Mountaire Bundle

Can Mountaire Company Continue Its Ascent in the Poultry Industry?

From its humble beginnings as a feed business, Mountaire Company has become a major player in the poultry industry. This transformation highlights the importance of strategic foresight and adaptability in a competitive market. Now, we explore the Mountaire SWOT Analysis to understand the company's current position and future potential.

This deep dive into Mountaire Company's growth strategy and future prospects will provide a comprehensive poultry industry analysis, examining its expansion plans and competitive advantages. We'll also explore how Mountaire Company navigates market challenges and capitalizes on investment opportunities. Understanding Mountaire's business model and its approach to sustainable farming practices is crucial for evaluating its long-term goals and impact on local communities.

How Is Mountaire Expanding Its Reach?

The Mountaire Company Growth Strategy is actively unfolding through strategic expansion initiatives. These efforts are designed to enhance operational capabilities and broaden its market reach within the poultry industry. Recent moves and future plans highlight a commitment to both organic growth and strategic acquisitions, positioning the company for sustained success.

The company's focus on expansion includes a blend of geographical growth and operational improvements. These strategic moves are intended to strengthen its market position and enhance its ability to meet the evolving demands of consumers. The company's expansion plans are a key component of its long-term vision.

Mountaire is also focused on strengthening its community ties and brand presence. These initiatives, while community-focused, implicitly strengthen local ties and brand presence within its operational areas. The company's commitment to its communities is a key part of its business model.

In late 2023, Mountaire acquired three grain elevators in Maryland from Nagel Farm Service, bolstering its grain operations. These grain operations were rebranded as 'Prime Quality' in April 2024, reflecting the company's historical presence in the feed business. This strategic move aims to secure better global markets and provide improved returns to local farmers.

Mountaire is actively expanding its physical infrastructure, including the acquisition of farmland for a new feed mill. This expansion led to the creation of 80 new permanent jobs, demonstrating a commitment to increasing production capacity and supporting local employment. These investments are integral to the company's long-term goals.

Mountaire has partnered with Redner's Markets to expand the distribution of its high-quality poultry products. This collaboration provides opportunities to increase its market share in retail. These partnerships are part of the company's strategic approach to supply chain management.

Mountaire actively engages in large-scale community initiatives to strengthen local ties and brand presence. The 'Thanksgiving for Thousands' program in late 2024 provided over 23,500 meals to families in need. The 'Easter for Thousands' event in 2023 packed 15,000 meal boxes. These programs demonstrate the company's commitment to its communities.

These expansion initiatives are a key part of Mountaire Company's strategy for the future. By focusing on strategic acquisitions, infrastructure investments, and community engagement, Mountaire is positioning itself for continued growth and success in the competitive poultry industry. To learn more about the company's core values, you can read about the Mission, Vision & Core Values of Mountaire.

Mountaire's expansion strategy encompasses acquisitions, infrastructure investments, and community initiatives to drive growth.

- Acquisition of grain elevators and rebranding of grain operations.

- Investment in farmland and creation of new jobs.

- Strategic partnerships to enhance product distribution.

- Community programs that strengthen local ties and brand presence.

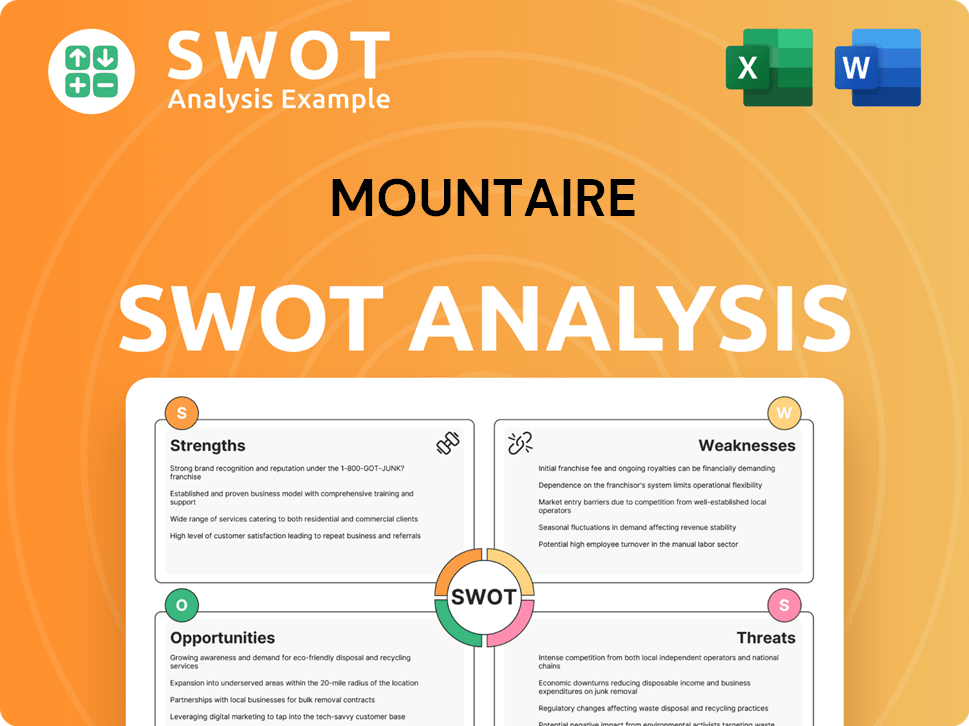

Mountaire SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Mountaire Invest in Innovation?

The commitment to innovation and technology is a core element of the Mountaire Company Growth Strategy. This focus helps the company to maintain its competitive edge within the poultry industry. Digital transformation and sustainable practices are key areas where the company is making significant investments.

Mountaire's strategic approach to technology and innovation is multifaceted, encompassing improvements in both operational efficiency and environmental sustainability. These initiatives are designed to enhance the company's overall performance and contribute to its long-term goals. The company's investments reflect a proactive stance towards meeting evolving market demands and addressing industry challenges.

Mountaire's approach to innovation is evident in its strategic investments in technology and sustainable practices. These efforts are designed to improve operational efficiency, reduce environmental impact, and enhance the company's overall market position. The company's focus on innovation is a key component of its long-term growth strategy.

The launch of the Prime Quality Farmer Portal and App in July 2024 demonstrates Mountaire's commitment to digital transformation. This platform streamlines grain sales, contract management, and market insights for farmers. This digital initiative enhances the efficiency and transparency of Mountaire's agribusiness operations.

Mountaire has consistently improved its processing technology over the past two decades. This ensures the timely and efficient delivery of packaged chicken products to grocery stores. These advancements are crucial for maintaining operational efficiency and meeting consumer demand.

In 2022, Mountaire used approximately 45,000 tons of recyclable Greencoat wax replacement packaging. This initiative helps prevent waste and supports environmental responsibility. The company's commitment to eco-friendly packaging highlights its dedication to sustainability.

Mountaire operates a Resource Recovery Plant that processes about 8.5 million pounds of inedible chicken products weekly. This plant converts these products into 1,350 tons of poultry meals and fats weekly. These materials are used in animal feed and organic fertilizers.

The Resource Recovery Plant is recognized as one of the most energy-efficient and advanced environmental systems in the industry. This showcases Mountaire's investment in cutting-edge sustainable practices. This efficiency contributes to the company's overall environmental goals.

Mountaire's long-term goals are supported by its commitment to innovation in poultry processing and environmental sustainability. The company's response to changing consumer demand and its strategic partnerships are also key. These elements contribute to the company's competitive advantages.

Mountaire's innovation strategy focuses on digital transformation, processing technology, and environmental sustainability. These initiatives enhance operational efficiency, reduce waste, and support the company's long-term goals. The company's investments in these areas are crucial for its future prospects within the poultry industry.

- Digital platforms improve supply chain management and farmer relations.

- Advanced processing technologies ensure efficient product delivery.

- Eco-friendly packaging and resource recovery reduce environmental impact.

- Energy-efficient plants support sustainable farming practices.

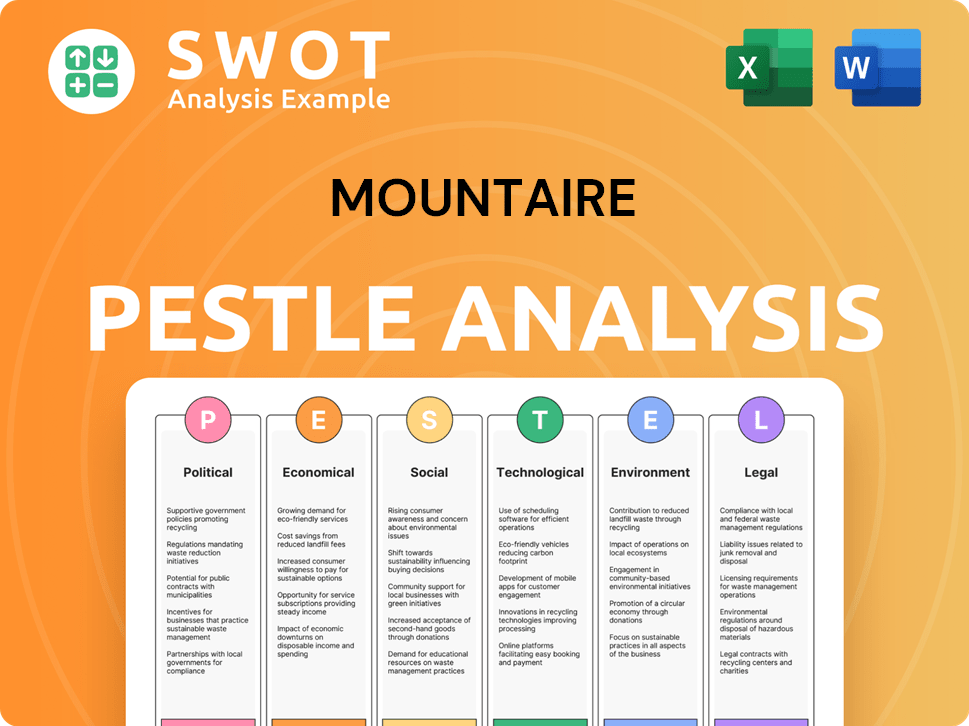

Mountaire PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Mountaire’s Growth Forecast?

The financial outlook for Mountaire Corporation is positive, supported by its strong performance in the poultry industry. The company's revenue reached $3.8 billion in 2024, making it the top private company in Arkansas that year. This represents significant growth from its 2023 revenue of at least $3 billion, demonstrating its ability to maintain a strong market position.

Mountaire's consistent revenue growth underscores its operational efficiency and competitive advantages within the poultry sector. The company's strategic initiatives, including acquisitions and investments in infrastructure, suggest a commitment to future expansion. The company's focus on digital transformation and strategic partnerships further supports its financial health and long-term goals.

The company's ongoing investments in new feed mill infrastructure and other expansion initiatives are key to its growth strategy. The company's commitment to operational improvements and market expansion underpins a positive financial narrative for its future. For a deeper dive into their marketing strategies, consider reading about the Marketing Strategy of Mountaire.

Mountaire's revenue increased to $3.8 billion in 2024, a substantial rise from the $3 billion reported in 2023. This growth reflects the company's strong market position and effective operational strategies. The company's focus on strategic investments and market expansion is key to its financial success.

Mountaire is investing in new feed mill infrastructure and acquiring grain elevators to support future growth. These investments are part of the company's long-term strategic plan. The company's commitment to innovation and expansion is expected to drive further financial gains.

Mountaire utilizes digital platforms like the Prime Quality Farmer Portal and App to improve operations. These digital tools enhance efficiency and strengthen relationships with agricultural partners. Digital transformation is a key component of Mountaire's strategy.

Mountaire maintains a leading position in the poultry industry through operational excellence and strategic market expansion. The company's ability to adapt to changing consumer demands and market challenges is crucial. The company's competitive advantages include its strong supply chain management.

Mountaire's focus on operational efficiency helps it maintain a strong market position. The company's streamlined processes and effective supply chain management contribute to its financial success. Continuous improvement is key to the company's strategy.

The company's strategic partnerships are expected to contribute to its long-term financial health. These partnerships help optimize operations and strengthen relationships with agricultural partners. Collaboration is a key element of Mountaire's business model.

Mountaire's market expansion initiatives are expected to drive future growth. The company's investments in new facilities and acquisitions support its expansion plans. The company's long-term goals include increasing its market share.

Mountaire's competitive advantages include its strong market position and operational efficiency. The company's ability to adapt to changing consumer demands is also a key factor. These advantages support its long-term financial health.

The company's financial performance is marked by consistent revenue growth and strategic investments. The company's focus on sustainable farming practices and innovation in poultry processing are also important. Mountaire's commitment to these areas supports its financial outlook.

Mountaire's future prospects are positive, supported by its strong financial performance and strategic initiatives. The company's ongoing investments and market expansion plans are expected to drive future growth. The company's long-term goals and response to changing consumer demand indicate a promising outlook.

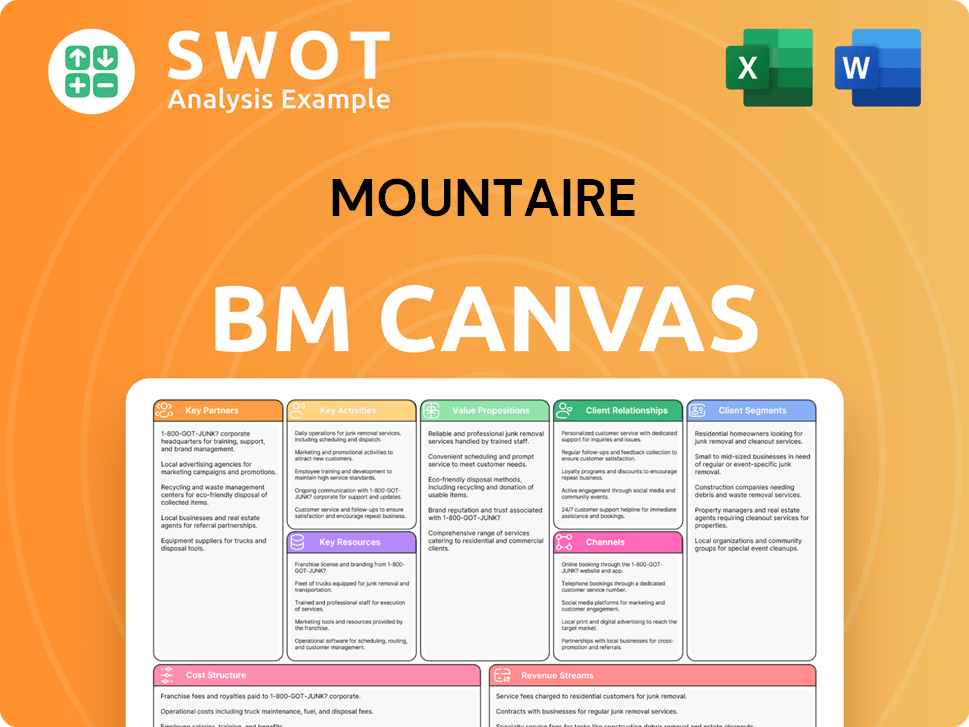

Mountaire Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Mountaire’s Growth?

The path to growth for Mountaire Farms is not without its challenges. The company faces several risks that could hinder its expansion and profitability. Understanding these obstacles is crucial for assessing the company's future prospects and making informed decisions.

Mountaire must navigate a competitive landscape and address regulatory and operational hurdles. These challenges, ranging from legal settlements to supply chain disruptions, require proactive strategies to maintain market share and achieve long-term goals. The company's ability to mitigate these risks will significantly influence its success.

The poultry industry, including Mountaire, is highly competitive. Major players like Tyson Foods and Pilgrim's Pride constantly vie for market share, putting pressure on pricing and profitability. This intense competition necessitates continuous innovation and efficiency improvements to stay ahead. For a deeper understanding of the competitive environment, consider reading about the Competitors Landscape of Mountaire.

Regulatory changes pose a significant threat. In April 2024, Mountaire, along with another company, agreed to pay a combined $22 million to settle claims of allegedly conspiring to depress worker wages between 2009 and 2019. Mountaire's share of this settlement was $13.5 million. These legal challenges highlight ongoing scrutiny and potential financial liabilities related to labor practices.

Supply chain disruptions can significantly impact operations. Disease outbreaks, such as Avian Flu, and inflation affecting grocery store prices are major concerns. These issues can lead to increased costs, reduced production, and decreased profitability. Addressing these vulnerabilities is a key priority for the company.

International trade restrictions can limit market access. In April 2025, China suspended imports of poultry meat from certain U.S. companies, including Mountaire Farms of Delaware, Inc., due to Salmonella detection. Such actions can significantly impact international sales and revenue, requiring the company to diversify its markets and mitigate trade-related risks.

Operational incidents, such as the fire in 2024 at a North Carolina poultry facility, can lead to significant losses. Approximately 21,000 chickens died in the fire, resulting in production disruptions and financial losses. Effective risk management and robust safety protocols are essential to prevent and minimize the impact of such incidents.

Mountaire employs workforce development programs to build a skilled labor force. Community engagement, including charitable donations, helps build goodwill. These strategies can help it navigate challenges and maintain a positive reputation.

The company faces competition from large players, regulatory changes, and supply chain vulnerabilities. These factors could influence the company's financial performance and market share. Managing these challenges is crucial for long-term success.

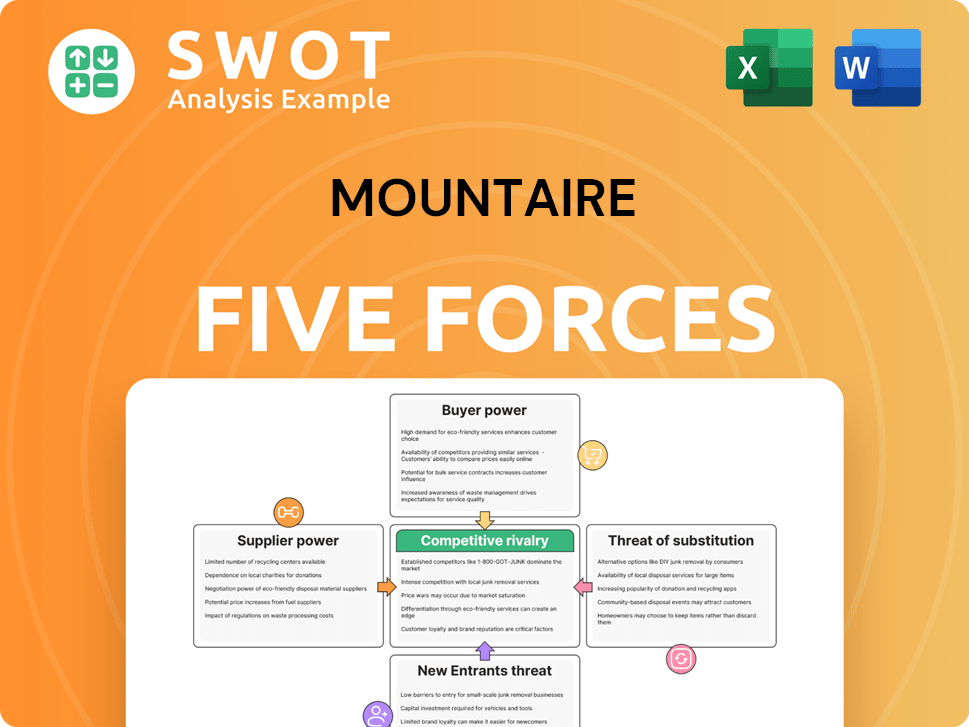

Mountaire Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mountaire Company?

- What is Competitive Landscape of Mountaire Company?

- How Does Mountaire Company Work?

- What is Sales and Marketing Strategy of Mountaire Company?

- What is Brief History of Mountaire Company?

- Who Owns Mountaire Company?

- What is Customer Demographics and Target Market of Mountaire Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.