Makita Bundle

Can Makita Maintain Its Cutting Edge?

Founded over a century ago, Makita has evolved from a small electric motor repair shop into a global power tool giant. With a projected 15% market share by 2025, understanding Makita's Makita SWOT Analysis is crucial for investors and industry watchers alike. This analysis explores the company's ambitious plans for expansion and innovation in a rapidly changing market.

Makita's journey from a local Japanese business to a multinational corporation is a testament to its effective Makita growth strategy. This in-depth

How Is Makita Expanding Its Reach?

The expansion initiatives of the company are primarily focused on strengthening its global presence and diversifying its product portfolio. This includes a strong emphasis on the cordless outdoor power equipment (OPE) sector. The company is strategically positioning itself for growth in emerging markets.

A key element of the company's strategy involves expanding its lineup of high-value-added products, especially those centered around its 40Vmax batteries (XGT series). The company is also actively developing cordless OPE for professionals, aiming to improve efficiency and increase returns. The company is also committed to increasing brand awareness among new audiences by demonstrating how their products can enhance convenience and improve quality of life.

The company's growth strategy includes introducing new products in new categories, such as robotic lawnmowers and cordless sweepers. This diversification supports its long-term growth potential. For a deeper understanding of the company's customer base, check out the Target Market of Makita.

The company aims to increase its presence in emerging markets. The goal is to achieve a 25% revenue contribution from these regions by 2025. This builds on the 18% revenue growth from regions outside Japan in 2023.

The company is focused on expanding its range of high-value-added products. This includes cordless OPE, which comprised over 10% of total sales revenue in fiscal year 2024. New product categories, such as robotic lawnmowers and cordless sweepers, are also being introduced.

North America remains a key market, despite a slight decrease in its contribution to overall sales. In fiscal year 2024, North America accounted for approximately 13.0% of total sales. This is down from 15.9% in the previous year, but it remains the third-largest market for the company.

The company is committed to enhancing brand awareness among new audiences. It is demonstrating how their products can improve quality of life. The company is aligning its products with global trends, such as the needs of an aging population.

The company's expansion plans are multifaceted, focusing on geographic growth, product innovation, and customer engagement. These strategies are designed to capitalize on market trends and opportunities. The company is actively investing in research and development to support its product innovation efforts.

- Focus on emerging markets for revenue growth.

- Expand the 40Vmax (XGT series) product line.

- Increase the cordless OPE product offerings.

- Introduce new products in emerging categories.

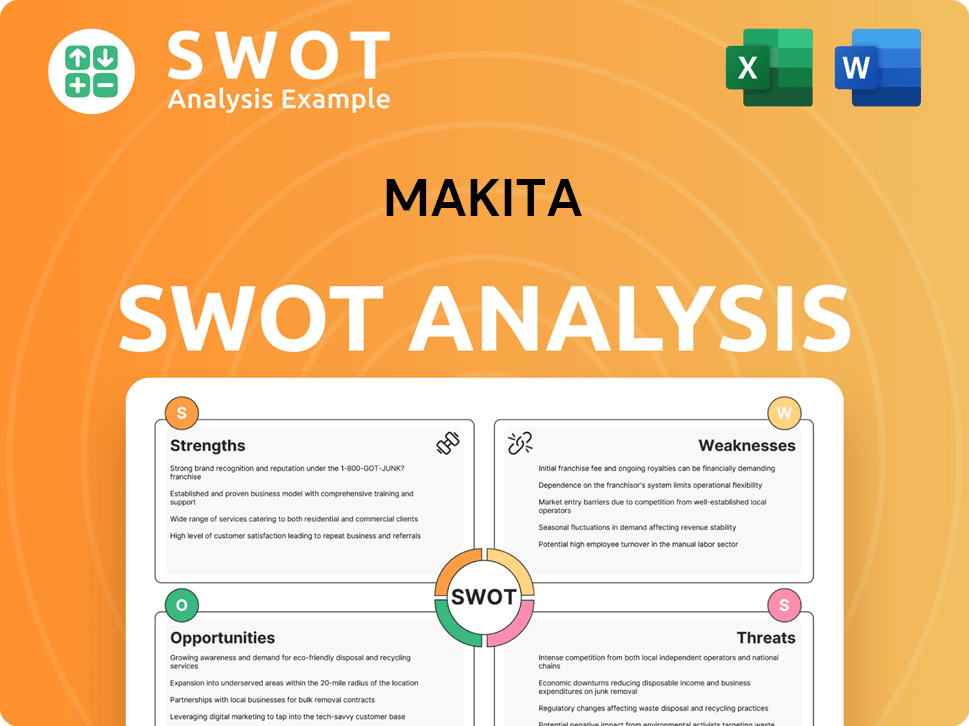

Makita SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Makita Invest in Innovation?

The success of the Makita growth strategy is deeply rooted in its commitment to innovation and technological advancement. This focus allows the company to meet the evolving needs of its customers, who increasingly demand more efficient, powerful, and user-friendly tools. Understanding these customer needs drives Makita's product innovation and helps maintain its competitive edge.

Customer preferences are shifting towards cordless tools, driven by the convenience and flexibility they offer. Professionals and DIY enthusiasts alike are looking for tools that provide high performance without the constraints of cords or the emissions of fuel-powered alternatives. This trend is a key factor in shaping Makita's future prospects, as the company continues to invest in and expand its cordless tool offerings.

The company's focus on sustainability, with initiatives like battery recycling and reduced emissions, also appeals to environmentally conscious customers. This approach not only aligns with global trends but also enhances the brand's appeal to a broader audience, contributing to its long-term growth potential.

In 2023, the company allocated 8% of its revenue to research and development. By 2024, this investment is planned to increase to 10%, with approximately $50 million earmarked for R&D.

This significant investment in R&D has led to the introduction of over 30 new products within the year, demonstrating Makita's commitment to innovation.

A key focus of these new product launches is the XGT 40V max series. This series offers enhanced power and runtime, specifically designed for professional users, showcasing Makita's dedication to meeting the needs of its core customer base.

The company's approach to digital transformation and the use of advanced technologies is evident in its continuous refinement of tools. The LXT 18V Lithium-Ion battery platform remains a reliable choice.

The XGT, 40V max, and 80V max battery systems are designed for demanding tasks. These systems offer extended runtime, faster charging, and enhanced durability, catering to the needs of professionals.

As of Q1 2024, Makita holds over 150 patents in battery technology. This strong patent portfolio solidifies its leadership in cordless tool advancements, a key factor in its Makita market share.

Aligned with global trends towards decarbonization, Makita has ceased production of engine-powered products. This strategic shift highlights the company's commitment to environmental responsibility and its focus on sustainable practices.

- Committed to its advanced XGT battery technology to offer performance comparable to fuel-powered models without emissions, excessive noise, or vibrations.

- Target to reduce carbon emissions in manufacturing by 30% by 2025, having achieved a 20% reduction in 2023.

- In 2024, invested $20 million in sustainable manufacturing technologies and processes.

- Recovered over 1,000 tons of lithium and cobalt through battery recycling initiatives in 2023.

For a deeper understanding of the company's origins and evolution, consider reading Brief History of Makita. This historical context provides valuable insights into the company's journey and its strategic decisions.

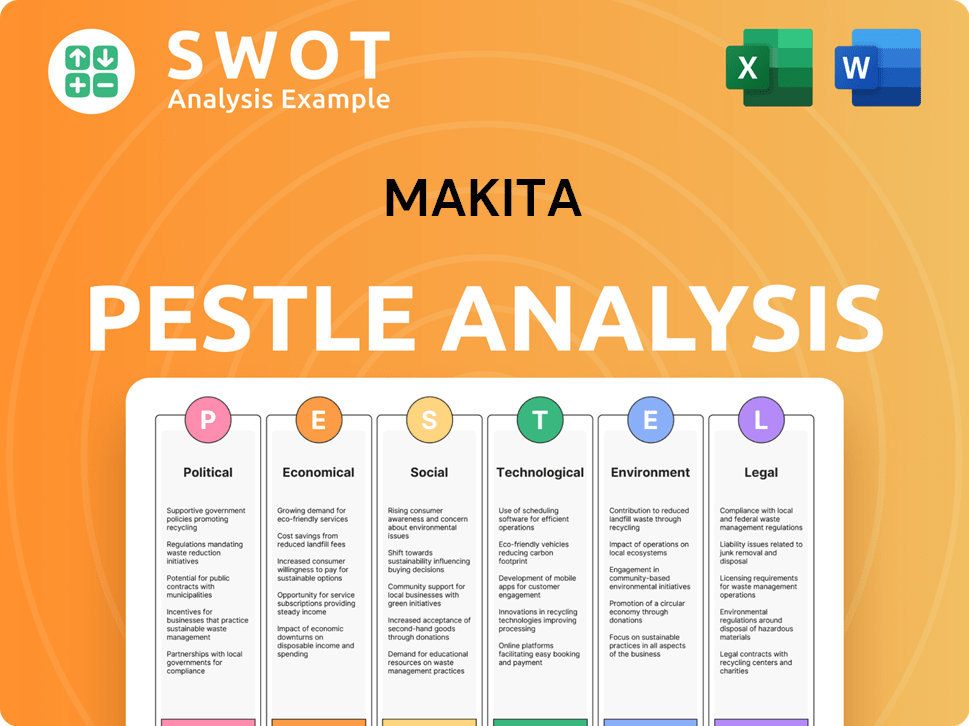

Makita PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Makita’s Growth Forecast?

The financial outlook for the fiscal year ending March 31, 2025, indicates a positive trajectory for the company. The company anticipates a modest increase in revenue, alongside a significant rise in operating profit. This positive outlook is a key aspect of the overall Makita growth strategy.

For FY2025, the company's companywide revenue is estimated at JPY 753 billion, reflecting a 2.4% year-on-year growth. This growth, coupled with strategic financial management, is expected to drive profitability. The company's focus on operational efficiency and market expansion contributes to its positive financial performance, influencing its Makita future prospects.

The company's operating profit reached JPY 107 billion in FY2024, with a margin of 14.2%. For FY2025, the company has revised its consolidated earnings guidance, projecting revenue of JPY 730,000 million, operating profit of JPY 85,000 million, and profit attributable to owners of the parent of JPY 61,000 million. This financial performance is a core component of the Makita company analysis.

The company anticipates revenue of JPY 730,000 million and an operating profit of JPY 85,000 million for FY2025. These projections reflect the company's strategic financial planning. These figures show a positive outlook for the company's financial health.

The operating profit margin reached 14.2% in FY2024. The company's focus on efficient operations contributes to maintaining healthy profit margins. This focus on profitability is a key driver of the company's financial performance.

The North America segment experienced a decrease in sales, with revenue at JPY 96.111 billion for FY2024. This represents a 21% decrease from the previous year. Despite this, the company's overall performance remains strong.

The company plans to raise its annual dividend to JPY 20 in the first half of FY2024. The company has set a total shareholder payout ratio target of 35%. This demonstrates the company's commitment to shareholder value.

Despite a slight decrease in overall revenue for the fiscal year ending March 31, 2025, the company anticipates an increase in profit. The company's strategic initiatives are aimed at enhancing profitability and Makita market share. The company's focus on innovation and efficiency is a key factor in its continued success, as highlighted in Mission, Vision & Core Values of Makita.

The company is forecasting a top-line compound annual growth rate of 4.2% for 2025-2029. This growth rate indicates a positive outlook for the company's long-term financial performance. This forecast is a key indicator of the company's potential.

The company's Return on Equity (ROE) improved to 8.8% in FY2025. This improvement in ROE indicates enhanced profitability and efficient use of shareholder equity. This is a key indicator of the company's financial health.

The company announced a buyback of JPY 10 billion for fiscal year 2023. The company has set a target total shareholder payout ratio of 35%, including both dividends and buybacks. This demonstrates the company's commitment to shareholder value.

The company plans to raise its annual dividend to JPY 20 in the first half of fiscal year 2024. This increase in dividends reflects the company's strong financial performance. This increase is a positive signal for investors.

Operating profit increased by 61.8% to JPY 107,038 million for the fiscal year ending March 31, 2025. The company's focus on operational efficiency and market expansion contributes to its positive financial performance. This significant growth underscores the company's strong financial health.

Profit attributable to owners of the parent increased by 81.6% to JPY 79,338 million for the fiscal year ending March 31, 2025. This substantial increase in profit demonstrates the company's strong financial performance. This growth is a key indicator of the company's success.

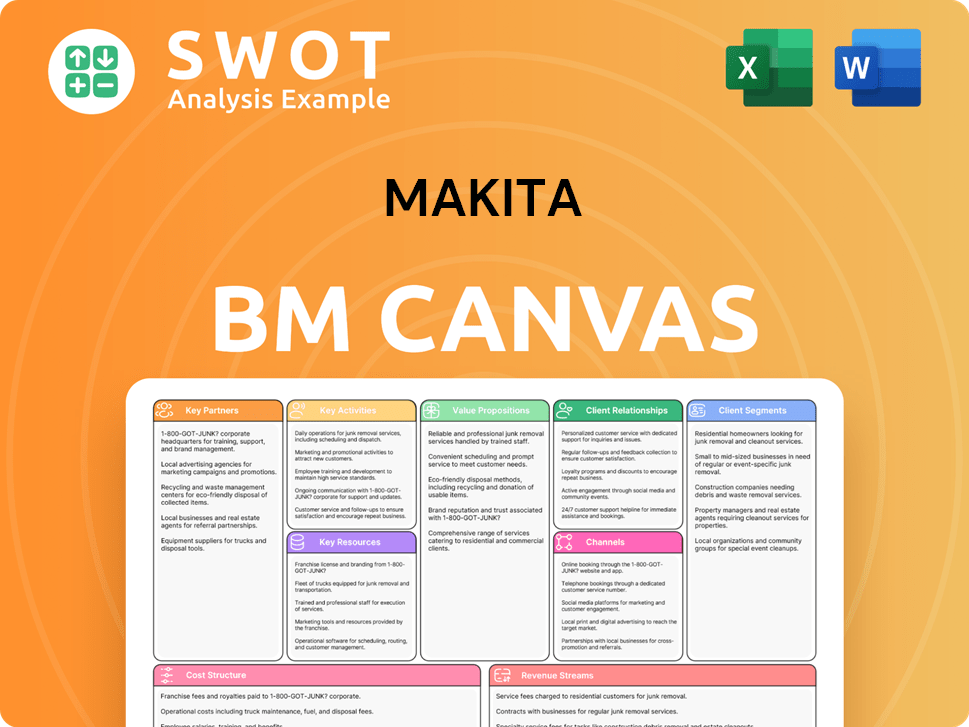

Makita Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Makita’s Growth?

The path of the company is not without its hurdles. Several strategic and operational risks could impact the company's growth trajectory. Understanding these potential challenges is crucial for investors and stakeholders evaluating the long-term viability of the company.

One of the major concerns is the competitive landscape, especially in regions like North America, where intense rivalry has affected profitability. Additionally, external factors such as regulatory changes, economic downturns, and technological disruptions pose significant threats. The company is actively working to mitigate these risks through strategic planning and operational adjustments.

The company's approach involves proactive measures to address these risks, including diversifying production locations, investing in research and development, and adapting to market changes. This proactive stance is essential for maintaining its market position and achieving its long-term goals. To get more insights, consider reading this article for Owners & Shareholders of Makita.

The power tool market is highly competitive, with key players like Stanley Black & Decker, Bosch, and Techtronic Industries (TTI) vying for market share. The company faces challenges in maintaining its Makita market share, especially in North America, where competition is particularly fierce. Increased product extensions and technological innovation further intensify the competitive environment.

Regulatory changes and trade policies, such as tariffs, pose a significant risk to the company. The announcement of tariffs by the US has already impacted the company's stock. The company is mitigating these risks by shifting production for the US market from China to other regions like Thailand, Romania, and Germany. This strategic move aims to reduce the impact of potential tariff hikes.

Supply chain vulnerabilities and economic downturns present obstacles. The global economy's uncertain prospects, coupled with high interest rates and soaring construction material prices, have weakened housing investment in regions like North America, leading to decreased revenue. The prolonged downturn in the Chinese real estate market has also impacted demand for tools in Asia.

Technological disruption is a continuous risk, demanding consistent investment in research and development to stay ahead. The company addresses this by consistently investing in R&D and focusing on advanced battery technologies and new product categories. This commitment to innovation is crucial for sustaining its competitive advantage in the long term.

Internal resource constraints, such as labor shortages, also pose a concern. However, the company believes this will drive demand for high-efficiency tools. The company is actively working to optimize its operations and improve efficiency to mitigate the effects of these constraints.

The company employs several strategies to mitigate these risks. These include expanding high-value-added products, differentiating through after-sales services, and leveraging its global production network to mitigate tariff impacts. These proactive measures are essential for navigating the challenges in the power tool market and ensuring long-term success.

The competitive landscape is dynamic. Key competitors such as Stanley Black & Decker and Bosch constantly innovate, influencing the company's market share. Monitoring market trends and competitor activities is vital for strategic planning and maintaining a competitive edge. The company must continue to focus on product innovation to stay ahead.

Tariffs, especially those imposed by the US, directly impact the company. Approximately 60% of the products sold in the US are shipped from China. The company's strategy to shift production to other regions is a key factor in mitigating the financial impact. The company's ability to adapt quickly is crucial for navigating these challenges.

Continuous investment in research and development is crucial. The company's commitment to advanced battery technologies and new product categories is a key component of its growth strategy. This focus helps the company maintain its competitive advantage in the long term. Recent R&D spending figures provide insight into the company's innovation efforts.

Supply chain issues and economic downturns pose significant risks. The company's global production network and diversification efforts help in mitigating these risks. Monitoring economic indicators and adjusting production strategies are essential for ensuring supply chain resilience. This proactive approach helps to minimize disruptions.

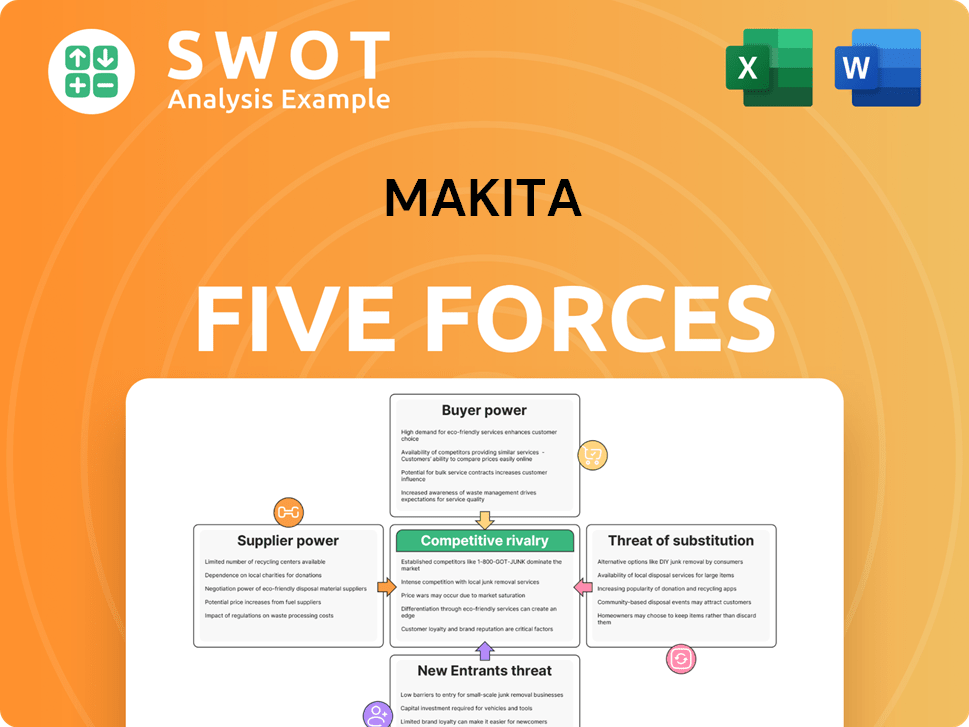

Makita Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Makita Company?

- What is Competitive Landscape of Makita Company?

- How Does Makita Company Work?

- What is Sales and Marketing Strategy of Makita Company?

- What is Brief History of Makita Company?

- Who Owns Makita Company?

- What is Customer Demographics and Target Market of Makita Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.