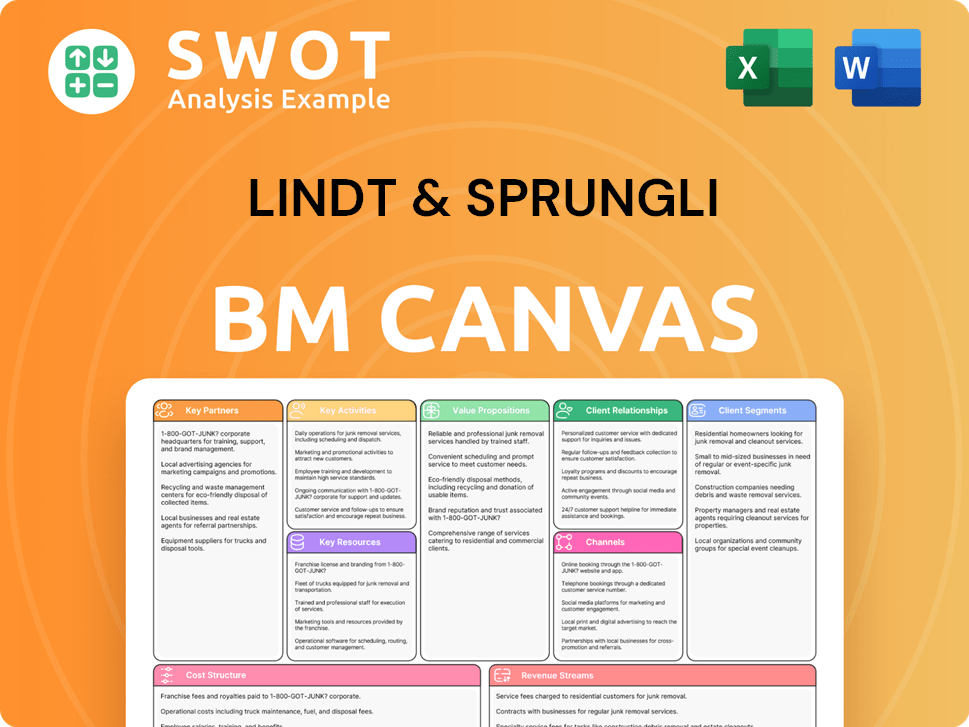

Lindt & Sprungli Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Lindt & Sprungli’s Growth?

The path to growth for the company is not without its hurdles. The global chocolate industry is highly competitive, with many established and emerging brands vying for consumer attention. Successfully navigating this landscape requires continuous innovation and maintaining a strong brand identity.

Regulatory changes, particularly concerning food labeling, sustainability, and international trade, pose another set of challenges. Adapting to evolving rules around sugar content or cocoa sourcing can demand significant adjustments to product formulations and supply chains. Furthermore, supply chain vulnerabilities, especially concerning cocoa bean sourcing, present ongoing risks.

Climate change, political instability in cocoa-producing regions, and ethical sourcing concerns can lead to price volatility and supply disruptions. The company actively mitigates these risks through programs like the Farming Program, which aims to improve the livelihoods of cocoa farmers and ensure sustainable cocoa production. Rapid expansion while maintaining product quality and brand consistency across diverse markets can also be challenging.

The confectionery market is fiercely competitive, with numerous Swiss chocolate brands and international players. Maintaining market share necessitates continuous innovation in product offerings and marketing strategies. The company must differentiate itself from competitors to retain consumer loyalty and attract new customers.

Changes in food labeling regulations, particularly regarding sugar content, and evolving sustainability standards pose significant challenges. Compliance with these regulations requires adjustments to product formulations, packaging, and sourcing practices. International trade policies and tariffs can also impact operational costs and market access.

The supply chain, particularly for cocoa beans, is vulnerable to climate change, political instability, and ethical sourcing concerns. These factors can lead to price volatility and supply disruptions. The company addresses these risks through direct sourcing programs and diversification of its supply base.

Competitors leveraging new technologies, such as personalized nutrition or direct-to-consumer sales, could disrupt the market. Adapting to these technological advancements is crucial for maintaining a competitive edge. The company must invest in digital marketing and e-commerce strategies to meet evolving consumer preferences.

Managing rapid expansion while maintaining product quality and brand consistency across diverse markets presents internal challenges. The company must ensure that its brand image and product standards are upheld globally. Effective risk management frameworks and continuous monitoring of market trends are essential.

Economic downturns, currency fluctuations, and changes in consumer spending patterns can significantly impact the company's performance. The company must monitor global economic trends and adapt its strategies accordingly. Diversification of geographical markets can help mitigate these economic risks.

The company employs robust risk management frameworks to address these challenges. It diversifies its product portfolio and geographical markets to reduce reliance on any single market or product category. Continuous monitoring of global economic and industry trends allows for proactive adaptation of strategies.

The company's strong brand recognition worldwide, particularly in the Swiss chocolate brands segment, provides a significant advantage. Its focus on premium products and innovative marketing strategies helps it stand out in the confectionery market. Strategic partnerships and acquisitions further strengthen its market position.

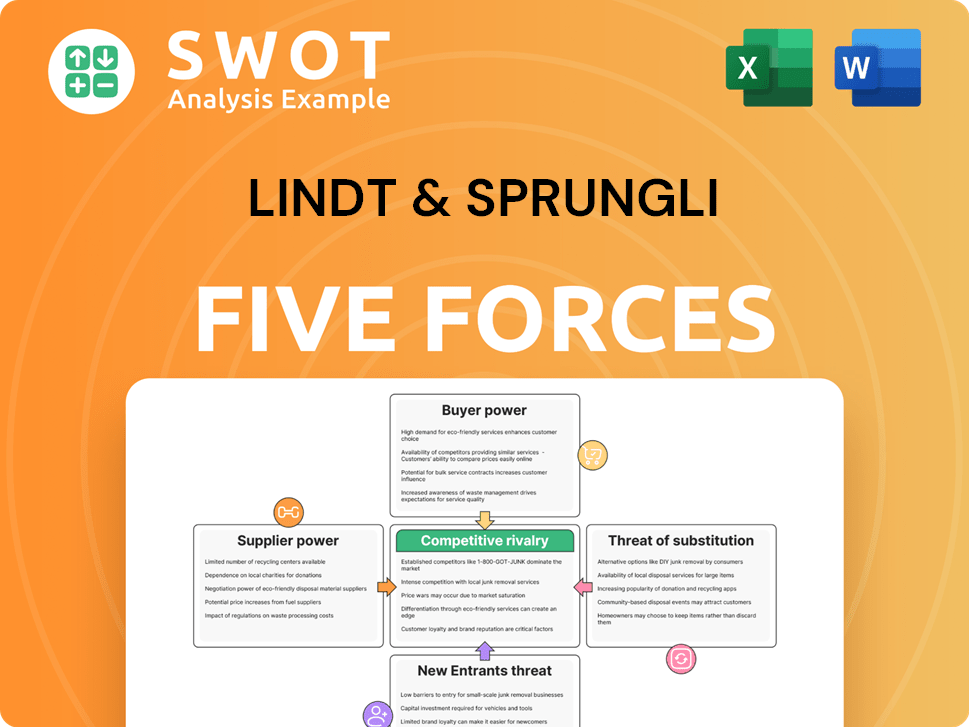

Lindt & Sprungli Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lindt & Sprungli Company?

- What is Competitive Landscape of Lindt & Sprungli Company?

- How Does Lindt & Sprungli Company Work?

- What is Sales and Marketing Strategy of Lindt & Sprungli Company?

- What is Brief History of Lindt & Sprungli Company?

- Who Owns Lindt & Sprungli Company?

- What is Customer Demographics and Target Market of Lindt & Sprungli Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.