Ruby Tuesday Bundle

Can Ruby Tuesday Reclaim Its Former Glory?

In the ever-evolving landscape of the casual dining market, Ruby Tuesday's journey is a compelling case study of adaptation and strategic maneuvering. Founded in 1972, the company has faced numerous challenges and opportunities in the competitive restaurant industry. Understanding the Ruby Tuesday SWOT Analysis is crucial to grasping its current position and future trajectory.

This analysis will explore Ruby Tuesday's growth strategy, examining its expansion plans for 2024, menu innovation strategies, and digital marketing initiatives. We'll delve into the Ruby Tuesday company's financial performance review and market share analysis, providing insights into its ability to navigate the casual dining market. Furthermore, we'll assess the Ruby Tuesday future prospects, considering its turnaround strategy and potential investment opportunities in light of changing consumer preferences and competitive pressures.

How Is Ruby Tuesday Expanding Its Reach?

The Revenue Streams & Business Model of Ruby Tuesday company's expansion initiatives are centered on optimizing its current operational footprint and exploring new ways to engage customers. This strategy is a response to the evolving casual dining market and aims to enhance the company's financial performance. The focus is on strategic adjustments rather than rapid expansion, reflecting a careful approach to growth within the competitive restaurant industry.

A key aspect of the company's strategy involves evaluating its existing locations, which includes closing underperforming restaurants. Simultaneously, there's a focus on improving the profitability of its core restaurants. This approach is part of a broader turnaround strategy aimed at strengthening the brand and improving its market position. The company is adapting to changing consumer preferences by focusing on operational efficiency and customer experience.

The company is exploring non-traditional formats to leverage its brand recognition. This includes smaller-format restaurants and partnerships in travel hubs. These initiatives are part of the company's efforts to adapt to evolving consumer behaviors and market dynamics. The company's digital platforms and third-party delivery services are also key components of its expansion strategy.

The company is actively managing its restaurant portfolio by closing underperforming locations. This strategic move is designed to improve overall profitability and efficiency. By focusing on the most successful locations, the company aims to strengthen its financial performance. This is a key part of the Ruby Tuesday turnaround strategy.

Ruby Tuesday is exploring smaller-format restaurants and partnerships in travel hubs. These initiatives aim to increase brand visibility and reach new customer segments. The company is looking for innovative ways to adapt to changing consumer habits. These efforts are part of the Ruby Tuesday growth strategy.

Enhancing online ordering and delivery services is a priority for Ruby Tuesday. This includes improving digital platforms and partnering with third-party delivery services. The goal is to expand its reach and diversify revenue streams. This is a key element of the Ruby Tuesday digital marketing initiatives.

While large-scale international expansion is not the current focus, the company remains open to opportunistic partnerships. These partnerships must align with the brand values and growth objectives. Ruby Tuesday is carefully considering its options for future growth. This approach reflects a cautious but strategic outlook.

The company's expansion strategy involves optimizing its current footprint and exploring new customer engagement avenues. This includes closing underperforming restaurants and focusing on profitable locations. The emphasis is on enhancing the customer experience and operational efficiency.

- Portfolio Optimization: Closing underperforming locations to improve overall profitability.

- Non-Traditional Formats: Exploring smaller restaurants and partnerships.

- Digital Initiatives: Enhancing online ordering and delivery services.

- Strategic Partnerships: Considering opportunistic partnerships that align with brand values.

Ruby Tuesday SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ruby Tuesday Invest in Innovation?

The innovation and technology strategy of the company is focused on improving operational efficiency, enhancing customer experience, and optimizing menu offerings. The company is likely investing in digital transformation to streamline back-of-house operations. A key area of focus is the continued development and refinement of its online ordering platform and mobile application, aiming to provide a seamless and user-friendly experience for takeout and delivery customers.

The company is expected to utilize data-driven insights to optimize staffing, manage food waste, and refine menu development. Sustainability initiatives, such as responsible sourcing and waste reduction, are also likely to be integrated into operational improvements. This approach aligns with growing consumer demand for environmentally conscious businesses, which is a critical factor in the restaurant industry analysis.

The company's digital marketing initiatives are also crucial. By leveraging data analytics, the company aims to personalize offers and better understand customer preferences, thereby driving repeat business. This customer-centric approach is vital for maintaining a competitive edge in the casual dining market and ensuring a positive Ruby Tuesday performance.

The company is investing in digital transformation to streamline operations. This includes inventory management and supply chain logistics. The focus is on enhancing efficiency and reducing costs.

The company is refining its online ordering platform and mobile app. The goal is to provide a seamless and user-friendly experience for takeout and delivery. This is crucial for adapting to changing consumer preferences.

Data analytics is used to personalize offers and understand customer preferences. This helps drive repeat business and improve customer loyalty programs. It is a key component of the company's digital marketing initiatives.

Data-driven insights are used to optimize staffing and manage food waste. This supports menu development and enhances overall efficiency. It is part of the company's turnaround strategy.

The company integrates sustainability initiatives like responsible sourcing. Waste reduction is also a focus, aligning with consumer demand. This is a key element of the company's Marketing Strategy of Ruby Tuesday.

The company is focused on menu innovation strategies to attract customers. This includes refining menu development based on data insights. This approach supports the company's growth.

The company is leveraging technology to improve operations and customer experience. While specific figures for R&D are not readily available, the focus is on digital solutions and data-driven decision-making.

- Digital Ordering: Enhancing online and mobile ordering platforms.

- Data Analytics: Using data to personalize offers and understand customer behavior.

- Operational Efficiency: Optimizing staffing, managing food waste, and refining menu development.

- Sustainability: Implementing responsible sourcing and waste reduction practices.

Ruby Tuesday PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ruby Tuesday’s Growth Forecast?

Analyzing the financial outlook for the Ruby Tuesday company requires understanding the broader trends within the casual dining market. The restaurant industry analysis indicates a focus on operational efficiency and revenue enhancement. Given its private status, specific financial projections for 2024-2025 are not publicly available. However, the company's strategies likely revolve around optimizing performance within a competitive landscape.

The casual dining market is facing various pressures, including rising labor costs and shifts in consumer dining habits. To navigate these challenges, Ruby Tuesday's future prospects depend on its ability to adapt and differentiate itself. This includes enhancing the customer experience, streamlining operations, and implementing targeted marketing campaigns. The company's ability to innovate and respond to market dynamics will be critical for its long-term success.

Investment is expected to be directed towards technology upgrades, restaurant renovations, and marketing initiatives. The company's strategic focus is on ensuring long-term stability and profitability. For a deeper dive into the company's history, consider reading the Brief History of Ruby Tuesday.

Focus on controlling expenses, particularly labor and food costs, to maintain or improve profit margins. This is a key element of the Ruby Tuesday growth strategy. The restaurant industry analysis shows that effective cost management is crucial for survival.

Strategies to increase sales, such as menu innovation, promotional offers, and enhanced customer experience. Ruby Tuesday's efforts to improve same-store sales are a key part of its Ruby Tuesday future prospects. The casual dining market is competitive.

Investing in technology to improve order accuracy, streamline operations, and enhance the customer experience. Digital marketing initiatives are also crucial. This is a key aspect of Ruby Tuesday's adaptation to changing consumer preferences.

Implementing targeted marketing campaigns and strengthening brand recognition to attract and retain customers. Customer loyalty programs can also play a significant role. This is a crucial aspect of Ruby Tuesday's turnaround strategy.

Introducing new menu items and seasonal offerings to keep the menu fresh and appealing. This is a core part of Ruby Tuesday menu innovation strategies. The goal is to attract new customers and retain existing ones.

Improving the efficiency of restaurant operations to reduce costs and improve service times. This includes streamlining processes and optimizing staffing. Efficient operations are essential for Ruby Tuesday performance.

Enhancing the overall customer experience through improved service, ambiance, and food quality. This is a central element of the Ruby Tuesday growth strategy. Positive customer experiences drive loyalty.

Regularly assessing the competitive landscape and adjusting strategies to maintain a competitive edge. This includes monitoring rivals and identifying opportunities. Ruby Tuesday competitive analysis against rivals is essential.

Maintaining a strong focus on financial discipline, including careful management of cash flow and debt. This supports long-term stability. This is key for Ruby Tuesday investment opportunities.

Adapting to changing consumer preferences and market trends, such as the increasing demand for convenience and healthier options. How is Ruby Tuesday adapting to changing consumer preferences is a key question. This is crucial for the Ruby Tuesday company.

Ruby Tuesday Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ruby Tuesday’s Growth?

The path forward for the company is fraught with potential pitfalls. Several external and internal factors could hinder the company's ability to achieve its growth targets. Understanding these risks is crucial for assessing the company's long-term viability and investment potential.

The casual dining sector is highly competitive, and the company faces challenges from both established players and emerging fast-casual concepts. Moreover, changes in consumer preferences and economic conditions can significantly impact the company's performance. Addressing these challenges requires strategic agility and proactive risk management.

The company's financial health and operational efficiency are also subject to various risks. Fluctuations in commodity prices, labor costs, and supply chain disruptions can squeeze profit margins. Internal operational challenges, such as maintaining consistent service quality across all locations, also pose significant hurdles.

The casual dining market is intensely competitive, with numerous established chains and innovative fast-casual restaurants vying for market share. This competition can lead to price wars, reduced profit margins, and the need for constant innovation. The need for the company to differentiate itself is crucial.

Consumer tastes are constantly evolving, with a growing demand for healthier options, diverse cuisines, and convenient dining experiences. The company must adapt its menu, service models, and marketing strategies to align with these shifts. Failing to do so can result in declining customer traffic and sales.

Economic downturns, inflation, and changes in consumer spending habits can significantly impact the company's financial performance. During economic uncertainty, consumers may reduce their discretionary spending, leading to lower restaurant visits and reduced average check sizes. The company must be prepared to navigate economic volatility.

Rising labor costs, including minimum wage increases and employee benefits, can put pressure on the company's profit margins. Changes in labor laws and regulations, such as those related to scheduling and overtime, can also increase operational expenses. The company must manage labor costs effectively.

Fluctuations in food prices, supply chain disruptions, and challenges in sourcing quality ingredients can impact the company's profitability. Events such as natural disasters, geopolitical instability, or transportation issues can disrupt the supply chain. The company needs to maintain a resilient supply chain.

The rapid advancement of technology presents both opportunities and risks. Failing to keep pace with digital trends in areas like online ordering, loyalty programs, and data analytics can put the company at a disadvantage. Investing in technology is essential for staying competitive.

Managing a large restaurant footprint and ensuring consistent service quality across all locations can be a significant operational hurdle. Maintaining brand standards, training employees, and efficiently managing inventory are critical for operational success. Effective execution is key to achieving profitability.

High debt levels, fluctuating commodity prices, and the need for capital expenditures can create financial risks. Managing cash flow, controlling costs, and making strategic investments are essential for financial stability. The company must maintain a strong financial position.

To mitigate these risks, the company likely employs robust risk management frameworks, including diversified sourcing strategies and scenario planning to anticipate market shifts. The company's ongoing efforts to optimize its restaurant portfolio and invest in digital capabilities demonstrate its proactive approach to overcoming these obstacles. For more information about the company's target market, you can read about it here: Target Market of Ruby Tuesday.

Navigating these risks successfully will be crucial for the company's future prospects. The company's ability to adapt to changing consumer preferences, manage costs effectively, and invest in technology will determine its long-term success. The company's performance in the coming years will be closely watched by investors and industry analysts.

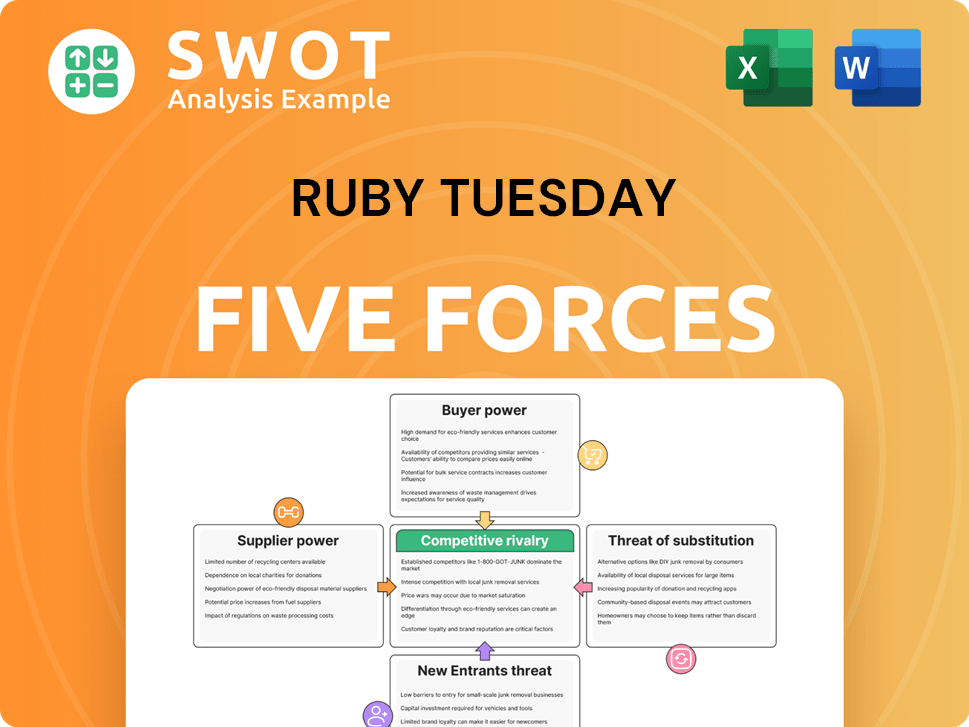

Ruby Tuesday Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ruby Tuesday Company?

- What is Competitive Landscape of Ruby Tuesday Company?

- How Does Ruby Tuesday Company Work?

- What is Sales and Marketing Strategy of Ruby Tuesday Company?

- What is Brief History of Ruby Tuesday Company?

- Who Owns Ruby Tuesday Company?

- What is Customer Demographics and Target Market of Ruby Tuesday Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.