Schueco Group Bundle

Can Schueco Group Continue to Innovate and Thrive?

Schüco Group, a titan in building envelope solutions, has built its legacy on groundbreaking innovation since 1951. With a global network of partners and a commitment to energy efficiency, Schüco has consistently adapted to the evolving demands of the construction industry. But what does the future hold for this industry leader, and how will it maintain its competitive edge?

This exploration delves into the Schueco Group SWOT Analysis, examining its growth strategy and future prospects. We'll analyze Schueco's market position, expansion plans, and commitment to sustainable building solutions. Understanding Schueco's strategic partnerships and product innovation is key to grasping its potential for future market share analysis and financial performance.

How Is Schueco Group Expanding Its Reach?

The Schueco Group is actively expanding its operations to boost its growth strategy and secure its Schueco future. This involves a multi-faceted approach, including international expansion, strategic partnerships, and product innovation. These initiatives are designed to broaden the company's market reach and diversify its offerings, solidifying its position in the building envelope solutions market.

A key element of this strategy is international expansion. The company has established a Regional Headquarters in Riyadh, Saudi Arabia, specifically targeting large commercial projects in the Arabian peninsula. This move underscores the company's commitment to growing its presence in key international markets and capitalizing on regional construction opportunities. Furthermore, the company is also focused on expanding its product range and entering new markets to drive revenue growth.

Strategic investments and acquisitions are also central to Schueco's expansion plans. These moves are designed to enhance market penetration and strengthen its competitive position in the industry. The company's focus on sustainable building solutions also aligns with the increasing demand for environmentally friendly products and services, contributing to its long-term growth prospects.

Schueco Group is expanding its global footprint, with a focus on the Arabian peninsula. This involves setting up regional headquarters and targeting large commercial projects. This strategic move aims to capitalize on regional construction opportunities and increase market share in key areas.

The company is continually launching new products to offer advanced building solutions. Recent examples include the AS PD 75 sliding system and the AS FD bi-fold door system. These innovations cater to modern building designs and enhance the company's product portfolio.

Schueco is forming strategic partnerships to expand its reach. The investment in Skyline Windows LLC in May 2024, is a key example, making Schueco the exclusive distributor in North America. This partnership is expected to double Skyline Windows' revenue in five years.

Acquisitions and investments are crucial to Schueco's expansion strategy. The acquisition of a 49% stake in the Austrian Stemeseder Group in February 2024, strengthens its position in the market for hybrid windows. This move enhances market penetration and consolidates their partnership in development, production, and sales.

In terms of product categories and market entry, Schueco is expanding its modular system for windows, patio doors, and lift-and-slide doors, Schueco Perfect, to include PVC-U materials for the first time, in addition to aluminum. This expansion is designed to cater to value-enhancing renovation processes and adaptive reuse projects, addressing the increasing demand for sustainable and resource-conserving solutions in existing buildings. For a deeper dive into the competitive landscape, consider reviewing the Competitors Landscape of Schueco Group.

Schueco's expansion initiatives are multifaceted, focusing on international growth, product innovation, and strategic partnerships. These initiatives are designed to increase market share and drive revenue growth. The company's strategic investments and acquisitions also play a vital role in its expansion strategy.

- International expansion with a focus on the Arabian Peninsula.

- Product innovation with new launches like the AS PD 75 sliding system.

- Strategic partnerships, such as the investment in Skyline Windows LLC.

- Acquisitions, including a stake in the Austrian Stemeseder Group.

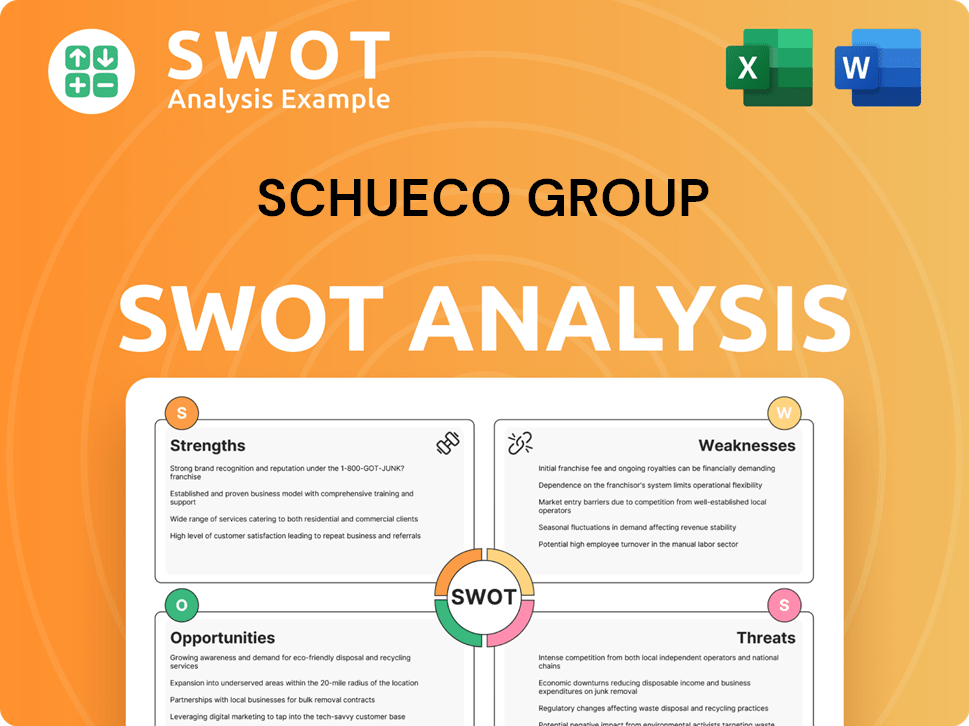

Schueco Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Schueco Group Invest in Innovation?

The Schueco Group's growth strategy heavily relies on innovation and technology, aiming to lead in sustainable and digital building solutions. This approach involves both in-house development and strategic collaborations to integrate cutting-edge technologies. A key focus is on sustainability, with initiatives like the Schueco Carbon Control, designed to reduce the carbon footprint of building envelopes throughout their lifecycle.

Digital transformation is another core pillar, with the company providing digital solutions for all phases of a building project, from planning and design to fabrication, installation, and after-sales services. The company emphasizes intelligent building control and smart home solutions to enhance convenience, efficiency, and security, increasing property value. Automation and simplification of complex processes are also central to their innovative solutions.

The company's commitment to innovation is evident through its product launches and industry recognition. They consistently showcase new developments and prototypes at major trade fairs, focusing on circular and sustainable construction. Products like the Schueco FocusIng window system and the Schueco Perfect system highlight their focus on aesthetics and functionality. Design excellence is recognized through accolades like the Red Dot Design Award.

Schueco's sustainability efforts include the Schueco Carbon Control, a modular concept aimed at reducing the carbon footprint of building envelopes. The company is also developing PVC-U profiles with bio-attributed PVC made from tall oil, improving the CO2 balance for residential sectors.

Digital solutions are offered for all phases of a building project, from planning and design to after-sales services. This includes intelligent building control and smart home solutions to enhance convenience and security, increasing property value. Automation plays a key role.

New developments and prototypes are consistently showcased at major trade fairs like BAU 2025, focusing on circular and sustainable construction. The Schueco FocusIng window system and the Schueco Perfect system exemplify this focus. Design excellence is recognized through awards.

The company has received accolades such as the Red Dot Design Award for its AS PD 75 sliding system. They also host the Schueco Excellence Awards, celebrating design innovation and technical expertise in the built environment.

Schueco actively engages in strategic collaborations to integrate cutting-edge technologies. These partnerships are crucial for driving innovation and expanding their range of sustainable and digital building solutions.

The company's emphasis on circular and sustainable construction is a core element of its innovation strategy. This includes the use of sustainable materials and the development of products designed for recyclability and reduced environmental impact.

The company's innovation strategy is centered around several key technological advancements. These advancements are designed to enhance the performance, sustainability, and user experience of their products. For a deeper dive into the strategies, consider reading the Marketing Strategy of Schueco Group.

- Development of bio-attributed PVC profiles for improved CO2 balance.

- Integration of smart home solutions for enhanced convenience and security.

- Use of automation to simplify complex processes in building projects.

- Focus on sustainable materials and circular economy principles.

- Continuous product launches and prototypes showcased at major trade fairs.

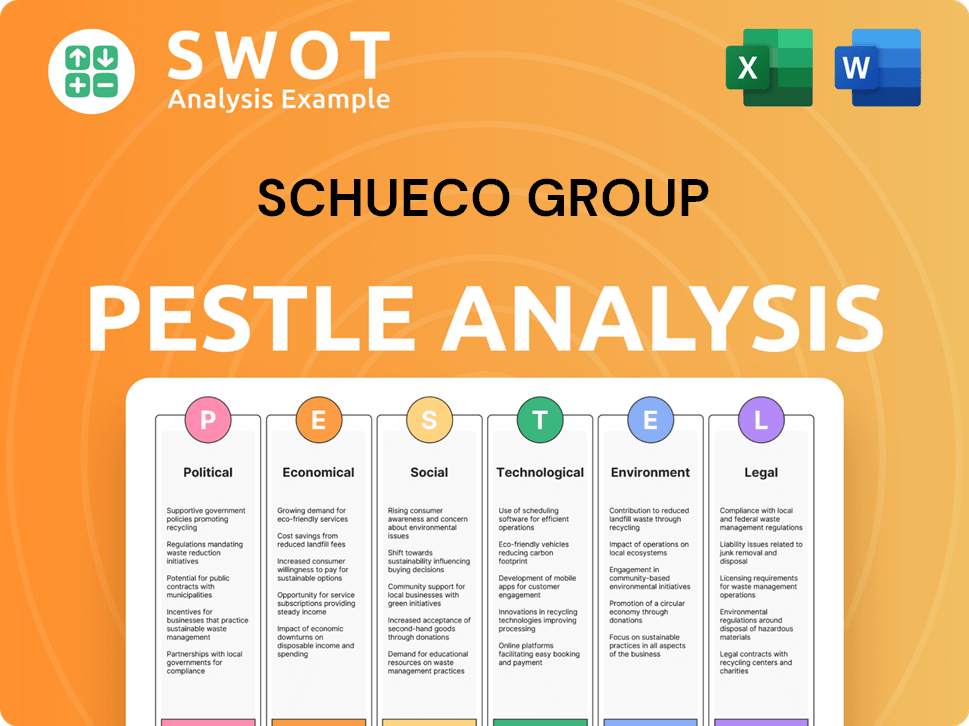

Schueco Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Schueco Group’s Growth Forecast?

The financial outlook for the Schueco Group reflects both challenges and opportunities within the global construction market. The company's Schueco market analysis indicates a strategic focus on sustainable solutions and digital transformation to drive future growth. Despite facing macroeconomic headwinds, the company is actively pursuing Schueco Group expansion plans and strategic partnerships to strengthen its market position.

In 2023, Schueco Group reported a turnover of €2.11 billion, a decrease from the previous year due to construction industry challenges. However, the 2024 Annual Report showed a revenue of €2.15 billion, demonstrating resilience and effective strategies. As of May 2025, Schüco International KG's annual revenue reached $5 billion, highlighting its significant market influence and financial health.

The Schueco Group is investing in its future, with €52.6 million invested in 2023, including a new product supply and distribution site. These investments, along with strategic acquisitions like a stake in Skyline Windows LLC and the Austrian Stemeseder Group, support its Schueco Group growth strategy. The company's financial narrative is driven by its commitment to decarbonizing the building envelope and providing comprehensive building lifecycle solutions. For more insights, explore Target Market of Schueco Group.

In 2023, the Schueco Group reported a total turnover of €2.11 billion. The 2024 Annual Report indicated a revenue of €2.15 billion, demonstrating the company's ability to adapt. As of May 2025, annual revenue reached $5 billion, showcasing strong financial performance.

The company invested €52.6 million in 2023, including a new supply and distribution site. Strategic investments include a minority stake in Skyline Windows LLC and a 49% stake in the Austrian Stemeseder Group. These investments support Schueco Group's expansion and innovation.

The acquisition of a 49% stake in the Austrian Stemeseder Group in February 2024 is a key strategic move. This partnership aims to expand collaboration in development, production, and sales. These partnerships are crucial for Schueco Group's market growth.

The company is focusing on sustainable solutions, such as PVC-U with bio-attributed PVC. Schueco Group's commitment to decarbonizing the building envelope is a significant part of its strategy. This focus on sustainability will drive future revenue streams.

The construction industry faced challenges in 2023, including high material costs and rising interest rates. These factors affected the Schueco Group's turnover. Despite these challenges, the company demonstrated resilience.

Schueco Group is investing in digital transformation to enhance its operations and customer experience. This includes new digital tools and platforms. These efforts are expected to contribute to future growth.

Schueco Global Services KG, established in 2022, achieved a turnover of €28 million in 2023. This growth reflects the expansion of after-sales services internationally. The expansion of services is a key component of the company's strategy.

While specific profit margins are not detailed, the company's focus on sustainable solutions and digital transformation supports long-term revenue growth. Schueco Group is focused on long-term market trends.

Expanding the product portfolio, particularly in sustainable solutions, is a key strategy for Schueco Group. New product launches are expected to drive revenue. The company is focused on Schueco Group product innovation.

Schueco Group is positioned to capitalize on future market trends, including the demand for sustainable building solutions. The company is well-prepared for Schueco Group future growth. The company’s strategic initiatives align with future market trends.

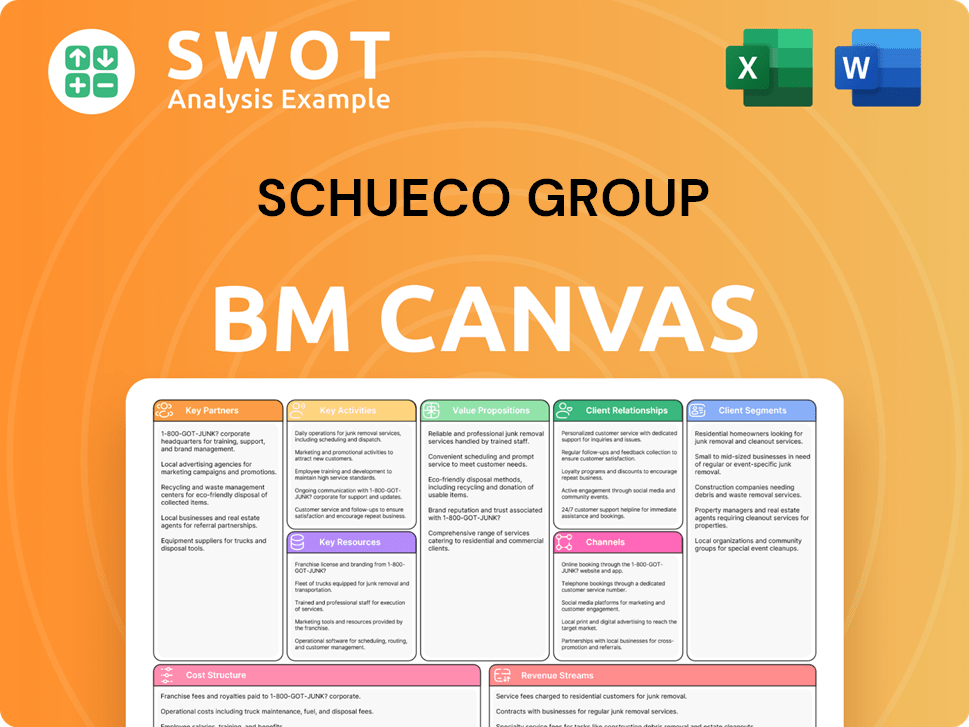

Schueco Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Schueco Group’s Growth?

The Schueco Group faces several risks and obstacles as it pursues its growth strategy. These challenges span economic volatility, intense market competition, supply chain issues, and the need to adapt to technological and regulatory changes. Understanding these potential pitfalls is crucial for evaluating the company's future prospects and investment opportunities.

Economic instability, particularly in Europe, poses a significant threat. High material costs, rising wages, and increased interest rates, combined with labor shortages, create a difficult operating environment. The reluctance of investors to commit to new construction and renovation projects further complicates the situation.

Competition from established multinational firms and regional players is another major hurdle. Maintaining a competitive edge requires continuous innovation in design, materials, and performance. Moreover, supply chain vulnerabilities and the need to adapt to evolving regulations regarding climate policy and decarbonization add to the complexity.

The economic climate, particularly in Europe, presents a significant challenge. Factors such as high material costs, rising wages, and increased interest rates, combined with labor shortages, can negatively impact the company's financial performance. The company's turnover decreased slightly in 2023, highlighting the impact of these economic pressures. This affects the Schueco Group's growth strategy.

The Schueco Group operates in a competitive market. The competitive landscape includes numerous established multinational firms and regional players, necessitating continuous advancements in design, materials, and performance to maintain a competitive edge. Constant innovation is essential for securing Schueco market share analysis and ensuring long-term success.

Supply chain vulnerabilities and resource shortages can significantly impact material availability and costs. Additionally, regulatory changes, particularly those related to climate policy and the decarbonization of the building sector, demand continuous adaptation and investment in new solutions. This can affect the Schueco Future.

Technological advancements, including AI and automation, present both opportunities and challenges for the Schueco Group. While these technologies are leveraged for digital transformation, the need for new skills and managing unstructured data can be obstacles. Internal resource constraints, such as limited local product development, can also hinder agility and responsiveness to market demands.

The evolving regulatory landscape, particularly concerning climate policy and the decarbonization of the building sector, requires constant adaptation and investment. This includes developing sustainable products and services, which can be a costly and time-consuming process. The company's commitment to sustainability is key to addressing these risks.

Internal resource constraints, such as limited local product development and longer manufacturing lead times, can hinder agility and responsiveness to market demands. These limitations, as highlighted in a SWOT analysis, can affect the company's ability to quickly adapt to changing market conditions and customer needs. This impacts Schueco Group revenue growth.

The Schueco Group mitigates these risks through diversification, strategic partnerships, and a strong focus on sustainable and innovative solutions. Investments, such as those in the Stemeseder Group and Skyline Windows, expand market presence and product offerings, diversifying revenue streams. The company's commitment to achieving Net Zero emissions by 2045 and its focus on sustainable practices demonstrate a proactive approach to environmental and regulatory risks, which are essential for Schueco Group expansion plans.

The development and implementation of sustainable building solutions are crucial. This includes products like Schüco Carbon Control and initiatives focused on reducing emissions and waste. These efforts are vital for aligning with evolving regulatory requirements and meeting the growing demand for environmentally friendly products. These are key factors for Schueco Group sustainable building solutions.

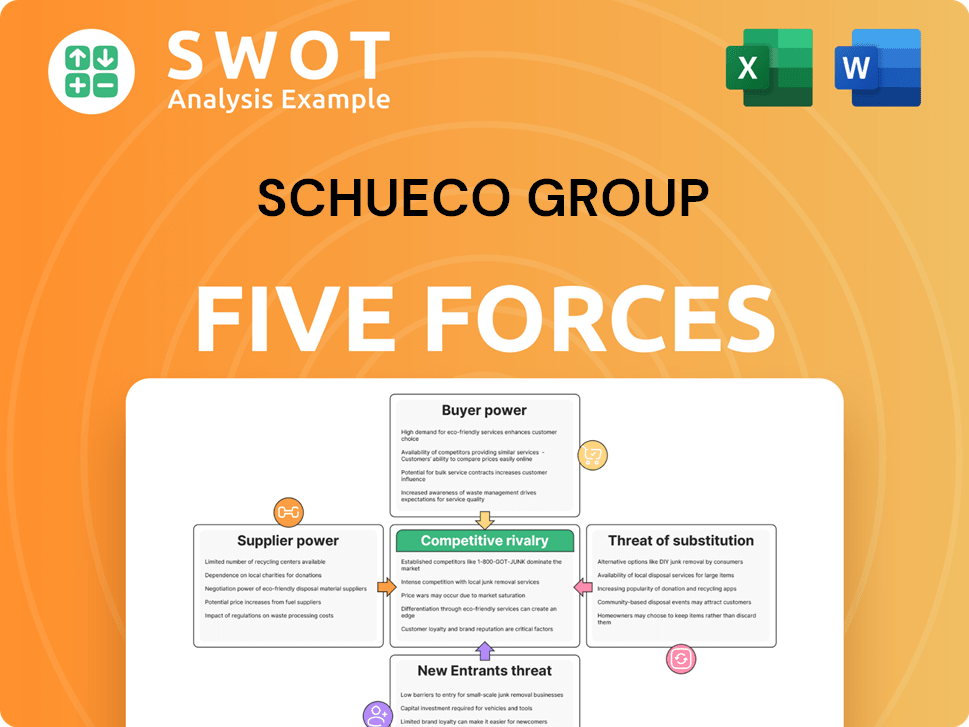

Schueco Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Schueco Group Company?

- What is Competitive Landscape of Schueco Group Company?

- How Does Schueco Group Company Work?

- What is Sales and Marketing Strategy of Schueco Group Company?

- What is Brief History of Schueco Group Company?

- Who Owns Schueco Group Company?

- What is Customer Demographics and Target Market of Schueco Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.