Tokyo Electron Bundle

Can Tokyo Electron Maintain Its Semiconductor Dominance?

In the dynamic world of semiconductors, understanding a company's growth strategy is crucial. Tokyo Electron (TEL), a global leader in semiconductor equipment, stands at the forefront of technological advancement. From its humble beginnings, the Tokyo Electron SWOT Analysis reveals a journey of innovation and strategic market penetration, making it a pivotal player in the digital era.

This exploration dives into the heart of TEL Company's future, examining its growth strategy within the competitive semiconductor equipment market. We'll analyze its expansion initiatives, technological innovations, and financial outlook to understand how Tokyo Electron plans to navigate future challenges and capitalize on opportunities. This includes a deep dive into its market share analysis and business development strategies, offering insights into its competitive advantage and overall impact on the semiconductor industry.

How Is Tokyo Electron Expanding Its Reach?

The expansion initiatives of Tokyo Electron (TEL) are primarily driven by the rising demand for advanced semiconductor manufacturing equipment. This demand is fueled by technological advancements and the increasing use of digital technologies. The company is strategically growing its global footprint to better serve its international clients and seize opportunities in emerging markets.

TEL is focusing on new product development in critical areas for next-generation semiconductor fabrication. This includes advanced etching, deposition, and coater/developer systems. These systems are essential for manufacturing cutting-edge integrated circuits. The company's expansion also involves strategic partnerships and collaborations.

These collaborations aim to keep TEL's equipment at the forefront of technological innovation. Furthermore, the company is exploring new business models to diversify revenue streams and enhance customer loyalty. While specific timelines for new product launches and market entries are proprietary, TEL consistently updates its product roadmap to align with the semiconductor industry's rapid innovation cycles.

TEL is expanding its presence in key regions. These regions include North America, Europe, and Asia. This expansion aims to meet the needs of its international clients. It also helps capture opportunities in emerging markets. This is a key part of the TEL Company's growth strategy.

TEL focuses on developing new products. These products are for advanced semiconductor manufacturing. This includes advanced etching, deposition, and coater/developer systems. These systems are crucial for making cutting-edge integrated circuits. TEL's R&D investment is a significant factor.

TEL collaborates with leading semiconductor manufacturers. These collaborations speed up technological development and market penetration. Joint development projects help create solutions for future industry demands. These partnerships are vital for TEL's growth strategy.

TEL explores new business models, such as subscription-based services. These models diversify revenue streams and improve customer retention. This approach enhances TEL's financial performance. It also strengthens its market position.

TEL's expansion strategy includes several key areas. These areas are crucial for its future growth. The company aims to stay competitive in the rapidly evolving semiconductor industry. The company's focus on innovation and strategic partnerships is critical.

- Geographical expansion in North America, Europe, and Asia.

- Development of advanced semiconductor manufacturing equipment.

- Strategic collaborations with leading manufacturers.

- Exploration of new business models for revenue diversification.

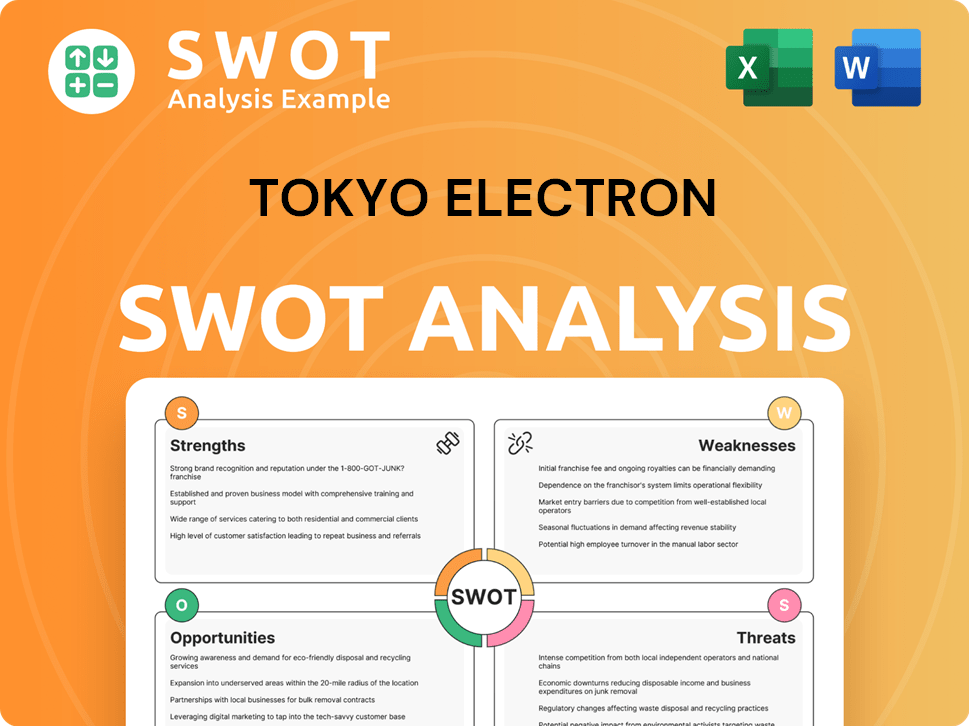

Tokyo Electron SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tokyo Electron Invest in Innovation?

The innovation and technology strategy of the TEL Company is crucial for its ongoing expansion. The company's focus on research and development (R&D) and the adoption of advanced technologies are central to its success in the competitive semiconductor equipment market. TEL consistently invests a significant portion of its revenue into R&D to stay ahead of industry trends.

TEL's strategic approach involves developing cutting-edge equipment for etching, deposition, coater/developers, and test systems. These advancements enable the production of smaller, more powerful, and energy-efficient semiconductors. This commitment to innovation helps TEL meet the evolving needs of the semiconductor industry and maintain its competitive edge. This approach is essential for sustaining growth and capturing opportunities in the dynamic semiconductor equipment sector.

TEL's R&D efforts are specifically geared towards addressing the challenges of advanced process nodes, such as Gate-All-Around (GAA) transistors and 3D stacking technologies. These technologies are critical for future semiconductor generations, and TEL's innovations in these areas are vital for its continued success. The company's focus on these advanced technologies ensures that it remains at the forefront of the industry, driving technological advancements and supporting the growth of its customers.

TEL dedicates a substantial portion of its revenue to R&D, which is a key driver of its innovation strategy. This commitment allows TEL to stay ahead of industry trends and develop cutting-edge equipment. The company's focus on R&D is crucial for its long-term growth and competitiveness.

TEL's R&D efforts are focused on advanced process nodes like GAA transistors and 3D stacking technologies. These innovations are essential for future semiconductor generations. By addressing these challenges, TEL ensures it remains at the forefront of technological advancements.

TEL is actively engaged in digital transformation initiatives, leveraging AI, machine learning, and IoT. These technologies enhance equipment performance and efficiency. Smart manufacturing solutions enable predictive maintenance and real-time process optimization.

TEL is committed to sustainability, integrating environmentally friendly features into its products. The company aims to reduce energy consumption and chemical waste. This commitment aligns with global efforts to promote sustainable manufacturing practices.

TEL holds key patents in areas like atomic layer deposition (ALD) and advanced patterning. These patents underscore TEL's leadership in innovation. They are a testament to the company's commitment to technological breakthroughs.

TEL collaborates with research institutions and customers to drive innovation. These partnerships ensure its position at the forefront of semiconductor manufacturing technology. Through these collaborations, TEL fosters a dynamic ecosystem of innovation.

TEL's innovation and technology strategy is multifaceted, encompassing significant R&D investments, digital transformation, and sustainability initiatives. These elements work together to drive the company's growth and maintain its competitive advantage in the semiconductor equipment market. For more insights, you can explore the Target Market of Tokyo Electron.

- R&D Investment: TEL consistently invests a significant portion of its revenue in R&D. In fiscal year 2024, the company allocated approximately ¥190 billion to R&D, demonstrating its commitment to innovation.

- Digital Transformation: TEL leverages AI, machine learning, and IoT to improve equipment performance. This includes smart manufacturing solutions that enable predictive maintenance and real-time process optimization.

- Sustainability Initiatives: TEL integrates environmentally friendly features into its products and manufacturing processes. The company aims to reduce energy consumption and chemical waste, aligning with global sustainability goals.

- Key Patents: TEL holds key patents in areas like atomic layer deposition (ALD) and advanced patterning. These patents underscore its leadership in innovation.

- Strategic Collaborations: TEL actively collaborates with research institutions and customers. These partnerships ensure its position at the forefront of semiconductor manufacturing technology.

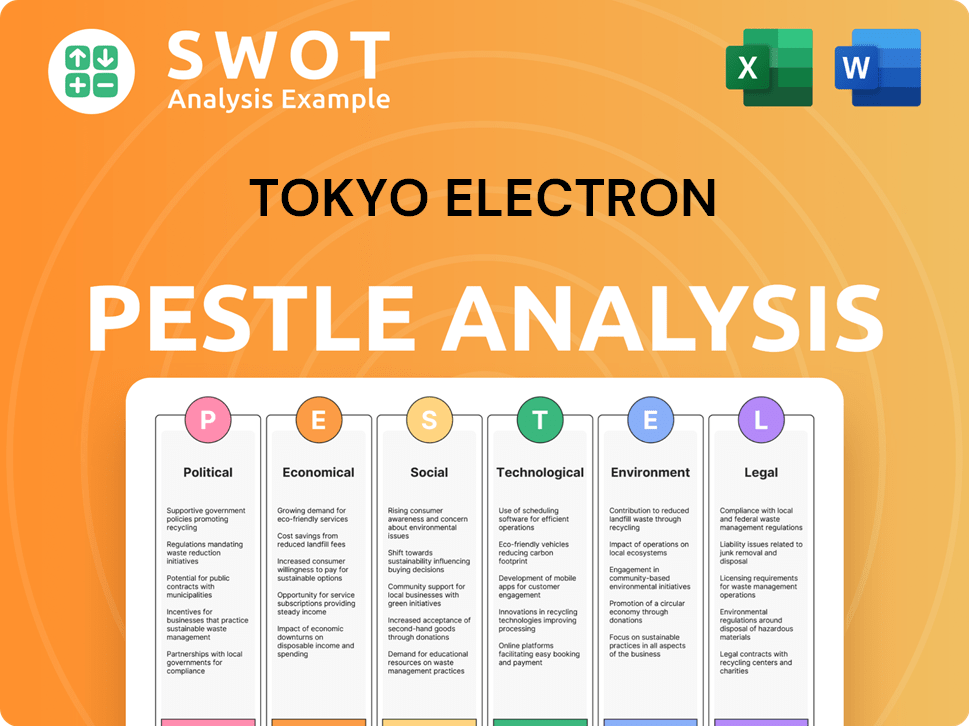

Tokyo Electron PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Tokyo Electron’s Growth Forecast?

The financial outlook for Tokyo Electron (TEL) remains strong, reflecting its strategic position in the semiconductor equipment market. The company's performance is closely tied to the global demand for semiconductors, which is driven by technological advancements in areas like artificial intelligence, 5G, and the Internet of Things. This demand supports TEL's continued growth and profitability.

For the fiscal year ending March 31, 2025, Tokyo Electron projects significant financial results. The company anticipates net sales of ¥2,200.0 billion, operating income of ¥550.0 billion, and net income attributable to owners of the parent of ¥400.0 billion. These projections build upon the strong financial performance of the previous fiscal year, demonstrating the company's resilience and growth potential.

In the fiscal year that ended on March 31, 2024, TEL reported net sales of ¥1,816.0 billion, operating income of ¥439.4 billion, and net income attributable to owners of the parent of ¥326.6 billion. This solid performance provides a strong foundation for the company's future growth. The company's ability to maintain and improve upon these figures underscores its competitive advantage and effective Marketing Strategy of Tokyo Electron.

Tokyo Electron's diverse product portfolio, including equipment for wafer processing, coater/developers, and cleaning systems, contributes to its strong financial performance. This diversification allows the company to capture market share across various critical equipment segments. The company's ability to adapt and innovate within its product offerings is crucial for sustained growth.

TEL's commitment to research and development (R&D) and capacity expansion is a key factor in its financial outlook. High investment levels in these areas are expected to continue, enabling the company to meet future market needs and maintain its technological leadership. These investments are crucial for innovation and staying ahead of the competition.

Analysts generally maintain positive forecasts for TEL, citing its technological leadership and the long-term growth trends in the semiconductor industry. The ongoing global demand for semiconductors, driven by advancements in various technologies, supports the company's continued financial success. The company's strategic positioning allows it to capitalize on these trends.

Strategic partnerships play a vital role in supporting TEL's financial outlook. These collaborations enhance its market presence and enable the company to address the evolving needs of the semiconductor industry. These partnerships contribute to the company's ability to innovate and expand its global reach.

TEL's global expansion strategy is a significant factor in its financial outlook. The company's ability to capture market share in key regions, including China, is essential for its long-term growth. This expansion is supported by its strong product portfolio and technological expertise.

Tokyo Electron's sustainability initiatives are increasingly important, contributing to its long-term financial health. By focusing on environmental, social, and governance (ESG) factors, TEL enhances its reputation and attracts investors. These initiatives support the company's commitment to responsible business practices.

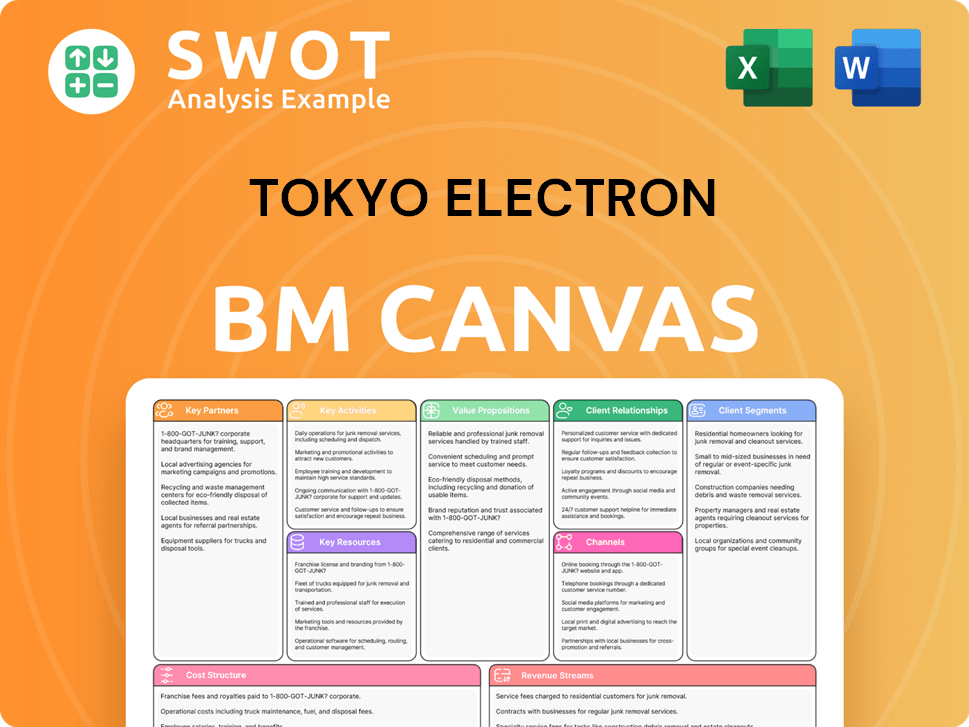

Tokyo Electron Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Tokyo Electron’s Growth?

Despite the promising Growth Strategy of Tokyo Electron (TEL) Company, several potential risks and obstacles could influence its future. The semiconductor industry's cyclical nature, with its inherent boom-and-bust cycles, poses a significant challenge. Downturns in demand can directly impact TEL Company's equipment sales and overall profitability.

Intense competition from other global Semiconductor Equipment suppliers also presents a continuous challenge, demanding ongoing innovation and cost efficiency. Furthermore, regulatory changes, particularly in international trade and technology export controls, represent another critical risk. Geopolitical tensions and trade restrictions could disrupt supply chains and limit market access.

Supply chain vulnerabilities, including reliance on a limited number of suppliers for critical components, could lead to production delays and increased costs. The rapid pace of technological disruption in the semiconductor industry requires continuous adaptation and substantial R&D investment to stay ahead. TEL Company mitigates these risks through diversification, robust risk management, and proactive scenario planning.

The semiconductor market is known for its cyclical nature, experiencing periods of high growth followed by downturns. These fluctuations directly affect TEL's equipment sales. Understanding and responding to these cycles is crucial for maintaining financial stability and Business Development.

TEL faces strong competition from other global Semiconductor Equipment suppliers. Maintaining a competitive edge requires continuous innovation, efficient operations, and strategic partnerships. Market Analysis is essential to identify emerging trends and competitive threats.

Changes in international trade policies and geopolitical tensions can significantly impact TEL's operations. Trade restrictions and export controls can disrupt supply chains and limit market access. TEL must navigate these challenges through strategic planning and risk management.

Reliance on a limited number of suppliers can lead to production delays and increased costs. Diversifying the supply chain and building resilient infrastructure are crucial. Proactive measures are needed to mitigate potential disruptions and ensure operational efficiency.

The rapid pace of technological advancements requires continuous adaptation and significant R&D investment. Staying ahead of the curve necessitates a strong focus on innovation and a commitment to developing cutting-edge solutions. TEL's R&D investment is a key factor.

Global economic conditions can influence demand for semiconductors and, consequently, TEL's products. Economic downturns can lead to decreased capital expenditure by customers. Monitoring economic indicators and adjusting strategies accordingly is essential.

TEL employs several strategies to mitigate these risks. These include diversifying its customer base and product portfolio to reduce dependence on any single market or product line. The company also maintains robust risk management frameworks to identify and address potential threats proactively. Furthermore, TEL engages in proactive scenario planning to anticipate and respond to market shifts and geopolitical developments, including strengthening supply chain resilience and localizing production where feasible.

In fiscal year 2024, TEL reported strong financial results, with net sales of over ¥2 trillion. However, the company is also facing challenges related to the slowdown in the memory market. Despite these challenges, TEL remains committed to its long-term Growth Strategy, focusing on innovation and global expansion. For detailed insights, you can read more about Mission, Vision & Core Values of Tokyo Electron.

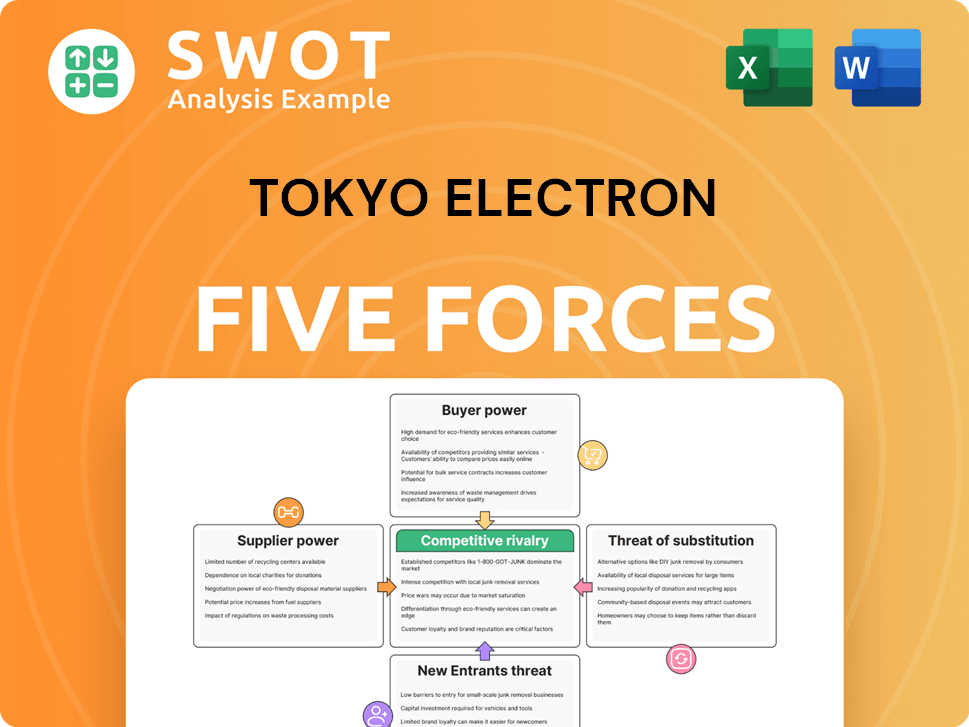

Tokyo Electron Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tokyo Electron Company?

- What is Competitive Landscape of Tokyo Electron Company?

- How Does Tokyo Electron Company Work?

- What is Sales and Marketing Strategy of Tokyo Electron Company?

- What is Brief History of Tokyo Electron Company?

- Who Owns Tokyo Electron Company?

- What is Customer Demographics and Target Market of Tokyo Electron Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.