Pidilite Industries Bundle

Can Pidilite Industries Maintain Its Dominance?

From a single product, Fevicol, to a multi-billion dollar enterprise, Pidilite Industries has revolutionized the adhesives and sealants market. This Pidilite Industries SWOT Analysis explores the company's remarkable journey and its current market position. But what does the future hold for this industry leader, and how will it navigate the evolving landscape?

This analysis delves into the core of Pidilite's Growth Strategy and examines its Pidilite Future prospects, providing a comprehensive Business Analysis of its strategic initiatives. We'll dissect its expansion plans, innovation strategies, and financial performance to understand how Pidilite Company aims to sustain its competitive edge. Stay tuned to uncover key Market Trends and investment opportunities within the specialty chemicals sector.

How Is Pidilite Industries Expanding Its Reach?

Pidilite Industries is actively pursuing several expansion initiatives to drive future growth, focusing on both geographical reach and product portfolio diversification. The company aims to strengthen its presence in rural markets by increasing retail points and focusing on overall consumer engagement. This strategy is crucial for capturing a larger share of the market, especially in regions where construction and consumer spending are on the rise.

In terms of product expansion, Pidilite Company plans to introduce new products in categories such as waterproofing, tile adhesives, and other construction chemicals to broaden its offerings. This diversification helps the company cater to a wider range of consumer needs and reduces its reliance on any single product category. The company's focus on innovation and new product development is a key element of its Growth Strategy.

Pidilite Future growth also hinges on international expansion. While some international subsidiaries faced modest sales growth in Q4 FY25 due to global economic challenges, inflation, and political instability, Pidilite remains optimistic about medium-term demand. This optimism is supported by a good monsoon and increased construction activities in India. The company is also making a conscious effort to diversify its revenue streams by increasing exports, with approximately 20-25% of its products currently sold internationally.

Pidilite Industries is expanding its presence in rural markets by increasing retail points and focusing on consumer engagement. This strategy aims to capture a larger market share in regions with growing construction and consumer spending. The focus is on enhancing distribution networks to reach a wider customer base.

The company plans to introduce new products in waterproofing, tile adhesives, and other construction chemicals. This diversification strategy aims to cater to a wider range of consumer needs. Innovation and new product development are key elements of Pidilite's growth strategy.

Pidilite is focusing on international expansion despite global economic challenges. The company is optimistic about medium-term demand, supported by increased construction activities in India. Exports account for approximately 20-25% of its product sales, indicating a strong global presence.

Pidilite explores strategic acquisitions to strengthen its position, such as the 2020 acquisition of Araldite. The company launched its paint brand, Haisha, in 2023, planning to expand in rural and semi-urban areas. Ventures into the coatings market with products for paper-based applications are also underway.

Pidilite Industries has a history of strategic acquisitions, such as the acquisition of Araldite in 2020 to strengthen its epoxy adhesives portfolio. The company is also exploring potential stakes in other companies to solidify its market position. These moves are part of a broader strategy to expand its product offerings and market reach.

- Acquisition of Araldite: Enhances the epoxy adhesives portfolio.

- Potential stake in AkzoNobel India: Further solidifies position in the paints market.

- Launch of Haisha paint brand: Expansion planned in rural and semi-urban areas.

- Venturing into coatings market: Products for paper-based applications.

Furthermore, Pidilite is exploring strategic acquisitions to strengthen its position in the specialty chemicals market. For instance, in 2020, it acquired Araldite from Huntsman Corporation to enhance its epoxy adhesives portfolio. The company may also be considering a stake in AkzoNobel India, which would further solidify its position in the paints market. In 2023, Pidilite launched its paint brand Haisha, which it plans to expand in rural and semi-urban areas across various Indian states. Pidilite is also venturing into the coatings market with a range of products for paper-based applications, including water repellence, oil and grease resistance, and cold seal coatings. To understand the company's core values and mission, you can read more about it here: Mission, Vision & Core Values of Pidilite Industries.

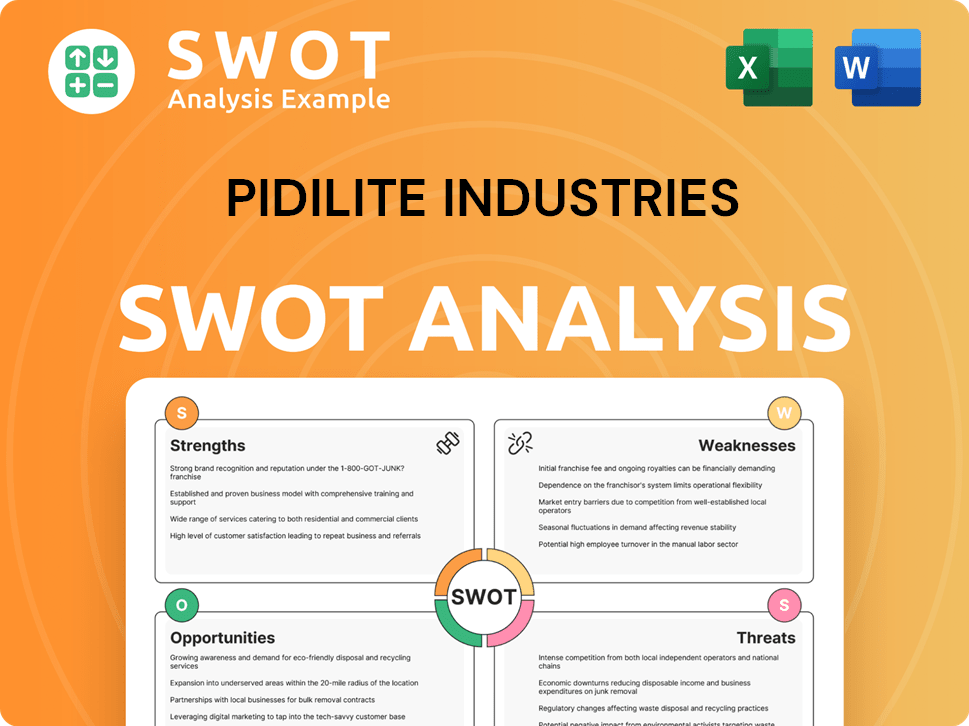

Pidilite Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Pidilite Industries Invest in Innovation?

Pidilite Industries recognizes that innovation and technology are crucial for its Growth Strategy and future success. The company's commitment to research and development (R&D) is substantial, enabling it to create new products and improve existing ones. This focus helps Pidilite Company stay competitive in the market and meet evolving consumer demands.

By investing heavily in R&D, Pidilite Industries aims to develop cutting-edge solutions and maintain its market leadership. This approach supports the company's ability to introduce innovative products, which is essential for driving Pidilite Future growth. The company's strategic use of technology and focus on consumer needs are key elements of its long-term strategy.

The company's strategy includes a strong emphasis on understanding and responding to customer needs. This involves gathering insights from professionals like carpenters and plumbers to ensure new products effectively address market requirements. This consumer-centric approach is vital for Pidilite Industries to maintain relevance and drive growth in a dynamic market.

In FY 2022-2023, Pidilite Industries invested approximately ₹140 crores (about $17 million) in R&D. This investment focused on advanced materials and eco-friendly products.

Pidilite has developed around 6,500 products across its portfolio. This extensive product range supports its market presence and caters to diverse customer needs.

The company utilizes marketing technology (MarTech) for faster creative iterations and real-time insights. This helps in lead generation and improves overall marketing effectiveness.

Pidilite gathers input from professionals like carpenters and plumbers to align new products with market needs. This ensures that its innovations meet the specific demands of its target customers.

Pidilite is developing products for sustainable applications, such as coatings for paper cups. It has also set up a 1.8MW off-site solar farm in Upleta, Gujarat, as part of its environmental initiatives.

Pidilite explores technological partnerships to enhance its product offerings in advanced packaging and conversion. These collaborations support sustainable growth and innovation.

Pidilite Industries focuses on leveraging technology and innovation to drive growth. This includes significant investments in R&D, consumer-centric innovation, and digital transformation.

- R&D Investments: Continuous investment in research and development to create new products and improve existing ones, with a focus on advanced materials and eco-friendly solutions.

- Digital Transformation: Utilizing marketing technology (MarTech) for faster creative iterations, real-time insights, and lead generation to enhance marketing effectiveness.

- Consumer-Centric Innovation: Gathering input from professionals like carpenters and plumbers to ensure that new products meet market needs and address specific customer requirements.

- Sustainable Initiatives: Developing products for sustainable applications, such as coatings for paper cups, and implementing environmental initiatives like solar farms.

- Strategic Partnerships: Exploring technological partnerships to enhance product offerings in advanced packaging and conversion for sustainable growth.

For a deeper understanding of Pidilite Industries' business model and revenue streams, you can read Revenue Streams & Business Model of Pidilite Industries.

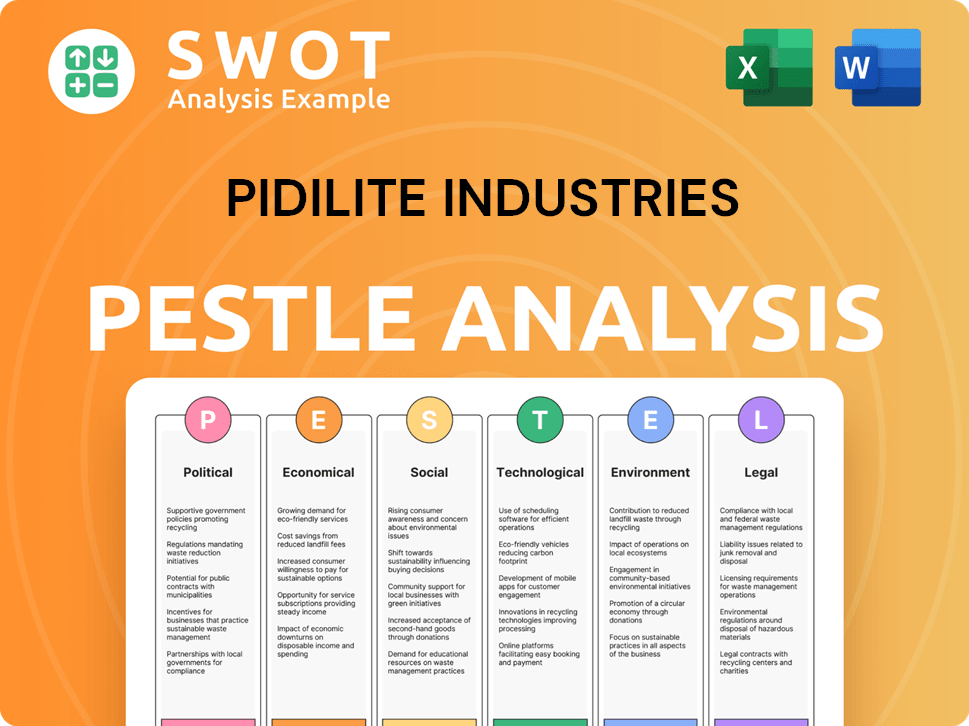

Pidilite Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Pidilite Industries’s Growth Forecast?

The financial outlook for Pidilite Industries appears robust, supported by strong performance and positive growth projections. For the fiscal year ending March 31, 2025 (FY25), the company reported a consolidated revenue of ₹13,094 crore, reflecting a 6.1% increase compared to the previous year. This growth underscores the effectiveness of its growth strategy and its ability to capitalize on market trends.

Pidilite Company demonstrated significant profitability, with a net profit of ₹2,096 crore for FY25, marking a 20% rise from the previous year. This financial performance reflects the company's strong market position and efficient operational strategies. The fourth quarter of FY25 also showed promising results, with consolidated net sales growing by 10% to ₹3,130 crore.

The company's focus on both volume growth and margin improvement is evident in its financial results. The Consumer & Bazaar (C&B) segment and the Business to Business (B2B) segment showed strong underlying volume growth (UVG). With double-digit sales growth reported by domestic subsidiaries in Q4 FY25, the company is well-positioned for continued expansion and success. Further details on Pidilite Future and its strategic direction can be found in this 0.

Consolidated revenue for FY25 reached ₹13,094 crore, a 6.1% increase year-over-year. This growth is driven by strong performance across various segments and geographical markets. Pidilite Industries continues to expand its market share through strategic initiatives and product innovation.

Net profit for FY25 increased by 20% to ₹2,096 crore, showcasing the company's strong financial health. The fourth quarter of FY25 saw a 21% growth in Profit Before Tax and Exceptional Items (PBT) to ₹601 crore. This improvement highlights efficient cost management and strategic pricing.

The Consumer & Bazaar (C&B) segment experienced an 8.0% underlying volume growth (UVG). The Business to Business (B2B) segment showed a strong UVG of 16.4%. These figures demonstrate the diversified nature of Pidilite's business and its ability to cater to different market segments.

EBITDA before non-operating income for Q4 FY25 grew by 10% to ₹633 crore. EBITDA margins for FY25 were at 23.6%, up from 22.9% in the previous year. This improvement reflects better operational efficiency and favorable input costs.

Analysts anticipate over 13% EBITDA and 16% net profit growth for Pidilite Industries between financial years 2024 and 2027. This growth is expected to be driven by volume increases in construction, furnishings, and new product launches. The company's focus on premiumization and strategic partnerships will also contribute to its future success.

- Double-digit underlying volume growth is a key target for management.

- The company aims for overall growth rather than solely margin expansion.

- A dividend of ₹20 per share has been recommended for FY25.

- Strategic initiatives include new product launches and market expansion.

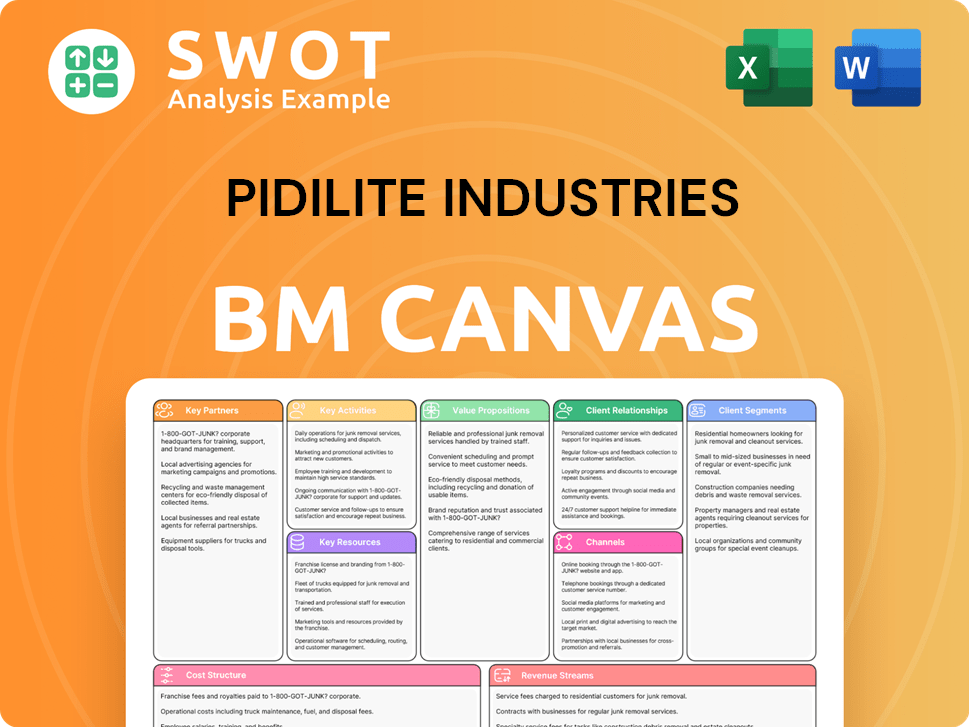

Pidilite Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Pidilite Industries’s Growth?

The growth trajectory of Pidilite Industries, while promising, is not without its challenges. Several potential risks and obstacles could impact its future performance. Understanding these challenges is crucial for a comprehensive Business Analysis of the company and its Growth Strategy.

Pidilite Industries faces a complex market environment. Competition from both domestic and international players, coupled with evolving regulatory landscapes, creates a need for constant adaptation. The company's strategic decisions, such as potential acquisitions, also introduce financial and operational risks.

Furthermore, external factors like supply chain vulnerabilities and shifting consumer preferences add layers of complexity. These elements can influence Pidilite Future prospects and its ability to maintain its market position.

The adhesives, sealants, and construction chemicals markets are highly competitive. Key competitors include global players like 3M, Henkel, and Sika. Local competitors also pose a significant challenge to Pidilite Company.

Acquiring AkzoNobel's paint division, for instance, could introduce financial and integration risks. Successful integration is critical for realizing expected synergies and avoiding operational disruptions. This impacts Pidilite Industries growth strategy analysis.

Changes related to environmental sustainability and product safety necessitate continuous investment. Compliance with evolving regulations requires ongoing adaptation of manufacturing processes and product formulations, affecting Pidilite Industries financial performance.

Global economic uncertainties and geopolitical tensions can disrupt supply chains. These disruptions can impact international operations and export sales, potentially affecting Pidilite Industries market share. The company is focused on building a resilient supply chain.

A slowdown in urban demand, coupled with rural areas sometimes outpacing urban growth, poses a challenge. This shift is influenced by inflationary pressures on household budgets. It is crucial to understand the Market Trends.

Reliance on key products like Fevicol and Dr. Fixit makes the company vulnerable. Counterfeit products also pose a significant threat to brand reputation and market share. For more information, check out the Target Market of Pidilite Industries.

Higher staff costs and increased advertising and sales promotion (A&SP) expenses can pressure profitability. In Q4 FY25, A&SP spends were at 5.4% of net sales. Managing these costs is critical for maintaining profit margins. Pidilite Industries must balance these costs.

Counterfeit products significantly harm brand reputation and market share. Addressing this issue requires robust anti-counterfeiting measures. This is a crucial aspect of protecting Pidilite Industries product portfolio and revenue. The company must be vigilant.

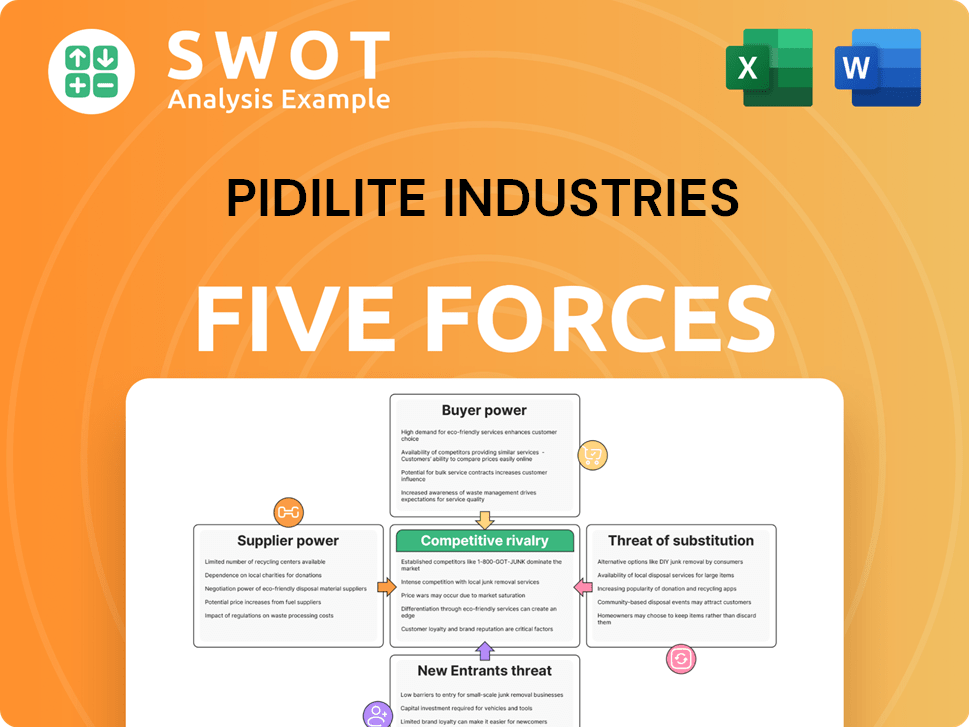

Pidilite Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pidilite Industries Company?

- What is Competitive Landscape of Pidilite Industries Company?

- How Does Pidilite Industries Company Work?

- What is Sales and Marketing Strategy of Pidilite Industries Company?

- What is Brief History of Pidilite Industries Company?

- Who Owns Pidilite Industries Company?

- What is Customer Demographics and Target Market of Pidilite Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.