Red Robin Gourmet Burgers Bundle

Can Red Robin Rebound?

Red Robin Gourmet Burgers, a staple in the casual dining scene, is at a critical juncture. From its humble beginnings as Sam's Tavern, the company has grown into a recognizable brand, but now faces a rapidly changing Red Robin Gourmet Burgers SWOT Analysis. This analysis will explore Red Robin's strategic moves to navigate the competitive restaurant industry and secure its future.

This in-depth company analysis will dissect Red Robin's growth strategy, examining its expansion plans, digital marketing strategy, and efforts to enhance the guest experience. Understanding the future prospects of Red Robin requires a close look at its financial performance, market share analysis, and ability to adapt to evolving consumer preferences. The success of Red Robin's turnaround plan will be crucial in determining its long-term viability in the gourmet burgers market.

How Is Red Robin Gourmet Burgers Expanding Its Reach?

Red Robin's growth strategy centers on strengthening its existing operations and leveraging strategic partnerships. The company is focused on optimizing its current footprint and enhancing its offerings rather than rapidly expanding its physical presence. This approach aims to improve financial performance and adapt to changing consumer preferences within the competitive restaurant industry.

As of December 29, 2024, the company's primary focus was on initiatives like the Donatos pizza partnership, which allows it to diversify its menu and attract a broader customer base. This strategy is designed to drive revenue growth without the significant capital expenditure associated with new restaurant openings. Furthermore, the company is actively managing its portfolio by evaluating and potentially closing underperforming locations.

The company's approach includes strategic asset management and operational efficiency improvements. The sale of properties and the closure of underperforming restaurants are part of a broader plan to strengthen its financial position and optimize resource allocation. These steps are crucial for ensuring the company's long-term sustainability and competitiveness within the market.

The partnership with Donatos pizza is a key growth initiative. As of December 29, 2024, Donatos pizzas were available in 269 Red Robin locations. This allows Red Robin to offer a new menu option and attract more customers.

Red Robin is actively optimizing its restaurant portfolio. The company plans to close 14 restaurants by the end of 2025. This strategy aims to improve profitability by focusing on the most successful locations.

Red Robin is strategically managing its assets to strengthen its financial position. In the first quarter of fiscal 2025, the company sold three owned properties, generating $5.8 million in gross proceeds. These funds were used to reduce debt.

Red Robin's franchise model includes locations in both the United States and Canada. As of December 29, 2024, there were 91 franchised restaurants. The company monitors franchisees' performance to ensure brand standards are met.

The future prospects for Red Robin depend on the successful execution of its current strategies. These include the continued rollout of the Donatos pizza partnership, optimizing the existing restaurant portfolio, and maintaining strong franchise relationships. These initiatives are crucial for long-term growth within the Owners & Shareholders of Red Robin Gourmet Burgers.

- Focus on operational efficiency and cost management.

- Leveraging digital marketing and loyalty programs to enhance customer engagement.

- Adapting to changing consumer preferences through menu innovation.

- Strengthening the financial position through strategic asset management.

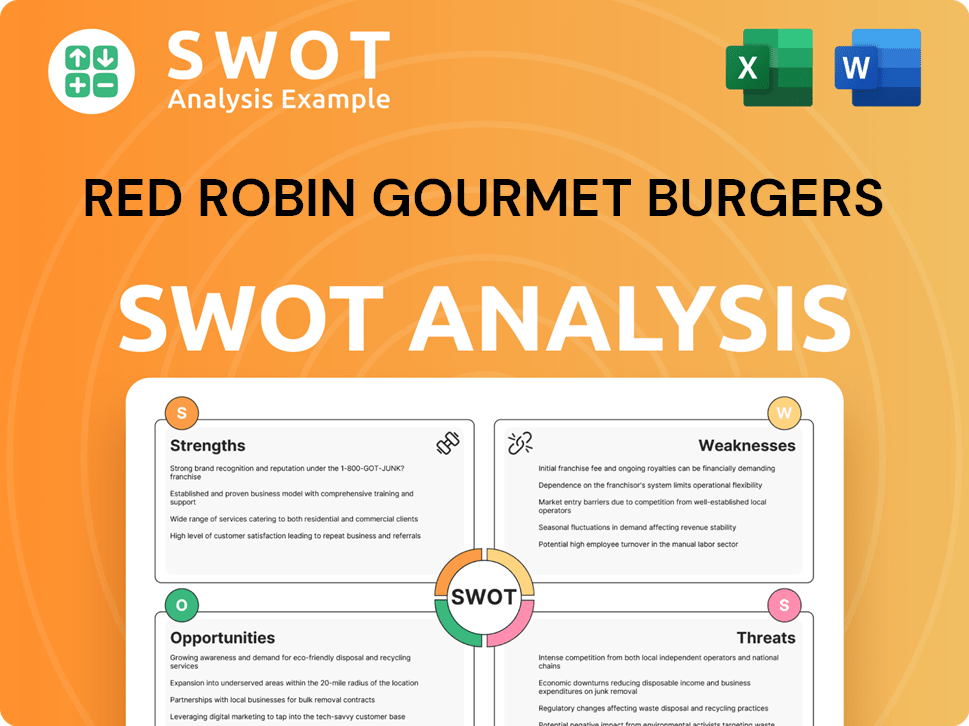

Red Robin Gourmet Burgers SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Red Robin Gourmet Burgers Invest in Innovation?

Red Robin's growth strategy heavily emphasizes innovation and technology to enhance both operational efficiency and the guest experience. The company is actively investing in digital transformation and data infrastructure to improve its capabilities, particularly in off-premise and online ordering services. This focus is crucial for adapting to evolving customer preferences and maintaining a competitive edge within the restaurant industry.

A key element of this strategy involves partnerships with third-party delivery services and the integration of these services into its point-of-sale (POS) and kitchen display systems (KDS). Furthermore, Red Robin is committed to enhancing its digital platform through website improvements and a new mobile app to streamline operations.

The company's commitment to technology and innovation is evident in its efforts to modernize its infrastructure, which are designed to improve the performance, stability, and security of its current technology solutions. These initiatives are designed to drive higher-order conversion and increase guest frequency.

Red Robin is focused on digital transformation to improve its off-premise and online ordering capabilities. This includes integrating third-party delivery services and enhancing its digital platform.

The revamped Red Robin Royalty program offers faster rewards and exclusive perks. By the end of the first quarter of fiscal 2025, the loyalty program had approximately 15.3 million members.

The company is working to streamline operations by integrating third-party delivery services into its POS and KDS systems. This should improve order accuracy and speed.

Infrastructure modernization efforts are underway to improve the performance, stability, and security of current technology solutions. This includes improving the speed and security of their website.

Enhancements to the digital platform, including website and mobile app improvements, aim to boost the guest experience. This also includes improving the loyalty program.

Future plans include collaborating with additional third-party delivery partners and improving its digital platform. This will allow the company to adapt to the changing demands of the Target Market of Red Robin Gourmet Burgers.

Red Robin's innovation and technology strategy focuses on improving operational execution, driving higher-order conversion, and increasing guest frequency. The company is using technology to improve its business.

- Digital Ordering: Investments in online ordering and delivery integration are designed to capture more off-premise sales.

- Loyalty Program: The Red Robin Royalty program aims to increase customer retention and encourage repeat visits. The loyalty program has approximately 15.3 million members.

- Operational Efficiency: Streamlining operations through technology helps reduce costs and improve service speed.

- Infrastructure: Modernizing technology infrastructure ensures stability and security.

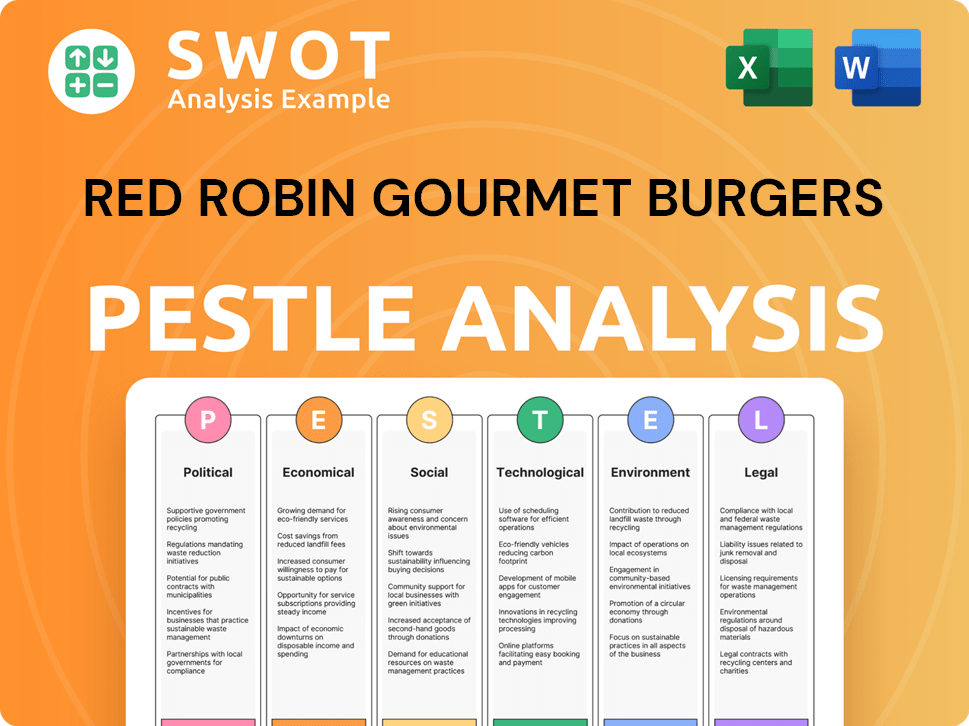

Red Robin Gourmet Burgers PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Red Robin Gourmet Burgers’s Growth Forecast?

The financial outlook for Red Robin Gourmet Burgers reflects a strategic focus on profitability and debt reduction. The company is navigating a challenging macroeconomic environment, as indicated by its updated financial guidance for fiscal year 2025. This guidance provides insights into the company's revenue expectations, profitability targets, and capital expenditure plans.

For fiscal year 2025, the company projects total revenue between $1.21 billion and $1.23 billion. This slight adjustment from prior guidance indicates a cautious approach to revenue growth. The restaurant industry is competitive, and factors such as inflation and changing consumer preferences can impact revenue. The company's focus on restaurant-level operating profit and Adjusted EBITDA suggests an emphasis on operational efficiency and cost management.

In the first quarter of fiscal 2025, Red Robin reported total revenues of $392.4 million. Comparable restaurant revenue increased by 3.1%, driven by a 6.8% increase in net menu prices. This shows the company's ability to manage pricing strategies despite a decline in guest traffic of 3.5%. The company's financial performance in the first quarter of 2025, including a net income of $1.2 million and an Adjusted EBITDA of $27.9 million, reflects its efforts to improve profitability.

The company forecasts total revenue between $1.21 billion and $1.23 billion for fiscal year 2025. This projection reflects the company's expectations for revenue generation in the coming year, considering market conditions and operational strategies. The slight adjustment from prior guidance indicates a cautious approach to revenue growth in the face of economic uncertainties.

Restaurant-level operating profit is expected to be between 12.0% and 13.0% for fiscal 2025. This metric is a key indicator of the company's operational efficiency and its ability to manage costs at the restaurant level. The projected range suggests a focus on improving profitability through efficient operations and cost management.

Adjusted EBITDA is forecasted in the range of $60 million to $65 million for fiscal 2025. This figure represents the company's earnings before interest, taxes, depreciation, and amortization, adjusted for certain non-cash or unusual items. The forecast provides insight into the company's overall profitability and financial health.

Capital expenditures for fiscal 2025 are anticipated to be approximately $30 million. This amount reflects the company's planned investments in property, plant, and equipment, such as new restaurant openings, renovations, and technology upgrades. These investments are crucial for supporting long-term growth and operational efficiency.

Red Robin's financial strategy also includes debt reduction. As of April 20, 2025, the company had outstanding borrowings under its credit facility of $171.7 million, a reduction of $17.8 million from year-end fiscal 2024. The company's liquidity was approximately $59.2 million, including cash and cash equivalents and available borrowing capacity. The company anticipates a headwind of approximately 240 basis points in comparable restaurant revenue results in the second quarter of fiscal 2025 due to a non-recurring benefit from its loyalty program in 2024, potentially leading to a 3% decline in comparable restaurant sales for the quarter. Despite this, the company expects Adjusted EBITDA for Q2 2025 to be in the range of $13 million to $16 million. For further insights into the company's marketing strategies, consider reading about the Marketing Strategy of Red Robin Gourmet Burgers.

Total revenues for Q1 2025 were $392.4 million, an increase of $3.8 million compared to Q1 2024. Comparable restaurant revenue increased by 3.1%. This growth was driven by a 6.8% increase in net menu prices.

Net income for Q1 2025 was $1.2 million, a significant improvement from a net loss of $9.5 million in Q1 2024. Adjusted EBITDA for Q1 2025 surged to $27.9 million, an increase of $14.5 million from Q1 2024. This indicates a strong recovery in profitability.

As of April 20, 2025, outstanding borrowings were $171.7 million, a decrease of $17.8 million from year-end fiscal 2024. Liquidity was approximately $59.2 million. This demonstrates the company's focus on reducing debt and maintaining financial flexibility.

The company anticipates a headwind of approximately 240 basis points in comparable restaurant revenue in Q2 2025. Adjusted EBITDA for Q2 2025 is expected to be in the range of $13 million to $16 million. This outlook reflects the company's expectations for the second quarter.

The 6.8% increase in net menu prices in Q1 2025 contributed to the comparable restaurant revenue growth. This highlights the importance of pricing strategies in the restaurant industry. The company is managing menu prices effectively.

Guest traffic declined by 3.5% in Q1 2025. This decrease in guest traffic underscores the challenges in the restaurant industry. The company is addressing this through various strategies.

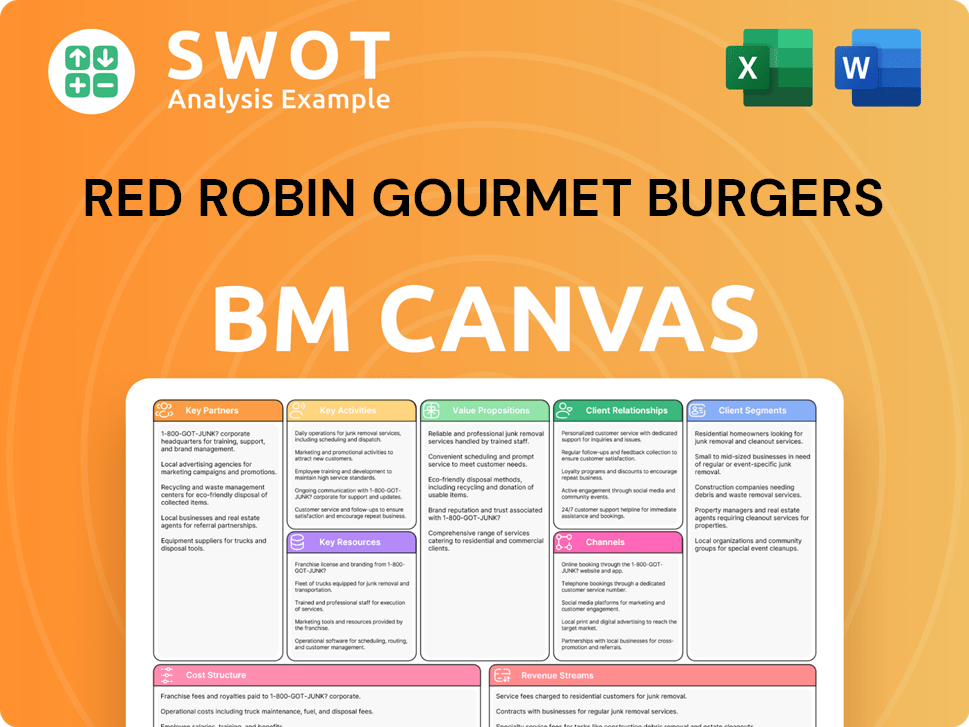

Red Robin Gourmet Burgers Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Red Robin Gourmet Burgers’s Growth?

The casual dining sector presents considerable challenges to Red Robin. The company must navigate intense competition and evolving consumer preferences to achieve its growth strategy. Several factors, including economic pressures and operational hurdles, could affect Red Robin's financial performance and future prospects.

Red Robin Gourmet Burgers faces several strategic and operational risks that could impede its growth ambitions in the highly competitive casual dining market. A primary challenge is heightened competition and shifting consumer preferences, which necessitate continuous adaptation. The company has experienced a decline in guest traffic, with a 3.5% decrease in Q1 2025 despite a 6.8% increase in menu prices. This indicates that while pricing strategies may offset rising costs, attracting and retaining customers remains a significant hurdle.

Commodity cost inflation, projected around 3%, could further pressure profit margins. Additionally, the company anticipates absorbing cost headwinds from current tariff policies without implementing further menu price increases in 2025. Supply chain vulnerabilities and labor market competitiveness also pose ongoing risks, impacting the company's ability to manage costs and maintain operational efficiency. Red Robin is actively working to optimize labor costs, acknowledging this as a key focus area for 2025.

The Restaurant Industry is highly competitive. Red Robin competes with a variety of restaurant concepts, from fast-casual to full-service dining, which impacts its ability to attract customers. Consumer preferences are constantly evolving, requiring Red Robin to innovate its menu and dining experience continually.

Economic downturns can reduce consumer spending on dining out, impacting Red Robin's sales. Inflation and rising commodity costs, particularly for ingredients like beef and produce, can squeeze profit margins. Changes in tariff policies could also affect the cost of goods and, consequently, profitability.

Managing labor costs and ensuring adequate staffing levels are ongoing challenges. Supply chain disruptions can lead to higher costs and potential shortages of key ingredients. Maintaining consistent food quality and service standards across all locations is crucial for customer satisfaction and brand reputation.

Changes in consumer behavior, such as a shift towards healthier eating options or increased demand for convenience, require adaptation. The company must stay current with digital trends, including online ordering and delivery services. Negative Red Robin customer reviews or social media sentiment can quickly damage the brand's image.

High debt levels can increase financial risk, especially during economic downturns. Underperforming restaurants can strain financial resources and impact overall profitability. The Red Robin stock price forecast can be affected by these risks, influencing investor confidence.

Changes in the Red Robin market share analysis and the entry of new competitors can impact the company's ability to grow. The success of Red Robin expansion plans, including new restaurant openings and franchising opportunities, depends on favorable market conditions. Red Robin must adapt to evolving competitive landscape.

Red Robin is implementing several strategies to mitigate these risks. The 'North Star' plan focuses on operational efficiencies, and the company has made investments and upgrades in food quality and hospitality to enhance the guest experience. The revamped loyalty program, with approximately 15.3 million members, is designed to increase guest frequency and engagement. Furthermore, the company is actively managing its restaurant portfolio, with plans to close 14 underperforming restaurants by the end of 2025. The sale of three owned properties in Q1 2025, generating $5.8 million, was part of a broader strategy to strengthen the financial position and reduce debt. For a deeper understanding of the financial performance, consider exploring a comprehensive company analysis.

Red Robin is focusing on improving guest traffic and navigating market dynamics. This includes optimizing labor costs, enhancing the guest experience through food quality and hospitality upgrades, and leveraging its loyalty program to increase customer engagement. The company is also actively managing its restaurant portfolio, closing underperforming locations and strengthening its financial position. The success of these initiatives is critical for achieving sustainable growth.

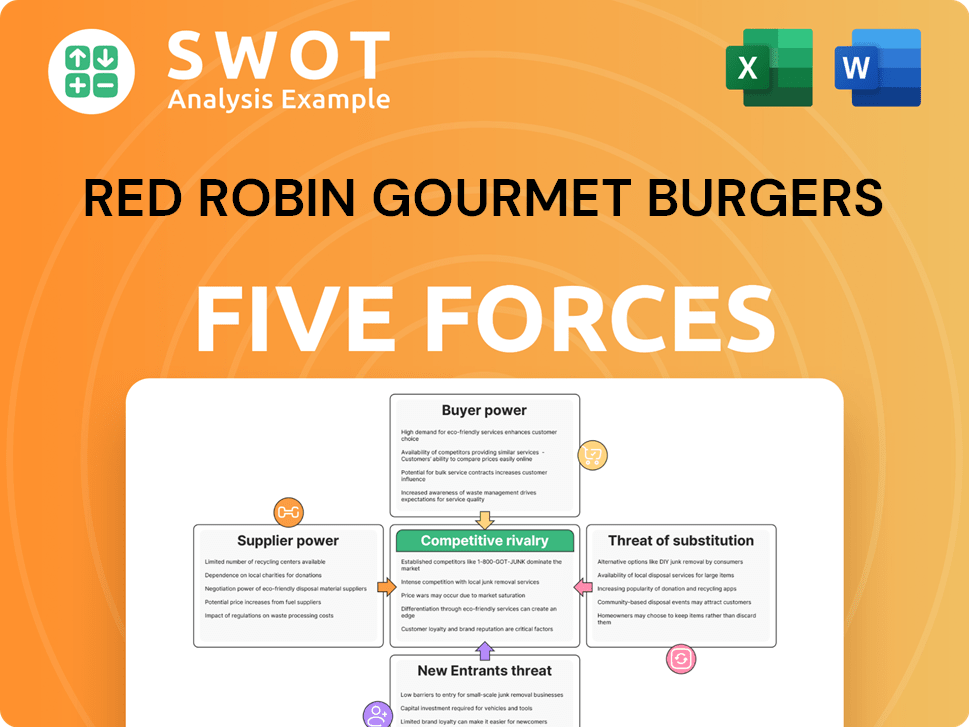

Red Robin Gourmet Burgers Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Red Robin Gourmet Burgers Company?

- What is Competitive Landscape of Red Robin Gourmet Burgers Company?

- How Does Red Robin Gourmet Burgers Company Work?

- What is Sales and Marketing Strategy of Red Robin Gourmet Burgers Company?

- What is Brief History of Red Robin Gourmet Burgers Company?

- Who Owns Red Robin Gourmet Burgers Company?

- What is Customer Demographics and Target Market of Red Robin Gourmet Burgers Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.